Investing using index funds and ETFs (exchange-traded funds) is an excellent way to invest passively in various stock markets and assets. But, if you’re looking to invest in index funds and ETFs from Europe, it’s important to make sure you’re armed with all the relevant information.

At first glance, understanding how to buy ETFs in Europe can feel slightly overwhelming and confusing – especially if you’re also considering buying US ETFs from European investment platforms.

To clear things up and explain everything you need to know about investing in index funds and ETFs from Europe, this article will lay things out in a straightforward way so that you can begin to invest and build wealth!

How to buy ETFs in Europe (step-by-step)

Sometimes people can make the investing process more complex than it needs to be. So, here’s a straightforward step-by-step guide explaining how you can invest in ETFs in Europe:

1. Choose an ETF

You have plenty of choices available, and you don’t have just to pick ETFs that track European markets. If you want, you can invest in ETFs that track investments or stock markets in the UK, Europe, the US, emerging markets like China, or even a global index fund. An example of a famous ETF is the S&P 500 (which we’ve covered in our article about how to invest in the S&P 500 from Europe).

The right Europe ETF for you will depend on your individual investing strategy and what your goals are. If you’re in need of some inspiration, one of the best ways to find an ETF that suits your needs is to look at the biggest and most popular ETFs available.

Looking at the most popular ETFs available to European investors will give you an idea about what other investors are doing, revealing the most popular index investing options.

Here’s what the biggest European ETFs look like right now in terms of assets under management (AUM) with data taken from justETF.com:

| Name | ISIN | Ticker | Annual fee (TER) | Replication method | Use of income | Fund size (€ billions) |

| iShares Core S&P 500 UCITS ETF | IE00B5BMR087 | CSPX | 0.07% | Physical | Acc | 49+ |

| iShares Core MSCI World UCITS ETF USD | IE00B4L5Y983 | SWDA | 0.20% | Physical | Acc | 42+ |

| Vanguard S&P 500 UCITS ETF | IE00B3XXRP09 | VUSA | 0.07% | Physical | Dist | 26+ |

| iShares Core MSCI Emerging Markets IMI UCITS ETF | IE00BKM4GZ66 | EIMI | 0.18% | Physical | Acc | 14+ |

| iShares Core FTSE 100 UCITS ETF | IE0005042456 | ISF | 0.07% | Physical | Dist | 12+ |

| iShares Core S&P 500 UCITS ETF USD | IE0031442068 | IUSA | 0.07% | Physical | Dist | 11+ |

| Invesco S&P 500 UCITS ETF | IE00B3YCGJ38 | SPXS | 0.05% | Synthetic | Acc | 11+ |

| iShares Core Euro Corporate Bond UCITS ETF | IE00B3F81R35 | IEAC | 0.20% | Physical | Dist | 10+ |

| Vanguard FTSE All-World UCITS ETF | IE00B3RBWM25 | VWRL | 0.22% | Physical | Dist | 8+ |

| Xtrackers MSCI World UCITS ETF 1C | IE00BJ0KDQ92 | XDWD | 0.19% | Physical | Acc | 7+ |

*Each ETF has different tickers. We decided to choose one of them and analyse it for simplicity reasons. Nonetheless, we encourage you to go to justetf.com, search for each ETF using the ISIN code, select it and look for the tab “Listing”. There, all tickers will be presented.

2. Select a broker to invest in ETFs

A broker is a platform that allows you to buy/sell shares of ETFs – an intermediary between the investor and the stock exchange.

Not all European brokerages will give you access to every ETF on the market. So, once you’ve decided on the ETF you want to invest in, your next step is to find a share dealing platform in Europe that gives you access to the particular ETFs you want to invest in.

Along with finding a platform that gives you access to the ETF you want, it’s also worth using somewhere cheap because that’s one of the best things about ETFs – they’re low-cost. So you don’t want to end up paying high share dealing or platform fees.

