Did you know about ARK before COVID-19? Probably not. The company gained widespread recognition during that period for its strategy of “investing solely in disruptive innovation,” which led to extraordinary performance and increased visibility for its founder, Cathie Wood.

Cathie Wood has propelled the ARK ETF family from obscurity four years ago to becoming the 16th largest issuer today. Along the way, she made some bold predictions, such as Tesla stock reaching $4,000 in 2023 (which did not happen) and Bitcoin rising to $500,000.

The ARK Innovation ETF (ARKK) is not the company’s first ETF, but it has become its flagship product, focusing on the team’s best ideas across various industries.

So, can European or UK investors invest in ARKK ETF?

Yes, ARKK ETF is available in Europe. However, there are three key points to consider before investing:

- Limited Availability: Most brokers do not offer the ARK Innovation ETF. The only broker we found that provides access to it is Interactive Brokers (see image below).

- Low Assets Under Management (AUM): The AUM is $92 million, as of May 2025. Typically, if an ETF’s AUM does not exceed the $100 million mark within a year, the likelihood of the fund closing increases.

- High Total Expense Ratio (TER): The TER is 0.75%, which is relatively high for an ETF.

Other ETFs to consider from ARK Invest:

| ETF name | ISIN | Tickers | TER | AUM |

| ARK Artificial Intelligence & Robotics UCITS ETF | IE0003A512E4 | ARCI, AAKI, ARKIx, ARKI | 0.75% | +$56 million |

| ARK Genomic Revolution UCITS ETF | IE000O5M6XO1 | ARKG, AAKG, ARKGx, ARCG | 0.75% | +$8 million |

| Rize Global Sustainable Infrastructure UCITS ETF* | IE000QUCVEN9 | RIZD, NFRA, BRIK, NFRA | 0.45% | +$95 million |

Data as of May 2025.

*The Rize ETF is the result of a partnership with ARK.

Another option is to indirectly invest in the “original” ARK Invest ETFs (through CFDs – explained below). Since US-listed ETFs do not comply with European UCITS regulations (indicated by their ISIN starting with “US” – for example, US00214Q1040), they cannot be offered to European investors.

Thus, if you search for “ARK Innovation” or “ARKK” on any European broker platform, you will likely find no results unless it is a contract-for-difference (CFD).

What is a CFD?

A CFD allows you to achieve the same returns (positive or negative) as you would by investing directly in the asset by replicating it. It can also provide leverage to potentially increase your returns. Therefore, a CFD can give you the same exposure to the ARKK ETF by mimicking its daily movements (1-to-1 or even in a leveraged format). This is called indirect exposure since you do not actually own the asset.

How accurate is the CFD replication?

