With many online brokers in France, finding the best one can be challenging.

Our extensive experience in this field – reviewing and monitoring dozens of online brokers daily – will guide you in finding exactly what you need, whether it’s earning interest on cash, a platform for ETFs, or trading forex.

In this article, we’ll present and compare the best trading platforms in France that we identified based on our experience.

Best online brokers in France in 2025

No time to read the whole article? Here are our suggestions for best brokers in France:

- Interactive Brokers: Best broker in France overall. On the downside, it might be a bit overwhelming for beginners

- eToro: Best online broker in France for beginners and social trading

- Scalable Capital: Leading broker in France with Robo-Advisor feature

- Freedom24: Best for access to high-yield ETFs (6%–12% in select cases)

- Saxo Bank: Best online broker for experienced investors

- DEGIRO: Top trading platform in France with a wide product portfolio

- Trading 212: One of the best online brokers with commission-free ETFs

- Pepperstone: Best app for CFDs and Forex trading

Disclaimer: Investing involves risk of loss.

✔️ All of them are authorized to operate in France by the Autorité des Marchés Financiers (AMF). As such, all are under investor protection schemes.

For a list of brokers we do not recommend, you can visit our full list of broker reviews, and filter by “Not recommended”.

Investing involves risk of loss.

62% of retail CFD accounts lose money.

Investing involves risk of loss.

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

74-89% of retail CFD accounts lose money.

Comparison of the best online brokers in France

Other resources

- Check our Youtube channel! You will find step-by-step guides of how to invest in the S&P 500 on different apps, as well as other educational videos about investing and investment platforms.

- Explore our tools: Check our comparison tool, reviews, broker bonuses, broker interest rates, BrokerMatch, and others.

