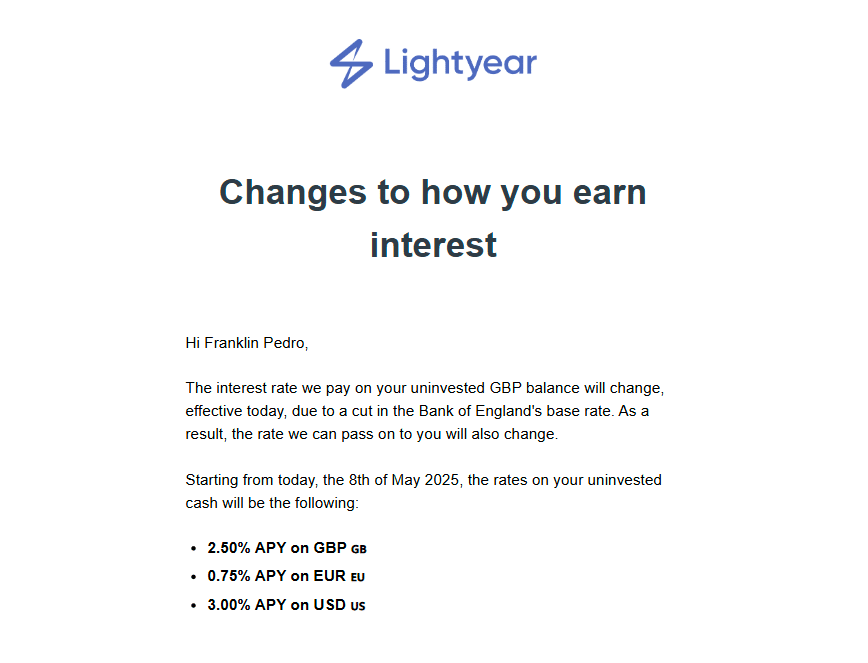

Lightyear is one of many brokers paying interest on uninvested cash, namely 0.75% in EUR, 2.50% in GBP and 3.00% in USD (as of June 2025):

Besides, it also offers Savings/Vaults where your money is invested in Money Market Funds (MMFs), and rates can go up to 2.24% in EUR, 4.33% in USD and 4.39% in GBP (as of June 2025). The mechanism differs from the “interest on uninvested cash” mentioned above, as explained below.

How are these rates defined? Is my money protected? Is there any catch? Let’s dig in!

How does Lightyear offer these rates?

Your uninvested money is placed in a deposit within a financial institution, and the interest rate is dependent on the Central Bank’s policy moves.

For example, on April 17th, 2025, the European Central Bank (ECB) cut interest rates by 0.25% (from 2.50% to 2.25%). As such, Lightyear announced that it would follow suit and reduce its rate from 1.25% to 0.75%.

The rate we refer to is called “deposit facility”, the interest rate banks earn when depositing money in the ECB. So, in practice, Lightyear, by offering you a lower rate (0.75% vs 2.25%) is taking a fixed fee of 1.50%.

Is the Lightyear interest safe? What are the risks?

Yes. Your uninvested money is segregated from Lightyear accounts and deposited in regulated EU credit institutions.

Nonetheless, if all appropriate safeguards fail, funds are ultimately protected by the Investor Protection Sectoral Fund only for amounts up to €20,000 across all your multi-currency account balances.