Here’s a breakdown of some of the best ETF brokers in Europe:

| Broker | ETF Fees | Min. Deposit | Number of ETFs | Regulators |

| eToro | $0 (other fees apply) | $50 (varies between countries) | 300+ | FCA, ASIC, CySEC |

| DEGIRO | £/€0 (in some ETFs) + €/£1 handling fee), plus an annual £/€2.50 connectivity fee | €/£0.01 | 5,000+ | DNB, AFM |

| BUX | €0 | €1 | 300+ | AFM, BaFin |

| Trading 212 | €/$/£0 | €/$/£1 | 10,000+ | FCA, CySEC, FSC |

| Interactive Brokers | Varies by exchange with tiered Pricing: 0.05% of Trade Value (min: €1.25, max: €29.00) | €/$/£0 | 13,000+ | FINRA, SIPC, SEC, CFTC, IIROC, FCA, CBI, AFSL, SFC, SEBI, MAS, MNB |

| XTB | €/$/£0 | €/$/£1 | 300+ | FCA, KNF, CySEC, DFSA and FSC |

*XTB only offers ETFs in Portugal, Italy, Poland, Slovakia, the Czech Republic, France, Spain, Romania, and Germany.

Disclaimer: Investing involves risk of loss.

3. Buy your ETF

All you have to do is find the ETF within your chosen broker and place a buy order. For this example below, we’ll use DEGIRO.

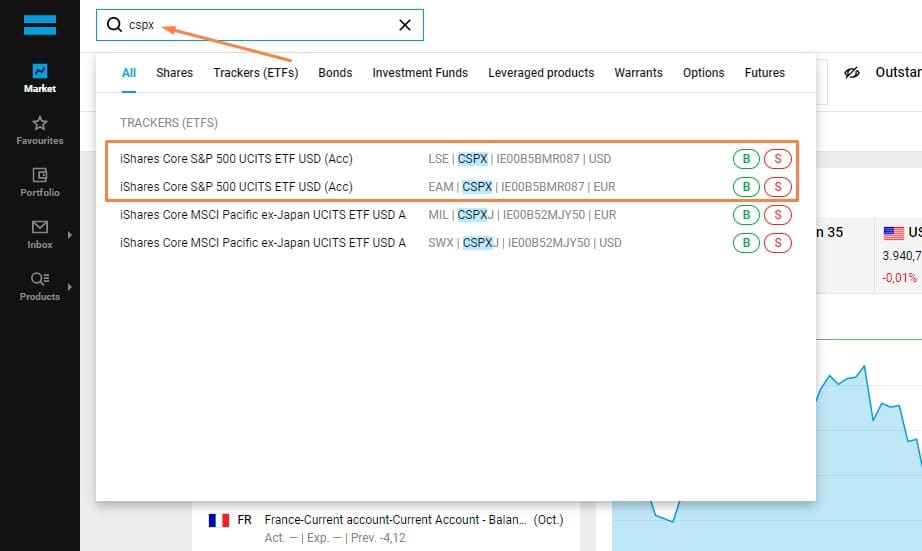

a) Search for your ETF – for example CSPX:

