Hello, fellow investor! We will give our honest review of Trading 212 Invest!

We recommend Trading 212 if you are looking for commission-free stocks and ETFs trading* and/or want to get an automated investing feature called: “AutoInvest”**.

New users get one free fractional share with a value of up to €100 by using our Trading 212 promo code: IITW!***

On the downside, the platform is limited in the product offering, has no relevant fundamental tools, and charges a 0.15% currency conversion fee.

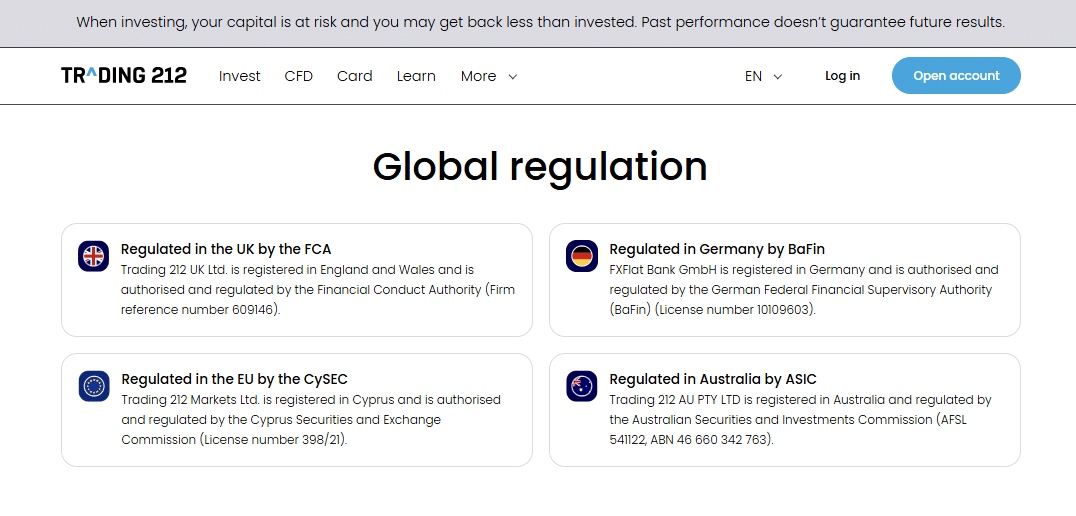

In terms of safety, Trading 212 is authorized and regulated by the FCA (Financial Conduct Authority), ASIC (Australian Securities and Investments Commission), CySEC (Cyprus Securities and Exchange Commission), and BaFin (Federal Financial Supervisory Authority).

That’s Trading 212 in a nutshell. Keep reading if you want to find out what our research team has to say after carefully analyzing Trading 212!

* Other fees may apply. See terms and fees.

** Pies & Autoinvest is an execution only service, following your own investment decisions. Not investment advice or portfolio management.

*** To get a free fractional share worth up to €/£100, you can open an account with Trading 212 using the IITW promo code. Terms apply.

Overview

Founded in 2004, Trading 212 is a fintech company with a clear goal: democratize investment activity. It has become increasingly popular among retail and professional investors for its simple and easy-to-use trading platforms.

In Trading 212 Invest, you may trade commission-free stocks and ETFs from several exchanges, including the NYSE, Nasdaq, LSE, Euronext, etc.

It presents a feature called “AutoInvest”, where you can create a diversified portfolio and customize it to your unique financial goals in an automated way. Besides, you will get access to Model Pies and Community Pies, where instead of creating a pie from scratch, you can prefill your slides with some of the Pies constructed by the Trading 212 community. Bear in mind you will continue to have full control over your investments. Your copy of the pie is not linked to the original. If the Original Pie edits its pie, it will not reflect in your portfolio.

On February 15th, 2024, Trading 212 started offering portfolio transfers (not yet fully released – more info here), meaning you can transfer your stocks or ETFs to another broker if you decide to do so. No fees are charged to transfer to or from your account. After requesting it, the whole process should be completed no longer than 30 calendar days.