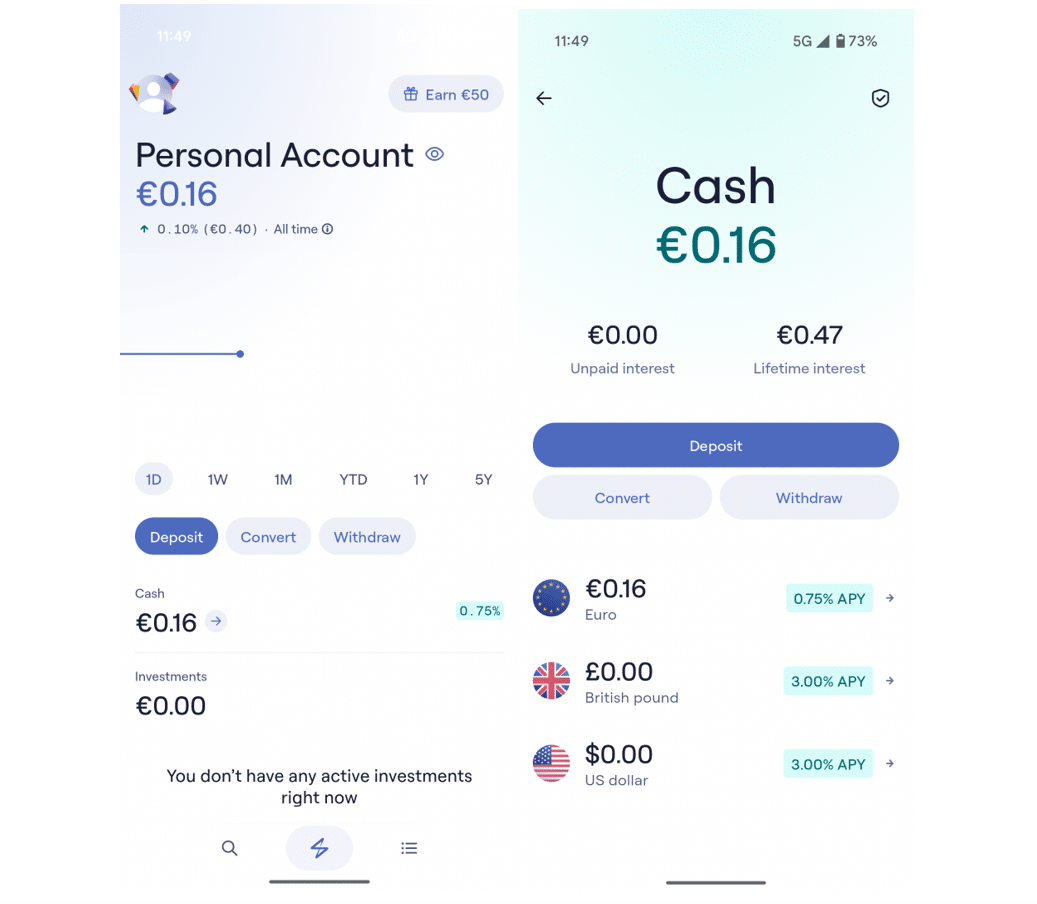

How can I start earning interest?

It is pretty simple. You only need to transfer money to your Lightyear account, and you will start earning money instantly:

Please remember that the interest is earned daily but paid monthly on the 1st of the following month.

Is the Lightyear interest rate fixed or variable?

The interest rate paid is variable, according to the Central Banks’ decisions.

For example, the ECB Governing Council monetary policy holds 8 meetings per year (roughly every 6 weeks). These meetings serve to set the interest rates in the Euro Area, among other things. The participants are the ECB President, the ECB Vice President, the ECB Executive Board (4 members), and the heads of each of the national central banks of the Euro Area.

You can check all the scheduled meetings here.

So, if the ECB changes its policy by raising or lowering its key interest rates, the interest on cash will likely change in the same direction.

Are there any constraints?

No, but you should consider the following:

- There is no minimum or maximum amount to earn interest;

- You are free to use your money when needed (withdrawals or investments), and there are no interest penalties;

- The interest is accrued daily but paid monthly.

Do I have to pay taxes on Lightyear interest?

Yes, most likely. Except for special account types, like the ISA in the UK, taxes will be due on the interest you receive.

This article is intended for all Lightyear clients. We cannot analyse each country’s particularities separately or your personal circumstances, but you are almost certain to pay taxes. Please contact your tax authorities to determine what actions to take.

Lightyear alternatives for interest

If you’re looking for alternatives to the Lightyear interest on uninvested cash, check our articles, where we filter the best brokers and digital banks to get interest on your cash in EUR, USD and GBP.

What about the Savings/Vaults? Why does it pay higher interest?

