Choosing the right stock trading app is not easy, especially if you’re just starting out. At Investing in the Web, we follow +100 investment platforms globally.

Prioritize safety: safe beats cheap! Remember that investing is a long-term game, so it’s best to choose a trading app that you can trust as years go by. Make sure that it is allowed to operate in the UK by the FCA.

In this article, we will compare some of the best stock trading apps available to UK investors to help you choose the perfect fit for you.

Best Stock Trading Apps in the UK

Interactive Brokers

Best UK Stock Trading App Overall.

eToro

Best for commission-free stocks and ETFs (other fees apply).

Disclaimer: Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Trading 212

Best for automating investments and earning interest. New users get a free fractional share.

Webull

Best for beginners looking for quick exposure to US stocks. New users get a signup promotion.

Freetrade

Best for low Fees.

Hargreaves Lansdown

Best for Stocks and Shares ISA.

Interactive Investor

Best for Bonds and Gilts.

Lightyear

Best for interest on uninvested cash.

Trading apps that we do not recommend

For a list of brokers we do not recommend, you can visit our full list of broker reviews, and filter by “Not recommended”.

Stock Trading Apps in the UK Compared

At a high level, we have already outlined some of the best stock trading apps in the UK for many different features which investors often regard as most important.

If you want to dig a little deeper, check out the comparison table below and a brief review of some of what we regard to be the top stock trading apps on offer in the UK.

| Broker | Fees on stocks and ETFs | Minimum deposit | Educational resources | Stocks and Shares ISA | Demo account |

| eToro | No fees for stocks and some ETFs. | $50 | ✔ | ✔ | ✔ |

| Interactive Brokers | Low fees with tiered and fixed structures to pick from | £0 | ✔ | ✔ | ✔ |

| Trading 212 | No fees for stocks or ETFs. | £10 | ✔ | ✔ | ✔ |

| Webull | 0.025% commission for US Stocks | £0 | ✔ | ✘ | ✔ |

| Freetrade | No commission fees for stocks or ETFs, but large FX fees of 0.99% | £0 | ✔ | ✔ | ✘ |

| Hargreaves Landsdown | If in a previous month, you had 0–9 deals £11.95, 10–19 deals £8.95, 20 or more deals £5.95 (per deal) | £0 | Limited | ✔ | ✘ |

| Interactive Investor | Monthly subscription starting from £4.99 | £0 | ✔ | ✔ | ✔ |

| Lightyear | US Shares 0.1% (capped at £1), UK Shares £1, ETFs Free | £1 | Very Limited | ✘ | ✘ |

Other resources to check

Want to explore other alternatives?

Some interesting resources to check are:

- BrokerMatch tool, to get matched with your right broker based on your country and preferences,

- Biggest brokers by assets: check which platforms have the highest assets under management and how they compare to other providers. High net worth individuals tend to choose platforms that they can trust and provide good services.

- Broker Comparison,

- Broker reviews,

- Bonuses,

- Best brokers for earning interest.

It is difficult to choose the best trading app for every investor, as the best broker will depend on which country you live in, your investor experience, the financial products you want to trade, and more.

Explore the pages mentioned here, our tools, and decide for yourself!

And if you need any help, feel free to reach out to us.

