Hi there, fellow investor. In this article, we will review Saxo to help you discover if it’s the best investment platform for you.

Saxo is a multi-asset broker providing retail and institutional clients access to stocks, bonds, funds, derivatives, and other products. It boosts over 71,000 different investments.

The company’s headquarters are in Denmark, but it has offices around the world and is regulated in multiple jurisdictions, including the UK, Switzerland, Singapore and Australia.

Many online brokers claim to offer multi-asset products but, in reality, only offer CFDs on different asset classes. Saxo is one of the only brokers on the market today that offers private investors access to a full suite of investment products, like stocks, bonds, managed funds, and leveraged trading products, including options, futures, and CFDs.

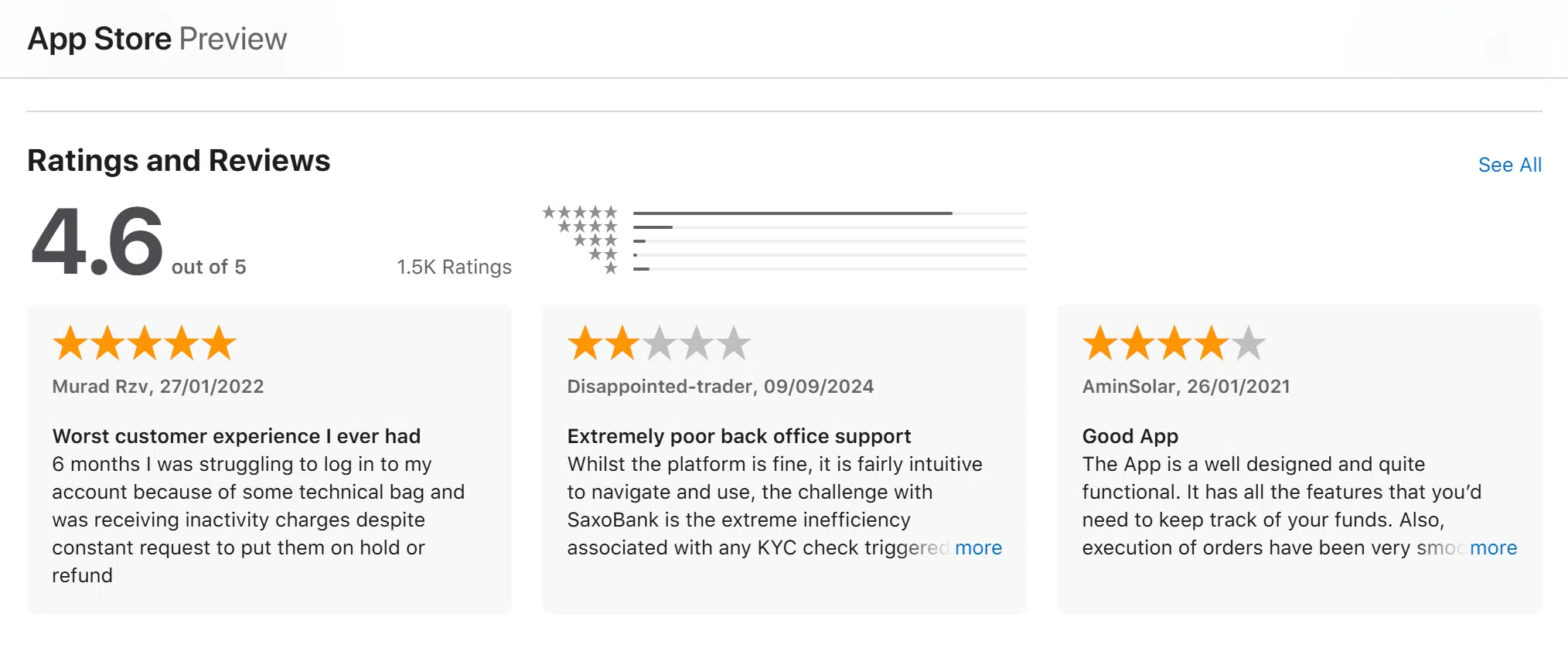

Saxo also has a proprietary trading platform and high touch customer support, meaning investors can typically speak on the phone to an account manager or support agent if they need help. But that does come at a price, and Saxo fees tend to be higher as a result.

That’s Saxo in a nutshell. If you want to find out what our research team has to say after analysing Saxo, keep reading.

