Hello, fellow investor! We will review Lightyear to help you determine whether it is the right investment platform for you.

Lightyear provides an affordable and user-friendly mobile platform tailored for entry-level investors.

With a straightforward account opening process and a high interest rate on uninvested cash, it’s an ideal choice for those venturing into investing without unnecessary complexity.

However, there are trade-offs, such as the absence of multiple investment options, such as forex, options, futures, cryptocurrencies, and more.

Lightyear is a EU-based stockbroker. Lightyear introduced its trading app to the UK market in late 2021. It later expanded into Ireland and many parts of Europe during the summer of 2022, with Estonia serving as its operational base.

Concerned about safety? No need to worry – Lightyear follows the rules and regulations in both the UK and Estonia. We’ll look into how Lightyear keeps things secure for you as an investor.

You can open a Lightyear account here! Sign up with the promo code INVESTINGINTHEWEB, deposit at least £/€50, and get 10 trades for free (T&Cs apply. Capital at risk).

Video summary

Overview

Launched in 2020, Lightyear is a UK-based stockbroker specifically designed for individuals entering the realm of investment. With a user-friendly approach, Lightyear aims to simplify the complexities of stocks and ETFs, making it an ideal choice for beginners and first-time investors.

However, in terms of investment options, Lightyear’s offerings are relatively limited compared to competitors like Interactive Brokers and eToro. They focus solely on Stocks and ETFs, which may not align with the preferences of investors seeking more advanced trading options, such as cryptocurrencies, CFDs, Futures, Forex, Options, and others.

Lightyear provides a generally well-designed mobile trading app with a user-friendly interface and a straightforward order placement process. The app caters to users who prefer on-the-go trading, enhancing the overall experience for novice and intermediate investors. Introduced to the UK market in late 2021 (if offers Cash and Stocks & Shares ISA), the app is now available across a significant part of Europe, facilitated by its operational base in Estonia.

