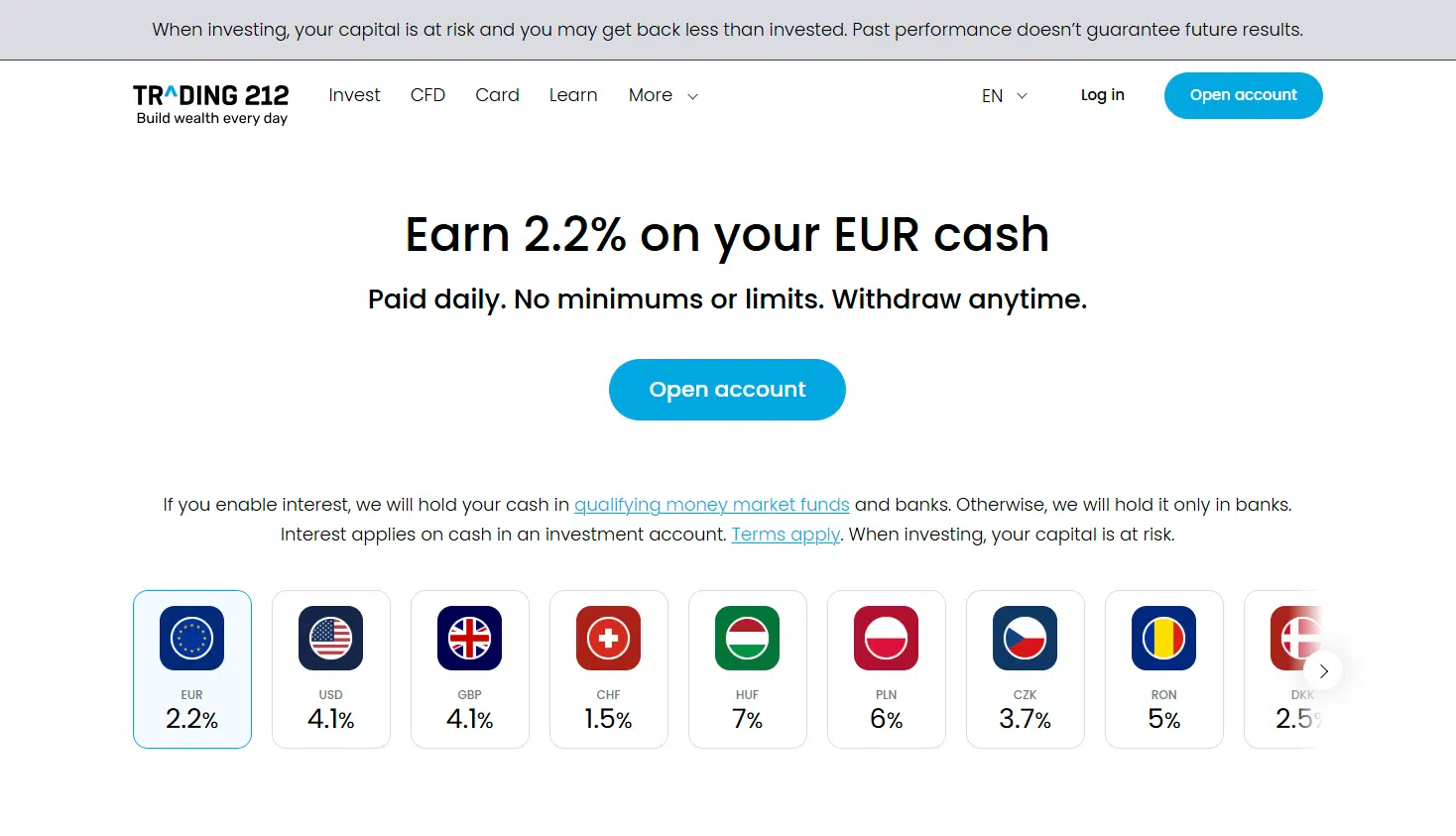

Trading 212 is one of many brokers paying interest on invested cash (thirteen currencies), including EUR (2.20%), USD (4.10%) and GBP (4.10%):

When investing, your capital is at risk. If you enable interest, Trading 212 will hold your cash in qualifying money market funds and banks. Otherwise, your cash will be held only in banks. Interest applies on cash in an investment account. Terms apply.

