Are you beginning your financial journey or looking for the ideal platform to manage your investments in Ireland? You’re not alone – we’ve been there too, and we understand how overwhelming it can be to choose the right platform. That’s why we created this comprehensive guide, where we present the top six trading platforms available in Ireland.

In this article, we’ll compare each platform and provide practical reviews to help you make an informed decision. Let’s dive in!

Best trading platforms in Ireland

- Interactive Brokers: Best overall

- eToro: Best trading platform for beginners and social trading

- Trading 212: Best for highest interest rates and sign-up bonus worth up to €100

- Trade Republic: The best trading platform for a mix of security and high interest rates on cash (EUR)

- DEGIRO: Good trading platform for buy-and-hold investors

- Lightyear: A new trading platform with a high interest rate on cash

For a list of brokers we do not recommend, you can visit our full list of broker reviews, and filter by “Not recommended”.

Disclaimer: Investing involves risk of loss.

Comparison

Best trading platforms in Ireland reviewed

#1 Interactive Brokers

Why do we consider Interactive Brokers the best overall trading platform? Firstly, it is a public-traded company on NASDAQ and is regulated by top-tier authorities such as the Central Bank of Ireland (CBI). Additionally, it participates in the Irish Investor Compensation Scheme (ICS), which protects funds up to €20,000 in case of firm failure.

Interactive Brokers also offers an advanced platform that supports a wide range of products, including stocks, options, mutual funds, ETFs, futures, bonds, cryptocurrencies and currencies. The platform also provides comprehensive tools for both technical and fundamental analysis to support your investment decisions.

Furthermore, IBKR’s financial strength and stability are underscored by its ability to navigate complex market conditions. While unforeseen challenges can arise in the financial markets, IBKR’s robust infrastructure and strong regulatory oversight ensure that it remains resilient. This commitment to security and financial integrity is a key reason why IBKR is considered one of the top brokers globally.

For a deeper understanding of IBKR’s financial resilience and the measures they have in place, you can explore more in their Financial Strength and Security Facts Overview.

Although beginners and intermediate investors have access to educational resources, the platform’s steep learning curve can be challenging. However, highly responsive customer service ensures clear and direct answers.

Interested in knowing more about Interactive Brokers? Read our Interactive Brokers review.

Pros

- Low commissions on US stock trading

- No monthly inactivity fee

- The broadest product and markets range in the brokerage industry

- Demo account

- Excellent reputation (founded in 1978)

- Extensive research and Education tools

- Has a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors, IBKR GlobalTrader.

- Offers interest on uninvested cash balances

Cons

- Complicated and lengthy account opening process (but fully online)

- Steeper learning curve for beginners

- Website is difficult to navigate

- Interactive Advisors (Robo-advisor feature) is only available for US customers

#2 eToro

61% of retail CFD accounts lose money.