One of the few fees it applies is the 0.15% currency conversion fee. Are you based in a EUR country and want to invest in Apple (quoted in USD)? The 0.15% will be applied to the buying and selling (0.30% in total). An investment of €1,000 would roughly cost you €3 in total.

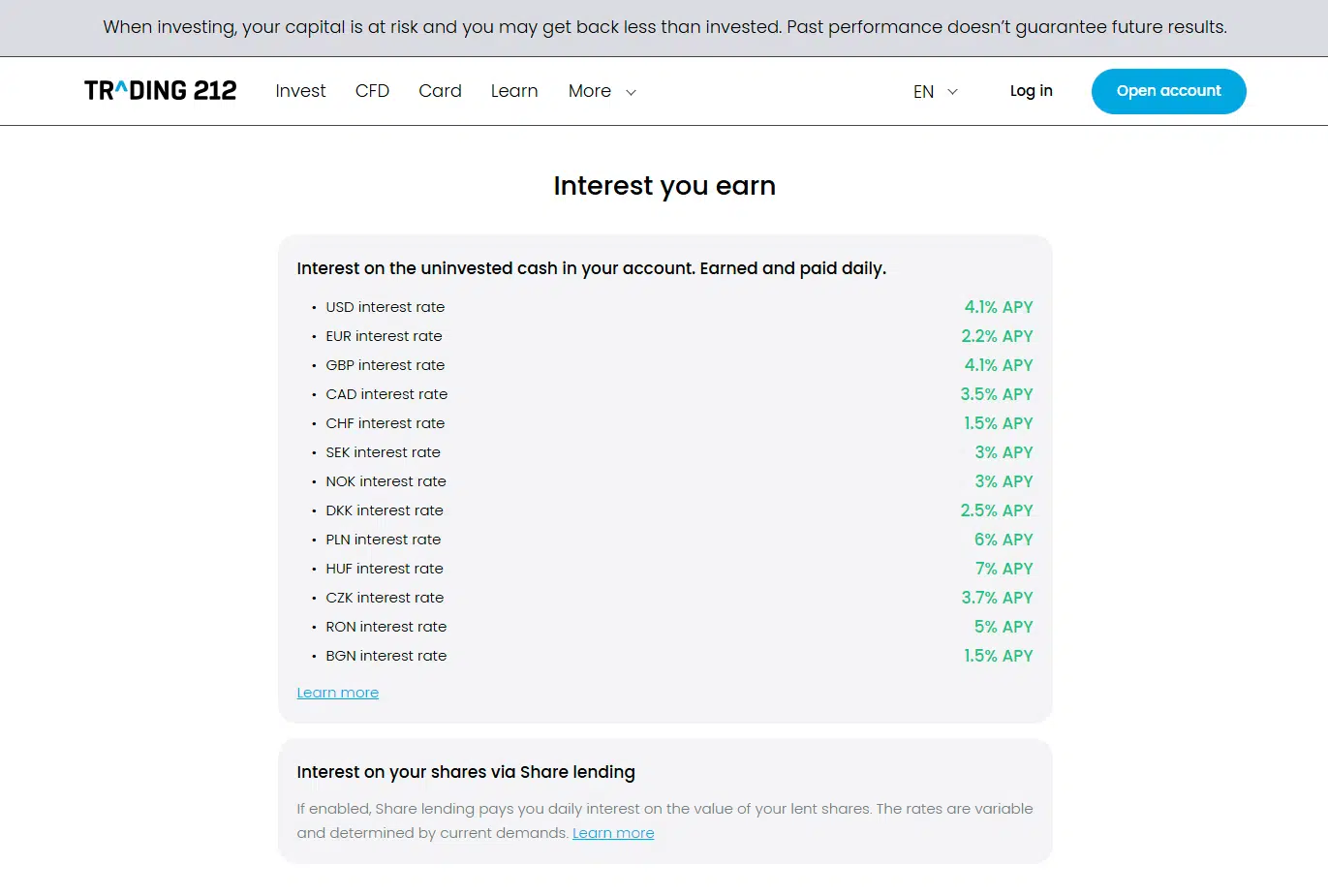

It gives you access to fractional shares. From as little as €/£1, you can invest in Amazon without paying thousands of dollars for a single share! Isn’t that great? Plus, it lets you earn interest on uninvested cash in your account:

By using Trading 212, you can choose to lend or not the financial instruments held in your account. Lending your shares allows Trading 212 to earn a daily interest, which they share with you by making it a 50/50 profit split. The collateral used to lend the shares are government treasuries.