Broker reviews

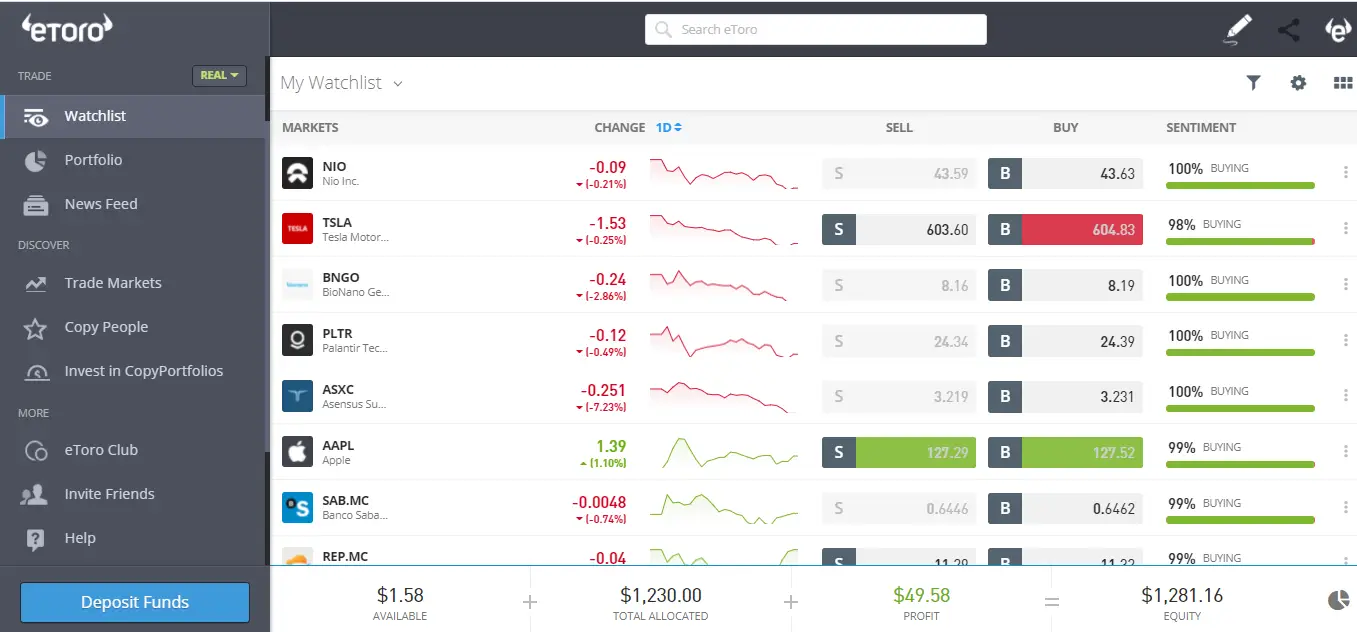

#1 eToro: Best online broker in France for beginners and social trading

eToro at a glance

One of the best trading platforms in France is eToro, an international online broker with over 35 million users who trade stocks, ETFs, cryptocurrencies and CFDs on stocks, ETFs, commodities, Forex and indices. It is known for its social trading feature, where you can copy the trades of other traders. There are thousands of verified traders on eToro, and you can pick the best trader based on past Return on Investment (ROI), risk profile, or other factors.

The eToro platform gives users access to over 3,000 financial instruments, including stocks and ETFs. Additionally, users can invest in ready-made investment portfolios (Smart Portfolios), a group of several assets or traders combined based on a theme or strategy.

eToro’s biggest strength is its zero commissions on ETFs, making it a cost-effective way for European investors to build a diversified portfolio. However, it’s no longer completely commission-free with most stock trades costing $1, and trades on Australia, Hong Kong, Dubai, and Abu Dhabi exchanges costing $2 per trade.

Opening an account and depositing is easy, and you can even try it out with virtual money (a demo account). On the downside, spreads can be high for some products.

eToro is fully regulated and supervised by top-tier regulators such as the UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC) in Australia. The subsidiary in Europe, formerly known as “eToro (Europe) Ltd,” is authorised and regulated by the Cyprus Securities Exchange Commission (CySEC).

If you want to learn more, check out our eToro Review.

Pros

- Low stock trading fees (from $0 per trade)

- Commission-free ETFs (other fees apply)

- Social trading and other innovative products

- Wide variety of financial products

- Slick, modern, and easy for anyone to use

- European users have access to three account currencies: EUR, USD and GBP

- Top tier regulators

Cons

- Limited disclosed financial information

- Withdraw and inactivity fees

- Spread, overnight, inactivity, and currency conversion fees higher than average

