Investing in the stock market has never been easier, thanks to the numerous online brokers available today. As such, you will need to make a choice, and finding the best online broker in the United Arab Emirates can be challenging.

Fortunately, we successfully analyzed many trading apps before and conducted multiple online broker reviews so that we can clarify some of your doubts and help you make an informed decision! In this article, we listed the best online brokers in the UAE, comparing their specificities and highlighting their strengths.

In a nutshell: Best Online Brokers in Dubai & the UAE

- Interactive Brokers: Best for intermediate and advanced investors

- Sarwa: Best for beginners and auto-invest (you can get an up to AED 3,000 referral bonus)

- eToro: Best for social trading

- XTB: Best for low-fee CFD and Forex trading

- amana: Best for 0% commissions (you can get a $100 referral bonus)

- Capital.com: Best for fee-free AED deposits and commission-free CFD trading (other fees may apply) with local support.

- Plus500: Ideal for demo accounts and CFDs

- Saxo Bank: Best for powerful trading tools

50% of retail CFD accounts lose money.

70-80% of retail CFD accounts lose money.

Investing in physical shares carries risk. Trading leveraged derivatives and volatile digital assets is high-risk and requires caution.

79% of retail CFD accounts lose money.

62% of retail CFD accounts lose money.

Comparison of the Best Trading Platforms in the UAE

Other resources

- Check our Youtube channel! You will find step-by-step guides of how to invest in the S&P 500 on different apps, as well as other educational videos about investing and investment platforms.

- Explore our tools: Check our comparison tool, reviews, broker bonuses, broker interest rates, BrokerMatch, and others.

Broker reviews

Interactive Brokers at a glance

Interactive Brokers has proven to be one of the most reliable brokers in the market. The company was founded over 40 years ago and survived many financial crises, making it a well-established and trustworthy broker regulated by many top-tier regulators, including the SEC and FCA. Interactive Brokers is dedicated to enhancing its services for the Emirates market and has incorporated UAE dirhams (AED) as an accepted currency!

They offer several investment platforms: Trader Workstation (TWS), Client Portal, IBKR mobile, and IBKR Globaltrader. All these platforms allow you to trade stocks, ETFs, options, and other financial instruments with sophisticated and powerful tools and low transaction costs. Each trading platform is based on the users’ knowledge and experience. For example, the mobile app IBKR GlobalTrader is a user-friendly app suitable for beginners because it simplifies investments without losing the powerful tools for which the broker is famous, including solid trade execution (IB SmartRouting), and a set of technical and fundamental tools to help you in your investment decisions.

While IBKR does not explicitly have an Islamic account; however, if you trade using a cash account, you won’t be charged any interest.

On the downside, Interactive Brokers’ fee structure is quite complex, the registration process is lengthy (but fully online), and the broker doesn’t offer commission-free trading. However, when considering FX fees, narrower spreads, and the stock loan program, Interactive Brokers’ clients still get significant savings compared to most brokers.

Please check our Interactive Brokers review to find out more about the broker.

Pros

- Low commissions on US stock trading

- No monthly inactivity fee

- The broadest product and markets range in the brokerage industry

- Demo account

- Excellent reputation (founded in 1978)

- Extensive research and Education tools

- Has a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors, IBKR GlobalTrader.

- Offers interest on uninvested cash balances

Cons

- Complicated and lengthy account opening process (but fully online)

- Steeper learning curve for beginners

- Website is difficult to navigate

- Interactive Advisors (Robo-advisor feature) is only available for US customers

Sarwa at a glance

Sarwa is a Dubai-based investment company that offers 4 main services/products:

- Sarwa Save: A savings account to earn interested on your cash;

- Sarwa Trade: A trading account that allows you to trade US-listed stocks, ETFs and US options on your own;

- Sarwa Invest: A robo-advisory solution that allows you to create and manage ETF portfolios automatically

- Sarwa Crypto: An account that allows you to trade cryptocurrencies

The platform is acclaimed for its low fees, accessibility, transparency, and the promo code bonus. It is a great option for beginners or those looking for a local solution.

Their flagship product, Sarwa Invest, creates tailored portfolios using affordable index funds (ETFs), and charging an annual management fee between 0.5% and 0.8%, dependent on the portfolio size, in addition to a 0.1% underlying portfolio expense. Investors can further customize their Sarwa Invest experience by opting for Conventional, Halal, Socially Responsible Investing (SRI), or Crypto plans and can select from six distinct risk levels within each.

