Are you confused about whether to choose Revolut Trading vs Trade Republic as a broker for your investing needs?

In this side-by-side comparison, we analyse Revolut Trading vs Trade Republic to help you understand how these apps compare on some of the most common features and make a better-informed decision about the best broker for you.

Below, you’ll find the pros and cons of each broker, as well as a comparison table that features the different fees charged, the financial instruments supported, the regulation, and more. Keep reading!

Revolut Trading vs Trade Republic

- Revolut Trading is best for beginner investors looking for quick exposure to US stocks. Combines everyday banking with trading, making it convenient if you want an all-in-one app.

- Trade Republic is best for interest and creating savings plans with stocks/ETFs

Both brokers are low-cost, and offer a convenient way to invest through a user-friendly app.

If you’re serious about investing, then we would recommend Trade Republic, since this company is focused only on investing, while Revolut is more focused on digital banking.

If you only want quick exposure to the most popular ETFs or stocks, then Revolut is a great alternative as well. It combines everyday banking with trading, making it convenient if you want an all-in-one app.

Side-by-side comparison

| Category | Revolut Trading | Trade Republic |

| Demo account | No | No |

| Account minimum | $0 | €0 |

| Interest on uninvested cash (annually) | Revolut US: Up to 3% in USD; Revolut International: Up to ~2.26% in EUR (differs by account plan and country) | EUR: 2.00% |

| US stocks fees | One free trade per monthAfterwards, it varies according to your country of residency. | €/$/£0+ €1 settlement fee per trade |

| EU stock fees | One free trade per monthAfterwards, it varies according to your country of residency. | €/$/£0+ €1 settlement fee per trade |

| ETFs | One free trade per monthAfterwards, it varies according to your country of residency. | €/$/£0+ €1 settlement fee per trade |

| Currency conversion fee | 0% up to €/£1,000 per month; 0.40% above the €/£1,000 of free allowance | 0% |

| Regulators | SEC, FCA (as an AR), Bank of Lithuania | BaFin |

About Revolut Trading

Revolut was created to disrupt the banking industry by reducing and removing fees associated with the traditional banking system.

It also offers other financial services, namely the possibility of buying US stocks, cryptocurrencies, and precious metals (Gold and Silver).

The quick access to investment products, combined with low commissions, remains the most engaging differential that enables Revolut to stand out from its competitors.