- Doesn’t offer bonds, futures, or options

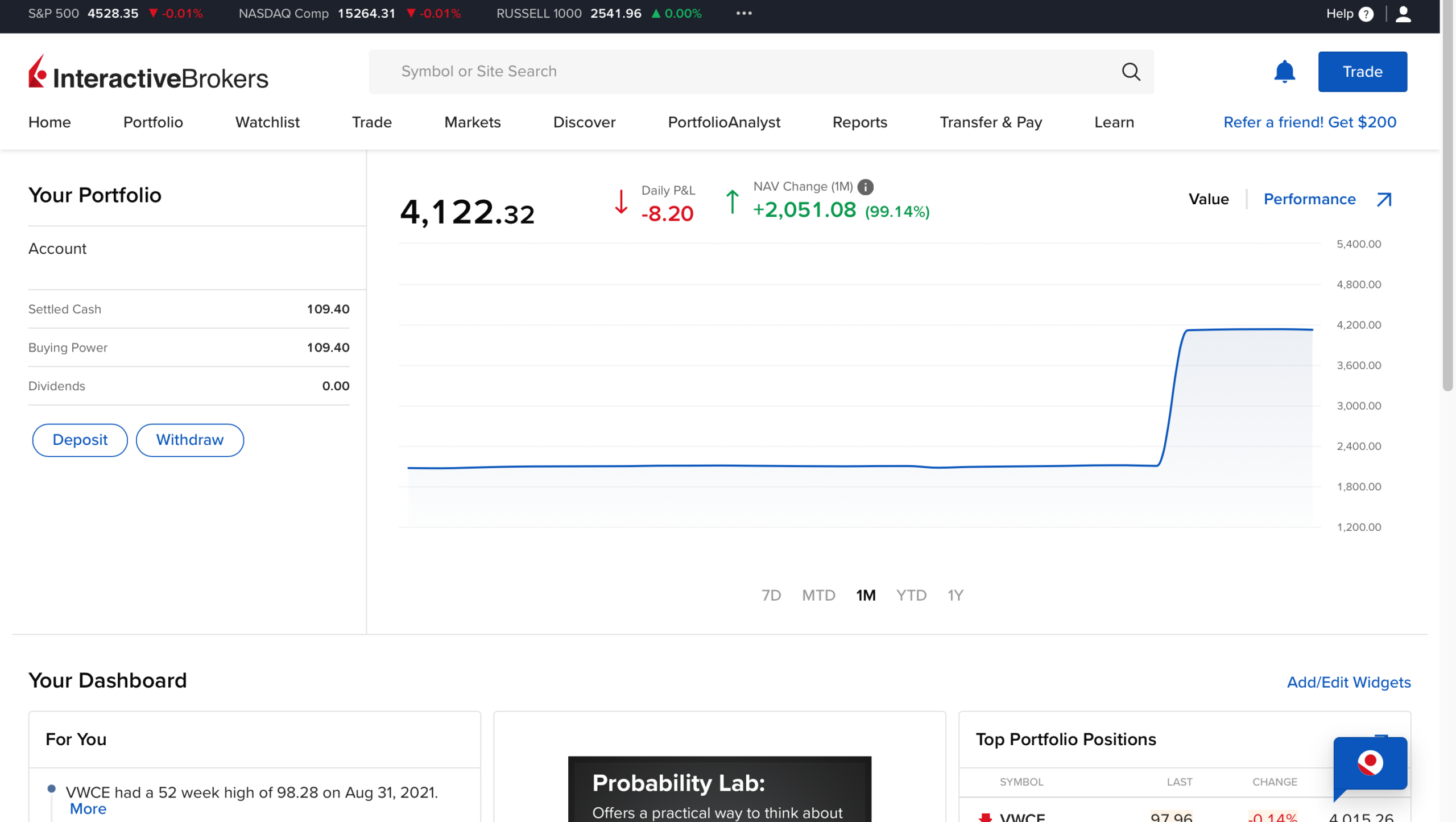

#2 Interactive Brokers: Best broker in France for lowest FX fees

Interactive Brokers at a glance

Another exceptional trading platform in France is Interactive Brokers. Founded in 1978 and publicly listed in NASDAQ (ticker: IBKR), Interactive Brokers is a global online broker that surpassed major financial crises, showing resilience and a rigorous risk management process.

Interactive Brokers offers an advanced investment platform that includes a wide range of products (stocks, options, mutual funds, ETFs, futures, bonds, and currencies) from +135 markets, solid trade execution (IB SmartRouting), and a set of technical and fundamental tools to help you in your investment decisions.

Beginners and intermediate investors have educational tools to explore, but the learning curve will be steep. Besides, customer service gives clear answers to your doubts, so there is no need to go back and forth.

On the downside, Interactive Brokers’ fee structure is quite complex, the registration process is lengthy (but fully online), and the broker doesn’t offer commission-free trading. However, when considering FX fees, narrower spreads, and the stock loan program, Interactive Brokers’ clients still get significant savings compared to most brokers.

Interactive Brokers also launched IBKR GlobalTrader, a modern mobile trading app to trade stocks, ETFs, and options, which is ideal for beginner investors. Some of the features of IBKR GlobalTrader include automatic currency conversions, fractional shares, and a demo account.

Want to know more about Interactive Brokers? Check our Interactive Brokers Review.

Pros

- Low commissions on US stock trading

- No monthly inactivity fee

- The broadest product and markets range in the brokerage industry

- Demo account

- Excellent reputation (founded in 1978)

- Extensive research and Education tools

- Has a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors, IBKR GlobalTrader.

- Offers interest on uninvested cash balances

Cons

- Complicated and lengthy account opening process (but fully online)

- Steeper learning curve for beginners

- Website is difficult to navigate

- Interactive Advisors (Robo-advisor feature) is only available for US customers

#3 Scalable Capital: Leading broker in France with Robo-Advisor feature

Scalable Capital at a glance

Founded in 2014, Scalable Capital is a German fintech that offers two services: Brokerage, where you can trade shares, ETFs, funds, crypto, and derivatives and invest via a savings plan by yourself, and a Wealth Service (Robo-advisor), where you get a personalized portfolio managed by Scalable Capital.

On the brokerage side, the range of available products is considerable: 7,500+ shares, 2,400+ ETFs, 3,000+ Funds, 70+ Crypto ETPs, and 375,000+ derivatives. It offers three pricing plans: “Free broker” for €0/month; “Prime Broker” for €2.99/month and “Prime Broker Flex” for €4.99. In all of them, you have free trading in a list of “PRIME ETFs”. Commission-free trading in shares is included in the “Prime Broker” plan.

