Navigating the UK’s online brokerage scene can be difficult for every investor, mainly beginners. You can feel overwhelmed by the many fee structures, products, and marketing noise.

Throughout the article, you will find an extended analysis of what we consider to be the nine best online brokers in the UK. Whether you’re a beginner seeking a user-friendly platform, a fan of buy-and-hold funds and ETFs, or a crypto and CFD enthusiast, we’ve got you covered!

Don’t want to read the whole article? Find our summarized list below:

In a nutshell: best online brokers in the UK in 2025

- Interactive Brokers: Best UK broker overall

- eToro: Best broker for commission-free investing and social trading

- XTB: Best broker for commission-free ETF trading

- Webull UK: Best for beginners looking for quick exposure to US stocks

- Plus500: Best broker for CFDs

- Saxo Markets: Best broker for professionals

- Freetrade: Best broker for beginners

- Trading 212: Best broker for auto investing and ISA

- InvestEngine: Cheapest ETF broker

Comparison of UK online stock brokers

| Online Broker | Minimum deposit | Financial products available | Fees on US stocks | Regulators |

| Interactive Brokers | £0 | Stocks, ETFs, Options, Futures, Forex, Commodities, Bonds and Funds. | Between $0.0005 and $0.0035 per US share (min. $0.35) | FINRA, SIPC, SEC, CFTC, IIROC, FCA, CBI, AFSL, SFC, SEBI, MAS, MNB |

| eToro | $50 | ETFs, Stocks, Cryptocurrencies and CFDs on Stocks, ETFs, Commodities, Forex and Indices | $0 | FCA, CySEC, and ASIC |

| XTB | £0 | Stocks, ETFs, Forex, and CFDs on Stocks, ETFs, Indices, cryptocurrencies and commodities. | £0 | FCA, KNF, CySEC, DFSA and FSC |

| Webull | £0 | US Stocks, Options, Asian Stocks, and GBP savings account | 0.025% per share | FCA |

| Plus500 | £100 | Shares (Plus500 Invest) and CFDs on Indices, Forex, Commodities, Cryptocurrencies, Shares, Options and ETFs. | $0.006 per share | FCA, CySEC, FSCA, FMA and ASIC |

| Saxo | £0 | Stocks, ETFs, Bonds, Mutual Funds, Crypto ETPs, Options, Futures, Forex, Forex Options, Crypto FX, CFDs and Commodities | Between $0.01 and $0.02 per US share (minimum between $3 and $10 per order) | ASIC, FSA, FCA, SFC, MAS, FINMA, DFSA |

| Freetrade | £0 | Stocks, ETFs, Investment Trusts, REITs and SPACs. | £0 | FCA |

| Trading 212 | £10 | Stocks, ETFs, Forex, CFDs on stocks, crypto, indices and ETFs. Fractional shares, automatic investment system. | £0 | FCA, CySEC, and FSC |

| InvestEngine | £100 | Only ETFs. | Not available (only ETFs) | FCA |

Interactive Brokers at a glance: Best overall

Interactive Brokers leads the list as the best online broker in the UK.

Founded in 1978, Interactive Brokers is one of the largest international brokers listed on the NASDAQ exchange (Ticker: IBKR). It is regulated by many international top-tier regulators, including the FCA, with no minimum deposit requirement.

It caters to both beginners and professional investors looking for any type of financial products (bonds, ETFs, shares, you name it!), an easy-to-use platform, advanced technical and fundamental trading tools, and a great educational component.

Interactive Brokers supports various account base currencies, including GBP, USD, EUR, and other major currencies. However, funding these accounts is limited to bank transfers. They offer one of the tightest spreads in the market, ensuring favourable trading conditions, but their commission is tier-based, meaning it varies depending on your monthly trading volume.

For investors who prefer to trade on the go, Interactive Brokers offers the IBKR Mobile app providing convenience and advanced functionality.