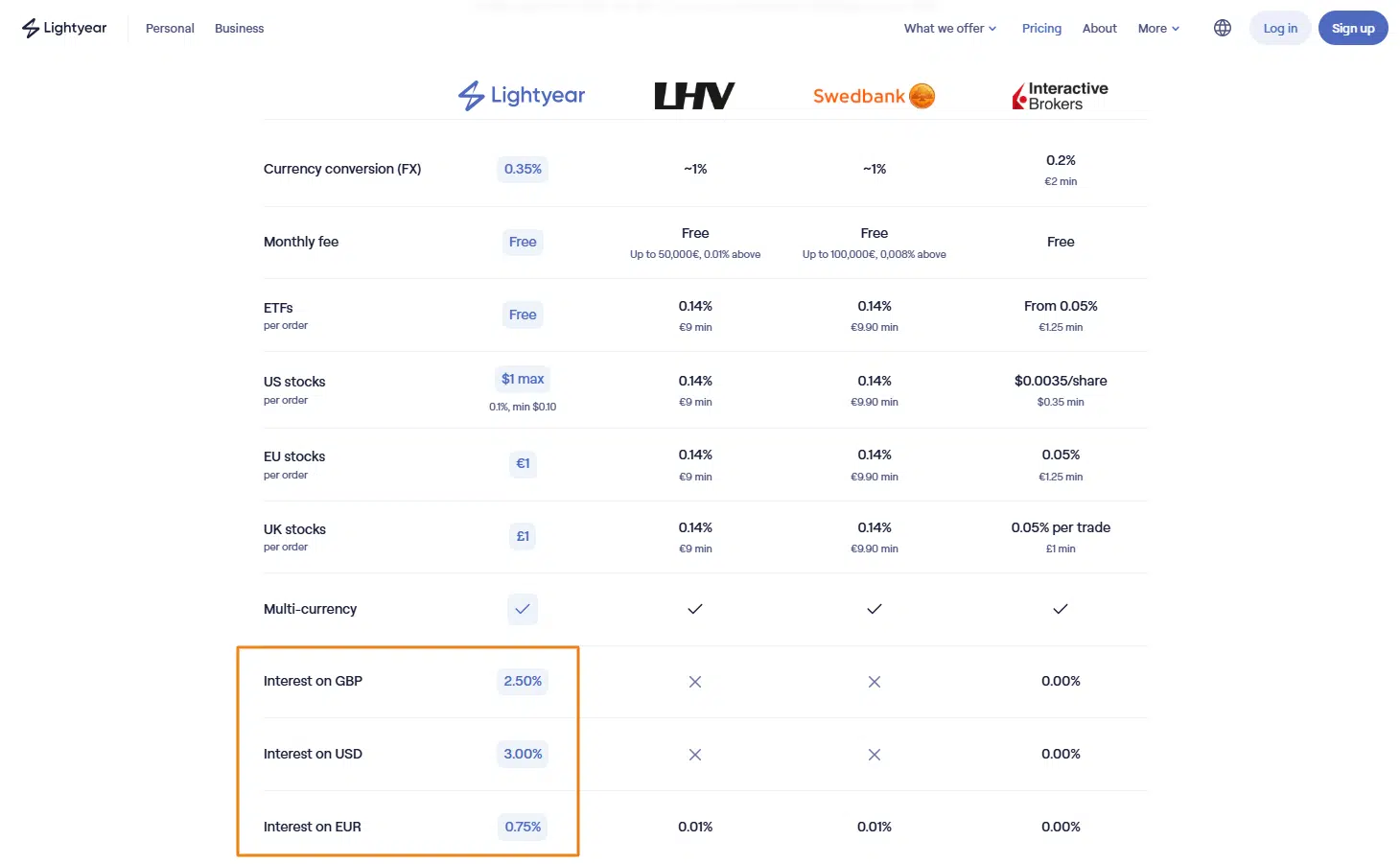

One of Lightyear’s notable strengths is its commitment to simplicity and transparency. The platform employs a clear fee structure, ensuring users have a transparent understanding of trading fees and associated costs. Another compelling aspect that makes Lightyear an attractive option is its competitive interest rates on uninvested cash – 3.00% for USD, 2.50% for GBP and 0.75% for EUR, as of this writing.

Highlights

| 🗺️ Supported countries | 22 European Countries |

| 💰 Stocks fees | 0.10% (up to $1) for US Stocks; €1 for EU Stocks; £1 for UK Stocks |

| 💰 ETFs fees | Free of Lightyear execution fees (other fees may apply) |

| 💰 Bonds fees | €1 for Baltic Bonds |

| 💰 Inactivity fee | $0 |

| 💰 Withdrawal fee | $0 |

| 💰 Currency conversion fee | 0.35% |

| 💰 Deposit fee | $0 (0.5% after the €500 / HUF200,000 limit for debit card/Apple Pay/Google Pay payments is reached) |

| 💵 Minimum deposit | €/£/$1 |

| 📍 Products offered | Stocks, ETFs, MMFs, Baltic Bonds |

| 🎮 Demo account | No |

| 📜 Regulatory entities | FCA, EFSA |

Pros and cons

Pros

- 0% Lightyear execution commission on ETF trading (other fees may apply)

- No account opening, inactivity, or withdrawal fees

- High interest on uninvested cash

- Free multi-currency account

- Minimum deposit of €/£/$1

- Fractional Shares

- Account opening promotion with the promo code INVESTINGINTHEWEB

Cons

- Limited financial instruments (no options, bonds, commodities, or futures)

- No demo account

- Only available in 22 european countries (not available internationally)

- 0.35% currency conversion fee

Fees

Lightyear offers 0% execution commissions on ETFs (other fees may apply) and competitive stock fees, while enjoying the advantage of no account, inactivity, custody, or withdrawal fees. A noteworthy aspect is the flexibility to hold multiple currencies simultaneously, allowing users to strategically manage their investments and avoid FX conversion fees. This is particularly advantageous when dealing with stocks denominated in currencies different from the cash on hand, as a 0.35% FX fee is applied in such cases.

While Lightyear encourages fee-free bank transfer deposits, it’s essential to be mindful of the €500 limit for debit card/Apple Pay/Google Pay payments. Once this threshold is reached, a 0.5% charge is applied to subsequent deposits.

| Fee types | Classification |

| ETF | €0 per trade |

| US stocks | 0.10% (up to $1 max) per trade |

| EU stocks | €1 per trade |

| UK stocks | £1 per trade |

| Baltic bonds | €1 per trade |

| Deposit fee | €0 (0.5% after the €500 / HUF200,000 limit for debit card/Apple Pay/Google Pay payments is reached) |

| Inactivity fee | €0 |

| Withdrawal fee | €0 |

| Currency conversion (FX) fee | 0.35% |

Products & markets

Stocks and ETFs

Lightyear mainly focuses on stocks and ETFs in what they offer, which is more specific compared to broader investment platforms. While it includes US, UK, and EU stocks, along with EU-listed ETFs, this selection is relatively standard compared to similar brokerages.