Sarwa Save is designed for those seeking a safer cash management option, promising a 4.1% projected return without imposing minimum balances or management fees. An alternative Halal version does charge a 0.5% management fee. Sarwa Crypto caters to cryptocurrency enthusiasts, allowing trades without commissions but applying a 0.75% spread, and supports various order types.

For those focused on stocks and ETFs, Sarwa Trade offers trading exclusively on US stocks and options, and ETFs with features like fractional shares, though it doesn’t support margin trading.

Moreover, Sarwa offers personalized financial consultations with their licensed experts. Transactions via local UAE banks are free of funding or withdrawal charges, and the platform adheres to fixed exchange rates for AED-USD conversions.

On the downside, it lacks important assets like bonds, options, or shares listed outside the USA. It is also a newcomer in the industry, with short track record when compared with some of the names mentioned here.

Pros

- Access to human financial advisor

- Low fees

- Slick and easy to use app

- Sarwa Invest (Robo-advisor) is a good option for beginners

- Sarwa Save is a good alternative to earn interest on cash

Cons

- Newcomer in the industry: short track record

- Limited asset offering: no bonds or stocks listed outside the USA

- US options are quite expensive ($4 per contract)

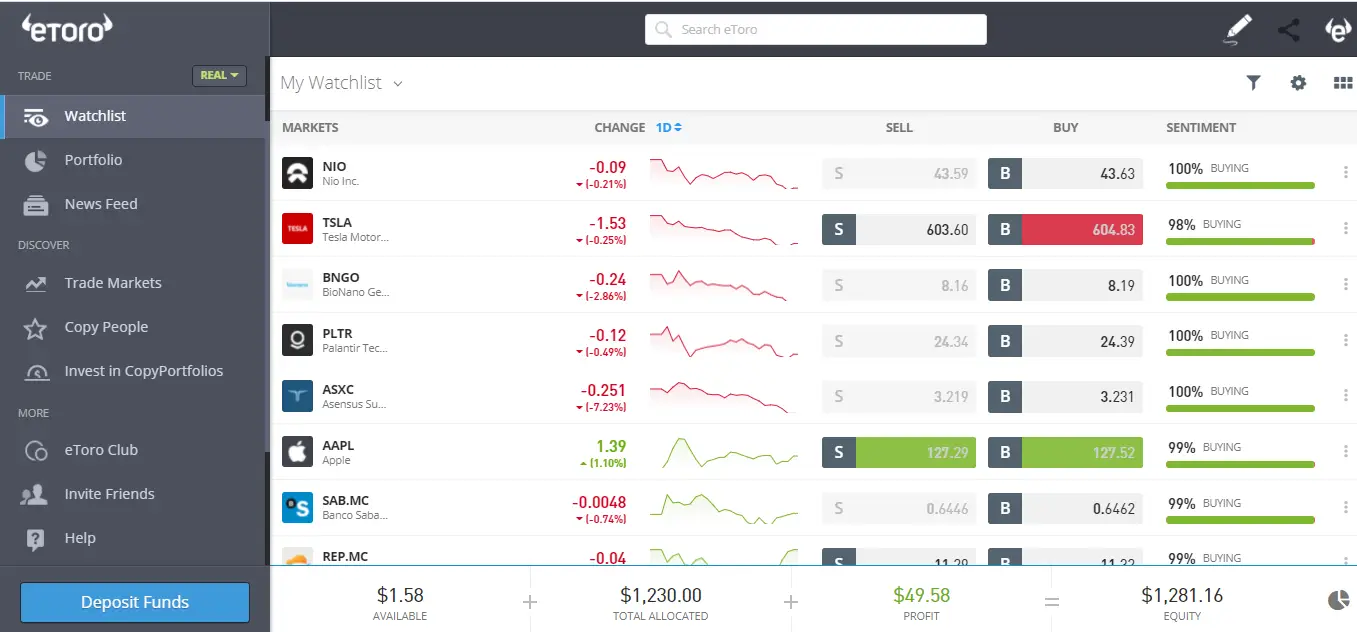

eToro at a glance

50% of retail CFD accounts lose money.

eToro is a broker founded in 2007, famous for its social trading features. Today, the fintech is one of the most well-established in the world, with over 35 million users, offering more than 3,000 different assets, including stocks from 17 different stock exchanges.

eToro’s investment platform, which can be web-based or mobile-based, is a social trading platform that allows investors to discuss investments and market news with other traders, copy strategies, and open a demo account.

Both have comprehensive and user-friendly interfaces where you can intuitively trade commission-free stocks from many countries, such as the US, UK, Germany, and many others. Besides, eToro offers an Islamic (swap- and interest-free) account to all who contact customer service and fund their accounts to at least 1,000 USD.

