One of the most common broker choices for European investors looking for stock and ETF investing has been none other than DEGIRO. Since its inception in 2008, the Dutch broker has become one of the leading brokers in Europe, with over 3 million users.

The platform is also well-renowned and reputable because it is:

- Regulated by AFN and DNB;

- One of the largest publicly traded companies on the German stock exchange;

- In possession of a banking license.

However, the platform is not without its flaws. Other than the limited availability of the platform (only 15 European countries), some of the other cons include:

- A limited offer of leveraged products;

- Not having the option of a demo account;

- Mixed reviews and customer service satisfaction by some users;

- Imposing additional fees for seemingly commission-free products.

Additionally, since mid-2023, DEGIRO has increased several commissions, namely:

- €1 commission per trade for local stocks (from your country), US and Canadian stocks (plus the current €1 handling fee);

- €2 commission per trade for Global ETFs, except the ones inside the ETF Core Selection (plus the current €1 handling fee);

- €1 handling fee for its ETF Core selection. The handling fee also applies to all other DEGIRO products except for Stocks on the Tradegate exchange, Options, and Futures (excl. OMX Nordics).

These recent changes have made DEGIRO’s fee structure more complex and its services more expensive for the end user. You could also be charged other fees, such as a currency exchange fee (0.25%), a real-time price feed fee (for some exchanges), and the exchange connection fee (€2.50 per exchange per year).

If you are looking for alternatives to DEGIRO, we’ve got you covered. These are our top picks for DEGIRO alternatives, the choice of which depends on your investing needs:

Best DEGIRO alternatives in 2025

Interactive Brokers | Best global broker overall

Founded in 1978, Interactive Brokers is one of the world’s most trustworthy investing platforms. It offers US stocks investing from $0.35 per trade and ETFs from €1.25 per trade.

Trading 212 | Best for commission-free stocks and ETFs

A simple and intuitive platform, commission-free stocks & ETFs trading (Other fees may apply. See terms and fees), and fractional shares make Trading 212 ideal for beginner investors.

eToro | Best for commission-free ETF trading and social investing

Since being founded in 2007, eToro has amassed over 35 million users by offering commission-free stock trading and innovative features such as social investing (copying and following other investors’ trades and portfolios). It also offers other financial products such as ETFs, cryptocurrencies, and CFDs.

Disclaimer: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Plus500 | Best for CFD trading

Plus500 is a broker that is primarily specialized in CFD investing. They offer zero commissions when trading CFDs in indices, forex, commodities, cryptocurrencies, stocks, options, and ETFs. There is also an account type for those who want to invest in physical shares (Plus500 Invest).

82% of retail CFD accounts lose money.

Saxo Bank | Best for experienced traders

This Danish broker offers experienced traders access to over 120 market exchanges worldwide. It also has a wide financial product selection, including options, forex options, commodities, futures, and more. It is most suitable for advanced investors because of its relatively high fees.

Comparison

| Broker | Minimum deposit | Supported Products | Currency conversion fee | Available in | Trading fees (US stocks) |

| Interactive Brokers | $/€/£0 | Stocks, bonds, ETFs, mutual funds, currencies, options, and futures | 0.08-0.20 basis points x Trade Value per order ($1-$2)minimum per order) | Internationally (exceptions apply) | From $0.0005 (Tiered) to $0.005 (Fixed); Free to US investors |

| Trading 212 | €/£1 (€/£10 for bank transfers) | Stocks, ETFs (Trading 212 Invest), CFDs (Trading 212 CFD) | 0.15% (Invest account), 0.50% (CFD account) | Internationally (not available in the US, Canada, and some other countries) | Commission-free (other fees may apply) |

| eToro | $50 (varies across countries) | ETFs, stocks, cryptocurrencies, CFDs | Between 50 and 150 PIPs | Internationally (exceptions apply) | $1 |

| Plus500 82% of retail CFD accounts lose money. |

$100 ($500 for bank transfers) | Stocks (Plus500 Invest), CFDs (Plus500 CFD) | Spot rate ± 0.7% (Plus500 CFD) | Internationally – not available in the US and some other countries (Plus500 CFD) | 0.006$ per share – higher on other exchanges (Plus500 Invest) |

| Saxo Bank | $/€2,000 (depending on your residency) | Stocks, ETFs, bonds, currencies, futures, options, mutual funds, CFDs | 0.25% | Internationally (exceptions apply) | $1 minimum (Classic account) |