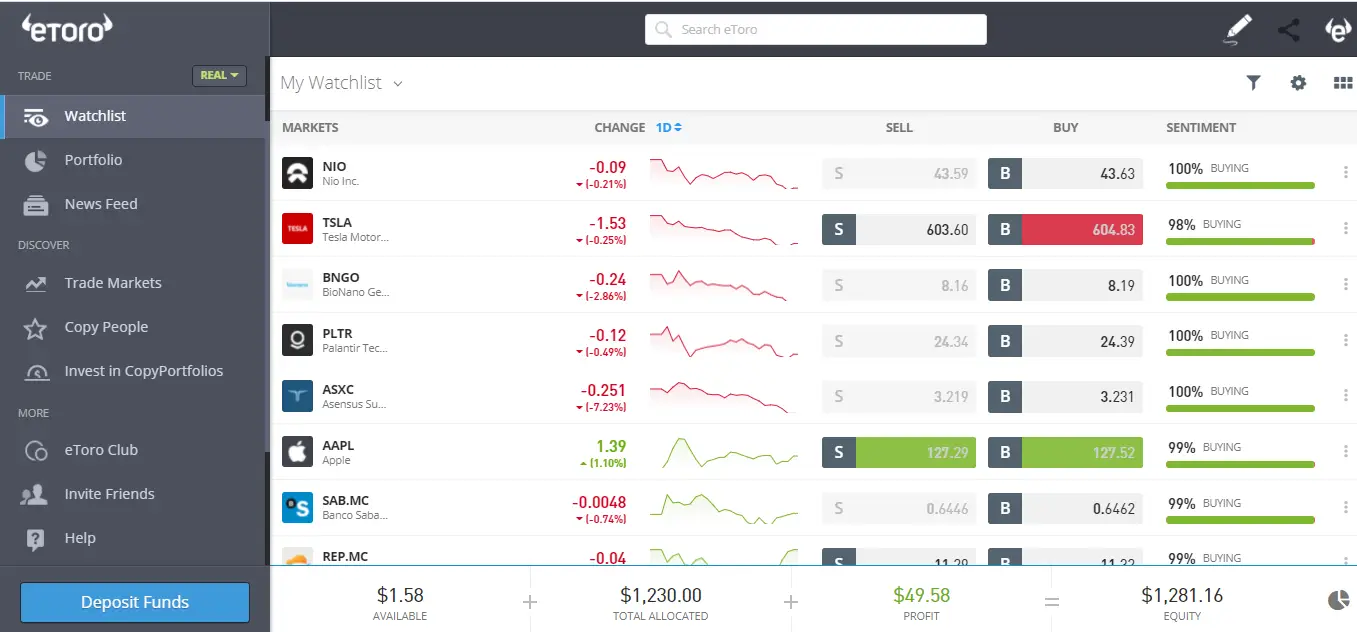

Another excellent trading platform for Irish users is eToro, an international broker with over 30 million users trading a variety of assets, including stocks, forex, commodities, cryptocurrencies, CFDs, and ETFs.

The platform offers over 3,000 financial instruments, including stocks, ETFs, and ready-made investment portfolios (Smart Portfolios). It features an intuitive interface suitable for beginners, with advanced options like one-click trading and a stop-loss feature. The eToro Research Tab, powered by TipRanks, provides valuable insights for informed decision-making.

While eToro is beginner-friendly, it may not be ideal for day traders or experienced investors due to relatively high spreads and a $5 withdrawal fee. Despite these drawbacks, eToro remains a robust option for Irish investors looking for a versatile trading platform.

Interested in knowing more about eToro? Read our eToro review.

Pros

- Low stock trading fees (from $0 per trade)

- Commission-free ETFs (other fees apply)

- Social trading and other innovative products

- Wide variety of financial products

- Slick, modern, and easy for anyone to use

- European users have access to three account currencies: EUR, USD and GBP

- Top tier regulators

Cons

- Limited disclosed financial information

- Withdraw and inactivity fees

- Spread, overnight, inactivity, and currency conversion fees higher than average

