Hello, fellow investor! We will review Freedom24 to help you decide whether it is the right investment platform for you.

Founded in 2015, Freedom24 offers to its 300,000+ worldwide clients 40,000+ stocks, 3,600+ ETFs, 800,000+ US Stock Options, and 145,000+ bonds on the largest exchanges in Europe, Asia, and the US. It is offering a welcome bonus with up to 20 gift stocks.

Video summary

Overview

Established in 2008, with 300,000+ worldwide clients and a 4 out of 5 rating on Trustpilot, Freedom24 continues to show its mark. You can invest in stocks, ETFs, bonds, futures, and US options at one of the lowest prices in Europe, and it gives you access to several international markets such as NASDAQ, NYSE, CME, HKEX, LSE, Deutsche Börse, and KASE.

Freedom24 provides several financial services, including the traditional broker service, as seen in its competitors like eToro or DEGIRO. To begin trading, customers can choose two plans in EUR (“Smart” and “Prime”) and one in USD (“All-inclusive”) that fits their trading style and goals. The fees on the “All-inclusive” also include a “Personal Manager”.

Also, the InvestIdeas blog from award-winning Freedom24 securities analysts, which includes actual recommendations and financial forecasts, is a helpful tool for beginning (and experienced) traders.

In terms of security, Freedom Finance Europe Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license CIF 275/15 and it is registered in several countries under the “freedom to provide services”.

Freedom24’s customer service is ready to help new traders with their questions and requests for advice on investments in specific areas. The customer service can be reached by phone call, secure e-mail, live support chat, and social messaging applications, depending on the customer’s geographical area.

Highlights

| 🗺️ Supported countries | +30 countries, mostly European |

| 💰 Stocks and ETFs fees | From €/$0.02 per share (min. €/$2) |

| 💰 Currency conversion fee | ~0.005% (USD/EUR) |

| 💰 Inactivity fee | €/$0 |

| 💰 Withdrawal fee | €7 |

| 💵 Minimum deposit | €/$0 |

| 📍 Products offered | Stocks, ETFs, Bonds, Futures and Options |

| 🎮 Demo account | Yes |

| 📜 Regulatory entities | CySEC |

Pros and cons

Pros

- Low commissions on stock and ETF trading

- No minimum deposit for general trading

- Demo trading

- Slick, modern, and easy for anyone to use

- No custody fee

Cons

- €7 per withdrawal

- No cryptocurrencies

Account opening

You can open a Freedom24 account in a matter of minutes (2-15 minutes for validation) once you supply your personal information. This will let you immediately try out their Demo trading platform to test its functionality.

Here are the steps required to open an account:

- Sign up;

- Fill your tax residency;

- Sign the agreement.

Freedom24 has no minimum deposit amount for stock, ETFs, bonds, and options trading.

There are three different deposit methods available to clients: Credit Card, Bank Wire Transfer or Digital Assets. Credit card funds will appear on your account immediately. A Bank Wire Transfer usually takes up to 3 business days.

To withdraw, you will be asked to fill in the details of your banking information (IBAN, Beneficiary Account Number, SWIFT,…):

Trading platform

If you want to invest via Freedom24, you have two options – web version or through the mobile app. Both trading platforms are adequate for executing trades. They are well designed and intuitive, but lack customization options.