How are the rates defined? Are the investments guaranteed? What is the difference between an APY and an APR rate? Is there any catch? Let’s dig in!

What interest is Trading 212 offering?

The answer depends on the currency you are referring to. Each interest rate follows the policy stated by its corresponding central bank. For instance, the interest rate paid in EUR is conditional on the European Central Bank’s (ECB) monetary policy decisions.

These are the rates paid per currency:

- EUR (Euro): 2.20%

- USD (United States Dollar): 4.10%

- GBP (British Pound Sterling): 4.10%

- CHF (Swiss Franc): 1.5%

- HUF (Hungarian Forint): 7%

- PLN (Polish Zloty): 6%

- CZK (Czech Koruna): 3.70%

- RON (Romanian Leu): 5%

- DKK (Danish Krone): 2.5%

- NOK (Norwegian Krone): 3%

- SEK (Swedish Krona): 3%

- CAD (Canadian Dollar): 3.5%

- BGN (Bulgarian Lev): 2.5%

Looking for other brokers offering high interest? Check our broker interest tool!

How does Trading 212 offer such rates?

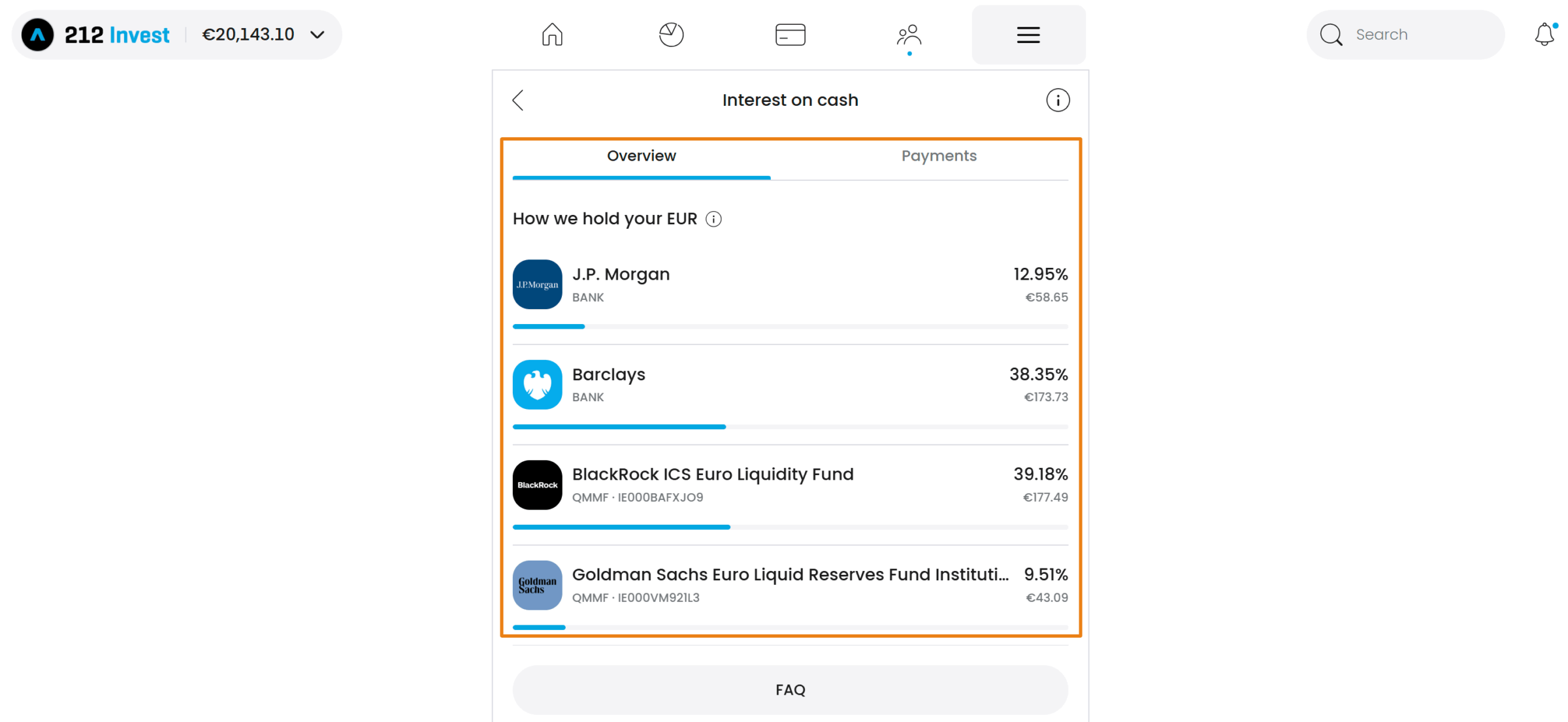

Trading 212 uses a combination of “qualifying money market funds (QMMFs), time deposits, and current accounts” to provide the rates stated on their platform. To help you understand each of these products, we have divided the information per segment:

Qualifying money market funds (QMMFs)

QMMFs are funds that invest in low-risk, short-term debt securities, such as government bonds, and aim to maintain stable share prices. What makes them “qualifying” is that the QMMF must meet higher regulatory standards for quality and liquidity, which makes them cash equivalents.

Money market funds are widely used by institutional investors, such as pension funds, insurance funds, and banks. In Europe, 1.4 trillion euros are invested in those financial vehicles.

A common example of a money market fund used by other brokers is the BlackRock ICS Euro Liquidity Fund. Please note, however, that Trading 212 does not publicly disclose the qualifying money market funds that are used to invest clients’ money.

Is the money in QMMFs protected?