The broker provides reliability and safety to its customers: it is regulated by top-tier authorities such as the FCA and ASIC, and your funds will be segregated and also secured by up to 1 million Euros, or equivalent in USD, due to private insurance. If you are still not convinced or want to know more about this subject, please check out the article we prepared about the safety of eToro.

Considering all these factors, eToro is a solid option for beginners, intermediate, and experienced investors, and certainly one of the best online brokers in the UAE. Please check our eToro review if you would like to know more about their services.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 50% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pros

- Low stock trading fees (from $0 per trade)

- Commission-free ETFs (other fees apply)

- Social trading and other innovative products

- Wide variety of financial products

- Slick, modern, and easy for anyone to use

- European users have access to three account currencies: EUR, USD and GBP

- Top tier regulators

Cons

- Limited disclosed financial information

- Withdraw and inactivity fees

- Spread, overnight, inactivity, and currency conversion fees higher than average

- Doesn’t offer bonds, futures, or options

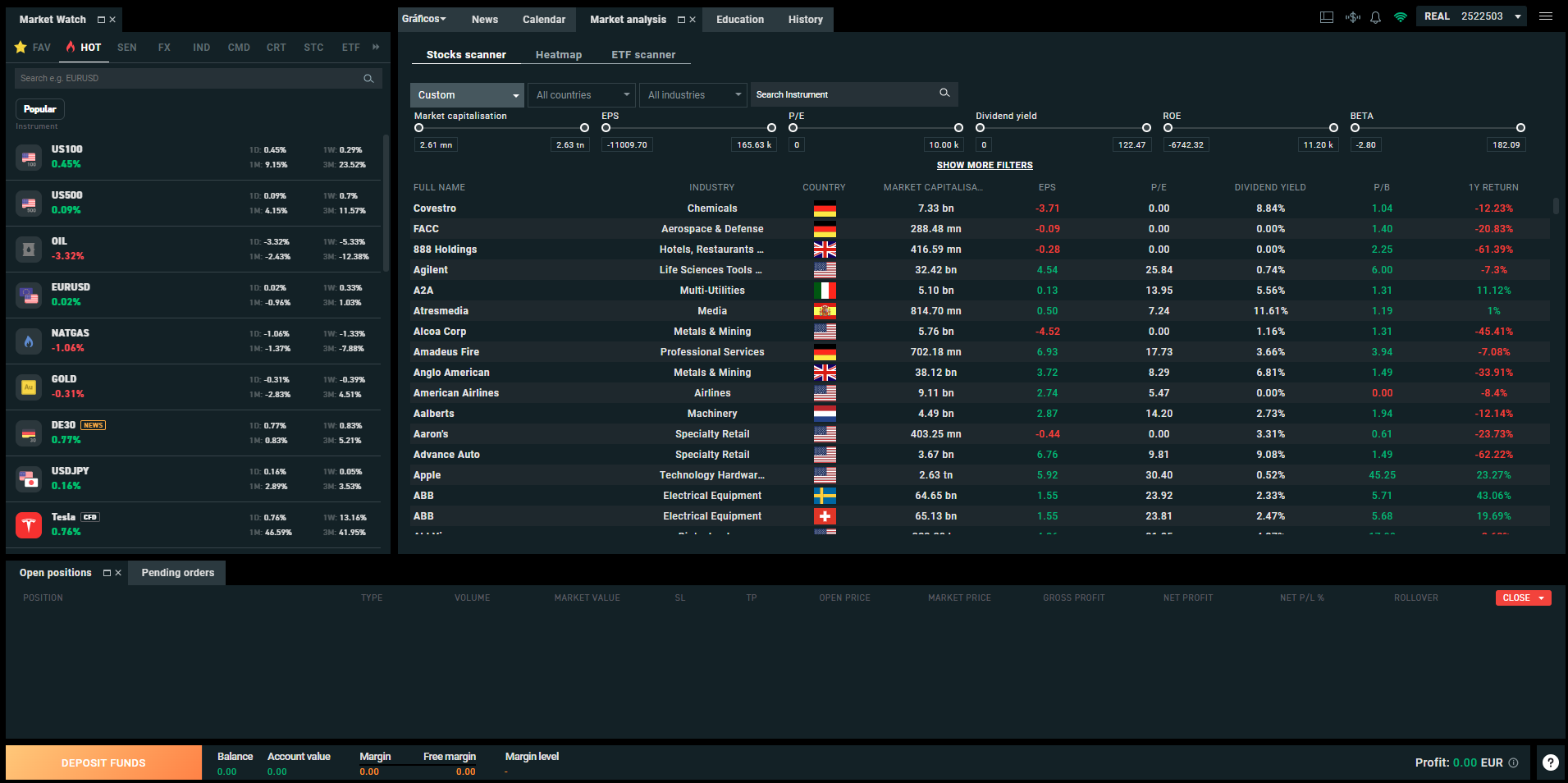

XTB at a glance

70-80% of retail CFD accounts lose money.

