Hello, fellow investor! In this article, we will give you our honest review of XTB to help you determine whether it is the right online broker for you!

XTB is a world leader in Forex and CFD trading, and it is listed on the Warsaw Stock Exchange. As such, it must publicly disclose its financial statements (meaning more financial transparency).

On the negative side, XTB has a limited product portfolio, mainly covering CFDs and FX.

With over 1,000,000 clients, 15 years of experience, offices in 13+ countries, and regulated by top tier regulators, including the Financial Conduct Authority (FCA), XTB has proven to be resilient through several financial crises and facing ongoing competition, which gives us some excellent reasons to consider it safe and reliable.

That’s XTB Review in a nutshell. If you want a more detailed XTB Review, keep on reading.

Overview

Founded in 2002, XTB is a global online broker with headquarters in Warsaw, Poland. The business model was first designed to accommodate CFD and Forex enthusiasts. It has even been awarded as the best CFD and Forex broker by several external entities, including Rankia. Over time, the company decided to cater to investors looking for real stocks and ETFs.

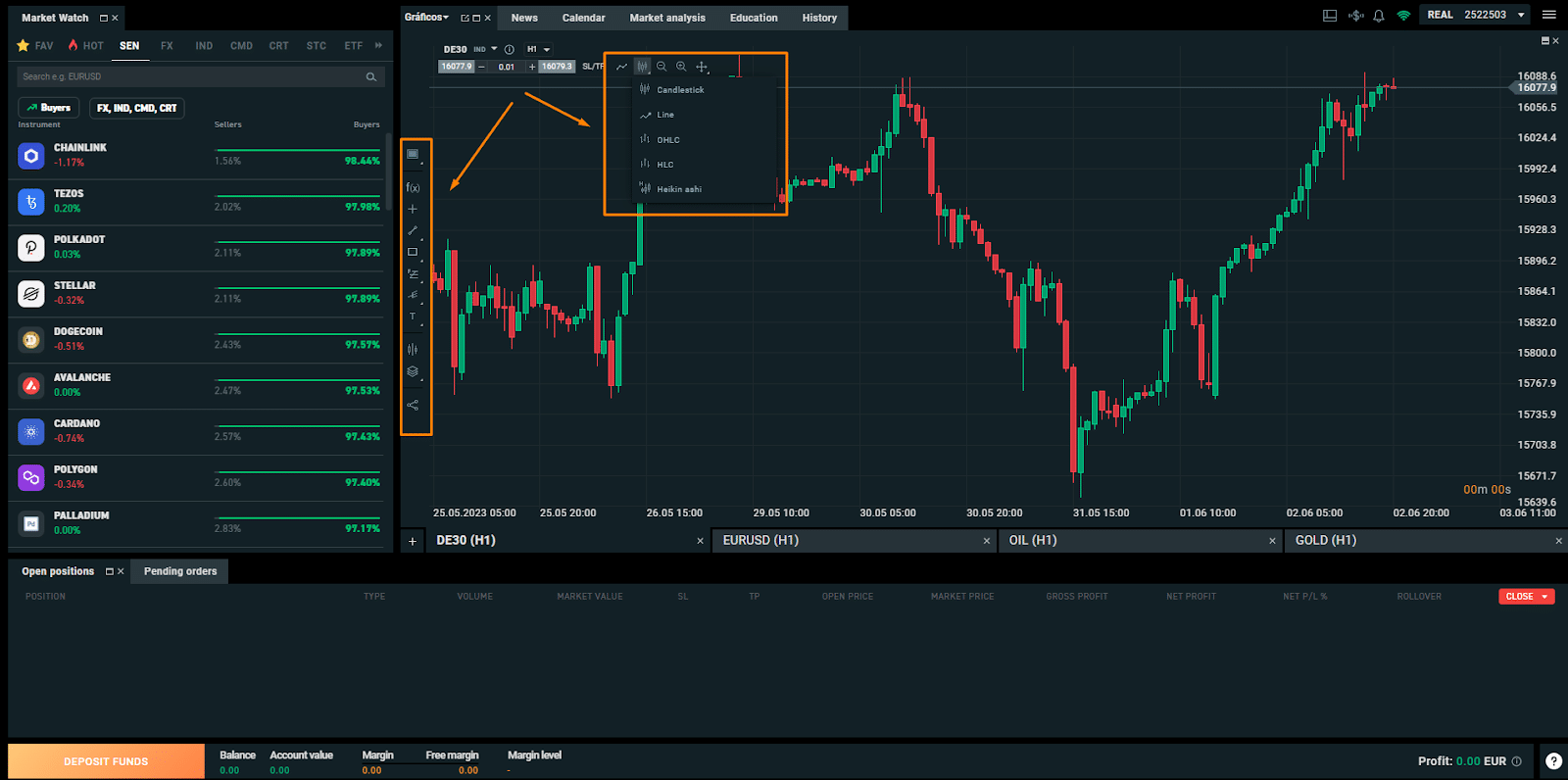

