eToro, the leading social trading platform, is available in Germany! This online platform enables more than 35 million people to trade almost anything: ETFs, Stocks, and CFDs on Stocks, ETFs, Commodities, Forex, Indices, and Cryptocurrencies (CFD).

It offers low-commission stock trading (including stocks from the Frankfurt Stock Exchange—Adidas, Bayer, BMW, and much more!), a slick and easy-to-use platform, and the ability to follow and copy other investors!

On the downside, you will be charged currency conversion fees upon deposit and withdrawal (unless you deposit in EUR or USD). To invest in real stocks, you must make sure that you buy the underlying asset, otherwise you will be investing in CFDs and not real stocks. (Check out our article about the differences between CFDs and real stocks.)

Want to know more? We have got you covered! Keep reading.

Is eToro legal in Germany?

Yes, it is! eToro has a list of blocked countries on its website, and Germany is not one of them! Using eToro as an investment platform is perfectly legal in Germany.

Besides, the Federal Financial Supervisory Authority (BaFin—Bundesanstalt für Finanzdienstleistungsaufsicht) allows eToro to operate in Germany without any constraints.

eToro Germany highlights

| 👨⚖️ Legal in Germany | Yes |

| 💰 Stocks fees | From $1 per trade |

| 💰 ETFs fees | Free of charge (other fees apply) |

| 💰 CFDs fees | Low |

| 💰 Inactivity fee | $10 after 1 year of inactivity |

| 💰 Withdrawal fee | $5 |

| 💵 Minimum Deposit | $/€50 |

| 📍 Products offered | Stocks, ETFs and CFDs (crypto CFDs included) |

| 🎮 Demo Account | Yes |

| 📜 Regulatory entities (based countries) | FCA, CySEC, ASIC |

How safe is eToro?

Most of the time, this is the first question that comes to everyone’s mind and we entirely get that! As investors ourselves, this was our first concern as well!

eToro presents three layers of safety:

- Your securities are held in a segregated account: eToro is an intermediary in the financial system. Each time you buy a non-leveraged position in a stock or ETF, you acquire a financial asset that belongs to you, and it is deposited in a custodian bank. In other words, if something went wrong with eToro, you would be allowed to transfer your securities to another broker;

- Investor Protection (Regulatory obligation): As a German investor, you open an account through the subsidiary “eToro (Europe) Ltd”, which is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC). As a result, it must maintain membership in the Cyprus Investor Compensation Fund (ICF), giving an investment protection coverage of up to €20,000 per client per account;

- Private insurance: eToro has partnered with Lloyd’s of London to provide free insurance for up to 1 million Euros. Every eToro investor is automatically granted this insurance as soon as they open an account.

If you need more details on security, check out our analysis of the safety of eToro.

What financial instruments/features will I find?

You can trade a wide variety of financial products:

- Stocks: You will be able to trade stocks from 17 different stock exchanges, including Zurich, Amsterdam, Frankfurt, London, Madrid, Milan, New York and Nasdaq;

- ETFs: eToro also offers ETFs from providers like iShares, Vanguard, PIMCO, Invesco, Market Vectors, among other asset managers.

- Commodities: You can easily invest in gold, silver, copper, platinum, palladium, and others;

- Forex: You can gain exposure to the foreign exchange market through many currency pairings. The most commonly used ones are EUR/USD, AUD/USD, and GBP/JPY, though 40 other currency pairs are available;

- CFDs: eToro allows you to leverage your returns in all the asset classes previously mentioned through CFDs. Be aware that if you do this, the likelihood of significant losses does increase.

Besides, you can enjoy the Copy Trading feature to simply copy other investors, thereby delegating your investment to someone you believe will deliver superior returns. Amazingly enough, you can copy portfolios of up to 100 investors at the same time.

eToro’s fees

As with any other business, eToro needs to make money. Its primary source of revenue comes from the spreads – the difference between ask and bid prices.

From stock trading, eToro charges a commission fee of $1 per trade on stocks listed on exchanges in the UK, Europe and the US. Stocks listed on all other exchanges incur a commission fee of $2 per trade.

When trading CFDs, you’ll be charged a spread every time you buy and sell. Spreads can be high for some products, so make sure you take a look at eToro’s fees page to make sure you know how much you’re paying.

Additionally, there are financing rates (interest income, for leveraged positions only) and conversion fees. Regarding non-trading fees, eToro charges a fee for inactivity ($10 per month if not logged in for 12 months) and another one when you withdraw funds from your account ($5).