The account opening process is fast, 100% digital, and requires a minimum deposit of €/£10. Trading 212 offers multi-currency accounts meaning you can have several currencies in your portfolio (GBP, USD, EUR, CHF, DKK, NOK, PLN, SEK, CZK, RON, BGN, HUF). We faced some trouble with ID verification, but it was quickly “fixed” by repeating the process (which took less than 2 min).

Finally, customer support is highly effective in response time. It is 24 hours available, and it can answer inquiries in 16 languages.

Highlights

| 🗺️ Supported countries | Worldwide – Exceptions include the US, Canada, and Belgium |

| 💰 Interest on uninvested cash (annually) | EUR: 2.20%; GBP: 4.10%; USD: 4.10% |

| 💰 Stocks and ETFs fees | Free of charge |

| 💰 CFDs fees | Low-Medium |

| 💰 Currency conversion fee | 0.15% |

| 💰 Inactivity fee | €/£0 |

| 💰 Withdrawal fee | €/£0 |

| 💵 Minimum deposit | €/£10 |

| 📍 Products offered | Stocks and ETFs |

| 🎮 Demo account | Yes |

| 📜 Regulatory entities | FCA, CySEC, ASIC, BaFin |

Pros and Cons

Pros

- Commission-free Real Stocks and ETFs trading (other fees may apply. See terms and fees)

- AutoInvest & Pies feature

- Fast and easy account opening process

- Demo account

- Top Tier Regulators

- Free fractional shares worth up to €100

- High interest on uninvested cash

Cons

- Limited product portfolio (no Options, Bonds, Mutual Funds or Futures)

- No relevant Fundamental tools

- 0.15% of Foreign exchange fees

Invest account type

In Trading 212 Invest, you may trade commission-free +10,000 real stocks and ETFs from several exchanges, including the NYSE, Nasdaq, LSE, Euronext, etc. You can build a diversified pie – with Pies & AutoInvest – and customize it to your unique financial goals. It gives total flexibility in the way you can divide your funds. Once you finalize your allocation, you can invest and reinvest dividends into your pie automatically.

Trading platform

Trading 212 has both a mobile and a web trading platform and, as mentioned above, presents two account types. For this review, we’ll help you navigate through Trading 212 invest’s web trading app since the others will be intuitive to explore after you acknowledge this one.

As soon as you are logged in, you have an immediate view of your account balance, a left vertical sidebar which helps you find all the products available, a clear oversight of what is up or down from the pre-selected tab (“Hot,” “Watchlist”, “Top Winners” and so on), and a little icon in the bottom left corner that puts you in instant contact with a customer support agent:

If you scroll down, you will get more details on the company that appears in the highlight (Tesla, in this example), which includes the company overview, key ratios, financial summary and instruments details:

Going through the left panel, you can navigate to other tabs like “Portfolio,” where you can easily see your current holdings:

Do you already know what you came looking after? If so, you can simply click on the search icon and look for your stock/ETF:

On the “Calendar” tab, you will notice the major worldwide economic events, including Federal Reserve meeting, job reports, Consumer Price Index (CPI) and more:

Finally, within the “videos” tab, you will find plenty of educational videos. We watched some of the content and quickly realized that it is mostly dedicated to beginners. So, intermediate or advanced investors will not find useful information. It also drew our attention to the partnerships they have with some YouTubers, including the PensionCraft:

Products and markets

Trading 212 Invest offers stocks and ETFs. You can buy in bulk or just a fraction, from as little as $1.

| Products | Available |

| Stocks | ✔ |

| ETFs | ✔ |

You can easily find all the financial assets in Trading 212 Invest, including the “Exchange” (highlighted), “Type,” and “Currency”:

Trading 212 AutoInvest

Trading 212 AutoInvest is a feature inside Trading 212 that tries to solve two investment issues:

- Having a diversified portfolio with stocks and/or ETFs and

- Being able to do it automatically without having to ask yourself every month, “In which ETF/stock should I put my money in?”