IBKR GlobalTrader is another mobile trading app offered by Interactive Brokers that allows traders to engage in simple and worldwide trading. The app offers the flexibility to trade in fractions and invest with as little as $1, making trading accessible to traders of all levels. You can also open a simulated trading account to practice trading before opening a live account and gain access to $10,000 in simulated cash to trade in a simulated trading environment.

On the downside, you might be overwhelmed by the number of buttons and features available on each platform, especially if you are new to investing. However, Interactive Brokers offers a lot of educational materials and video tutorials to assist you in navigating and utilizing their platforms effectively. These resources can be beneficial regardless of the specific platform you are trading or using.

Want to know more? Check out our comprehensive Interactive Brokers review and visit IBKR’s website.

Pros

- Low commissions on US stock trading

- No monthly inactivity fee

- The broadest product and markets range in the brokerage industry

- Demo account

- Excellent reputation (founded in 1978)

- Extensive research and Education tools

- Has a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors, IBKR GlobalTrader.

- Offers interest on uninvested cash balances

Cons

- Complicated and lengthy account opening process (but fully online)

- Steeper learning curve for beginners

- Website is difficult to navigate

- Interactive Advisors (Robo-advisor feature) is only available for US customers

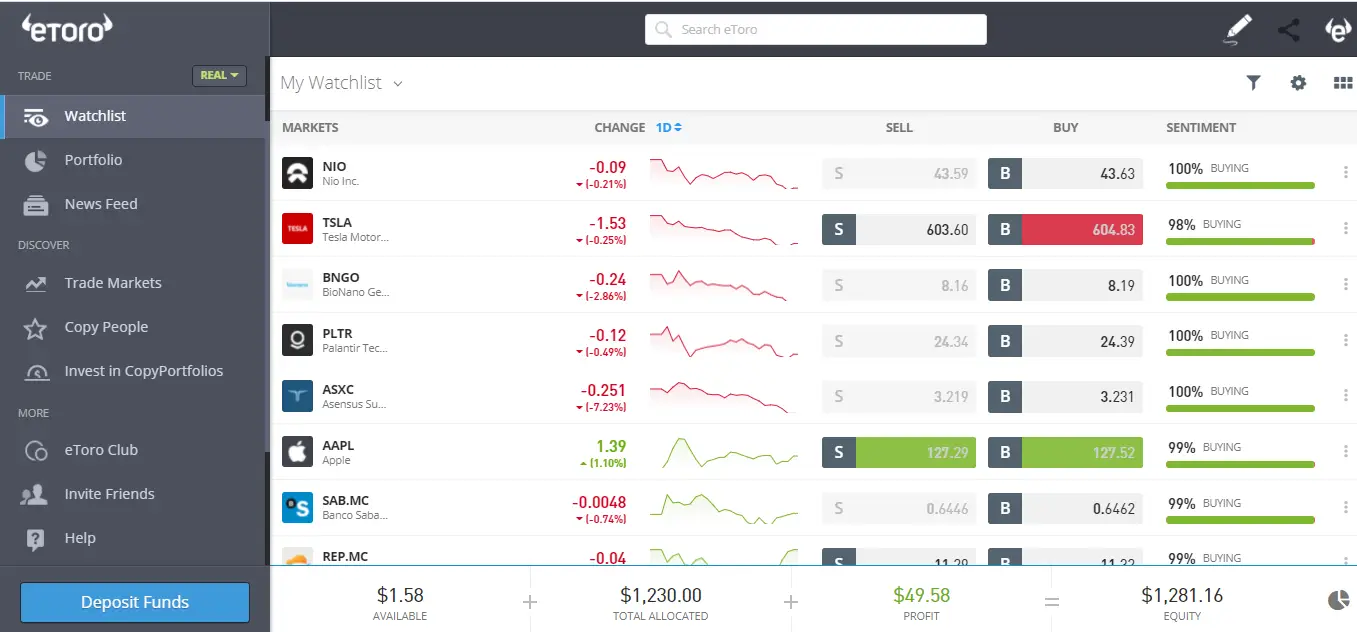

eToro at a glance: Best for commission-free investing and social trading

61% of retail CFD accounts lose money.