UK stock trading apps reviewed

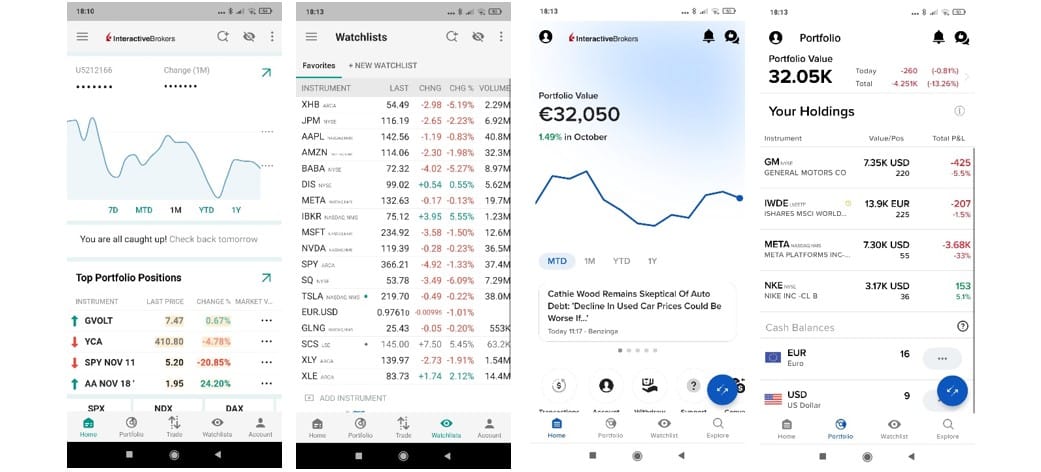

#1 Interactive Brokers

Founded in 1978 and publicly listed in NASDAQ (ticker: IBKR), Interactive Brokers is a global online broker which surpassed major financial crises, showing resilience and a rigorous risk management process.

Interactive Brokers offers an advanced investment platform that includes a wide range of products (stocks, options, mutual funds, ETFs, futures, bonds, and currencies) from 150 markets, solid trade execution (IB SmartRouting), and a set of technical and fundamental tools to help you in your investment decisions.

Interactive Brokers also launched IBKR GlobalTrader, a modern mobile trading app to trade Stocks, Options and ETFs, ideal for beginner investors. Some of the features of IBKR GlobalTrader include automatic currency conversions, fractional shares, demo accounts, and more.

On the downside, Interactive Brokers’ fee structure is quite complex, the registration process is lengthy but fully online, and the broker doesn’t offer commission-free trading. However, when considering FX fees, narrower spreads, and the stock loan program, Interactive Brokers’ clients still get significant savings compared to most brokers.

Pros

- Low commissions on US stock trading

- No monthly inactivity fee

- The broadest product and markets range in the brokerage industry

- Demo account

- Excellent reputation (founded in 1978)

- Extensive research and Education tools

- Has a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors, IBKR GlobalTrader.

- Offers interest on uninvested cash balances

Cons

- Complicated and lengthy account opening process (but fully online)

- Steeper learning curve for beginners

- Website is difficult to navigate

- Interactive Advisors (Robo-advisor feature) is only available for US customers

Want to know more about Interactive Brokers? Check our Interactive Brokers Review.

#2 eToro

50% of retail CFD accounts lose money.

Established in 2006, eToro is a well-known worldwide fintech startup and the leader in social trading (following other people’s trades), with over 30 million users worldwide. You can also invest in other products through their platform, which is intuitive and simple to use, making it a good choice for beginners. Plus, they offer commission-free stock trading in the UK.

Opening an account and depositing is easy; you can even try it out with virtual money. eToro also supports GBP deposits. On the downside, spreads can be high for some products.

Social trading allows users to observe and learn from experienced traders in real time. New traders can follow the strategies of successful investors, understand their decision-making processes, and gain insights into market trends and trading techniques.

eToro’s social trading feed is super intuitive. You quickly filter your feed and engage with other users on companies and other investment opportunities that interest you most.

Pros

- Low stock trading fees (from $0 per trade)

- Commission-free ETFs (other fees apply)

- Social trading and other innovative products

- Wide variety of financial products

- Slick, modern, and easy for anyone to use

- European users have access to three account currencies: EUR, USD and GBP

- Top tier regulators

Cons

- Limited disclosed financial information

- Withdraw and inactivity fees

- Spread, overnight, inactivity, and currency conversion fees higher than average

- Doesn’t offer bonds, futures, or options

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 50% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

#3 Trading 212

Trading 212 at a glance

Capital at Risk. Sponsored Link. To get free fractional shares worth up to 100 EUR/GBP, you can open an account with Trading 212 through this link. Terms apply.

Trading 212 is a fintech company based in London that aims to democratise the entire investment process through a simple web and mobile application.

