Have you ever wondered if you are really buying a share (or any other “real” asset) in your brokerage account? In other words, are you actually a legit owner of a piece of a company or is it only a “number” on your screen?

From our research, we have concluded that a considerable number of investors are not fully aware of the differences between owning a CFD and a Real Product (represented here by shares). Many of these investors are actually investing in CFDs rather than in Real Products without even knowing it.

In this article, we’ll get through the main differences between these two financial products so that, in the future, you can make better-informed decisions.

From now on, we will use Shares (or Stocks) as an example of a Real product and CFDs on Shares (or Stocks) as an example of a CFD to help you better grasp the concepts.

Stock and shares are two terms are used interchangeably, but there are differences (yet small). “Stocks” is a generic term used to describe a slice of ownership of one or more companies. In contrast, “Shares” has a more specific meaning: it often refers to the ownership of a particular company.

A share is just proof of property. Thus, with a share, you become part-owner of a company. You are fully entitled to any dividends distributed or capital appreciation of the company over time. It is like having a piece of your local bakery. If the business goes well, you get your share of the profits; if it doesn’t, you may lose some money or all of it in case it goes bankrupt.

What is a CFD?

A CFD, Contract for difference, is financial jargon to tell you, among other things, that you do not actually own the asset. You have an instrument that reflects what a share does in the market. In essence, it’s a contract between you and the broker, where they promise to pay you any profits that you make through your CFDs trading activity, even if they didn’t buy the real asset for you.

Formally, it is a financial derivative created by financial institutions to give exposure to certain assets (long or short). It works as an agreement between you and the CFD broker that promises to give you the difference in the value of a financial product between the time you open and close the contract. You can voluntarily cease the contract at any time or be obligated to do so if you do not have the minimum margin required.

Yeah, that can happen, and the reason for it is called: leverage. In CFDs trading, you invest your own money (the margin) and borrow money from your broker. If the value of the assets goes the opposite way of your original trade (go down/up when you expected to go up/down), you will be required to inject more of your money, or the trade may be closed by the broker.

Example: You are investing in a CFD of Amazon that is trading at $100. Assume you want to buy 1,000 CFDs because you think the price will go up. Amazon has a margin rate of 5%, which means that you only have to deposit 5% of the position’s value as position margin. Your CFD position margin (your money) will be $5,000 (5% x (1,000 units x $100)). Remember that if the price moves against you, you could lose more than your initial position margin of $5000 on that specific trade. However, if that were all the amount of money you had on your CFD trading account, you would not lose more than $5,000 due to the Negative Balance protection followed by the August 2018 restrictions in CFD trading by the European Securities and Markets Authority (ESMA) – only applies to European regulated Brokers and investors.

eToro

NAGA

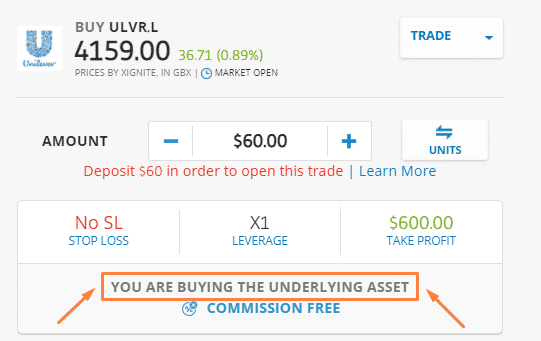

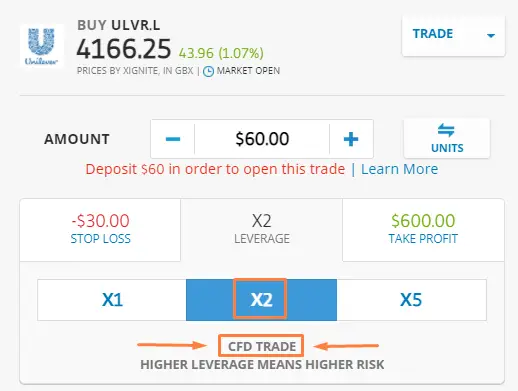

In eToro, before placing an order, you can clearly distinguish between trading the underlying assets (“the real thing”) or a CFD for the same company (Unilever in the illustration).

