Investing in the stock market has never been easier, thanks to the many trading apps available today. Choosing the best stock trading app in Singapore can be challenging, but we’ve reviewed and analyzed numerous platforms to help you decide. In this article, we compare Singapore’s top stock trading apps, highlighting their features and strengths.

Best stock trading apps in Singapore

- Interactive Brokers: Best overall

- Plus500: Ideal for CFDs

- Saxo Bank: Best for advanced investors

Best stock trading apps in Singapore compared

| Broker | Fees on stocks | Minimum deposit | Trading apps |

| Interactive Brokers | Between $0.0005 and $0.0035 per US share. Between 0.01% and 0.08% for other markets. | S$0 | IBKR GlobalTrader, IBKR Mobile and Trader Workstation |

| Plus500 | $0.006 per share on US stocks and 0.045% on European stocks with a minimum of €2 per order (only on Plus500 Invest) | S$100 | Plus500 WebTrader |

| Saxo Bank | Between 0.03% and 0.08% of the trade value for US stocks with a minimum of $1 per trade | S$2,000 | SaxoTraderGO and SaxoTrader Pro |

#1 Interactive Brokers

Interactive Brokers has proven to be one of the most reliable brokers in the market. The broker, licensed and regulated by the Monetary Authority of Singapore via the subsidiary Interactive Brokers Singapore Pte. Ltd. (License No. CMS100917), was founded in New York over 40 years ago and survived many financial crises, making it a well-established and trustworthy broker that many top-tier regulators regulate.

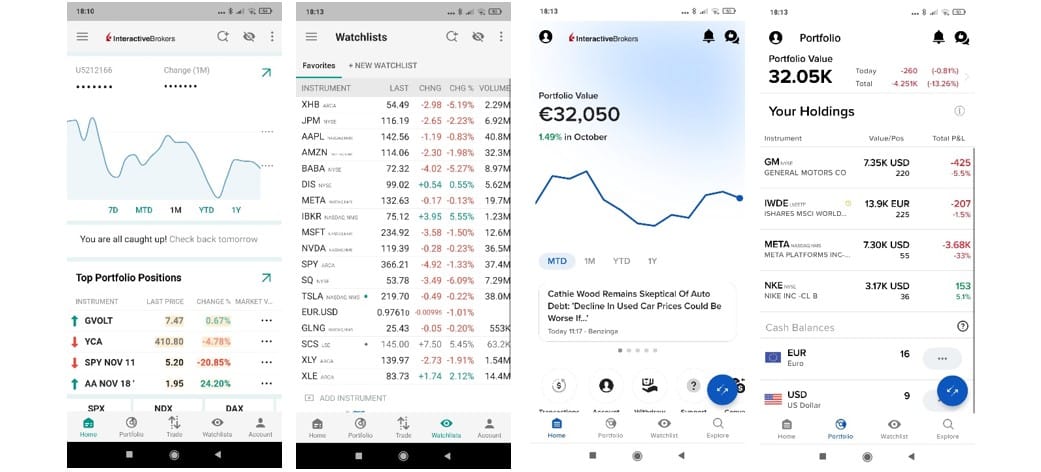

They offer trading apps with sophisticated and powerful tools, a wide range of products available for trading, and low prices. The broker offers different mobile apps and web-based platforms that you can use based on your knowledge and experience. The mobile app IBKR GlobalTrader is a user-friendly app suitable for beginners because it simplifies investments without losing the powerful tools for which the broker is famous.

If you want to maximize the broker’s powerful tools, you can use IBKR Mobile, a complete and sophisticated trading app for stocks, ETFs, and options. However, as the app’s features can be overwhelming for beginners, we recommend the IBKR GlobalTrader if you do not have much experience.

In addition to the mobile apps, you will also find a desktop app and web-based apps where you have advanced trading tools to access the global financial markets. Overall we believe that Interactive Brokers offers the best stock trading apps in Singapore, and you can find what you are looking for, irrespective of your needs! Please check our Interactive Brokers review to find out more about the broker.

#2 Plus500

82% of retail CFD accounts lose money.

Plus500 is a broker based in Israel that was founded in 2008 and whose shares are traded on the London Stock Exchange. Regulated by top-tier authorities such as FCA and CySEC, the broker offers its services in Singapore via the subsidiary Plus500SG Pte Ltd, licensed and regulated by the Monetary Authority of Singapore (License No. CMS100648).

