Finding the best brokers in Poland may seem like a daunting task, particularly if you’re just getting started (I was in your shoes some years ago!).

In this post, we will provide you with a detailed look at what we consider to be the best online brokers in Poland. Whether you’re new to trading and looking for a user-friendly platform, or you’re interested in various investment alternatives (ETFs, cryptocurrencies, CFDs,…), there is a solution for you!

Best brokers in Poland – Top 7 list

- eToro: Best broker for commission-free ETF investing and social trading

- Interactive Brokers: Best broker overall

- XTB: Best broker for Low Forex spreads

- Freedom24: Best for investment in bonds

- Plus500: Best broker for CFDs

- Saxo Markets: Best broker for professionals

- Trading 212: Best broker for beginners and auto-invest

61% of retail CFD accounts lose money.

69-80% of retail CFD accounts lose money.

Investing involves risk of loss.

82% of retail CFD accounts lose money.

62% of retail CFD accounts lose money.

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Best brokers in Poland – Comparison table

For a list of brokers we do not recommend, you can visit our full list of broker reviews, and filter by “Not recommended”.

Broker reviews

#1 Interactive Brokers: Best online broker in Poland overall

Interactive Brokers leads the list as the best online broker in Poland.

Founded in 1978, Interactive Brokers is one of the largest international brokers listed on the NASDAQ exchange (Ticker: IBKR). It is regulated by many international top-tier regulators, including the FCA, with no minimum deposit requirement.

It caters to both beginners and professional investors looking for any type of financial products (bonds, ETFs, shares, you name it!), an easy-to-use platform, advanced technical and fundamental trading tools, and a great educational component.

Interactive Brokers supports various account base currencies, including GBP, USD, EUR, and other major currencies. However, funding these accounts is limited to bank transfers. They offer one of the tightest spreads in the market, ensuring favourable trading conditions, but their commission is tier-based, meaning it varies depending on your monthly trading volume.

IBKR GlobalTrader is another mobile trading app offered by Interactive Brokers that allows traders to engage in simple and worldwide trading. The app offers the flexibility to trade in fractions and invest with as little as $1, making trading accessible to traders of all levels. You can also open a simulated trading account to practice trading before opening a live account and gain access to $10,000 in simulated cash to trade in a simulated trading environment.

On the downside, you might be overwhelmed by the number of buttons and features available on each platform, especially if you are new to investing. However, Interactive Brokers offers a lot of educational materials and video tutorials to assist you in navigating and utilizing their platforms effectively. These resources can be beneficial regardless of the specific platform you are trading or using.

Want to know more? Check out our comprehensive Interactive Brokers review and visit IBKR’s website.

Pros

- Low commissions on US stock trading

- No monthly inactivity fee

- The broadest product and markets range in the brokerage industry

- Demo account

- Excellent reputation (founded in 1978)

- Extensive research and Education tools

- Has a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors, IBKR GlobalTrader.

- Offers interest on uninvested cash balances

Cons

- Complicated and lengthy account opening process (but fully online)

- Steeper learning curve for beginners

- Website is difficult to navigate

- Interactive Advisors (Robo-advisor feature) is only available for US customers

#2 eToro: Best for commission-free ETF investing and social trading

61% of retail CFD accounts lose money.

