According to the 2023 annual report, Revolut is trusted by 45 million and has $22B+ in customer accounts.

It has gathered a massive audience that now has access to interest on uninvested cash in three currencies: EUR, USD, and GBP.

Revolut calls this service “Savings”, and, in this article, we will take a deep dive into how you earn this interest, where it comes from, the risks involved and more!

Key points

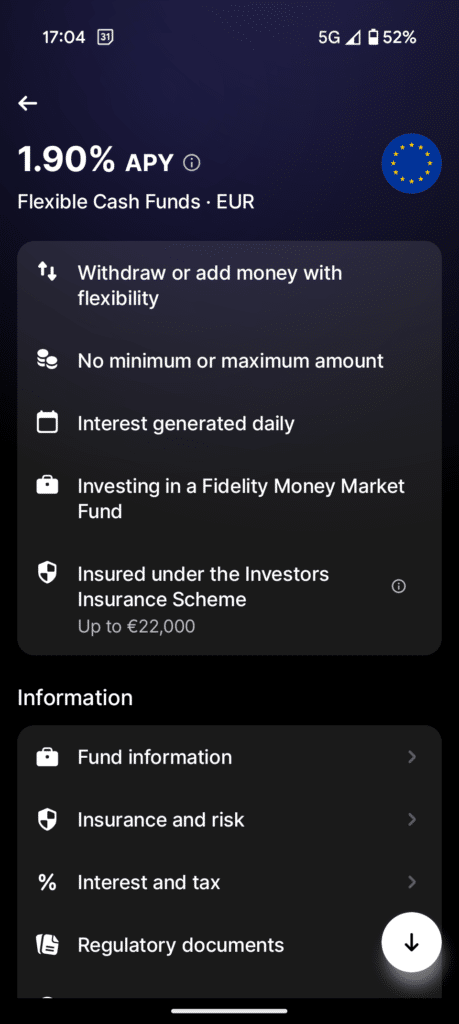

- No minimum or maximum amount;

- Deposit or withdraw money at any time;

- You are investing in a Fidelity Money Market Fund;

- You can set recurring transfers to your savings every day, week, or month;

- Insured under the Lithuanian Investors Insurance Scheme up to €22,000;

- Revolut is not a bank, so it is not covered by the European deposit guarantee scheme up to 100,000€;

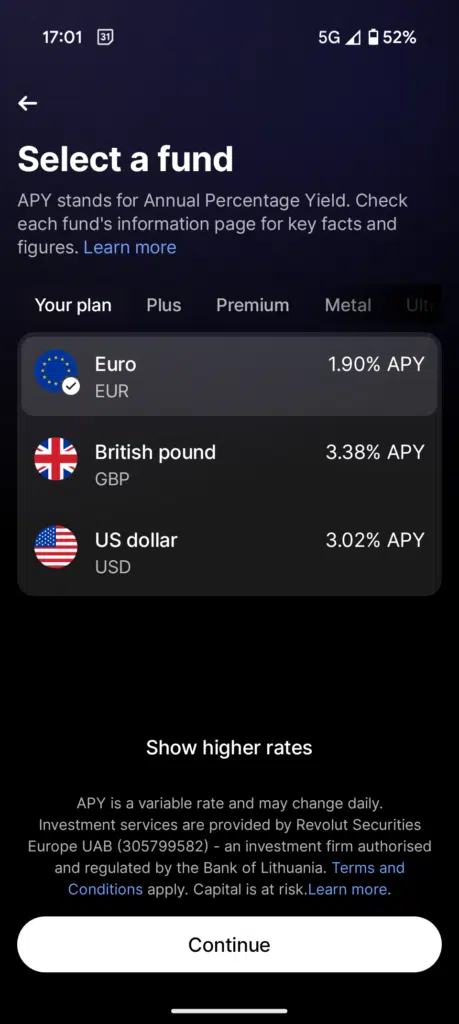

- Rates vary according to your plan. The free version (“standard”) offers an annual percentage yield (APY) of 1.90% in EUR, 3.38% in GBP and 3.02% in USD, as of March 2025;

- Rates also vary according to market conditions but are compounding.

What is “Savings”?

There are several reasons to use Revolut: to exchange money between different currencies, as a cash management app and to invest. All of these have a common denominator: there will always be some cash not in use, also known as “uninvested cash”.

“Savings” is a feature that lets you earn interest on that cash, whether your cash balance is €1 or €1,000,000. So, you can always have your money working for you.

What are the interest rates offered?

The rates vary according to your plan and market conditions. As of March 2025, these were the rates per currency:

| Currency/plan | Standard (Free) | Plus (€3.99/month) | Premium (€8.99/month) | Metal (€15.99/month) | Ultra (€50/month) |

| EUR | 1.90% | 2.05% | 2.50% | 2.65% | 2.75% |

| USD | 3.02% | 3.27% | 3.77% | 4.02% | 4.37% |

| GBP | 3.38% | 3.63% | 4.13% | 4.38% | 4.53% |

How does Revolut offer such rates?

Revolut can offer those rates because it invests in Money Market Funds (MMFs). MMFs are funds that invest in low-risk, short-term debt securities, such as government bonds, and aim to maintain stable share prices.

Money market funds are widely used by institutional investors, such as pension funds, insurance funds, and banks. In Europe, 1.4 trillion euros are invested in those financial vehicles.

The MMF used by Revolut for EUR cash (example) is the Fidelity Funds – Euro Cash Fund Class R Flex Distributing Shares:

This fund is currently yielding a 3.03% return in EUR. Since Revolut only pays 1.90% in the “Standard” account, the +1% difference can be considered a fee charged by Revolut. This charge is not explicitly mentioned by Revolut.

