Investors across Europe are growing increasingly attracted to covered call ETFs, thanks to their ability to deliver steady income and offer a measure of downside resilience.

By selling call options on the equity holdings, these funds collect premiums that result in monthly distributions. In a climate of uncertain equity returns and historically low interest rates, the income from covered call ETFs can feel particularly reliable.

In the US, Goldman Sachs’s covered call ETFs, most notably GPIX (S&P 500 Premium Income ETF) and GPIQ (Nasdaq‑100 Premium Income ETF), have emerged as two of the fastest‑selling ETFs in the first half of 2025, according to The Daily Upside.

Similarly, Reuters reports a high influx of inflows to U.S. covered call funds as investors seek higher returns and protection from broader market volatility.

The piece underscores investor demand for consistent yield strategies that offer “lower highs and higher lows,” capturing around 85% of the upside while delivering monthly payouts in the 8–10% range.

Will this upswing trend also happen in Europe? Let’s find out!

What are the best covered call ETFs for European investors?

First of all, covered call ETFs based in the US are not available in Europe. This means that your only option is investing through ETFs based in Europe (Ireland and Luxembourg are the main countries where European ETFs are domiciled).

As of October 2025, according to JustETF, Europe hosts only a few covered call ETFs structured under UCITS regulations, which are available to retail investors.

This fact emphasises the early stage of market development in the region and the potential for further growth. From our analysis, we highlight four which seem a good start for exploring these kinds of strategies (some can be directly explored through Freedom24):

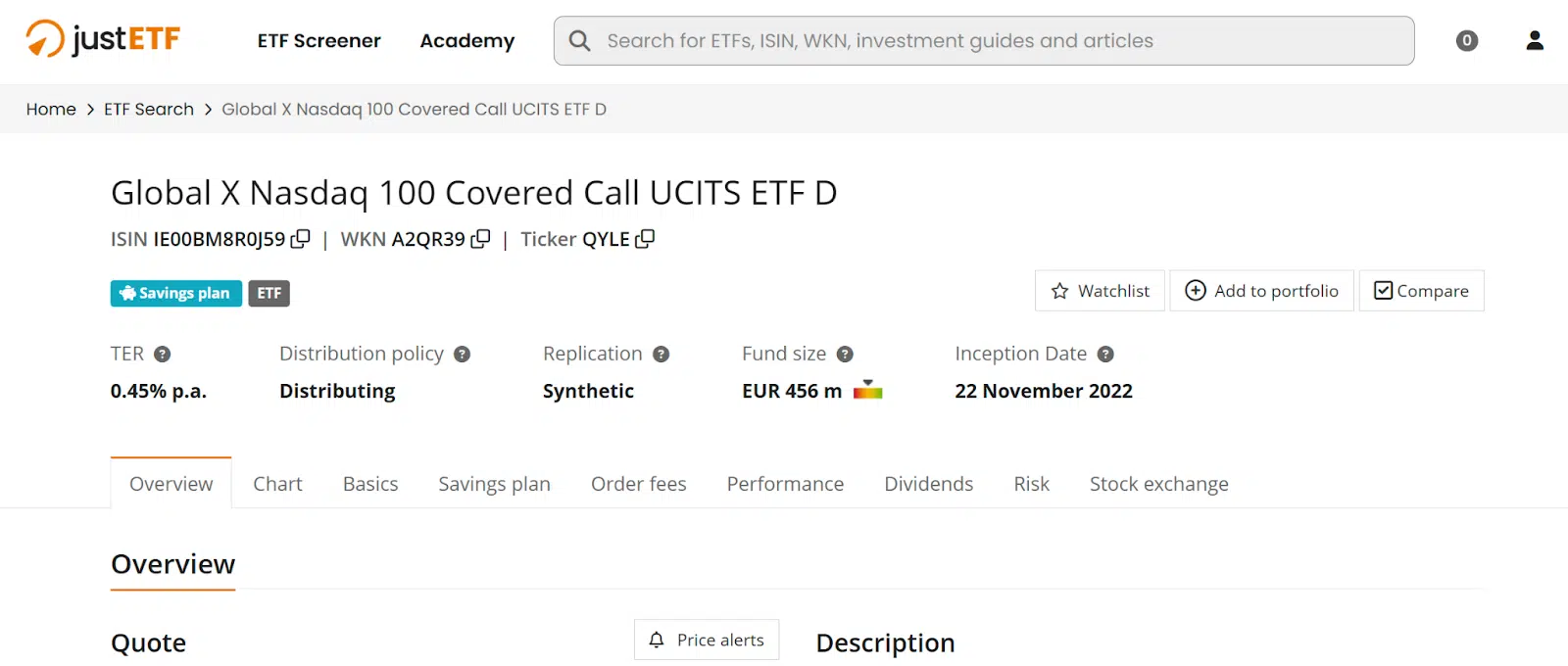

1. Global X Nasdaq 100 Covered Call ETF (QYLD.EU)

- ISIN: IE00BM8R0J59

- Ticker: QYLD

- Sector: Technology, passive management (CBOE Nasdaq-100 BuyWrite Index)

