Hello, fellow investor! Our first-hand review of Trade Republic will help you assess whether it fits your investing needs.

It has an intuitive platform on PC and mobile, and a top-tier regulator supervises it.

On the downside, it charges an external fee of €1, presents no demo account, and Trade Republic doesn’t offer direct access to US Stock Exchanges – so you won’t be able to buy some stocks of US-listed companies such as Reddit.

In May 2024, Trade Republic finally released its card. You can get a physical card (for a one-time off of €5 or €50, depending on the card you choose: “Classic” or “Mirror”) or a virtual one. Benefits include:

- A 1% Saveback on your card payments into your savings plan (maximum of €15 per month since it is applicable on up to €1,500 monthly card spending; to qualify, invest at least €50 monthly in savings plans);

- Round up your card payments and invest your spare change on the go;

- No monthly subscription fee. Unlimited Free ATM withdrawals worldwide (only below €100).

Besides, the money you do not spend earns 2.00% p.a. interest (paid monthly). As soon as more details are provided, we will update our review.

Overview

Founded in 2015, Trade Republic is a discount broker based in Berlin, Germany. It focuses on five types of financial assets: stocks, ETFs, bonds, cryptocurrencies, and derivatives. Stocks and ETFs can be traded daily from 7:30 to 23:00 CET, crypto 24/7, and derivatives from 8:00 to 22:00 CET.