Revolut Trading pros and cons

Pros

- Simple trading platform

- Easy account opening process

- At least, one free trade per month

- Low trading commissions

- No inactivity fee

Cons

- Limited range of investment instruments

- Investments not covered by the Financial Services Compensation Scheme

About Trade Republic

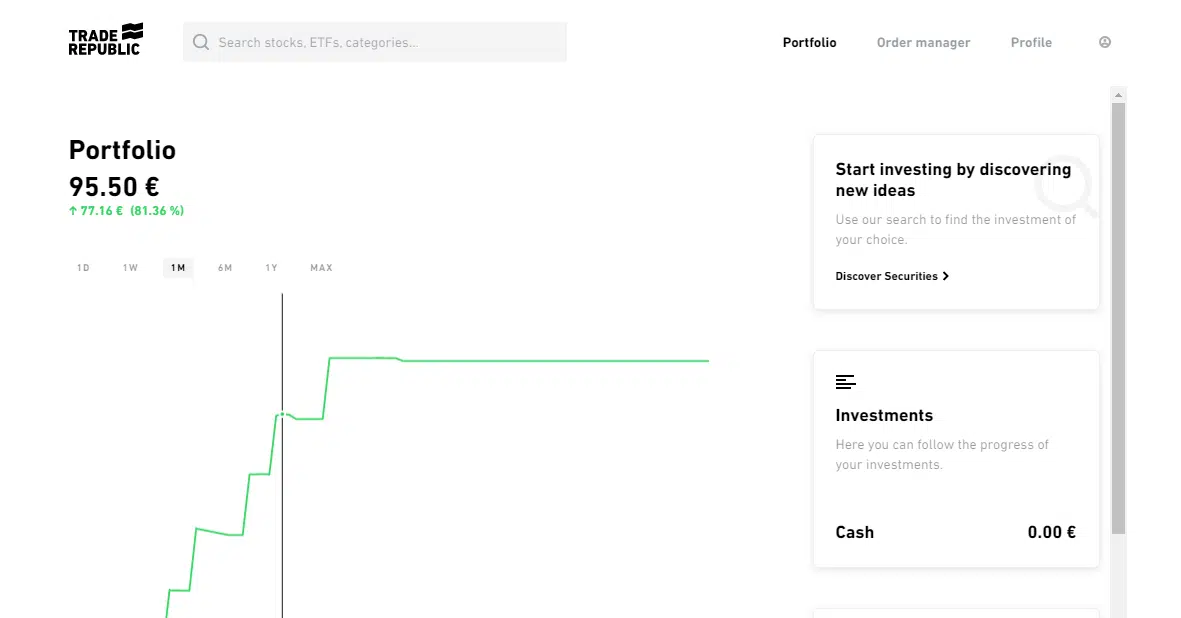

Trade Republic is a discount broker based in Berlin, Germany. It focuses on four types of financial assets: stocks, ETFs, cryptocurrencies, and derivatives.

It uses the motto “From the people, for the people” to express its commitment to its customer by selling itself as a “no order fee” platform.

Nonetheless, a €1 external fee is applied in every single trade (Except saving plans), meaning that in practice, you will charge at least €2 (€1 for buying and another €1 for selling).

Trade Republic pros and cons

Pros

- Automatic saving plans

- Interest paid in idle cash balances

- Invest from only €1

- No minimum deposit

- Direct debit in the share-saving plans

- Supervised and regulated by a top-tier regulator

- Has a banking license - deposits are protected by deposit guarantee scheme

Cons

- €1 flat external fee in every single trade (Except saving plans)

- No demo account

- Only one base currency (EUR), except in Poland where it accepts Zloty.

- No direct access to US Stock Exchanges - you might not be able to buy some popular US-listed companies, such as Reddit

- Currency conversion fees apply

- Engages in PFOF - Payment for Order Flow

Interest & deposit protection

Revolut

As an EU-licensed bank (in most European countries), Revolut typically covers eligible deposits under the local deposit guarantee scheme (e.g., up to €100,000 in the EEA).

Specific coverage may vary depending on your country of residence and the exact Revolut entity you use.

Revolut often provides interest via savings “vaults” or specific interest-bearing accounts.

If these accounts are classified as bank deposits, they are usually covered by the deposit guarantee scheme.

If Revolut offers investment products or money market funds, those are not covered by deposit insurance (they’re investment products, not insured bank deposits).

Want to know more? Check out our separate article explaining Revolut’s interest offer.

Trade Republic

Trade Republic partners with a German bank to hold your uninvested cash, typically protected under the German deposit guarantee scheme (up to €100,000).

However, if you opt into money market fund-style products for your idle cash (for example, certain “Cash” features), those funds are considered investments and are not protected by deposit insurance.

Some uninvested cash might earn interest if it’s kept in a protected deposit.

If the interest offer comes via a money market fund, you gain potential higher returns but lose deposit guarantee protection because it’s an investment product rather than a bank deposit.

Want to know more? Check our separate article explaining Trade Republic’s savings account.

How to invest in the S&P 500 on Revolut and Trade Republic

Want to learn how to invest in the S&P 500 on both Revolut, as well as Trade Republic?

Check our step-by-step videos below.

It might also help you decide which app is more user-friendly and how you feel about each broker:

Trade Republic vs Revolut Trading: our veredict

Revolut Trading

Best for beginner investors looking for quick exposure to US stocksTrade Republic

Best for beginners and creating savings plans with stocks/ETFs

Choosing between these two online brokers isn’t always an obvious decision. The differences between Revolut Trading vs Trade Republic come from the trading platforms, products, fees, and security. Do you prefer a primary trading platform? Do you want to invest in ETFs only? Do you value security more?

Ultimately, the best online broker for you will depend on your profile, personal preferences, and objectives. Explore the websites above and decide for yourself!

Want to know more about Revolut Trading vs Trade Republic? Explore our in-depth broker reviews, comparison table, and BrokerMatch tool.