Overview

Saxo was founded in 1992 by Kim Fournais, a Danish businessman and entrepreneur based in Copenhagen. Today the company’s headquarters are still in Copenhagen, but Saxo is a large conglomerate with offices and regulatory licences in financial hubs across the globe.

The broker offers investors access to a large set of investment and trading products.

On the investment side, clients can invest in stocks, bonds, mutual funds, and managed portfolios. UK investors can access these products via ISAs or SIPPs.

Saxo also gives investors access to a broad range of trading products, namely options, futures, foreign exchange, and CFDs.

Another feature Saxo offers, which is uncommon among other providers, is a business account. This means corporates can open an investing account with the broker and get access to the services it offers.

Investors can trade in Saxo ’s products using one of three proprietary trading platforms that the company offers – SaxoTraderGO, SaxoInvestor, and SaxoTraderPRO. Demo accounts are available for all three, so investors can get a feel for what the platforms are like before opening an account with the broker.

We’ll look at these platforms in more detail later in this review, but in simple terms, you are more likely to use one of these platforms depending on whether you are looking to invest, trade, or do both.

Saxo operates globally and provides services to investors in 84 different jurisdictions, although that can change over time. Investors can also open an account in 23 different currencies with the broker.

As that implies, Saxo is regulated in multiple tier-1 jurisdictions. That includes the UK, Singapore, Australia, Switzerland, and the Netherlands.

Saxo does charge higher fees than some of its peers, but that is arguably compensated for by the quality of service it offers, primarily in terms of customer support but also via its technology stack.

Finally, another positive for the broker is that it regularly publishes detailed accounts on its website, despite being a private company. This means investors can see the strength of the company’s balance sheet but also have the comfort that the company is confident and transparent enough to reveal its financials.

Highlights

| 🗺️ Supported regions | +80 regions – excluding the US |

| 💰 CFDs fees | Tiered system, with lower fees for higher volume traders |

| 💰 Currency conversion fee | 0.25% |

| 💰 Inactivity fee | €/$/£0 |

| 💰 Withdrawal fee | €/$/£0 |

| 💵 Minimum deposit | Varies by region |

| 🎮 Demo account | Yes |

| 📜 Regulatory entities | FCA, FSA (Denmark), MAS, FINMA, AMF, ASIC, SFC, FSMA, DNB |

Pros and cons

Pros

- Excellent research materials

- Outstanding trading platforms (SaxoTraderPRO and SaxoTraderGO)

- Extensive range of investment products

- Long track record

- Supervised by worldwide top-tier regulators

Cons

- High minimum deposit (varies between countries)

- Fees higher than average

- Fee structure is complex

- Does not accept US residents

Account opening

Opening an account with Saxo is simple and does not take long to do. To get started, investors simply hit the ‘Open Account’ option on the broker’s homepage.