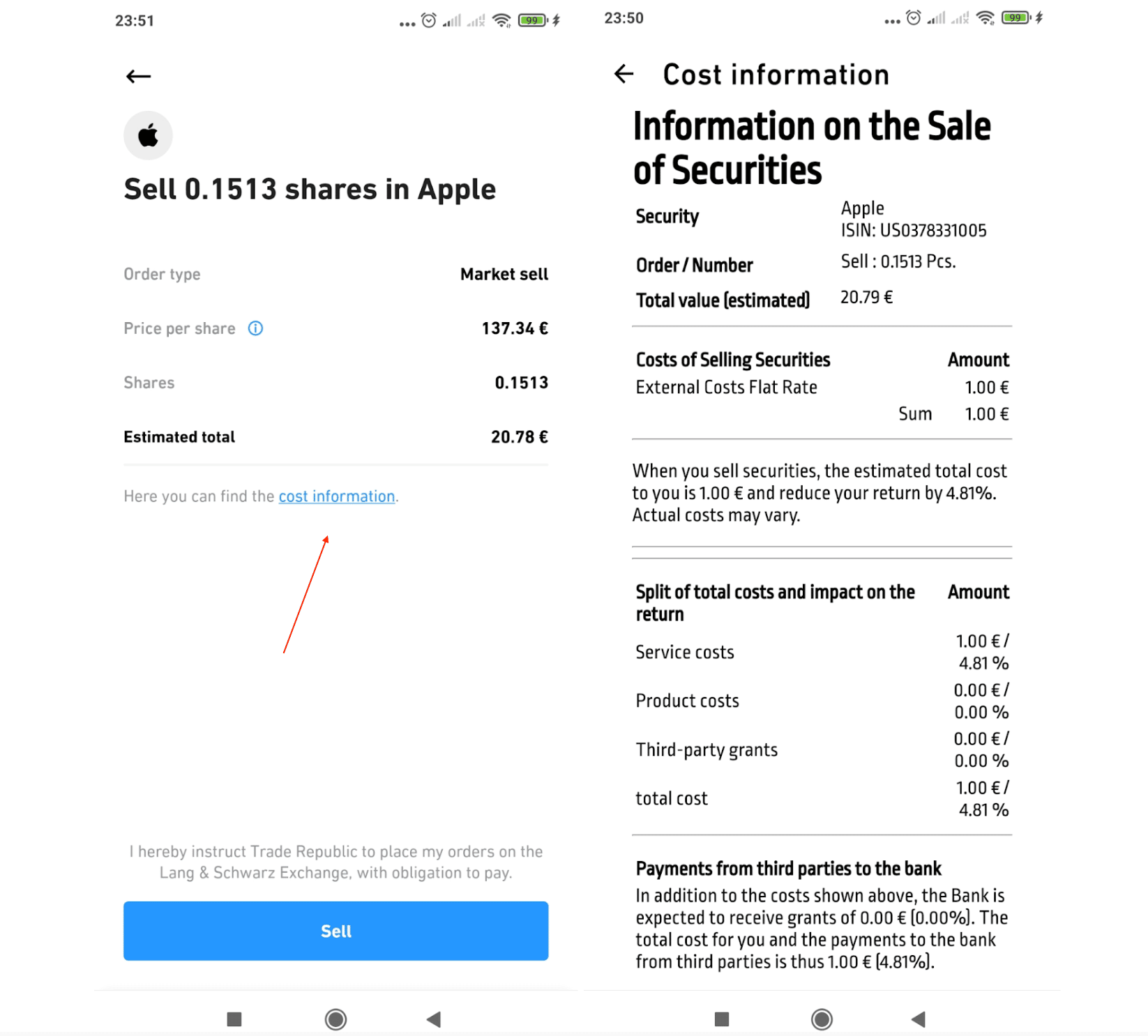

It uses the motto “Do more with your money” to express its commitment to its customers by selling itself as a “no order fee” platform. Nonetheless, a €1 external fee is applied in every single trade (Except saving plans), meaning that in practice, you will charge at least €2 (€1 for buying and another €1 for selling). It is still competitive but not commission-free.

Trade Republic was the first European broker to increase the interest rate paid in euros after many years of zero-to-low interest rates due to the European Central Bank (ECB) policies. The money not invested in your account will earn 2.00% per year (paid monthly). Most banks are (still) not paying close to that, so transferring money to Trade Republic to earn some interest might be a reasonable idea! Besides, it is the first broker in Europe to allow investment in corporate and government bonds for as little as €1 through fractional trading.

You can’t open a business brokerage account with Trade Republic, only a private account. Besides, you can’t open a joint account, and there is no possibility of opening an account for minors (under 18 years old), including power of attorney from their parents.

The broker is regulated by BaFin and also supervised by the Deutsche Bundesbank. Your investment assets and cash are fully protected up to €20,000 and €100,000, respectively.

Finally, Trade Republic will send you the annual tax statement directly within the app in the first quarter of the following year (e.g., until April/May 2025, you will get the yearly report for 2024). Hopefully, it will help you fulfil your tax needs hassle-free.

Highlights

| 🗺️ Supported countries | Most Eurozone countries |

| 💰 Stocks, ETF, Bonds, and Crypto fees | Free (+€1 external fee per trade) |

| 💰 Currency conversion fee | It varies between currencies |

| 💰 Inactivity fee | €0 |

| 💰 Withdrawal fee | €0 |

| 💵 Minimum deposit | €0 |

| 📍 Products offered | Stocks, ETFs, Bonds, Derivatives, and Crypto (+Saving Plans that include all these assets) |

| 🎮 Demo account | No |

| 📜 Regulatory entities | BaFin, Deutsche Bundesbank |

Pros and cons

Pros

- Automatic saving plans

- Interest paid in idle cash balances

- Invest from only €1

- No minimum deposit

- Direct debit in the share-saving plans

- Supervised and regulated by a top-tier regulator

- Has a banking license - deposits are protected by deposit guarantee scheme

Cons

- €1 flat external fee in every single trade (Except saving plans)

- No demo account

- Only one base currency (EUR)

- No direct access to US Stock Exchanges - you might not be able to buy some popular US-listed companies, such as Reddit

- Currency conversion fees apply

- Engages in PFOF - Payment for Order Flow

Trading platform

Trade Republic offers both Web and Mobile trading platforms:

| Web App | ✔ |

| Mobile App | ✔ |

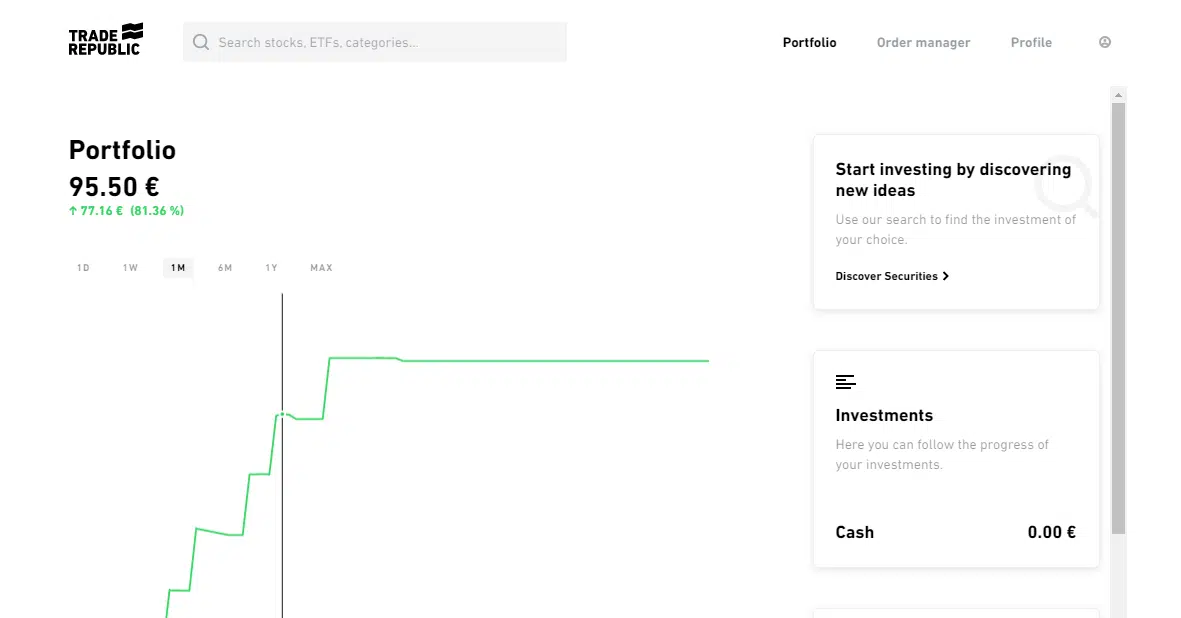

While exploring both platforms, we found the interface straightforward when compared to its competitors. You will quickly notice the search bar (the easiest way to find what you are looking for), your portfolio balance, and your cash amount. You can also easily observe the portfolio movements over time.

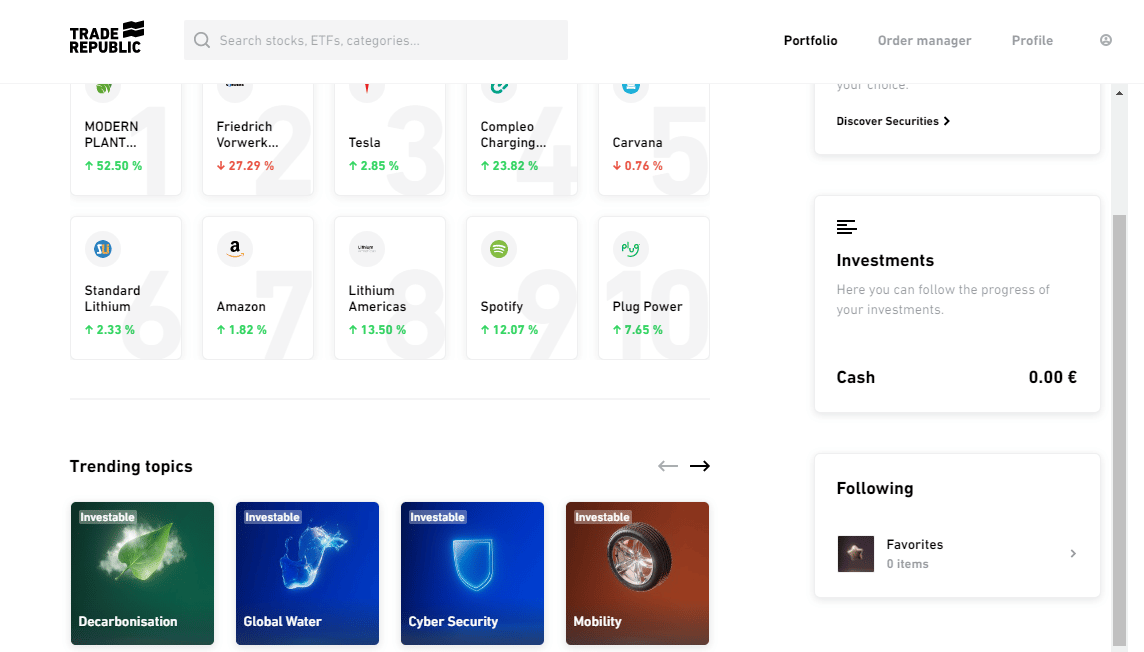

If you scroll down, you will notice that it highlights “trending stock and topics”:

