With many online brokers in Belgium, finding the best one can be challenging.

Our extensive experience in this field – reviewing and monitoring dozens of online brokers daily – will guide you in finding exactly what you need, whether it’s earning interest on cash, a platform for ETFs, or trading forex.

In this article, we’ll present and compare the best trading platforms in Belgium that we identified based on our experience.

Best online brokers in Belgium

Don’t want to read the whole article? Here are our suggestions for the best online brokers in Belgium:

- Interactive Brokers: Best trading platform in Belgium overall

- Saxo Markets: Best for experienced investors in Belgium

- DEGIRO: Best online broker in Belgium for low fees

- Lightyear: Best emerging low-cost broker in Europe

- BUX: Best trading platform in Belgium with no minimum deposit

- Revolut Trading: Top online broker with no inactivity fee

Disclaimer: Investing involves risk of loss.

62% of retail CFD accounts lose money.

Investing involves risk of loss.

Terms apply, seek guidance if necessary. When you invest, your capital is at risk.

Investing involves risk of loss.

Comparison of the best trading platforms in Belgium

Other resources

- Check our Youtube channel! You will find step-by-step guides of how to invest in the S&P 500 on different apps, as well as other educational videos about investing and investment platforms.

- Explore our tools: Check our comparison tool, reviews, broker bonuses, broker interest rates, BrokerMatch, and others.

