Charles Schwab is an investment company that’s well-known and respected around the world. So it’s no surprise that European investors from France, Germany, Italy, Poland, Portugal, Spain, the Netherlands, and the rest of Europe all want to know if it’s possible to trade stocks and shares using the platform!

Keep on reading if you’re keen to find out if the Charles Schwab platform is available to investors in Europe and the EU. We will cover everything Europeans need about the Charles Schwab stock brokerage and reveal potential alternatives.

Is Charles Schwab available in Europe?

Yes, it is possible to sign up for the Charles Schwab International brokerage account in parts of Europe. But, not every country has access, and there are some crucial things European investors need to understand about using the platform.

Charles Schwab does offer an ‘international’ service that’s open to some applicants from Europe.

The downside is that the only base currency is the dollar (USD), which means that an EUR investor will face unnecessary currency conversion fees, and residents from some countries are not eligible.

How to use Charles Schwab in Europe

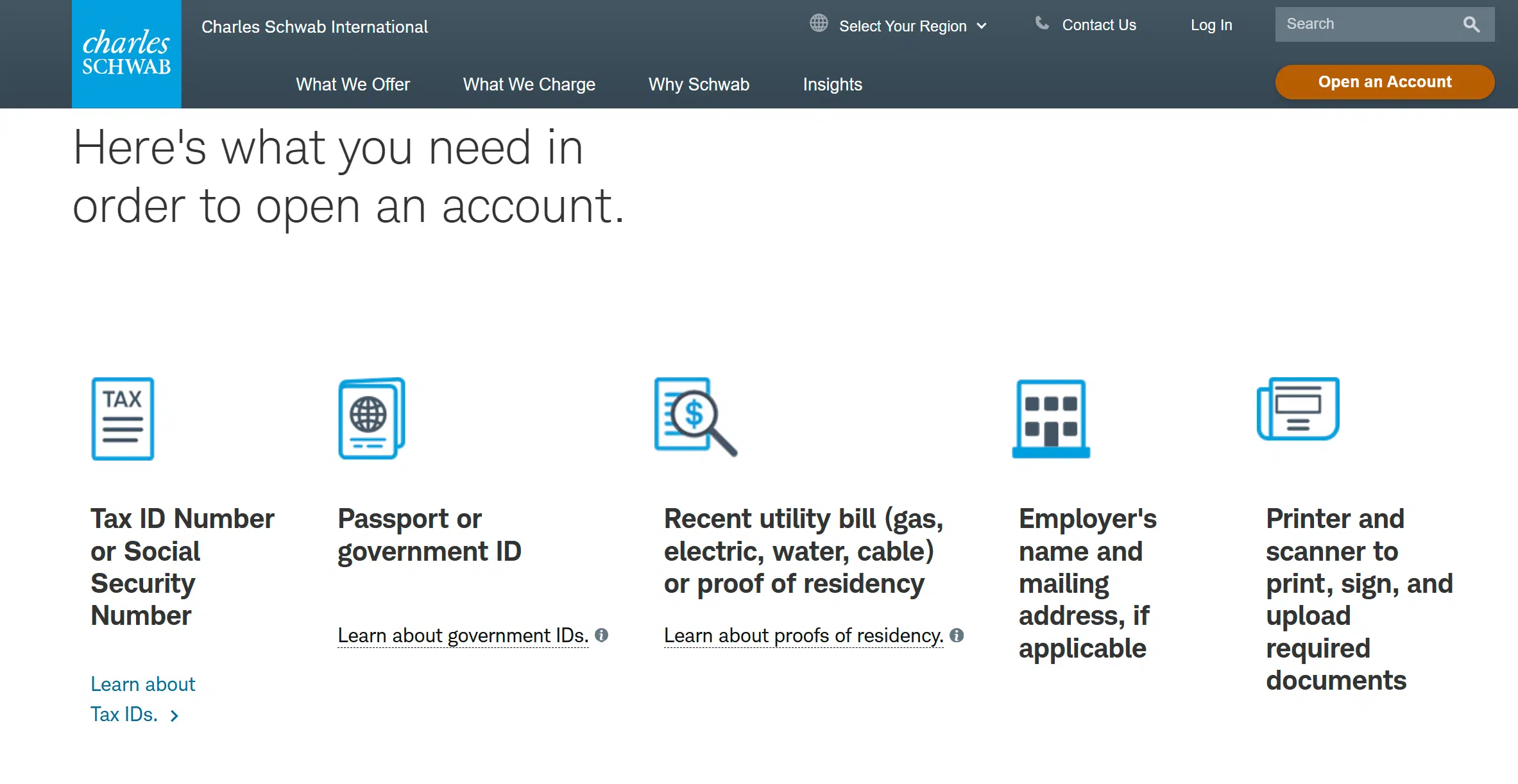

If you’re curious about using the Charles Schwab brokerage in Europe, you’ll need the following information to hand:

- Your tax ID or social security number – in Europe, this will depend on your country of residence.

- Current ID – this will need to be your passport, or another suitable form of identification (depending on where you’re based).

- Proof of residence – you’ll need a recent utility bill or some other proof of address (containing your full name, address, and date).

- Employment details – you have to provide the name and mailing address of your current employer.

- Access to a scanner – to upload all your documents with Charles Schwab, you’ll need a printer and a scanner.

Along with all these documents, Charles Schwab has some pretty strict requirements and limitations for investors in Europe hoping to use its Schwab One International brokerage account.

Which European residents can invest with Charles Schwab?

Charles Schwab may adjust which countries are eligible for an account, but at the moment, you should be able to open an account with this broker if you’re based in:

- Austria

- Belgium

- Czech Republic

- Denmark

- Finland

- Germany

- Greece

- Iceland

- Ireland

- Luxembourg

- Poland

- Portugal

- Spain

- Sweden

- Switzerland

Restricted countries

Major European countries where investors will have to look elsewhere to invest include:

- Bulgaria

- Croatia

- Cyprus

- Estonia

- France

- Hungary

- Italy

