You have probably heard about the Robinhood app on YouTube and want to know if it is available in the Netherlands, right?

Robinhood is a modern and easy-to-use investment app from the US, which has introduced the concept of commission-free trading in financial products such as stocks and ETFs.

Want to know if the Robinhood app is available in the Netherlands, its expansion plans, and the alternatives available in Nederland? We’ve got you covered!

What is Robinhood?

Robinhood was founded in 2013. Since then, it has played a major role in disrupting the brokerage industry by allowing US retail investors to trade with no commissions, alongside its biggest rival, Webull. Robinhood is a commission-free online broker offering the possibility of trading stocks, ETFs, options, and cryptocurrencies.

The results are clear: over 25 million users! The competitors of Robinhood have been monitoring this exponential growth closely, and some major well-established brokers in the US, such as E*TRADE, TD Ameritrade, and Charles Schwab, announced in quick succession that they were eradicating trading fees.

Is Robinhood available in the Netherlands?

Robinhood is available in the Netherlands, but only for crypto trading. So, if you are looking to invest in stocks, ETFs, options or any other financial instruments, you should look elsewhere.

Earlier this year, Robinhood has launched its cryptocurrency trading service in the European Union, marking a milestone in its international expansion.

This new offer allows users to buy, sell, and hold more than 25 cryptocurrencies, including Bitcoin, Ethereum, Ripple, Cardano, Solana, and Polkadot, among others.

With the commitment to add more cryptocurrencies and features such as transfers and “staking” in 2025, Robinhood promises to be a safe and low-cost platform for cryptocurrency trading in the EU.

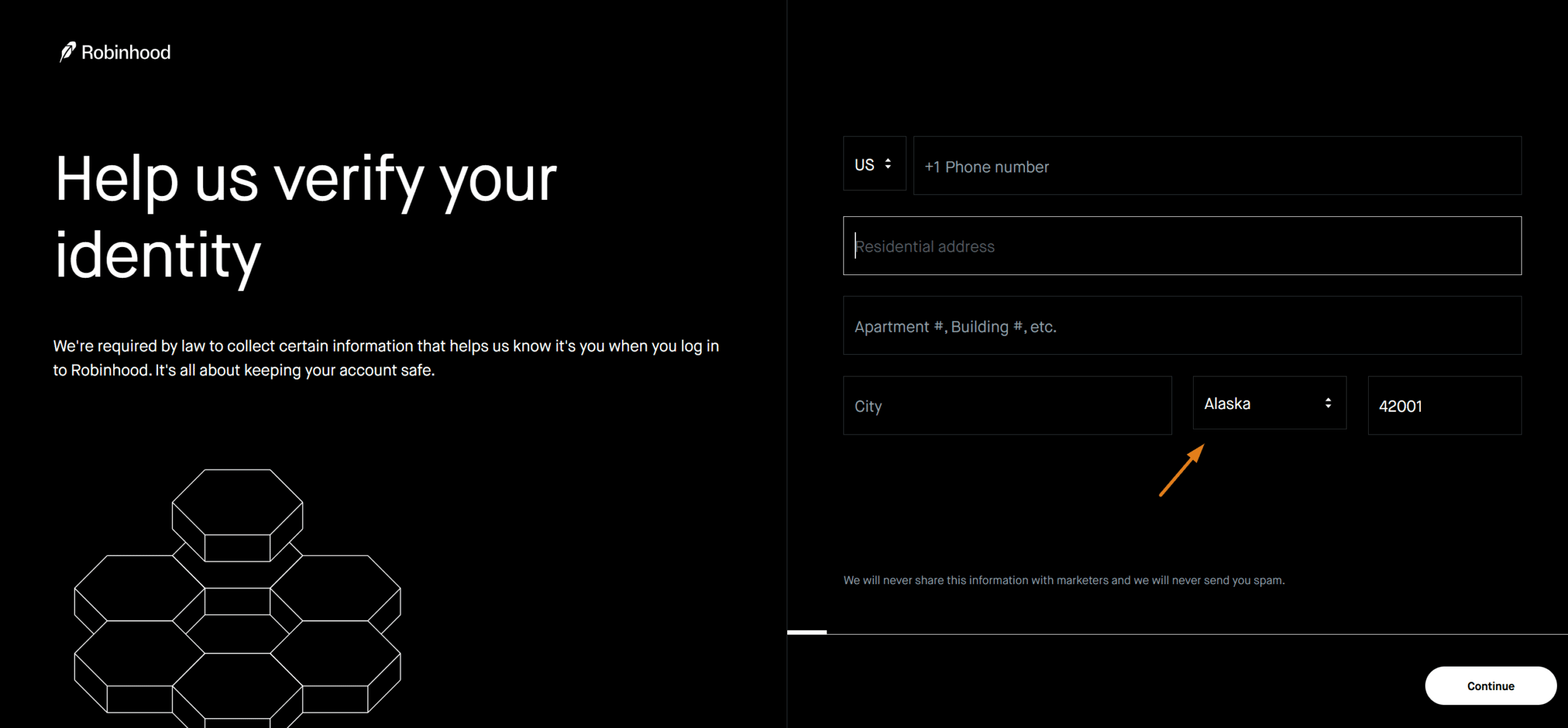

This means that if you live in the Netherlands, you will not be able to open an account to invest in stocks, but only in cryptocurrencies. Besides, if you try to open an account through Robinhood website, you will quickly notice that only people with an address in the US can continue the sign-up process:

However, in April 2025, Robinhood was granted a brokerage license from the Lithuanian central bank. The central bank said in a press release that “The Bank of Lithuania has issued an A-category brokerage license to Robinhood Europe, a wealth tech company”. In practice, this means that Robinhood may enter the European market, including the Netherlands, in the near future.

Robinhood alternatives in the Netherlands

To help us answer this question, we focused on low-cost online brokers available in the Netherlands. Given that, here are our suggestions:

Disclaimer: Investing involves risk of loss.

69-80% of retail CFD accounts lose money.

61% of retail CFD accounts lose money.

82% of retail CFD accounts lose money.

Investing involves risk of loss.

All the companies mentioned here are regulated and/or registered by the Dutch Authority for the Financial Markets (AFM).

XTB at a glance

69-80% of retail CFD accounts lose money.

Founded in 2002, XTB is a major player in the brokerage industry, boasting extensive worldwide experience and regulation by the Financial Conduct Authority (FCA), as well as other relevant regulatory bodies. The company is also listed on the Warsaw Stock Exchange.

You can invest through xStation 5 and xStation Mobile in different investment products, such as stocks, ETFs, and CFDs on stocks, Forex, indices, commodities, and cryptocurrencies (this product offering may vary slightly from country to country). It offers 0% commission on stocks and ETFs.

Opening an account and transferring money is a quick and hassle-free process. For beginners, it presents a demo account where you can trade as if it were real money to help you feel the investment platform firsthand, and you get access to educational tools. For intermediate and advanced investors, you will find plenty of technical and fundamental tools to help you better assess your investment decisions.

On the downside, you will face an inactivity fee of €10/month after one year of non-trading, and if you have not deposited in the last 90 days, it charges high commissions on CFDs of cryptocurrencies but low costs for Forex.

Want to know more about XTB? Check our XTB Review.

eToro at a glance

61% of retail CFD accounts lose money.

Founded in 2006, eToro is a well-known worldwide fintech startup and the leader in the social trading field (following other people’s trades), with over 38 million users worldwide. You can also invest in other products through their platform, which is intuitive and simple to use, making it a good choice for beginners. Plus, they offer commission-free ETF trading (other fees apply).

Opening an account and depositing is easy, and you can even try it out with virtual money. On the downside, spreads can be high for some products. For more information, read our review of eToro in the Netherlands.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Interactive Brokers at a glance

Founded in 1978 and publicly listed in NASDAQ (ticker: IBKR), Interactive Brokers is a global online broker that has surpassed major financial crises, showing resilience and a rigorous risk management process.

Interactive Brokers offers an advanced investment platform that includes a wide range of products (stocks, options, mutual funds, ETFs, cryptocurrencies, futures, bonds, and currencies) from 150 markets, solid trade execution (Smart routing), and a set of technical and fundamental tools to help you in your investment decisions.

Beginners and intermediate investors have educational tools to explore, but the learning curve will be steep. That´s why we mainly endorse it to more advanced traders. Besides, customer service gives crystal clear answers to your doubts, so there is no need to go back and forth.

On the downside, Interactive Brokers’ fee structure is quite complex, the registration process is lengthy but fully online, and the broker doesn’t offer commission-free trading. However, when considering FX fees, narrower spreads, and the stock loan program, Interactive Brokers’ clients still get significant savings compared to most brokers.

Interactive Brokers also launched IBKR GlobalTrader, a modern mobile trading app to trade stocks, options and ETFs, ideal for beginner investors. Some of the features of IBKR GlobalTrader include automatic currency conversions, fractional shares, demo account, and more.

Want to know more about Interactive Brokers? Check our Interactive Brokers Review.

Plus500 at a glance

82% of retail CFD accounts lose money.

Founded in 2008, Plus500 is an online broker offering various financial products, including real shares (on Plus500 Invest) and CFDs on Forex, Cryptocurrencies, Stocks, Commodities, ETFs, Options, and Indices. It is available in over 50 countries and is listed on the London Stock Exchange (ticker: PLUS).