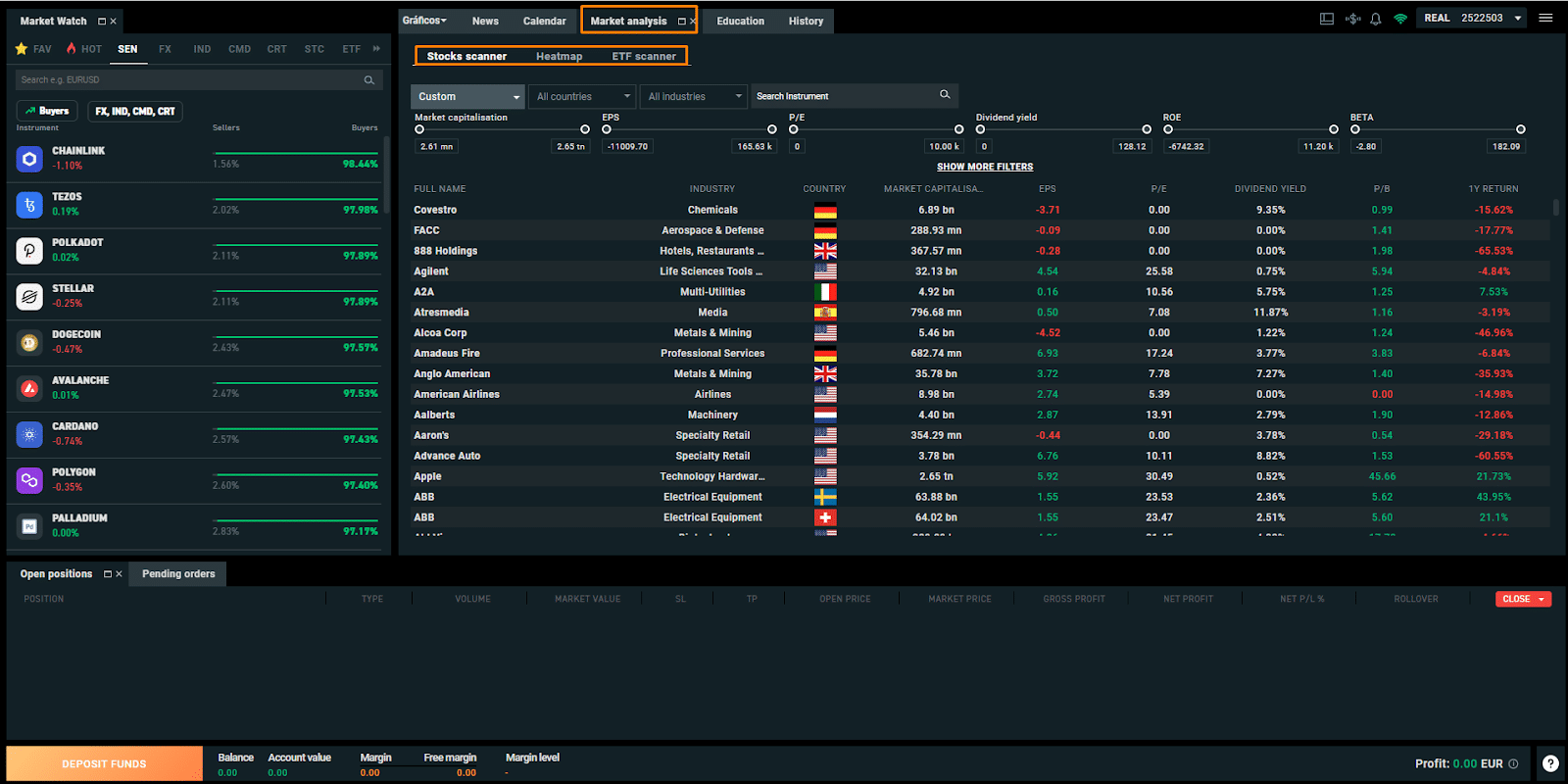

XTB presents two trading platforms: xStation 5 (Web version) and xStation Mobile, with good search functions, a high level of customization, and user-friendly for first-timers, from our hands-on experience (this an improvement compared to the last time we reviewed XTB). Most available tools are made for technical analysis rather than fundamental analysis. Still, on the latter, XTB has a “market analysis” tool that will help you filter stocks and ETFs by fundamental indicators.

Its Forex and stock index CFDs’ fees are relatively low. The account opening process is hassle-free, the deposit and withdrawals are fast and easy. A demo account is a great tool to familiarize yourself with the platform quickly!

In terms of products, XTB differs from region to region. You may trade from a list of 5,500+ financial instruments in several asset classes. Its Forex and stock index CFDs’ fees are relatively low. The account opening process is hassle-free, the deposit and withdrawals are fast and easy. A demo account is a great tool to familiarize yourself with the platform quickly!

Highlights

| 🗺️ Supported Countries | Worldwide – Exceptions include the US |

| 💰 Stocks and ETFs fees | Free of charge |