Short reviews of the best brokers

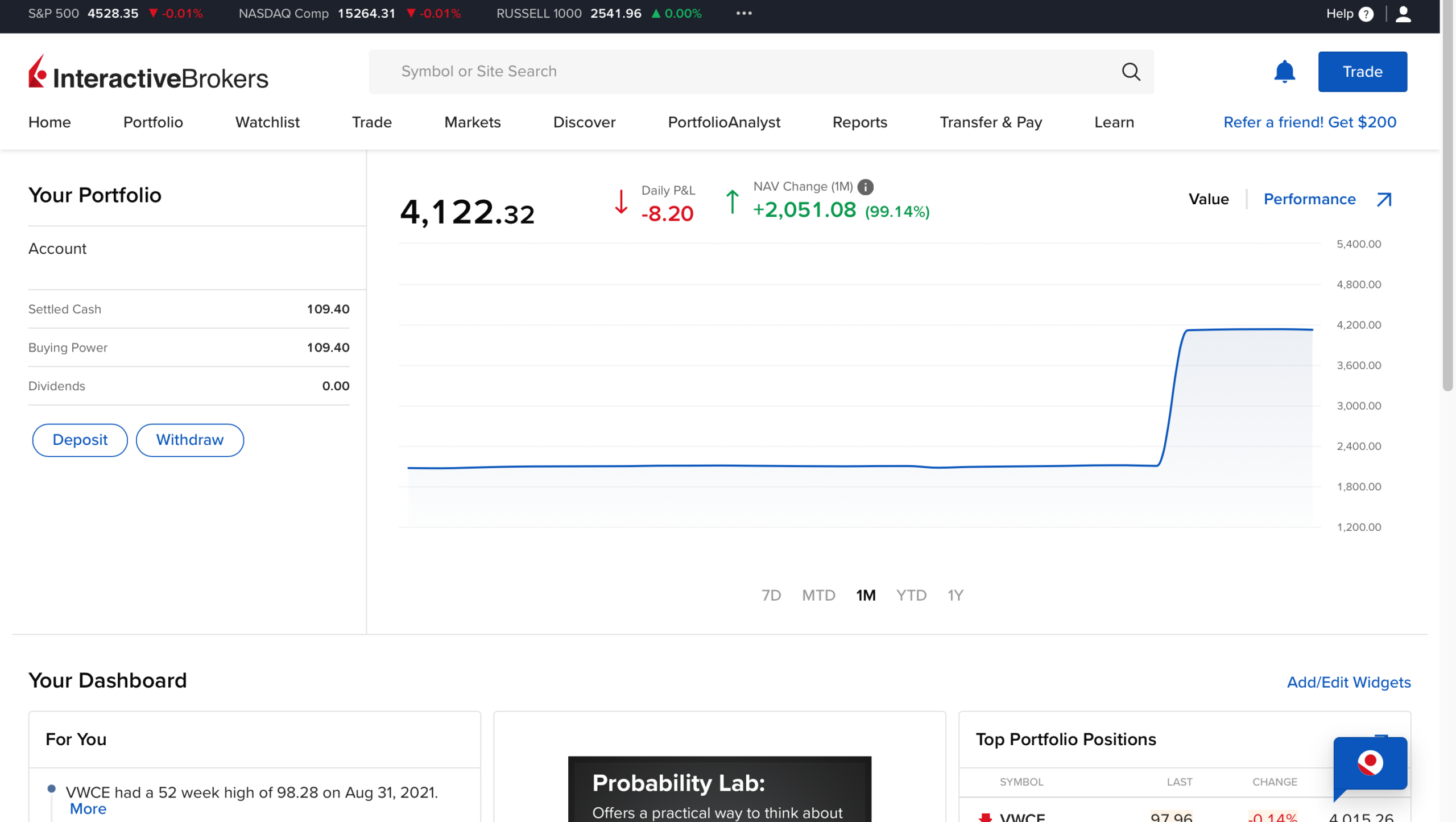

Interactive Brokers at a glance

An exceptional trading platform in Belgium is Interactive Brokers. Founded in 1978 and publicly listed in NASDAQ (ticker: IBKR), Interactive Brokers is a global online broker that surpassed major financial crises, showing resilience and a rigorous risk management process.

Interactive Brokers offers an advanced investment platform that includes a wide range of products (stocks, options, mutual funds, ETFs, futures, bonds, and currencies) from +135 markets, solid trade execution (IB SmartRouting), and a set of technical and fundamental tools to help you in your investment decisions.

Beginners and intermediate investors have educational tools to explore, but the learning curve will be steep. Besides, customer service gives crystal clear answers to your doubts, so there is no need to go back and forth.

On the downside, Interactive Brokers’ fee structure is quite complex, the registration process is lengthy (but fully online), and the broker doesn’t offer commission-free trading. However, when considering FX fees, narrower spreads, and the stock loan program, Interactive Brokers’ clients still get significant savings compared to most brokers.

Interactive Brokers also launched IBKR GlobalTrader, a modern mobile trading app to trade stocks, ETFs, and options, ideal for beginner investors. Some of the features of IBKR GlobalTrader include automatic currency conversions, fractional shares, and a demo account.

Want to know more about Interactive Brokers? Check our Interactive Brokers Review.

Pros

- Low commissions on US stock trading

- No monthly inactivity fee

- The broadest product and markets range in the brokerage industry

- Demo account

- Excellent reputation (founded in 1978)

- Extensive research and Education tools

- Has a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors, IBKR GlobalTrader.

- Offers interest on uninvested cash balances

Cons

- Complicated and lengthy account opening process (but fully online)

- Steeper learning curve for beginners

- Website is difficult to navigate

- Interactive Advisors (Robo-advisor feature) is only available for US customers

Saxo at a glance

62% of retail CFD accounts lose money.

Launched in 1992, Saxo Bank is one of the most solid financial entities in the brokerage industry, with a proven track record of success. It lets you trade over 70,000 financial instruments through their trading platforms: SaxoTraderPRO (for PC) and SaxoTraderGO (on mobile).

The wide range of cash and margin trading products across global markets includes stocks, ETFs, bonds, mutual funds, cryptos, options, futures, CFDs, forex, and more! Saxo Bank presents its advanced research tools for “Buy and hold or trade on leverage”.

The Saxo Bank account tiers are the following:

- Classic: No minimum deposit is required (depending on the country of residency), giving you access to tight spreads and customer and technical support 24/5.

- Platinum: A minimum €200,000 deposit is required. In addition to Classic features, it also lowers trading prices by up to 30% and prioritizes local-language customer support.

- VIP: A minimum €1,000,000 deposit is required. Here, you will find the best prices, access to trading experts, and exclusive event invitations.

The pricing structure will vary according to your account tier. For instance, a US stock order will be 0.08% of the trade value, with a minimum of $1 in Classic. However, within the VIP tier, the same trade would be 0.03% of the trade value with the same minimum of $1. Plus, for accounts with stocks, ETFs/ETCs, or bond positions, a custody fee of up to 0.15% p.a. will apply.

The listed prices are approximate and will differ based on the resident country. For precise pricing details, refer to the platform’s trade tickets for a comprehensive overview.

