Investing in exchange-traded funds (ETFs) is among the most attractive methods compared to direct investment in a single asset due to several factors, such as diversification and lower volatility. Like stocks and Forex, brokers give you access to ETFs through their platforms.

Finding the best ETF broker in the UK can be challenging, given the large number of brokers available, each offering a different set of services. For instance, you must consider the number of ETFs you will get access to, the fees you’ll incur, the trading platform you will use, and which regulatory body supervises the broker.

Below, we compare 9 different well-established UK brokers that offer ETF trading. We included the fees charged per ETF trade, the minimum deposit, the ISA fees, the range of ETFs it offers, and the currency conversion fee (in case you deposit in a different currency or invest in a product that is not in GBP).

Best ETF platforms in the UK in 2025

XTB

Cheapest ETF trading platform in the UK

InvestEngine

Best for managed ETF portfolios

Interactive Brokers

Best reputation and widest range of ETFs supported

eToro

Best for social trading

Disclaimer: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

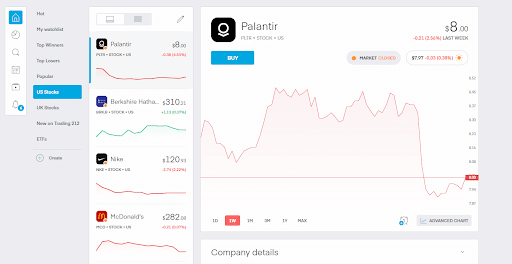

Trading 212

Best for ISA and commission-free ETF trading

Freetrade

Best for beginners

| Top Platforms (+others) | Fee per ETF trade | Minimum Deposit | ISA fee | Range of ETFs |

| XTB | £0 up to a monthly trading volume equivalent to 100,000 EUR (after that, 0.2% with a minimum of 10 GBP) | £0 | £0 | 700+ |

| Interactive Brokers | Varies by exchange with tiered Pricing: 0.05% of Trade Value (min: €1.25, max: €29.00) | £0 | Minimum monthly activity fee of £3 | 13,000+ |

| eToro | Free (other fees apply) | $50 | £0 | 260+ |

| Freetrade | Free | £0 | £5.99 (monthly) | 400+ |

| Interactive Investor | £5.99 | £0 | From £4.99 (monthly) | 1,000+ |

| InvestEngine | £0 (No dealing fees) | £100 | £0 | 500+ |

| Trading 212 | £0 | £1 | £0 | 2,000+ |

| Saxo Bank | From 0.08% (min. $1) on US listed ETFs | £0 | £0 | 6,000+ |

| Hargreaves Lansdown | £11.95 | £0 | 0.45% p.a. | 1,000+ |

Below, we briefly review the brokers that we consider the best for UK ETF investors: Interactive Brokers, InvestEngine, Trading 212, eToro, and Freetrade.

#1 XTB

XTB at a glance

69-80% of retail CFD accounts lose money.

XTB is a global investment firm offering a comprehensive range of financial instruments, including stocks, ETFs, forex, commodities, indices, and cryptocurrencies.

One of XTB’s latest offerings is the Individual Savings Account (ISA), a tax-efficient savings and investment account available to UK residents. The Stocks & Shares ISA allows investors to build a diversified portfolio from over 3,000 stocks and more than 700 ETFs, with the benefit of earning interest or returns without paying tax on them.

XTB offers competitive terms for its ISA accounts, including free account opening and maintenance for all active clients, regardless of trading volume or account balance. Investors can enjoy a 0% commission on stocks and ETFs up to a monthly trading volume equivalent to €100,000; transactions above this limit incur a commission of 0.2% (minimum £10). A currency conversion fee of 0.5% may apply. Moreover, XTB provides interest on uninvested funds, with rates up to 4.75% for GBP balances, calculated daily and paid out monthly.

XTB’s ISA aims to provide a user-friendly and cost-effective solution for individuals seeking to grow their investments while benefiting from tax advantages.

