Hello, investor! Are you trying to decide between Freetrade and Trading 212 for your investment needs? This article will guide you through a detailed, side-by-side comparison to help you make the best choice.

In this analysis, we’ll explore how Freetrade and Trading 212 stack up against each other in key areas like features, fees, supported financial instruments, and regulations. By the end, you’ll have a clear understanding of which broker aligns better with your investment strategy.

Below, you’ll find a comparison table and a breakdown of each platform’s pros and cons, highlighting the key differences. Let’s dive in!

Freetrade vs Trading 212

- Trading 212: Best for beginners seeking commission-free trading, fractional shares, cheap ISA, and interest on uninvested cash.

- Freetrade: Ideal for long-term investors who don’t mind paying a monthly fee and looking for a simple, commission-free platform with tax-efficient ISA and SIPP options.

Comparison

| Category | Trading 212 | Freetrade |

| Demo account | Yes | No |

| Account minimum | €/$/£0 | £0 |

| Interest on uninvested cash (annually) | GBP: up to 4.1% USD: up to 4.1% EUR: up to 2.2% |

GBP: up to 5.0%Up to £3k uninvested cash (with paid plan) |

| US, EU & UK stock fees | €/£0 | £0 |

| ETFs fees | €/£0 | £0 |

| Currency conversion fee | 0.15% | 0.39% (Plus plan) 0.59% (Standard plan) 0.99% (Basic plan) |

| Regulators | FCA, CySEC, and FSC | FCA |

| SIPP | No | Yes |

| ISA | Yes | Yes |

Want to see a more in-depth comparison? Check the full comparison of Freetrade vs Trading 212 in our broker comparison tool.

About Trading 212

Trading 212 is a fintech company based in London that aims to democratize the entire investment process through a simple web and mobile application.

The company supports more than 4.5 million registered users to invest in over 10,000 stocks and ETFs, Forex, commodities, CFDs, and cryptocurrencies. An interesting fact is that your shares are held in a pooled account at Interactive Brokers, commonly known as an omnibus account. For more information, you can visit the Trading 212 website.

Additionally, it offers an attractive interest rate on uninvested cash. For more details, you can explore how the Trading 212 interest on uninvested cash works.

You will find commission-free stocks and ETFs trading, fractional shares, and even an automatic investment system through Trading 212 AutoInvest. New users can also receive a free fractional share worth up to £/€100 by signing up with the Trading 212 promo code: IITW.

On the downside, Trading 212 has some limitations in terms of available investment products, focusing mainly on stocks, ETFs, and CFDs. If you’re looking for other asset classes like bonds, options, or futures, you might find the platform lacking.

For UK residents, Trading 212 offers a competitive ISA (investment savings account), with no monthly fees, but it lacks personal pensions (SIPP).

Interested in learning more about Trading 212? Read our Trading 212 Review.

Trading 212 pros and cons

Pros

- Commission-free Real Stocks and ETFs trading (other fees may apply. See terms and fees)

- AutoInvest & Pies feature

- Fast and easy account opening process

- Demo account

- Top Tier Regulators

- Free fractional shares worth up to €100

- High interest on uninvested cash

Cons

- Limited product portfolio (no Options, Bonds, Mutual Funds or Futures)

- No relevant Fundamental tools

- 0.15% of Foreign exchange fees

About Freetrade

Freetrade is a UK-based fintech company that focuses on simplifying the investment process through an easy-to-use mobile application.

The platform has gained over 1 million users and offers access to a wide range of investment options, including over 6,000 stocks and ETFs across the UK, US, and European markets. Freetrade operates with an emphasis on transparency, and all shares are held in individual, segregated accounts, ensuring the safety of your investments. For more details, you can visit the Freetrade website.