How to open an account?

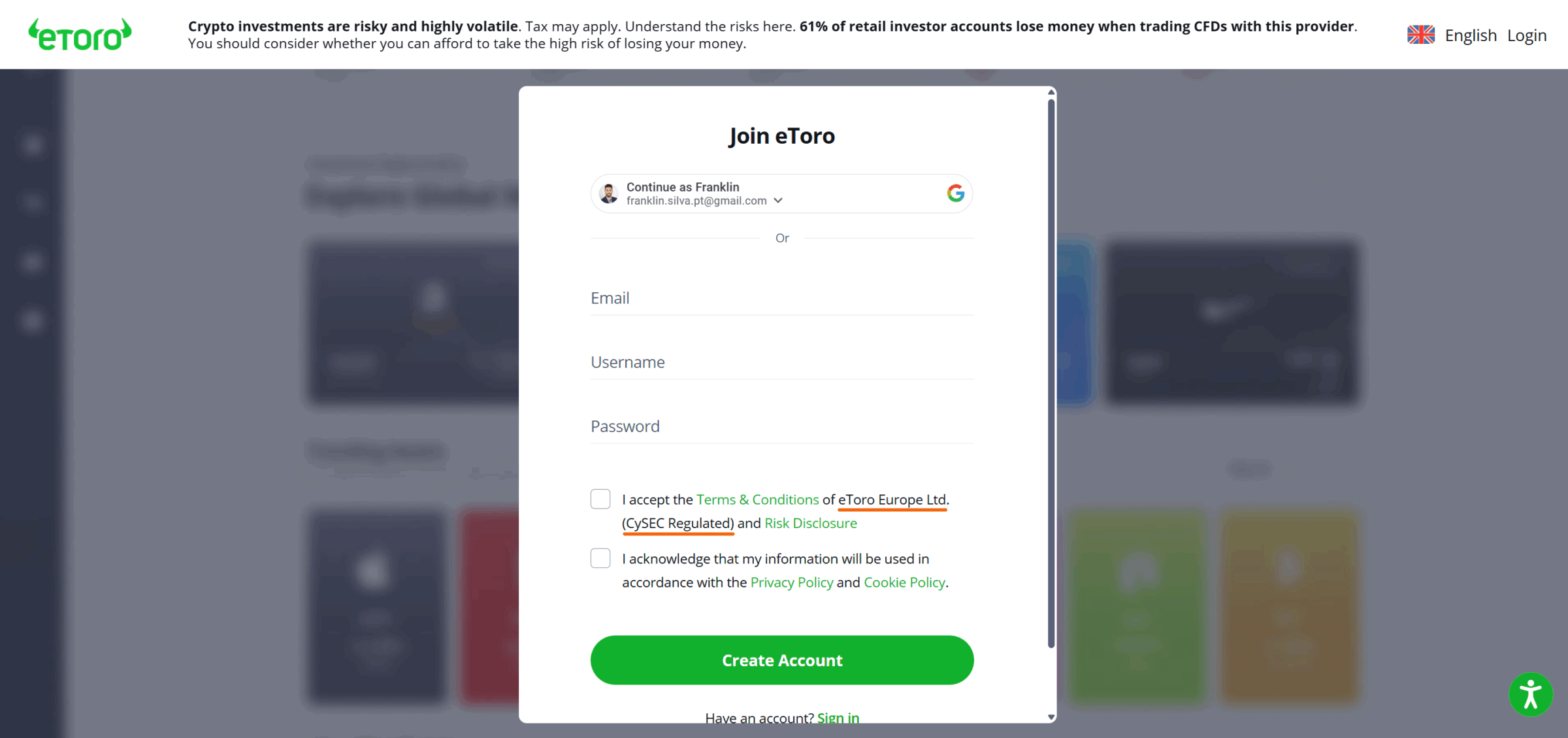

To open an account, you need to go to eToro’s website, click on “Join now”, and provide the required information, as shown in the following image:

In the first check box (underlined in red), confirm in which subsidiary you are registering.

After this step, you need to verify your identity and address. Your proof of identity could be your ID or your passport. Meanwhile, your proof of residency could be your driving licence, a copy of a bank statement or a utility bill.

We suggest you submit all the remaining documents as soon as you open an account to prevent delays when withdrawing your money! We have witnessed no issues in taking money out of the platform, but it may take a more extended period if your account is not fully updated or verified.