Reviews

Interactive Brokers at a glance

Having been around since 1978 and surviving multiple financial crises, the Interactive Brokers’ major advantage is its reputation. It is also publicly listed on the NASDAQ exchange (ticker: IBKR), making it a bit more regulated than other platforms.

Other significant advantages of using Interactive Brokers are its wide selection of financial products from over 150 markets, solid trade execution (IB SmartRouting), and supporting 24 currencies in its account. There are also 100+ currency pairs available for exchange.

Some downsides of using Interactive Brokers are:

- The complex fee structure;

- Lengthier than average registration and fund deposit processes;

- Limited commission-free trading (only available for US investors).

However, the last point is largely mitigated by using narrower spreads and lower FX fees than most of its competitors.

Speaking of the fee structure, there are two distinct plans to choose from – Tiered and Fixed, with the former fees depending on the trade volume. The fees also vary across different markets. You can see the full fee structure here.

There are 3 apps to choose from when accessing your account: Interactive Brokers Trader Workstation (TWS) desktop app, IBKR GlobalTrader mobile app, and Client Portal web-based app.

The Interactive Brokers Trader Workstation (TWS) app offers many basic and advanced features, such as a demo account, watch lists, alerts and monitoring in real-time, advanced technical analysis tools, and more. One of the downsides of the platform is that the learning curve can be steep for beginners, even with the provided educational materials.

The IBKR GlobalTrader mobile app is a much more intuitive choice for beginner investors, offering stocks, ETFs, and options trading in a more user-friendly format. Other app features include automatic currency conversions and fractional shares (only for certain US stocks).

There is also a web-based application named Client Portal, which is halfway between TWS and Global Trader in terms of user experience and available features. It offers some of the advanced trading tools of the TWS in a more user-friendly format.

Overall, Interactive Brokers is a good choice for beginners and advanced investors looking for a secure broker and access to a wide choice of financial products. If you need more info about it, feel free to check out our more detailed review of Interactive Brokers.

Pros

- Low commissions on US stock trading

- No monthly inactivity fee

- The broadest product and markets range in the brokerage industry

- Demo account

- Excellent reputation (founded in 1978)

- Extensive research and Education tools

- Has a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors, IBKR GlobalTrader.

- Offers interest on uninvested cash balances

Cons

- Complicated and lengthy account opening process (but fully online)

- Steeper learning curve for beginners

- Website is difficult to navigate

- Interactive Advisors (Robo-advisor feature) is only available for US customers

Trading 212 at a glance

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Founded in 2004, Trading 212 claims the title of the first-ever commission-free broker in both the U.K. and Europe. As of 2023, it has over 2 million users with over €3.5 billion in assets under management (AUM).

It offers two distinct account types: Trading 212 Invest, which offers commission-free stocks and ETFs trading, and Trading 212 CFD, which offers CFD trading only.

The Trading212 Invest account has been rapidly gaining popularity with beginner investors especially, and with good reasons:

- The minimum deposit is just €/£1 (€/£10 for bank transfers);

- Commission-free stocks and ETFs trading is available (along with fractional shares);

- The platform is very simple to use (for both account opening and trading).

Trading212 is available in 100+ countries, but that list does not include the U.S. or Canada, among some other countries. The account opening and fund depositing process is one of the simplest ones on the market. Trading is also easy and intuitive when using the platform, both on mobile and web-based apps. There are almost zero fees for the end user when depositing funds by bank transfer and trading stocks or ETFs.