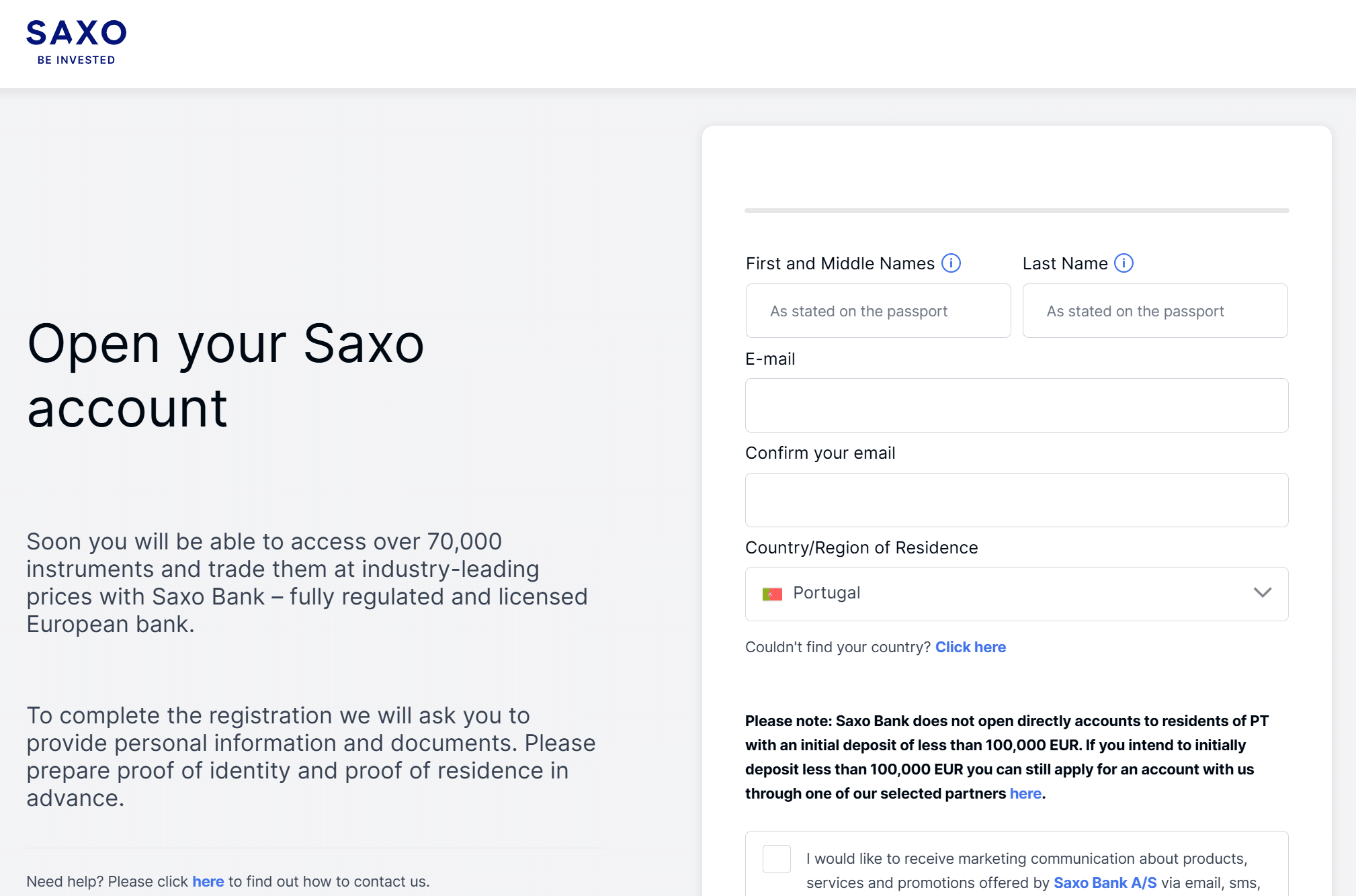

You then fill in some simple details:

You will have to provide some proof of your identity, as well as some tax information in order to get the account opened – so be ready with a passport or driving license if you want to make the process as smooth as possible.

Finally, you must provide some information about your bank account in order to finalise your account opening and start to make a deposit.

Deposits to Saxo can be made using a debit card or via a bank/wire transfer.

Trading platform

Saxo offers investors three different proprietary trading platforms that they can use to invest or trade.