Another exceptional trading platform in the UK is eToro, an international online broker with over 30 million users who trade stocks, forex, commodities, cryptocurrencies, CFDs, and ETFs. It is known for its social trading feature where you can copy the trades of other experienced traders. There are thousands of verified traders on eToro, and you can pick the best trader based on past Return on Investment (ROI), risk profile, or other factors.

The eToro platform gives users access to over 3,000 different financial instruments, including stocks and ETFs. Additionally, users can invest in ready-made investment portfolios (Smart Portfolios), a group of several assets or traders combined together based on a theme or strategy.

Plus, eToro offers commission-free stock and ETF trading in the UK (other fees apply).

Opening an account and depositing is easy, and you can even try it out with virtual money (a demo account). On the downside, spreads can be high for some products. The only currency accepted (base currency) is the USD, which means that you’ll be charged currency conversion fees upon deposit and withdrawal if you deposit in another currency.

If you want to learn more, check out our eToro Review.

Pros

- Low stock trading fees (from $0 per trade)

- Commission-free ETFs (other fees apply)

- Social trading and other innovative products

- Wide variety of financial products

- Slick, modern, and easy for anyone to use

- European users have access to three account currencies: EUR, USD and GBP

- Top tier regulators

Cons

- Limited disclosed financial information

- Withdraw and inactivity fees

- Spread, overnight, inactivity, and currency conversion fees higher than average