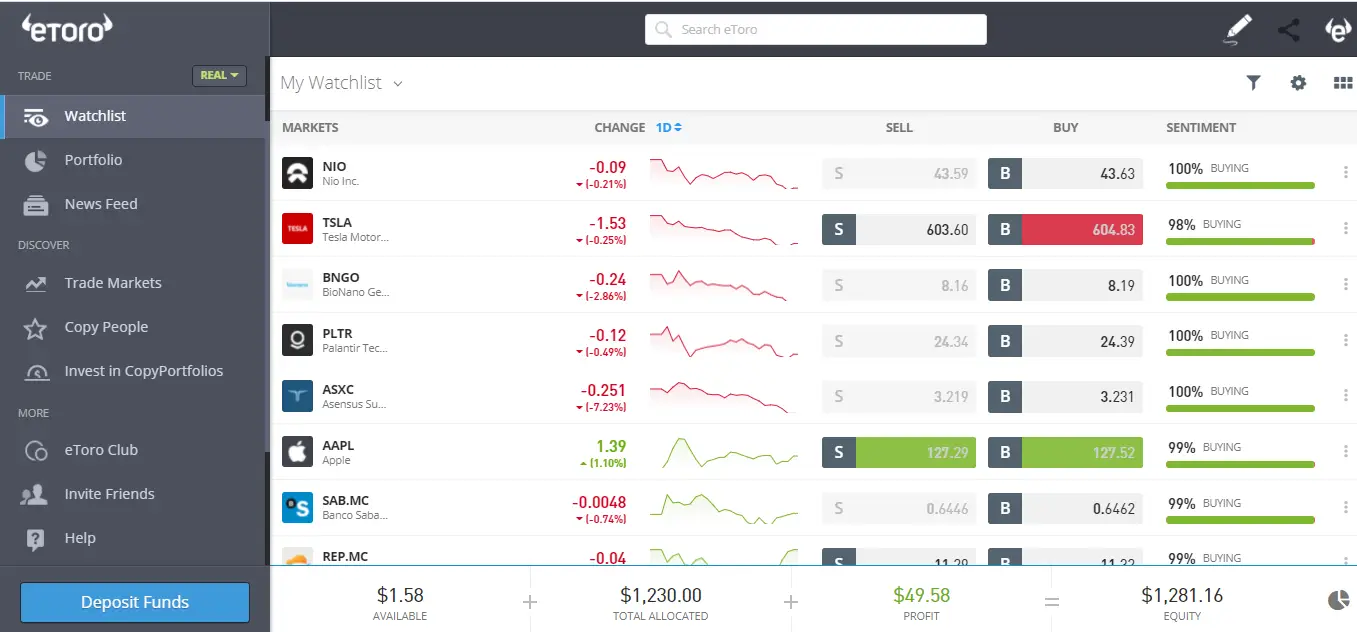

Another exceptional trading platform in Poland is eToro, an international online broker with over 38 million users who trade stocks, forex, commodities, cryptocurrencies, CFDs, and ETFs. It is known for its social trading feature, where you can copy the trades of other experienced traders. There are thousands of verified traders on eToro, and you can pick the best trader based on past Return on Investment (ROI), risk profile, or other factors.

The eToro platform gives users access to over 3,000 different financial instruments, including stocks and ETFs. Additionally, users can invest in ready-made investment portfolios (Smart Portfolios), a group of several assets or traders combined together based on a theme or strategy.

Plus, eToro offers commission-free ETF trading in Poland. In terms of stocks, you will pay $1 per trade in any US or European stock exchange, but $2 for Australia, Hong Kong, Dubai, and Abu Dhabi exchanges.

Opening an account and depositing is easy, and you can even try it out with virtual money (a demo account). On the downside, spreads can be high for some products.

If you want to learn more, check out our eToro Review.

Pros

- Low stock trading fees (from $0 per trade)

- Commission-free ETFs (other fees apply)

- Social trading and other innovative products

- Wide variety of financial products

- Slick, modern, and easy for anyone to use

- European users have access to three account currencies: EUR, USD and GBP

- Top tier regulators

Cons

- Limited disclosed financial information

- Withdraw and inactivity fees

- Spread, overnight, inactivity, and currency conversion fees higher than average