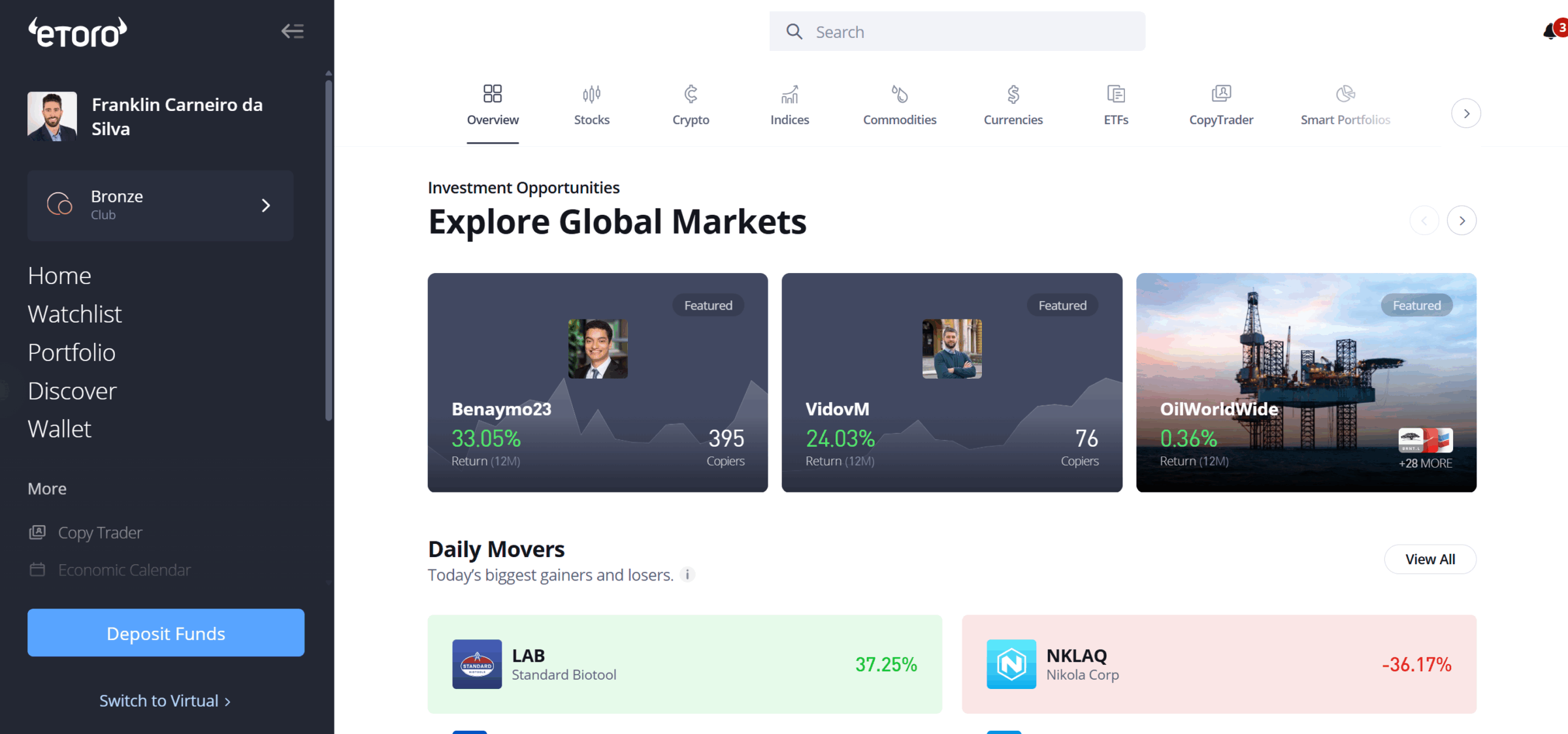

Once everything is correctly set up, you’ll be able to deposit money to start trading with your real account on the eToro platform:

It is effortless to navigate through all the sidebars and the search function on the top. We are confident that you will find what you came looking for in less than a minute.

How to deposit and withdraw?

Before answering this question, let us remind you that you have the option to use a Demo Account before deciding whether to deposit funds or not.

Deposits: On your eToro dashboard, you will find “Deposit Funds”. When clicking on it, you will notice a pop-up window with six types of deposit options. The eToro minimum deposit in Germany is $50.

Withdraws: You will also find a tab called “Withdraw Funds”. The method you used for depositing should be the same for withdrawing money from the platform. Keep in mind that the minimum withdrawal amount is $30, and there is a fixed withdrawal fee of $5 (per withdrawal).