Yes, your funds and assets (like the QMMFs) are covered by the €20,000 (EU clients) or the £85,000 (UK clients) protection under the Cyprus Investor Compensation Scheme (ICS) and the Financial Services Compensation Scheme (FSCS), respectively.

Keep in mind that money placed with a QMMF is treated as an investment and not as money held with a bank.

Still, funds in QMMFs are held separately from Trading 212’s operational funds, meaning that in case something happens to Trading 212 (bankruptcy, for example), your money is intact from any actions from its creditors. In practice, you would only need to transfer your investment in the QMMFs to another broker.

Time deposits

A time deposit is an investment product in which a bank client (Trading 212 in this case) transfers a sum of money into a separate account for a fixed period of time to earn a predefined interest rate.

Current accounts

A current account is a simple bank account to manage your income and day-to-day expenses. It is money just parked in an account.

Is the Trading 212 interest safe? What are the risks?

Safety and Protections

- Interest and Protection Mechanisms: Trading 212 offers interest on uninvested cash by placing it in qualifying money market funds (QMMFs), time deposits, and current accounts with banks. For EU and UK customers, funds and assets are protected up to €20,000 and £85,000 under the ICS and the FSCS schemes, respectively;

- Insurance: For EU customers, Trading 212 provides additional protection through insurance by Lloyd’s of London up to €1 million. This insurance does not extend to UK customers, meaning UK investors are primarily reliant on the FSCS coverage for funds held in banks.

Risks

- Investment Risk: QMMFs, while generally low-risk, are still subject to market fluctuations. In rare scenarios, such as financial crises, these funds can lose value, directly affecting the uninvested cash. This inherent risk means there is no absolute guarantee of safety.

Trading 212’s interest rates are competitive compared to other brokers and savings accounts. However, the lack of full protection on all funds and the inherent risks in QMMFs, even if very low, make it essential for users to weigh the benefits against potential risks.

How can I start earning interest?

