You have probably heard about the Robinhood app on YouTube and want to know if it’s available in Canada, right?

Robinhood is a modern and easy-to-use investment app from the US, which has introduced the concept of commission-free trading in financial products such as stocks and ETFs, alongside its biggest rivals, Webull, E*TRADE, and TD Ameritrade.

Want to know if Robinhood is available in Canada, its expansion plans, and the alternatives available for Canadian users? We’ve got you covered!

Is Robinhood available in Canada?

Unfortunately, Robinhood is not yet available in Canada.

Outside the US, Robinhood is only available in the UK and in Europe.

Currently, Robinhood has show no indications to expand to Canada. While it is a great market for brokers, it is also a highly regulated and competitive market.

Robinhood alternatives in Canada

If you’re in Canada and want to access the best brokerages and investing options, there are some alternatives to Robinhood that provide more choice and flexibility. Here are some of the best brokerages available in Canada that may be more suitable than the limited Robinhood:

- Interactive Brokers | Sophisticated trading tools

Online broker with a sophisticated trading platform that offers a wide range of products. The company, founded in the US and active in Canada for decades, also lets you access the useful IBKR GlobalTrader app. - Questrade | Excellent platform

The Canadian brokerage offers both DIY investing services and pre-built portfolios. It’s a great low-cost option that allows you to invest in stocks, ETFs, options, mutual funds and more. - XTB | Cheap for stocks and ETFs

Headquartered in Poland and listed on the Warsaw Stock Exchange, XTB FR offers Canadian investors over 5,000 instruments to trade. Including stocks, ETFs, CFDs, indices and Forex at a competitive price. - Qtrade | Simple fee structure

Based in Canada, Qtrade has been around for over 20 years and offers Canadian investors the ability to trade stocks, ETFs, mutual funds, and options. It offers a few different price plans and also commission-free trading on some ETFs.

| Broker | Fees for US stocks | Minimum Deposit |

| Interactive Brokers | $0.005 per share (min $1, max 1% of trade) | $0 |

| Questrade | $0.01 CAD per share (min $4.95, max $9.95) | $1,000 |

| XTB FR | $0 | $0 |

| Qtrade | $6.95 – $8.75 CAD | $0 |

#1 Interactive Brokers

Interactive Brokers at a glance

Interactive Brokers is an exceptional broker available to Canadian traders and investors. The company was founded in 1978 and landed in Canada in 2000 through the legal entity Interactive Brokers Canada Inc. (IB Canada). Since its arrival, the company has become one of the most reliable brokers in the world.

Due to its sophisticated and powerful tools, the wide range of products available for trading, and its low prices, Interactive Brokers normally attracts advanced traders. However, the mobile app IBKR GlobalTrader is user-friendly and more suitable for beginners, simplifying investments without losing the powerful tools for which the broker is famous.

Interactive Brokers offers attractive features such as low commissions on US stocks, a demo account for practising investments, a wide range of tradable assets, and trading in CAD$.

#2 Questrade

Questrade at a glance

Questrade is a Canadian broker that’s been helping investors since 1999 as an alternative to the big banks. Only Canadian residents are able to open an account with Questrade.

You can invest using the app or web desktop and can choose from a few different plans, including the competitively priced ‘Questwealth Portfolios’ for pre-built ETF portfolios. You’re only able to hold cash in USD or CAD, but this brokerage is a solid option for beginners and more advanced investors with plenty of resources like up-to-date research, stock data, and charting tools.

#3 XTB

XTB at a glance

69-80% of retail CFD accounts lose money.

XTB is a Polish company founded in 2002 that offers Canadian investors the ability to trade through its French branch of the XTB Group, XTB FR.

Along with real stocks and ETFs, you can trade various CFDs (forex, equity, indices, crypto commodity) with XTB. However, these are riskier and more complex trading instruments that should only be used by experienced traders.

With lots of investment options and a well-built interface, XTB is a reliable alternative to Robinhood for beginners and advanced traders in Canada. It’s a very cheap platform with low fees and no minimum deposit. If you want to learn more about the broker, check our XTB review!

#4 Qtrade

Qtrade at a glance

Qtrade is a Canadian brokerage that started back in 2000. You’re able to sign up for a 30-day trial account and select between two plans, but the ‘Investor’ plan is the most accessible to retail investors (unless you make lots of trades/have a large portfolio).

Canadian investors have the ability to trade stocks, ETFs, options, mutual funds, and debentures (a type of bond). It’s a flat commission for most trades, apart from some ETFs which are free.

Qtrade is an excellent alternative to Robinhood for Canadian investors because there’s no minimum deposit, a free trial account, and it’s a solid brokerage with a simple fee structure.

Which platform should you choose?

Some factors you should know when choosing an online broker are the fees charged if it is regulated by top-tier institutions such as the IIROC in Canada, the range of products it allows you to trade (not all platforms allow you to trade Canadian stocks), among others.