For more information on XTB, please take a look at our review.

#2 InvestEngine

InvestEngine at a glance

When investing your capital is at risk.

InvestEngine is a UK-based robo-advisor and investment platform launched in 2020. It provides users with access to low-cost, diversified portfolios of exchange-traded funds (ETFs) designed to meet their investment goals and risk tolerance. InvestEngine offers both managed portfolios and a do-it-yourself (DIY) option for investors who prefer to build and manage their own portfolios.

Pros:

- Low-cost investing: InvestEngine provides a low-cost solution for investing, with competitive fees for both managed portfolios and the DIY option.

- Diversification: The platform offers a range of ETFs, enabling investors to create a diversified portfolio tailored to their risk tolerance and investment objectives.

- Auto-rebalancing: For managed portfolios, InvestEngine periodically rebalances the portfolio to maintain the desired level of risk and diversification.

- User-friendly interface: The platform is easy to navigate and provides helpful tools, such as risk assessment questionnaires and educational resources.

Cons:

- Limited investment options: Compared to some other platforms, InvestEngine offers a smaller selection of ETFs. Investors looking for a wider range of investment options might find this limiting.

- No individual stocks or bonds: InvestEngine focuses exclusively on ETFs, which might not be suitable for investors who wish to invest in individual stocks, bonds, or other types of instruments.

All in all, it is a great solution for buy-and-hold investors looking to only invest in ETFs for the long term.

