Investing in the stock market has never been easier, thanks to the numerous online trading apps available today. However, it can be challenging to choose one…

If you don’t do proper research, you could end up with a platform that is difficult to use, expensive, unsafe, or simply limited, considering your investment profile and experience.

Fortunately, we have successfully analyzed many trading apps before and conducted multiple trading app reviews, so we can clarify some of your doubts and help you make an informed decision!

In this article, we listed the best stock trading apps in the UAE, comparing their specificities and highlighting their strengths and weaknesses.

Don’t want to read the whole article? Find our summarized list below:

In a nutshell: Best apps in the UAE

- eToro: Best for trading app overall. New users earn a free share worth $50 with our referral link. More details here.

- Interactive Brokers: Best for intermediate and advanced investors

- XTB: Best for forex and CFDs

- Plus500: Ideal for demo account and CFDs

- Saxo Bank: Best for professionals

- Sarwa: Best for beginners and auto-invest

Comparison of best trading apps in Dubai & the UAE

#1 eToro: Best trading app overall

eToro at a glance

61% of retail CFD accounts lose money.

Founded in 2006, eToro is a well-known, worldwide fintech startup and the leader in social trading (following other people’s trades), with over 30 million users globally. You can also invest in products like stocks and ETFs through their intuitive platform, but also CFDs and cryptocurrencies, making it ideal for those who want to learn the art and science of trading. They offer commission-free stock and ETF trading for most names (other fees apply).

Opening an account and depositing is easy, and you can even try it out with virtual money. On the downside, spreads can be high for some products. The only currency accepted is the USD, which means that you’ll be charged currency conversion fees upon deposit and withdrawal if you deposit in another currency.

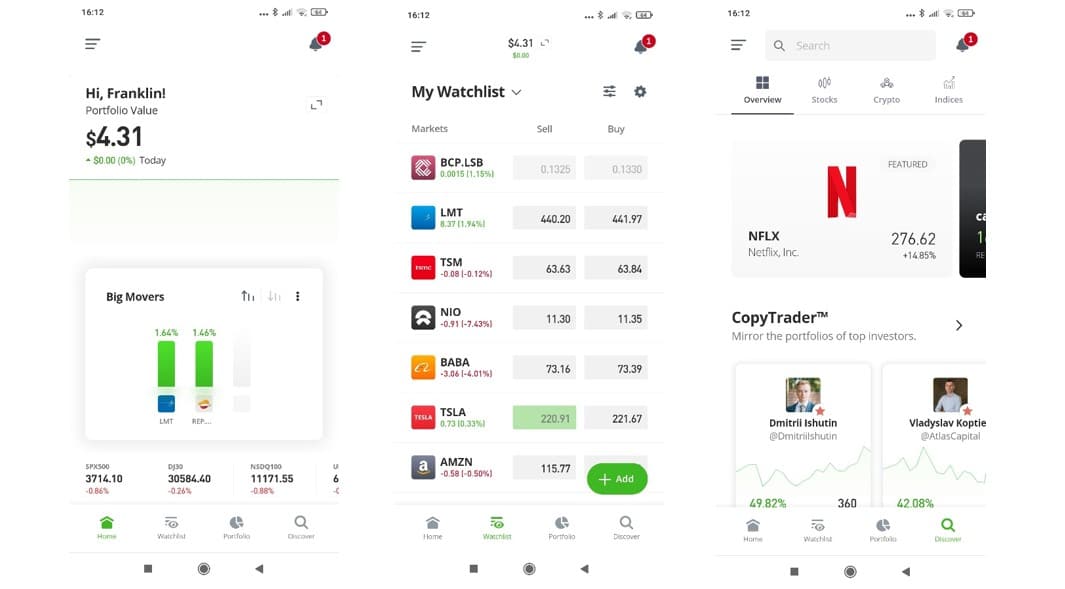

eToro’s trading app, which can be web-based or mobile-based, is a social trading platform that allows investors to discuss investments, speculations, and market news with other traders, copy strategies, and open a demo account. Both apps have comprehensive and user-friendly interfaces where you can intuitively trade commission-free stocks from many countries, such as the US, UK, Germany, and many others. Besides, the app also offers ETFs, cryptocurrencies, and CFDs.