Firstly, you must manually enable interest on cash in your personal settings:

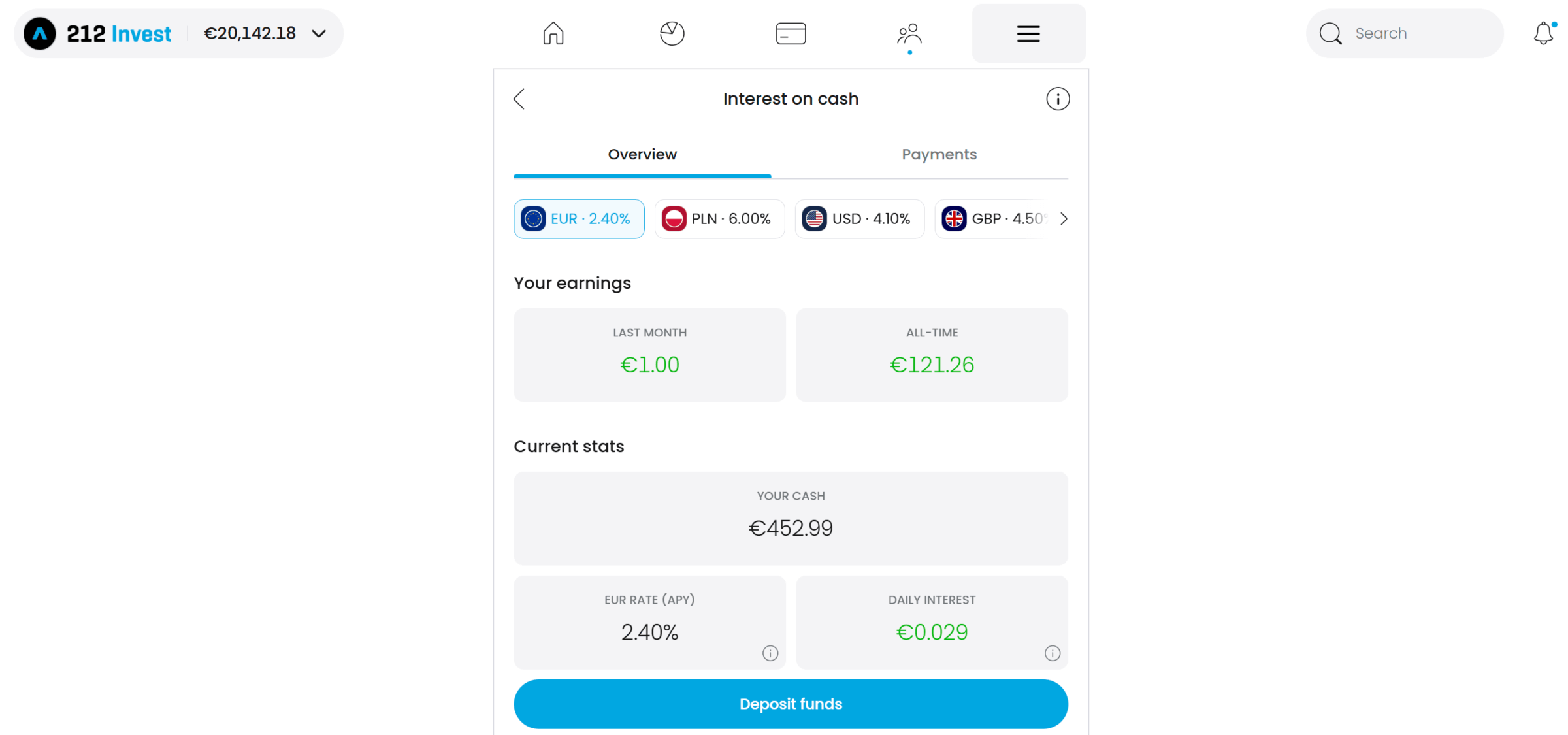

As soon as you activate it, you are able to deposit and start earning interest immediately:

You can also notice that your money is in Banks and also in QMMFs:

Are Trading 212 interest rates fixed or variable?