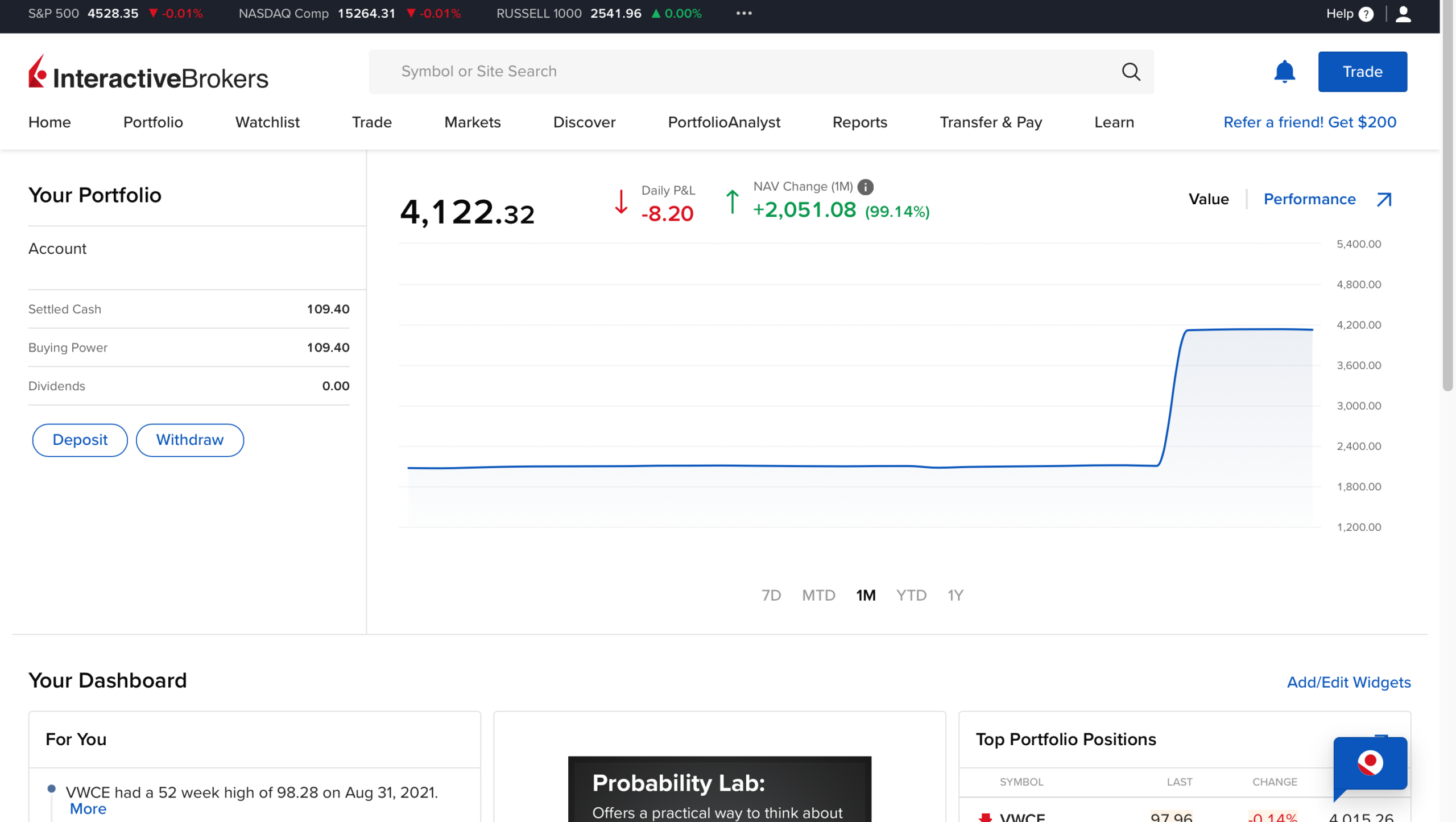

#3 Interactive Brokers

Interactive Brokers at a glance

Interactive Brokers is another outstanding broker that offers the most extensive range of ETFs and allows you to trade almost any financial instrument, such as stocks, options, futures, Forex, commodities, bonds, and even over-the-counter (OTC) securities. It was founded in 1978 and is regulated by many top-tier regulators, such as the SEC and the FCA.

Nearly all UK investors are eligible to open an account at Interactive Brokers, and it is suitable for any investor. Although its web-based Client Portal, GlobalTrader Mobile app, and professional Trader Workstation platform (TWS) are very well designed and simple to use, a newbie may find the number of tools available overwhelming.

Deposits can be made through bank wire transfer, with no minimum deposit requirement to open an account. As for ETF trading, the fees follow tier-based pricing and vary depending on the exchange and the volume of your trades. For instance, the fees on most EU-listed ETFs are 0.05% of trade value, with a minimum fee of €1.25 and a maximum of €29.00.

As for their customer support, you can reach them by phone, email, live chat, or through their automated “iBot.” Even though their team is quite experienced, email inquiries might not get a reply right away.

Interactive Brokers also offers UK residents tax-favourable Self-Invested Personal Pension (SIPP), Stocks and Shares ISA, and Junior ISA accounts.

Overall, Interactive Brokers is a good choice for beginners and advanced investors looking for a secure broker and access to a wide choice of financial products. If you need more info about it, please check out our more detailed review of Interactive Brokers.