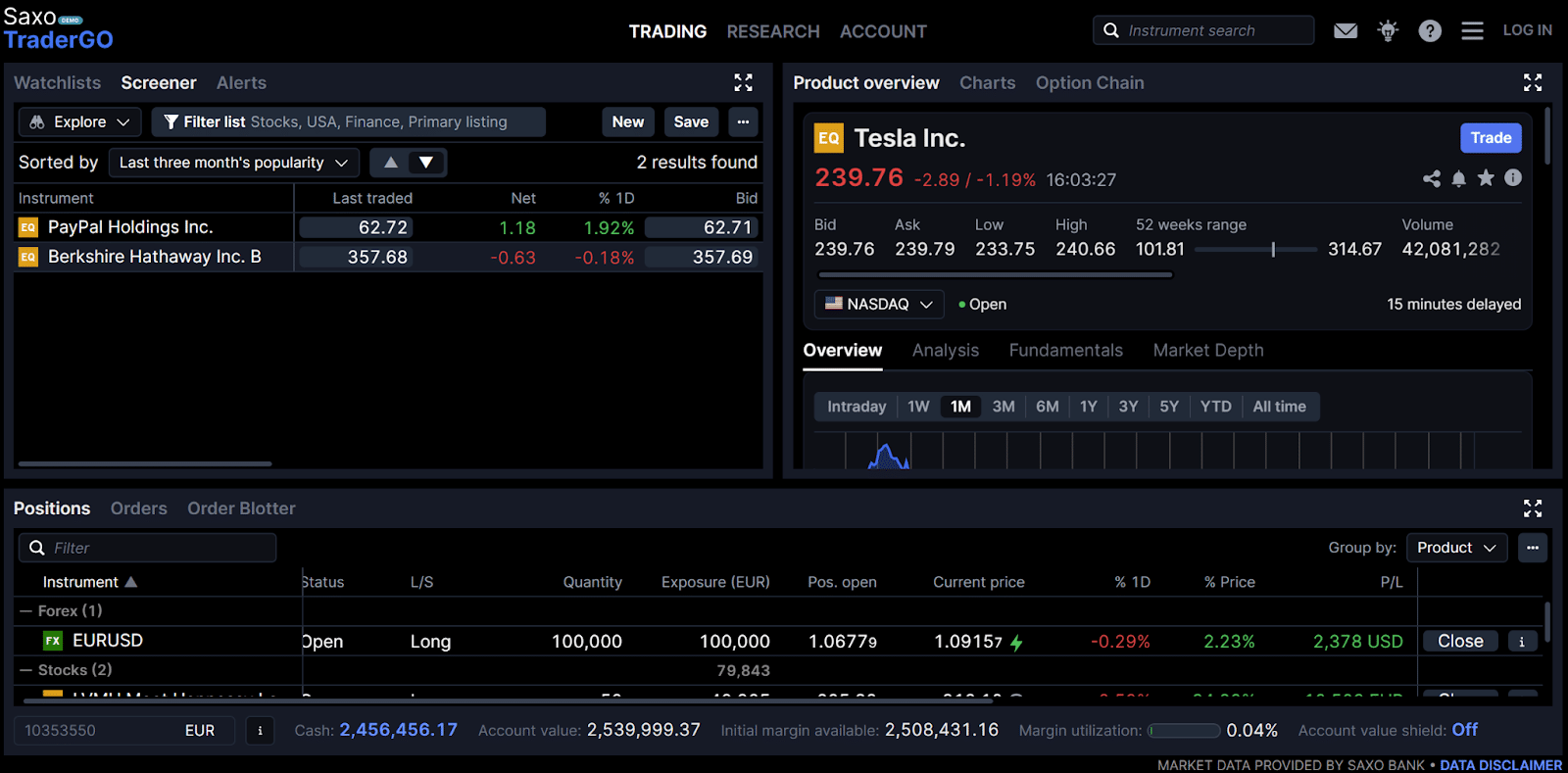

The first of these is called SaxoTraderGO, which you can see in a screenshot below.

This platform is aimed at users who want to have one account which they can use to invest or trade. This means you can access the full range of Saxo products on the platform, whether that be stocks and bonds or options and CFDs.

SaxoTraderGO has lots of useful features for both types of investing. For instance, charting tools and technical analysis features may appeal more to short term traders, whereas company fundamentals data is more likely to be useful for long-term investors in stocks.

Saxo’s more trading-focused platform is called SaxoTraderPRO. This platform is similar to SaxoTraderGO but is primarily for professional derivatives traders who are either trading on their own accounts or work at a financial institution.

Because of this, it has features like the ability to create dashboards across multiple screens and more advanced tools for managing risk exposure in products like FX.