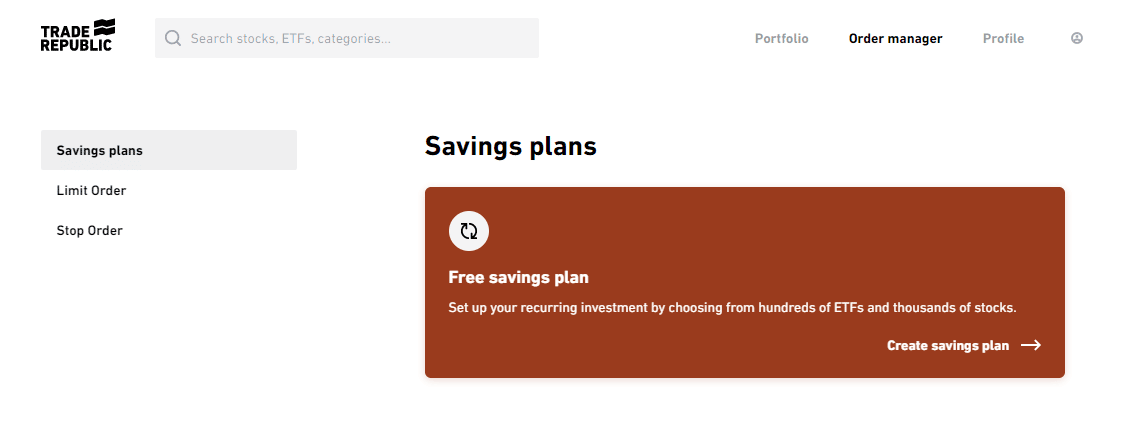

Apart from this, there isn’t much to highlight. In “Order manager,” you will have access to the savings plan and a brief explanation of Limit and Stop orders (it isn’t mentioned here, but it also has Market orders). This page is a little odd since it only works as a glossary, so there is little you can do about it.

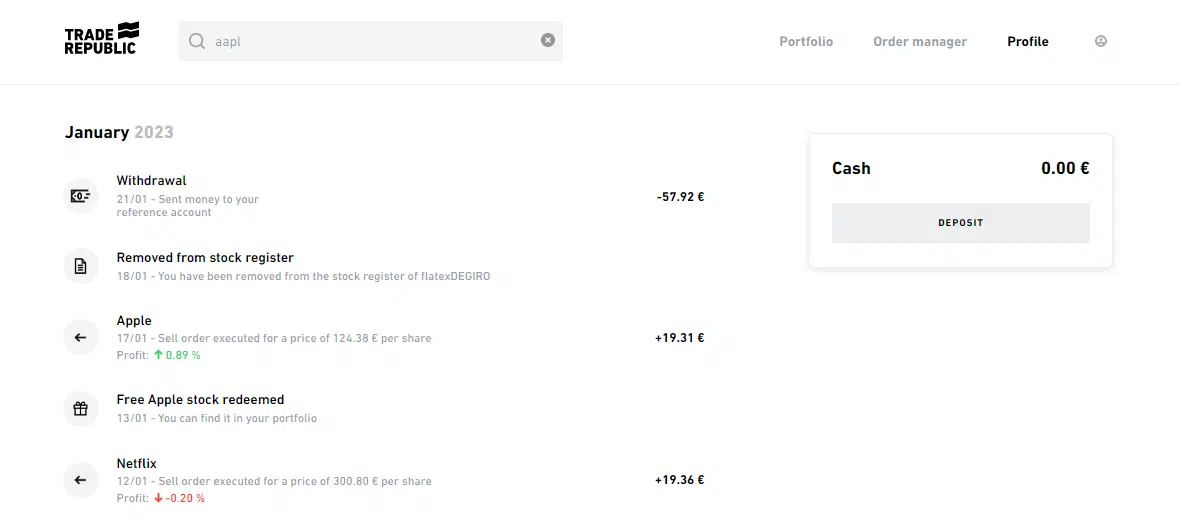

Finally, in your “profile”, you can see all the activities of your account: transactions, withdrawals, and deposits, among others.

Products and markets

Trade Republic offers five different financial instruments: Stocks (9,000+), ETFs (2,000+), Bonds (500+), Cryptos (50+), and Derivatives (10,000+). All of these assets are traded in EUR.

