For both Android and iOS, there remains a virtually limitless plethora of trading apps available to Europeans. Sifting through them all to find the coveted best trading app in Europe feels like a daunting challenge. How do we go through them all?

To save you hours googling through the choices, we’ve narrowed down the field to the top options. Each trading app specialises in a different competitive edge. In other words, collectively, they are the best trading apps in Europe, depending on your preferences.

Our criteria includes: the mobile platform itself, products available, regulatory environment, fees, minimum deposits, and customer suport.

The best trading apps in Europe

- Interactive Brokers: Best overall investing app in Europe

- eToro: Best for commission-free ETF investing and social trading

- XTB: Best for CFD and Forex trading

- Trading 212: Best for commission-free stock, ETF and crypto investing (Other fees may apply. See terms and conditions)

- Trade Republic: Best to earn interest on uninvested cash

- DEGIRO: Best for low-cost investing

- inbestMe: Best for automated investing

- Lightyear: Best for interest on uninvested cash

Disclaimer: Investing involves risk of loss.

For a list of brokers we do not recommend, you can visit our full list of broker reviews, and filter by “Not recommended”.

46% of retail CFD accounts lose money.

69-80% of retail CFD accounts lose money.

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Investing involves risk of loss.

Investing involves risk of loss.

Terms apply, seek guidance if necessary. When you invest, your capital is at risk.

Comparison of European trading apps

Video summary

Other resources

- Check our Youtube channel! You will find step-by-step guides of how to invest in the S&P 500 on different apps, as well as other educational videos about investing and investment platforms.

- Explore our tools: Check our comparison tool, reviews, broker bonuses, broker interest rates, BrokerMatch, and others.

Trading app reviews

#1 Interactive Brokers (IBKR GlobalTrader)

With IBKR GlobalTrader, this is the all-around best trading app in Europe. Its track record spans over 40 years, through several financial crises, with an incredible range of products, access to over 150 markets, and the latest trading technology.

The mobile app designed for more advanced users, IBKR Mobile, features trading features perfect for those coming with some experience. However, these may feel daunting for learners, such as the spread grid and order entry wheel.

IBKR GlobalTrader remains much simpler to use, available in several languages, and a joy to use. It’s perfect for European investors simply wanting to execute trades quickly in multiple asset classes.

For US stocks, commissions start at $0.005 per share ($0.35 minimum), while for European ETFs, costs are 0.05% of the order value (€1.25 minimum, €29 maximum).

IBKR is one of the most trustworthy names in the business as its parent company, Interactive Brokers Group, is publicly listed on NASDAQ. In addition, the broker is regulated by several leading financial authorities.

Read our comprehensive IBKR review.