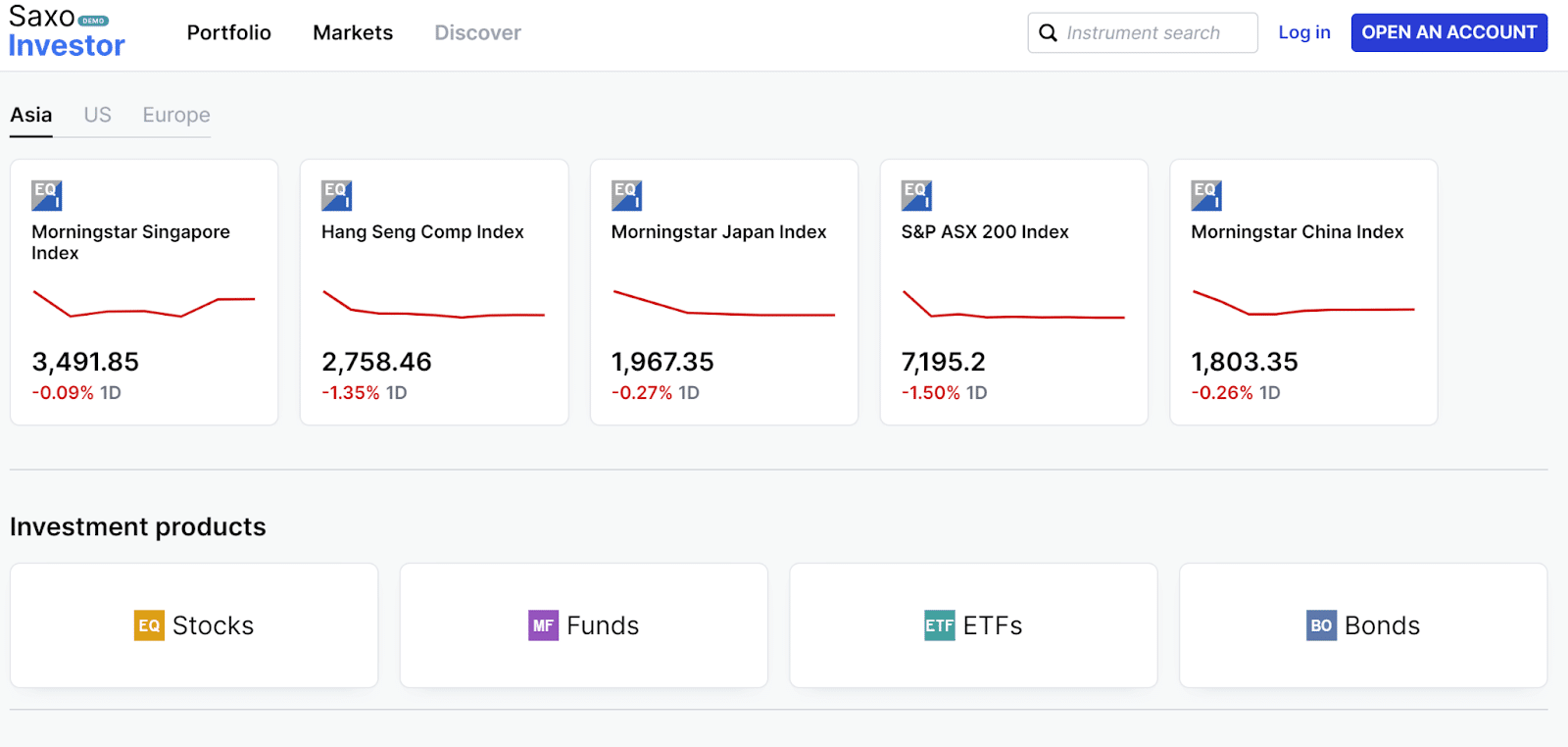

The final platform is called SaxoInvestor. This is designed for investing in long-term, lower risk products, like stocks, bonds, and mutual funds. You cannot access derivatives, like CFDs or options, on SaxoInvestor.

SaxoInvestor has not been fully rolled out yet, so may not be available in the jurisdiction in which you are based.

Saxo can also be accessed via third-party platforms. TradingView may appeal to private investors that want to open an account with Saxo, but the other third-party platforms are a bit like SaxoTraderPRO, primarily aimed at professional investors.

Products and markets

Saxo has one of the largest product ranges in the retail brokerage industry.

Depending on what region you are based in, you may be able to access over 71,000 different investments with Saxo today. This includes:

- Stocks

- Bonds

- ETFs

- ETCs

- Options

- Futures

- CFDs

- Forex

Within each of those asset classes, Saxo also offers a large range of products.

For example, if you look at the company’s stock investing offering, you can access exchanges in almost 30 countries. Some of these, like the US and UK, are standard offerings. But others are very difficult for foreign investors to access. For example, Saxo is one of the only brokers to offer access to Malaysian stocks to investors.

The same is true of the broker’s options and futures offering. Again, you have a huge range of options – no pun intended – to invest in, which you would struggle to find at another provider.