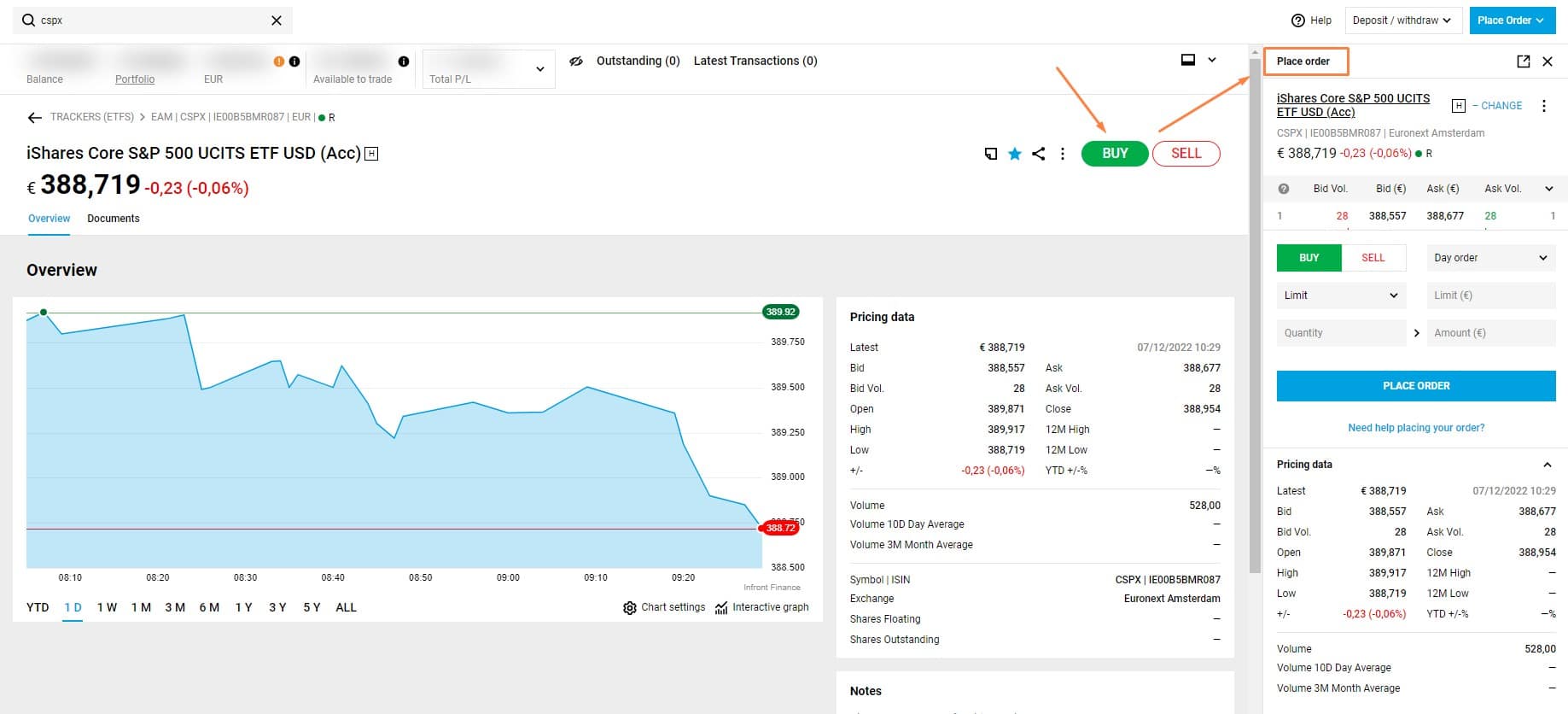

b) Click “Buy” – you might notice that several ETFs appear. Generally, you should choose the one that has the same currency as yours (to avoid currency conversion fees), the highest trading volume, and with the lowest transaction fee (ex: some ETFs are commission-free). After selecting it, and clicking “BUY”, you will be presented with the table shown on the right side:

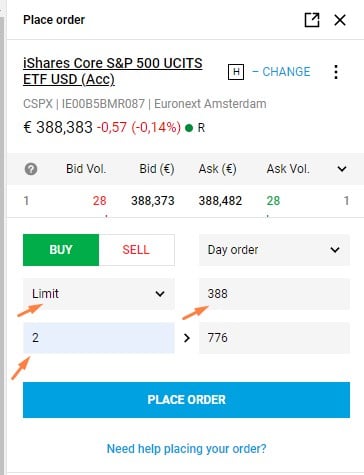

c) Choose the order details – Now, it’s time to fill all boxes presented below (“BUY” and “Day order” appear by default, which is good):

- Type of order: “Limit” appears by default because it supposes you want to buy at a maximum price, but you can change to “Market order”, for example, where you will buy at the prevailing market price;

- Limit Amount: Assuming you kept the “Limit” as the type of order, you just need to insert that maximum amount in the box right after it “Limit (€)”;

- Quantity: In “Quantity”, define the number of units you want to purchase;

- Amount: The “Amount (€)” should be automatically filled as soon as “Limit (€)” and “Quantity” are defined

d) Place your order: Finally, click “Place Order” and a new window will show up. Here, you can take a final look at all the details before clicking “confirm”:

The difference between an Index Fund and ETF

If you’re not quite clear on the difference between an index fund and an ETF (exchange-traded fund) – don’t panic, you’re not alone.