Founded in 2002, XTB is a major player in the brokerage industry with extensive worldwide experience, regulated by the Financial Conduct Authority (FCA) – plus other relevant regulatory bodies – and listed on the Warsaw Stock Exchange. In the UAE, it acts through the subsidiary XTB MENA Limited, authorized and regulated by the Dubai Financial Services Authority (License No. F006316). XTB caters to the specific needs of UAE residents by offering an Islamic (swap-free) account.

You can invest through xStation 5 and xStation Mobile in different investment products, such as stocks, ETFs, and CFDs on Forex, Indices, and Commodities. It offers 0% commission on stocks and ETFs.

With 0% commissions on stocks and ETFs, no minimum deposit, Islamic accounts, and a free demo account that can be used for a month, XTB is a good and reliable option for beginners and advanced investors, which puts it in third place on our list of best online brokers in the UAE.

If you want to find out more about the broker, please check our XTB review!

Pros

- Free stocks trading (only applicable to some countries)

- Customizable trading platform (charts and workspace)

- Low Forex Spreads

- Demo account

- No minimum account deposit

- Valuable education materials

- Top-tier Regulators

Cons

- Complex trading platform for a beginner

- High Stock CFD spreads

- Limited product portfolio

- Withdrawal fees for transfers below $100

- Inactivity fee (€10/monthly after 1+ year with no activity plus no deposit in the last 90 days)