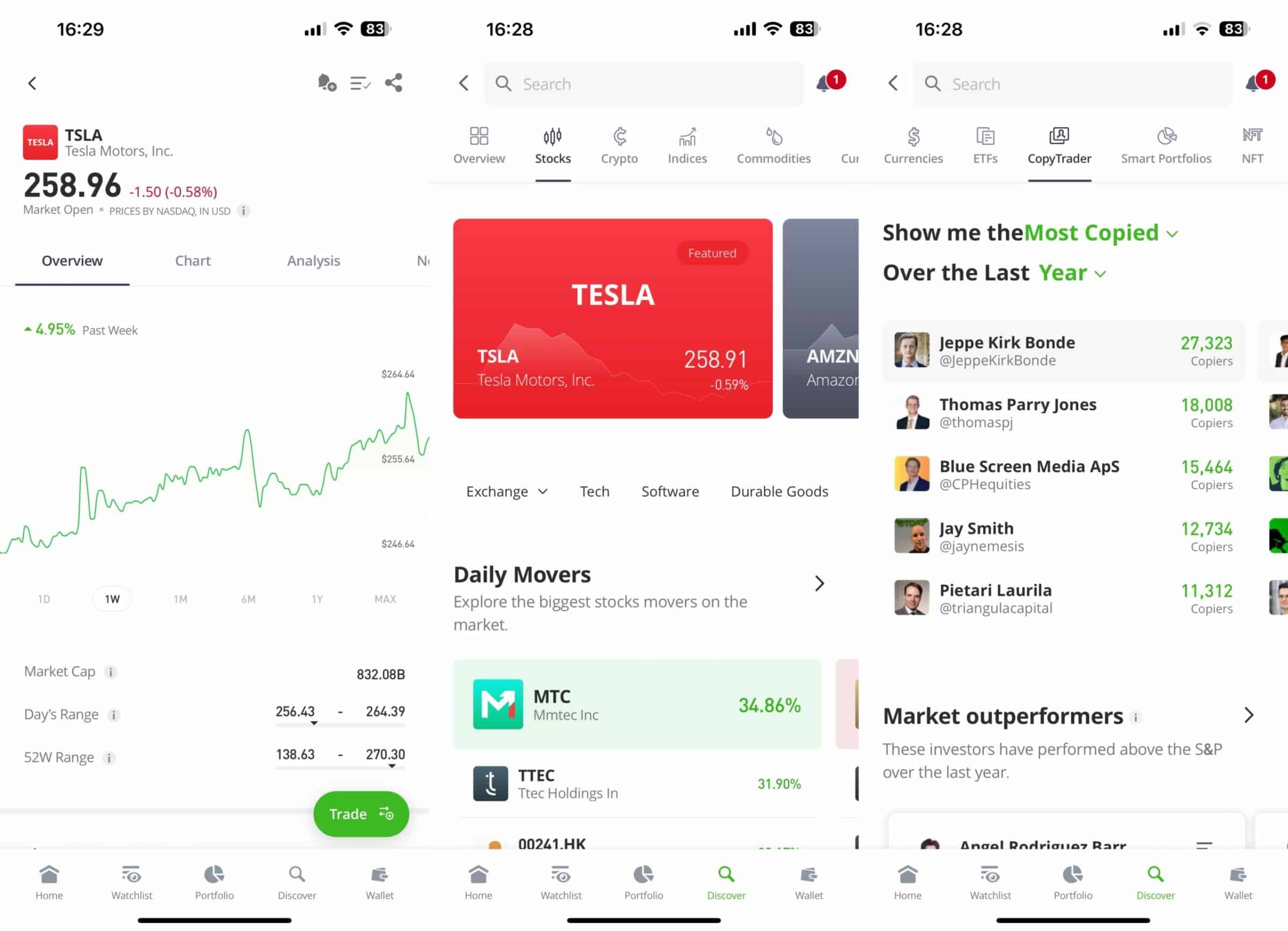

#2 eToro

46% of retail CFD accounts lose money.

Home to over 35 million users, eToro remains a popular name amongst European beginners desiring simplicity and access to a good range of products. It’s the best trading app in Europe for social trading. ETFs are traded commission-free, as a whole, or fractional shares (other fees apply). US, EU and UK stocks have a commission of $1 per trade, per side (when buying and selling).

eToro’s investment platform, accessible through both web and mobile platforms, is a social trading hub. Here, investors can engage in discussions about investments, speculations, and market news with fellow investors. eToro also allows users to replicate trading strategies (CopyTrader™) and invest in ready-made investment portfolios (Smart Portfolios) based on thematic investment strategies.

The demo account is particularly useful for a beginner ($100,000 of virtual money). It lets you have real hands-on experience as you would be using real money. So, when switching to a real account, you will notice no difference between your training and real-life investing. On the downside, there is a withdrawal fee of $5, and If you do not log into your account for over one year, a monthly inactivity fee of $10 will be charged.

eToro is fully regulated and supervised by top-tier regulators such as the UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC) in Australia. The subsidiary in Europe, formerly known as “eToro (Europe) Ltd,” is authorised and regulated by the Cyprus Securities Exchange Commission (CySEC).

Read our eToro review.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 46% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

#3 XTB

69-80% of retail CFD accounts lose money.