In many ways, they are very similar. Both allow you to invest your money into a whole basket of stocks, shares, bonds, or other types of assets with just one single investment. An index fund is a type of investment that tracks a particular index. An ETF (exchange-traded fund) often does the same, except that the fund can be bought and sold in lots of different places – that’s what ‘exchange-traded’ refers to.

Typically, both European index funds and ETFs will track a major industry benchmark or focus on a particular market sector. This may sound complex, but it just means that they copy a big list of investments and put some of your money into each asset on the list. The benefit of this is that it gives you instant diversification with a single investment that often comes with low costs and fees.

The key difference between an index fund and an ETF comes down to where and when you can buy them:

- Index funds – have to be bought from the specific provider running the fund. This means you have to buy them directly, so they’re not as easily accessible as an ETF. Index funds can have larger minimum investment requirements, and the price of an index fund is decided daily with no intraday fluctuations. So if you place a buy order, it will be at the next available valuation point (not a spot live price).

- ETFs – trade on stock exchanges, which means they are widely accessible on lots of different investment and share dealing platforms from various countries. The price of an ETF can move up and down during the day, and you can make an investment at any time during trading hours using the live price.

Can you buy Index Funds from Europe or do you have to use an ETF?

You’re not able to buy index funds directly from most providers (unless you’re based in the UK and open an account with Vanguard), but with wide access to ETFs across Europe, you can basically use them as the same investment. Index funds that track a particular index or benchmark usually have an ETF equivalent that tracks the same companies or assets.

So, although you may struggle to buy index funds from Europe, it’s easy to navigate around this by purchasing an ETF equivalent of the same fund.

UCITS Legislation of European ETFs

You’ll notice that with all the ETFs available in Europe, the letters ‘UCITS’ will be in the name. It stands for ‘undertaking for collective investment in transferable securities’ and refers to the regulatory framework set out by an EU directive that the funds must comply with. This may sound boring on the surface, but it’s to protect you as an investor.

You don’t need to know all the ins and outs of the legal jargon, but this regulation controls how European ETFs have to be managed and marketed to investors. Part of the UCITS legislation is that all ETFs based in Europe must provide you with a Key Information Document (KID) in the native language of each country.

This document outlines all the important details regarding an ETF, which allows you to more easily compare different options. If you want to buy US ETFs in Europe, it’s usually worth investing through a European-based ETF that tracks US investments rather than a US-based ETF. Because US ETFs don’t provide you with a KID, which is why the majority of US-based ETFs can’t be listed on stock exchanges in Europe and the UK and are difficult to invest in.

Differences between accumulation and distribution Index Funds/ETFs

Another thing you’ll see with European and US index funds and ETFs is that they will have ‘Acc.’ or ‘Dist.’ in the fund name, here’s what each term refers to:

- Acc. – an abbreviation for ‘accumulation’ and just means any income or dividends are automatically reinvested back into the fund.

- Dist. – short for ‘distribution’ and means that dividend income will be paid out to you as cash and you can decide if you want to reinvest it or use it elsewhere.

Beware that, depending on your country of residency, accumulating ETFs could be more beneficial than distributing ETFs – this is mostly due to tax and simplicity. Below we explore more about the taxation landscape of ETFs in Europe.

ETF taxation in Europe

Lower taxes = higher returns, right? Different European countries have different taxation systems. Here are a few tips to keep in mind:

- Maximize your tax allowances: Some countries have tax allowances (an amount of investment gains on which you don’t pay taxes). Germany is one example.