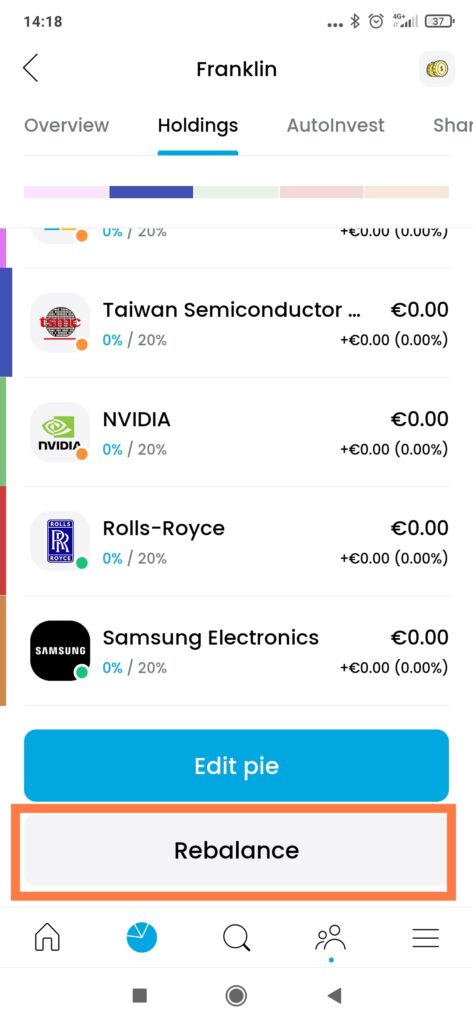

Your initial step is to build your Pie. You can build a custom pie of stocks and/or ETFs chosen by you (including the target weights) or choose a ready-made pie. Each Pie can hold up to 100 securities, and you may have multiple pies.

We believe you will be well suited with only one pie to avoid excessive diversification (equal to lower expected returns). In our opinion, it will not add much value in the long run, but only confusion…

On the app, you will notice model pies and community pies, which means that you can copy other people’s pies and interact with other community members. Just make sure to keep an eye on your pie since it does not automatically adjust when the original pie changes.

From this point, AutoInvest comes in: You have the option to invest in a pie through a manual process or an automated one where you can customize your desired investment duration, deposit amount, and deposit schedule through a direct debit from your bank account (you may change this feature at any time).

After the money arrives at your Trading 212 account, it will automatically buy shares according to your pie’s targets. The beauty of AutoInvest is that your money will start working for you after setting up your investment goals!

Rebalancing

Let’s imagine the following situation: you decide to invest in four securities with a target weight of 25% in each. After six months, the actual weights are 40%/30%/20%/10%. You believe it is time to sell the overweight assets and buy the underweighted ones.

Trading 212 solves this problem in just a single tap called “Rebalance”. It will automatically adjust your pie to the desired target weights. Done. If you have assets trading in different areas, you may not see this effect immediately because some markets may be closed, but it should not take more than 24h to complete the rebalancing action.

Investment goals

You may also set a goal for your investments to help you define a clear target.

Besides, Trading 212 will project how your investment value should evolve according to your pre-selected investment instruments and amounts. However, it is based on a historical basis, so it is never enough to stress that past performance is no guarantee of future results. A projection is still a projection. It feels great to see those numbers but, please, do not set too high expectations.

Does AutoInvest charge additional fees?

The answer is no. You do not pay any extra commissions or fees for using AutoInvest.

AutoInvest & Pies is designed to make you participate in the world of wealth creation while not committing too much of your precious time!

How to use AutoInvest

In our opinion, the best investment plan would be to use the AutoInvest feature. It is a strategy formerly known as Dollar Cost Averaging. The idea is to set a regular investment fixed amount and schedule (weekly, monthly,…) regardless of the market conditions. In some months, you will buy more shares (when prices are lower), and in others, you will buy fewer shares (when prices are higher).