This online trading platform provides reliability and safety to its customers: it is regulated by top-tier authorities such as the FCA, ASIC, and the CySEC, and your funds will be segregated and also secured by up to 1 million Euros, due to private insurance. If you are still not convinced or want to know more about this subject, please check out the article we prepared about the safety of eToro.

Considering all these factors, eToro is a solid option for beginners, intermediate, and experienced investors, and certainly one of the best stock trading apps in the UAE. eToro does offer an Islamic (swap- and interest-free) account to all who contact customer service and fund their accounts to at least 1,000 USD.

Want to know more about eToro? Check eToro’s website and read our review.

Pros

- Low stock trading fees (from $0 per trade)

- Commission-free ETFs (other fees apply)

- Social trading and other innovative products

- Wide variety of financial products

- Slick, modern, and easy for anyone to use

- European users have access to three account currencies: EUR, USD and GBP

- Top tier regulators

Cons

- Limited disclosed financial information

- Withdraw and inactivity fees

- Spread, overnight, inactivity, and currency conversion fees higher than average

- Doesn’t offer bonds, futures, or options

#2 Interactive Brokers (IBKR GlobalTrader)

Interactive Brokers at a glance

Interactive Brokers has proven to be one of the most reliable brokers in the market. The company was founded over 40 years ago and survived many financial crises, making it a well-established and trustworthy broker regulated by many top-tier regulators.

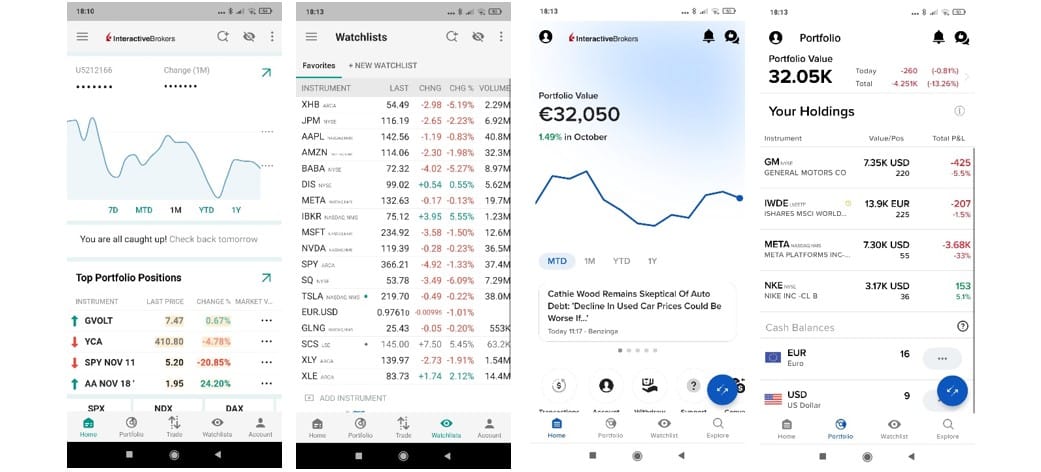

They offer trading apps to trade stocks with sophisticated and powerful tools, a wide range of products available for trading, and low prices. This advanced trading platform offers different mobile apps and web-based platforms that suit various trading strategies and should be used according to your knowledge and experience. The mobile app IBKR GlobalTrader is a user-friendly app suitable for beginners because it simplifies investments without losing the powerful tools for which the broker is famous.

If you want to make the most out of the powerful tools the broker provides, you can use the IBKR Mobile, a complete and sophisticated trading app where you can trade stocks, ETFs, and options. As the features of this app can be overwhelming for beginners, we would recommend the IBKR GlobalTrader if you do not have a lot of experience.