- Doesn’t offer bonds, futures, or options

#3 Trading 212

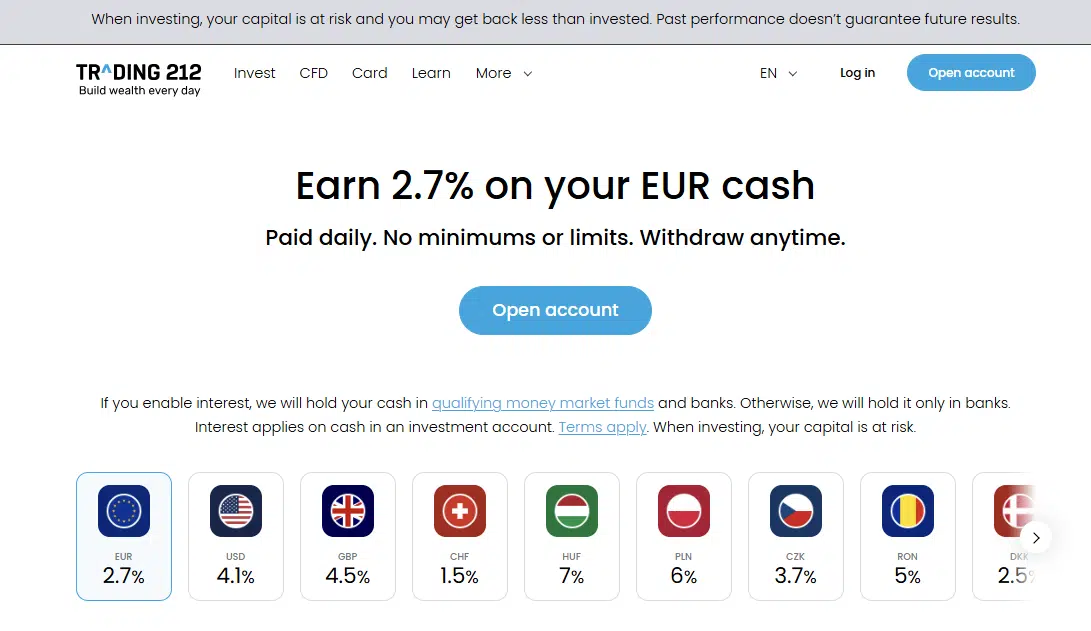

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Founded in 2006, Trading 212 is a London-based fintech with over 3 million funded accounts, dedicated to democratizing investing through its simple mobile application. The platform offers access to over 10,000 stocks and ETFs, and new users, including Irish investors, can receive a free fractional share worth up to £/€100 by signing up with the Trading 212 promo code: IITW.

Trading 212 provides commission-free trading for stocks and ETFs, fractional shares, and an automatic investment system. However, it does not offer certain products, such as bonds and options. Trading 212 also introduces a feature called “Pies”, allowing investors to create personalized portfolios or copy existing portfolios crafted by other users.

Irish investors, like all users, can earn interest in thirteen different currencies, including EUR, GBP, and USD, making it one of the most competitive offers in the market. For more details on the Trading 212 interest on uninvested cash, you can read our detailed article here.

The Trading 212 Cashback program also provides cashback on everyday purchases, allowing users to reinvest these rewards. In terms of safety, Trading 212 is regulated by FCA, CySEC, ASIC and BaFin.

Interested in learning more? Check out our Trading 212 Review.

Pros

- Commission-free Real Stocks and ETFs trading (other fees may apply. See terms and fees)

- AutoInvest & Pies feature

- Fast and easy account opening process

- Demo account

- Top Tier Regulators

- Free fractional shares worth up to €100

- High interest on uninvested cash

Cons

- Limited product portfolio (no Options, Bonds, Mutual Funds or Futures)

- No relevant Fundamental tools

- 0.15% of Foreign exchange fees

#4 Trade Republic

Investing involves risk of loss.

Founded in 2015, Trade Republic is a Berlin-based discount broker specializing in five key financial assets: stocks, ETFs, bonds, cryptocurrencies, and derivatives. Although it promotes itself as a “no order fee” platform with the motto “Do more with your money,” Trade Republic applies a €1 external fee to every trade (except for savings plans), meaning €1 for buying and another €1 for selling.

Trade Republic also offers an attractive 2.00% annual interest on unlimited cash balances, with interest paid out monthly. You can find a detailed explanation of this in this article.

Additionally, Trade Republic has introduced a new debit card featuring a 1% cashback benefit. This innovative card allows Irish investors, to automatically save a portion of their spending, making it easier to grow their savings. If you’re interested in learning more, check out our article exploring how the Trade Republic Saveback feature works here.

Trade Republic is also the first broker in Europe to enable fractional investment in corporate and government bonds for as little as €1.

Interested in learning more? Check out our Trade Republic Review.