- Doesn’t offer bonds, futures, or options

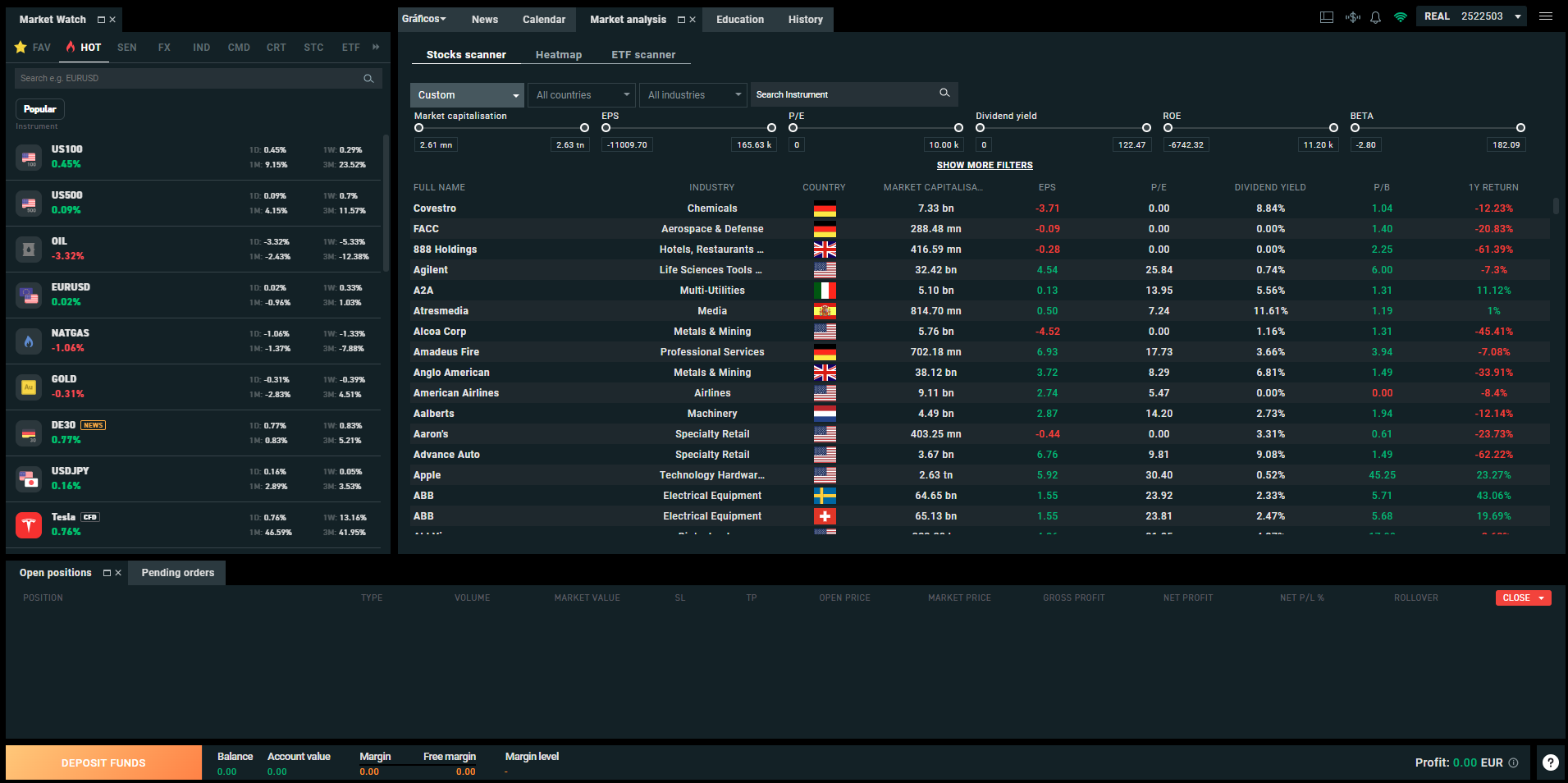

#3 XTB: Best broker for Low Forex spreads

69-80% of retail CFD accounts lose money.

Founded in 2002, XTB is a major player in the brokerage industry with extensive worldwide experience, regulated by the Financial Conduct Authority (FCA) – plus other relevant regulatory bodies – and listed on the Warsaw Stock Exchange.

The platform offers 0% commissions on stocks. However, its software is more oriented to CFDs and forex trading with competitive costs.

Opening an account and transferring money is a quick and hassle-free process. For beginners, it presents a demo account where you can trade as if it were real money to help you feel the investment platform firsthand, and you get access to educational tools. For intermediate and advanced investors, you will find plenty of technical and fundamental tools to help you better assess your investment decisions.

XTB also offers other financial products, such as commodities and cryptocurrencies. XTB charges high commissions on CFDs of cryptocurrencies but low costs for Forex. Besides, you will face an inactivity fee of €10/month after one year of non-trading and if you have not made any deposit in the last 90 days.

Still any doubts? Go through our XTB Review!

Pros

- Free stocks trading (only applicable to some countries)

- Customizable trading platform (charts and workspace)

- Low Forex Spreads

- Demo account

- No minimum account deposit

- Valuable education materials

- Top-tier Regulators

Cons

- Complex trading platform for a beginner

- High Stock CFD spreads

- Limited product portfolio

- Withdrawal fees for transfers below $100

- Inactivity fee (€10/monthly after 1+ year with no activity plus no deposit in the last 90 days)

#4 Freedom24: Best for investment in bonds

Investing involves risk of loss.

Freedom24, part of the Freedom Holding Corp., has emerged as a cost-effective brokerage option for retail investors compared to traditional brokerage firms. This broker provides access to a diverse range of global financial products, including stocks, ETFs, bonds, futures, and options.

Freedom24 launched Bonds Showcase, allowing small investments of just €/$1,000. It is a list of high-rated bonds (B+ and above) designed to offer investors a predictable and stable return. This new feature streamlines the process of finding and purchasing bonds, making it more accessible for investors seeking reliable market opportunities and long-term financial growth.