It now even accepts UAE dirhams (AED)!

On the downside, Interactive Brokers’ fee structure is complex, the registration process is lengthy (but online), and the broker does not offer commission-free trading in the UAE. However, when considering FX fees, narrower spreads, and the stock loan program, Interactive Brokers’ clients still get significant savings compared to most investment apps.

Overall, we believe that Interactive Brokers offers some of the best stock trading apps in the UAE, and you can find what you are looking for, irrespective of your needs!

Pros

- Low commissions on US stock trading

- No monthly inactivity fee

- The broadest product and markets range in the brokerage industry

- Demo account

- Excellent reputation (founded in 1978)

- Extensive research and Education tools

- Has a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors, IBKR GlobalTrader.

- Offers interest on uninvested cash balances

Cons

- Complicated and lengthy account opening process (but fully online)

- Steeper learning curve for beginners

- Website is difficult to navigate

- Interactive Advisors (Robo-advisor feature) is only available for US customers

#3 XTB

XTB at a glance

69-80% of retail CFD accounts lose money.

Founded in 2002, XTB is a major player in the brokerage industry with extensive worldwide experience, regulated by the Financial Conduct Authority (FCA) – plus other relevant regulatory bodies – and listed on the Warsaw Stock Exchange.

You can invest through xStation Mobile in different investment products, such as stocks, ETFs, and CFDs on Forex, Indices, and Commodities. It also offers a 0% commission on stocks and ETFs.

XTB also has offices in the United Arab Emirates through the entity XTB MENA Limited, which has a license from the DFSA (Dubai Financial Services Authority) to operate in the region.

XTB does offer Islamic (swap-free) accounts for residents of UAE.

With no commission on stocks and ETFs, no minimum deposit, Islamic accounts, and a free demo account that can be used for a month, XTB is a good and reliable option for beginners and advanced investors, which puts it in third place on our list of best stock trading apps in the UAE.

Pros

- Free stocks trading (only applicable to some countries)

- Customizable trading platform (charts and workspace)

- Low Forex Spreads

- Demo account

- No minimum account deposit

- Valuable education materials

- Top-tier Regulators

Cons

- Complex trading platform for a beginner

- High Stock CFD spreads

- Limited product portfolio

- Withdrawal fees for transfers below $100

- Inactivity fee (€10/monthly after 1+ year with no activity plus no deposit in the last 90 days)

#4 Plus500

Plus500 at a glance

82% of retail CFD accounts lose money.

