A brokerage account is not only available to private individuals. Companies and self-employed people can also invest their assets in investment accounts.

However, there are significantly fewer providers of company accounts, and they usually do not actively advertise them.

Below, we cover three different business brokerage accounts that work for international investors. So, if you live in Europe, the MENA region, or anywhere else outside the USA, we’ve got you covered!

Best international business brokerage accounts

- Interactive Brokers: Best overall

- eToro: Most user-friendly platform

- Saxo Bank: Best for professionals looking to diversify their holdings in different brokers

61% of retail CFD accounts lose money.

62% of retail CFD accounts lose money.

Comparison

Reviews

Interactive Brokers corporate accounts at a glance

Founded in 1978 and publicly listed in NASDAQ (ticker: IBKR), Interactive Brokers is a global online broker which surpassed significant financial crises, showing resilience and a rigorous risk management process.

Interactive Brokers offers an advanced investment platform that allows you to invest globally in stocks, options, futures, currencies, bonds, and funds from a single integrated account. Its advanced trading and account management tools let you control and delegate user permission for a business brokerage account.

With Interactive Brokers, businesses around the world can open a company account. Some institutions that can open an Interactive Account include Small Businesses, Hedge Funds, Prop Traders, Family Offices, and more. It gives you solid trade execution through IB SmartRouting, and a set of technical and fundamental tools to help you make investment decisions.

Interactive Brokers’ fee structure is also quite complex, the registration process is lengthy but fully online, and the broker doesn’t offer commission-free trading outside the US. However, when considering FX fees, narrower spreads, and the stock loan program, Interactive Brokers’ clients still get significant savings compared to most brokers.

Want to know more about Interactive Brokers? Read more details directly on Interactive Brokers’ landing page, or check our step-by-step guide on how to open a business brokerage account with Interactive Brokers.

Pros

- Low commissions on US stock trading

- No monthly inactivity fee

- The broadest product and markets range in the brokerage industry

- Demo account

- Excellent reputation (founded in 1978)

- Extensive research and Education tools

- Has a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors, IBKR GlobalTrader.

- Offers interest on uninvested cash balances

Cons

- Complicated and lengthy account opening process (but fully online)

- Steeper learning curve for beginners

- Website is difficult to navigate

- Interactive Advisors (Robo-advisor feature) is only available for US customers

Saxo Bank business accounts at a glance

62% of retail CFD accounts lose money.