| 💰 Cryptos and CFDs fees | Low |

| 💰 Currency Conversion fee | 0.50% |

| 💰 Inactivity fee | €/$/£10 per month after one year of non-trading, and if you have not made any deposit in the last 90 days |

| 💰 Withdrawal fee | €/$/£5 for withdraws lower than €/$/£50; Free above €/$/£50 |

| 💵 Minimum Deposit | €/$/£1 |

| 📍 Products offered | Stocks, ETFs, and CFDs on stocks, Forex, indices, commodities, and cryptocurrencies. |

| 🎮 Demo Account | Yes |

| 📜 Regulatory entities | FCA, KNF, CySEC, DFSA and FSC |

Pros and cons

Pros

- 0% commission on stock and ETF trading (only applicable to some EU countries)

- 0% commission on Stock and ETF CFDs

- Fractional Shares

- Low Forex spreads

- Customizable trading platform (charts and workspace)

- Demo account

- No minimum account deposit

- Valuable education materials

- Top-tier Regulators

Cons

- Complex trading platform for a beginner

- Limited product portfolio offering

- Withdrawal fees for transfers below $100 or €200

- Inactivity fee (€10/monthly after 1+ year with no activity plus no deposit in the last 90 days)

Trading platform

XTB has a web (xStation 5) and mobile (xStation Mobile) trading platform. Below, we’ll help you navigate through XTB’s web trading app.