What does it mean? Well, let’s use US stocks as an example. Apple, the iPhone manufacturer, is traded on the NASDAQ in USD, but in the Trade Republic trading platform, you will only be available to buy in XETRA in EUR. So, owning Apple stock in EUR or USD should give you the same results in EUR, but the EUR version presents much less liquidity, so wider spreads may apply.

On the downside, if the company you want to buy is only listed in the US, you might not be able to access it through Trade Republic, which is a big downside, since Trade Republic doesn’t offer direct access to US exchanges. If you prefer a broker with many stocks from different exchanges including US shares, we recommend Interactive Brokers.

| Products | Available? |

| Stocks | ✔ |

| ETFs | ✔ |

| Bonds | ✔ |

| Funds | ✘ |

| Options | ✘ |

| Futures | ✘ |

| Warrants, Knock-outs, and Factor certificates | ✔ |

| Forex | ✘ |

| Cryptocurrencies | ✔ |

| Commodities | ✘ |

You can also buy fractional shares in a selected list of stocks and ETFs (we did not find that list). Still, it is only possible with market orders executed via the Lang & Schwarz (LS) Exchange electronic trading system, where Trade Republic is the counterpart.

Bonds

On Bonds, you can invest in corporate and government bonds. Starting from €1, you can invest in fractions of a bond while receiving the proportion interest payments in return. Whole bonds are traded on the LSX exchange, whereas fractions are traded with Trade Republic as a counterpart.

Cryptos

On Cryptos, you are trading real assets (no derivatives), so you own your cryptocurrencies. You can trade them 24/7 (yep, including weekends and holidays). Trade Republic indicates that each crypto is held in a cold wallet to be offline and protected from cyberattacks. Besides, as with stocks and ETFs, the crypto assets are kept separate from the Trade Republic balance sheet by Trade Republic Custody GmbH (based in Vienna) to guarantee their safety.

Please remember that it is not possible to send or receive any crypto via Trade Republic. Besides, the crypto offering is only available in the following countries: Austria, France, Germany, Ireland, Italy, Latvia, Lithuania, Portugal, and Spain.

Derivatives

Concerning derivatives, these are, as the name implies, financial instruments that derive their price from an underlying asset, such as stocks, commodities, bonds… Almost anything). In Trade Republic, you can trade three types:

- Warrants: They work similarly to Options in the sense that they give you the right, but not the obligation, to buy or sell a financial asset at a specific price before the expiration date.

- Knock-outs: An option with a built-in mechanism to expire worthless if a specified price level in the underlying asset is reached (that’s where its name comes from). It limits your upside but can be bought at a lower premium than a standard option.

- Factor Certificates: A financial instrument replicating a particular security’s price movement but with a leverage factor (higher potential gains, but higher potential losses as well). Contrary to Warrants and Knock-outs, factor certificates have unlimited duration. This kind of instrument is not indicated for holding more than a day.

The providers of these derivatives include Société Générale, CITI, and HSBC.

We advise you to be extra careful when dealing with these products since they are hard to understand completely. Indeed, we were expecting a deeper explanation for each derivative within the platform, but no detailed information is provided apart from this general explanation.

Also, most include leverage (borrowed money), so high profits or losses can be achieved very quickly. That’s why they usually aim for more experienced investors who intend to hedge certain positions or speculate on price movements.

Savings Plans

Finally, it offers savings plans (4,900+), which can combine all the four assets mentioned above. Here, you can invest automatically in stocks, ETFs, bonds, and crypto with no third-party costs (this is the only place where the €1 external fee does not apply). When the XETRA exchange is open, the saving plans are executed on the 2nd, 9th, 16th, or 23rd of the month.

It allows you to set up your payment method (direct debit or cash account) and the withdrawal interval of your savings plan (weekly, bi-weekly, monthly, or quarterly execution).

Interest on uninvested cash

With Trade Republic, your uninvested cash (money doing “nothing” in your account) earns 2.00% per annum on unlimited cash balances. The interest is accrued daily and paid every month. Besides, you can withdraw it anytime.

Your money is safe up to €100,000 since it is guaranteed by the Deposit Guarantee Scheme:

Fore more details, please consult the Depositor Information Sheet.

