Hello, fellow investor! We will look into Sarwa, covering the brokerage and robo-advisor sides.

Sarwa offers a brokerage service through Sarwa Trade (US stocks, ETFs, options, and crypto) and a robo-advisor service through Sarwa Invest (automated investment in pre-built portfolios). You can also access Sarwa Save to earn interest on uninvested cash.

Finally, Sarwa is supervised by the Financial Services Regulatory Authority (“FSRA”) in the Abu Dhabi Global Markets (“ADGM”).

As a side note, Sarwa offers an AED 500 bonus when you invest at least $500.

That’s Sarwa in a nutshell! Let’s explore all the details!

Overview

Sarwa is a digital wealth management platform based in Abu Dhabi. It provides investment solutions to residents of multiple countries, including the UAE, Kuwait, Bahrain, and Saudi Arabia.

Sarwa offers multiple services in a single app, namely:

- Sarwa Trade: a “do-it-yourself” platform where you buy/sell US stocks, ETFs, options and crypto (through Sarwa Crypto). No advice is given to Sarwa Trade clients;

- Sarwa Invest: offers low-cost, globally diversified portfolios customized to match your risk tolerance. These portfolios are entirely ETFs, and the investment process is completely automated;

- Sarwa Save: earn up to 4.4% in USD.

You can only access Sarwa Trade through their mobile app, which is intuitive and user-friendly.

Besides, it presents zero transfer fees for local UAE accounts, and there is no account opening fee, custody fee, withdrawal fee, account closing fee or even an inactivity fee. Yes, there are fees that we will explore in the “Fees” section.

Highlights

| 🗺️ Supported countries | Worldwide, exceptions include the US and Cyprus |

| 💵 Minimum deposit | Sarwa Trade: $1; Sarwa invest: $500 |

| 📍 Products offered | US stocks, ETFs and options; crypto; high-yield cash account |

| 💰 Sarwa Trade fees | Stocks and ETFs: the greatest of $1 per trade or 0.25% of the traded amount; US options: $4 per contract |

| 💰 Sarwa Invest fees | 0.5% to 0.85% annual fee (a minimum of $7 will be charged every month) |

| 💰 Sarwa Crypto fees | 0.75% spread |

| 💰 Sarwa Save | 0.50% |

| 💰 Inactivity fee | $0 |

| 💰 Withdrawal fee | $0 |

| 🎮 Demo account | No |

| 📜 Regulatory entities | FSRA |

Pros and cons

Pros

- Access to human financial advisor

- Low fees

- Slick and easy to use app

- Sarwa Invest (Robo-advisor) is a good option for beginners

- Sarwa Save is a good alternative to earn interest on cash

Cons

- Newcomer in the industry: short track record

- Limited asset offering: no bonds or stocks listed outside the USA

- US options are quite expensive ($4 per contract)

Account opening

The sign-up process is pretty simple. You just need to fill in your personal details and provide the necessary documentation (passport and proof of residency):

Investment platform

Sarwa Invest is available both on PC and mobile. However, you can only use Sarwa Trade in the mobile app. We will cover both.

In the PC, this is your dashboard as soon as you log into Sarwa:

You can clearly see your account balance (my account had $50 at this review), returns, deposits and any withdrawals. Plus, you can manage your account settings.

The mobile is also pretty intuitive:

Within Sarwa Trade, your order can be set as “market” and “limit” orders.

Products & markets

As mentioned above, Sarwa offers multiple services. We will take a look at each one of them.

Sarwa Trade

Sarwa Trade allows you to freely trade in US stocks, ETFs, and options. It directly competes with brokers like eToro and Interactive Brokers. Characteristics:

- Access to 4,000+ US stocks and ETFs (and options);

- No minimum deposit;

- Market and limit orders;

- Fractional shares.

A gentle reminder that this feature is only available through the Sarwa app:

Sarwa Invest

Sarwa Invest distinguishes itself from Sarwa Trade since it is a pre-defined investment process that incentivizes you to “take the hand from the wheel” and simply let your investment run in a portfolio that corresponds to your risk level.

There are several portfolios to choose from, namely:

Conventional

The conventional portfolios give you six diverse portfolios from “low risk” to “more risk”. The “low risk” allocations give you more exposure to US and Global Bonds:

Whereas, as you go through the risk profile, the allocations to US and other developed market stocks increase:

In any of the portfolios chosen (from 1 to 6), the combined allocation to Real Estate and Emerging Markets does not surpass 20% of the total allocation.