The company aims to do this by allowing its over 5 million users to invest in over 10,000 stocks, ETFs, Forex, commodities, CFDs, and cryptocurrencies.

You will find commission-free stocks, ETFs and crypto trading, fractional shares, copy trading, social investing, and even an automatic investment system. Another very popular feature that Trading 212 offers is its Pies, which allow you to instantly build a diversified portfolio and customise it to your unique financial goals.

New users get one free fractional share worth up to £100 (promo code IITW). On the downside, it shows limitations regarding available products.

Pros

- Commission-free real stock, ETFs and crypto trading (other fees may apply. See terms and fees)

- AutoInvest & Pies feature

- Fast and easy account opening process

- Demo account

- Top Tier Regulators

- Free fractional shares worth up to €100

- High interest on uninvested cash

Cons

- Limited product portfolio (no Options, Bonds, Mutual Funds or Futures)

- No relevant Fundamental tools

- 0.15% of Foreign exchange fees

Disclaimer: When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

#4 Webull

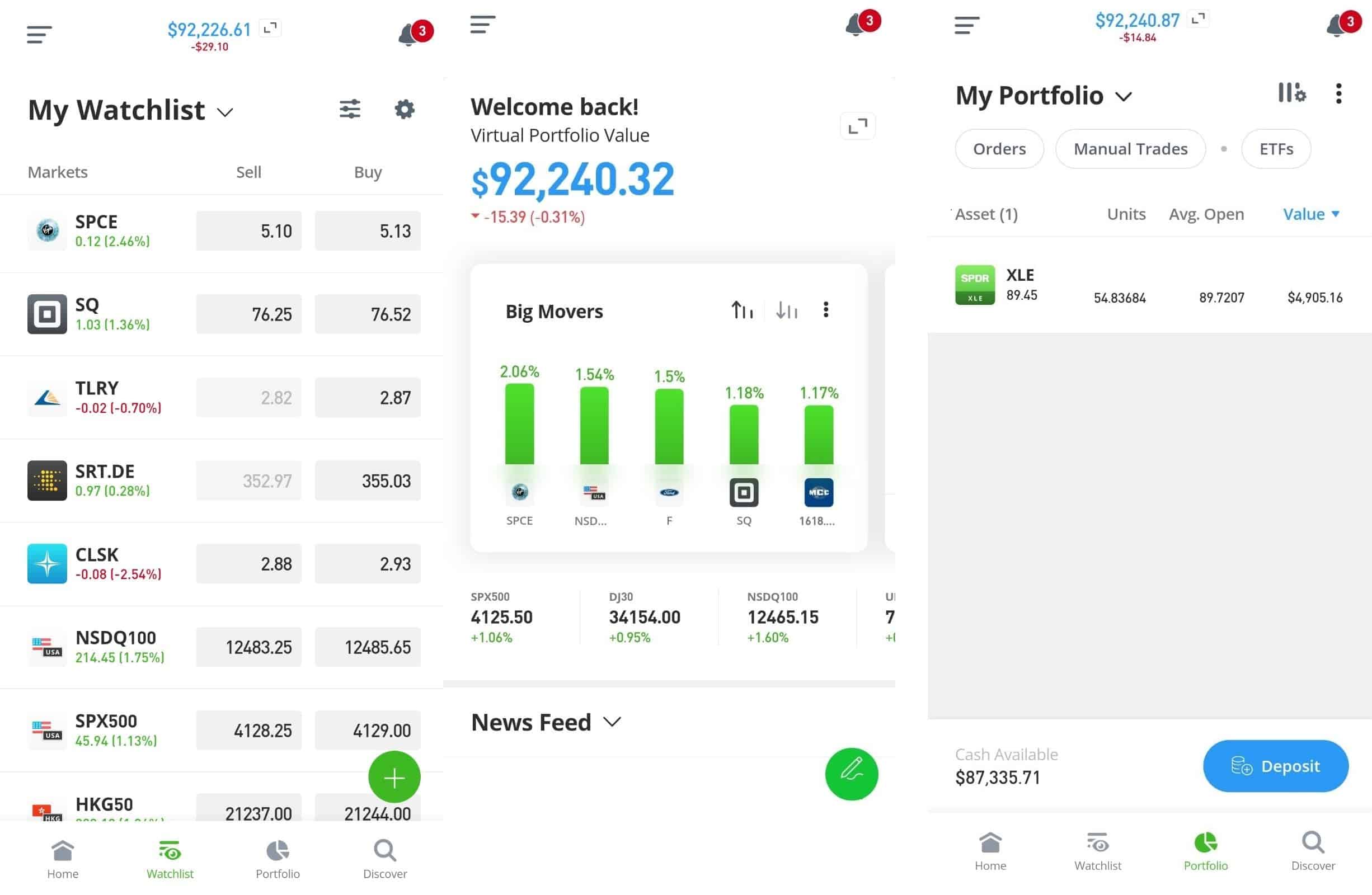

Webull is one of the biggest US discount brokers. Recently, it launched in the UK.

Users can invest in US stocks, fractional shares, and options, with very low commissions, and new users get a signup bonus. Furthermore, Webull also offers access to Emerging markets and a high yield savings account.

Webull offers a demo account, no minimum deposit, and very low fees: there is no withdrawal, deposit, inactivity, or platform fees.

All in all, it is a great trading platform for beginners looking for low commissions, a great mobile app, and access to US shares.

On the downside, it lack important assets, such as ETFs, bonds cryptocurrencies, and there is no ISA or SIPP. As a new broker in the UK, Webull does have plans to include other assets and account types in the platform!

Finally, Webull UK is authorised and regulated by the Financial Conduct Authority (FCA). As such, it is also under the Financial Services Compensation Scheme (FSCS) protection, which protects your money (assets + cash) up to £85,000 in case Webull goes bust.