- Latvia

- Lithuania

- Macedonia

- Malta

- Monaco

- Montenegro

- Netherlands

- Romania

- Serbia

- Slovakia

- Slovenia

Other things you need to know about using Charles Schwab in Europe

Some points you need to consider about opening a European Charles Schwab account:

- There’s no minimum deposit to open an account.

- You can only trade in US dollars.

- Only using one currency means that if you use the Euro or any other currency, you’ll have to pay a currency conversion fee to invest.

- For most US stocks, there’s no commission, but investment choice is limited. For example, you can’t buy US ETFs.

Charles Schwab alternatives in Europe

If you’re in Europe and want to access the best brokerages and investing options, there are some alternatives to Charles Schwab that provide more choice and flexibility.

Here are some of the best brokerages available in Europe that may be more suitable than the limited Charles Schwab Account:

eToro: Social trading and 0% commissions on ETFs

Established in 2007, eToro is a fintech company that allows investors to safely invest in multiple assets such as ETFs, Stocks, Cryptocurrencies, and CFDs on Stocks, ETFs, Commodities, Forex, and Indices. The social-trading platform is user-friendly, comprehensive, and functional.

Disclaimer: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Interactive Brokers: The best Charles Schwab alternative in Europe

Online broker with a sophisticated trading platform that offers a wide range of products. The company, founded in the US and active in Europe for decades, you also get access to the useful IBKR GlobalTrader app.

XTB: Helpful trading tools for technical analysis

XTB lets most European investors trade stocks and ETFs for free. It’s also a world leader in Forex and CFD trading and is listed on the Warsaw Stock Exchange.

Freedom24: Direct investment in bonds. New users get up to 20 free share

Freedom24 is an online broker offering access to global stocks, ETFs, bonds, and stock options. It stands out for allowing investors to directly invest in bonds. New users can earn up to 20 free stocks.

Trading 212: Low fees and excellent app. New users get a free share

Trading212 is an online brokerage that lets you trade stocks, ETFs, and CFDs. You’re able to trade with no commissions and there’s even a ‘pie’ feature where you create your own portfolio.

DEGIRO: Low ETF trading and FX fee

DEGIRO is one of the leading online brokers in Europe, with over 3 million users. It has competitive FX fees and a low-cost structure, particularly on their ETF Core Selection list (external fees apply).

Disclaimer: Investing involves risk of loss.