| Stock | Offering |

| ETFs | 200+ ETFs worldwide |

| US stocks | 3,000+ stocks from NASDAQ and NYSE |

| Canada stocks | 100+ stocksYou can also invest in companies from outside the United States, which have American Depositary Receipts (ADR). These companies, like Barclays or Alibaba, are listed on US exchanges. |

| Asian stocks | 40+ stocksYou can also invest in companies from outside the United States, which have American Depositary Receipts (ADR). These companies, like Barclays or Alibaba, are listed on US exchanges. |

| EU stocks | 100+ stocks from France, Germany, Belgium, and the Netherlands |

| UK stocks | 50+ UK stocks |

It’s noteworthy that Lightyear doesn’t diversify its product range to encompass other asset classes, such as mutual funds, bonds, or options, making it a bit inferior compared to other trading platforms available for UK and EU Investors.

| Investment Product | Availability |

| Stocks | Yes |

| ETFs | Yes |

| Forex | No |

| Funds | Yes (MMFs) |

| Bonds | Yes (Baltic) |

| Options | No |

| Futures | No |

| CFDs | No |

| Crypto | No |

Fractional US Shares

With Lightyear, you can also buy parts of shares, known as fractional shares. Still, this feature is only available for US stocks. This accessible option is perfect for entry-level and first-time investors with less money to invest, allowing them to buy parts of shares. It’s a low-cost way to enter the investment world.

Imagine you’re a beginner and want to invest in companies like Netflix, but their shares are quite expensive at $600 each. No worries! With Lightyear’s fractional shares, you can invest with as little as $100, getting a fraction of a Netflix share in return. It’s a straightforward way for new investors to dip their toes into the market without needing a large sum of money.

Just keep in mind that when you buy fractional shares, you have to buy them at the current market price. You can’t set a specific price for the future like you can with a regular order. Plus, you will still be charged a trading fee as you would with a whole share.

Money Market Funds (MMF)

In 2023, Lightyear partnered with BlackRock, the world’s largest investment company, to introduce a new product called Money Market Funds (MMFs).

These are three distributing Money Market Funds offered by Lightyear, available in USD, GBP, and EUR, with fees ranging from a minimum of 0.09% to a maximum of 0.3%. Importantly, there’s no high barrier to entry, making it accessible for beginners or first-time investors.

The yields on these products vary. As of May 2025, they were the following: EUR: 2.28%; USD: 4.34%; GBP: 4.45%. They are also offered “wrapped” under the Savings Vaults product. This is an investment product, so capital is at risk (this is not the same as “interest on uninvested cash”).

The goal of these funds is to maintain a net asset value of $/€/£ 1 per share, and any extra earnings from interest on the portfolio holdings are distributed to investors as monthly dividend payments. Lightyear customers will see a daily return deposited into their accounts on the first day of each month.

Money Market Funds specialise in investing in highly liquid, short-term debt instruments, prioritising a high level of liquidity. Unlike exchange-traded funds (ETFs) that actively trade on the stock exchange, MMFs follow a different rhythm, trading once a day. Lightyear aims to make this low-cost, straightforward investment option easily accessible to all, regardless of their level of experience in investing.

Please be aware that Money Market Funds may not be accessible in your country, as indicated in the disclaimer presented on Lightyear’s website.

Multi-Currency Account

At Lightyear, you can choose from four main currencies: GBP, EUR, USD, and HUF (only in Hungary). This feature enables you to avoid paying FX fees by holding the currency corresponding to the asset you’re purchasing.

However, if you fund your account with EUR, for example, and then purchase a UK stock, a 0.35% currency conversion fee will be applied.

Interest on Uninvested cash

An excellent feature offered by Lightyear is the ability to earn interest on your uninvested cash balance. This means your money continues to grow in your account, even when it’s not actively invested. The interest on uninvested cash differs from Money Market Funds in the sense that this money is deposited in institutional bank accounts that are designed for financial firms to hold their customers’ money.

Currently, the interest rates are quite attractive, though it’s important to note that they are subject to frequent changes. As of May 2025, the interest rates were the following:

| Currency | Interest (per year) |

| EUR | 0.75% |

| GBP | 2.50% |

| USD | 3.00% |

| HUF | 4.00% |

Baltic bonds

Lightyear now offers access to Baltic bonds, a new addition that includes bonds from Estonia, Latvia, and Lithuania, marking the first-ever availability of this asset class.

Baltic bonds are currently expanding, and you can now trade over 25 bonds issued by both companies and governments from these Baltic countries on Lightyear. You can explore Lightyear’s bond offerings and filter by the criteria that matter most to you.