There are two distinct account types:

- Plus500 CFD: It only focuses on CFD products;

- Plus500 Invest: Where you can trade stocks (real shares);

The web platform you will use is the WebTrader, Plus500’s proprietary platform, offering a stable trading experience and reliable access from multiple devices, including a mobile app. All platforms are accessible and responsive, and you can start testing the features by opening a demo account.

Their customer support is helpful and readily assessed through a chat that is always shown on the trading platform. Their spreads are low, offering accounts in sixteen currencies, including USD, EUR, and GBP. Still, they charge a 0.70% currency conversion fee and a $10 monthly fee following three months with no activity. On Plus500 Invest, they only charge a small commission per trade (US market: $0.006/share).

Finally, it is regulated by several financial regulators like the FCA and CySEC, meaning that Plus500 is appropriately supervised and that there is an investor protection scheme under the entity you open an account. For instance, If you open an account as a European investor through Plus500CY Ltd, you are protected up to €20,000 (in the UK, the protection is up to £85,000). Additionally, Plus500 provides negative balance protection for CFD trading on a per-account basis.

Want to know more about Plus500? Check our Plus500 Review.

BUX at a glance

BUX is an online broker launched in 2019 that has positioned itself as an affordable way for Europeans to increase their savings. It brings a simple and elegant way to start investing.

It allows users to trade US and EU stocks (Dutch, German, Belgian, French, and Austrian) and 30+ ETFs, completely commission-free. New users will also benefit from one free share worth up to €200 (terms available on P.30 of the BUX Client Agreement). You also have access to fractional investing, making it easy to invest in companies with big share prices (Amazon, Tesla, Alphabet,…) starting for as little as €10.

In addition, crypto trading is also available for free! Investors can trade Bitcoin, Ethereum, Litecoin, among other cryptocurrencies.

Another great point for BUX is that it is very transparent: it has no hidden fees, and if you want to benefit from more premium services such as market or limit orders, it’ll cost you €1 (all of that is available in the pricing page).

On the downside, the only place to trade is its mobile app (no desktop or web trading platform available), the products available are limited and it has no demo account.

BUX is regulated by the Dutch Authority for Financial Markets (Autoriteit Financiële Markten – AFM). If you want to learn more, check out our BUX Review.

DEGIRO at a glance

Investing involves risk of loss.

Founded in 2013, DEGIRO is a low-cost brokerage firm that has become very popular due to its low rates! With over 3 million users, the innovative platform has become widely known for its “do-it-yourself” philosophy in that you have everything at your disposal to start investing on your own. It offers a wide range of financial assets to trade, including stocks, ETFs, bonds, options, futures contracts, warrants, investment funds, and some leveraged products (not quite the same as CFDs. More info here).

For instance, you can trade some ETFs for free (a €1.00 flat handling fee – external costs – still apply) with no minimum amount required. The web trading platform is basic, but it is efficient and straightforward to use. In a matter of minutes, you get used to it. The same applies to its mobile app. On the downside, there is an absence of any significant fundamental research, a €2.50 connectivity fee applies, and pricing alerts are missing.

Regarding security, DEGIRO is the Dutch branch of flatexDEGIRO Bank AG (a German-regulated bank). In the unlikely event that the segregated assets cannot be returned to clients, DEGIRO falls under the German Investor Compensation Scheme, which compensates any losses from non-returned assets up to 90% (with a maximum of €20,000), so do bear this in mind if you are planning to invest much larger volumes. Furthermore, any money deposited on a DEGIRO Cash Account with flatexDEGIRO Bank AG will be guaranteed up to an amount of €100,000 under the German Deposit Guarantee Scheme.

Still any doubts? Go through our DEGIRO Review!

Which platform should you choose?

Some factors you should know when choosing an online broker are the fees charged, if it is regulated by top-tier institutions such as the FCA in the UK, BaFin in Germany, AMF in France, or AFM in the Netherlands, the range of products it allows you to trade (not all platforms allow you to trade EU stocks), among others.

The best online broker in your specific case will depend on your profile, preference, and objectives. Explore the websites above and decide for yourself!

A reminder that the above should not be seen as investment advice and should be considered information only. Investors should do their own research and due diligence about the services and opportunities best suited for their risk, returns, and impact strategy.

Other FAQs about Robinhood

How exactly does Robinhood make money?

The online broker earns money from interest earned on customers’ cash balances (money in your account not invested), by selling order information to third parties (high-frequency traders, for instance), and margin lending.

Regarding the selling of orders, the US Securities and Exchange Commission (SEC) is still investigating Robinhood for not fully disclosing its practice of selling clients’ orders to high-speed trading firms.

Until October 2018, Robinhood would not clearly state that it was receiving payments for order flows. By law, any financial company must reveal all the material facts an investor would want to know before making any investment decision.