It is a great tool to neutralize short-term volatility in the broader equity market and makes you avoid the typical mistakes in trying to time the market (market timing).

Fees

| Fee type | Classification |

| Real Stocks and ETFs | 0% commission |

| Currency conversion | 0.15% |

| Inactivity | €/£0 |

| Withdrawal | €/£0 |

| Custody | €/£0 |

In Trading 212 Invest, you only have the 0.15% currency conversion fee (=foreign exchange fee). That’s all!

In other related fees, Trading 212 does not charge withdrawal, deposit, or inactivity fees.

Safety and regulation

Trading 212 segregates customer funds and maintains this level of protection across all subsidiaries. This means that if it goes bust or insolvent, its client’s funds will be separated from the financial institution’s funds. In practice, you would only need to transfer your assets from Trading 212 to another broker.

Trading 212 is fully regulated and supervised by three top-tier regulators: the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC) and Germany’s Federal Financial Supervisory Authority. The subsidiary in Europe, formerly known as “Trading 212 Markets Ltd.”, is authorized and regulated by the Cyprus Securities Exchange Commission (CySEC).

In addition to FCA, ASIC and CySEC oversights, Trading 212 also maintains membership in the following Investor Compensation Funds (ICFs):

- Trading 212 Markets Ltd.: You are under the Cyprus ICF, meaning that you are protected up to €20,000 of the amount you have lost (cash + assets);

- Trading 212 UK Ltd.: You will be under the FCA jurisdiction, which gives you a protection amount (cash + assets) of up to £85,000 from the Financial Services Compensation Scheme (FSCS).

- FXFlat Bank GmbH (only applicable to German investors): Your money is protected up to €100,000 by the EdB and up to €20,000 money protection by the EdW.

It is registered in several countries, meaning that it must have authorization from the local financial markets authorities. For instance, Trading 212 is registered in CMVM in Portugal.

Trading 212 is a private company, meaning there is less transparency in its financial situation compared to a company listed on the stock market. As a private company, it does not need to disclose its annual report on its site. So, this is something to take into account when deciding to open an account.

Finally, besides the mandatory regulatory protections, Trading 212 offers an additional layer of protection (private insurance) from Lloyd’s of London, giving coverage of up to 1 million euros. For more information, click here.

Do you want to read a deeper analysis? Check out our dedicated article on investment protection (for EU investors)!

Supported countries

Trading 212 operates in over 100 countries globally, including:

- Australia

- Denmark

- France

- Germany

- Italy

- Luxembourg

- Norway

- Portugal

- Spain

- Sweden

- The United Kingdom

- And the list goes on!

Nonetheless, due to regulation, Trading 212 cannot accept clients from the United States, Canada and Belgium.

Account opening

The process of opening an account with Trading 212 is straightforward. You just need to follow an intuitive step-by-step registration procedure. Firstly, click “Open account” on the homepage:

Then, choose your “country of residency” and click “next”:

Select your account (remember that you will have access to both – this is only for you to choose which one to start with):

Now, insert your chosen email and password. You must accept the terms & conditions that appear below. Keep in mind that the Trading 212 subsidiary will be the one dedicated to your country. Since we are registering from a European Union country, we are under the “Trading 212 Markets Ltd.”:

And you are ready to go (to deposit and withdraw, you will need to verify your account by providing your identity card and other information):

Bottom line

Trading 212 is a platform offering a comprehensive suite of investment tools and features, making it a viable option for novice and experienced investors. With its user-friendly interface and intuitive design, the platform ensures a seamless investing experience, allowing users to easily execute trades.

One of the critical advantages of Trading 212 is its cost-effective nature. The platform offers commission-free trading on stocks and ETFs, making it an attractive choice for investors looking to minimize trading expenses. Additionally, Trading 212’s commitment to investor education is another noteworthy aspect.

On the downside, the limited products available, the currency conversion fee of at 0.15% and the lack of fundamental tools may constrain your investment decisions.

We hope to have helped with this review!