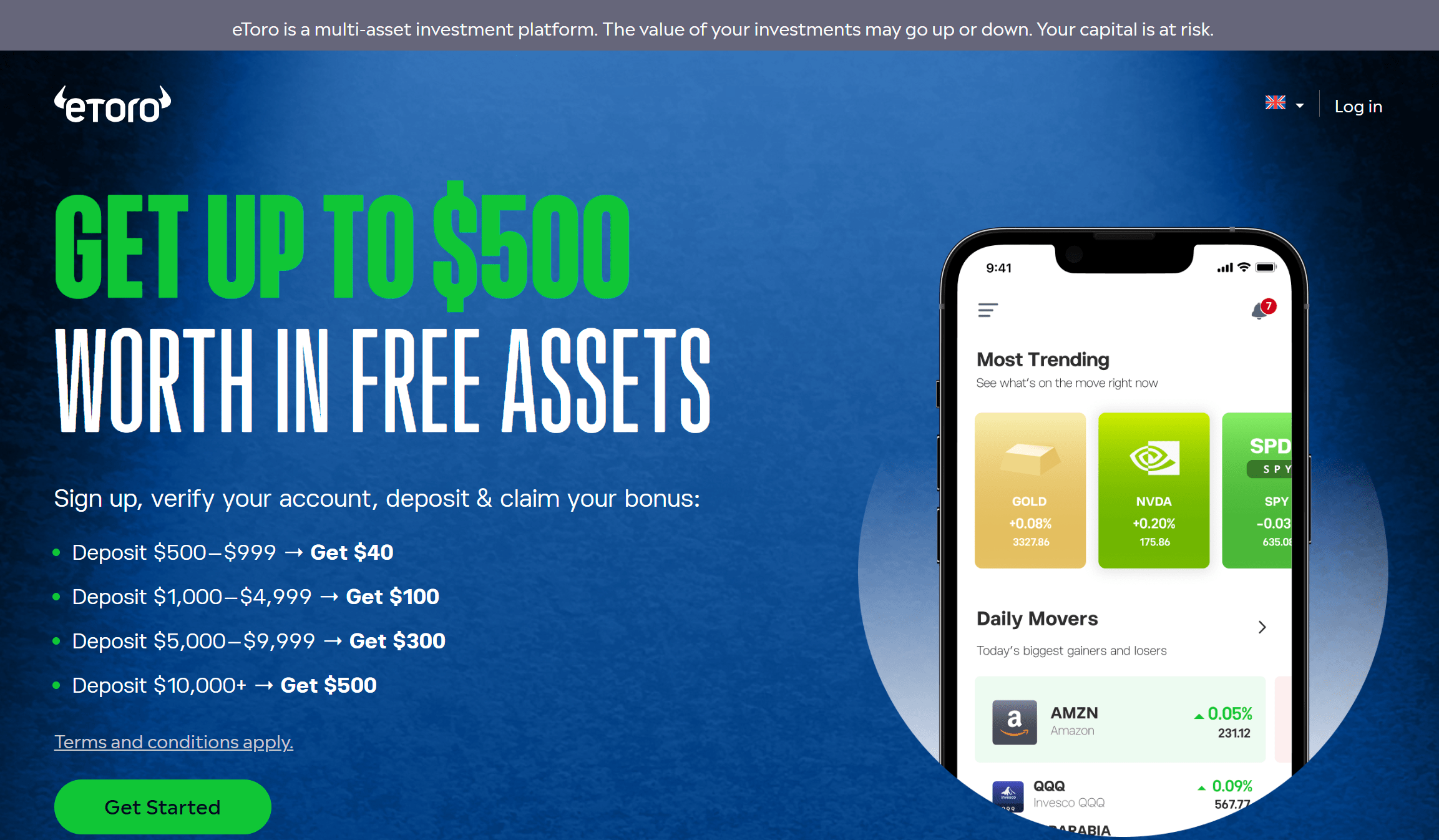

eToro free asset: from $40 to $500

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

As part of its marketing strategy, eToro promotes its trading app by giving you a free asset (or share) worth between $40 to $500, just by signing up and depositing more than $500:

Video summary

Want to see how it works in video? Check our in-depth video guide:

Other free share promotions

| Referral link | Bonus promotion | Terms and conditions |

| Freedom24 | Up to 20 free shares | Freedom24 bonus details |

| Trading 212 | 1 free fractional share up to €100 | Trading 212 bonus details |

| Lightyear | 1 free fractional share up to €100 | Lightyear bonus details |

| Interactive Brokers | Up to $1,000 of free IBKR stock | IBKR free share details |

| Mintos | Up to €200 | Mintos bonus details |

| Webull | Up to £3,000 | Webull UK bonus details |

| Freetrade | 1 share worth up to £100 | Freetrade free share details |

Explore our Broker Bonus tool to get to know even more investment platforms that offer signup bonuses, filtered by country.

When can I sell my eToro free asset?

Once the bonus asset is credited to your account, you are free to sell it like any other asset on the platform.

However, there are important conditions before you can sell it:

- You must make a first-time deposit that meets the required thresholds (e.g., deposit of $500).

- This first deposit must remain in your account for at least 90 days. If you withdraw it earlier, you lose eligibility for the Welcome Bonus.

In short: You can sell your free eToro stock or crypto once it has been credited to your account, but you must keep your qualifying deposit untouched for 90 days to stay eligible for the bonus. After that, the free asset is yours to trade or sell as you wish.

Where is the eToro free asset program available?

The eToro Welcome Bonus program is available in the European countries where eToro operates.

These include:

- Austria

- Belgium

- Croatia

- Republic of Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

And the list goes on!

Nonetheless, due to regulation, eToro cannot accept clients from the United States and Canada.

Is eToro regulated?

Yes, it is! The regulation applicable to you will depend on your country. For example, as a German resident (or any European country), you will open an account through eToro (Europe) Ltd, which is regulated by the Cyprus Securities and Exchange Commission (CySEC).

This is the full list of regulatory bodies that directly supervise eToro:

| Company | Regulator | Supported Countries | Investment Protection |

| eToro (UK) Ltd | Financial Conduct Authority (FCA) | United Kingdom | Up to £85,000 per person under the Financial Services Compensation Scheme (FSCS) |

| eToro (Europe) Ltd | Cyprus Securities and Exchange Commission (CySEC) | European Union countries (except where otherwise restricted) | Up to €20,000 per person under the Investor Compensation Fund (ICF) |

| eToro (Aus) Capital Ltd | Australian Securities and Investments Commission (ASIC) | Australia | Not applicable |

| eToro (ME) Ltd | Financial Services Regulatory Authority of the Abu Dhabi Global Market (FSRA) | Middle East countries (e.g., UAE, Bahrain, Kuwait, Oman, Qatar) | Not applicable |

Bottom line

We always applaud platforms that create win-win agreements: You are satisfied with the platform, recommend it to your friends and family, and everyone wins.

Some brokers demand that you deposit a certain amount, and others want you to trade a specific volume before giving access to your fractional share. eToro is plain simple. Just sign up, deposit $500 or more, and get a free asset.

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results. Other fees may apply. See terms and fees.

eToro free asset FAQs

How good is eToro as a brokerage?

If you want to know more about eToro, check our eToro review.

Where is eToro available?

eToro is available globally, however, this promotion only applies to European countries.

Will my eToro asset be subject to tax when I sell it?

Most likely, yes. Please contact a tax advisor who can inform you about the appropriate tax treatment for this promotion.

Why do companies give free fractional shares?

Companies give free fractional shares to incentivize referrals and grow their customer base.

Are there other trading apps offering free fractional shares?

Yes, other trading apps with free bonuses include Trading 212, Freedom24, and others.