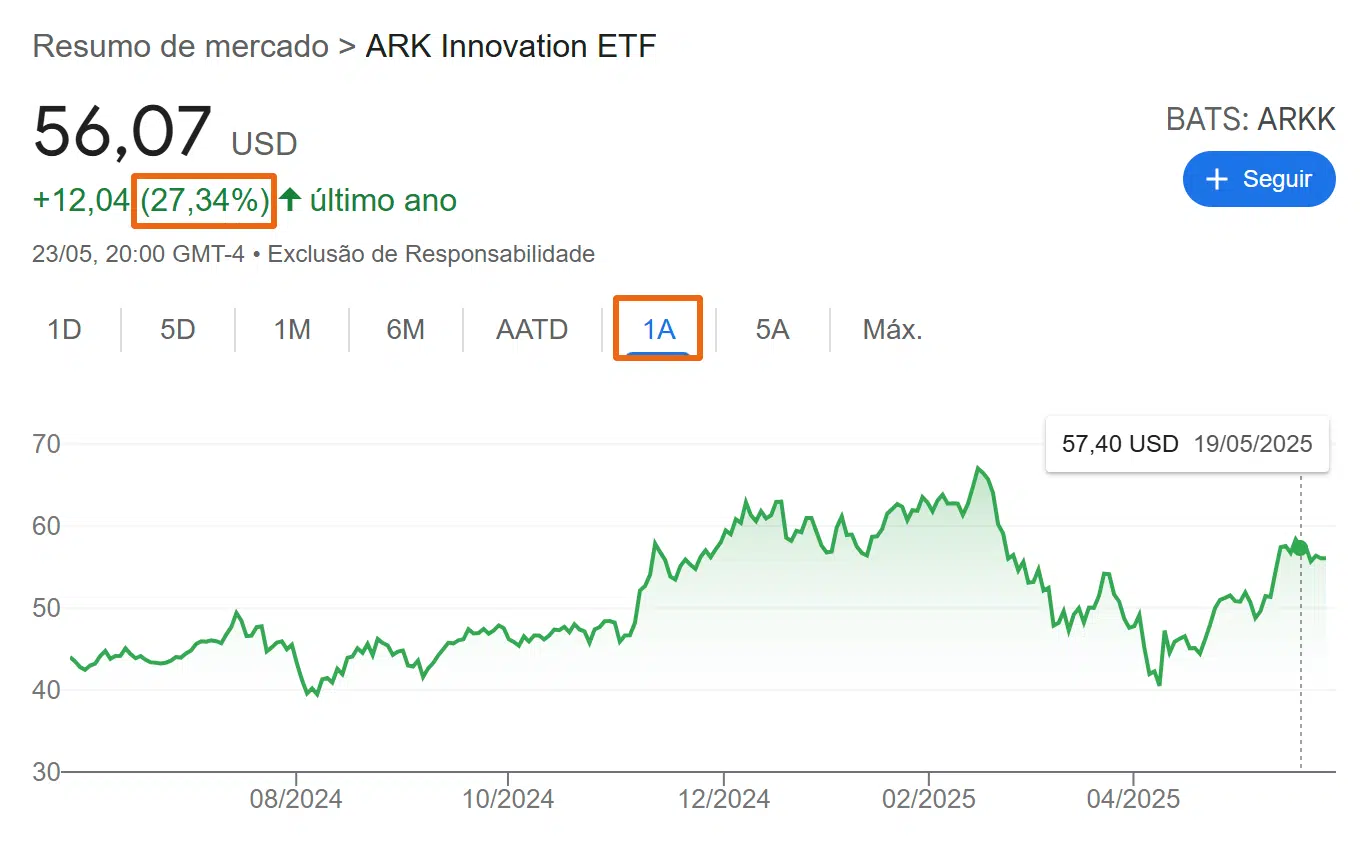

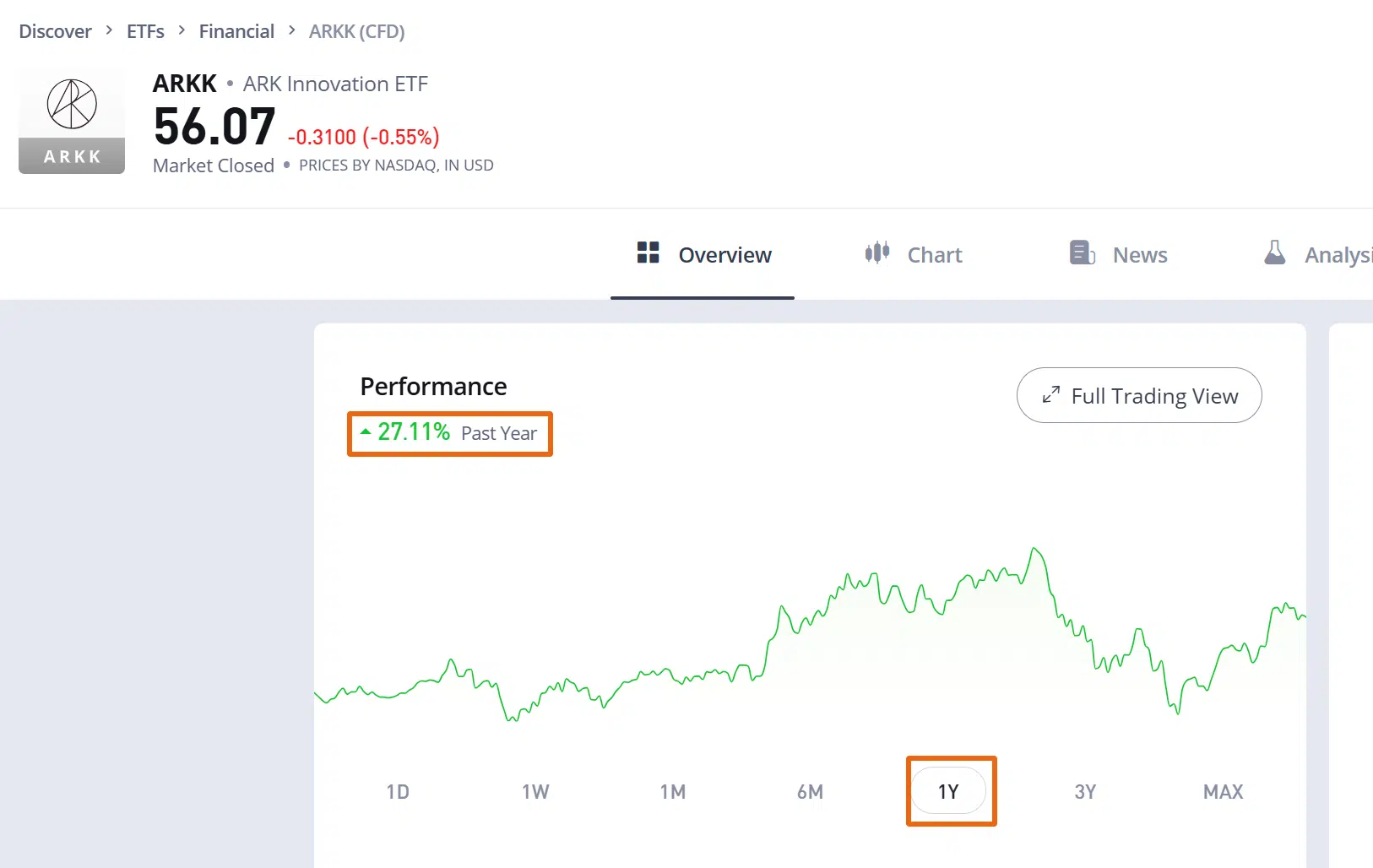

In eToro, an online broker with over 35 million users, you can buy a CFD of ARKK. As previously stated, in practice, owning the ARKK ETF or a non-levered CFD of ARKK ETF should give you a very similar performance, as shown here (performance from 26/05/2024 to 27/05/2025):

-

ARK Innovation ETF:

-

CFD on ARK Innovation ETF:

As you can notice, the “real” ARK Innovation ETF had a one-year performance of +27.34%. On the other hand, the CFD on ARK innovation ETF had a one-year performance of +27.11% for the same period.