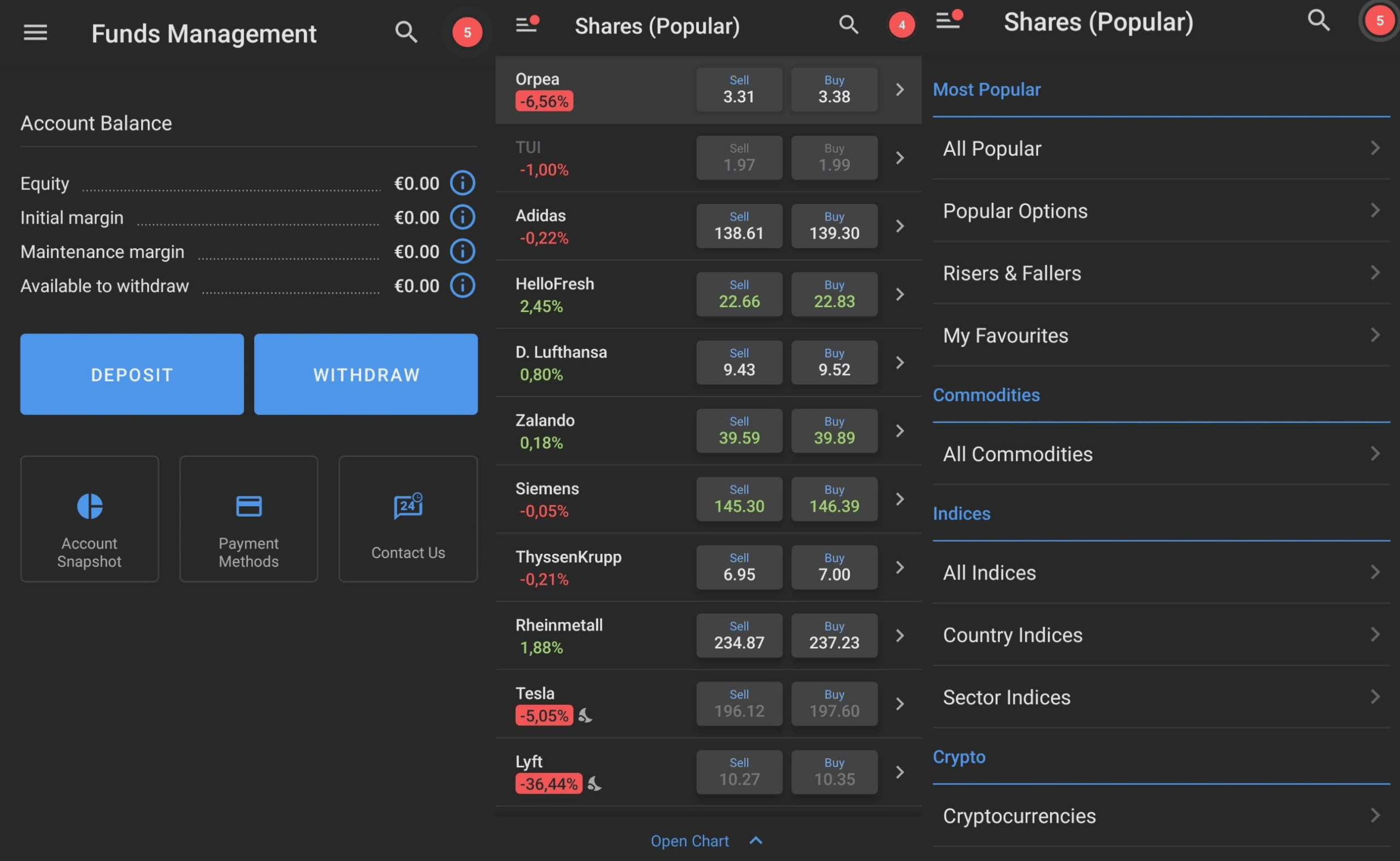

Plus500 is a broker founded in 2008 whose shares are traded on the London Stock Exchange and who operates in the UAE via the subsidiary Plus500AE Ltd, authorized and regulated by the Dubai Financial Services Authority (License No. F005651). Regulated by top-tier authorities such as FCA and CySEC, the broker provides a mobile app named Plus500 and a web-based platform called WebTrader. Both are comprehensive and accessible, and you can test their features by opening a demo account.

When trading from the UAE, you can only access Plus500 CFD, where you can trade CFDs on several financial instruments but not real stocks. CFDs are leveraged and riskier products, which may exacerbate your losses.

Overall, the broker offers solid CFD stock trading apps for Emirate customers. The platforms have low costs, reliability and safety, interesting features and products for beginners and experienced traders, and good usability. Besides, the broker allows customers to open Islamic accounts. As a downside, you will not have access to real stocks and ETFs.

If you want to learn more about Plus500, please check our full Plus500 review.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

This information is NOT relevant to EU residents who are to be serviced by EU subsidiaries of the Plus500 Group, such as Plus500CY Ltd, authorized by CySEC (Reg. 250/14). Different regulatory requirements apply in Europe, such as leverage limitations and bonus restrictions.