In line with this expansion, Nasdaq Baltic announced on September 17, 2024, that Estonian government bonds were listed on the Nasdaq Baltic Bond List by Nasdaq Tallinn. The nominal value of each bond is EUR 100, with a yearly interest rate fixed at 3.3%, and the bonds will mature on September 16, 2026. The offering was oversubscribed by more than four times, with 2,000,000 bonds issued and a total demand of €821 million. You can read more about the Nasdaq Baltic announcement here.

Cash and Stock & Shares ISA

For UK investors only, Lightyear offers a cash ISA and Stocks and Shares ISA. It works in the same way as a general investment account but with the tax advantages associated with these products. You have no account, custody or subscription fees. Plus, no withdrawal penalties.

Trading platforms

Lightyear offers both web and mobile platforms. You can access your investments through your computer or your mobile phone.

Web Trading Platform

Lightyear’s web trading platform is easy to use and has a well-designed interface. However, it offers only a one-step login and does not include price alerts. The Lightyear Web Trading Platform is still in its beta phase but has improved rapidly over the past few months.

On the left side, there’s a bar with three things: Portfolio, Watchlist, and Activity. In the Watchlist, you can keep tabs on the assets you’ve added. On the right side, there’s a list of the most watched assets on Lightyear and a calendar showing events related to your assets in the watchlist. Scrolling down, you’ll find Top Stories, where you can check out articles and videos about the finance world.

In the Activity section, you can find a statement of your transactions on the platform, as well as the details of each order. Your actions can be filtered by dates with various time frames, as well as by fiscal years.

The search bar in the top-right corner is quite intuitive, as you can filter by different assets, markets, features, composition (bonds to ETFs, for example), and popularity, which will show the most trending investment products on the platform.

When you select an asset to see the details clearly, you come across the following screen:

In this screen, you can place an order for the selected asset. The orders available are Market and Limit – you can also set a recurrent order. However, a giant drawback is that more advanced order types, like stop-loss orders, are not offered, and there are no options for setting order time limits.

This screen provides all the details you need about the chosen asset. From market trends and analyst ratings to financial and earning performance, it’s got everything. Plus, there’s a section with key info about the company and news related to the asset and related topics.

Mobile Trading Platform

Lightyear’s mobile trading platform is user-friendly and well-designed, featuring an efficient search function and neatly organised asset groups. It’s available for both Android and iOS. One drawback compared to the web platform is that the mobile app is only available in English.

In the mobile app, you are prompted to choose a 4-digit PIN to secure your app. One notable feature of the mobile app is that it allows you to use biometric data (Face ID or fingerprint) to log in.

After setting the PIN, when you attempt to open the app, you will need to unlock it. Following that, you will see the explore bar:

In this section, you can find a search bar at the top along with essential information, such as the announcement “You’re earning interest.” This indicates that your uninvested cash is earning interest, and the percentage depends on the currency of your uninvested funds.

As you scroll down a bit, you’ll come across a section titled “Popular this week.” This section is further divided into Stocks and ETFs, serving as a collection of “Trending Assets” on the platform for the current week. Clicking on “View All” will provide you with a more comprehensive list featuring 30+ popular stocks/ETFs.

If you scroll further down in the Explore section, you will find all the assets on the platform divided into groups, categorised in a way that we find very intuitive. You can find stocks and ETFs categorised by region. Plus, there are interesting collections of assets, organised based on technical aspects such as daily movers, gainers, and losers, as well as social categories like female-led, clean energy, and more.

Still, in the Explore section, you’ll discover a really cool feature in the app called “investors,” related to social trading. Here, you can connect with your contacts and check out what they’re investing in. This is a great feature for those looking for an all-in-one app with lots of cool functions – it is especially interesting for first-time investors and those looking for social trading.

The Lightyear mobile app offers Market, Limit, and recurring orders, just like the web trading platform. Although it’s complete in providing all the web platform options, it’s essential to note that compared to competitors such as Interactive Brokers, Trading 212 and eToro, the order choices are somewhat limited. This could be a downside, especially for advanced investors seeking more diverse order options.

On the search bar, just like on the web version you can filter your search by different asset types, markets, features, composition (bonds to ETFs, for example), and by popularity.

Just like on the web platform, choosing an asset gives you lots of detailed information. This information is beginner-friendly and varies for each asset.