Founded in 2002, XTB is a major player in the brokerage industry with extensive worldwide experience, regulated by the Financial Conduct Authority (FCA) – plus other relevant regulatory bodies – and listed on the Warsaw Stock Exchange.

You can invest through xStation 5 and xStation Mobile in different investment products, such as stocks, ETFs, and CFDs on stocks, Forex, indices, commodities, and cryptocurrencies (this product offering may vary slightly from country to country). It offers 0% commission on stocks and ETFs, but only in some European countries*. International investors only get a 0% commission on stock and ETF CFDs.

Opening an account and transferring money is a quick and hassle-free process. For beginners, it presents a demo account where you can trade as if it were real money to help you feel the investment platform firsthand, and you get access to educational tools. For intermediate and advanced investors, you will find plenty of technical and fundamental tools to help you better assess your investment decisions.

On the downside, you will face an inactivity fee of €10/month after one year of non-trading, and if you have not deposited in the last 90 days, it charges high commissions on CFDs of cryptocurrencies but low costs for Forex.

Want to know more about XTB? Check our XTB Review.

*The Czech Republic, France, Germany, Italy, Poland, Portugal, Romania, Slovakia, and Spain.

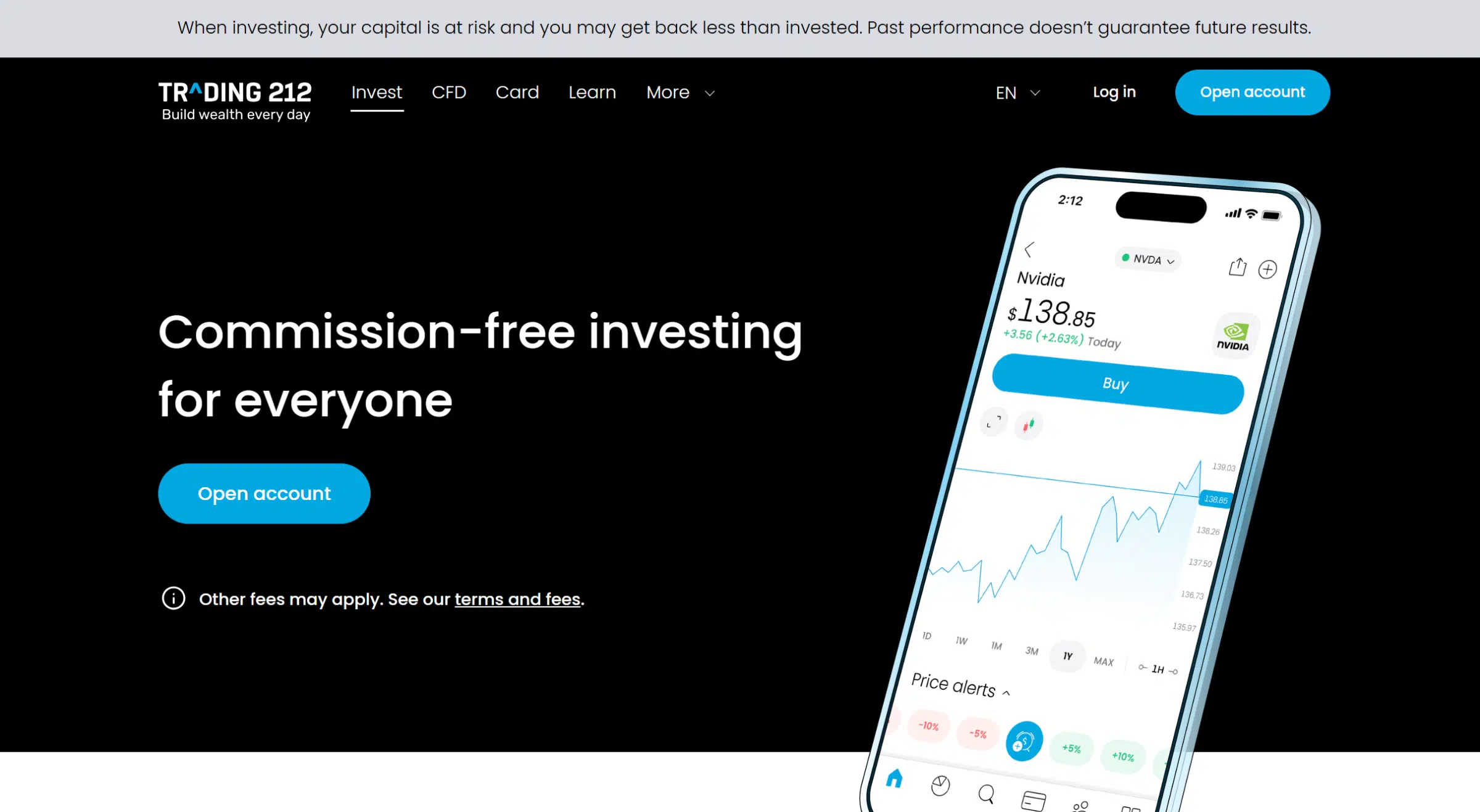

#4 Trading 212

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Founded in 2006 and with over 5 million funded accounts, Trading 212 is a fintech based in London that aims to democratize the entire investment process through a simple mobile application by allowing anyone to invest in more than 10,000 stocks, ETFs and crypto plus CFDs on several assets. It offers a free fractional share worth up to €100!

In Trading 212, you will find commission-free stocks, ETFs and crypto trading, fractional shares, and an automatic investment system. On the downside, it shows some limitations regarding the products available, such as the lack of bonds and options.

Opening an account is quick and easy. Within the app, you will notice two distinct sub-platforms: Trading 212 Invest, where you can trade a range of assets free of charge, and Trading 212 CFD, where you may trade leveraged financial products (CFDs). On Trading 212 CFD, the currency conversion fee (FX fee) is higher (0.50%) than on Trading 212 Invest (0.15%).

The minimum deposit and withdrawal amounts are both €/£10. There are no deposit fees if you use bank transfer (other options include cards and Google/Apple Pay). For withdrawals, there is no fee, regardless of the method used.

In terms of safety, every Trading 212 is regulated by the following regulators: the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC) and the German Federal Financial Supervisory Authority (BaFin).

To learn more about the platform, check out our Trading 212 review.