Pros

- Acessible and responsive platform

- Low spreads

- No dealing commissions

- Demo Account

- Top-tier regulators

Cons

- No ETF offering

- Inactivity fee ($10 per month after no login activity in 3 months)

- High overnight funding fees

- Very little research and education provided

#5 Saxo

SAXO at a glance

62% of retail CFD accounts lose money.

Saxo Bank is a distinguished multi-asset broker renowned for its exceptional trading platform experience and extensive range of over 72,000 tradable instruments. It was founded in 1992 and offers a comprehensive suite of advanced trading tools, in-depth research capabilities, and premium features.

Saxo Bank lets you open an account in a wide range of currencies, including USD, EUR, GBP, AED, and several other major currencies. They have three account types (Classic, Platinum, and VIP), each with its own features and services.

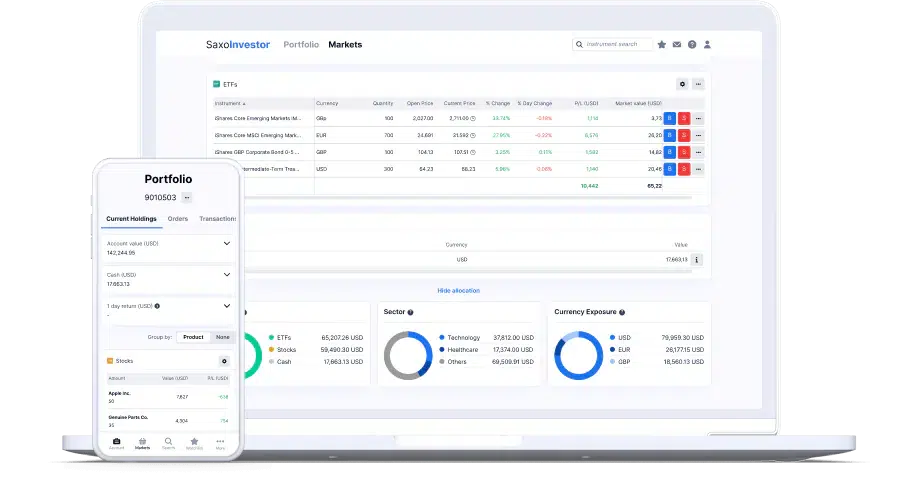

Saxo operates in the UAE via its representative office in the UAE, whose license was issued by the Central Bank of the UAE. They offer in the UAE a comprehensive and customizable mobile trading app that is among the best in the market: SaxoTraderGO.

SaxoTraderGO is a user-friendly, customizable, and award-winning trading platform that can be used by experienced investors and beginners. The app has a mobile and a desktop version. The broker also offers SaxoTraderPRO, a desktop-based platform (that works on Windows and MAC) developed for advanced traders due to its level of detail and complexity. The app is extremely customizable, offers sophisticated tools to analyze and track your performance, and can be used on up to 6 different screens.

Considering that the trading apps have excellent educational resources, low prices, and an impressive range of tradable assets, Saxo deserves a place on our list of the best stock trading apps in the UAE. The only downside we could think of is that after registering and completing the verification, you will need to fund your account with at least $5,000 to start trading, which can be burdensome for some beginners.

Pros

- Excellent research materials

- Outstanding trading platforms (SaxoTraderPRO and SaxoTraderGO)

- Extensive range of investment products

- Long track record

- Supervised by worldwide top-tier regulators

Cons

- High minimum deposit (varies between countries)

- Fees higher than average

- Fee structure is complex

- Does not accept US residents

#6 Sarwa

Sarwa at a glance

Sarwa is a Dubai-based investment company that offers 4 main services/products:

- Sarwa Save: A savings account to earn interest on your cash;

- Sarwa Trade: A trading account that allows you to trade US-listed stocks, US options and ETFs on your own;

- Sarwa Invest: A robo-advisory solution that allows you to create and manage ETF portfolios automatically

- Sarwa Crypto: An account that allows you to trade cryptocurrencies

The platform is acclaimed for its low fees, accessibility, transparency, and promo code bonus. It is a great option for beginners or those looking for a local solution.