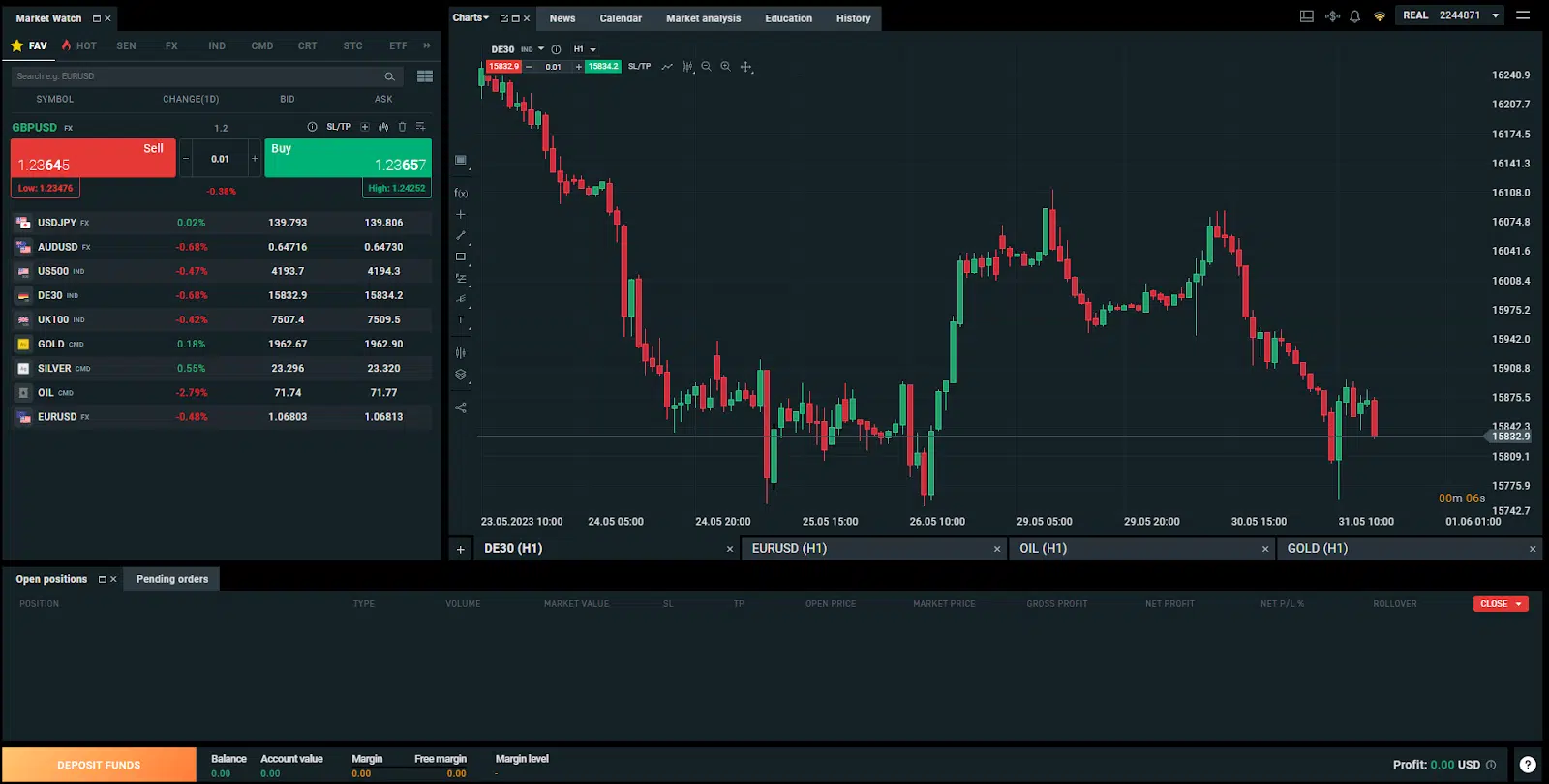

After login, you will be presented with the following dashboard:

On the top left corner, you can search for the asset class and instrument type (“FX” for Forex, “IND” for indices, “CMD” for commodities, and so on). If you already know what to invest in, you can use the search bar instead.