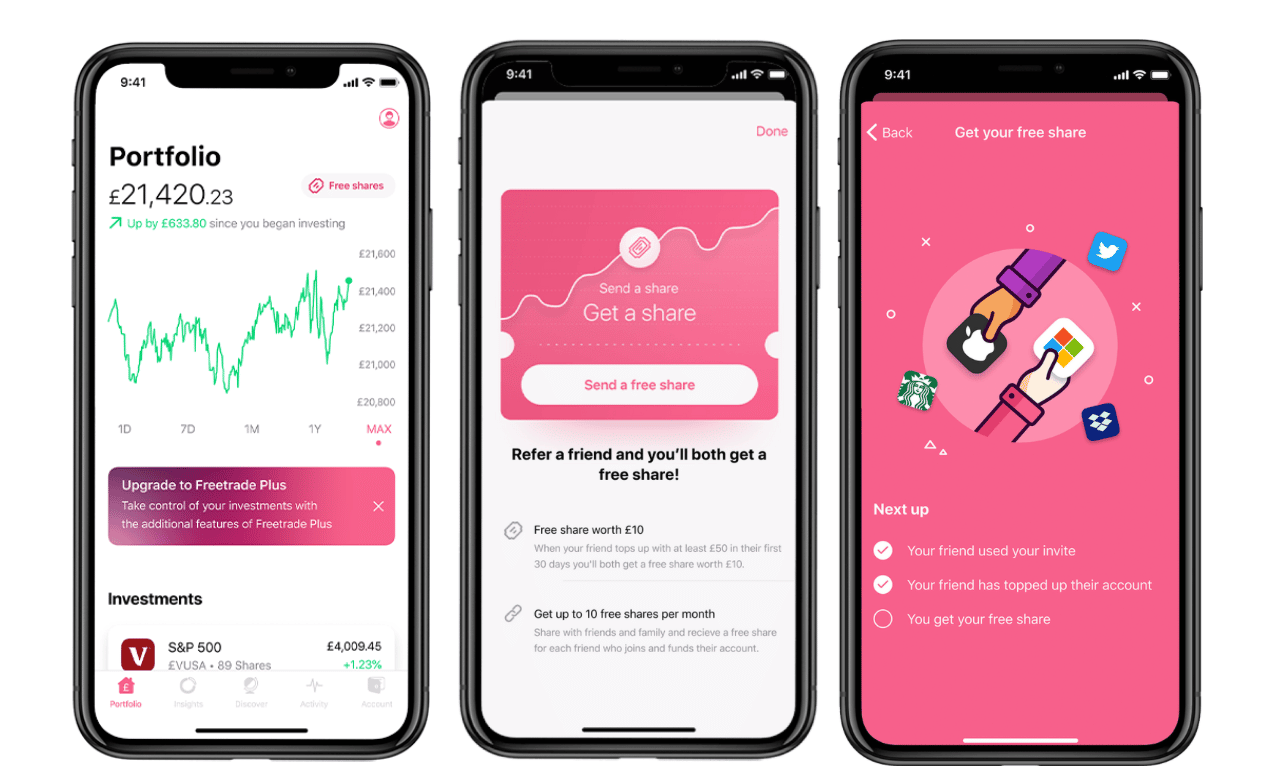

Freetrade also offers tax-efficient investing through its ISA (Individual Savings Account) option, available with a paid Freetrade Plus subscription. You will find commission-free trading for stocks and ETFs, as well as the ability to invest in fractional shares. New users can also receive a free fractional share worth up to £100 by signing up with this Freetrade referral link.

On the downside, Freetrade has a somewhat limited range of investment products, focusing primarily on stocks, ETFs, REITs, and investment trusts.

If you’re looking for more asset classes, like bonds, forex, or cryptocurrencies, this platform may not meet your needs. Additionally, some advanced features are only available with the paid Freetrade Plus account.

Freetrade offers both ISA and SIPP accounts for UK residents.

Interested in learning more about Freetrade? Check out our Freetrade Review where we have conducted a full analysis of the platform.

Freetrade pros and cons

Pros

- Free stock and ETF trading

- GIA, ISA, and SIPP

- No inactivity, account, or withdrawal fees

- No minimum deposit

- Great community (forum) – where users share ideas and learn about investing

- Nice and user-friendly app

Cons

- Limited asset classes (only stocks, ETFs, REITs, and investment trusts)

- Limited research and education

- Graphs and portfolio tracking still need some development

- No phone support – however, live chat support is very fast and efficient

Fees & commissions

| Fee structure | Trading 212 | Freetrade |

| Stocks (US, EU, and UK) | £/€0 | Commission-free (other fees apply) |

| ETFs | £/€0 | Commission-free (other fees apply) |

| Cryptocurrencies | 1.5% fee (CFDs only) | Not applicable |

| Currency conversion fee | 0.15% | 0.39% (Plus plan) 0.59% (Standard plan) 0.99% (Basic plan) |

| Spreads | From 0.7 pips (Forex) | Not applicable |

| Social trading | No extra fees | Not applicable |

| Withdrawal fees | £/€0 | £0 |

| Inactivity Fee | £/€0 | £0 |

| ISA monthly fee | £/€0 | £4.99/month (on basic plan) |

| SIPP monthly fee | Not applicable | £11.99 per month (on plus plan) |

Trading 212 offers a commission-free structure ideal for beginner investors and those looking for interest on uninvested cash, but it lacks advanced investment products like bonds and options. It also offers an ISA with no monthly fees.

Freetrade, on the other hand, is tailored for long-term investors seeking a simple platform with tax-efficient ISA and SIPP options, though higher currency conversion fees and monthly fees can be a downside for investors.