Within the Wealth Service, you will only be presented with different portfolios/strategies using ETFs. First, you need to answer a short questionnaire to access your risk profile, and then an appropriate portfolio will be set for you. Up to €100,000, you are charged an annual management fee of 0.75%. You can pay the minimum annual fee of 0.49% if you deposit over €500,000.

Scalable Capital has regulatory permission from the German Federal Financial Supervisory Authority (BaFin) to provide securities services, and it is also supervised by the German Federal Bank (Deutsche Bundesbank). As such, it is a member of the investor compensation scheme, which protects your cash (up to €100,000) and your assets (limited to 90%, up to a maximum of €20,000 per investor).

Pros

- Stocks and ETFs commission-free (in PRIME Broker)

- €1 minimum deposit

- Interest on idle cash

- No custody fee

- Regulated by Bafin

Cons

- No access to US stock exchanges

- No fractional shares

- Limited crypto available

- €3.99 per trade on Xetra

#4 Freedom24: Best for investment in bonds

Freedom24 at a glance

Investing involves risk of loss.

Freedom24, part of Freedom Holding Corp. (NASDAQ: FRHC), has emerged as a standout brokerage platform for retail investors by providing access to a diverse range of global financial products, including stocks, bonds, futures, options and a strong focus on ETF investing.

Providing access to more than 3,600 ETFs, Freedom24 offers not only the most popular ETFs from global issuers like Vanguard, iShares, and Invesco, but also a range of investment strategies, including dividend-focused and short-term bond ETFs, as well as niche and high-yield options such as covered call and swap-based ETFs. If a specific ETF isn’t listed, clients can request its addition directly (a unique level of flexibility rarely seen in European brokerage platforms).

Freedom24 also launched Bonds Showcase, allowing small investments of just €/$1,000. It is a list of high-rated bonds (B+ and above) designed to offer investors a predictable and stable return. This new feature streamlines the process of finding and purchasing bonds, making it more accessible for investors seeking reliable market opportunities and long-term financial growth.

The platform’s web and mobile interfaces are intuitive and straightforward, complemented by market analysis tools (“Investideas”) and educational resources (“Freedom Academy”) to support investment decisions. Furthermore, it offers a signup promotion of up to 20 free stocks (worth up to $800 each).

With no minimum deposit, it presents two pricing plans: “Prime in EUR”, which you can get access to a personal manager and “Smart in EUR”, which is more adequate for investors with lower trading volumes. On the downside, it charges a withdrawal fee of €7 and offers no cryptocurrencies.

Freedom Finance Europe Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC). In the unlikely event that the segregated assets cannot be returned to clients, Freedom24 falls under the Investor Compensation Fund (ICF), which compensates for any losses from non-returned investments up to €20,000.

Want to learn more? Check out our Freedom24 Review or visit Freedom24 directly!

Pros

- Low commissions on stock and ETF trading

- No minimum deposit for general trading

- Demo trading

- Slick, modern, and easy for anyone to use

- No custody fee

Cons

- €7 per withdrawal

- No cryptocurrencies

#5 Saxo Bank: Best online broker for experienced investors

Saxo Bank at a glance

Launched in 1992, Saxo Bank is one of the most solid financial entities in the brokerage industry, with a proven track record of success. It lets you trade over 70,000 financial instruments through their trading platforms: SaxoTraderPRO (for PC) and SaxoTraderGO (on mobile).

The wide range of cash and margin trading products across global markets includes stocks, ETFs, bonds, mutual funds, cryptos, options, futures, CFDs, forex, and more! Saxo Bank presents its advanced research tools for “Buy and hold or trade on leverage”.

The Saxo Bank account tiers are the following:

- Classic: A minimum €2,000 deposit is required (depending on the country of residency; for France, there is no minimum deposit requirement), giving you access to tight spreads and customer and technical support 24/5.

- Platinum: A minimum €200,000 deposit is required. In addition to Classic features, it also lowers trading prices by up to 30% and prioritizes local-language customer support.

- VIP: A minimum €1,000,000 deposit is required. Here, you will find the best prices, access to trading experts, and exclusive event invitations.

The pricing structure will vary according to your account tier. For instance, a US stock order will be 0.08% of the trade value, with a minimum of $1 in Classic. However, within the VIP tier, the same trade would be 0.03% of the trade value with the same minimum of $1. Plus, for accounts with stocks, ETFs/ETCs, or bond positions, a custody fee of up to 0.15% p.a. will apply.