Pros

- Automatic saving plans

- Interest paid in idle cash balances

- Invest from only €1

- No minimum deposit

- Direct debit in the share-saving plans

- Supervised and regulated by a top-tier regulator

- Has a banking license - deposits are protected by deposit guarantee scheme

Cons

- €1 flat external fee in every single trade (Except saving plans)

- No demo account

- Only one base currency (EUR)

- No direct access to US Stock Exchanges - you might not be able to buy some popular US-listed companies, such as Reddit

- Currency conversion fees apply

- Engages in PFOF - Payment for Order Flow

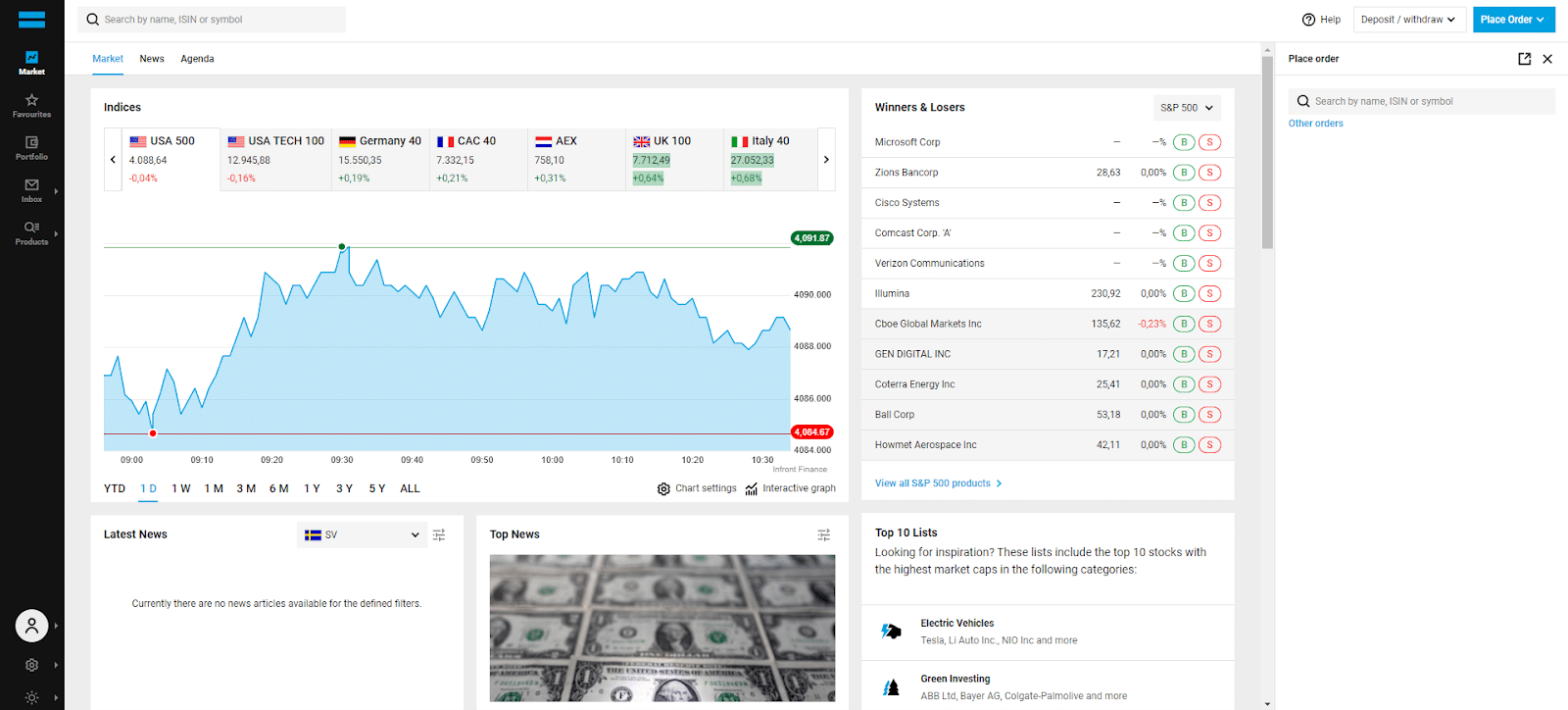

#5 DEGIRO

Investing involves risk of loss.