Going to the right, you will quickly notice a sizeable graphic representation of the asset selected (in this case: “DE30”, the German Index). It includes several technical indicators to improve your analysis, including Fibonacci retracements, trendlines, and Elliot Waves:

By clicking on “Market Analysis”, you get valuable tools such as Stock and ETF scanners to quickly selected the best stocks/ETFs according to your criteria:

At the bottom, you have a summary of your open positions, current account balance, and profit/loss.

Markets and products

XTB product and market offerings differ from region to region. In total, it presents stocks, ETFs, and CFDs on stocks, Forex, indices, commodities, and cryptocurrencies.

In December 2024, it started offering Flexible Stocks & Shares ISA in the UK, where you can:

- Invest in more than 3,000 stocks and more than 700 ETFs with 0% commission up to a monthly trading volume equivalent to 100,000 EUR (after that, 0.2% with a minimum of 10 GBP). A 0.5% currency conversion fee may apply.

- Earn 4.50% interest on GBP uninvested cash (calculated daily and paid out monthly).

- Earn interest or returns without paying tax on them. Withdraw the money and replace it within the same tax year without affecting your annual allowance.

| Products | Available? |

| Stocks | ✔ |

| ETFs | ✔ |

| Bonds | ✘ |

| Funds | ✘ |

| Options | ✘ |

| Futures | ✔ (CFDs) |

| Forex | ✔ (CFDs) |

| Cryptocurrencies | ✔ (CFDs) |

| Commodities | ✔ (CFDs) |

| CFDs | ✔ (on stocks, Forex, indices, commodities, and cryptocurrencies) |

- Stocks: Over 3,000 names in 16 exchanges around the world. The minimum value per transaction is only €10 (you have fractional shares) and commission-free for values up to €100,000 per month. It includes access to real-time quotes and a stock screener utterly free of charge.

- ETFs: Over 300 ETFs of indices, sectors, or even commodities. The minimum transaction is also €10 per trade and commission-free for values up to €100,000 per month. An ETF screener is provided as well.

- Forex: Through CFDs, you can leverage up to 30x for European and UK residents. In other countries, you can get go high as on leverage as 500x. Spreads start at 28 pips and are offered more than 50 currency pairs.

- Indices: Via CFDs, you can leverage up to 20x for European and UK residents. In other regions, the leverage can go as high as 500x. Spreads start at 39 pips and are offered 35 Indices CFDs in total.

- Commodities: By using CFDs, you can leverage up to 10x for European and UK residents. In other regions, the leverage can go as high as 500x. Spreads start at 1 pip and are offered +20 Commodities CFDs (Gold, Silver, Oil, Natural Gas)

- Cryptocurrencies: Finally, you can also use CFDs on cryptocurrencies (Bitcoin, Ethereum, Stellar, Dogecoin) with leverage up to 2x. Spreads start at 22 pips, and you have +50 crypto CFDs available.

CFDs

| Instrument (all as CFDs) | Number of instruments | Spreads | Leverage* |

| Stocks | +3,000 | Low | None |

| ETFs | +300 | Low | None |

| Forex | +50 | From 28 pips | Up to 30x |

| Indices | +35 | From 39 pips | Up to 20x |

| Commodities | +20 | From 1 pip | Up to 10x |

| Cryptocurrencies | +50 | From 22 pips | Up to 2x |

*Leverage can be higher (up to 500x) in countries outside Europe and the UK.

Fees snapshot

The information relating to fees in XTB is less transparent than in other brokers – It varies depending on the type of account and the jurisdiction you are in. Below, you will find a snapshot of fees referring to the Standard account type.

| Fee type | Classification |

| Stocks and ETFs |

0% commission |

| Stock CFDs and ETF CFDs | 0% commission |

| Forex & Commodity fees | Low commissions and very competitive spreads (from 0.1 pips) |

| Indices fees | Low commissions, competitive spreads (from 0.1 pips) |

| Crypto fees | Spreads start from 0.22% |

| Withdrawal fees | $/€/£5 for withdrawals below $/€/£50; Free above $/€/£50 |

| Inactivity fee | €10/monthly after 1+ year with no activity and no deposit made in the last 90 days |

| Currency conversion fee | 0.50% |

XTB offers commission-free stock and ETF trading up to €100k monthly volume (after that, 0.2% min. €/£10).