- Doesn’t offer bonds, futures, or options

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

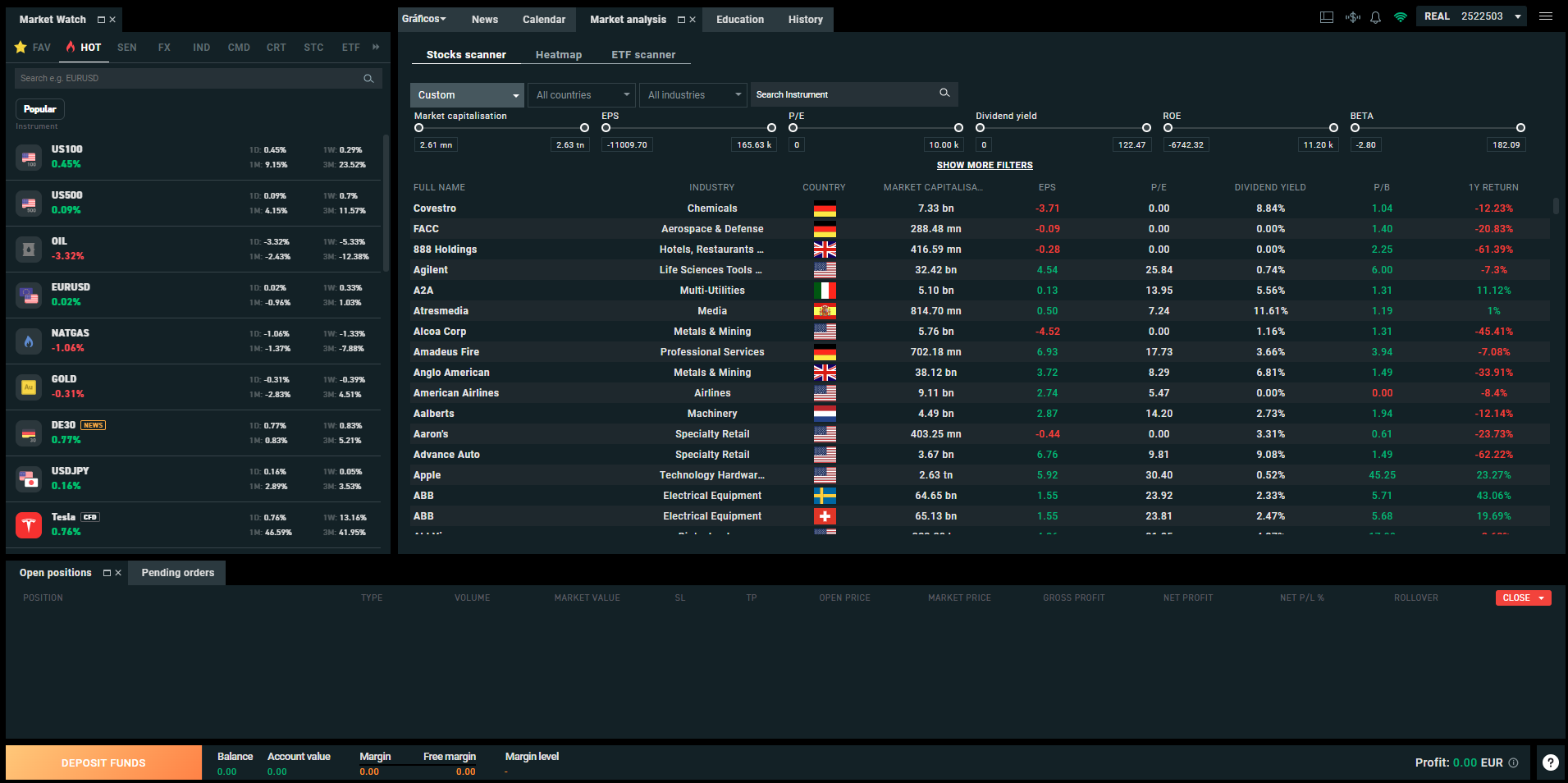

XTB at a glance: Best for commission-free ETF trading

69-80% of retail CFD accounts lose money.

Founded in 2002, XTB is a major player in the brokerage industry with extensive worldwide experience, regulated by the Financial Conduct Authority (FCA) – plus other relevant regulatory bodies – and listed on the Warsaw Stock Exchange.

You can invest through xStation 5 and xStation Mobile in different investment products, such as stocks, ETFs, and CFDs on stocks, Forex, indices, commodities, and cryptocurrencies. It offers 0% commission on stocks and ETFs and flexible Stocks & Shares ISA with the following features:

- Invest in more than 3,000 stocks and more than 700 ETFs with 0% commission up to a monthly trading volume equivalent to 100,000 EUR (after that, 0.2% with a minimum of 10 GBP). A 0.5% currency conversion fee may apply.

- Earn 4.75% interest on GBP uninvested cash (calculated daily and paid out monthly).

- Earn interest or returns without paying tax on them. Withdraw the money and replace it within the same tax year without affecting your annual allowance.

Opening an account and transferring money is a quick and hassle-free process. For beginners, it presents a demo account where you can trade as if it were real money to help you feel the investment platform firsthand, and you get access to educational tools. For intermediate and advanced investors, you will find plenty of technical and fundamental tools to help you better assess your investment decisions.

On the downside, you will face an inactivity fee of €10/month after one year of non-trading, and if you have not deposited in the last 90 days, it charges high commissions on CFDs of cryptocurrencies but low costs for Forex.

Want to know more about XTB? Check our XTB Review.

Pros

- Free stocks trading (only applicable to some countries)

- Customizable trading platform (charts and workspace)

- Low Forex Spreads

- Demo account

- No minimum account deposit

- Valuable education materials

- Top-tier Regulators

Cons

- Complex trading platform for a beginner

- High Stock CFD spreads

- Limited product portfolio

- Withdrawal fees for transfers below $100

- Inactivity fee (€10/monthly after 1+ year with no activity plus no deposit in the last 90 days)

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 69-80% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Webull at a glance: Best for US stocks

Founded in 2017 in the US and launched in the UK in July 2023, Webull joins the British brokerage industry with low commissions. At the moment, it offers access to US stocks and options, as well as emerging market stocks and a GBP savings account. New users get a signup bonus.