Pros

- Free Shares Sign Up Promotion

- Mobile-friendly app

- Fractional Shares

- Access to US-listed stocks and options

- One of the largest brokerages in the USA

- Regulated by the FCA

- Demo Account (paper trading)

Cons

- No ISA or SIPP

- Limited range of assets available - no ETFs, bonds, crypto

- FX fee

- No commission-free trading

#5 Freetrade

Freetrade is a commission-free UK stockbroker. It is an excellent choice for investors looking to build a long-term portfolio of stocks and ETFs with low fees.

They operate under a freemium (free+premium) business model. As you go up the pricing plans, users get extra features, such as ISA and SIPP, 3% interest on cash, and more.

Freetrade’s Basic plan is free, the Standard plan is £5.99 p/m, and the Plus plan is £9.99 p/m.

If you are someone who likes to trade quite a lot on your mobile app, you should be aware that the Fx conversion fees are quite high at 0.99% on the basic account, which can really add up over time. If you upgrade to the Standard or Plus plan, then the Fx conversion fees drop to 0.59% and 0.39%, respectively (still higher than some competitors).

Pros

- Free stock and ETF trading

- GIA, ISA, and SIPP

- No inactivity, account, or withdrawal fees

- No minimum deposit

- Great community (forum) – where users share ideas and learn about investing

- Nice and user-friendly app

Cons

- Limited asset classes (only stocks, ETFs, REITs, and investment trusts)

- Limited research and education

- Graphs and portfolio tracking still need some development

- No phone support – however, live chat support is very fast and efficient

#6 Hargreaves Lansdown

Hargreaves Lansdown is one of the biggest UK platforms for individual investors. It serves more than 1.5 million clients with over £120 billion AUMs.

You will find the most relevant financial instruments (Stocks, ETF, funds,…). It’s a bit pricey, but it makes up for it by being one of the most reliable brokers.

It is well-established, secure, and regulated by the FCA. The customer service is market-leading, and their educational resources are superb.