Fees

Trade Republic is quite transparent with the fees. The only fee you will quickly notice will be the €1 external fee per trade in stocks, ETFs, derivatives, bonds, and crypto. The company states that this cost is 100% third-party related (settlement cost). In the case of partial executions, the third-party fee is charged only once per trading day.

There is no withdrawal fee or custody fee. Also, Trade Republic charges no commission on shares dividend payments and ETF distributions, but other external fees may apply.

Since your base currency is in EUR, you will be charged a currency conversion fee for any earnings (e.g., dividends) you get from your holdings since these will immediately be converted to EUR once received. Their website states, “The selling and buying rates required for currency conversions are calculated on the basis of these rates, taking into account a premium or discount in accordance with the buying and selling margins (…)(our bolding). You can find those margins here.

| Instruments/Others | Fees |

| Stocks | €0 (+€1 external fee) |

| ETFs | €0 (+€1 external fee) |

| Bonds | €0 (+€1 external fee) |

| Derivatives | €0 (+€1 external fee) |

| Crypto | €0 (+€1 external fee) |

| Withdrawal fees | €0 |

| Custody fees | €0 |

| Currency conversion fee | Varies according to each part of currencies |

We advise you to take a look at all its pricing details directly.

Safety and regulation

Trade Republic is regulated by BaFin, the Federal Financial Supervisory Authority in Germany. However, it is supervised by both BaFin and the Deutsche Bundesbank.

In your account, you will have two types of assets: cash deposits and investment assets (excluding crypto). Each is treated differently:

- Cash deposits: Your cash is deposited in banks like Solarisbank, Citibank, J.P. Morgan SE, and Deutsche Bank. All banks within the EU are subject to national and EU-wide regulations that ensure the security of private deposits. Your cash balance at Trade Republic is protected up to €100,000.

- Investment assets: These assets are entirely segregated from Trade Republic (Bank HSBC Germany is the custodian, and the depositary of the securities is Clearstream in Frankfurt) and are your property (in other words, you’ll be the legal owner of the securities at all times). So, if it went bankrupt, you would only need to transfer your assets to another broker. Besides, it is under the German Deposit Guarantee Scheme, which covers losses up to €20,000 (from non-returned assets up to 90%). This last part usually enters into force when there is fraud.Besides, Trade Republic does not engage in securities lending. It is a common practice in the brokerage industry that would add more risk, but a negligent one. You can find this on platforms like DEGIRO and eToro.

Supported countries

Trade Republic accepts clients from the following countries: Austria, Belgium, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, Portugal, Slovakia, Slovenia, and Spain.

Please keep in mind that not all products are offered in all countries (e.g., crypto). You can quickly check that on your region’s Trade Republic website.

Account opening

Opening an account is relatively easy, as you would expect. It usually takes less than 10 minutes. As soon as you click “Open Free Account” on the homepage, the following page will appear:

You will only have to go through each intuitive step and insert all the information related to “Personal Data,” “Identification,” and “Experience & Knowledge.” It may take up to 24h to confirm that everything is valid.

As a heads-up, you can only open an account if you meet the following criteria:

- You have a valid identification document (identity card, passport, or residence card)

- You are at least 18 years old

- You are a permanent resident in an EU country (please check the “Supported countries” section)

- You are liable for tax in the same EU country

- You have a European cell phone number

- You have a SEPA bank account

- A document to confirm your address

Alternatives

Are you looking for more features? More products? A better trading platform? We have organized some alternatives that might better answer your goals!

| Brokers | Our classification |

| Interactive Brokers | Best Overall |

| eToro | Best for social trading and stock commission-free trading |

| DEGIRO | Best for low-cost trading from Europe |

| Plus500 | Best for CFDs |

Want to know more about these and other Trade Republic alternatives? Feel free to check our Broker Comparison Table, In-depth Broker Reviews, and the Broker Matching Tool.

Bottom line

From our analysis, we believe Trade Republic has room for improvement in product offering, platform interaction, and customer service against competitors like eToro, IBKR, or DEGIRO. Nonetheless, it does its job as a do-it-yourself platform.

Beginners will probably prefer this broker over others in the market due to its simplicity but will find no educational resources.

Intermediates and advanced users may lack some deeper fundamental and technical analysis. Furthermore, stock investors might prefer another broker if they value US or penny stocks – since these might not be available on Trade Republic.

We hope you found our review useful!