As a UK user, you also have access to a demo account where you can buy and sell as you would with real money. You can only deposit in pound sterling (GBP), which means that when investing in US stocks (traded in US dollars), you will be charged a currency conversion fee of 0.35%. Besides, each trade has a cost of 0.025%. Basically, you would pay roughly 0.375% per transaction (minimal regulatory fees also apply).

The offering of fractional shares is also crucial since most US stocks trade at high market values per share. Still, the limited range of asset types (no ETFs, bonds,…) and only offering a general investment account (no tax-efficient accounts like Stocks and Shares ISA) may affect users also looking for broader solutions.

Finally, Webull UK is authorised and regulated by the Financial Conduct Authority (FCA). As such, it is also under the Financial Services Compensation Scheme (FSCS) protection, which protects your money (assets + cash) up to £85,000.

Pros

- Free Shares Sign Up Promotion

- Mobile-friendly app

- Fractional Shares

- Access to US-listed stocks and options

- One of the largest brokerages in the USA

- Regulated by the FCA

- Demo Account (paper trading)

Cons

- No ISA or SIPP

- Limited range of assets available - no ETFs, bonds, crypto

- FX fee

- No commission-free trading

Plus500 at a glance: Best for CFDs

82% of retail CFD accounts lose money.

Founded in 2008, Plus500 is an online broker offering a wide range of financial products, including real shares and CFDs on forex, indices, shares, commodities, options, ETFs, and cryptocurrencies. It is available in over 50 countries and is listed on the London Stock Exchange.

There are two distinct account types:

- Plus500 CFD: It only focuses on CFD products;

- Plus500 Invest: Where you can trade stocks (real shares);

The web platform you will use is the WebTrader, Plus500’s proprietary platform, offering a stable trading experience and reliable access from multiple devices, including a mobile app. All platforms are accessible and responsive, and you can start testing the features by opening a demo account.

Their customer support is helpful and readily assessed through a chat that is always shown on the trading platform. Their spreads are low, offering accounts in sixteen currencies, including USD, EUR, and GBP. Still, they charge a 0.70% currency conversion fee and a $10 monthly fee following three months with no activity. On Plus500 Invest, they only charge a small commission per trade (US market: $0.006/share).

Finally, it is regulated by financial regulators like the FCA and CySEC, meaning that Plus500 is appropriately supervised and that there is an investor protection scheme under the entity you open an account. For instance, as a UK investor, you open an account through Plus500UK Ltd, and you are protected up to £85,000 by the Financial Services Compensation Scheme (FSCS).

Want to know more about Plus500? Check our Plus500 Review.

Pros

- Acessible and responsive platform

- Low spreads

- No dealing commissions

- Demo Account

- Top-tier regulators

Cons

- No ETF offering

- Inactivity fee ($10 per month after no login activity in 3 months)

- High overnight funding fees

- Very little research and education provided

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

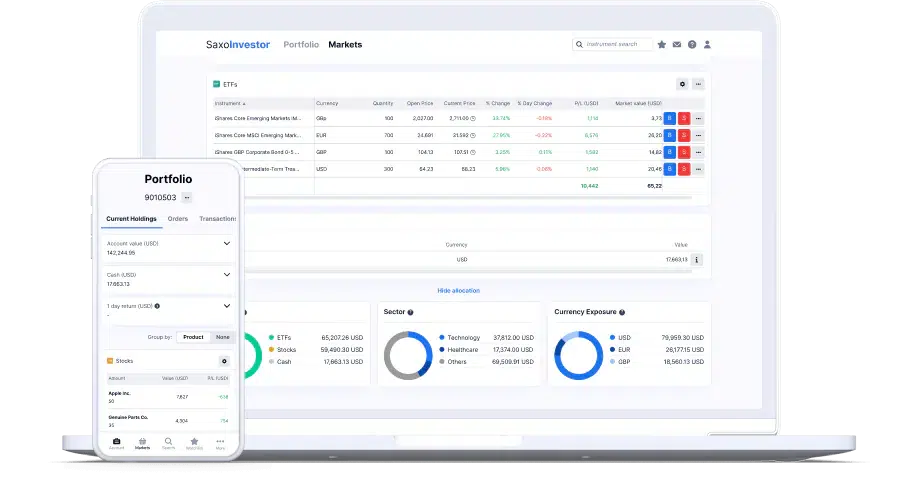

Saxo at a glance: Best for professionals

62% of retail CFD accounts lose money.