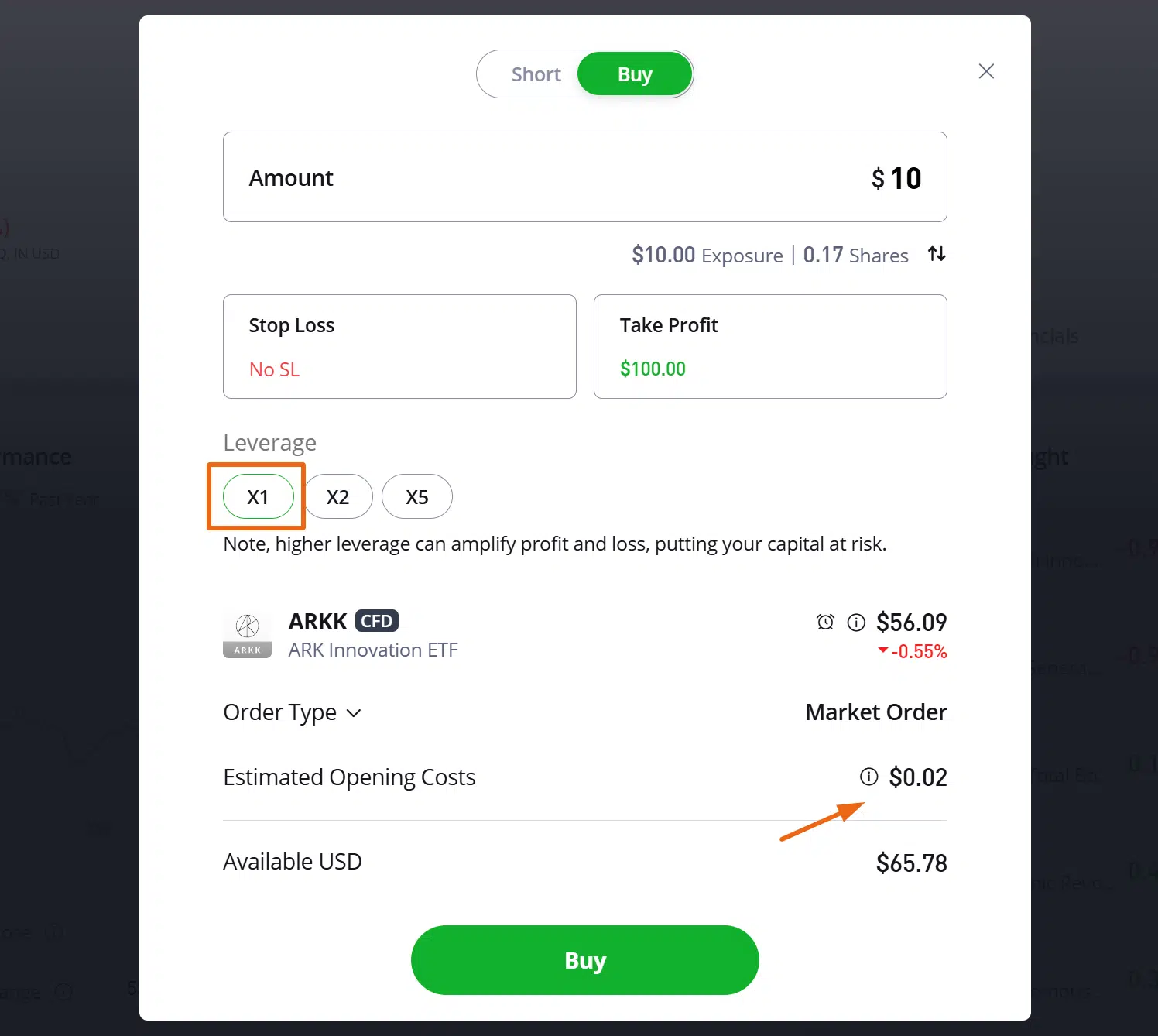

In eToro, you will not incur any overnight or weekend fees for using a CFD to trade ARKK ETF when using an “X1 leverage” factor. In other words, a 1% move in the ETF will dictate a 1% move in the CFD. Still, if you want to get more aggressive, you can leverage your exposure up to 5 times (additional leverage fees will apply). The only fee you will face is the spread for buy/selling, which, for US-based instruments, is $0.02 per share.

This is what it looks like before giving a buy/sell order:

For more information on the platform, check our eToro review.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pros and cons of using a CFD in eToro to invest in ARKK ETF

Pros

-

You get a 1-to-1 exposure (non-leverage replication)

-

No overnight or weekend fees (as opposed to leveraged CFDs)

-

Ability to go long and short

- Wide range of trading opportunities

Cons

-

You do not own the asset (ARKK ETF, in this case)

-

Leverage risks (in case you go for the leverage versions)