Safety

Lightyear operates under the regulations of Estonia and the UK authorities. Lightyear Europe is directly regulated by the Estonian Financial Supervision Authority (EFSA) -4.1-1/31. In the UK, Lightyear UK Ltd, which is authorised and regulated by the Financial Conduct Authority (FCA).

In terms of safety, it’s crucial to consider two factors: how your investments are protected and the broker’s background. Lightyear ensures protection for US stocks through its US partner, Alpaca Trading, which is covered up to $500,000 by the US Securities Investor Protection Corporation (SIPC).

The European investors are protected up to €20,000 by the Estonian Investor Protection Sectoral Fund. The UK customers are covered by up to £85,000 through the Financial Services Compensation Scheme (FSCS). Please note that these protections do not cover losses due to poor investment performance.

In terms of the broker´s background, it’s important to be aware that Lightyear is a recent company with a limited track record, which is a drawback since it hasn’t been in the market for time enough to show resilience to negative events. Additionally, Lightyear’s status as a not publicly listed company means it has fewer obligations to disclose information compared to publicly listed brokers.

It’s worth emphasising that customer assets, including securities and cash, are kept fully segregated. This segregation provides assurance that, even in the event of Lightyear facing bankruptcy, clients can still access their assets.

Countries accepted

Lightyear is a UK/EU-based stockbroker and is available in 22 European Countries. The expansion of Lightyear in Europe was very fast, which can be indicative that the company has plans to expand worldwide in the future years. However, this is just pure speculation because there is no public plan for expansion.

You can find the complete list of countries available here!

Account opening

| Account opening | |

| Minimum deposit | €0 |

| Currencies supported | EUR, GBP, USD and HUF |

| Currency conversion fees | 0.35% |

| Deposit methods | Credit/debit Card, bank transfer, wire transfer and electronic wallets (Google Pay, Apple Pay, iDEAL) |

| Deposit fees | €0Completely free for bank transfers. However, please note the €500 limit for debit card/Apple Pay/Google Pay transactions. Once this limit is reached, a 0.5% fee will be applied to any additional deposits. |

To open an account in Lightyear, you’ll need to download their app available for Android and iOS. While you can initiate the process on the web platform, it must be completed using the mobile app.

Signing up on the mobile app is a breeze and usually takes around 10-15 minutes. It’s a fully digital process, super easy to follow. Here’s what you need to do:

- Download the app on your mobile phone.

- Enter your phone number to receive a confirmation code.

- Provide personal details such as your name, date of birth, and email address.

- Include your address and nationality.

- Provide tax details.

- Provide information about your source of wealth.

- Complete the verification by submitting your national ID and a selfie.

To confirm your identity and where you live, you might have to upload your national ID. Make sure it has the same name and address you used to sign up. If it’s a bill, statement, or rental agreement, it should be from the last 6 months. Here are the documents we accept as proof of address:

- Utility bill (like electricity, water, gas, telephone, or internet);

- Bank or credit card statement;

- Residence permit (if your address is on it);

- Signed rental agreement;

- Document from a trusted public authority (such as a municipality bill, social insurance statement, or local government registry extract)

Lightyear mentions that most people get confirmed in just a few minutes, but in some cases, it might take up to two business days.

Promo code

If you’re an investor in the UK or Ireland interested in opening a Lightyear account, simply follow this link. After signing up on the mobile app, like explained above, deposit £/€50 and enter the following promo code: INVESTINGINTHEWEB, you’ll get 10 trades for free!

T&Cs apply. Capital at risk.

Customer support

Lightyear’s support can only be reached by email – there’s no phone or live chat support, and they’re unavailable 24/7. While they offer assistance through email, the response time can be inconsistent, with some queries taking several days to address.

On a positive note, Lightyear’s website features a helpful FAQ section, well-organized to provide answers to various questions.

However, the lack of phone and live chat support, coupled with limited availability, remains a downside, highlighting the need for improvement in offering more diverse and timely customer service options.

Bottom line

In a nutshell, Lightyear stands out as a user-friendly stockbroker, perfect for beginners diving into the investment world. With zero minimum deposit requirements and a straightforward account opening process, it caters to entry-level investors looking for an accessible and low-cost platform in the UK and most parts of Europe.

Pros include a user-friendly mobile app, commission-free ETF trading, and high interest rates on uninvested cash. However, limitations lie in the absence of diverse investment options beyond stocks and ETFs, a limited web-trading platform, and a lack of phone/live chat support. The platform operates under regulations in the UK and Estonia, ensuring a certain level of safety for investors.

While Lightyear offers a solid foundation for new investors, those seeking advanced features or extensive customer support may find it falls short.