The platform’s web and mobile interfaces are intuitive and straightforward, complemented by market analysis tools (“Investideas”) and educational resources (“Freedom Academy”) to support investment decisions. Furthermore, it offers a signup promotion of up to 20 free stocks.

With no minimum deposit, it presents two pricing plans: “Prime in EUR”, which you can get access to a personal manager and “Smart in EUR”, which is more adequate for investors with lower trading volumes. On the downside, it charges a withdrawal fee of €7 and offers no cryptocurrencies.

Freedom Finance Europe Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC). In the unlikely event that the segregated assets cannot be returned to clients, Freedom24 falls under the Investor Compensation Fund (ICF), which compensates for any losses from non-returned investments up to €20,000.

Want to learn more? Check out our Freedom24 Review or visit Freedom24 directly!

Pros

- Low commissions on stock and ETF trading

- No minimum deposit for general trading

- Demo trading

- Slick, modern, and easy for anyone to use

- No custody fee

Cons

- €7 per withdrawal

- No cryptocurrencies

#5 Plus500: Best EU Broker for CFDs

82% of retail CFD accounts lose money.

Founded in 2008, Plus500 is an online broker offering a wide range of financial products, including real shares and CFDs on forex, indices, shares, commodities, options, ETFs, and cryptocurrencies. It is available in over 50 countries and is listed on the London Stock Exchange.

There are two distinct account types:

- Plus500 CFD: It only focuses on CFD products;

- Plus500 Invest: Where you can trade stocks (real shares);

As a side note, Plus500 Futures, a platform only available for US users and where you can trade Futures, is also part of the Plus500 group.

The web platform you will use is the WebTrader, Plus500’s proprietary platform, offering a stable trading experience and reliable access from multiple devices, including a mobile app. All platforms are accessible and responsive, and you can start testing the features by opening a demo account.

Their customer support is helpful and readily assesses through a chat that is always shown on the trading platform. Their spreads are low, offering accounts in sixteen currencies, including USD, EUR, and GBP. Still, they charge a 0.70% currency conversion fee and a $10 monthly fee following three months with no activity. On Plus500 Invest, they only charge a small commission per trade (US market: $0.006/share).

Finally, it is regulated by financial regulators like the FCA and CySEC, meaning that Plus500 is appropriately supervised and that there is an investor protection scheme under the entity in which you open an account. For instance, when you open an account as a Polish investor through Plus500CY Ltd, you are protected up to €20,000. Additionally, Plus500 provides negative balance protection for CFD trading on a per-account basis – only to retail clients from the European Union.

Want to know more about Plus500? Check our Plus500 Review.

Pros

- Acessible and responsive platform

- Low spreads

- No dealing commissions

- Demo Account

- Top-tier regulators

Cons

- No ETF offering

- Inactivity fee ($10 per month after no login activity in 3 months)

- High overnight funding fees

- Very little research and education provided

#6 Saxo: Best broker in Poland for professional traders

62% of retail CFD accounts lose money.

Launched in 1992, Saxo Bank is one of the most solid financial entities in the brokerage industry, with a proven track record of success. It lets you trade over 70,000 financial instruments through their trading platforms: SaxoTraderPRO (for PC) and SaxoTraderGO (on mobile).

The wide range of cash and margin trading products across global markets includes stocks, ETFs, bonds, mutual funds, cryptos, options, futures, CFDs, forex, and more! Saxo Bank presents its advanced research tools for “Buy and hold or trade on leverage”.

The Saxo Bank account tiers are the following:

- Classic: A minimum $2,000 deposit is required (depending on the country of residency), giving you access to tight spreads and customer and technical support 24/5.

- Platinum: A minimum $200,000 deposit is required. In addition to Classic features, it also lowers trading prices by up to 30% and prioritizes local-language customer support.

VIP: A minimum $1,000,000 deposit is required. Here, you will find the best prices, access to trading experts, and exclusive event invitations.

The pricing structure will vary according to your account tier. For instance, a US stock order will be 0.08% of the trade value, with a minimum of $1 in Classic. However, within the VIP tier, the same trade would be 0.03% of the trade value with the same minimum of $1. Plus, for accounts with stocks, ETFs/ETCs, or bond positions, a custody fee of up to 0.15% p.a. will apply.

Saxo Bank A/S is a fully licensed European bank under the supervision of the Danish Financial Supervisory Authority (FSA). Saxo Bank is a member of the Danish Guarantee Fund, which protects client cash deposits up to €100,000 and financial securities (stocks, ETFs,…) up to €20,000 per client.