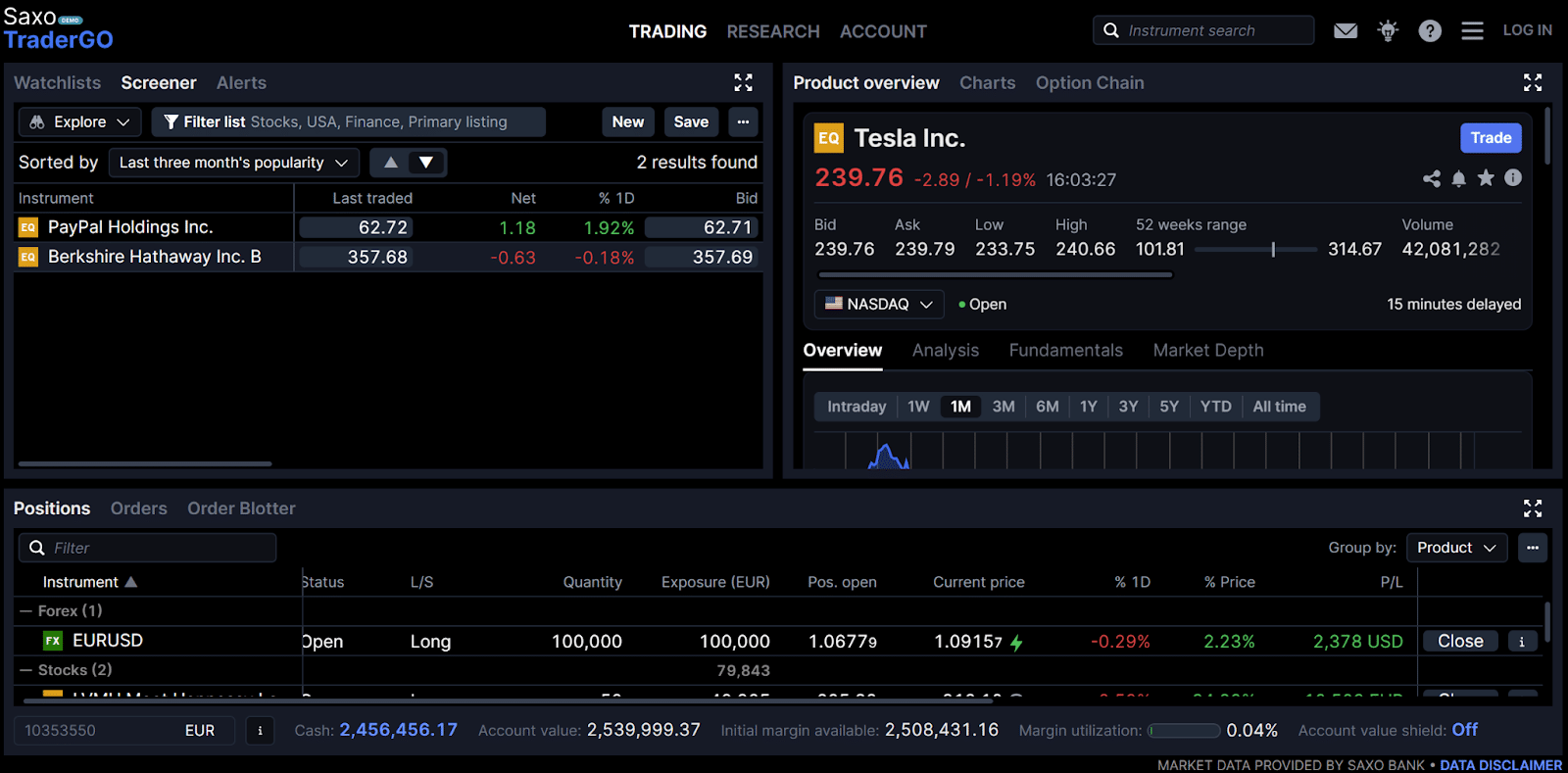

Launched in 1992, Saxo Bank is one of the most solid financial entities in the brokerage industry, with a proven track record of success. It lets you trade over 70,000 financial instruments through their trading platforms: SaxoTraderPRO (for PC) and SaxoTraderGO (on mobile).

The Saxo Bank corporate account tiers are the following:

- Classic: A minimum $100,000 deposit is required, giving you access to tight spreads and customer and technical support 24/5.

- Platinum: A minimum $200,000 deposit is required. In addition to Classic features, it also lowers trading prices by up to 30% and prioritizes local-language customer support.

- VIP: A minimum $1,000,000 deposit is required. Here you will find the best prices, access to trading experts, and exclusive event invitations.

The pricing structure will vary according to your account tier. For instance, a US stock order will be 0.08% (min. $1) of the trade value in Classic. However, within the VIP tier, the same trade would be 0.03% (min. $1) of the trade value.

Saxo Bank states that it usually takes one week to approve a business investment account, assuming they are provided with clear copies of the following documents:

- Memorandum and Article of Association

- Certificate of Incorporation

- Proof of the company’s business address if different from its registered address (e.g. a company bank statement or utility bill less than three months old and issued in the company’s name)

- Latest financial statement

- Group structure diagram (for entities within complex group structures only)

In addition, every beneficial owner with a 25% or greater company holding and each company director should send other documents, namely:

- Passport

- Proof of residency – a utility bill less than three months old that displays the date, applicant’s name and address that matches the one on the application

If you want to know more details about Saxo Bank’s corporate account, check their landing page for corporate investment accounts.

Pros

- Excellent research materials

- Outstanding trading platforms (SaxoTraderPRO and SaxoTraderGO)

- Extensive range of investment products

- Long track record

- Supervised by worldwide top-tier regulators

Cons

- High minimum deposit (varies between countries)

- Fees higher than average

- Fee structure is complex

- Does not accept US residents

eToro business accounts at a glance

61% of retail CFD accounts lose money.