Saxo Bank A/S is a fully licensed European bank under the supervision of the Danish Financial Supervisory Authority (FSA). Saxo Bank is a member of the Danish Guarantee Fund, which protects client cash deposits up to €100,000 and financial securities (stocks, ETFs,…) up to €20,000 per client.

Want to know more about Saxo? Check out our Saxo review!

Pros

- Excellent research materials

- Outstanding trading platforms (SaxoTraderPRO and SaxoTraderGO)

- Extensive range of investment products

- Long track record

- Supervised by worldwide top-tier regulators

Cons

- High minimum deposit (varies between countries)

- Fees higher than average

- Fee structure is complex

- Does not accept US residents

DEGIRO at a glance

Investing involves risk of loss.

Founded in 2013, DEGIRO is a low-cost brokerage firm that has become very popular due to its low rates! With over 3 million users, the innovative platform has become widely known for its “do-it-yourself” philosophy in the sense that you have everything at your disposal to start investing on your own. It offers a wide range of financial assets to trade, including stocks, ETFs, bonds, options, futures contracts, warrants, investment funds, and some leveraged products (not quite the same as CFDs. More info here).

For instance, you can trade ETFs in the Core Selection list at a low cost (a €1.00 flat handling fee – external costs – still apply) with no minimum amount required. The web trading platform is basic, but it is efficient and straightforward to use. In a matter of minutes, you get used to it. The same applies to its mobile app. On the downside, there is an absence of significant fundamental research, a €1.00 commission for US stocks, a €2.50 connectivity fee applies, and pricing alerts are missing.

Regarding security, DEGIRO is the Dutch branch of flatexDEGIRO Bank AG (a German-regulated bank). In the unlikely event that the segregated assets cannot be returned to clients, DEGIRO falls under the German Investor Compensation Scheme, which compensates any losses from non-returned assets up to 90% (with a maximum of €20,000), so do bear this in mind if you are planning to invest much larger volumes. Furthermore, any money deposited on a DEGIRO Cash Account with flatexDEGIRO Bank AG will be guaranteed up to €100,000 under the German Deposit Guarantee Scheme.

Still any doubts? Go through our DEGIRO Review!

Pros

- ETF Core Selection list (external fees apply)

- User-friendly web and mobile app

- Wide range of investment options

- Education material: Investor’s Academy and Investing with DEGIRO

- Low overall commission structure

- No account opening, inactivity, or withdrawal fee

Cons

- 0.25% currency conversion fee (charged if you deposit or invest in a different currency than your base currency)

- €/£1 flat handling fee (charged in most transactions)

- €/£2.50 of connectivity fee (paid annually), per exchange where you’re invested

- Does not offer Forex, CFDs, and Cryptos

- No ISA account (for UK residents)