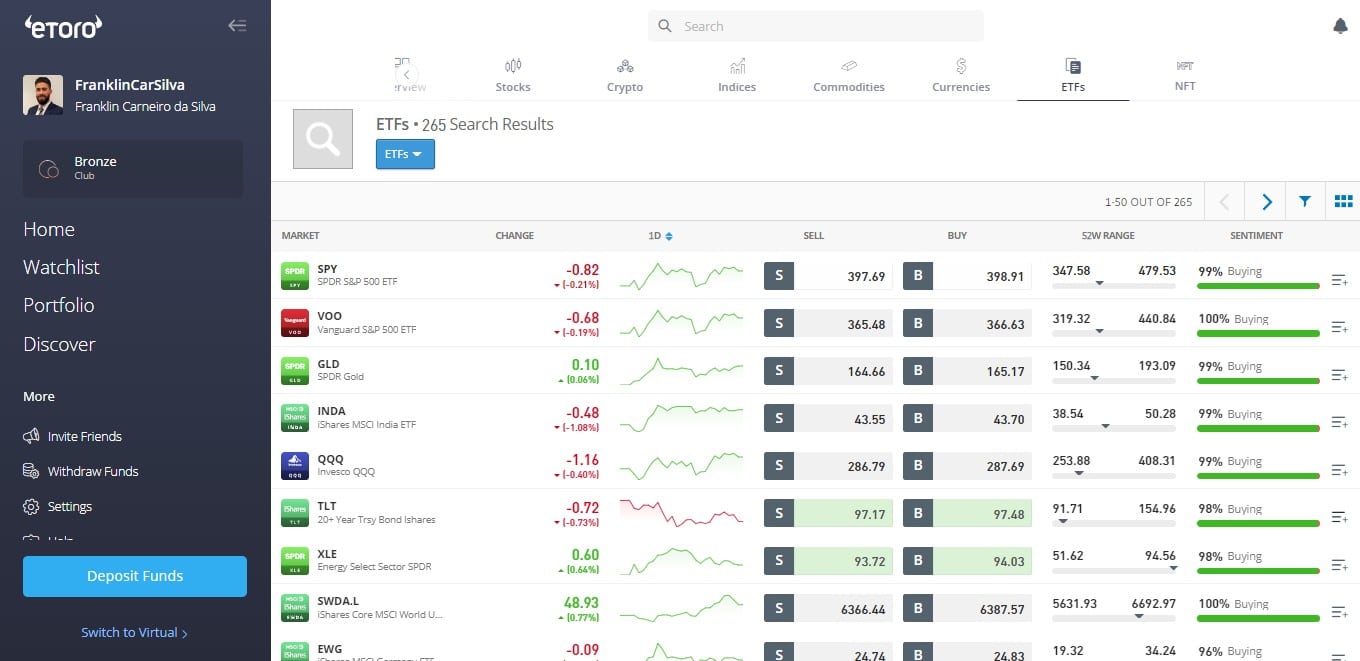

#4 eToro

eToro at a glance

61% of retail CFD accounts lose money.

eToro, a global online broker, is at the top of the list of the best ETF brokers in the UK. It has been known for its social trading platform, where you can copy the trades of other successful investors. eToro has a vast community of over 30 million investors with access to more than 3,000 financial products, including 260+ ETFs.

Their trading platform is intuitive, and you can easily open an account at eToro and fund it through various methods such as credit or debit cards, Paypal, Skrill and bank transfer. Their minimum deposit is relatively low at $100. Moreover, they do not charge any fee on deposits, and you can benefit from commission-free trading on certain ETFs.

It offers a stocks and shares ISA account through a partnership with Moneyfarm.

eToro is regulated and supervised by several top-tier regulators, such as the Financial Conduct Authority (FCA) and the Cyprus Securities Exchange Commission (CySEC). As per the European Securities and Markets Authority (ESMA) regulation, eToro also provides negative balance protection for Forex and CFD trading on a per-account basis to retail clients from the European Union.

On the downside, they charge a $5 fee per withdrawal, and if your deposit currency is different than your account currency, a currency conversion fee will be applied (for example: from GBP to USD is 0.50%). Finally, their customer support may take over two business days to reply to customer requests.

For a full assessment, read our comprehensive eToro review.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

#5 Trading 212

Trading 212 at a glance

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Founded in 2004, Trading 212 claims the title of the first-ever commission-free broker in both the U.K. and Europe. As of 2025, it has over 3 million users with over €4 billion in assets under management (AUM).

It offers two distinct account types: Trading 212 Invest, which offers commission-free stocks and ETFs trading, and Trading 212 CFD, which offers CFD trading only.

The Trading212 Invest account has been rapidly gaining popularity with beginner investors especially, and with good reasons:

- The minimum deposit is just £1 (£10 for bank transfers);

- Commission-free stocks and ETFs trading is available (along with fractional shares and ISAs);

- The platform is straightforward to use (for both account opening and trading).