Halal

The Halal portfolios expose you to Sukuk, an Islamic financial certificate that complies with Islamic religious law (Sharia). The “lower risk” portfolio gives you a high allocation to Sukuk:

Going through the risk ladder, the portfolios look more like the Conventional ones. Also, you get a 5% exposure to Gold, an asset class (precious metals) not available in the Conventional portfolios:

Socially Responsible

The Social Responsible portfolios incorporate ETFs that invest in companies that meet certain sustainable criteria such as environmentally sustainable practices, fair labor standards, and others.

The allocations to each asset class are almost identical to the Conventional portfolios (remember that the change in ETFs does not affect the risk profile of an investor). The “Lower risk” portfolio:

And the “more risk” portfolio:

Please note that the minimum investment is $2,500 (not $500 as in Conventional and Halal portfolios).

Conventional Crypto

The Conventional crypto portfolios only comprise 5 portfolios in total (not 6) and add a 5% exposure to Bitcoin (Greyscale Bitcoin Trust (GBTC), the largest publicly traded Bitcoin fund in the world), no matter if it is a “lower risk” or “more risk” portfolio.

“Lower risk” portfolio exposure:

“Higher risk” portfolio exposure:

Socially Responsible Crypto

Finally, the Socially Responsible Crypto portfolios are similar to Conventional Crypto, but they change some ETFs to take a more sustainable investment approach.

Sarwa Crypto

Sarwa Crypto allows you to buy and sell cryptocurrencies from $5 and with 24/7 access to the crypto market.

Some of the characteristics include:

- Spreads of 0.75%

- Fractional crypto shares

- Start with $5 only

- Market, stop and limit orders

- Real-time crypto prices

Sarwa Save

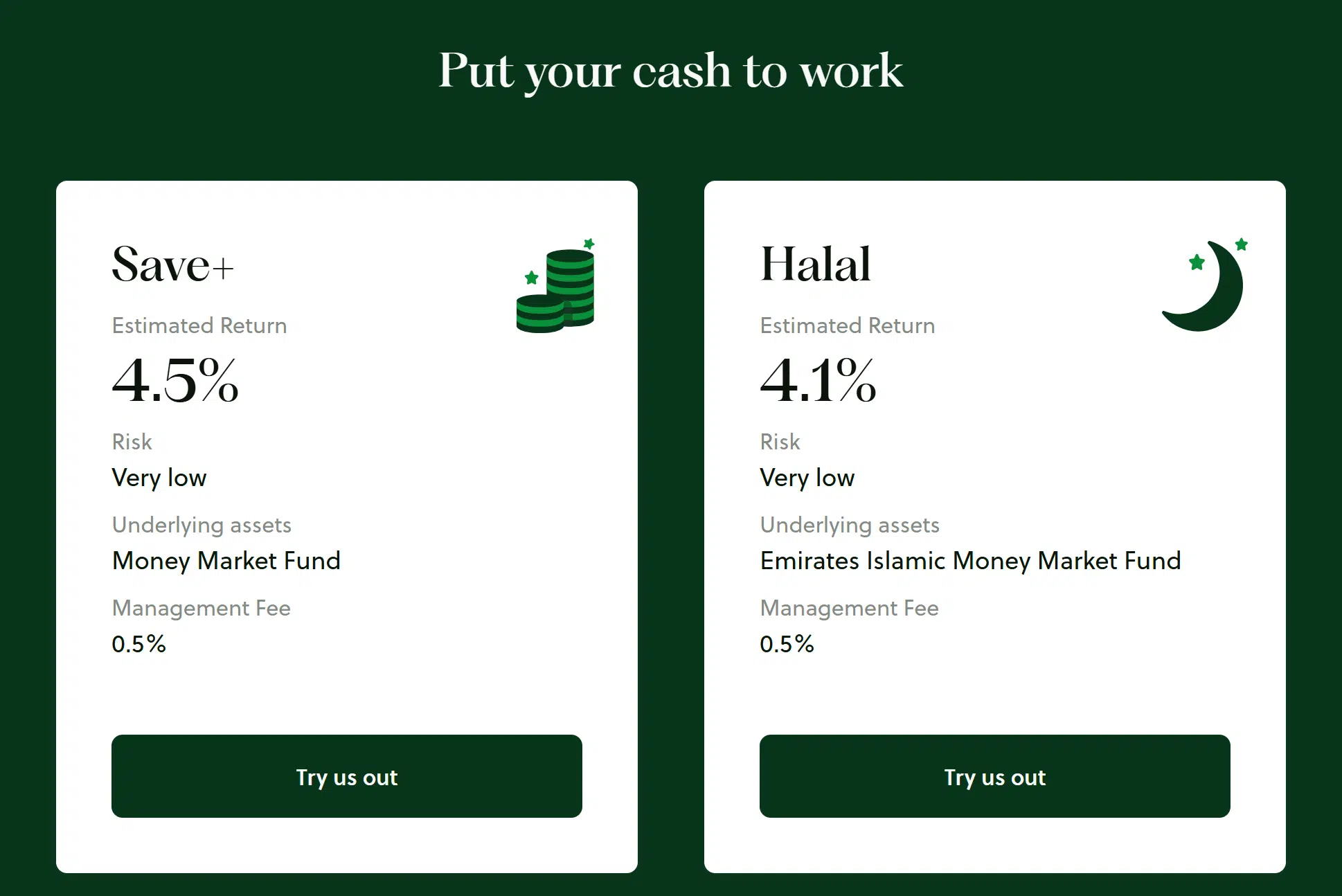

Sarwa Save lets you earn an expected return of 4.5% in USD with no minimum deposit requirement and no lock-in period but a 0.50% management fee:

Besides, it also gives you 4.1% in a Halal portfolio through the Emirates Islamic Money Market Fund:

Fees

These are the overall fees:

| Account type | Fees |

| Sarwa Trade | $1 or 0.25% of traded value for stocks and ETFs trading; $4 per option contract |

| Sarwa Invest | From 0.50% to 0.85% annual management fee (min. of $7 per month) |

| Sarwa Crypto | 0.75% spread (trading fee) |

| Sarwa Save | 0.50% annual management fee |

ETFs and stocks trading costs $1 or 0.25% per trade, and $4 per option contract.

Sarwa Invest (automatic investing) has an annual management fee ranging from 0.50% to 0.85%, with a minimum of $7 per month.

Sarwa Crypto applies a 0.75% trading spread on crypto trades (buy and sell), while Sarwa Save (interest) charges a 0.50% annual fee on your deposit amount.

There are no account opening, custody, withdrawal, account closing or even inactivity fees.

Regulation

Sarwa, formerly known as “Sarwa Digital Wealth (Capital) Limited”, is regulated by the Financial Services Regulatory Authority (FSRA) in the Abu Dhabi Global Markets (“ADGM”).

Your assets (investable cash and securities) are segregated from Sarwa’s balance sheet and held in a custodian account at Saxo, which is regulated by Finanstilsynet, the Danish Financial Supervisory Authority.

If Saxo cannot return securities (e.g., ETFs) held in safe custody, administered, or managed, the Danish Guarantee Fund will cover up to EUR 20,000 (or equivalent in USD) per client. For cash deposits (money not yet invested by Sarwa), the protection goes up to EUR 100,000 (or equivalent in USD).

Besides, Alpaca is the executing broker for Sarwa Trade and Crypto. Alpaca utilizes BMO Harris Bank as their custodian for client deposits.

Supported countries

Sarwa accepts clients worldwide; however, its main target is residents of the UAE, Kuwait, Bahrain, and Saudi Arabia. The list of restricted countries can be found here.

Bottom line

Sarwa is a versatile digital wealth management platform that caters to investors looking for both self-directed trading and automated investment options. With its diverse range of services, including Sarwa Trade, Sarwa Invest, Sarwa Crypto, and Sarwa Save, it offers a comprehensive investment ecosystem that appeals to different types of investors.

The platform’s competitive edge lies in its zero local transfer fees, no account maintenance fees, and the simplicity of accessing various asset classes through a user-friendly mobile app. Additionally, Sarwa’s regulation under the Financial Services Regulatory Authority (FSRA) provides a level of security, though investors should be mindful of the operational risks during fund transfers before reaching the custodian.

Overall, Sarwa is particularly well-suited for UAE residents who want a flexible, low-cost way to invest in US stocks and crypto or simply take a hands-off approach to growing their wealth.