Pepperstone: Ideal for a demo account and CFDs

Founded in 2010, it offers a range of investment products, including CFDs on stocks, forex, indices, commodities, cryptocurrencies, and ETFs. Their trading app is popular due to its user-friendly interface, competitive prices, and access to the global financial markets.

Disclaimer: 74-89% of retail CFD accounts lose money.

| Broker | Fees for US stocks | Minimum Deposit |

| eToro | $1 | $50 (varies) |

| Interactive Brokers | $0.0035 per share (min $0.35 per order) | €0 |

| XTB | €0 | €1 |

| Freedom24 | From €1.20 per order | €1 |

| Trading212 | €/£0 | €/£10 |

| DEGIRO | €/£1 (+ €/£1 handling fee) | €/£1 |

| Pepperstone | CFDs on stocks only | €0 |

#1 eToro

eToro at a glance

61% of retail CFD accounts lose money.

Founded in 2007, eToro is an international online broker with over 30 million users who can trade over 3,000 financial assets, including stocks, ETFs, Cryptos, and CFDs on Stocks, ETFs, Commodities, Forex, and Indices. ETFs are traded commission-free, as a whole, or fractional shares (other fees apply). US, EU and UK stocks have a commission of $1 per trade.

eToro’s investment platform, accessible through both web and mobile platforms, is a social trading hub. Here, investors can engage in discussions about investments, speculations, and market news with fellow investors. eToro also allows users to replicate trading strategies (CopyTrader™) and invest in ready-made investment portfolios (Smart Portfolios) based on thematic investment strategies.

The demo account is particularly useful for a beginner ($100,000 of virtual money). It lets you have a real experience hands-on as you would be using real money. So, when switching to a real account, you will notice no difference between your training and the real-life of investing. On the downside, there is a withdrawal of $5. Still, eToro is probably the best alternative you have to Charles Schwab in Europe.

eToro is fully regulated and supervised by top-tier regulators such as the UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC) in Australia. The subsidiary in Europe, formerly known as “eToro (Europe) Ltd,” is authorised and regulated by the Cyprus Securities Exchange Commission (CySEC).

For more details, visit our eToro review.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

It is important to read and understand the risks of this investment which are explained in detail at this link.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

#2 Interactive Brokers (IBKR)

Interactive Brokers at a glance

Interactive Brokers is an exceptional broker available to European traders and investors. The Trader Workstation (TWS) of Interactive Brokers is one of the top trading platforms in Europe. It caters both to beginners and professional investors looking for educational materials and an easy to use platform and advanced technical and fundamental trading tools and for in-depth research.

Due to its sophisticated and powerful tools, the wide range of products available for trading, and its low prices, Interactive Brokers normally attracts advanced traders. However, the mobile app IBKR GlobalTrader app is user-friendly and more suitable for beginners, simplifying investments without losing the powerful tools for which the broker is famous.

Interactive Brokers offers attractive features such as low commissions on US stocks, a demo account for practising investments, a wide range of tradable assets, and trading in EUR€. All of which makes it a great alternative to Charles Schwab for investors in Europe. Take a look at our full Interactive Brokers review for more details.

#3 XTB

XTB at a glance

69-80% of retail CFD accounts lose money.

Founded in 2002, XTB presents itself as a market player with extensive worldwide experience, regulated by the Financial Conduct Authority (FCA) – and other local regulators like BaFin – and listed on the Warsaw Stock Exchange. The platform offers 0% commissions on stocks in the Czech Republic, France, Germany, Italy, Poland, Portugal, Romania, Slovakia, and Spain. However, its software is more oriented to CFDs and forex trading.

XTB also offers other financial products, such as commodities and cryptocurrencies. XTB charges high commissions on CFDs of cryptocurrencies but low costs for Forex. One major downside is that you’ll face an inactivity fee of €10/month after one year of non-trading or if you have not made any deposit in the last 90 days.

Opening an account and transferring money is a quick and hassle-free process (demo account available). You can get started with just €1, which is much lower than the $25,000 Europeans need to open an international account with Charles Schwab. Take a look at our full XTB review for more details.

#4 Freedom24

Freedom24 at a glance

Investing involves risk of loss.