Saxo Bank is a distinguished multi-asset broker renowned for its exceptional trading platform experience and extensive range of over 72,000 tradable instruments. It was founded in 1992 and offers a comprehensive suite of trading tools, in-depth research capabilities, and premium features.

Saxo Bank lets you open an account in a wide range of currencies, including USD, EUR, GBP and several other major currencies. They have three account types (Classic, Platinum, and VIP), each with its own features and services.

Pros

- Extensive range of investment products

- Has ISA

- Long track record

- Supervised by worldwide top-tier regulators

Cons

- Fees higher than average and harder to understand

- More difficult to navigate the platform

Freetrade at a glance: Best for beginners

Freetrade is a mobile-only commission-free UK stockbroker founded in 2016 that lets you invest in more than 6,000 stocks (US, UK, German, Finnish and Dutch), as well as ETFs, for free.

Freetrade came to revolutionize the traditional brokerage industry. A lot of brokers still present high complexity over their platforms and product offer. Freetrade is on a mission to help customers achieve better long-term financial outcomes and, for that purpose, it wants to be as transparent and trustworthy as possible. Ultimately, their goal is to allow everyone to benefit from wealth creation.

In the Freetrade app, you will not find CFDs and other related complex products; it does not promote day trading and has no hidden fees. The accounting opening process is quick and smooth. The mobile app is remarkably user-friendly. The main drawback is the limited product offering (no options, bonds, Forex, CFDs, Commodities or Cryptocurrencies).

They operate under a freemium (free+premium) business model.

Pros

- Free stock and ETF trading

- GIA, ISA, and SIPP

- No inactivity, account, or withdrawal fees

- No minimum deposit

- Great community (forum) – where users share ideas and learn about investing

- Nice and user-friendly app

Cons

- Limited asset classes (only stocks, ETFs, REITs, and investment trusts)

- Limited research and education

- Graphs and portfolio tracking still need some development

- No phone support – however, live chat support is very fast and efficient

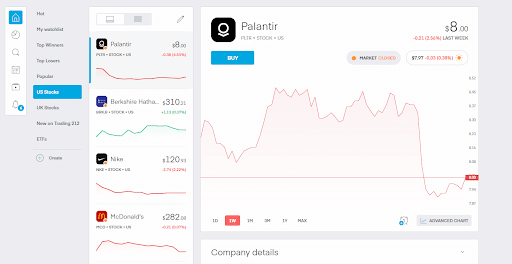

Trading 212 at a glance: Best for auto investing and ISA

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Founded in 2006, Trading 212 is a fintech based in London that aims to democratize the entire investment process through a simple mobile application. The company aims to do this by allowing anyone to invest in over 10,000 stocks and ETFs, Forex, commodities, CFDs, and cryptocurrencies. Over 15 million people have already downloaded the app.

In Trading 212, you will find commission-free stocks and ETFs trading, fractional shares, and even an automatic investment system (Robo-advisor). Opening an account is extremely quick and easy. On the downside, it shows limitations regarding available products, such as the lack of bonds and options. It charges a 0.15% currency conversion fee when buying assets in a currency different from your base account.

Within the app, you will notice two distinct sub-platforms: Trading 212 Invest, where you can trade a range of assets free of charge, and trading 212 CFD, where you may trade leveraged financial products (CFDs).

Finally, Trading 212 offers one free share worth up to €100! It may be worth checking that out.

If you want to learn more, check our Trading 212 Review.