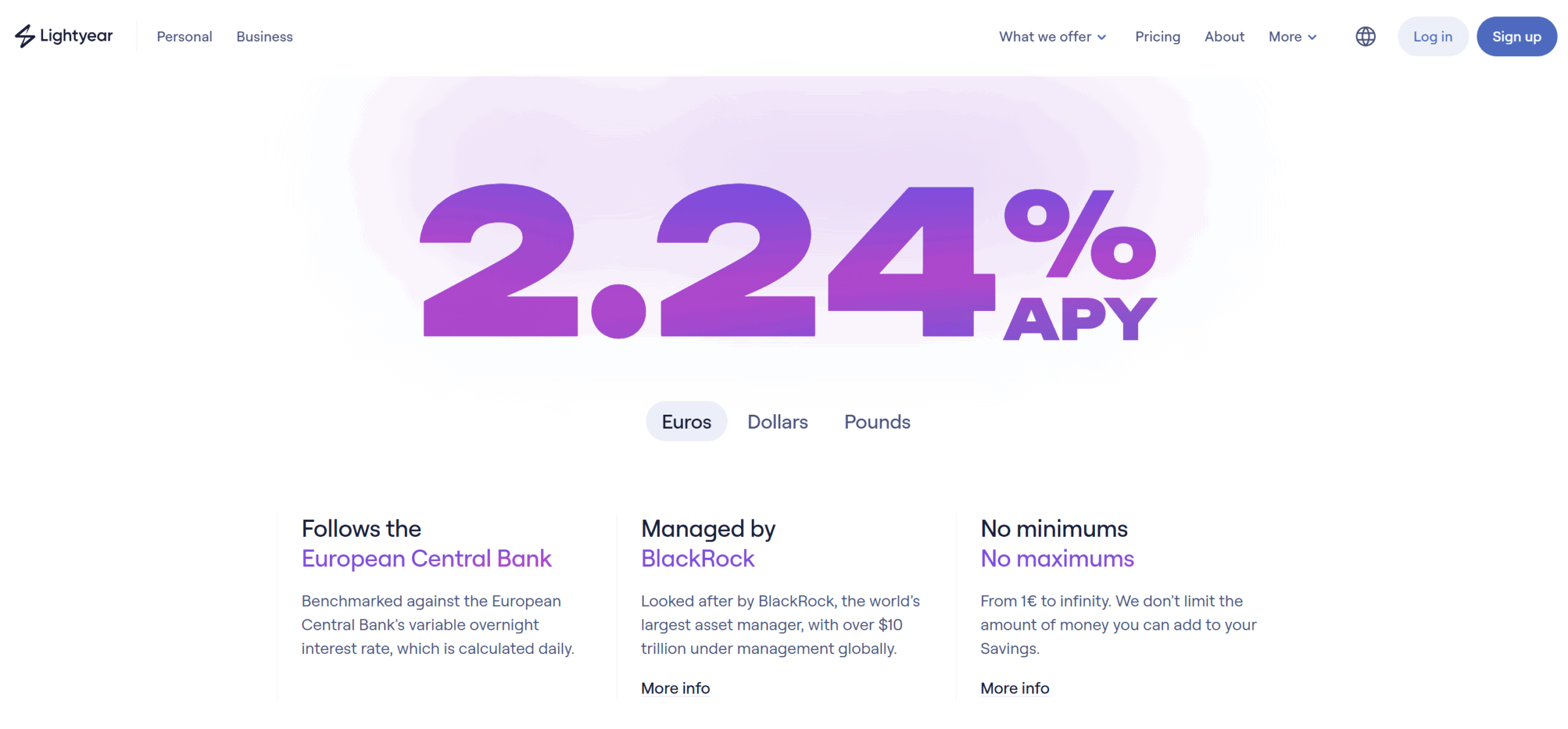

The Savings Vaults are a tool that helps invest in Money Market Funds (MMFs).

MMFs are funds that invest in low-risk, short-term debt securities, such as government bonds, and aim to maintain stable share prices.

Money market funds are widely used by institutional investors, such as pension funds, insurance funds, and banks. In Europe, 1.4 trillion euros are invested in those financial vehicles.

The MMF used by Lightyear for EUR cash is the BlackRock ICS Euro Liquidity Fund:

And, as of June 2025, it is paying 2.24% in EUR:

Do I pay any fee to invest in MMFs?

Yes, the rate shown above (2.24% APY) is what you get after the fee of 0.10%, compounded monthly over a year. The fund’s current 1-day yield is 2.34%.

2.34% – 0.10% fees = 2.24%.

Are Savings/Vaults available in my country?

As per the Lightyear website:

“Lightyear Savings is available in Austria, Estonia, Finland, France, Germany, Hungary, Italy, Lithuania, Luxembourg, Netherlands, Spain and the UK.

It is not currently available in Belgium, Croatia, Cyprus, Greece, Ireland, Latvia, Malta, Portugal, Slovakia and Slovenia.

Bottom line

All in all, Lightyear’s interest in uninvested cash or Savings/Vaults is a great way to park your money and get rewarded. However, always remember that these are different products with different risks associated.

Looking for a sign-up bonus? Lightyear offers you 10 free trades!

10 free trades

Lightyear operates under the regulations of Estonia and the UK authorities. Lightyear Europe is directly regulated by the Estonian Financial Supervision Authority (EFSA) -4.1-1/31. In the UK, Lightyear UK Ltd, which is authorised and regulated by the Financial Conduct Authority (FCA).

Do you have any feedback or doubts about this broker? Please consider reading our review and then contact us to share your experiences.