It is important to note that Trading 212 can offer commission-free trading primarily due to its share lending program, which is mandatory for Trading 212 users. In a nutshell:

- Trading 212 holds the right to lend your shares to a third party (borrower);

- This doesn’t affect your ability to trade the shares, receive dividends, etc.

- Trading 212 has to always hold collateral in the form of US Treasury Bonds that is equal to or more than 102% of the value of the shares lent.

However, that doesn’t mean there are no fees on Trading 212. Some of the fees that Trading 212 charges are;

- 0.7% for deposits by cards, Google Pay, Apple Pay & other (it’s free up to the first €2,000);

- 0.15% (Trading 212 Invest) or 0.50% (Trading 212 CFD) currency exchange fees;

- Overnight fees on CFDs.

Stocks and Shares ISA account is also available for UK residents at no extra fee.

For those of you who are thinking about joining Trading 212, you can even claim a free share when you sign up by following this link. After you verify your identity and fund the account, be sure to include promo code “IITW” to claim one free share worth up to €100.

To sum it up, Trading 212 is a good choice for beginner investors who want a simple, effective, and cheap way to buy stocks and ETFs.

If you need more info, feel free to check out our more detailed review of Trading 212.

#6 Freetrade

Freetrade at a glance

Freetrade is a mobile-only commission-free UK stockbroker founded in 2016 that lets you invest in more than 6,000 stocks (US, UK, German, Finnish and Dutch) and ETFs for free.

Freetrade came to revolutionise the traditional brokerage industry. Many brokers still present high complexity over their platforms and product offer. Freetrade is on a mission to help customers achieve better long-term financial outcomes and, for that purpose, it wants to be as transparent and trustworthy as possible. Ultimately, their goal is to allow everyone to benefit from wealth creation.

In the Freetrade app, you will not find CFDs and other related complex products; it does not promote day trading and has no hidden fees. The accounting opening process is quick and smooth. The mobile app is remarkably user-friendly. The main drawback is the limited product offering (no options, Forex, CFDs, Commodities or Cryptocurrencies).

As displayed on their website, Freetrade makes money through 3 revenue streams: ISA, their premium service, a fee of 0.45% of the Base FX rate on each US order placed, and a small amount of interest earned from banks on customers’ cash.

They operate under a freemium (free+premium) business model. If you’re interested, you can also read our full Freetrade Review.

Methodology

Investing in the Web aims to offer investors fair and unbiased reviews of online brokers. Our team thoroughly examined each of the brokers mentioned above to come up with this list, taking into account several variables, including:

- Regulation (registered in the FCA)

- ETF offering (access to several exchanges)

- Low trading and non-trading fees

- Easy deposit and withdrawal methods

- Sound customer service

- ISA

Finally, we ensured that all brokers give you access to other financial products if you want to expand your trading beyond ETFs.

What makes a good ETF broker?

A good ETF broker should first be a safe broker, and accordingly, it should be regulated by one of the top-tier financial authorities.

Deposit and withdrawal of funds should be available by traditional payment methods such as bank transfer, debit, or credit card, as well as other quick and simple methods.

As for fees, many brokers offer commission-free ETF trading; however, non-trading fees such as inactivity fees, deposit fees, and withdrawal fees should also be low, as these can eat your returns.

Bottom line

Finally, finding the best ETF platform in the UK is challenging due to the many brokers available, each offering different features with different pricing.

We examined the conditions offered by major UK brokers and came out with this list to assist you in choosing the best ETF platform. This list includes brokers that provide access to a wide variety of ETFs globally and have critical points of differentiation compared to other brokers.

You may always visit our broker reviews page for an in-depth, unbiased assessment of various brokers’ services and our comparison tool, a dynamic solution for comparing top brokers in your country.

We hope that this post addressed some of your concerns. Before deciding, we advise opening a demo account and exploring its features.