Risk disclaimer: When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

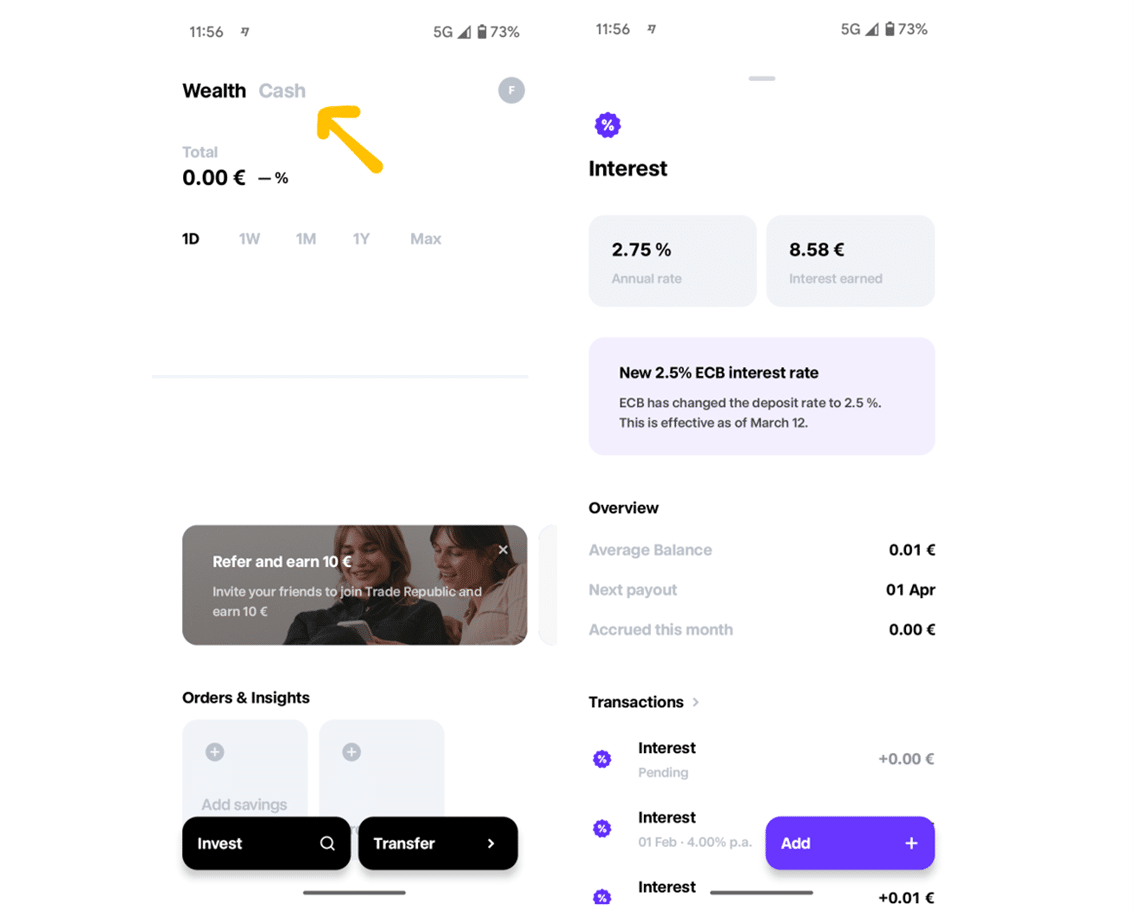

#5 Trade Republic

Investing involves risk of loss.

Founded in 2015, Trade Republic is a discount broker based in Berlin, Germany. It focuses on five types of financial assets: stocks, ETFs, bonds, cryptocurrencies, and derivatives. Stocks and ETFs can be traded daily from 7:30 to 23:00 CET, crypto 24/7, and derivatives from 8:00 to 22:00 CET.

It uses the motto “Do more with your money” to express its commitment to its customers by selling itself as a “no order fee” platform. Nonetheless, a €1 external fee is applied in every single trade (Except saving plans), meaning that in practice, you will charge at least €2 (€1 for buying and another €1 for selling). It is still competitive but not commission-free.

Trade Republic was the first European broker to increase the interest rate paid in euros after many years of zero-to-low interest rates due to the European Central Bank (ECB) policies. The money not invested in your account will earn 2.00% per year (paid monthly). Besides, it is the first broker in Europe to allow investment in corporate and government bonds for as little as €1 through fractional trading.

The broker is regulated by BaFin and also supervised by the Deutsche Bundesbank. Your investment assets and cash are fully protected up to €20,000 and €100,000, respectively.

Want to know more about Trade Republic? Check out our Trade Republic Review.