The listed prices are approximate and will differ based on the resident country. For precise pricing details, refer to the platform’s trade tickets for a comprehensive overview.

Saxo Bank A/S is a fully licensed European bank under the supervision of the Danish Financial Supervisory Authority (FSA). Saxo Bank is a member of the Danish Guarantee Fund, which protects client cash deposits up to €100,000 and financial securities (stocks, ETFs,…) up to €20,000 per client.

If you would like to learn more about Saxo, check out our Saxo review!

Pros

- Excellent research materials

- Outstanding trading platforms (SaxoTraderPRO and SaxoTraderGO)

- Extensive range of investment products

- Long track record

- Supervised by worldwide top-tier regulators

Cons

- High minimum deposit (varies between countries)

- Fees higher than average

- Fee structure is complex

- Does not accept US residents

#6 DEGIRO: Top trading platform in France with a wide product portfolio

DEGIRO at a glance

Investing involves risk of loss.

Founded in 2013, DEGIRO is a low-cost brokerage firm that has become very popular due to its low rates! With over 3 million users, the innovative platform has become widely known for its “do-it-yourself” philosophy in the sense that you have everything at your disposal to start investing on your own. It offers a wide range of financial assets to trade, including stocks, ETFs, bonds, options, futures contracts, warrants, investment funds, and some leveraged products (not quite the same as CFDs. More info here).

For instance, you can trade some ETFs for a low cost (a €1.00 flat handling fee – external costs – still apply) with no minimum amount required. The web trading platform is basic, but it is efficient and straightforward to use. In a matter of minutes, you get used to it. The same applies to its mobile app. On the downside, there is an absence of significant fundamental research, a €1.00 commission for US stocks, a €2.50 connectivity fee applies, and pricing alerts are missing.

Regarding security, DEGIRO is the Dutch branch of flatexDEGIRO Bank AG (a German-regulated bank). In the unlikely event that the segregated assets cannot be returned to clients, DEGIRO falls under the German Investor Compensation Scheme, which compensates any losses from non-returned assets up to 90% (with a maximum of €20,000), so do bear this in mind if you are planning to invest much larger volumes. Furthermore, any money deposited on a DEGIRO Cash Account with flatexDEGIRO Bank AG will be guaranteed up to €100,000 under the German Deposit Guarantee Scheme.

Still any doubts? Go through our DEGIRO Review!

Pros

- ETF Core Selection list (external fees apply)

- User-friendly web and mobile app

- Wide range of investment options

- Education material: Investor’s Academy and Investing with DEGIRO

- Low overall commission structure

- No account opening, inactivity, or withdrawal fee

Cons

- 0.25% currency conversion fee (charged if you deposit or invest in a different currency than your base currency)

- €/£1 flat handling fee (charged in most transactions)

- €/£2.50 of connectivity fee (paid annually), per exchange where you’re invested

- Does not offer Forex, CFDs, and Cryptos

- No ISA account (for UK residents)

- Low-quality customer support

- No interest paid on cash balances

#7 Trading 212: One of the best online brokers with commission-free ETFs

Trading 212 at a glance

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Founded in 2006, Trading 212 is a fintech based in London that aims to democratize the entire investment process through a simple mobile application. The company aims to do this by allowing anyone to invest in over 10,000 stocks and ETFs, Forex, commodities, CFDs, and cryptocurrencies. Over 15 million people have already downloaded the app.

In Trading 212, you will find commission-free stocks and ETFs trading, fractional shares, and even an automatic investment system (Robo-advisor). Opening an account is extremely quick and easy. On the downside, it shows limitations regarding available products, such as the lack of bonds and options. It charges a 0.15% currency conversion fee when buying assets in a currency different from your base account.

Within the app, you will notice two distinct sub-platforms: Trading 212 Invest, where you can trade a range of assets free of charge, and Trading 212 CFD, where you may trade leveraged financial products (CFDs).

On Trading 212 CFD, the currency conversion fee (FX fee) is higher (0.50%) than on Trading 212 Invest (0.15%).

The minimum deposit and withdrawal amounts are both €10. There are no deposit fees if you use bank transfer (other options include cards and Google/Apple Pay). For withdrawals, there is no fee, regardless of the method used.