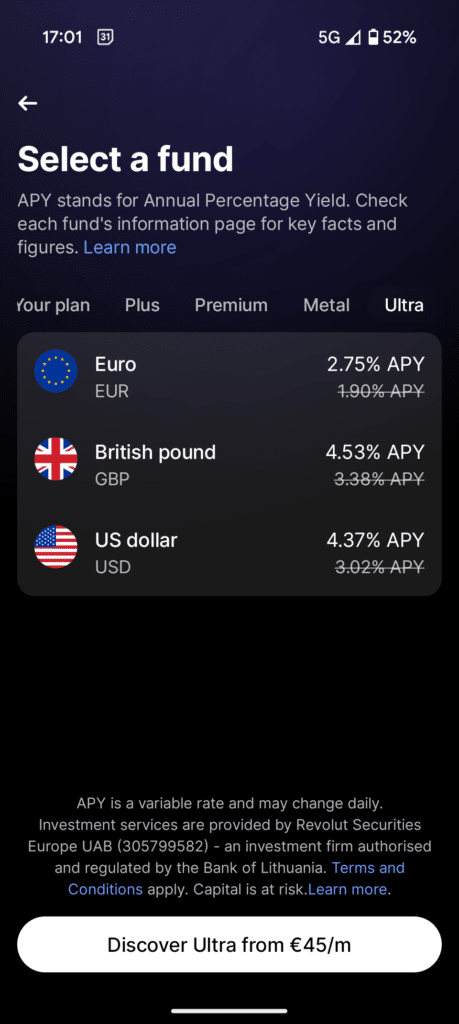

If you want to get the highest return offered by Revolut (2.75% in EUR), you would need to get the “Ultra” plan which costs €50 per month. It would only compensate for high investment amounts.

Is it safe?

Again, you are investing in low-risk bonds. To be precise, these are the holdings of the Fidelity MMF:

The credit quality is pretty good, and most bonds have a maturity of less than 90 days.

Besides, if something happens to Revolut (bankruptcy, for example), any amount in Savings is insured under the Lithuanian investors’ insurance scheme up to €22,000 (per investor). Please note that this protection doesn’t apply to investment losses.

Furthermore, the savings account is not covered by the European deposit guarantee scheme, so you might find other alternatives with a higher protection amount (explored below).

Pros and cons of the Revolut savings account

Pros:

- Competitive interest rates: Revolut offers attractive interest rates on its savings accounts, higher compared to traditional banks;

- Compounding rates: You earn interest on interest already earned;

- Easy account management: The Revolut app is user-friendly, allowing users to manage their savings accounts seamlessly from their smartphones.

- No minimum (or maximum) balance requirements: Revolut savings accounts do not require a minimum balance, making them accessible to a wider range of users.

- Integration with other Revolut services: Savings accounts are well-integrated with Revolut’s other financial services, such as budgeting tools, spending analytics, and investing.

Cons:

- Variable interest rates: Not really a “con”, but Interest rates can be variable and subject to change, which might affect the stability of earning;

- Limited availability: Revolut’s savings accounts might not be available in all regions or countries, limiting accessibility for some users;

- Not covered by the deposit guarantee scheme.

How can I activate this service?

In the Revolut app, in your “Home” tab, you scroll down until you see “Savings”:

Then, you will be presented with the rates for your account plan. Mine is “Standard”, so these are the rates – as of March 2025:

If you scroll right on the account plans and go to “Ultra”, you will find the highest rates for each currency:

I proceeded with the “Standard” plan, and after tapping “continue”, I was presented with the final details of the money market fund I was about to invest:

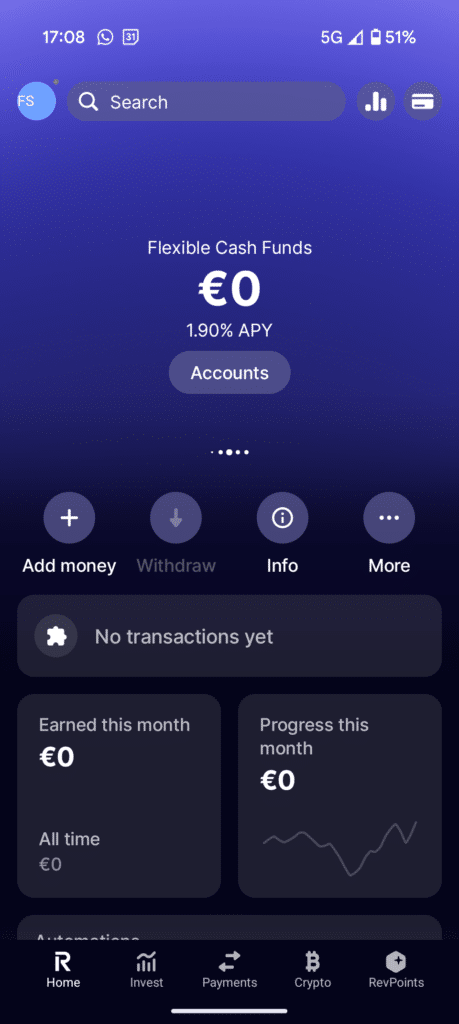

After everything is set, you will be presented with the following “Flexible Cash Funds” page:

Please note that I set up this account for EUR. If you want a similar account in GBP or USD, you will need to go through the same process, but instead of choosing EUR, choose the other currencies.

Revolut Savings alternatives

Bottom line

The Revolut savings account offers a modern, digital-first approach to saving, featuring competitive interest rates, ease of use, and seamless integration with Revolut’s comprehensive financial ecosystem. It stands out for its quick setup and no minimum balance requirements.

Overall, the Revolut savings account is an excellent option for tech-savvy individuals seeking a convenient and cost-effective way to manage their savings, but it may not be suitable for those who prefer a wide range of investment products or need extensive customer support.