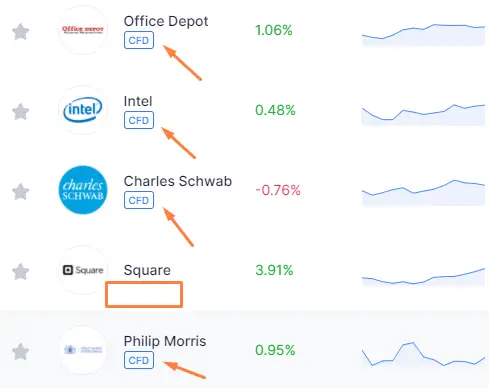

In NAGA, the same logic applies (no “CFD” under a company’s name means that it is a real stock), but, in this case, you can observe that even before choosing what asset to buy/sell.

Are there any particular charges when trading CFDs?

Most of the time, commissions, spread, and currency conversion fees will be applied whenever you buy/sell a Real share or a CFD. What additional charges do I have by trading CFDs?

You will be paying what is called “overnight funding”. Since you are using borrowed money, you pay interest on that capital. For instance, in eToro, the finance rate is 6.4% + LIBOR (per year) in long positions. Let’s use some numbers:

- Duration of the investment: 24h

- Investment amount: $2,000

- Price per share: $250

- Nº of shares: 8

- Overnight funding: (6.4% + LIBOR)/365

Result: ((0,064 + 0,0199) / 365)*8 shares*250 USD = 0,46 USD (cost per each day you hold the CFD). This cost will vary since the price per share and LIBOR are not constant.

Are CFDs on stocks riskier than Real Stocks?

CFDs are like a weapon. It may be used for good or bad. In pure terms of market movements and exposure, investing $100 of your own money or $20 of your capital plus $80 borrowed money (5x leverage) should give you the same exposure before fees.

Where is the danger in CFDs trading? It all starts when you place an order. Following the previous example, you could mistakenly invest $100, thinking that it is your maximum exposure when, in reality, that’s the 20% margin and not the full investment amount. With 5x leverage, you would be exposed by $500 instead of only $100.

Please, check all the details before placing an order!

What is the most suited for each type of investor?

Generally speaking, CFDs are a great tool when used for particular purposes such as easily going short, increase exposure using leverage, access a wider range of products and even trade them outside of normal trading hours and hedging your portfolio but… are much more complex and risky! Having said that, CFDs are more designed for experienced traders and/or short to medium trades.

From a long-term perspective and as a beginner, buying a real stock should be the best option to go for. Since you are not leveraged, you do not incur overnight funding costs, which may severely affect your long term performance.

|

Instrument

|

CDFs | Shares |

|

What am I investing in? |

A financial derivative that gives the same exposure to a real asset but does not give the possession of the real asset itself. |

The physical shares of a company. |

|

Does it use leverage? |

Yes. |

No. |

|

When can I trade? |

It is flexible, so you are not limited to the market schedule. |

Only when the market is open. |

|

Do I receive dividends? |

Yes (exceptions and adjustments may occur). |

Yes. |

|

What fees may be involved? |

Since you are leveraged, you pay overnight funding. Also, spreads, commissions, currency conversion fees. |

Commissions, spreads, currency conversion fees. |

|

Do I have counterpart risk? |

Yes. From the CFD broker. |

No. |

|

How does it work when I buy $100 worth of an asset? |

If it offers 5x leverage, you just need to allocate $20 of your own capital (80$ are borrowed). |

You use $100 of your own capital. |

|

For what kind of traders/investors? |

Generally, more suited to short and medium-term traders, and experienced professionals. |

Most used for long-term investors. |

If you did not fully understand the differences, memorize this: in CFDs, you do not own any asset and generally use leverage. In Shares, you have the right to claim a piece of the company in the same way you claim your bicycle or car property.