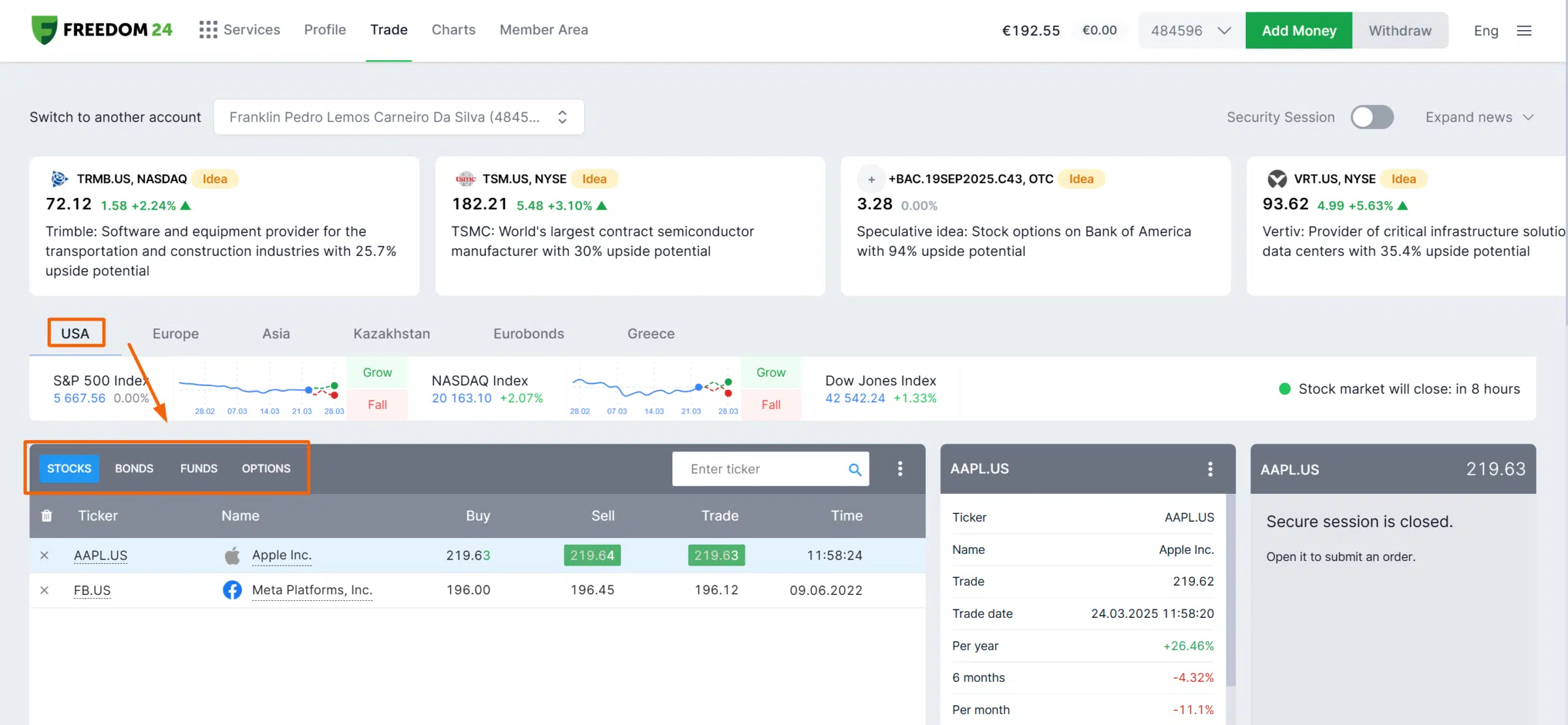

Starting with the web version, after login, you will notice a straightforward summary of your account:

This overview is enough for most investors (we value platforms that state the information in a simple manner). From there, you have access to several features such as the “Trade”, “Member Area”, and “Charts”:

The demo terminal appears as soon as you complete the first step of registration (between the step when you fill your e-mail and the final confirmation with selfie and opening real account). However, if the real account is opened, the terminal becomes real. You can register another “unconfirmed” account if you want to continue “real trading” and “demo trading” in parallel.

For security reasons, some accounts requests are “blocked”. To unlock, you will receive an SMS message on your mobile phone to ensure it is you (note: this has no cost! You will understand why we mention it as soon as you get to the “Fees” section).

The mobile app works in the same logic as the web version, which makes it a perfect alignment with the web version:

Products and markets

Freedom24 offers thousands of trading instruments, including stocks, ETFs, bonds, futures, and options on major American, Asian, and European exchanges (NASDAQ, NYSE, CME, HKEX, LSE, Deutsche Börse). From growth to value stocks, dividend aristocrats to oil companies, you have plenty of variety in which investment to choose from.

For example, in the US market, it offers access to stocks, bonds, funds and options:

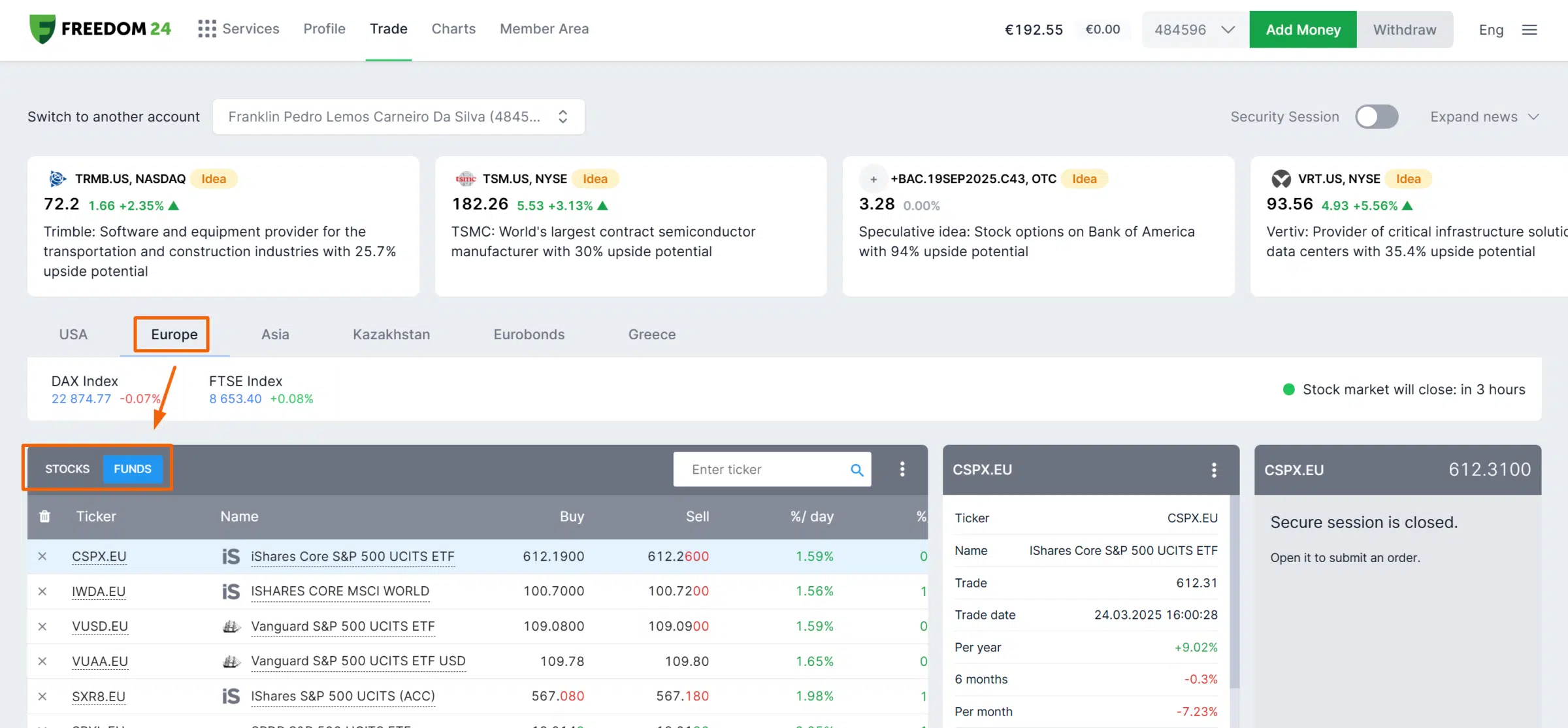

However, within the European market, you can only invest in stocks and bonds:

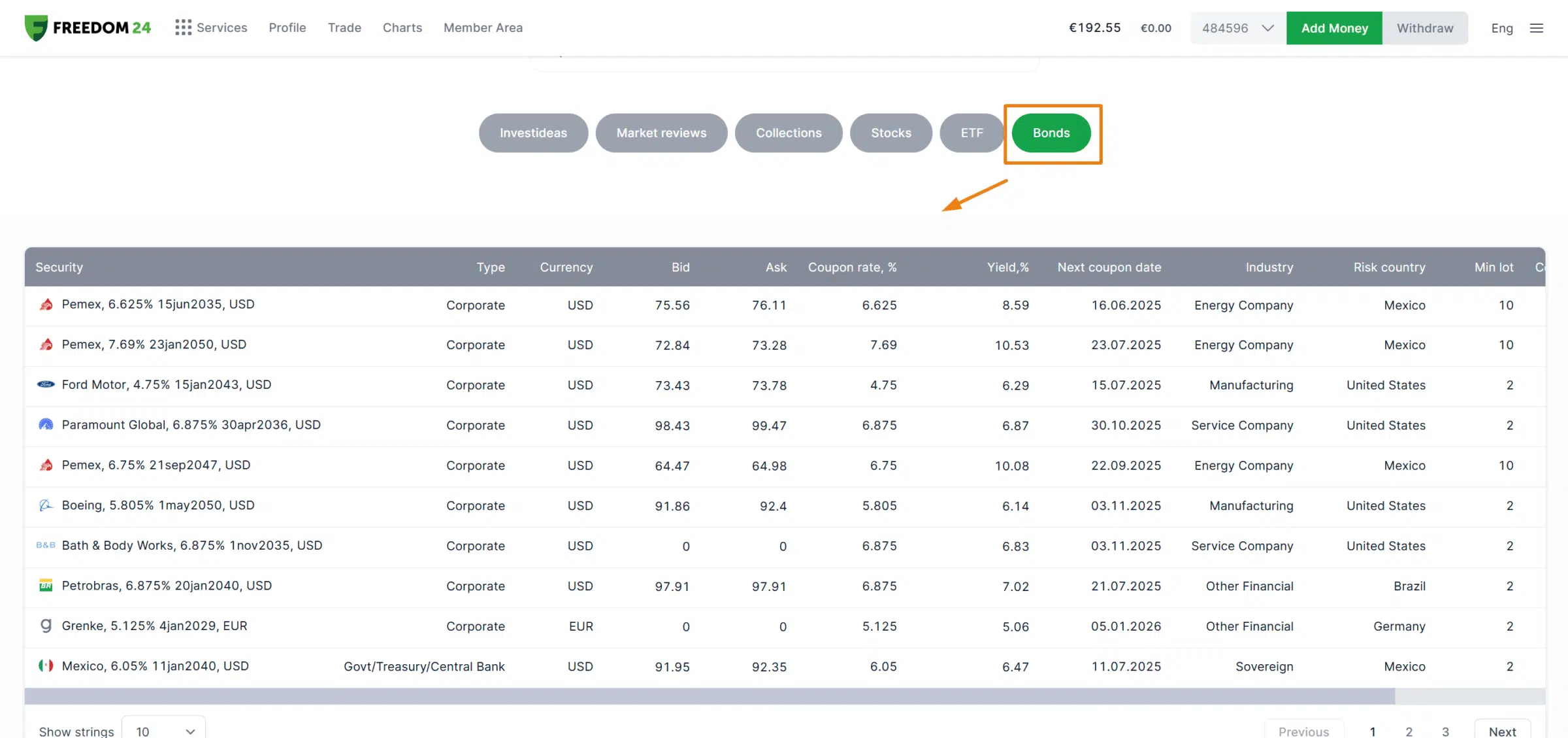

Concerning bonds, Freedom24 launched Bonds Showcase, allowing for small investments of just €/$1,000. It is a list of high-rated bonds (B+ and above) designed to offer investors a predictable and stable return. This new feature streamlines the process of finding and purchasing bonds, making it more accessible for investors seeking reliable market opportunities and long-term financial growth.

Other alternative investment opportunities offer competitive yields and a balanced approach to risk are the following:

*The offering of the product is subject to an appropriateness test.

Fees

Freedom24 offers two pricing structures: “Smart in EUR” and “Prime in EUR”.

Prime in EUR

You have no monthly fee, 0.30% of trade value + €0.012 of commission per share in stocks and ETFs in the US, Europe, and Asia (with a minimum of $/€1.2 per order), 0.25% commission per share in stocks and ETFs from Asia (with a minimum of 10HK$ per trade), US stock options per contract of $1.50, and, as an optionality, SMS notifications (transactions and alert notifications) for €0.05 each.

Smart in EUR

You have no monthly fee, $/€0.02 of commission per share in stocks and ETFs in the US, Europe, and Asia (with a minimum of $/€2 per order), 0.25% commission per share in stocks and ETFs from Asia (with a minimum of 10HK$ per trade), US stock options per contract of $0.65, and, as an optionality, SMS notifications (transactions and alert notifications) for €0.05 each.

For more details on the fee schedule, please visit this page.

Besides these fees, there is another set of fees that are the same across all service plans, namely:

- Margin Lending: From 0.049315% per day in EUR. When you decide to leverage your investments, you will pay a daily lending rate based on the amount leveraged.

- Withdrawal via bank transfer: €7

- Account closing: €/$100.

Finally, whether your base account is in EUR or USD, you need to be aware of the currency conversion fees. On the 17th of January 2025, the USD/EUR was quoted at 0.97005 (0.97005 EUR per 1 USD). At the same time, the purchase and sale prices in Freedom 24 were 0.97003 and 0.97008, meaning a spread of roughly 0.005%, which is extremely low.