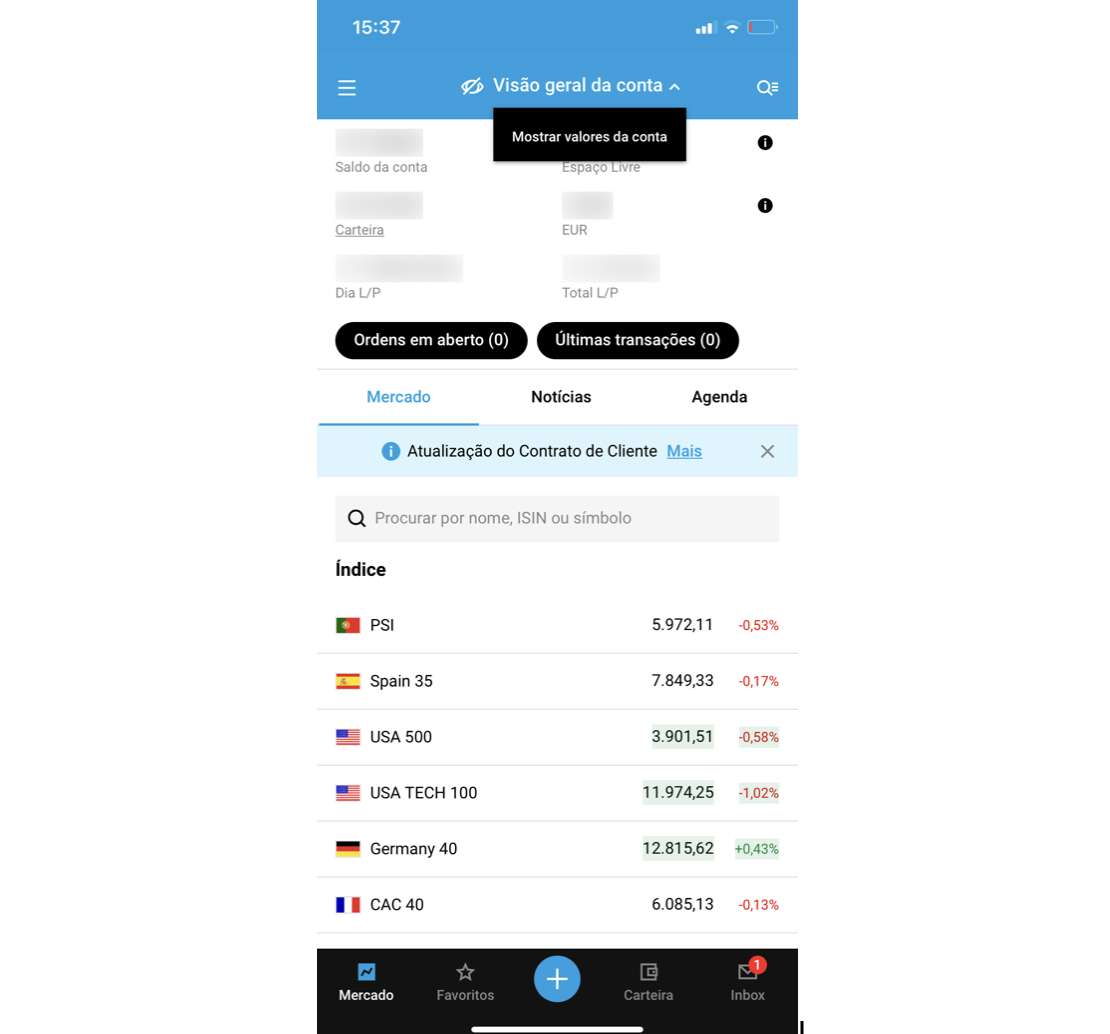

#6 DEGIRO

Investing involves risk of loss.

Founded in 2008, DEGIRO remains one of the best trading apps in Europe for traders specialising in equities and ETFs. It’s the discount broker for over 3 million Europeans, including beginners and more advanced users. It features low fees all-around, no inactivity fees, a +€/£1 commission for US stock trading (+€/£1 of external costs), and ETFs (+€/£1 of external costs).

The platform operates on a “do-it-yourself” basis by providing the necessary tools to trade many equities often. The products on offer include futures, warrants, investment funds, and some leveraged products in addition to stocks, ETFs, and bonds. That being said, DEGIRO is a winner for buy-and-hold investors, given a lack of fees for maintenance, custody, and inactivity.

While focusing on simplicity, its mobile app provides straightforward trade executions alongside two-way and biometric authentications. However, it lacks price alerts.

Read our DEGIRO review here.

#7 inbestMe

inbestMe is a Robo-Advisor that allows you to build a customized portfolio based on your financial objectives and risk tolerance. It is fully automated and even offers tax-loss harvesting (tax efficiency). It charges a maximum management fee of 0.41%/year. Access to a human advisor is available for amounts above €100,000.