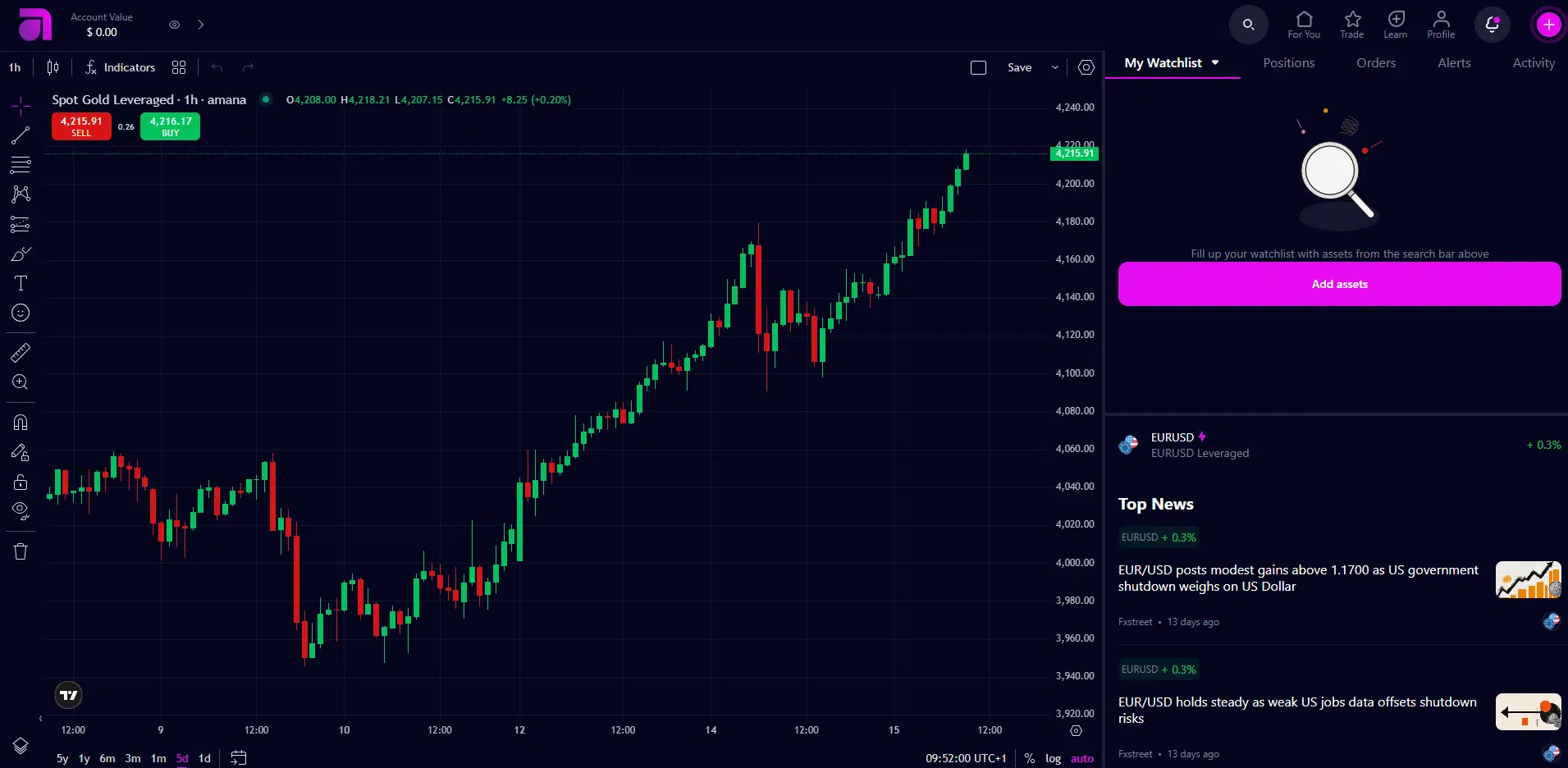

amana at a glance

Investing in physical shares carries risk. Trading leveraged derivatives and volatile digital assets is high-risk and requires caution.

amana is a UAE-based, regulated brokerage firm with over 15 years of experience in the financial markets. Headquartered in Dubai, it offers an easy and modern way for investors in the Middle East and beyond to access both local and global markets, all through a single intuitive app. New users get a $100 bonus.

It allows users to trade with 0% commissions on U.S. and international stocks, ETFs, cryptocurrencies (over 375 digital assets), and MENA region shares*, as well as other leveraged products such as forex and commodities.

Investors looking for a more hands-off approach can use amana invest, a passive investment feature that helps you build diversified portfolios through automated plans. Meanwhile, active traders benefit from 24/5 U.S. stock trading hours, cashback on every trade (up to 20% on every trade), and a transparent fee structure with no hidden charges.

Fractional investing is available, allowing you to buy a portion of high-priced shares like Apple, Tesla, or Amazon with a small starting amount.

amana also stands out for its crypto offering, supporting hundreds of coins, including Bitcoin, Ethereum, and Solana, with competitive spreads and simple onboarding.

On the downside, amana’s product range, while broad, may not include every product (bonds, options,…) or professional tools offered by global brokers, and access is still region-focused.

While amana promotes its UAE presence through Amana Financial Services (Dubai) Ltd, clients opening accounts through the amana app are legally contracting with AFS Global Limited, which is licensed by the Labuan Financial Services Authority (LFSA).

Client funds are held in segregated accounts with reputable banks in accordance with LFSA rules. However, it’s important to note that the amana app is not a DFSA-regulated product, and DFSA protections do not apply to amana app users, even if they are based in the UAE.

Pros

- 24/5 hours trading on stocks and ETFs

- $100 bonus with amana promo code “IITW”

- 0% commissions on stocks, ETFs and crypto

- Amana Invest (passive investment plans)

- Interest on idle cash

- Cashback on every trade (up to 20%)

- Multi-asset access: U.S. + MENA equities, forex, CFDs, and crypto all in one place.

- MT4/MT5 support for traditional traders

- Good local reach: Enables UAE/Saudi/Qatar trading, local AED deposits

- Amana Invest: Automated ETF and crypto portfolios with no management fees.

- 24/6 customer support

Cons

- Doesn’t offer bonds or options

- No position transfers to other brokers

- Limited product range: LSE/Irish ETFs not yet available

- Emphasis on leverage and CFDs, which may not fit conservative, long-term investors

*MENA stocks can be traded for zero commissions/zero exchange fees for the first $100,000 investment or 50 trades, then amana passes the exchange fees based on each exchange.

Disclaimer: Investing in physical shares carries risk. Trading leveraged derivatives and volatile digital assets is high-risk and requires caution.

