Imagine you just got a notification on your phone stating, “US Inflation sets fresh 40-year high”. You think to yourself, “Let’s reevaluate my portfolio and maybe sell some stocks which may be most affected by this unexpected inflation”. Soon, you realize that the market is not open yet. Is there a way to trade outside regular hours?

Yes! Extended hours trading allows you to react promptly to a possible macroeconomic event (e.g. inflation, Fed rates decisions, …), an increase in volatility following earnings reports and other scheduled, or unexpected events.

This article delves into three questions: Does DEGIRO offer pre and after-hours trading? If so, is it the right platform for that? Are there any alternatives? Let’s get right into it.

What is Pre-market and After-Hours trading?

Pre-market trading occurs before the market is open, and after-hours trading happens after regular trading hours.

What are the advantages of extended-hours trading? Well, the stock exchanges are usually open during working hours, so one advantage is the ability to trade outside what, for most people, is a busy time. It is also widespread that big market news such as unemployment and GDP numbers or quarterly/annual reports be released after-hours. An excellent example of this type of situation is the Federal Reserve, US’s central bank, which often makes major announcements between Friday’s market close and Monday’s reopening.

Does DEGIRO offer Pre-Market Trading and After-hours Trading?

Yes, DEGIRO offers the opportunity to trade more than 10,000 securities worldwide from 8 am to 10 pm (GMT +2 hours), including Dutch, European and US markets. This is done via Tradegate Exchange (TDG) which is fully regulated and 60% owned by Deutsche Börse AG, one of Europe’s biggest exchanges.

Disclaimer: Investing involves risk of loss.

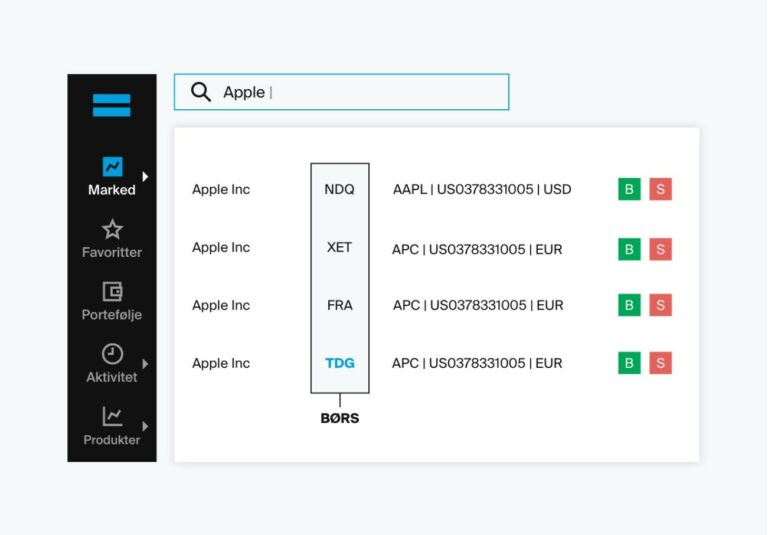

Example: Apple’s full-year financial results are released and blow expectations, but the market is closed. You can simply search for the Apple stock on DEGIRO with the TDG symbol and get in the action straight away:

Note: Keep in mind that, as it’s the case with all exchanges, if you buy a stock in Tradegate, that is also where you’ll sell it once you choose to do it, so if you own Apple shares bought in NASDAQ, you won’t be able to sell them after-hours using this DEGIRO feature since the after-hours trading only occurs in the Tradegate Exchange.

The Cons of DEGIRO Extended Hours Trading

For the cons, DEGIRO has a fixed €3.90 per trade after-hours fee, so you’d be buying Apple with a €3.90 fee, but if you did it during regular market hours, you would only pay €1.00.

Besides this, you should always be aware that when trading after-hours in any broker, there’s a lot less liquidity, more volatility and wider spreads (the difference between the buy and sell prices).

What does this mean? As less people will be buying and selling during this time, in a situation where you’ll need to sell some shares quickly, you might get stuck waiting a lot more time than if you did it at normal trading hours. For this reason, prices also tend to be more volatile, so you might want to place limit orders (the maximum/minimum price you are willing to buy/sell) on these trades to steer clear of outlandish prices above or below the current stock price.

DEGIRO Alternatives for Extended Hours Trading

If you want to save the €3.90 extra fee or just want to consider other alternatives, below we present some broker alternatives that require no additional costs for extended hours trading:

Interactive Brokers

Founded in 1978, IBKR is one of the world’s most trustworthy brokers worldwide. When placing an order, you will notice a field called “Time-in-force”, where you may select “Fill outside RTH (Regular Trading Hours)”. Check out our full Interactive Brokers review.

💡 Interactive Brokers also launched IBKR GlobalTrader, a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors.

Trading 212

Trading 212 is a versatile investment platform that allows pre-market and after-hours trading as an option available only for the most liquid US stocks available for leveraged trading. This means that Trading 212 allows you to trade US stock CFDs from 9:30 to 01:00 GMT without interruption with no extra cost or fees. Read our Trading 212 review for more details.

💡 You can get a free share of up to €100!

Disclaimer: When investing, your capital is at risk.

Wrapping Up

In conclusion, pre-market of after-hours trading might get you an advantage in trading the latest news right away by playing the volatility, but what do these two things have in common?

They require some experience in the markets and time spent analyzing them. Before you start exploring this possibility, it’s crucial to decide how much time you’re willing to devote to trading and how big your risk appetite is.

If your approach is passive and long term, you are most likely investing in ETFs or blue-chip companies. Then you’ll probably get better prices and effectiveness dollar-cost averaging in regular market hours.

Disclaimer: Investing involves risk of loss.