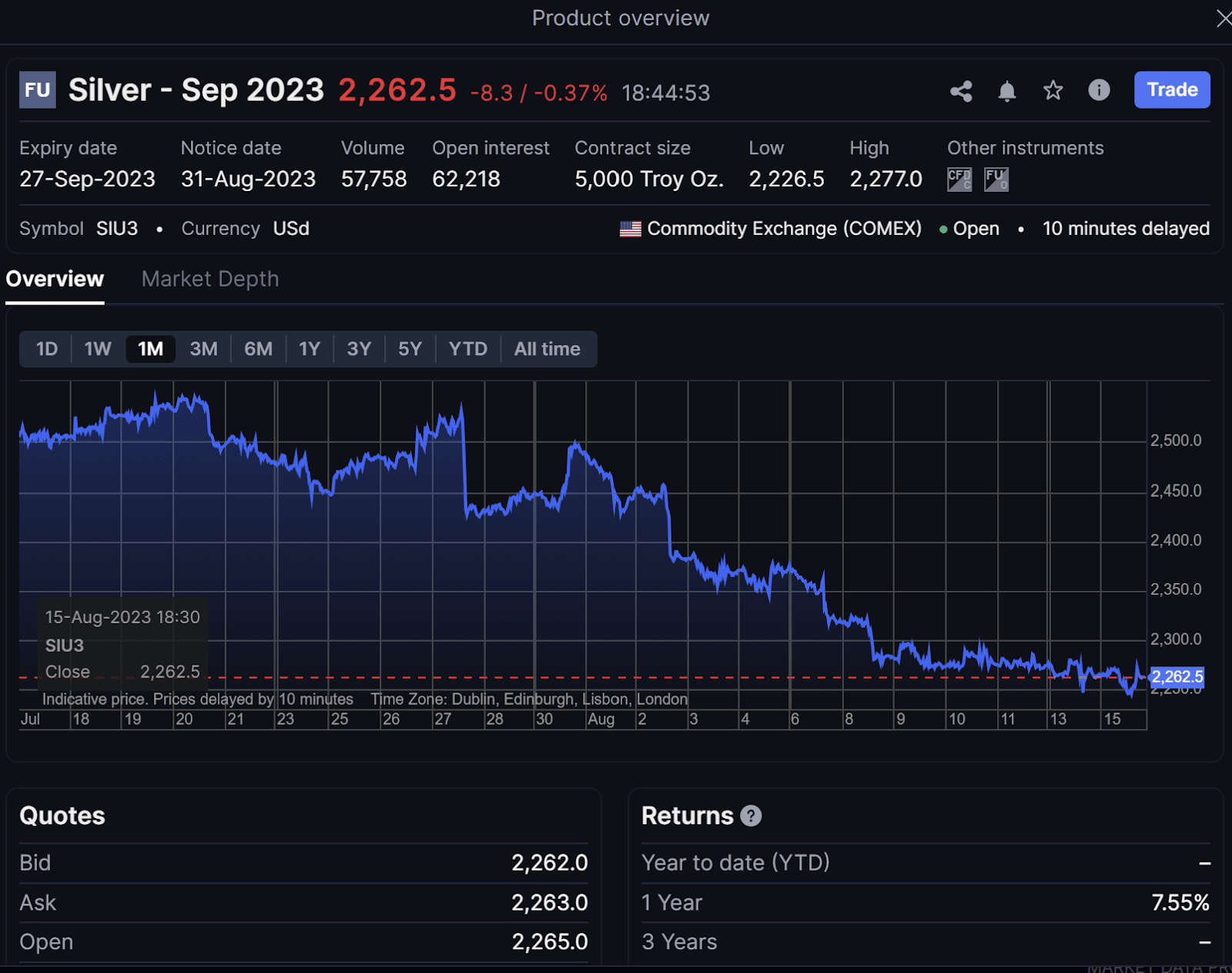

As noted, there is also a lot of information on Saxo’s platforms that can help you make your decisions here. For example, the screenshot below provides pricing and other information on silver futures contracts.

One other key attraction Saxo currently offers is interest on cash deposits in euros, pounds, dollars, and several other currencies. Rates vary depending on the currency you hold in your account, your account type, and how much you deposit.

For example, if you deposit in GBP, interest is only paid if you deposit £10,000 or more – although interest is paid on the whole amount, not just the amount in excess of that £10,000.

The more you deposit, the better the rate you receive. You receive the best interest rate by depositing £100,000 or more.

The broad range of products available on Saxo platforms is one of the broker’s key attractions. Investors will struggle to find another provider offering the same product range as Saxo.

Fees

Saxo’s fees vary and are hard to capture in a simple or succinct way.

This is because they are almost all tiered based on the type of account you have with the broker. That, in turn, is determined by how much you deposit.

Saxo offers the following accounts to its clients globally:

- Classic: minimum deposit from $0

- Platinum: minimum deposit of $200,000

- VIP: minimum deposit of $1,000,000

It’s important to note that these accounts vary by region.

For example, in the UAE, the minimum deposit is higher at $2,500. Apart from the UK, countries where the minimum deposit is €0 are Singapore, France, Switzerland, CEE (Poland, Czech Republic, Slovakia, etc.) and Australia.

As noted, your fees will vary depending on the asset class you are trading.

Exchanged-traded products, like stocks or options, will incur dealing fees that are charged on a per-contract or per-share basis.