Spreads may vary between asset classes and within the same asset class. The spread is the difference between the buy and the sell prices. Using CFDs on Indices as an example, you can clearly notice the disparity between them (also dependent on the market environment):

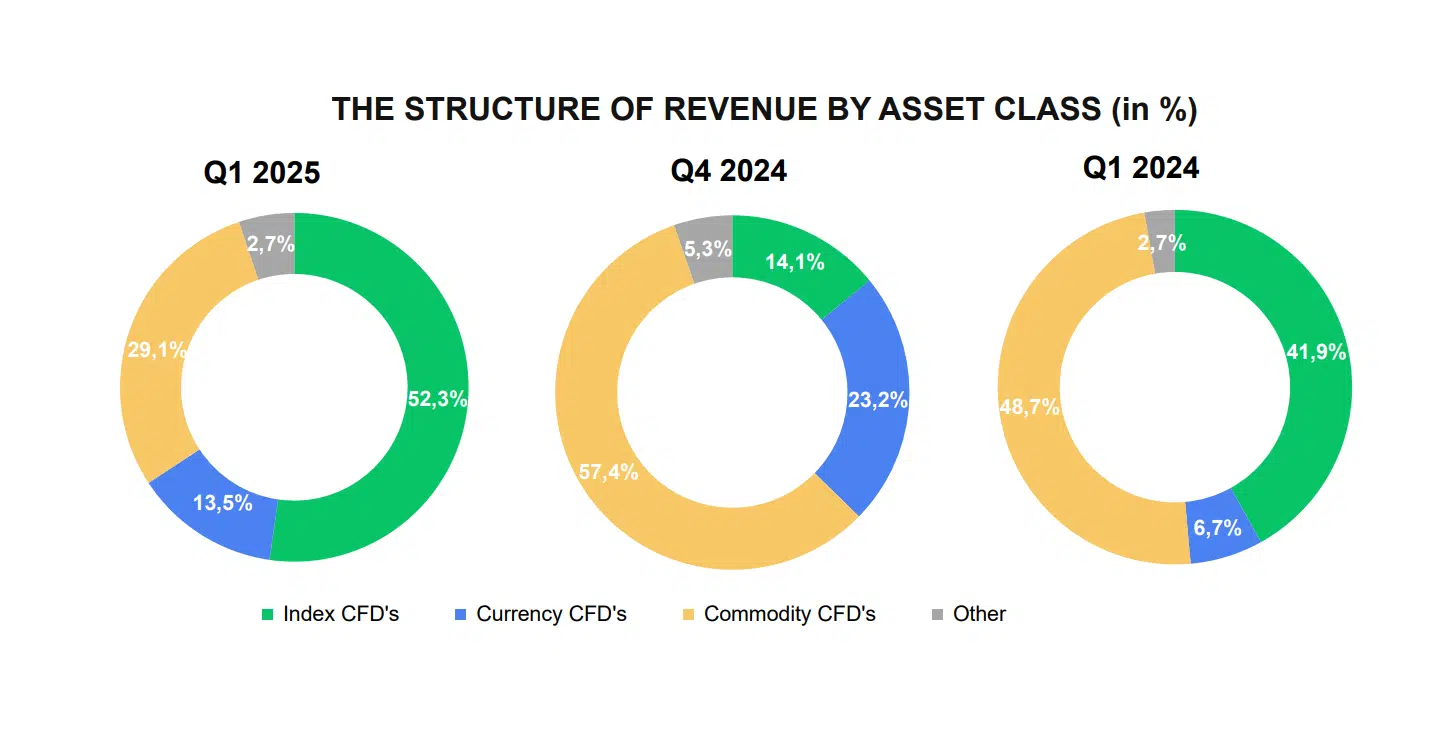

From their published financial statements, these are the contributions of the instruments traded:

When trading an asset in a different currency than your base currency, you will incur an exchange conversion rate of 0.50%. So, if you open an account in EUR and want to trade US stocks, exchanging EUR for USD will come at a cost. Besides, if you do not open your account over one year, an inactivity fee of €10/month will apply.