It is important to note that Trading 212 can offer commission-free trading primarily due to its share lending program, which is mandatory for Trading 212 users. In a nutshell:

- Trading 212 holds the right to lend your shares to a third party (borrower);

- This doesn’t affect your ability to trade the shares, receive dividends, etc.

- Trading 212 has to always hold collateral in the form of US Treasury Bonds that is equal to or more than 102% of the value of the shares lent.

However, that doesn’t mean there are no fees on Trading 212. Some of the fees that Trading 212 charges are;

- 0.7% for deposits by cards, Google Pay, Apple Pay & other (it’s free up to the first €2,000);

- 0.15% (Trading 212 Invest) or 0.50% (Trading 212 CFD) currency exchange fees;

- Overnight fees on CFDs.

There may be some additional smaller fees applied by different exchanges or countries. You can see the fee structure in more detail here for Trading 212 Invest and here for Trading 212 CFD. Other cons of the platform include a limited offer of financial products, supporting only 3 currencies (USD, EUR, and GBP), and high spreads on Forex CFDs.

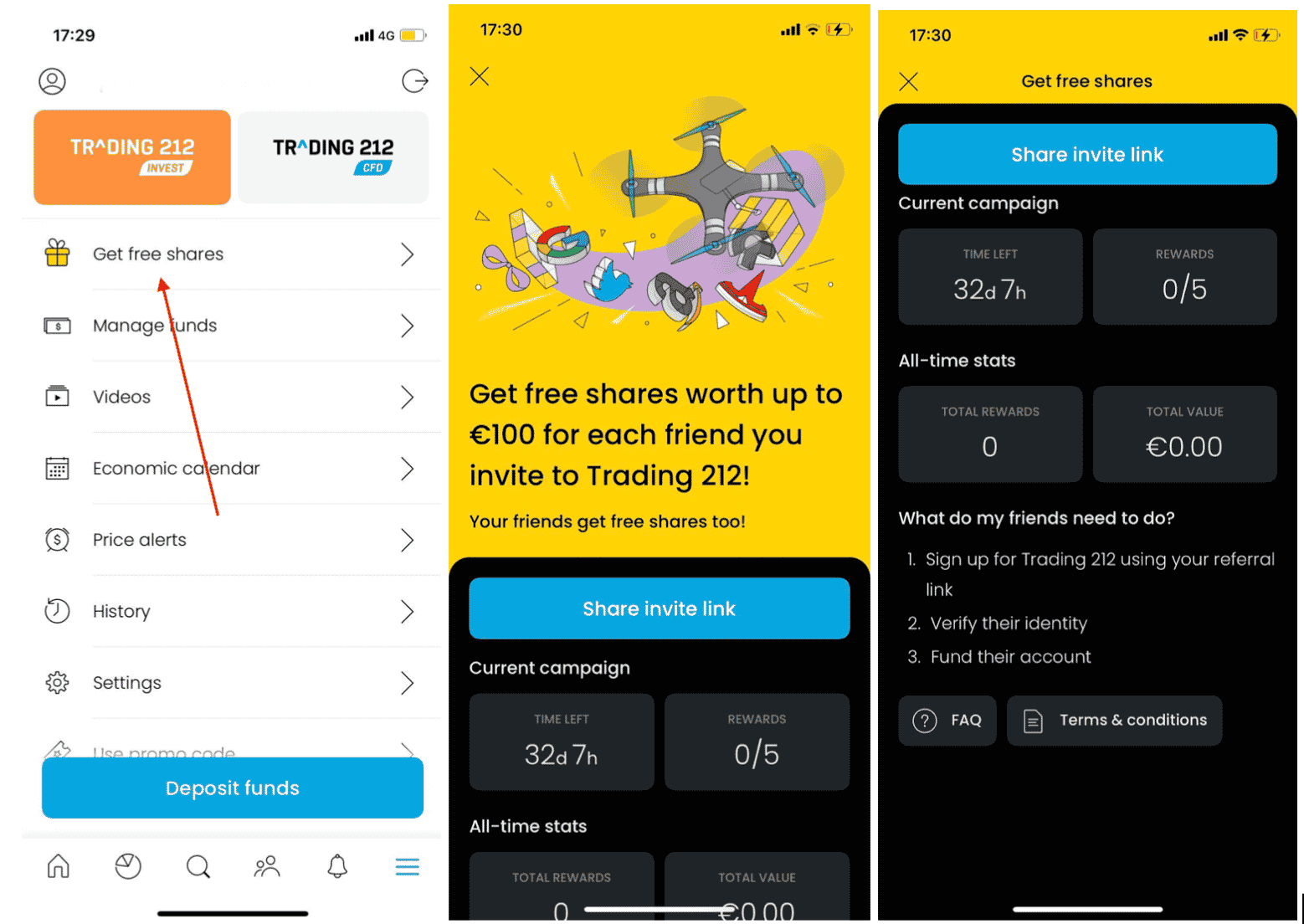

For those of you who are thinking about joining Trading 212, you can even claim a free share when you sign up by following this link. After you verify your identity and fund the account, be sure to include promo code “IITW” to claim free shares worth up to €100.

To sum it all up, Trading 212 is a good choice for beginner investors who want a simple, effective, and cheap way to buy stocks and ETFs.

If you need more info, feel free to check out our more detailed review of Trading 212.

Pros

- Commission-free Real Stocks and ETFs trading (other fees may apply. See terms and fees)

- AutoInvest & Pies feature

- Fast and easy account opening process

- Demo account

- Top Tier Regulators

- Free fractional shares worth up to €100

- High interest on uninvested cash

Cons

- Limited product portfolio (no Options, Bonds, Mutual Funds or Futures)

- No relevant Fundamental tools

- 0.15% of Foreign exchange fees

eToro at a glance

61% of retail CFD accounts lose money.

Being founded in 2007, regulated by top-tier financial institutions, and having over 35 million global users, eToro is a well-renowned broker. The platform is most known for its social trading feature, which you can use to follow and copy other investors’ trades and portfolios. There is also a wide selection of markets and financial products when investing by yourself, including stocks, ETFs, cryptocurrencies, and CFDs (on stocks, ETFs, commodities, currencies, indices, and cryptocurrencies).