Their flagship product, Sarwa Invest, creates tailored portfolios using affordable index funds (ETFs), and charging an annual management fee between 0.5% and 0.8%, dependent on the portfolio size, in addition to a 0.1% underlying portfolio expense. Investors can further customize their Sarwa Invest experience by opting for Conventional, Halal, Socially Responsible Investing (SRI), or Crypto plans and can select from six distinct risk levels within each.

Sarwa Save is designed for those seeking a safer cash management option, promising a 5.1% projected return without imposing minimum balances or management fees. An alternative Halal version does charge a 0.5% management fee. Sarwa Crypto caters to cryptocurrency enthusiasts, allowing trades without commissions but applying a 0.75% spread, and supports various order types. For those focused on stocks and ETFs, Sarwa Trade offers trading exclusively on US stocks and ETFs with features like fractional shares, though it doesn’t support margin trading.

Moreover, Sarwa offers personalized financial consultations with their licensed experts. Transactions via local UAE banks are free of funding or withdrawal charges, and the platform adheres to fixed exchange rates for AED-USD conversions.

On the downside, it lacks important assets like bonds or shares listed outside the USA. It is also a newcomer in the industry, with short track record when compared with some of the names mentioned here.

Pros

- Access to human financial advisor

- Low fees

- Slick and easy to use app

- Sarwa Invest (Robo-advisor) is a good option for beginners

- Sarwa Save is a good alternative to earn interest on cash

Cons

- Newcomer in the industry: short track record

- Limited asset offering: no bonds or stocks listed outside the USA

- US options are quite expensive ($4 per contract)

Methodology

When making this list, we wanted to help Emirate investors to make an educated choice when choosing the best stock trading app. Each of the trading apps that we presented has its main features, and we tried to provide a diverse list that will suit the needs of different profiles of investors. In any case, this is what we took into consideration:

- Prices: the price cannot be the only aspect to be considered when choosing the trading app to invest in, but it is definitely important, you do not want to pay more for a service when you can get the same quality for cheaper prices.

- Educational resources: high-quality educational resources may be a great advantage, especially for beginners, who can use them to educate themselves before investing money.

- Range of products and markets available: Does the app offer real stocks and ETFs, or only CFDs? Does it have crypto?

- Customer service: irrespective of your choice, problems almost always appear, and it is important to find trading apps developed to help you when it does happen.

- The trading app itself: of course, we took into consideration the functionalities and usability of the platform, as well as its specific features. Choose a platform with an intuitive interface that is easy to navigate for both beginners and experienced traders.

- Security: all platforms in the list are regulated by top-tier authorities. Ensure the platform is regulated by reputable authorities like the DFSA.

Account setup and process

Setting up a trading account in the UAE is simple when you follow these key steps:

- Obtain a National Investor Number (NIN) – only for investments in the UAE stock exchanges. Register for a NIN through the Dubai Financial Market (DFM) or NASDAQ Dubai.

- Choose a licensed brokerage firm: Select a reputable, DFSA-regulated broker such as Interactive Brokers, Saxo Bank, or Sarwa.

- Open a brokerage account: Complete the online application with your personal and financial information. Submit necessary documentation for verification.

- Fund your account: Deposit funds using bank transfers, credit/debit cards, or other available methods. Some brokers accept AED, reducing currency conversion fees.

- Set up your trading platform: Use platforms like SaxoTraderGO for professionals or IBKR GlobalTrader for beginner investors. Customize your dashboard with charts, market data, and analysis tools.

- Develop your investment strategy: Utilize market analysis and portfolio optimization tools provided by your broker. Diversify your investments across stocks, ETFs, Forex, and cryptocurrencies.

- Start Trading: Execute trades through your chosen platform.