In other words, if you want to purchase a US stock using EUR, you will need to convert your EUR at 0.97003, and if you decide to convert again to EUR instantly, you will get back your EUR at 0.97008. It would translate to an immediate loss of 0.005%.

Please read our dedicated article on Freedom24 fees.

Safety and regulation

Freedom Holding, the parent company of Freedom Finance Europe Ltd, which operates Freedom24, incorporates US SEC regulatory standards into its operations. For instance, the company complies with American audits under PCAOB rules, US GAAP principles, and IFRS standards, all audited by Deloitte. Freedom24 also fully complies with the Sarbanes-Oxley Act (SOX), which protects investors from misleading financial reports.

At the same time, Freedom Finance Europe Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license CIF 275/15 and it is registered in several countries under the “freedom to provide services”.

Freedom24 clients’ assets are segregated into separate entities[1] and thus protected against insolvency. In the unlikely event that the segregated assets cannot be returned to clients, Freedom24 falls under the Investor Compensation Fund (ICF), which compensates for any losses from non-returned investments up to EUR 20,000.

Freedom24 only acts as an intermediary between you and the stock exchange, meaning that the stocks you buy are yours. Still, in an extreme bankruptcy scenario, the regulators would assign an asset manager, after which the clients would be able to request to transfer their assets to another broker.

Please note, however, that Freedom24 is not regulated by top-tier regulators like the FCA, SEC and ASIC, but it is registered with BaFin (Germany), and with every other regulator in countries where Freedom24 operates. Furthermore, being part of Freedom Holding Corp, it is subject to more scrutiny from US regulators.

Public company details

Freedom24 is the online trading platform of Freedom Finance Europe. And Freedom Finance Europe is an EU-based subsidiary of Freedom Holding Corp, listed on the NASDAQ. Public companies are subject to rigorous disclosure laws regarding the financial condition, operating results, management compensation, and other business areas. This means that it is much higher scrutinized when compared to a private company.

Moreover, since their financial statements are displayed to everyone, it brings an additional layer of trust because we can follow their financial situation transparently, and that’s precisely what we have been doing. Looking at the last 10-Q (Q2 2025), we notice a massive increase in “net gain on trading securities” compared to the same quarter of last year:

The portion of “Trading Securities” in the Balance Sheet is relatively high when compared to the items “Cash and cash equivalents” and the “Shareholders’ Equity”. This means that the Freedom Holding corporation may be sensible to market risk:

Apart from the stated above:

- Freedom Holding Corporation has a “B” long-term credit rating assigned by Standard & Poor’s Global Ratings.

- Fully compliant with the MiFID II, a European regulatory framework that ensures the highest investor protection possible.

- Member of the Association for Financial Markets in Europe (AFME).

[1] Example: securities bought in US stock exchanges are allocated with LEK Securities, which has accounts in DTC, a US-based depository. Securities bought over the counter in Eurobonds are settled by and stored at Unicredit with Euroclear accounts in the EU.

Supported countries

Freedom24 accepts clients from the following countries:

- Austria

- Azerbaijan

- Belize

- Belgium

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Georgia

- Germany

- Greece

- Hungary

- Ireland

- Iceland

- Italy

- Liechtenstein

- Lithuania

- Luxembourg

- Latvia

- Kazakhstan

- Malta

- Moldova

- Netherlands

- Norway

- Poland

- Portugal

- Qatar

- Romania

- Slovenia

- Slovakia

- Spain

- Sweden

- Switzerland

- Thailand

- Ukraine

- United Arab Emirates

In the United Kingdom (UK), Freedom24 is temporarily not accepting new customers due to the new regulatory framework. The company is working with the Financial Conduct Authority (FCA) to reopen its activity in the UK, but no approval has been given yet.

Bottom line

Every trading platform has its pros and cons, and Freedom24 is no exception. One of Freedom’s biggest strengths is its ability to minimize the fee structure without compromising on the services it offers.

Freedom24 trading platforms, both PC and mobile, are well-designed and simple to use. It offers a “demo trading” and it can be a good choice for investors looking for a low-cost trading platform.

Disclaimer

Investments in securities and other financial instruments always involve the risk of loss of your capital. The forecast or past performance is no guarantee of future results. It is essential to do your own analysis before making any investment. If needed, you should carefully seek independent investment advice from a certified professional.