DEGIRO joins the list as one of the best trading platforms in Europe for low-cost investing. It’s an ideal choice for those looking to minimize trading expenses, with no fees for maintenance, inactivity, deposits, or withdrawals, and €/£1 commission per trade on US stocks (plus a €/£1 handling fee) and several popular ETFs. The platform also offers access to over 30 global exchanges.

Besides stocks and ETFs, DEGIRO’s product offerings include mutual funds, bonds, futures, options, and warrants, with the added benefit of pre-market and after-hours trading.

DEGIRO’s web trading platform features a modern, simple design that is highly intuitive. For instance, you can create a favorites list and stay updated with the latest news about your portfolio.

On the downside, DEGIRO does not offer forex trading and charges a €/£2.50 annual connectivity fee per exchange.

Interested in learning more? Check out our DEGIRO review.

Pros

- ETF Core Selection list (external fees apply)

- User-friendly web and mobile app

- Wide range of investment options

- Education material: Investor’s Academy and Investing with DEGIRO

- Low overall commission structure

- No account opening, inactivity, or withdrawal fee

Cons

- 0.25% currency conversion fee (charged if you deposit or invest in a different currency than your base currency)

- €/£1 flat handling fee (charged in most transactions)

- €/£2.50 of connectivity fee (paid annually), per exchange where you’re invested

- Does not offer Forex, CFDs, and Cryptos

- No ISA account (for UK residents)

- Low-quality customer support

- No interest paid on cash balances

#6 Lightyear

Terms apply, seek guidance if necessary. When you invest, your capital is at risk.

Lightyear is a European investment app that operates via Lightyear Europe AS, authorized and regulated by the Estonian Financial Supervision Authority (EFSA), with clients’ assets covered up to €20,000.

Lightyear offers commission-free trading for ETFs, and stock trades are capped at €/$/£1 per order. The platform also features a competitive 0.35% fee for currency conversion, which can be minimized through their multi-currency account in EUR, GBP, and USD.

Additionally, Lightyear provides some of the highest interest rates on uninvested cash in EUR, USD, and GBP.

The platform is ideal for beginners and intermediate investors, offering an easy-to-use app and access to over 5,000 stocks across US, UK, European, and Asian markets.

However, Lightyear offers a limited range of products (no options, commodities, or Forex), and does not include a demo account.

Interested in knowing more about Lightyear? Read our Lightyear review.

Pros

- 0% Lightyear execution commission on ETF trading (other fees may apply)

- No account opening, inactivity, or withdrawal fees

- High interest on uninvested cash

- Free multi-currency account

- Minimum deposit of €/£/$1

- Fractional Shares

- Account opening promotion with the promo code INVESTINGINTHEWEB

Cons

- Limited financial instruments (no options, bonds, commodities, or futures)

- No demo account

- Only available in 22 european countries (not available internationally)

- 0.35% currency conversion fee

How to buy S&P 500 from Ireland?

Are you new to investing or just looking to find the best S&P 500 ETFs?

We understand it can be overwhelming at first, but don’t worry!

We guide Irish investors step-by-step on how to buy the S&P 500 from Ireland.

Best trading platforms for earning interest on uninvested cash

Bottom line

To summarize here’s the list of the best trading platforms in Ireland:

- Interactive Brokers is perfect for those who need extensive investment options and strong regulatory oversight.

- eToro stands out for beginners and social traders with its user-friendly interface and social trading features.

- Trading 212 offers competitive interest rates on uninvested cash and a unique “Pies” feature, making it ideal for those looking to customize their portfolios.

- Trade Republic is a great choice for cost-conscious investors, with low fees and innovative features like fractional bond investments.

- DEGIRO is a good option for buy-and-hold investors.

- Lightyear offers some of the highest interest rates on uninvested cash, making it an attractive option for those looking to maximize idle funds.

Ultimately, the best platform for Irish investors will depend on your specific needs and investment goals. Whether you’re focused on maximizing returns on uninvested cash, minimizing trading costs, or accessing a wide range of investment options, there’s a platform in this list that can meet your needs.

For a deeper dive into each platform’s offerings, be sure to check out our full reviews. Happy investing!