- Yield: ~12.1% (as of June 2025) – Target figure, not guaranteed returns

- TER: 0.45%

- Replication: Synthetic

- Assets under management: $513 million

- Payout frequency: Monthly

- Key feature: High payout stability with limited capital growth potential

QYLD is designed for income-focused investors seeking a steady cash flow and a degree of downside protection in flat or declining markets. It’s best suited for those willing to trade off significant growth potential in return for high monthly distributions.

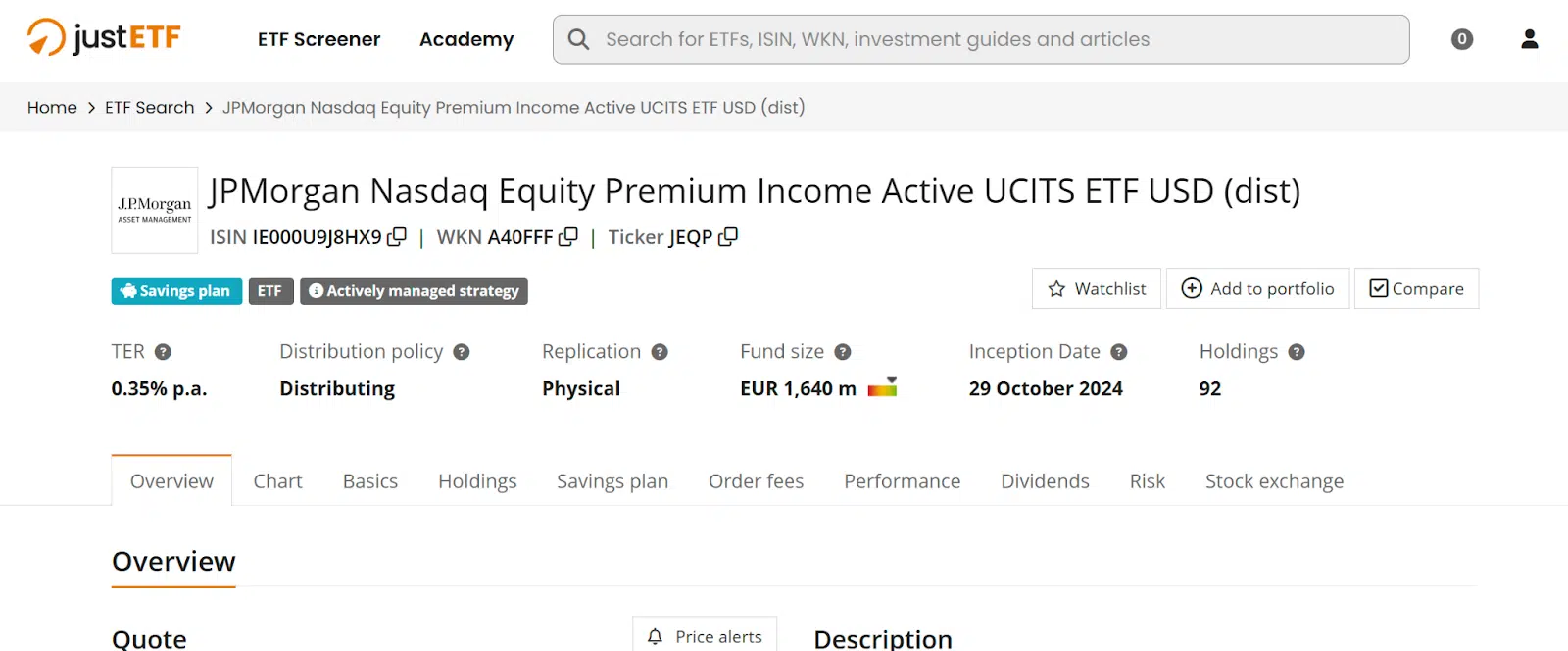

2. JPMorgan Nasdaq Equity Premium Income UCITS ETF (JEPQ.EU)

- ISIN: IE000U9J8HX9

- Ticker: JEPG

- Sector: Technology (Nasdaq 100)

- Yield: ~10.4% (as of June 2025) – Target figure, not guaranteed returns

- TER: 0.35%

- Replication: Physical

- Assets under management: +$1.5 billion

- Payout frequency: Monthly

Key feature: Actively managed, benefiting from high volatility premiums

JEPQ is designed for European investors seeking high monthly income and exposure to U.S. growth stocks with reduced volatility. It is well-suited for income-focused investors who want consistent cash flow and a smoother risk profile compared to owning Nasdaq equities outright.