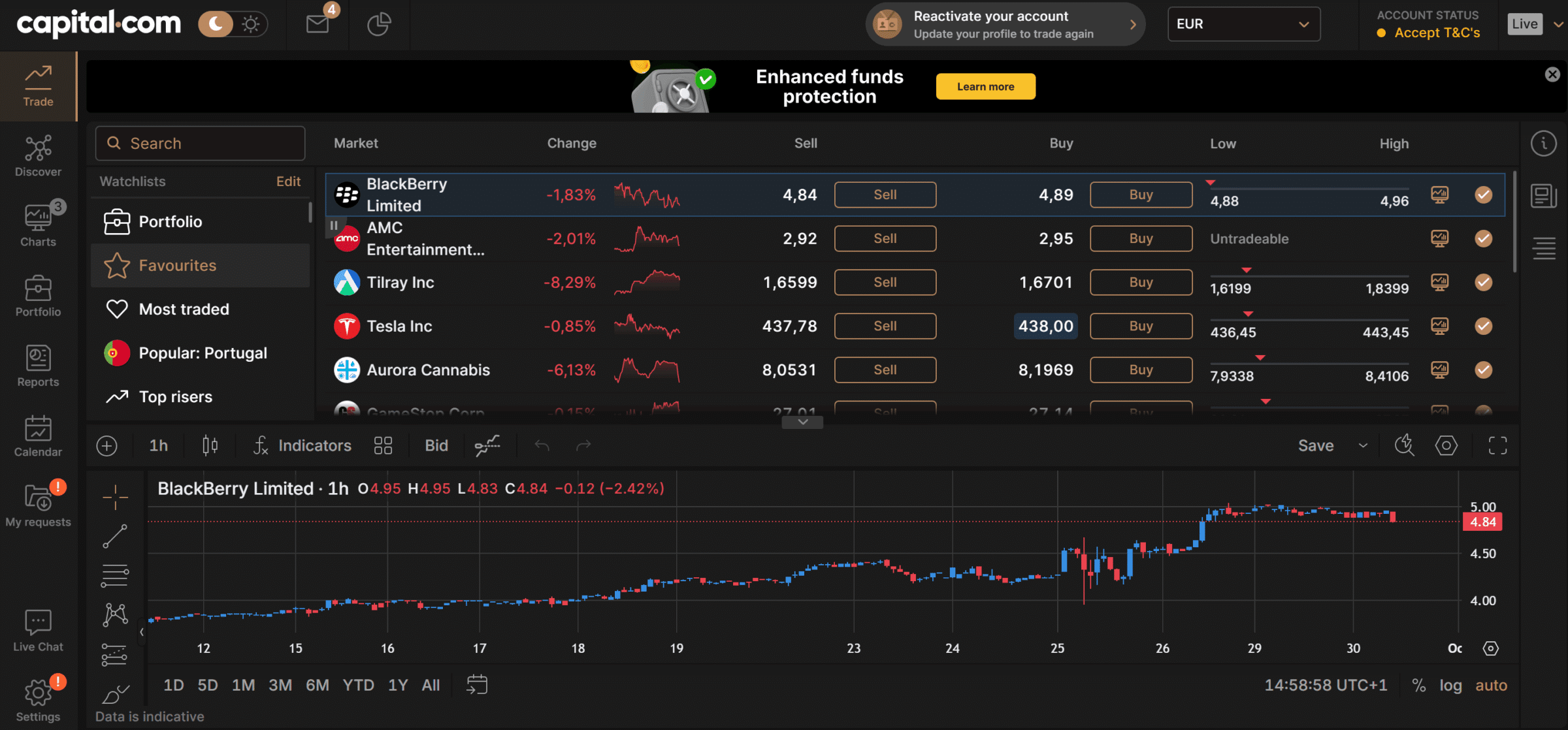

Capital.com at a glance

Founded in 2016, Capital.com is a global CFD trading platform that has quickly grown thanks to its commission-free model and user-friendly technology. Trusted by 750k+ traders worldwide, it offers access to a wide range of markets, including CFDs on forex, stocks, indices, commodities, and cryptocurrencies.

For UAE investors, one of the standout advantages is the ability to deposit and withdraw in AED without fees (other fees may apply). They offer their in-house web and mobile app (packed with smart tools such as AI-driven insights and risk management features), and you can also invest through the TradingView and MT4 platforms, where you can create automated investment strategies.

A free demo account is available to practice before investing real money. It also offers Islamic accounts. The customer support is Dubai-based, available 24/7 in English, and available in Arabic from 9:00 am to 6:00 pm Mon-Fri.

Capital.com doesn’t charge any commission on your trades. However, they charge a fee through the spread (the difference between the buy and sell price). Spreads are dynamic and change depending on the underlying market conditions. Still, you will get part of your spread back as a rebate each month.

On the downside, Capital.com is not a suitable platform for investors seeking traditional investment products, such as bonds, ETFs, or retirement accounts.

In terms of regulation, its UAE arm, Capital Com MENA Securities Trading LLC, holds a Category 1 license (No. 20200000176) from the Securities & Commodities Authority (SCA). Additionally, the company has a local office in Dubai, and customer support is available 24/7.