- Spread fees

Other European brokers that allow indirect exposure to ARKK ETF

Trading 212 at a glance

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

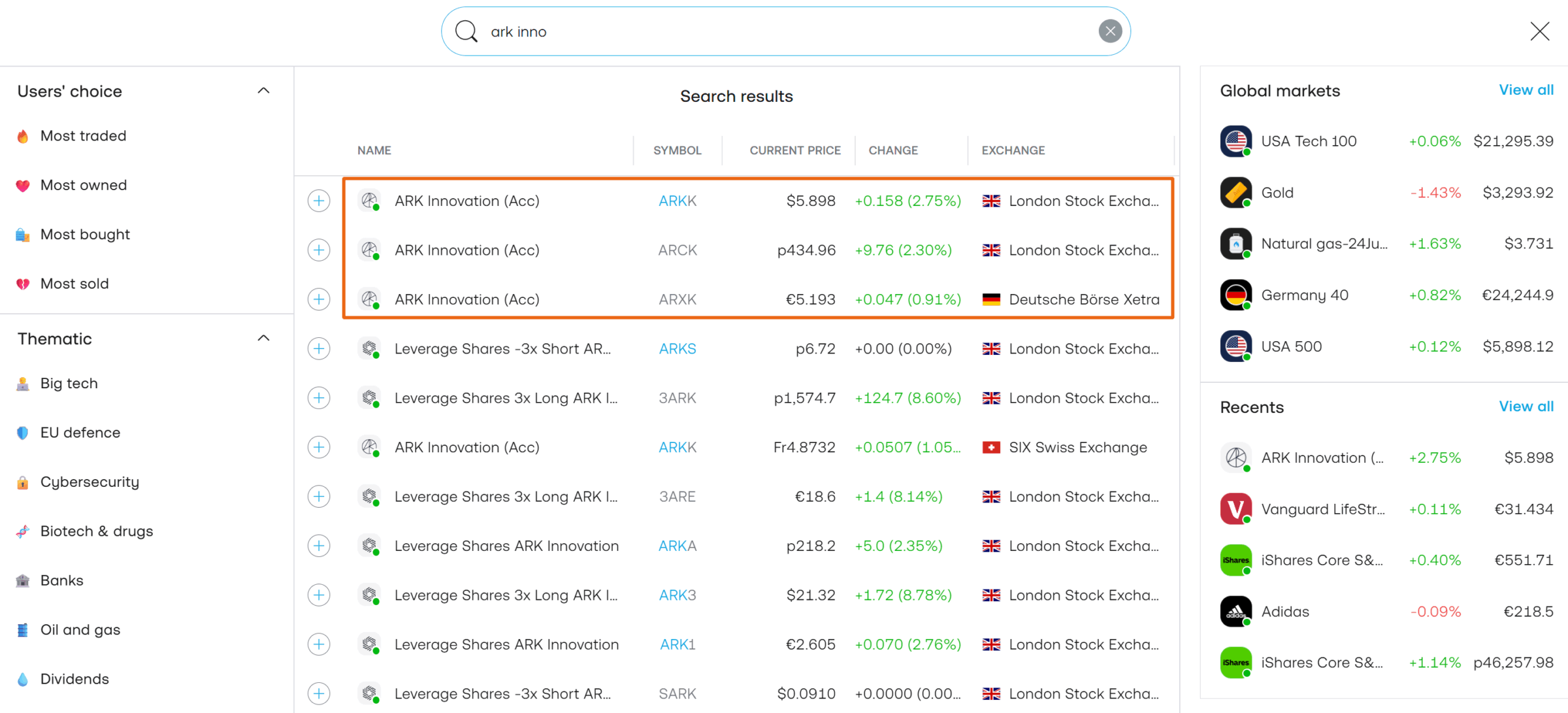

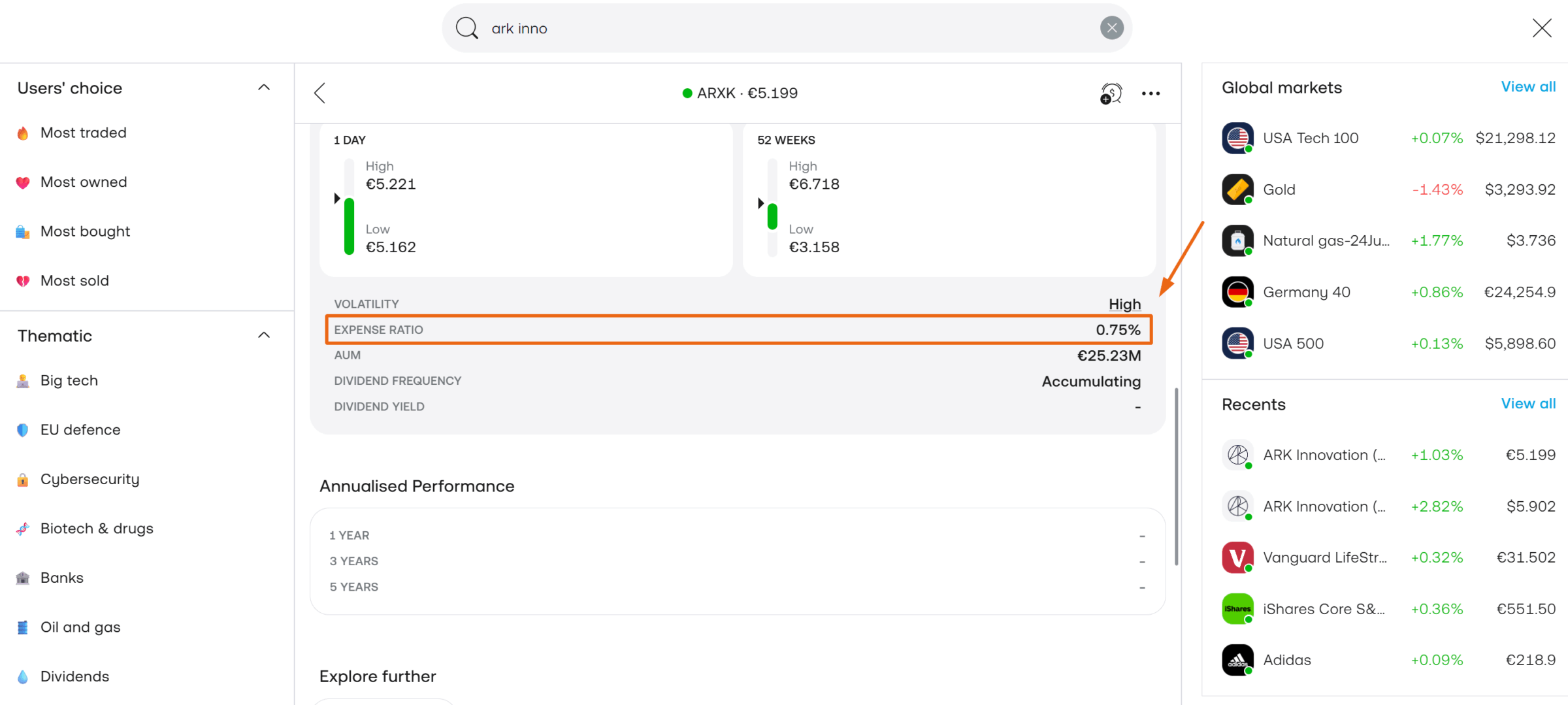

Trading 212 allows you to get direct exposure to the ARK Innovation ETF. As you can see in the image, it gives you access to it through three different currencies (EUR, USD, and GBP):

In addition, you have access to leveraged trackers: “3x” and “-3x”, meaning you can go long or short, respectively, with a more aggressive exposure.

The non-leveraged ETFs, the one highlighted in the previous image in EUR, present an annual cost of 0.75%, which is worse when compared to the version shown on the eToro platform.

As a side note, Trading 212 is offering one free share worth up to €100! It may be worth checking that out. For more details, check our Trading 212 review.

XTB at a glance

69-80% of retail CFD accounts lose money.