Types of trading platforms

Here are the main types of platforms available in the UAE:

- Stock trading platforms: Buy and sell shares of publicly traded companies.

- Forex trading platforms: Trade currency pairs in the foreign exchange market.

- Crypto trading platforms: Buy, sell, and trade cryptocurrencies.

- CFD trading platforms: Trade Contracts for Difference on various assets without owning them.

Selecting the right type ensures your app aligns with your investment strategy and goals.

Videos about investing from the UAE

Check our in-depth YouTube videos about how to invest and how to choose a trading app in the UAE:

Bottom line

To summarize here’s the list of “Best trading apps in Dubai & the UAE”:

eToro

Best overall trading appXTB

Best for CFD and Forex tradingInteractive Brokers

Best for intermediate and advanced investorsPlus500

Best for demo account and CFDsSaxo Bank

Best for professionalsSarwa

Best for professionals

It is hard to choose the right stock trading platform in the UAE. Luckily, we helped many people in the same situation before, and we can help you now. To facilitate your choice, we listed a few of the best stock trading apps in the Dubai & UAE in our opinion, comparing what they can offer and highlighting their strengths.

We know that trading stocks is a good way to achieve financial freedom, but, like everything in life, there are risks involved. We hope that our analysis was enough to help you make an educated decision that acknowledges those risks, whether you are experienced or a novice in the world of trading.

In any case, keep on studying, do due diligence, know your investment profile, and invest wisely!

FAQs

What are the safest trading platforms in the UAE?

All the online trading platforms mentioned in the article are regulated by top-tier regulators. Just to recap:

- eToro: Regulated by the FCA, CySEC, and ASIC, with segregated funds and private insurance up to 1 million Euros.

- Interactive Brokers (IBKR GlobalTrader): Regulated by multiple top-tier authorities including FINRA, SIPC, SEC, and FCA, and has a long-standing reputation for reliability.

- XTB: Regulated by the FCA, KNF, CySEC, and FSC, and has a significant global presence.

- Plus500: Regulated by the FCA, CySEC, MAS, ASIC, FMA, and DFSA, and is publicly traded on the London Stock Exchange.

- Saxo Bank: Regulated by ASIC, FSA, FCA, SFC, MAS, FINMA, and DFSA, with a long track record and a comprehensive range of tradable instruments.

- Sarwa: Regulated by the DFSA in Dubai, offering a transparent and user-friendly platform.

All of these platforms adhere to strict regulatory standards and have implemented various safety measures to protect their users, making them safe choices for trading in the UAE.

What factors should I consider when choosing a trading platform in the UAE?

When selecting a trading platform in the UAE, consider factors such as regulatory compliance, available financial products, fees and commissions, user interface and experience, customer support, and educational resources. Ensure reputable authorities like the DFSA in Dubai regulate the platform.

What is the Dubai Financial Services Authority (DFSA)?

The Dubai Financial Services Authority (DFSA) is the financial regulatory agency responsible for overseeing and regulating financial and related services conducted in or from the Dubai International Financial Centre (DIFC).

The DFSA’s responsibilities include licensing and supervising financial institutions, ensuring the protection of consumers, fostering market integrity, and enforcing compliance with its regulatory framework. It covers various financial services, including banking, asset management, insurance, and securities trading.

What is the difference between a stock and a stock CFD?

While the stock gives you a property right over a share of the company, the CFD does not. The stock CFD is a derivative contract where the underlying asset is the stock and where the broker promises to pay you back the difference in value between the time you opened the position and the time you close it. CFDs have a leverage effect: if you buy a stock CFD and its price goes down, you will need to borrow money from the broker to keep the position open. This makes the instrument a risky option that is not suitable for beginners.

What is an Islamic account?

An Islamic account follows the principles of Islamic law, which forbids the use of interest or interest-based lending in any form. Many online brokers can accommodate Muslim traders and offer interest- or swap-free accounts.