Freedom24, part of the Freedom Holding Corp., has emerged as a cost-effective brokerage option for retail investors compared to traditional brokerage firms. This broker provides access to a diverse range of global financial products, including stocks, ETFs, bonds, futures, and options.

The platform’s web and mobile interfaces are intuitive and straightforward, complemented by market analysis tools (“Investideas”) and educational resources (“Freedom Academy”) to support investment decisions. Furthermore, it offers a signup promotion of up to 20 free stocks.

With no minimum deposit, it presents two pricing plans: “Prime in EUR”, which you can get access to a personal manager and “Smart in EUR”, which is more adequate for investors with lower trading volumes. On the downside, it charges a withdrawal fee of €7 and offers no cryptocurrencies.

Freedom Finance Europe Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC). In the unlikely event that the segregated assets cannot be returned to clients, Freedom24 falls under the Investor Compensation Fund (ICF), which compensates for any losses from non-returned investments up to €20,000.

Want to learn more? Check out our Freedom24 Review or visit Freedom24 directly!

#5 Trading 212

Trading 212 at a glance

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Founded in 2006, Trading 212 is a fintech company based in London aiming to democratise the entire investment process through a simple mobile app. You can invest in over 10,000 stocks and ETFs, CFDs on Stocks, Forex, Indices, and Commodities. Over 15 million people have already downloaded the app.

In Trading 212, you will find commission-free stocks and ETFs trading, fractional shares, and even an automatic investment system. Opening an account is extremely quick and easy. On the downside, there are some limitations with the assets available (such as the lack of bonds and options). And, it charges a 0.15% FX fee when buying assets in a currency different from your base account. But, this Trading212 still offers much more than the Charles Schwab international account.

In a nutshell, the broker offers low prices, great educational resources, an impressive range of tradable assets, and user-friendly trading apps – making it an excellent alternative to investors in Europe thinking about using Charles Schwab. If you want to learn more, check out our Trading 212 review.

#6 DEGIRO

DEGIRO at a glance

Investing involves risk of loss.

DEGIRO was founded in 2008 and provides services to over 3 million European clients. In addition to stocks and ETFs, DEGIRO’s products include mutual funds, bonds, futures, and options, warrants, with the ability to trade on pre-market and after-hours trading.

DEGIRO is a great trading platform in Europe for ETF trading. It’s a perfect pick if you want to minimise your trading costs as it does not charge any fees for inactivity, deposits, or withdrawals while offering low costs on several popular ETFs (plus external fees). Furthermore, the platform gives access to over 30 exchanges around the world.

On the downside, DEGIRO does not offer forex trading, charges €/£1 commission for US stocks, and charges €/£2.50 annually per exchange as a connectivity fee. There are also handling fees to pay on most trades. However, this is still much more convenient than using Charles Schwab for most European investors. For further details, you can read our full DEGIRO review.

#7 Pepperstone

Pepperstone at a glance

74-89% of retail CFD accounts lose money.

Pepperstone is an Australian brokerage company founded in 2010 and regulated by many top-tier authorities such as the FCA or the ASIC. The broker allows you to trade on popular trading apps such as MetaTrader 4 and 5, and the trading app Pepperstone cTrader, available for iOS, Android, and Windows, is recommended by the company for all types of investors.

The company also provides a social trading platform called DupliTrade, where you can automate your investments from the MetaTrader account, coping strategies from other traders, and enjoy a demo account to practice investments.

Pepperstone is a CFD broker. This is an instrument that needs to be traded with extreme care because it often leads to losses due to the leverage effect that can magnify any loss.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Bottom line on Charles Schwab in Europe

Although you can open a Schwab One International account with Charles Schwab if you’re based in some large countries throughout Europe (like Germany or Spain), there are plenty of European countries (like France and Italy) where Charles Schwab is unavailable.

Even if you can access Charles Schwab in your country, it may not be the best move. You will have to convert EUR to USD, and you’ll be limited with your investment options.

Luckily, there are plenty of alternatives for European investors. You’re able to open accounts with numerous brokerages. Ones who also have a great reputation but don’t have such strict requirements and also give you more flexibility for your investment portfolio.

So, investing using Charles Schwab in Europe isn’t your only option.