Trade Republic is one of many brokers paying interest on uninvested cash, namely 2.00% per annum in euros:

How is this rate defined? Is my money protected? Is there any catch? Let’s dig in!

How does Trade Republic offer this rate?

On June 5th, 2025, the ECB decided to cut interest rates by 0.25% (from 2.25% to 2.00%). As such, Trade Republic immediately announced that it would follow suit and reduce its rate to 2.00%.

The rate we are referring to is called “deposit facility”, which is the interest rate earned by banks when depositing money in the ECB. So, in practice, Trade Republic, by offering you the same rate, is passing all the interest directly to you. Most banks or brokers offer a lower rate and pocket the difference.

For clients with a Trade Republic IBAN*

Your Trade Republic money can be placed in a deposit within a financial institution or in a “liquidity fund“, which is a fund that invests in low-risk, short-term debt securities. The interest rate paid is mainly dependent on the European Central Bank’s (ECB) policy moves.

*To check this, go to the app and select the top-left corner widget (with your name initial). In “Account”, copy your IBAN and check it here if it is a Trade Republic IBAN.

For clients without a Trade Republic IBAN

Your Trade Republic money is placed in a deposit account with a financial institution.

Is the Trade Republic interest safe? What are the risks?

Yes and no.

Firstly, your money in deposits is protected up to €100,000 per depositor by the Deposit guarantee scheme of German banks (Entschädigungseinrichtung deutscher Banken in German), which is an institution legally responsible for guaranteeing deposits in German banks by the European Union (EU) directives.

As stated on their Depositor Information Sheet, “Your deposit is covered by a statutory Deposit Guarantee Scheme. If insolvency of your credit institution should occur, your deposits would, in any case, be repaid up to EUR 100,000”.

Secondly, the money invested in the liquidity fund is subject to price fluctuations. These funds, also known as money market funds (MMFs), invest in low-risk, short-term debt securities, such as government bonds, and aim to maintain stable share prices. Still, the MMFs fall under the German Investor Compensation Scheme, which compensates any losses from non-returned assets up to 90% (with a maximum of EUR 20,000). Again, it only compensates you if Trade Republic goes bankrupt and cannot return your money in the MMF. This compensation is not for investment losses in MMFs.

After contacting the support team, they present a clear definition of what is a “deposit” and a “liquidity fund”:

How can I start earning interest?