- Low-quality customer support

- No interest paid on cash balances

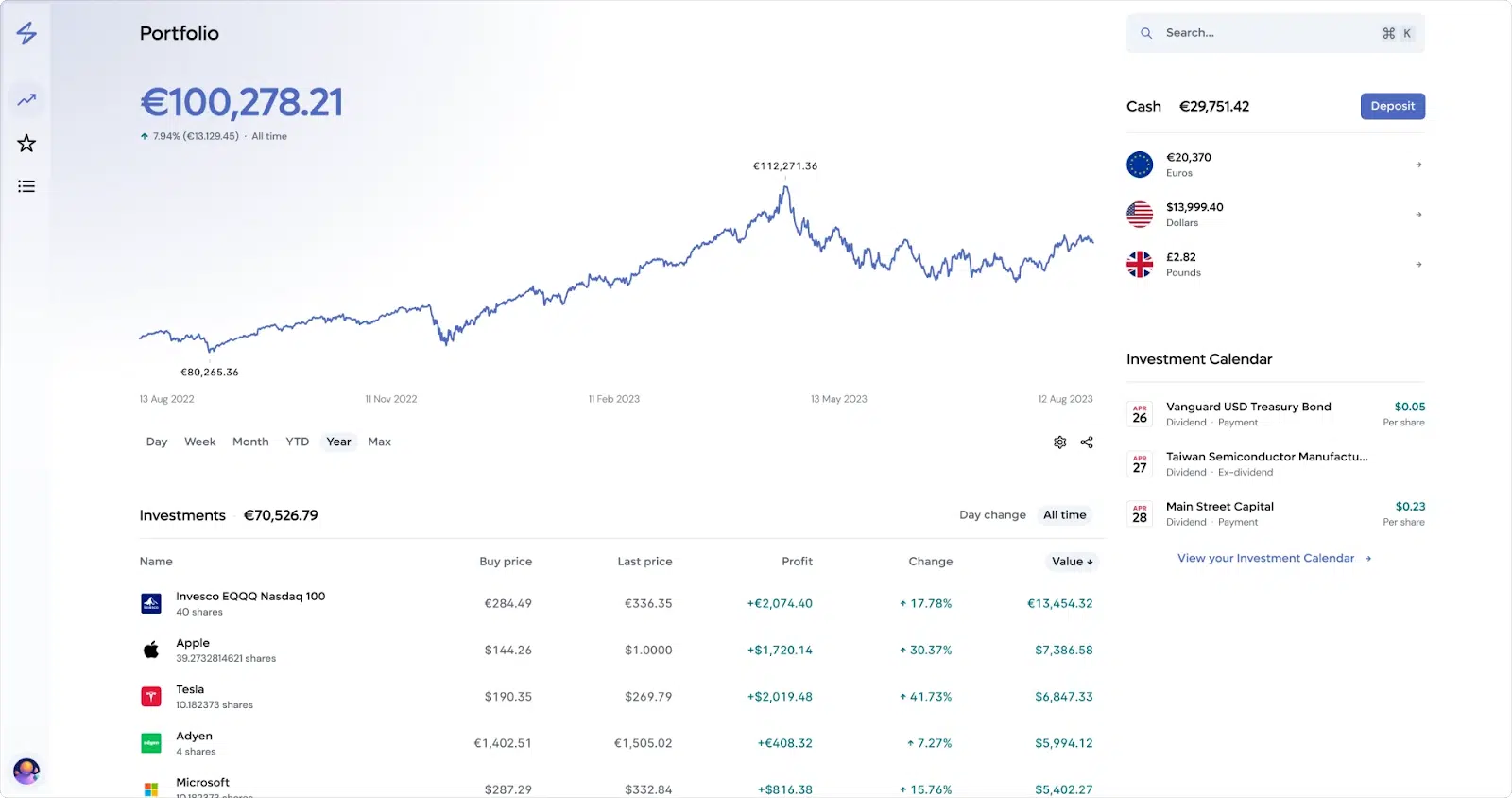

Lightyear at a glance

Terms apply, seek guidance if necessary. When you invest, your capital is at risk.

Lightyear is a European investment app that operates via the entity Lightyear Europe AS, authorized and regulated by the Estonian Financial Supervision Authority (EFSA – license number 4.1-1/31), with clients’ assets covered up to €20,000.

There are no Lightyear execution fees to trade ETFs. For stocks, commissions do not go over €/$/£1 per order, and there is a flat 0.35% fee for currency conversion (this fee can be minimized by their multi-currency account in EUR, GBP & USD). Lightyear offers one of the highest interest in uninvested cash: EUR: 2.30%; USD: 4.36%; GBP: 4.58% (as of May 2025).

The investment platform is suitable for beginners and intermediate investors who can safely invest in fractional shares. With an easy-to-use app and more than 5,000 stocks available from the US, UK, European, and Asian markets, Lightyear is an excellent way to get exposure to the stock market.

There are, however, some downsides to Lightyear’s investing app: the product offering is limited (there are no options, commodities, or Forex), and there is no demo account.

Do you want to know more about Lightyear? Check out our Lightyear review!

Disclaimer: Capital at risk. The provider of investment services is Lightyear Financial Ltd for the UK and Lightyear Europe AS for the EU. Terms apply: lightyear.com/terms. Seek qualified advice if necessary.

Pros

- 0% Lightyear execution commission on ETF trading (other fees may apply)

- No account opening, inactivity, or withdrawal fees

- High interest on uninvested cash

- Free multi-currency account

- Minimum deposit of €/£/$1

- Fractional Shares

- Account opening promotion with the promo code INVESTINGINTHEWEB

Cons

- Limited financial instruments (no options, bonds, commodities, or futures)

- No demo account

- Only available in 22 european countries (not available internationally)

- 0.35% currency conversion fee

BUX at a glance

It allows users to trade US and EU stocks (Dutch, German, Belgian, French, and Austrian) and 30+ ETFs. New users will also benefit from one free share worth up to €200 (terms available on page 31 of the BUX Client Agreement). You also have access to fractional investing, making it easy to invest in companies with big share prices (Amazon, Tesla, Alphabet,…) starting for as little as €10.

