Widely known in Europe, Trading 212 has attracted the attention of several Belgian investors, offering high interest on uninvested cash, a slick and modern app, low commissions, and a free share signup bonus.

Want to know if Trading 212 is available in Belgium, the company’s expansion plans, and the alternatives available for Belgian investors? We’ve got you covered!

Is Trading 212 available in Belgium? 🇧🇪

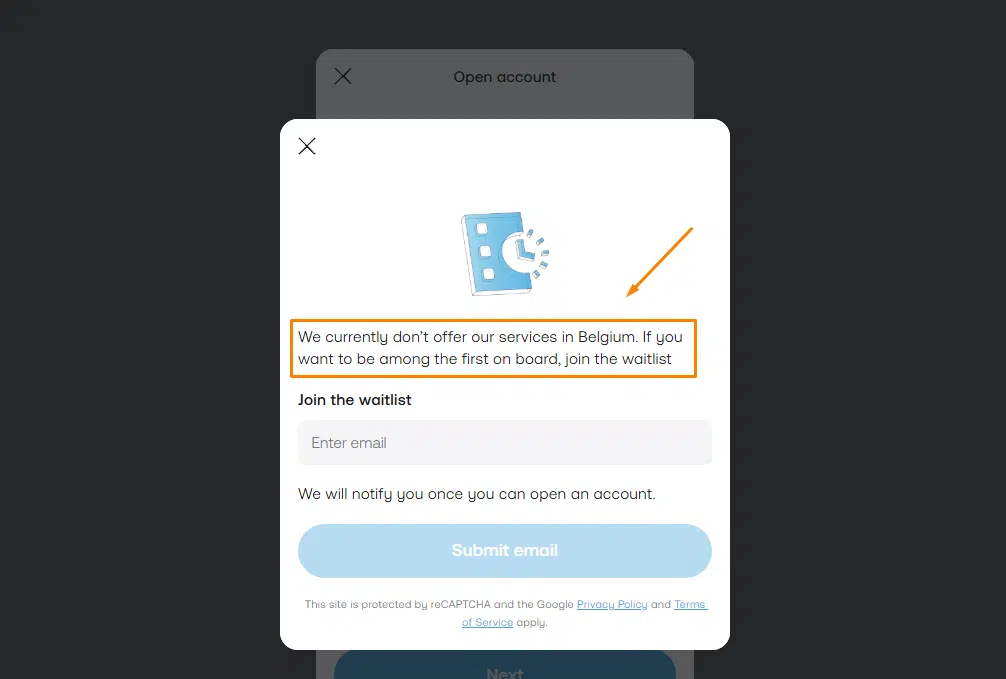

No, Trading 212 is not yet available in Belgium.

Despite its popularity across Europe, Trading 212’s services remain inaccessible to Belgian residents due to local regulations. This situation is “strange” for many, given that Trading 212 operates in nearly all other EEA countries. The company has acknowledged these challenges and has an open waiting list for Belgian investors:

Trading 212 Alternatives in Belgium

- Interactive Brokers: Best overall

- Saxo Bank: Best for experienced investors

- Lightyear: Best for beginners and interest

Conclusion

If you want to open a Trading 212 account from Belgium, you’re in bad luck: it is not possible. However, we believe any of the above mentioned brokers will be good choices.

Whether you value security and reputation or want a commission-free trading platform, the alternatives presented should be a good starting point. Explore their websites and decide for yourself!

If you haven’t found a match, you can still look at our comparison of online brokers available by country.