Note: Do not forget that you are subject to a currency conversion fee – for both deposits and withdrawals – if you deposit in EUR instead of USD. For example, if you use a bank transfer as a deposit method (from your EUR account), you will be charged 0.50%. Another 0.50% will apply when pulling money out of eToro. An easy way to get around this expense is by using a cheaper option like Wise.

How to trade stocks or any other security?

The process for buying or selling stocks is straightforward, and is similar to other asset classes (ETFs, CFDs or any security).

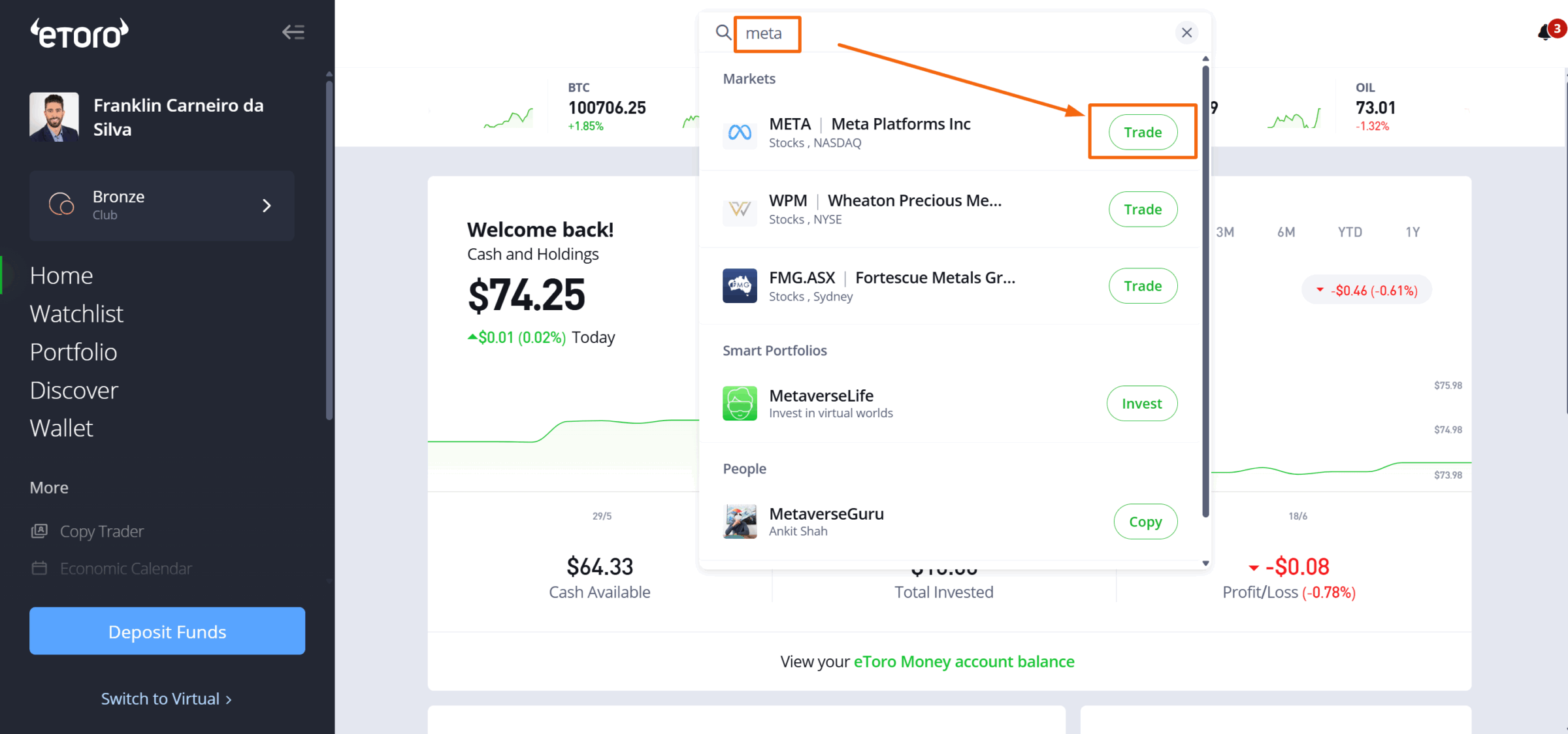

First, use the search bar to find the company you are looking for and then click on “Trade”, as shown in the image below:

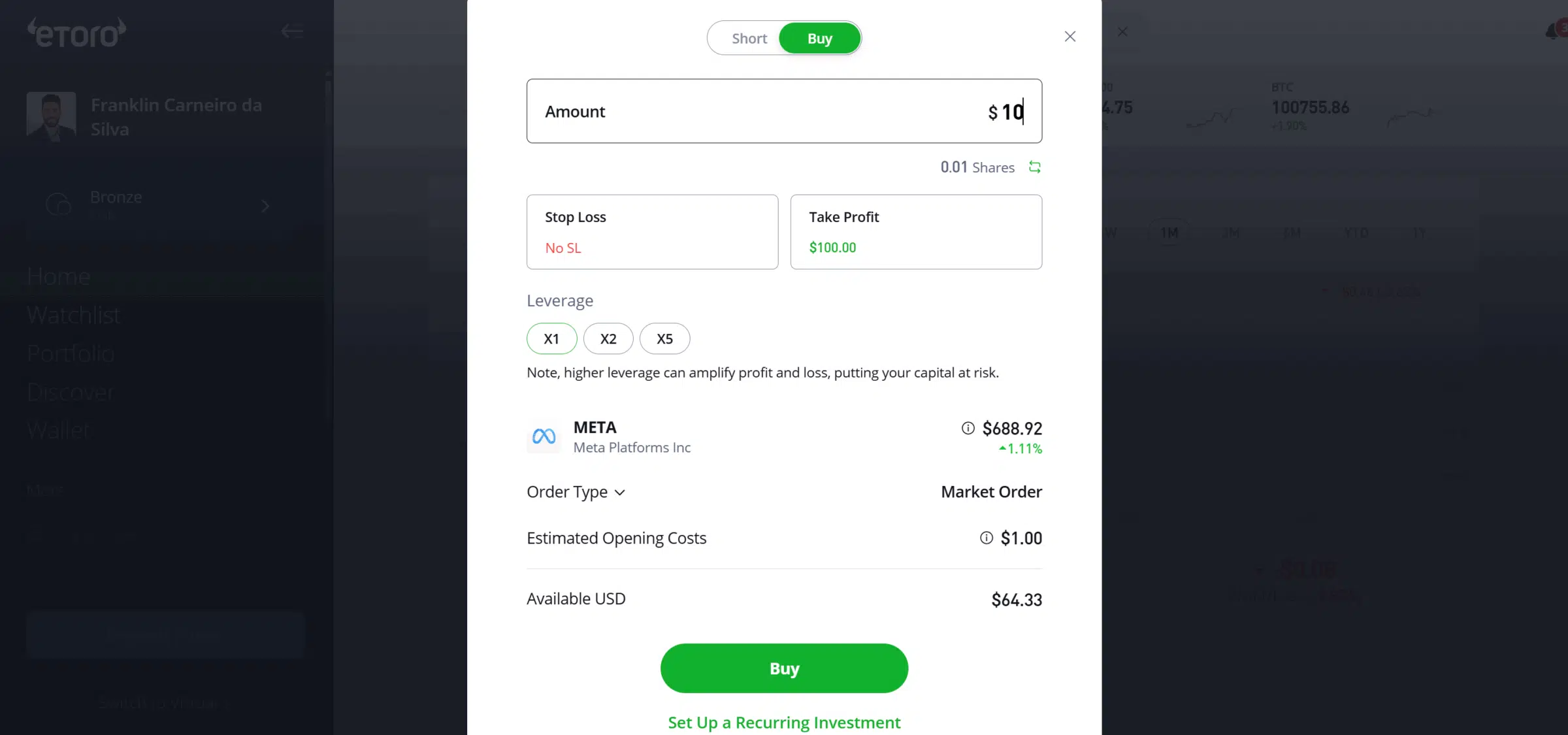

Second, a pop-up will appear where you can buy (or short) the stock. In this case, you are buying the underlying asset, and not a CFD. If you want to leverage your investment, you will need to change the “X1” to “X2” or to any other level of exposure that eToro allows.

Customer support

Our judgement of any customer support comes from our own experiences. Given that, we have noticed an improvement in response times since the Covid-19 pandemic.

We have contacted customer support more than once, and the response time varies. The longest we had to wait for a response was about seven days, but in normal circumstances, it takes less than three days.

Final thoughts

All in all, eToro is a solid option for any German investor, whether you are a beginner, an intermediate, or even a professional.

The company is currently going through a period of growth to further boost its reputation and credibility, and to gain even more customers.

For a complete overview of how eToro operates globally, please read our eToro review!

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.