Pros

-

Minimum deposit of 20 USD/80 AED

-

Demo account

-

Customer support 24/7

-

Local regulator body and office

-

Extended trading hours (in index CFDs)

-

Lots of educational content, including on risk management

- Fee-free AED deposits

Cons

-

The product offering is still limited to CFDs (missing real assets)

-

It may be overwhelming for beginners

- Inactivity fee after 1 year

Plus500 at a glance

79% of retail CFD accounts lose money.

Plus500 is a broker founded in 2008 whose shares are traded on the London Stock Exchange and who operates in the UAE via the subsidiary Plus500AE Ltd, authorized and regulated by the Dubai Financial Services Authority (License No. F005651). Regulated by top-tier authorities such as FCA and CySEC, the broker provides a mobile app named Plus500 and a web-based platform called WebTrader. Both are comprehensive and easy to use, and you can test their features by opening a demo account.

When trading from the UAE, you can only access Plus500 CFD, where you can trade CFDs on several financial instruments but not real stocks. CFDs are leveraged and riskier products, which may exacerbate your losses.

Overall, the broker offers solid CFD stock trading platforms for Emirate customers. The platforms have low costs, reliability and safety, interesting features and products for beginners and experienced traders, and good usability. Besides, the broker allows customers to open Islamic accounts, aligning with Sharia principles. Their spreads are low, offering accounts in sixteen currencies, including USD, AED, EUR, and GBP. Still, they charge a 0.70% currency conversion fee and a $10 monthly fee following three months with no activity.

If you want to learn more about Plus500, please check our full Plus500 review.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

This information is NOT relevant to EU residents who are to be serviced by EU subsidiaries of the Plus500 Group, such as Plus500CY Ltd, authorized by CySEC (Reg. 250/14). Different regulatory requirements apply in Europe, such as leverage limitations and bonus restrictions.

Pros

- Acessible and responsive platform

- Low spreads

- No dealing commissions

- Demo Account

- Top-tier regulators

Cons

- No ETF offering

- Inactivity fee ($10 per month after no login activity in 3 months)

- High overnight funding fees

- Very little research and education provided

SAXO at a glance

62% of retail CFD accounts lose money.

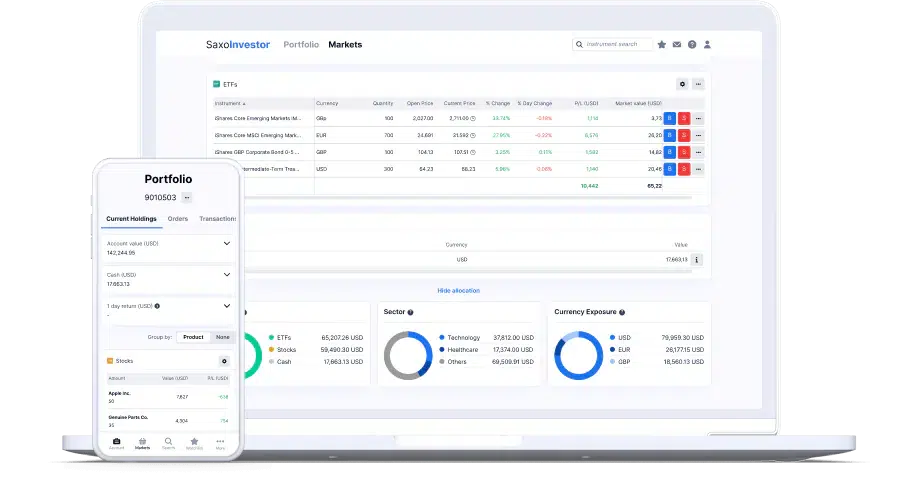

Saxo Bank is a Danish bank founded in 1992 and is a reliable option for advanced traders and beginners and provides safety, fair prices, and useful tools. Saxo operates in the UAE via its representative office in the UAE, whose license was issued by the Central Bank of the UAE. They offer in the UAE comprehensive and customizable mobile and web investment platforms that are among the best in the market: SaxoTraderGO and SaxoTraderPRO.

SaxoTraderGO is a user-friendly, customizable, and award-winning trading platform that experienced investors and beginners can use. The app has a mobile and a desktop version. The broker also offers SaxoTraderPRO, a desktop-based platform (that works on Windows and MAC) developed for advanced traders due to its level of detail and complexity. The app is extremely customizable, offers sophisticated tools to analyze and track your performance, and can be used on up to 6 different screens.