The platform is intuitive and well-suited even for beginners and also offers trading with virtual funds through its demo account. Account opening and depositing funds are both easy and fast. Zero commission trading is available for ETFs, coomissions for stocks start at $1 per trade and the minimum deposit is set at $50 (varies across countries).

The feature that eToro is best known for is probably its social trading feature named Copy Trader. It allows users to copy the trading behavior of other investors in real-time at no extra charge to the user.

Another unique feature of eToro is an automated investing tool named Smart Portfolios. Most Smart Portfolios are created and managed by the eToro Investment Team. Still, Partner Portfolios are created and managed by eToro’s partners, which include asset managers, data research companies, and more.

Low and transparent fees are one of the main pros of using eToro. The most common fees are:

- Currency exchange fees when depositing in currencies other than the USD or EUR;

- A fixed withdrawal fee of $5 (minimum withdrawal amount is $30);

- $10 inactivity fee after 1 year;

- Market (bid/ask) spreads;

- $1 commission for US, EU and UK stocks.

Overall, eToro is a good choice for most beginner investors looking for a simple and low-cost way to start investing through a reputable broker who offers access to a wide selection of financial products. Its innovative social and automated investing features could also be a way for many beginners to start their investing journey.

If you need more info, feel free to check out our more detailed review of eToro.

Pros

- Low stock trading fees (from $0 per trade)

- Commission-free ETFs (other fees apply)

- Social trading and other innovative products

- Wide variety of financial products

- Slick, modern, and easy for anyone to use

- European users have access to three account currencies: EUR, USD and GBP

- Top tier regulators

Cons

- Limited disclosed financial information

- Withdraw and inactivity fees

- Spread, overnight, inactivity, and currency conversion fees higher than average

- Doesn’t offer bonds, futures, or options

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Plus500 at a glance

82% of retail CFD accounts lose money.