The best online broker in your specific case will depend on your profile, preference, and objectives. Explore the websites above and decide for yourself!

A reminder that the above should not be seen as investment advice and should be considered information only. Investors should do their own research and diligence about the best-suited services and opportunities for their risk, returns, and impact strategy.

FAQs

Can I use Robinhood from Canada with a VPN?

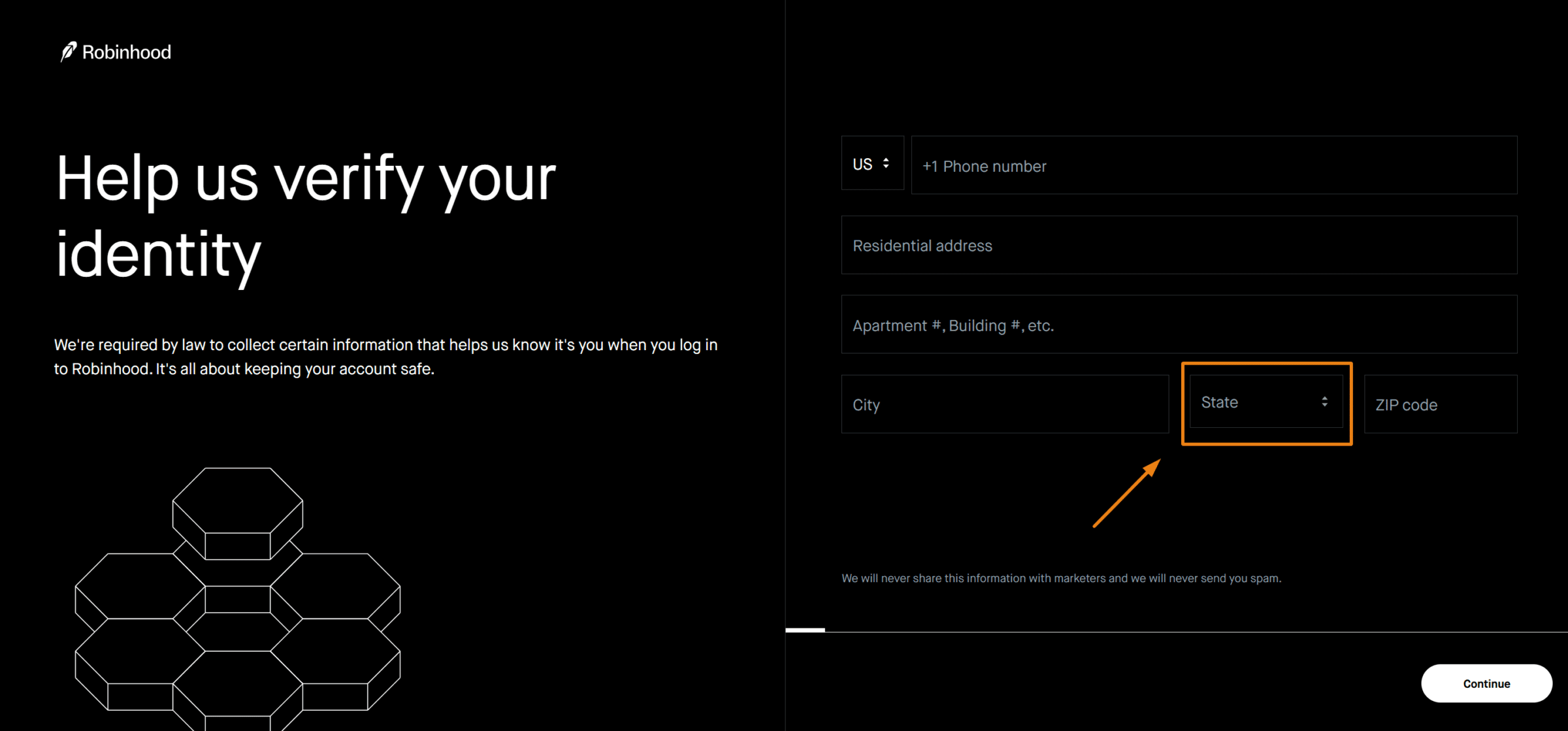

No, Canadian investors cannot use a VPN to open a Robinhood account. Upon account opening, Robinhood requires specific documentation that proves that you are a US citizen.

How exactly does Robinhood make money?

The online broker earns money from interest earned on customers’ cash balances (money in your account not invested), by selling order information to third parties (high-frequency traders, for instance), and margin lending.

Regarding the selling of orders, the US Securities and Exchange Commission (SEC) is still investigating Robinhoodfor not fully disclosing its practice of selling clients’ orders to high-speed trading firms.

Until October 2018, Robinhood would not clearly state that it was receiving payments for order flows. By law, any financial company must reveal all the material facts an investor would want to know before making any investment decision.