In addition, crypto trading is also available for free! Investors can trade Bitcoin, Ethereum, Litecoin, among other cryptocurrencies.

BUX is very transparent in its pricing structure: it charges no commission for zero orders for EU stocks and ETFs, but it will cost you €1.99 per market or limit Order in EU stocks and ETFs. US stocks charge €0.99 for market and limit orders. Besides, it also earns money through an FX markup (currency conversion fee) of 0.25% and a monthly service fee of €2.99.

On the downside, the only place to trade is its mobile app (no desktop or web trading platform available), the products available are limited, and it has no demo account.

BUX is regulated by the Dutch Authority for Financial Markets (Autoriteit Financiële Markten – AFM). If you want to learn more, check out our BUX Review.

Pros

- Low commissions on stock, ETF and ETC trading

- Offers one free share of up to 100€ upon deposit

- Fractional investing

- Modern and user-friendly mobile app

- No inactivity, custody, deposit or withdrawal fee

- No minimum required deposit

Cons

- Zero order execution delay

- No demo account

- Limited financial products

- Only available in eight countries

Revolut Trading at a glance

Investing involves risk of loss.

Founded in 2019, Revolut Trading is part of the Revolut app (existing since 2015) and provides its users with an efficient way to invest (all in one place). It only allows investment in American stocks (+1,000 companies) free of charge for up to 1 transaction per month, cryptocurrencies with a charge of 1.99% or EUR 0.99 per trade (whichever is higher), and gold and silver with a spread of 0.25% when the market is open. On the other hand, there are no inactivity or withdrawal fees.

The app is super intuitive, and the account opening process is 100% digital, fast, and secure. Unfortunately, it still has a very low offer of financial products, and the account can only be denominated in dollars. Some of the non-accessible assets are the following ones: ETFs, CFDs, Forex, bonds, and options. Furthermore, it does not have any educational or market research material, and it charges an annual custody fee of 0.12%.

Learn more in our in-depth Revolut Trading Review.

Pros

- Simple trading platform

- Easy account opening process

- At least, one free trade per month

- Low trading commissions

- No inactivity fee

Cons

- Limited range of investment instruments

- Investments not covered by the Financial Services Compensation Scheme

What broker has the best trading app in Belgium?

Selecting the best trading app in Belgium involves considering individual preferences.

DEGIRO is renowned for its low fees and straightforward interface. BUX, gaining popularity, focuses on user-friendly design and offers commission-free trading. Interactive Brokers provides a robust platform with extensive tools for experienced traders. Assess factors like user interface, security, available markets, and fees to determine the most suitable option. Recent reviews and ensuring regulatory compliance are crucial steps. DEGIRO is praised for affordability, BUX for simplicity, and Interactive Brokers for advanced features etc.

You might find out that none of the options mentioned here is a good fit for you. Explore each app to align with your specific trading needs, recognizing that the landscape may evolve, and new features could be introduced.

How to buy stocks in Belgium (Step-by-step)

To buy stocks in Belgium, follow these general steps:

- Research and Education: Understand the stock market, different companies, and the risks involved. Research potential stocks and stay informed about market trends.

- Select a Broker: Choose a reputable online broker that suits your preferences. DEGIRO, BUX, Interactive Brokers and other platforms mentioned in this article are some popular choices in Belgium. Ensure the broker is regulated by the relevant authorities.

- Account Setup: Open a trading account with the chosen broker. This typically involves providing personal information, financial details, and completing any necessary identity verification.

- Deposit Funds: Deposit funds into your trading account. Most brokers accept bank transfers or other payment methods.

- Stock Selection: Use the broker’s platform to search for and select the stocks you want to buy. Consider diversifying your portfolio for risk management.

- Place an Order: Once you’ve chosen the stocks, place a buy order through the broker’s platform. Specify the quantity and type of order (e.g., market order or limit order).

- Monitor Investments: Keep track of your investments and stay informed about market changes. Consider setting up alerts for significant price movements.