Finally, there is a withdrawal fee of $/€/£5 if you decide to take less than $/€/£50 from your account.

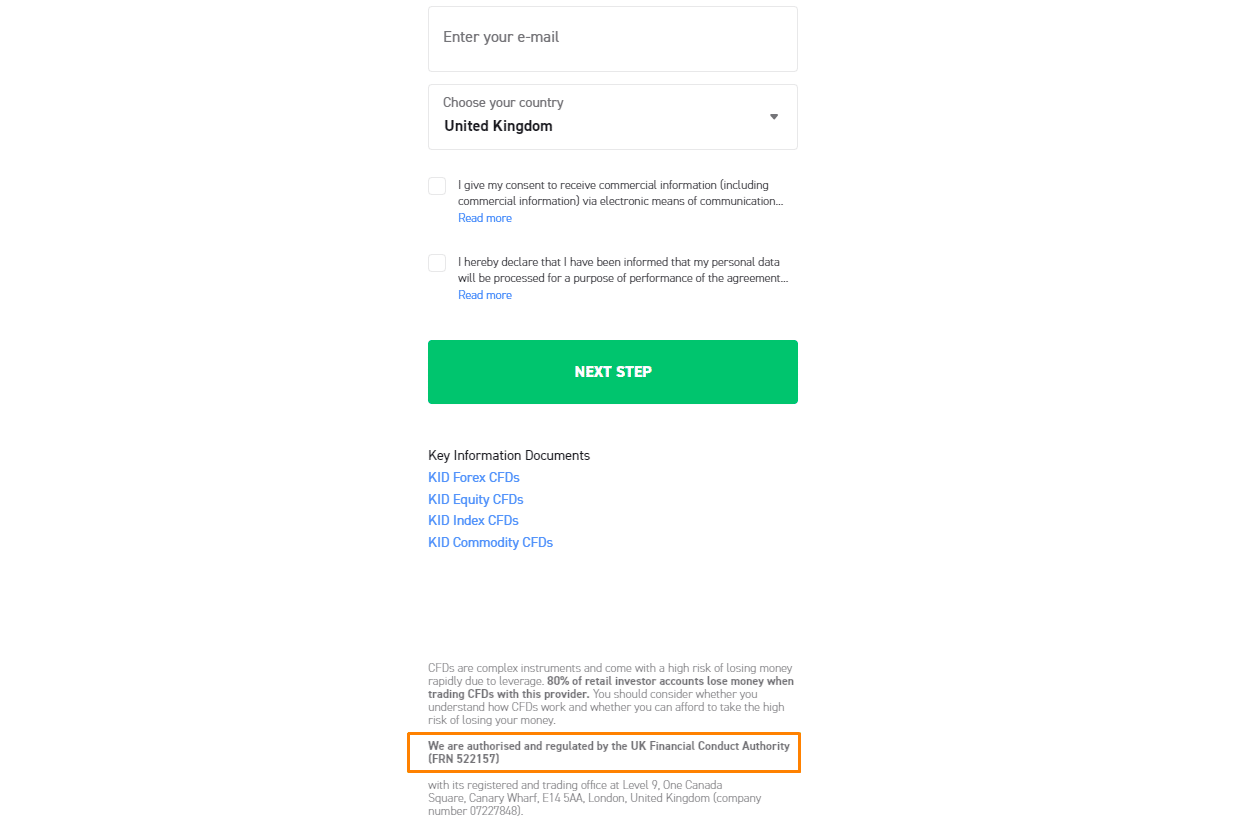

Account opening

Opening an account at XTB is done through its official website and is a fast, simple, and fully digital process. After clicking “create account” (on the homepage), you will be presented with the following page:

Afterwards, you just need to follow these steps:

- Fill out the registration form with your personal details, such as name, address, phone number, and date of birth;

- Answer some compliance questions related to your investor and personal profile.