For example, stock investing fees are paid as commissions when you place a trade. You can see this example in the picture below, with different exchanges and accounts incurring different charges.

These fees vary by market and the type of account you opened with Saxo. There are also minimum dealing sizes that vary by region and account size.

Over-the-counter derivatives, like forex contracts or CFDs, are charged for via the spread – the difference between the buy and sell price. Saxo also charges commissions on these products.

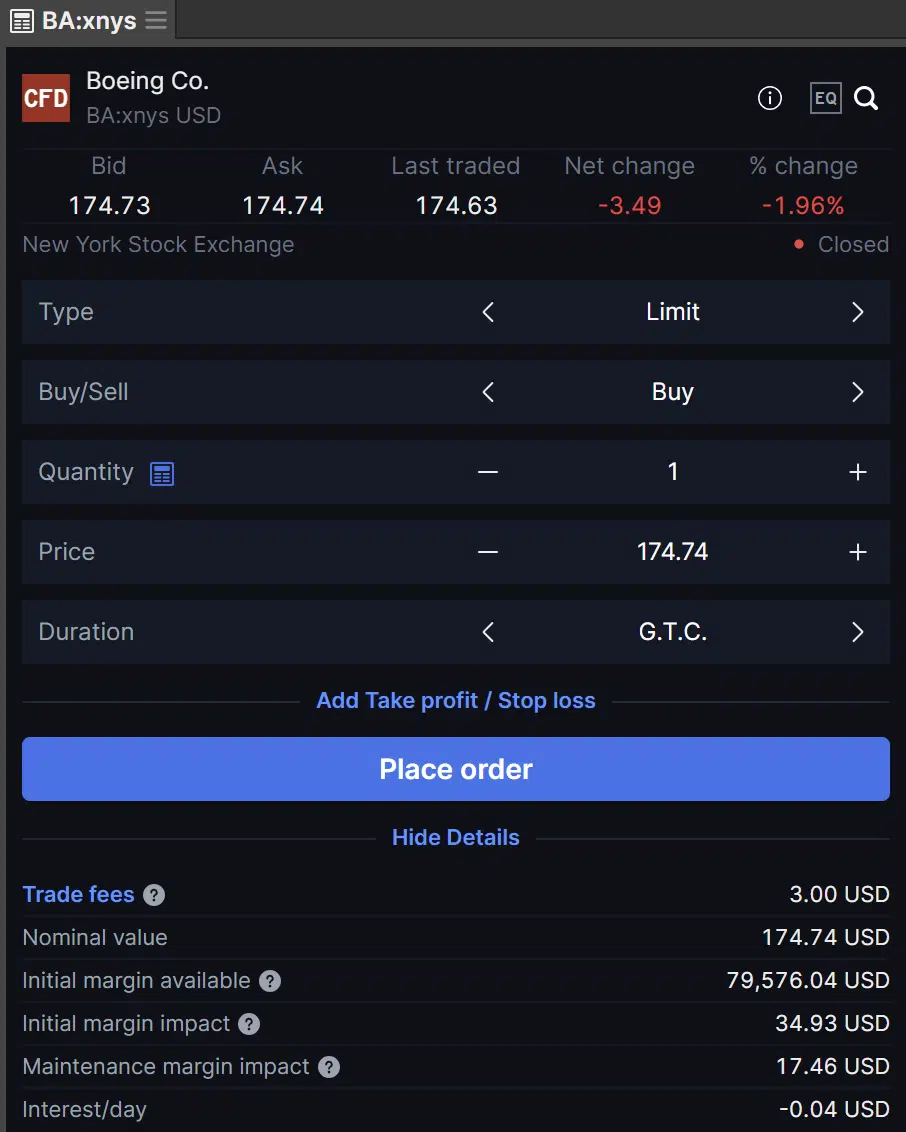

All of these fees are clearly laid out in the SaxoTraderGO platform’s fee calculator, so you can see what you are paying for in a simple way before placing a trade. The image below gives an example of this when trading a CFD on an ETF.

Aside from these common trading fees, Saxo has some other key fees that investors using the platform should be aware of.

- Borrowing costs: sometimes known as ‘swaps’ or ‘overnight fees’, this is interest you pay on the money you borrow when trading with CFDs

- Custody fees: this is a small percentage charged against the value of any stocks, ETFs or bonds you hold. It varies from 0.09% to 0.15%, depending on your account type.

- FX fees: this is the amount you are charged when changing one currency for another. This fee is 0.25%.