Interest rates are based on what Trading 212 can get from their deposits and the QMMFs. These rates are based on the central banks’ rates, like the European Central Bank (ECB) for EUR, the Bank of England for GBP and the US Federal Reserve base for USD.

So, if a central bank changes its policy by raising or lowering its key interest rates, the interest on cash will likely change in the same direction.

Trading 212’s interest rate is an APY – why does this matter?

The interest rate stated on the Trading 212 website is called annual percentage yield (APY), also known as the annual equivalent rate (AER). This rate is usually applied when the investment product (uninvested cash, in our case) has more than one compounding period. In Trading 212, the compounding is done daily.

On the other hand, brokers might also use the Annual Percentage Rate (APR), which is the yearly nominal interest paid to investors and does not account for the compounding effect. For instance, Trade Republic‘s stated 2.00% annual rate is an APR and it is compounded monthly, but again, their announced rate does not account for this.

If we want to compare these two offers directly, we must modify them to APY or APR. If they are both APY, these would be the figures:

- T212: 2.20%

- Trade Republic: 2.07%

If they are both APR, the rate would be the following:

- T212: 2.17%

- Trade Republic: 2.00%

Let’s make some calculations for you to better understand. Let’s imagine you have €1,000 as uninvested funds in Trading 212:

(1+r/n)^n – 1, where

- r = APY (or AER)

- n = compounding frequency: 365.25 days. Note that Trading 212 uses 365.25 days in the calculation to account for leap years.

Formula used: Daily payment (DP) = Cash balance * [(1 + APY) ^ 1/365.25 – 1]

Cash Balance = €1,000

APY = 2.20%

DP = €1,000 * [(1 + 0.022) ^ 1/365.25 -1]

DP = €1,000 * (1.022 ^ 1/365.25 – 1)

365.25th root of 1.022 ~ 1.0000595

DP = €1,000 * (1.0000595- 1)

DP = €1,000 * 0.0000595

DP = €0.0595 per day or €0.06 when rounded to the nearest penny

Now, if you multiply the €0.0595 by 365.25, it gives you €21.73. On €1,000, that equates to 2.17%, the APR rate for Trading 212.

Are there any constraints?

No, not at all. What to consider:

- No minimum or maximum amounts: Whether you have €100 or €1,000,000, you will receive interest on your total cash balance;

- You are free to use your money when needed (withdrawals or investments), and there are no interest penalties;

- The interest is paid daily.

Do I have to pay taxes on Trading 212 interest?

Yes, most likely. Except for special account types, like the ISA in the UK, taxes will be due on the interest you receive.

This article is intended for all Trading 212 clients. We cannot analyse each country’s particularities separately or your personal circumstances, but you are almost certain to pay taxes. Please contact your tax authorities to determine what actions to take.

Is there something I should be aware of?

Yes, there is. On June 5th, 2025, the ECB decided to cut interest rates by 0.25% (from 2.25% to 2.00%). As such, Trade Republic immediately announced that it would follow suit and reduce its rate to 2.00%.

In EUR, the maximum that brokers should be paying would be close to 2.00%, as per the “deposit facility” (interest rate earned by banks when depositing money in the ECB). Trading 212, by offering EUR rates above that amount, should be losing money or investing in riskier investments (even if only slightly riskier).

Trading 212 alternatives for interest

If you’re looking for alternatives to the Trading 212 interest, check our articles, where we filter the best brokers and digital banks for getting interest on your cash in EUR and USD.

Bottom line

All in all, Trading 212’s interest on uninvested cash is a great way to park your money and get rewarded with rates often higher than those of most banks.

Trading 212 is supervised by several top-tier regulators, such as the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) in Australia.

On the downside, it presents currency exchange fees (0.15% and 0.50% in “Invest” and “CFDs” accounts, respectively), which are charged when converting one currency into another.

Do you have any feedback or doubts about Trading 212? Please consider reading our review and then contact us to share your experiences.