Considering that Saxo has excellent educational resources, low prices, and an impressive range of tradable assets, Saxo deserves a place on our list of the best online brokers in the UAE. The only downside we could think of is that after registering and completing the verification, you will need to fund your account with at least $5,000 to start trading, which can be burdensome for some beginners.

Pros

- Excellent research materials

- Outstanding trading platforms (SaxoTrader and SaxoInvestor)

- Extensive range of investment products

- Long track record

- Supervised by worldwide top-tier regulators

Cons

- High minimum deposit (varies between countries)

- Fees higher than average

- Fee structure is complex

- Does not accept US residents

Methodology

When making this list, we wanted to help Emirate investors to make an educated choice when choosing an online broker. Each one presented has its main features, and we tried to provide a diverse list that will suit the needs of different profiles of investors. In any case, this is what we took into consideration:

- Fees: the fees cannot be the only aspect to be considered when choosing the trading app to invest in, but it is definitely important, you do not want to pay more for a service when you can get the same quality for lower prices;

- Educational resources: high-quality educational resources may be a great advantage, especially for beginners, who can use them to educate themselves before investing money;

- Range of products and markets available: Does the app offer real stocks and ETFs, or only CFDs? Does it have crypto?

- Customer service: irrespective of your choice, problems almost always appear, and it is important to find trading apps developed to help you when it does happen;

- The trading platform (PC and mobile): we took into consideration the functionalities and usability of the platform, as well as its specific features.

- Security: all platforms in the list are regulated by top-tier authorities.

Conclusion

It is hard to choose the right online trading platform in the UAE. Luckily, we helped many people in the same situation before, and we can help you now. To facilitate your choice, we listed a few of the best online brokers in Dubai & UAE, in our opinion, comparing what they can offer and highlighting their strengths.

We know that investing is a good way to achieve financial freedom, but, like everything in life, there are risks involved. We hope that our analysis was enough to help you make an educated decision that acknowledges those risks, whether you are experienced or a novice in the world of trading.

If your focus extends beyond stocks and you’re specifically searching for the best Forex brokers in the UAE or the best crypto exchanges in the UAE, you can check our dedicated reviews where we discuss their main features, pros, cons, and more.

In any case, keep on studying, do due diligence, know your investment profile, and invest wisely! Please let us know if the article was helpful and if you have any other doubts or feedback!

Other FAQs

How financial markets are regulated in the UAE?

The UAE, comprising seven emirates – Abu Dhabi, Dubai, Sharjah, Ajman, Umm Al Quwain, Ras Al Khaimah, and Fujairah – is divided into two key regulatory regions: the Dubai International Financial Centre (DIFC) and the rest of the country.

The DIFC, established in 2002, is regulated by the Dubai Financial Service Authority (DFSA). This body oversees financial activities, including stock trading within the DIFC. Conversely, the remaining emirates are under the regulatory umbrella of the Securities and Commodities Authority (SCA), a federal government agency instituted in 2000. The SCA holds authoritative control over financial activities within security and commodity markets, overseeing prominent exchanges such as the Dubai Financial Market (DFM), the Abu Dhabi Securities Exchange (ADX), and NASDAQ Dubai.

What is the difference between a stock and a stock CFD?

While the stock gives you a property right over a share of the company, the CFD does not. The stock CFD is a derivative contract where the underlying asset is the stock and where the broker promises to pay you back the difference in value between the time you opened the position and the time you close it. CFDs have a leverage effect: if you buy a stock CFD and its price goes down, you will need to borrow money from the broker to keep the position open. This makes the instrument a risky option that is not suitable for beginners.

What is an Islamic account?

An Islamic account follows the principles of Islamic law, which forbids the use of interest or interest-based lending in any form. Many online brokers can accommodate Muslim traders and offer interest- or swap-free accounts.

Which has the best mobile trading app for the UAE?

An Islamic account follows the principles of shari’a, or Islamic law, that forbids the use of interest or interest-based lending in any form. Fortunately, many online brokers can accommodate Muslim traders and offer interest- or swap-free accounts. Swaps often bear an interest element.

Can I open an account with Revolut if I live in the UAE?

No, Revolut is not currently available for users in the UAE. For a comprehensive overview of Revolut’s availability and alternative options, refer to our article, Where is Revolut Available? Supported Countries & Alternatives, where we delve into the countries where Revolut is accessible. If you are situated in the UAE and seeking online brokers, explore the options outlined in this article to meet your investment requirements.

Is Robinhood available in Dubai and the UAE?

Unfortunately, Robinhood is not currently available in the UAE. However, you can explore the options detailed in this article to identify suitable alternatives for your investment needs in Dubai or in the UAE.