Pros

- Excellent research materials

- Outstanding trading platforms (SaxoTraderPRO and SaxoTraderGO)

- Extensive range of investment products

- Long track record

- Supervised by worldwide top-tier regulators

Cons

- High minimum deposit (varies between countries)

- Fees higher than average

- Fee structure is complex

- Does not accept US residents

#7 Trading 212: Best broker for beginners and auto invest

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Founded in 2006, Trading 212 is a fintech based in London that aims to democratize the entire investment process through a simple mobile application. The company aims to do this by allowing anyone to invest in over 10,000 stocks and ETFs, Forex, commodities, CFDs, and cryptocurrencies. Over 15 million people have already downloaded the app.

In Trading 212, you will find commission-free stocks and ETFs trading, fractional shares, and even an automatic investment system (Robo-advisor). Opening an account is extremely quick and easy. On the downside, it shows limitations regarding available products, such as the lack of bonds and options. It charges a 0.15% currency conversion fee when buying assets in a currency different from your base account.

Within the app, you will notice two distinct sub-platforms: Trading 212 Invest, where you can trade a range of assets free of charge, and Trading 212 CFD, where you may trade leveraged financial products (CFDs).

If you want to learn more, check our Trading 212 Review.

Pros

- Commission-free Real Stocks and ETFs trading (other fees may apply. See terms and fees)

- AutoInvest & Pies feature

- Fast and easy account opening process

- Demo account

- Top Tier Regulators

- Free fractional shares worth up to €100

- High interest on uninvested cash

Cons

- Limited product portfolio (no Options, Bonds, Mutual Funds or Futures)

- No relevant Fundamental tools

- 0.15% of Foreign exchange fees

How to choose the best broker in Poland?

Choosing the best broker in Poland is important for a good trading experience. Here are simple steps to help you make the right choice:

- Check regulation: Look for brokers regulated by trusted authorities like FCA or CySEC to ensure they follow rules and protect your money.

- Fees and commissions: Compare fees and commissions. Lower costs mean more money stays in your pocket.

- Trading platforms: Check if the broker offers user-friendly platforms that suit your needs. A good platform is crucial for smooth trading.

- Financial instruments: Make sure the broker provides a variety of financial instruments, so you can trade what you’re interested in.

- Customer support: Test customer support. A responsive and helpful team is important if you have questions or issues.

- Reputation: Research reviews and ratings from other users to get an idea of the broker’s reputation. A good reputation indicates trustworthiness.

By considering these factors, you can pick the best broker in Poland for your trading goals.

Other resources

- Check our Youtube channel! You will find step-by-step guides of how to invest in the S&P 500 on different apps, as well as other educational videos about investing and investment platforms.

- Explore our tools: Check our comparison tool, reviews, broker bonuses, broker interest rates, BrokerMatch, and others.

Bottom line

In conclusion, choosing the best online broker in Poland depends on individual preferences and trading goals. Our top picks include:

Interactive Brokers

Known for low commission and a wide range of financial products.eToro

Renowned for commission-free ETF investing and social trading.XTB

Ideal for commission-free ETF trading, and low forex spreads.Freedom24

Best for investment in bonds.Plus500

Best for CFDs, offering accessibility and low spreads.Saxo

Suited for professional traders, offering an extensive range of investment products.Trading 212

Known for auto-investing and Pies feature.

Consider factors like regulation, fees, trading platforms, available financial instruments, and customer support when making your choice. Always conduct thorough research based on your risk tolerance and investment strategy.

FAQs

Is Charles Schwab available in Poland?

No, Charles Schwab is unavailable in Poland. It is primarily a US broker. However, it accepts new accounts from a handful of other countries.

How to invest in stocks from Poland?

You can use one of the online brokers shown above: Interactive Brokers, eToro, XTB, Plus500, Saxo, and Trading 212.

What is a brokerage company?

It is an entity designed to be the middleman between you and the people you are trying to buy or sell a stock, ETF, crypto,… you name it!

Which broker is best in Poland?

There is no single answer. It depends on what you value most: fees, security, investment platform or any relevant feature.

What are the types of investments you can make with a brokerage account?

You can trade stocks, ETFs, Forex, Bonds, Futures and CFDs on stocks, ETFs, indices, cryptocurrencies, commodities.

Can I invest in US stocks from Poland?

Yes, you can invest in US stocks from Poland. To do so, you’ll need to open an international brokerage account that allows trading on US stock exchanges.