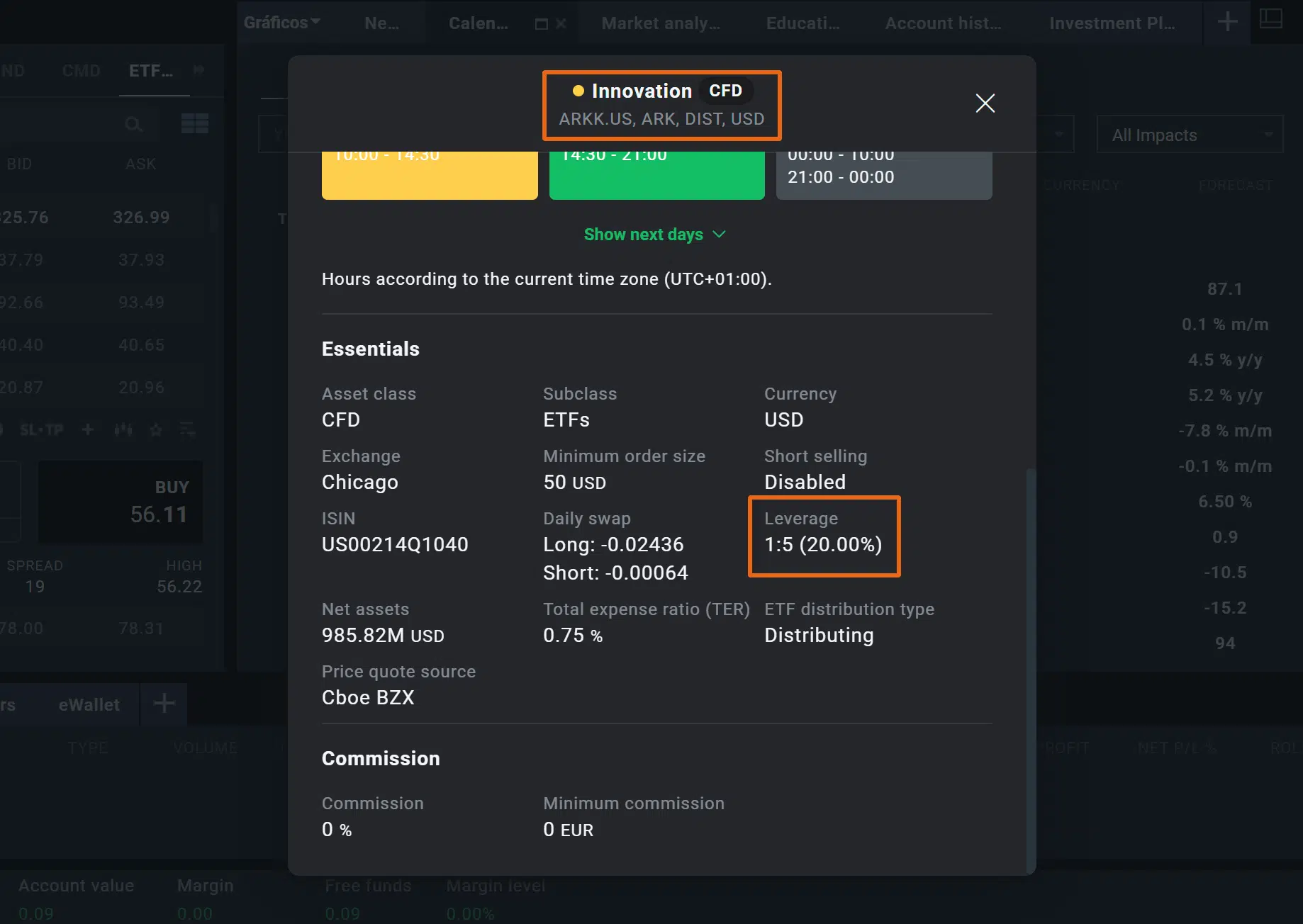

XTB also allows you to get on board in the ARK Innovation ETF through an ETF CFD. Contrary to what happened in eToro and Trading 212, here you have no option to get a 1-to-1 exposure. As seen below, you can only invest with a leverage factor of 5, meaning €100 invested is, in reality, €500 invested (€100 yours plus €400 borrowed). So, additional fees will be applied.

For more details, check our XTB review.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 69-80% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Bottom Line

All in all, you can invest in the ARK Innovation ETF, but it is likely that your broker does not offer it (or any other of the other ETFs offered by ARK). Through a CFD, you can get the same exposure so make sure you use the financial instrument that better aligns with your intention of getting exposure to the Cathie Wood ETF.

Nobody knows how “disruptive technology” will behave in the following market cycle. Still, we believe that ARK Invest ETF might be a good option to participate in large-scale investment opportunities in the public markets resulting from several thematics such as robotics, artificial intelligence, energy storage, and blockchain technology.

We hope it helped cover whether ARKK ETF was available for European and UK investors!

FAQs

Is ARK Innovation ETF available in DEGIRO?

No, it is not. DEGIRO does not offer any ARK Invest ETF.

Is ARK Innovation ETF available in Freetrade?

No, it is not. Freetrade does not offer any ARK Invest ETF.

Is ARK Innovation ETF available in Trade Republic?

No, it is not. Trade Republic does not offer any ARK Invest ETF.