Pros

- Excellent research and educational tools

- Great customer service

- No inactivity fee

- No withdrawal fee

- No minimum deposit

- High reliability and security

- Listed in the FTSE 100 index

- Has ISA, SIPP, and other products and services catered to british investors

Cons

- High trading commissions (UK and overseas shares, investment trusts, ETFs, gilts and bonds)

- Annual account charges for funds (up to 0.45%)

- No demo account

- Only one base currency: GBP

- High currency conversion fee (up to 1%)

#7 Interactive Investor

Disclaimer: As investment values can go down as well as up, you may not get back all of the money you invest. If you’re unsure if an investment account is right for you, please speak to an authorised financial adviser. Tax treatment depends on your individual circumstances and may be subject to change in the future.

Interactive Investor has a strong focus on the UK market and can boast that 1 in 4 UK shares are executed on their platform. Another stamp of approval is that over 50% of interactive investor’s customers have been with them for 10 years or more. You can only achieve stats like that if you run a tight ship and interactive investors have a great customer satisfaction rate.

It offers a vast selection of investment options, including trading, SIPP, and ISAs. The Stocks and Shares ISA starts at £4.99 per month (“Investor service plan”).

If investing your money responsibly is high in your priorities, Interactive Investor is a platform that can help you achieve this goal, as they have over 200 different sustainable investment options.

Pros

- User-friendly trading platforms

- Multi-currency account

- Access over 40,000 global investments

- Exclusive seminars and events

- Good educational resources

Cons

- Limited product offering

- Basic charting (limited customization) and analytic tools

- Expensive for investors with smaller portfolios

#8 Lightyear

Terms apply, seek guidance if necessary. When you invest, your capital is at risk.

Lightyear is one of the new kids on the block in the UK and has positioned itself as the low-frills option for investors. Their product offering is quite limited, but they make up for that by offering very low fees and great interest on uninvested cash (3.86% on GBP, as of December 2025).

One way brokers can catch you out is with FX conversion fees, which can really add up if you are buying the likes of US stocks. With Lightyear’s multi-currency account, you can save big on these fees. However, if you still need to convert within the app, the currency conversion fee is 0.35%.

Lightyear also offers a free share up to €100 with our promo code.

There are, however, some downsides to Lightyear’s stock trading app, firstly they do not currently have a Stocks and Shares ISA account available for UK investors, which can be a bit of a dealbreaker for many investors. Secondly, you cannot buy other financial products (options, forex, bonds,…).

Pros

- 0% Lightyear execution commission on ETF trading (other fees may apply)

- No account opening, inactivity, or withdrawal fees

- High interest on EUR, USD & GBP through MMFs

- Free multi-currency account

- Minimum deposit of €/£/$1

- Fractional Shares

- Account opening promotion with the promo code INVESTINGINTHEWEB

- You can automate your investments with "Plans"

Cons

- Limited financial instruments (no options, bonds, commodities, or futures)

- No demo account

- Only available in 25 european countries (not available internationally)

- 0.35% currency conversion fee

Disclaimer: Capital at risk. The provider of investment services is Lightyear Financial Ltd for the UK and Lightyear Europe AS for the EU. Terms apply: lightyear.com/terms. Seek qualified advice if necessary.

Bottom line

Ultimately, the choice of the best stock trading app for you hinges on factors such as your experience level, what products and features are most important to you, and your overall investment goals.

We are spoiled for choice in the UK, which is a good problem to have, but it can make your final decision very difficult.

If you still are unsure what stock trading app is best for you, make sure to check out our Help Me Choose tool, which can give you a short list of providers that will meet your needs and experience level.

FAQs

What are the most important features to have in a stock trading app in the UK?

It can be a bit of a minefield when you are trying to pick a stock trading app in the UK; there are so many different options with their own unique features. When it boils down to it, there are some basics that your stock trading app should have.

Here is a list of questions to ask yourself when you are assessing what stock trading app to choose:

- Is it User-Friendly?

- Can you top up your account from your Mobile?

- Portfolio Tracking – Is it easy to clearly track your portfolio’s performance?

- Security – are there two-factor authentication (2FA) or biometric authentication methods available?

- Can you open a demo account?

- Does it offer fractional share investing?

- News and Alerts – keep track of the latest market developments