- Use accumulating ETFs to be more tax-efficient: Accumulating ETFs can be more tax-efficient than Distributing ETFs in countries where you may have to pay taxes on distributed dividends but do not pay taxes on dividends reinvested by the ETF itself (for example, Portugal). So, if you receive €100 as dividends in your brokerage account, you would need to declare it and pay the appropriate tax rate. If that same €100 of dividends are not distributed (kept inside the ETF), it will be reinvested, and there is no tax on that amount.

- Beware of deemed dividends tax: Dividends of accumulating ETFs could still be taxed in certain countries. For example, this happens in the UK, Austria, and Switzerland.

Make sure to check the details for your specific country so that you can choose the ETFs that best fit your specific situation.

How to buy US ETFs in Europe

The process here will be exactly the same, it’s often best to buy ETFs based in Europe that track US indexes and markets because this way they’ll comply with the UCITS legislation.

As mentioned, you’ll find that most US ETFs aren’t listed on stock exchanges in Europe because they don’t meet the regulatory requirements, but this won’t stop you from buying US ETFs in Europe, you’ll just need to make sure a version of the ETF or index fund is listed on a European stock exchange.

Pro tips for investing in ETFs

- Don’t place orders when the markets are closed and at the end or beginning of the day, since it generally has higher volatility;

- ETFs with lower TER (total expense ratios) are preferable;

- ETFs with lower tracking errors are preferable;

- ETFs with lower transaction costs are preferable;

- ETFs with a higher fund size are preferable;

- ETFs from more reputable providers like iShares and Vanguard are preferable.

Pros and cons of investing in Index Funds and ETFs

Below breakdown of the major advantages and disadvantages of buying index funds and ETFs in Europe.

Pros

- Plenty of choices for investing in US, European, UK, and global markets.

- Cheap and low-cost fees in most cases.

- Lots of brokerages to choose from.

- Easy way to diversify with a single investment.

- Backed by UCITS regulatory framework.

Cons

- No direct access to US ETFs.

- ETFs track the market so there’s little chance of beating the market.

- Most ETFs are market-cap weighted so the bulk of your investment goes to the biggest holdings.

- Index funds are only available to UK-based investors.

Bottom line

To sum it up, here’s what you need to do:

- Pick an ETF.

- Find a suitable broker: Finding a good ETF broker is essential. You must consider the number of ETFs you will get access to, the fees you’ll incur, which regulatory body supervises the broker, etc.

- Open an account and deposit money: After deciding which trading platform to use, you must go through the account opening process and deposit money.

- Send a buy order to your broker for the picked ETF: That’s the easiest part (the process is intuitive)! After having your brokerage account and the name of the ETF that you want to buy, you just have to place a trade!

Investing and buying ETFs (or index funds for UK investors) from Europe is a great way to start putting your money to work, especially if you’re a beginner investor. Exchange-traded funds can be passively or actively managed, and there are options to cover just about every market and security you can think of.

Once you’ve picked your ideal ETFs to invest in (based on your index fund research), found a low-cost platform that suits your needs, and made your first investment – you can keep your deposits on autopilot. This will let you benefit from dollar-cost averaging and build wealth over time using the power of compound interest.

Other FAQs

How can I invest in the S&P 500 index fund from Europe?

You just need to select which fund or ETF you want to buy, create an account with a brokerage, and make a buy order. You can read a more in-depth guide here on how to invest in the S&P 500 from Europe.

Can you trade ETFs in Europe?

Yes! You can sign up to a share dealing platform and are free to both buy or sell ETFs, just make sure you’re using a cheap brokerage to keep your trading costs down.

Can I buy Vanguard ETFs in Europe?

Yes, but you’ll just need to check which brokerages have the Vanguard ETFs or index funds you want to buy.

Can I buy iShares ETFs in Europe?

Definitely, just double-check that the investing platform you’re looking to use will give you access.

What is the best ETF to buy in Europe?

This depends on your investing strategy and goals. Finding the best ETF to invest in for you will partly be related to your investment time horizon and attitude to risk. Whether you’re looking for capital growth or income from dividends can also help determine what’s the best ETF for you.