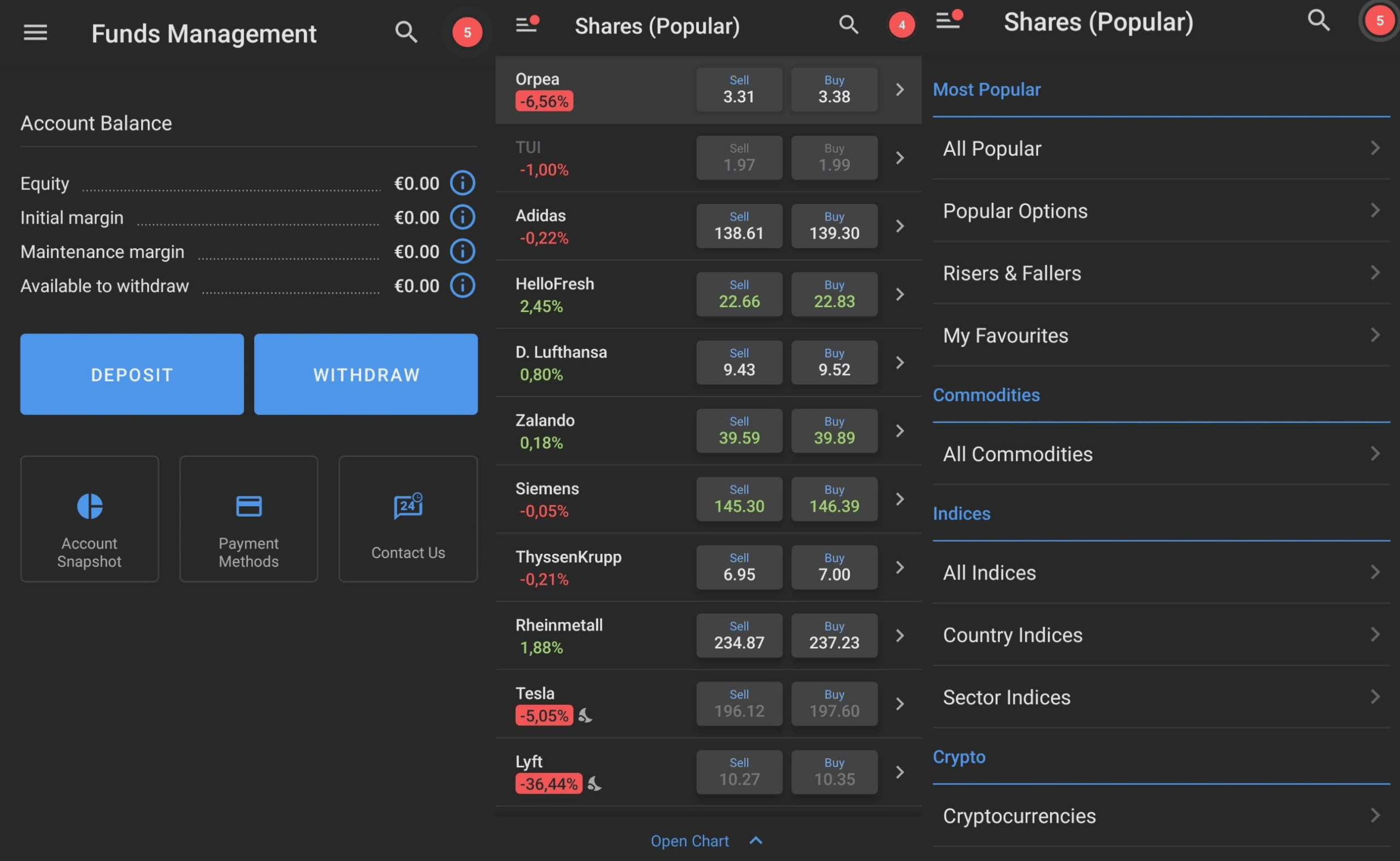

The broker provides a mobile app named Plus500 and a web-based platform called WebTrader. Both are comprehensive and accessible, and you can test their features by opening a demo account.

It is very important to differentiate the two different accounts you can access within the trading platforms: Plus500 CFD and Plus500 Invest.

In Plus500 Invest, you can trade stocks (real shares of the companies). In Plus500 CFD, on the other hand, you can only trade CFDs on several financial instruments. The distinction is important because CFDs are leveraged and riskier products which may exacerbate your losses.

Overall, the broker offers solid stock trading platforms for Singaporean customers. The platforms have low costs and reliability, interesting features and products for beginners (demo account) and experienced traders, and good usability. As a downside, though, you will not have access to ETFs. If you want to learn more about Plus500, please check our full Plus500 review.

This information is NOT relevant to EU residents who are to be serviced by EU subsidiaries of the Plus500 Group, such as Plus500CY Ltd, authorized by CySEC (Reg. 250/14). Different regulatory requirements apply in Europe, such as leverage limitations and bonus restrictions.

#3 Saxo

Saxo at a glance

62% of retail CFD accounts lose money.