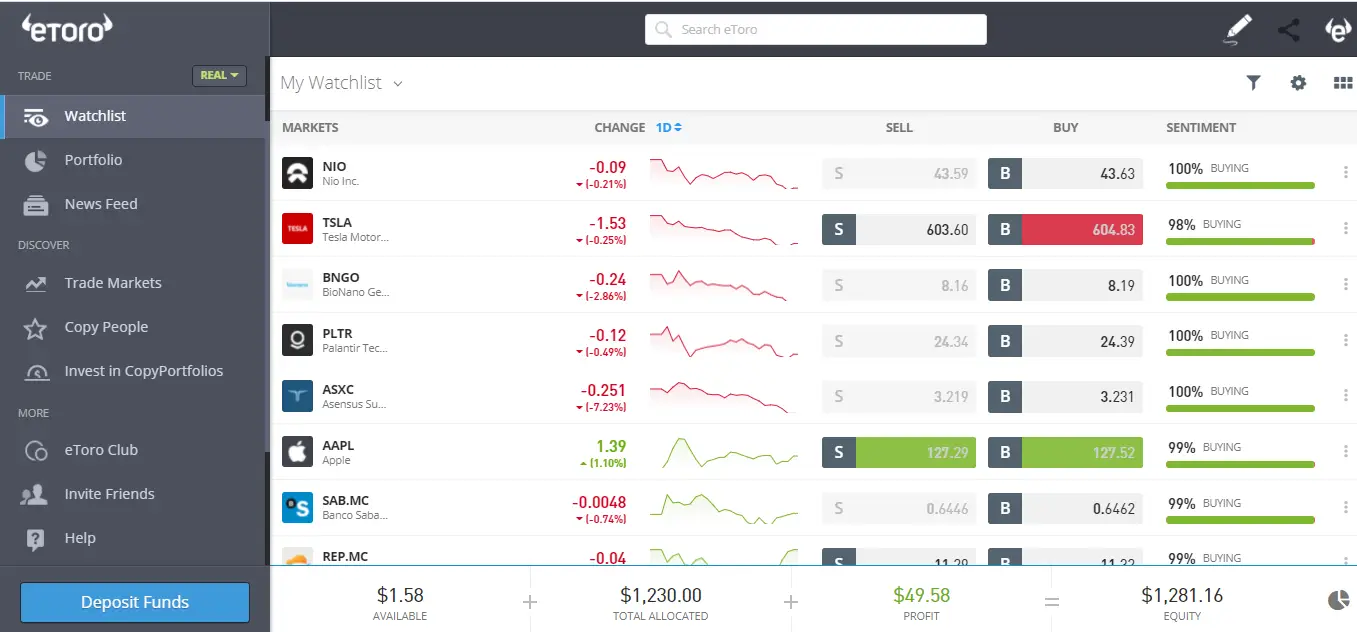

Founded in 2007, eToro is a commission-free trading platform with a worldwide presence (+140 countries) and over 30 million registered users. It is a multi-asset brokerage company offering stocks, ETFs, and thousands of CFD products on stocks, indices, currencies, and commodities.

Opening a business investment account through eToro is possible. However, depending on your location, the products and markets available to trade might vary. In some cases, corporate account holders can have access to better spreads and fees and increased leverage.

Your first step to opening an eToro corporate account is to contact customer support because there is no place on their website where you can start the process on your own. Since we have already reached them, you may get one step ahead by providing the documentation without waiting for their reply.

To open an eToro business investment account, you should open a ticket and provide eToro with the following information:

- What is the purpose of opening a corporate account with eToro?

- What type of legal entity is your company?

- Where is your company incorporated?

- Please provide a detailed description of your company’s business activity.

- Please provide a copy of your company Memorandum and Articles of Association or the local equivalent.

- The minimum initial deposit for a corporate account is 10,000 USD. Please confirm this will be acceptable.

Want to know more? Read eToro’s FAQs for opening a corporate account.

Pros

- Low stock trading fees (from $0 per trade)

- Commission-free ETFs (other fees apply)

- Social trading and other innovative products

- Wide variety of financial products

- Slick, modern, and easy for anyone to use

- European users have access to three account currencies: EUR, USD and GBP

- Top tier regulators

Cons

- Limited disclosed financial information

- Withdraw and inactivity fees

- Spread, overnight, inactivity, and currency conversion fees higher than average

- Doesn’t offer bonds, futures, or options

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What is a business brokerage account?

A business brokerage account is a brokerage account designed for companies and self-employed individuals, enabling them to trade, store, and manage securities.

Depending on the brokerage provider, various types of securities can be traded. Some business brokerage accounts allow trading of the following investment products:

- Stocks

- ETFs (Exchange-Traded Funds)

- Funds

- Bonds

- Derivatives (e.g., certificates or options)

- Cryptocurrencies

Stocks, ETFs, and funds are almost always available for trading in these accounts.

Why open a business investment account?

Investing your company’s spare cash could have significant benefits, including:

- Earn interest: Getting returns on your uninvested cash balances, which are higher than those offered by national banks

- Diversity: If you prefer no to invest in your business, then investing in other businesses could be a way to diversify your holdings

- Postpone taxes: Many businesses pay high taxes when taking money out. This way, you can still reinvest inside the corporation.

Conclusion

All in all, outside the USA, there are very few alternatives for those looking to open a corporate business account. In this post, we have covered three brokers that allow you to invest through your company – as we’ve done ourselves.

Feel free to reach out to us if you have any feedback and question – we’re happy to help!

FAQs

Can you open a business account at Trading 212?

No, currently a business account cannot be opened at Trading 212. Only retail private accounts are accepted.

Does DEGIRO offer a business account?

No, DEGIRO used to offer corporate accounts, but those are no longer available.

Does Trade Republic offer corporate accounts?

No, you can’t open a business account at Trade Republic, only a retail personal account.

Does Hargreaves Lansdown offer business accounts?

No, Hargreaves Lansdown does not offer corporate accounts.

Does XTB offer business accounts?

No, XTB does not offer corporate accounts.