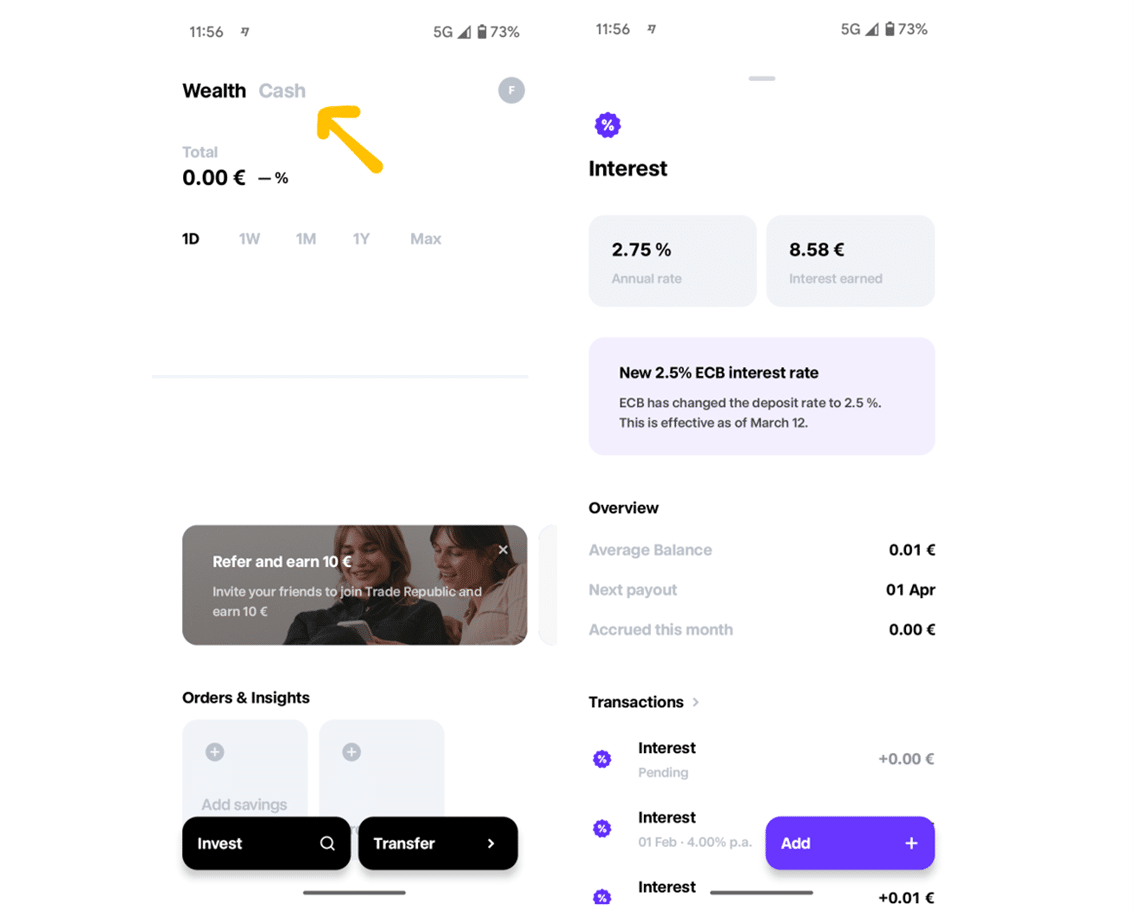

Firstly, you must manually enable interest on cash by tapping your avatar in the top left corner, then select “Interest”. Once you accept the Terms & Conditions, your uninvested cash balance will automatically begin earning interest.

Then, in “Cash”, you will find the tab “interest” that will tell you the annual rate in place and the interest earned so far. Besides, you also have access to “Transactions”, where you will see all the interest paid plus any deposit or withdrawal.

Is the Trade Republic interest rate fixed or variable?

The interest rate paid is variable, according to the ECB decisions.

The ECB Governing Council monetary policy holds 8 meetings per year (roughly every 6 weeks). These meetings serve to set the interest rates in the Euro Area, among other things. The participants are the ECB President, the ECB Vice President, the ECB Executive Board (4 members), and the heads of each of the national central banks of the Euro Area.

You can check all the scheduled meetings here.

So, if the ECB changes its policy by raising or lowering its key interest rates, the interest on cash will likely change in the same direction.

Are there any constraints?

Yes, you should consider the following:

- The interest paid is on cash balances up to €50,000 (there is no minimum amount) for clients without a Trade Republic IBAN and no limits for the other clients;

- You are free to use your money when needed (withdrawals or investments), and there are no interest penalties;

- The interest is accrued daily but paid monthly.

Do I have to pay taxes on Trade Republic interest?

Yes, most likely. Except for special account types, like the ISA in the UK, taxes will be due on the interest you receive.

This article is intended for all Trade Republic clients. We cannot analyse each country’s particularities separately or your personal circumstances, but you are almost certain to pay taxes. Please contact your tax authorities to determine what actions to take.

Trade Republic alternatives for interest

If you’re looking for alternatives to the Trade Republic interest, check our articles, where we filter the best brokers and digital banks for getting interest on your cash in EUR.

Bottom line

All in all, Trade Republic’s interest in uninvested cash is a great way to park your money and get rewarded. Unfortunately, it only offers interest in euros, so if you plan to earn interest in other currencies, you are out of luck.

Trade Republic is regulated by BaFin, the Federal Financial Supervisory Authority in Germany. However, it is supervised by both BaFin and the Deutsche Bundesbank. This gives us an additional level of comfort.

Do you have any feedback or doubts about this broker? Please consider reading our review and then contact us to share your experiences.