- Choose the account type (Standard or Pro Account).

- Verify your identity to activate your account – you will need to submit documents such as your proof of address, proof of identity (passport, national identity card, or driver’s license), proof of bank account, and, finally, making a video call with your proof of identity close to you.

- After their compliance department verifies everything, you are ready to fund your account and start trading!

Safety and regulation

XTB subsidiaries are fully supervised by top-tier regulators such as the Financial Conduct Authority (FCA), the Polish Financial Supervision Authority (PFSA or KNF in Polish), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Commission (FSC).

When opening an account, you will sign up through one of the XTB subsidiaries. Here are the main ones:

| Subsidiary | Regulatory body | Investor protection amount | Applicable regions |

| XTB Limited (CY) | CySEC | Up to €20,000 | Europe |

| XTB Limited (UK) | FCA | Up to £85,000 | UK |

| XTB International Limited (Belize) | FSC | None | International |

| XTB S.A. | KNF | Up to €20,000 | Poland |

| XTB MENA Limited | DFSA | None | United Arab Emirates |

As soon as you click “create account”, you will notice that at the bottom, you will notice the jurisdiction you will be in:

Remember that there are also several branches in other countries, meaning it must have authorization from the local financial markets authorities. For instance, XTB is registered in CMVM and BaFin in Portugal and Germany, respectively.

Additionally, XTB is listed on the Warsaw Stock Exchange (WSE) – WIG30 index, which means that the company must report its financial statements regularly, it is subject to higher regulatory requirements and higher scrutiny by the overall market participants. These characteristics create an additional layer of security.

Finally, following the August 2018 restrictions on CFD trading by the European Securities and Markets Authority (ESMA), XTB provides negative balance protection for Forex and CFD trading on a per-account basis to retail clients from the European Union. What does that mean? Imagine that you deposit 1000€ in your account and open a position with a 5:1 leverage. This increases your exposure to €5,000. If the market dropped 25%, you would lose €1,250 (25%*€5,000). As you can see, it is above your initial deposit of €1,000, meaning you would owe €250 to your broker. With ESMA regulation, your account balance is automatically readjusted to €0, so you only lose your deposit (more info here).

Do you want to read a deeper analysis? Check out our dedicated article on investment protection (for EU investors)!

Supported countries

XTB operates in most countries in the world. Due to regulation, there are some exceptions. XTB cannot legally offer its services in the following countries:

- Albania, Afghanistan, Australia, Austria, Bangladesh, Belgium, Belize, Bosnia and Herzegovina, Cuba, Congo (Republic), Congo (Democratic Republic), Ethiopia, Guyana, Hong Kong, Indonesia, India, Iran, Iraq, Israel, Japan, Kenya, Laos, Libya, Macao, Mauritius, Mozambique, New Zealand, North Korea, Pakistan, Panama, Palestine, Singapore, South Korea, Syria, Turkey, Uganda, United States, Vanuatu, Venezuela, Yemen, and Zimbabwe. Full list here.

Bottom line

XTB is a broker offering mixed services in several regions and countries. It provides a user-friendly and intuitive trading platform, making it accessible to beginners. Its strong reputation and supervision by reputable financial authorities also add trust to its services.

Some drawbacks include high spreads on specific trades, which can negatively impact profitability. Good customer support has been reported to be inconsistent, and while XTB offers a variety of educational resources, the depth and quality of these materials may not be as comprehensive as some other brokers.

Contact us and let us know your experiences with XTB!

Disclaimer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76-85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Past performance is not an indication of future results.