Founded in 2008, Plus500 is a trading platform best known for its wide choice of CFD products and low fees in its Plus500 CFD account. However, it also offers stocks (physical shares) in the Plus500 Invest account.

The company is also listed on the London Stock Exchange and is available in over 50 countries. There are 16 different base currencies to choose from (including USD, EUR, and GBP, to name a few).

The web platform (WebTrader) offers an intuitive interface with access from multiple devices, including a mobile app. There is also a demo account option to test the features and trade with virtual funds.

Plus500 CFD fees come mainly from the buy/sell (Bid/Ask) spreads, which vary widely across different financial products. When using Plus500 Invest, each trade has a fee, depending on the exchange you’re using. It could be as low as 0.006$ per share for US stocks but can be significantly higher for EU stocks (the minimum is between €2 and €6 per trade).

Keep in mind that there is also a currency conversion fee (up to 0.7% of the trade’s realized net profit and loss) and a $10 monthly inactivity fee (following three months of not logging in to the platform).

Find more detail about Plus500 CFD fees here and Plus500 Invest fees here. If you need more info about Plus500 in general, you can check out our detailed Plus500 review.

Pros

- Acessible and responsive platform

- Low spreads

- No dealing commissions

- Demo Account

- Top-tier regulators

Cons

- No ETF offering

- Inactivity fee ($10 per month after no login activity in 3 months)

- High overnight funding fees

- Very little research and education provided

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Saxo Bank at a glance

62% of retail CFD accounts lose money.

Founded in 1992, Saxo Bank is one of the longest existing global brokers. It is known for its wide variety of financial products (over 60,000), access to a large number of market exchanges (over 120), and a large number of base currencies (18).

Saxo Bank has, more than anything, been trying to appeal to professional investors. It has done so by offering advanced tools, such as its integration with the Trading View charting platform. The apps SaxoTraderGO and SaxoTraderPRO have also been tailored to the professional user, both by the number of their features and their relative complexity.

Those are probably some reasons why Saxo Bank has one of the highest initial deposit requirements in the industry. These can vary depending on your residency, starting from £500 for UK investors and €2,000 for most European countries. It is important to note that Saxo Bank is unavailable in some big global markets outside Europe, such as the US.

Three distinct account levels are available: Classic, Platinum ($200,000 minimum), and VIP ($1,000,000 minimum), each with its fee structure. Saxo Bank charges up to 0.08% (min. $1) for trading US stocks and ETFs.

The fee structure is fairly complex, and there are also some additional fees to be aware of. Just to name a few of the most common ones:

- Custody fee: Up to 0.15%;

- Inactivity fee (after not logging in for 6 months): €100;

- Currency conversion fees: between 0.25%.

It is probably best to select the desired financial product from their website to see its full fee structure.

In a nutshell, Saxo Bank is tailored to professional investors because of its advanced tools, higher-than-average fees, and complex interface. Those are also reasons why it may not be suitable for beginner or even intermediate investors.

Pros

- Excellent research materials

- Outstanding trading platforms (SaxoTraderPRO and SaxoTraderGO)

- Extensive range of investment products

- Long track record

- Supervised by worldwide top-tier regulators

Cons

- High minimum deposit (varies between countries)

- Fees higher than average

- Fee structure is complex

- Does not accept US residents

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Bottom line

To summarize, here’s our list of DEGIRO Alternatives:

Interactive Brokers

Best global broker overallTrading 212

Best for commission-free stocks and ETFseToro

Best for commission-free ETF trading and social investingPlus500

Best for CFD tradingSaxo Bank

Best for experienced traders

Choosing a broker among numerous options can be a daunting task. The key is to choose a broker that best suits your investing needs because there is no such thing as one broker tailored to all customers. All of them have certain pros and cons which may be more or less important to you.

Hopefully, this article made it easier for you to choose an alternative to DEGIRO.