- Review and Adjust: Regularly review your portfolio and adjust your holdings based on your investment goals and market conditions.

Always be aware of fees, taxes, and any specific regulations related to stock trading in Belgium. If you’re unsure about any aspect, seek advice from financial professionals or consult the resources provided by your chosen broker.

Belgian Stock Exchange Tax

It is important to know that Belgium imposes a tax on stock exchange transactions known as the “Belgian Stock Exchange Tax” (BSET) or ‘taks op de beursverrichtingen’ or ‘taxe sur les opérations de bourse’ (TOB). This tax applies to both Belgian and foreign securities transactions carried out on a Belgian stock exchange or through a Belgian intermediary.

Key points about the Belgian Stock Exchange Tax include:

- Tax Rate: The tax rate is a percentage applied to the transaction value. The rate can vary depending on the type of transaction (purchase or sale) and the characteristics of the security.

- Applicability: BSET typically applies to the purchase of stocks, bonds, and other financial instruments executed on a Belgian stock exchange or through a Belgian financial intermediary.

- Exemptions: Some transactions may be exempt from the Belgian Stock Exchange Tax. For example, transactions related to market makers, primary market transactions, and certain transactions involving small and medium-sized enterprises (SMEs) may be exempt.

- Payment and Reporting: The tax is often collected by the financial intermediary at the time of the transaction. Financial institutions are responsible for reporting and remitting the tax to the Belgian tax authorities.

It’s important to note that tax laws and regulations can change, and it’s advisable to consult with a tax professional or refer to the latest guidance from Belgian tax authorities for the most up-to-date information regarding the Belgian Stock Exchange Tax.

You can find more info on the subject here.

Bottom line

As we conclude our exploration of the best online brokers in Belgium, it’s evident that the landscape offers a spectrum of choices catering to diverse investor needs.

Our top pick include:

- Interactive Brokers: Best trading platform in Belgium overall.

- Saxo Markets: Best for experienced investors in Belgium.

- DEGIRO: Best online broker in Belgium for low fees.

- Lightyear: Best emerging low-cost broker.

- BUX: Best trading platform in Belgium with no minimum deposit.

- Revolut Trading: Top online broker with no inactivity fee.

The decision ultimately rests on your specific preferences, whether you’re seeking simplicity, advanced tools, or a balance of both. Stay informed about market trends, regulatory changes, and emerging features as you embark on your investment journey. Choose wisely, aligning your choice with your financial goals and trading style.

Some factors you should know when choosing an online broker are the fees charged if it is regulated by top-tier institutions, the range of products it allows you to trade (not all platforms allow you to trade EU stocks), among others.

A reminder that the above should not be seen as investment advice and should be considered information only. Investors should do their own research and diligence about the best-suited services and opportunities for their risk, returns, and impact strategy.

Happy investments!

FAQs about brokers in Belgium

What is a brokerage company?

It is an entity designed to be the middleman between you and the people you are trying to buy or sell a stock, ETF, crypto,… you name it!

Which broker is best in Belgium?

There is no single answer. It depends on what you value most: fees, security, investment platform or any relevant feature.

What are the types of investments you can make with a brokerage account?

You can trade stocks, ETFs, Forex, Bonds, Futures, Cryptocurrencies and CFDs on stocks, ETFs, indices, cryptocurrencies, commodities.

What is leverage in trading?

Leverage in trading involves using borrowed funds to amplify the potential returns of an investment. It allows traders to control larger positions with a smaller amount of capital, but it also increases the risk of significant losses.

Is Forex trading legal in Belgium?

Yes, Forex trading is legal in Belgium. However, the regulatory environment may impose certain restrictions, and traders should ensure compliance with local regulations. It’s recommended to use licensed and regulated brokers when engaging in Forex trading in Belgium.

Can a resident of Belgium trade US stocks?

Yes, residents of Belgium can generally trade US stocks. They can do so through international brokerage platforms that offer access to US markets. However, they should ensure compliance with any regulatory requirements and tax implications associated with international stock trading.

What are pips in trading?

“Pips” in trading refer to the smallest price move that a given exchange rate can make based on market convention. In most currency pairs, one pip is equivalent to a one-digit movement in the fourth decimal place, e.g., from 1.2345 to 1.2346. It measures price changes in the forex market.