Investment products

| Investment products | Trading 212 | Freetrade |

| Stocks | ✔ Available (real and CFDs) | ✔ Available (real only) |

| ETFs | ✔ Available (real and CFDs) | ✔ Available (real only) |

| Bonds | ✘ Not available | ✘ Not available |

| Cryptocurrencies | ✔ 20+ cryptos (CFDs only) | ✘ Not available |

| Forex | ✔ 180+ currency pairs (CFDs only) | ✘ Not available |

| Commodities | ✔ 45+ commodities (CFDs only) | ✘ Not available |

| REITs | ✔ Available | ✔ Available |

Trading 212 offers a wide range of assets, including over 9,000 stocks and ETFs, alongside cryptocurrencies and CFDs, making it ideal for active traders seeking access to a variety of asset classes. However, it does not provide access to bonds or options trading.

Freetrade, on the other hand, focuses on long-term investing, offering over 6,000 real stocks, ETFs, and REITs with commission-free trading. While it’s a strong choice for stock investors, it lacks exposure to cryptocurrencies, forex, commodities, bonds, or options.

Account types

| Account types | Trading 212 | Freetrade |

| Invest account (GIA) | ✔ Available (commission-free trading) | ✔ Available (commission-free trading) |

| ISA account | ✔ Available (no platform fees) | ✔ Available (£4.99/month) |

| CFD account | ✔ Available | ✘ Not available |

| SIPP account | ✘ Not available | ✔ Available (£9.99/month or part of Plus Plan) |

| Junior ISA account | ✘ Not available | ✘ Not available |

| Demo account | ✔ Available | ✘ Not available |

Trading 212 offers a broader range of accounts, including commission-free CFD and demo accounts, while Freetrade focuses on long-term investing with ISA and SIPP accounts, though it lacks a demo option.

Safety

| Aspect | Trading 212 | Freetrade |

| Regulatory Authorities | FCA, CySEC, BaFin, ASIC | FCA |

| Investor protection | Up to €20,000 (EU clients) Up to £85,000 (UK clients) |

Up to £85,000 (UK clients) |

| Private insurance | Yes, additional insurance of up to €1 million (EU clients) | ✘ |

| Asset segregation | ✔ | ✔ |

| Negative balance protection | ✔ | Not applicable |

| Licenses | Multiple jurisdictions | UK jurisdiction |

| Listed on exchange | ✘ | ✘ |

| Transparency | Average | Average |

Both Trading 212 and Freetrade offer strong regulatory protection and segregate client funds.

Trading 212 adds extra security with private insurance up to €1 million for EU clients and includes negative balance protection for leveraged trading.

Freetrade, focusing on non-leveraged investments like stocks and ETFs, doesn’t require these features. Neither platform is listed on a stock exchange, meaning they face less public scrutiny compared to publicly listed brokers.

Trading platforms

| Feature | Trading 212 | Freetrade |

| Platforms | Trading 212 web, mobile app | Freetrade mobile app only |

| User experience | Extremely user-friendly | Beginner-friendly, intuitive |

| Tools/indicators | Basic, but adequate | Limited to basic market data and research |

| Charting | Basic to intermediate | Limited, no advanced charting tools available |

Customer support

Trading 212

Trading 212 provides support through email, live chat, and a comprehensive FAQ section, available in multiple languages.

Freetrade

Freetrade offers support via email and in-app messaging. While there is no live chat or phone support, users can access a detailed FAQ section. Responses are typically provided within 1-2 business days.

Freetrade vs Trading 212: Final verdict

Trading 212

Best overallFreetrade

Best for beginner investors who don’t mind paying a monthly fee, and those looking for a simple, UK-focused platform, especially with tax-efficient ISA and SIPP options in the UK

Choosing between Freetrade and Trading 212 can be challenging. Here’s a breakdown to help you decide:

Do you prefer a simple, user-friendly investment app, with no monthly fees, and earning interest on uninvested cash? If so, Trading 212 is your best bet. It’s designed for beginners and those who want a straightforward platform to invest in stocks, ETFs, and more, all with commission-free trading and attractive interest rates on uninvested cash.

Or are you a long-term investor looking for a platform that offers commission-free investing with simple access to stocks, ETFs, ISAs, and SIPPs, and don’t mind paying a monthly fee? If so, Freetrade is the right choice. It’s perfect for those focused on building a diversified portfolio with tax-efficient ISA options and SIPP accounts for retirement planning, offering straightforward features for long-term investors. On the downside, most features are only available in the paid plan.

And remember, if you decide to go with Trading 212, you can benefit from a free fractional share worth up to £/€100 by signing up with the Trading 212 promo code IITW. On the other hand, if Freetrade aligns better with your investment goals, you can also receive a free fractional share worth up to £100 by signing up with this Freetrade referral link.

Want to learn more about other brokers? Check out our in-depth broker reviews, comparison table, and BrokerMatch tool to find the best option for you!