In terms of safety, every Trading 212 is regulated by the following regulators: the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Supervision Commission (FSC).

If you want to learn more, check our Trading 212 Review.

Pros

- Commission-free Real Stocks and ETFs trading (other fees may apply. See terms and fees)

- AutoInvest & Pies feature

- Fast and easy account opening process

- Demo account

- Top Tier Regulators

- Free fractional shares worth up to €100

- High interest on uninvested cash

Cons

- Limited product portfolio (no Options, Bonds, Mutual Funds or Futures)

- No relevant Fundamental tools

- 0.15% of Foreign exchange fees

#8 Pepperstone: Best for forex and CFDs

Pepperstone at a glance

74-89% of retail CFD accounts lose money.

Pepperstone, founded in 2010, has positioned itself as one of the largest Forex and CFD brokers, helping over 400,000 retail trading accounts worldwide. It has earned several rewards for its exceptional services, notably receiving the “Best MT4 and MT5 Broker” award for 2025 by us.

Pepperstone operates under strict regulations from top-tier authorities like ASIC and FCA, reinforcing its dedication to providing a secure and trustworthy trading environment. The broker offers various trading platforms, including MetaTrader 4, MetaTrader 5, cTrader and TradingView, with features such as advanced charting and automated trading.

Account types cater to various trader needs. The Razor account, favoured by scalpers and users of Expert Advisors, offers spreads starting from zero pips with a small commission, while the Standard account incorporates commissions into the spread rate and is suitable for those preferring a straightforward approach to trading.

Pepperstone is best for traders focused on CFDs/forex – it is even endorsed by the r/Forex subreddit—the largest forex community on the internet—alongside Interactive Brokers, which further attests to its credibility in the forex/CFD community.

On the downside, Pepperstone focuses on CFDs – no real stocks, shares, or crypto -, and it offers no interest your cash balances, a valued feature offered by other brokers.

Pros

- Quick customer support response times

- No fees for deposits, withdrawals, or account inactivity

- Competitive spreads in the Razor account with active trader rebates

- High leverage options up to 1:500 for Pro clients; Max retail leverage 1:400 (depending on location)

Cons

- Limited to CFD trading; no direct asset ownership

- Higher Forex spreads in the standard account

- Crypto offerings are limited compared to competitors

- Limited educational resources

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Which platform should you choose?

Consider various factors when selecting an online broker, including fees, regulatory compliance with top-tier institutions like the Autorité des Marchés Financiers (AMF) in France, and the variety of tradable products. For example, not all platforms have a demo account, so assess these aspects to make an informed choice.

The best online broker in your specific case will depend on your profile, preference, and objectives. Explore the websites above and decide for yourself!

A reminder that the above should not be seen as investment advice and should be considered information only. Investors should do their own research and diligence about the best-suited services and opportunities for their risk, returns, and impact strategy.

FAQs

How to invest in stocks from France?

You can use one of the online brokers shown above: eToro, Interactive Brokers, Saxo Bank, DEGIRO, Scalable Capital, and Trading 212. Most US-based stock brokers are not available in France (like Robinhood, Vanguard, or TD Ameritrade).

What is a brokerage company?

It is an entity designed to be the middleman between you and the people you are trying to buy or sell a stock, ETF, crypto,… you name it!

Which broker is best in France?

There is no single answer. It depends on what you value most: fees, security, investment platform or any relevant feature.

What are the types of investments you can make with a brokerage account?

You can trade stocks, ETFs, Forex, Bonds, Futures and CFDs on stocks, ETFs, indices, cryptocurrencies, commodities.

How to recognize a good broker?

A good broker is regulated by a reputable financial authority, offers a user-friendly platform, provides transparent fee structures, and has positive customer reviews. Additionally, a good broker aligns with your trading preferences and offers a variety of trading instruments and educational resources.

What are “pips” in trading?

“Pips” in trading refer to the smallest price movement in a currency pair. It stands for “percentage in point” and is typically the last decimal place in a price quote. Pips are crucial for measuring price changes, determining profit or loss, and expressing spread in the forex market.

Which broker in France has the lowest fees?

Brokers often adjust their fee structures, and new platforms emerge. It’s recommended to compare current fee schedules, taking into account trading commissions, spreads, and other costs. Always verify the latest fee information directly from the broker’s website or contact their customer support for the most accurate details.