FAQs

What is an ETF? How does it work?

ETFs give investors a way to mix their funds and make a collective investment in a basket of securities. They typically track the performance of a particular industry, index, commodity, or other asset class and are bought and sold throughout the day on an exchange. As a result, although their prices may change in response to supply and demand, they often stay close to the underlying securities’ net asset value (NAV). Over the last decade, ETFs have been the main financial instrument used by Robo-advisors to create their investment portfolios.

Do ETFs pay dividends?

Not all. There are two types of ETFs: distribution and accumulation. Distributing ETFs pay the whole amount of dividends received from the underlying stocks they hold, and usually, the payment frequency is quarterly. However, accumulating ETFs do not distribute dividends but rather use them to reinvest in the stocks that the ETF already owns.

What’s the difference between an ETF and a mutual fund?

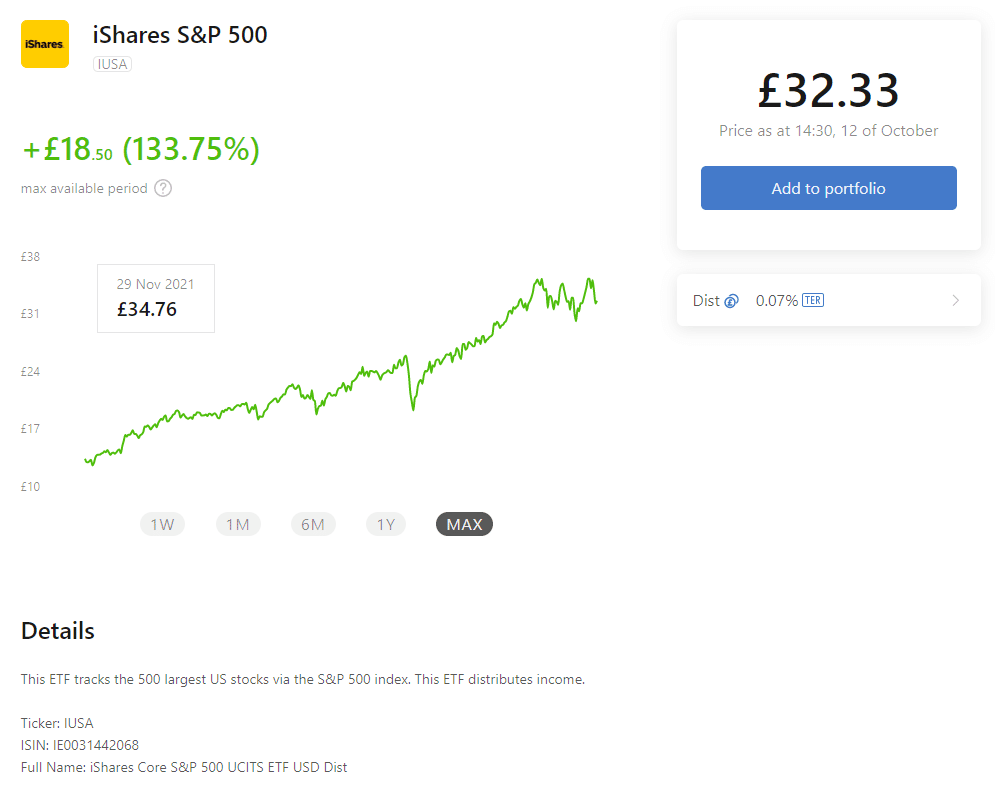

Despite many similarities, mutual funds and ETFs differ significantly in a few ways. For example, ETFs can be exchanged throughout the day on an exchange like stocks, while mutual funds can only be bought at the close of each trading day based on their net asset value. Another significant difference is the method each fund is managed. ETFs typically track a market index or sector and are passively managed. On the other hand, mutual funds are actively managed and have a fund manager who often buys and sells assets for the fund based on a specific investment mandate.