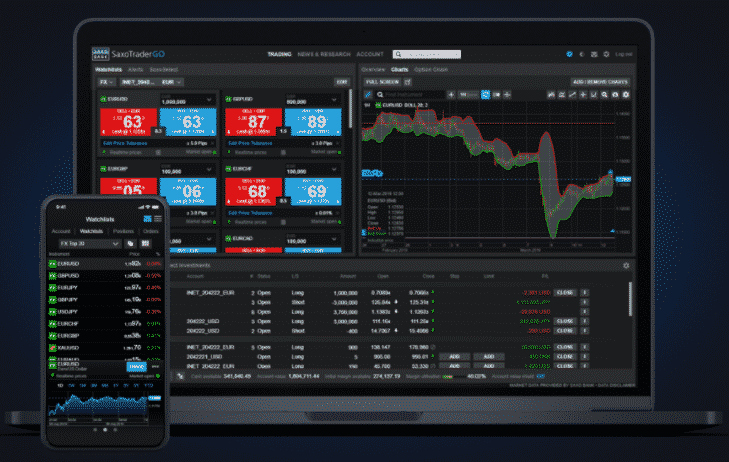

Saxo Bank is a Danish bank founded in 1992 that operates in Singapore through the entity Saxo Capital Markets Pte Ltd, licensed and regulated by the Monetary Authority of Singapore (License No. 200601141M). It is undoubtedly one of the most reliable options for advanced traders and beginners since it provides safety, fair prices, and valuable tools. Saxo can offer a stock trading app that is among the best in Singapore: SaxoTraderGO. These are comprehensive, customizable, and have attractive features for investors.

As the name suggests, SaxoTraderGO is a user-friendly, customizable, and award-winning trading platform that can be used by experienced investors and beginners. The app has a mobile and a desktop version. The broker also provides SaxoTraderPRO, a desktop-based platform (that works on Windows and MAC) developed for advanced traders, due to its level of detail and complexity. The desktop app is extremely customizable, offers sophisticated tools to analyze and track your performance, and can be used on up to 6 different screens.

Considering that the trading apps have excellent educational resources, low prices, and an impressive range of tradable assets, Saxo deserves third place on our list of the best stock trading apps in Singapore. The only downside we could think of is that, after registering and completing the verification, you will need to fund your account with at least S$2,000 to start trading, which can be burdensome for some beginners.

Methodology

When making this list, we wanted to help investors in Singapore to make an educated choice when choosing the best stock trading app. Each of the trading apps we presented has its main features, and we tried to provide a diverse list that will suit the needs of different profiles of investors. In any case, we prepared this list considering the following criteria:

- Prices: the price cannot be the only aspect to be considered when choosing the trading app to invest in, but it is definitely important, you do not want to pay more for a service when you can get the same quality for lower prices;

- Educational resources: high-quality educational resources may be a great advantage, especially for beginners, who can use them to educate themselves before investing money;

- Range of products and markets available: Does the app offer real stocks and ETFs or only CFDs? Does it have crypto?

- Access to the local market: all trading apps in this list allow you to invest in the Singaporean market;

- Customer service: irrespective of your choice, problems almost always appear, and it is important to find trading apps developed to help you when it does happen;

- The trading app itself: we took into consideration the functionalities and usability of the platform, as well as its specific features;

- Security: all platforms in the list are regulated not only in Singapore but also by top-tier authorities from other jurisdictions.

Bottom line

To summarize, here’s the list of “Best stock trading apps in Singapore”:

- Interactive Brokers: Best overall

- Plus500: Ideal for CFDs

- Saxo Bank: Best for advanced traders

It is hard to choose the right stock trading app in Singapore. Luckily, we helped many people in the same situation before, and we can help you now. To facilitate your choice, we listed a few of the best stock trading apps in Singapore, in our opinion, comparing what they can offer and highlighting their strengths.

We know that trading stocks is a good way to achieve financial freedom, but, like everything in life, there are risks involved. We hope that our analysis was enough to help you make an educated decision that acknowledges those risks, whether you are experienced or a novice in the world of trading.

In any case, keep on studying, do due diligence, know your investment profile, and invest wisely! Please let us know if the article was helpful and if you have any other doubts or feedback!

FAQs

What is the difference between a stock and stock CFD?

While the stock gives you a property right over a share of the company, the CFD does not. The stock CFD is a derivative contract where the underlying asset is the stock and where the broker promises to pay you back the difference in value between the time you opened the position and the time you close it. CFDs have a leverage effect: if you buy a stock CFD and its price goes down, you will need to borrow money from the broker to keep the position open. This makes the instrument a risky option that is not suitable for beginners.

Is Robinhood available in Singapore?

No, the US-based stock trading app Robinhood is not available in Singapore.