Pros

- Commission-free Real Stocks and ETFs trading (other fees may apply. See terms and fees)

- AutoInvest & Pies feature

- Fast and easy account opening process

- Demo account

- Top Tier Regulators

- Free fractional shares worth up to €100

- High interest on uninvested cash

Cons

- Limited product portfolio (no Options, Bonds, Mutual Funds or Futures)

- No relevant Fundamental tools

- 0.15% of Foreign exchange fees

InvestEngine at a glance: Cheapest ETF broker

When investing your capital is at risk.

InvestEngine is a leading broker in the UK, founded in 2016, that offers a range of innovative tools and features to help investors build and manage their investment portfolios. One of their standout offerings is fractional investing, allowing users to invest as little as £1 in any ETF on their platform, regardless of the ETF’s share price. They have over 550 ETFs available and are one of the cheapest ETF trading platforms in the UK.

Their trading platform offers several features. For instance, the smart order technology calculates the individual trades needed to align with your chosen portfolio weights.

With their Portfolio Look-through feature, investors can gain transparency and insight into the companies, sectors, geographical regions, and asset classes they invest in. AutoInvest is another convenient feature that automatically puts your available cash to work each day, ensuring you don’t miss out on rising markets. InvestEngine also offers one-click portfolio rebalancing, allowing you to reset your portfolio to your preferred asset allocation with a single click.

For those who prefer a managed portfolio, InvestEngine offers a choice of portfolios designed to suit different risk levels, with a management fee of just 0.25% per year. All their portfolios are accessible through their General Account, which allows investors to begin their investment journey with as little as £100 without any exit charges. In addition, it provides an Individual Savings Account (ISA) option, enabling investors to enjoy tax-free investing. Finally, it is worth noting that investments made with InvestEngine may be eligible for claims under the Financial Services Compensation Scheme (FSCS) for amounts up to £85,000, providing investors with an extra layer of security.

You can read our InvestEngine review for further analysis.

Pros

- Simple and intuitive investment platform

- No ISA fees

- No deposit or withdrawal fees

- Fractional Investing

- One-click rebalancing

- Auto-invest

Cons

- Only offers ETFs: no bonds, shares, and other products

- No interest on cash balances (still you can invest in money market funds)

Bottom line

To summarize here’s the list of “Best online brokers in the UK”:

Interactive Brokers

Best UK online broker overalleToro

Best online broker for commission-free investing and social tradingXTB

Best online broker for commission-free ETF tradingWebull

Best online broker for paper tradingPlus500

Best online broker for CFDsSaxo

Best online broker for professionalsFreetrade

Best broker for beginnersTrading 212

Best online broker for auto investing and ISAInvestEngine

Best online broker for zero-commission ETF trading

Some factors you should know when choosing an online broker are the fees charged, if it is regulated by top-tier institutions such as the FCA in the UK, the range of products it allows you to trade (not all platforms allow you to trade bonds), among others.

A reminder that the above should not be seen as investment advice and should be considered information only. Investors should do their own research and diligence about the best-suited services and opportunities for their risk, returns, and impact strategy.

Whether a new investor or a seasoned professional, we hope this article helped answer a few of your concerns. When choosing an online broker, we recommend opening a demo account and testing the features before making the final decision.

Happy investments!

FAQs

How to invest in stocks from the UK?

You can use one of the online brokers shown above: Interactive Brokers, eToro, Plus500, XTB, Webull, Saxo Bank, Trading 212, InvestEngine, and Freetrade.

What is a brokerage company?

It is an entity designed to be the middleman between you and the people you are trying to buy or sell a stock, ETF, crypto,… you name it!

Which broker is best in the UK?

There is no single answer. It depends on what you value most: fees, security, investment platform, or any relevant feature.

What are the types of investments you can make with a brokerage account?

You can trade stocks, ETFs, Forex, Bonds, Futures, and CFDs on stocks, ETFs, indices, cryptocurrencies, commodities.