This is not a comprehensive list of all Saxo’s fees. As you’ve seen, the company offers a lot of products across many regions, so the fees will depend on where you are based, the account you have with the broker, and what products you trade in.

Regulation

Saxo is regulated in multiple jurisdictions, all of which are in developed markets that have stringent standards.

We list all of Saxo’s current entities below and what entity you would be regulated under if you opened an account with that entity.

If that sounds confusing, then remember that Saxo is a global company. As a result, investors may be based in countries where Saxo has no office or only a representative office or local branch.

Branches and representative offices are similar. In simple terms, a broker opens a representative office in a certain country or jurisdiction. They can market their services to clients in that region. But the actual services will be provided by another regulated entity outside of that country.

So if you open an account with Saxo in a country which has no local entity or which only has a local branch or representative office, you will actually be opening an account with the broker’s Denmark-regulated entity.

The exceptions to this are if you are in France, Belgium, or the Netherlands. In these countries, investors open an account with the company’s Dutch-regulated entity. You can see all of this information in the table below.

Saxo offices

| Country | Office type | Ultimate regulator |

| 🇩🇰 | Headquarters | Danish Financial Supervisory Authority (FSA) |

| 🇦🇪 | Representative office | Danish FSA |

| 🇧🇷 | Representative office | Danish FSA |

| 🇨🇿 | Local branch | Danish FSA |

| 🇬🇧 | Regulated local entity | Financial Conduct Authority (FCA) |

| 🇸🇬 | Regulated local entity | Monetary Authority of Singapore (MAS) |

| 🇨🇭 | Regulated local entity | Swiss Financial Market Supervisory Authority (FINMA) |

| 🇮🇹 | Regulated local entity | Italian Market Authority (CONSOB) |

| 🇯🇵 | Regulated local entity | Japanese Financial Services Agency (JFSA) |

| 🇭🇰 | Regulated local entity | Securities and Futures Commission (SFC) |

| 🇦🇺 | Regulated local entity | Australian Securities and Investments Commission (ASIC) |

| 🇳🇱 | Regulated local entity | Dutch Central Bank and Authority for the Financial Markets (DNB) |

| 🇧🇪 | Local branch | DNB |

| 🇫🇷 | Local branch | DNB |

The main point to note here is that every entity that Saxo operates is required by regulation to segregate client assets. That means those funds are not commingled with the firm’s and cannot be misused. This reduces the risk that you will lose your money if the firm enters financial difficulties.

Another core strength of Saxo is its transparency. The firm is private, so it does not have to publish its accounts. It still does so, and you can see these clearly on the company’s website by visiting the ‘Investor Relations’ page, a screenshot of which is below.

These accounts should reassure potential investors that may want to open an account with Saxo. This is because you can clearly see the firm’s financial strength and how it carries out business.

Accepted countries

Saxo currently accepts clients from dozens of countries, although this number is not fixed and can change over time. Currently, investors from the following jurisdictions can open an account with Saxo:

Australia, Austria, Belgium, Croatia, Czech Republic, Denmark, Estonia, Faroe Islands, Finland, France, Germany, Greece, Greenland, Hong Kong, Hungary, Iceland, Ireland, Israel, Italy, Japan, Latvia, Lithuania, Luxembourg, Malaysia, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Qatar, Romania, Saudi Arabia, Singapore, Slovakia, Slovenia, Spain, Sweden, Switzerland, Thailand, United Arab Emirates, United Kingdom.

Check back in the future to open an account with Saxo as your country may be available in the future if it is not today.

Alternatives

Saxo is a great brokerage solution for experienced traders and those looking for a multiproduct broker with a great reputation.

However, there are other great choices outside of the USA, similar to Saxo. Our first choice would be Interactive Brokers, a global broker that also provides a wide range of financial products.

It is a great option for retail investors interested in trading international stocks, ETFs, bonds, futures, options, and even penny stocks. It is ideal for beginners or professionals looking for a large number of instruments and a safe broker.

Bottom line

Saxo is a well-respected player in the investment world and is a great option for anyone looking to invest long-term or trade in more speculative products.

The company’s main strengths are the huge range of products it offers, top level customer support, and a set of proprietary trading platforms that are geared towards the needs of different types of investors.

Saxo is also regulated in tier-1 jurisdictions and is a transparent company that regularly publishes clear financial accounts. The fact it does large amounts of business with other financial institutions should give private investors the confidence to do the same.

The broker does charge higher fees than some of its peers but we believe that is because the quality of service is among the highest in the industry.