The inbestMe app is not particularly relevant when compared to the brokers’ app since you do not have the purpose of trading, following the news or set alerts. The main functions will be to deposit/withdraw and follow your current portfolio through your investment dashboard. Nonetheless, it is a smooth app, and in the palm of your hand, you check how your portfolio evolves.

You have four available ETF investment styles: inbestMe ETF, inbestMe ETFs Dynamic, inbestMe ETFs Value, and a Socially Responsible Investing ETF. You can start investing in this portfolio with a minimum of €/$5,000.

InbestMe is regulated and supervised by the CNMV (National Securities Market Commission), the body supervising and inspecting the Spanish securities markets. Your investments are protected up to €100,000 by FOGAIN, depending on which Interactive Brokers account is opened (€20,000 for IB Ireland and up to $500,000 for the IB United States).

#8 Lightyear

Terms apply, seek guidance if necessary. When you invest, your capital is at risk.

Lightyear is an emerging investing app in Europe. Its user-friendly and well-designed mobile trading platform features an efficient search function and neatly organised asset groups. It’s available for both Android and iOS. One drawback compared to the web platform is that the mobile app is only available in English.

In the mobile app, you are prompted to choose a 4-digit PIN to secure your app. One notable feature of the mobile app is that it allows you to use biometric data (Face ID or fingerprint) to log in.

Lightyear offers one of the highest interest rates in uninvested cash through MMFs in EUR, GBP and USD.

You can find a search bar at the top and essential information, such as the announcement “You’re earning interest”, “Popular this week” or “Discover”. These sections are further divided into Stocks and ETFs, serving as a collection of “Trending Assets” on the platform for the current week. The Lightyear mobile app offers Market, Limit, and recurring orders, just like the web trading platform. However, it’s essential to note that compared to competitors such as Interactive Brokers, the order choices are somewhat limited.

Lightyear operates under the regulations of Estonia and the UK authorities. Lightyear Europe is directly regulated by the Estonian Financial Supervision Authority (EFSA) -4.1-1/31. In the UK, the service is provided by Lightyear UK Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 987226).

Lightyear also offers a free share up to €100 with our promo code.

Disclaimer: Capital at risk. The provider of investment services is Lightyear Financial Ltd for the UK and Lightyear Europe AS for the EU. Terms apply: lightyear.com/terms. Seek qualified advice if necessary.

Bottom line

To summarize here’s the list of the best trading apps in Europe:

Interactive Brokers

Best overall trading app in EuropeeToro

Best for commission-free ETF investing and social tradingXTB

Best for CFD and Forex tradingTrading 212

Best for commission-free stock and ETF investingTrade Republic

Best to earn interest on uninvested cashDEGIRO

Best for low-cost tradingInbestMe

Best for automated investingLightyear

Best for interest on uninvested cash

Venturing into online trading feels daunting at first–we’ve made the journey ourselves–but it is one filled with new opportunities and new rewards daily. Before registering with a new broker, take the time to evaluate your priorities.

Do you value ETFs with minimal fees? DEGIRO. Not sure, but do you simply want to get started today with a great mobile app? Interactive Brokers.

We hope you’ve found this article helpful and feel confident in your next trading journey, whether you’re new to the game or getting back in.

FAQs

What is the best trading app in Europe?

The “best” app depends upon your personal preferences and priorities. However, most traders cannot go wrong with our recommended choices.

What is the best trading app in Europe for beginners?

All four trading apps mentioned in this article are suitable for beginners. If you do opt for IBKR, be sure to select IBKR GlobalTrader instead of IBKR Mobile.

How much money is needed to get started?

As little as a single euro or pound, given that many European brokers offer commission-free trading for stocks and ETFs, alongside no minimum deposit. IBKR, and DEGIRO are prime examples.

Is using a desktop better than an app?

The majority of trades still happen through desktop trading instead of through an app. Given the increased monitor size and processing speed, avid traders tend to prefer desktops while using mobile phones when away from the desk. More casual traders can still do well using only a mobile app.