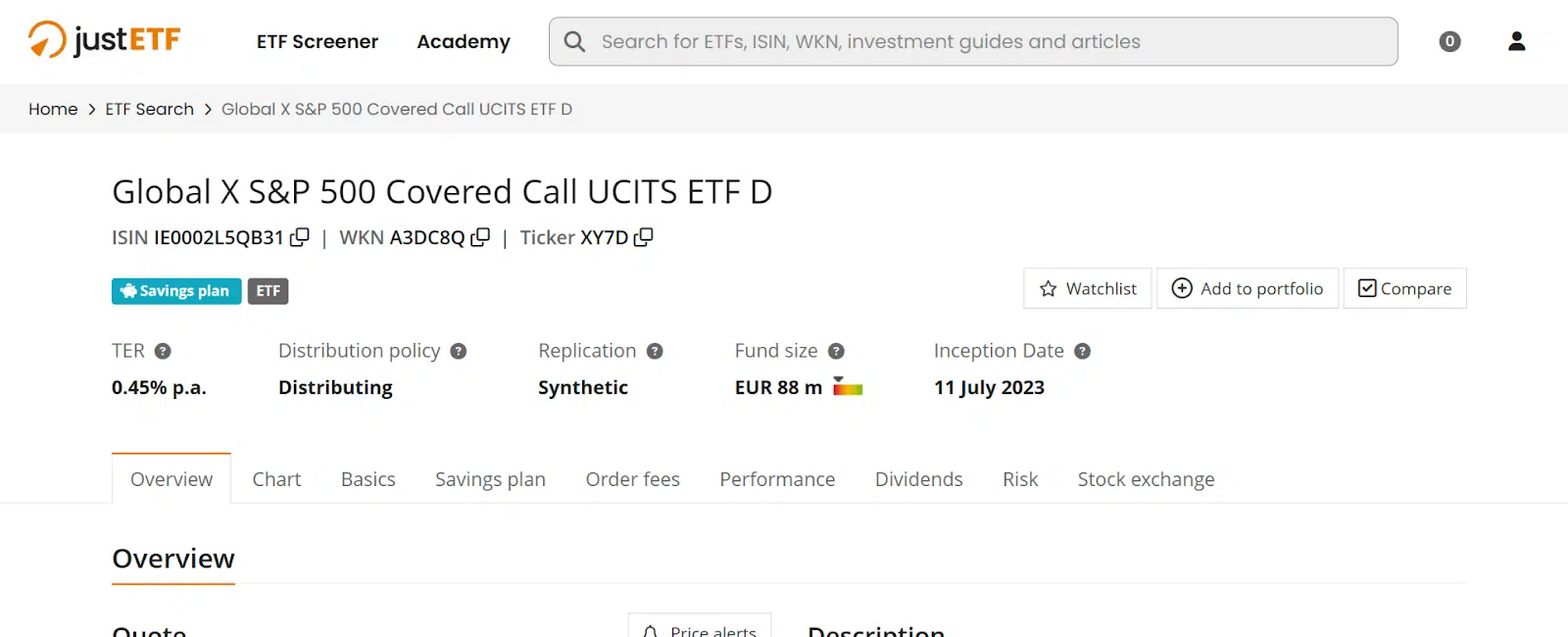

3. Global X S&P 500 Covered Call UCITS ETF D (XYLU.EU)

- ISIN: IE0002L5QB31

- Ticker: XYLU

- Sector: U.S. Equity, passive management

- Yield: ~9.0% (as of June 2025) – Target figure, not guaranteed returns

- TER: 0.45%

- Replication: Synthetic

- Assets under management: approx. €88 m (~$101 m USD)

- Payout frequency: Monthly

This ETF is designed for income-focused investors who seek high monthly distributions via a covered call strategy on the S&P 500, with limited upside potential and some downside cushion.

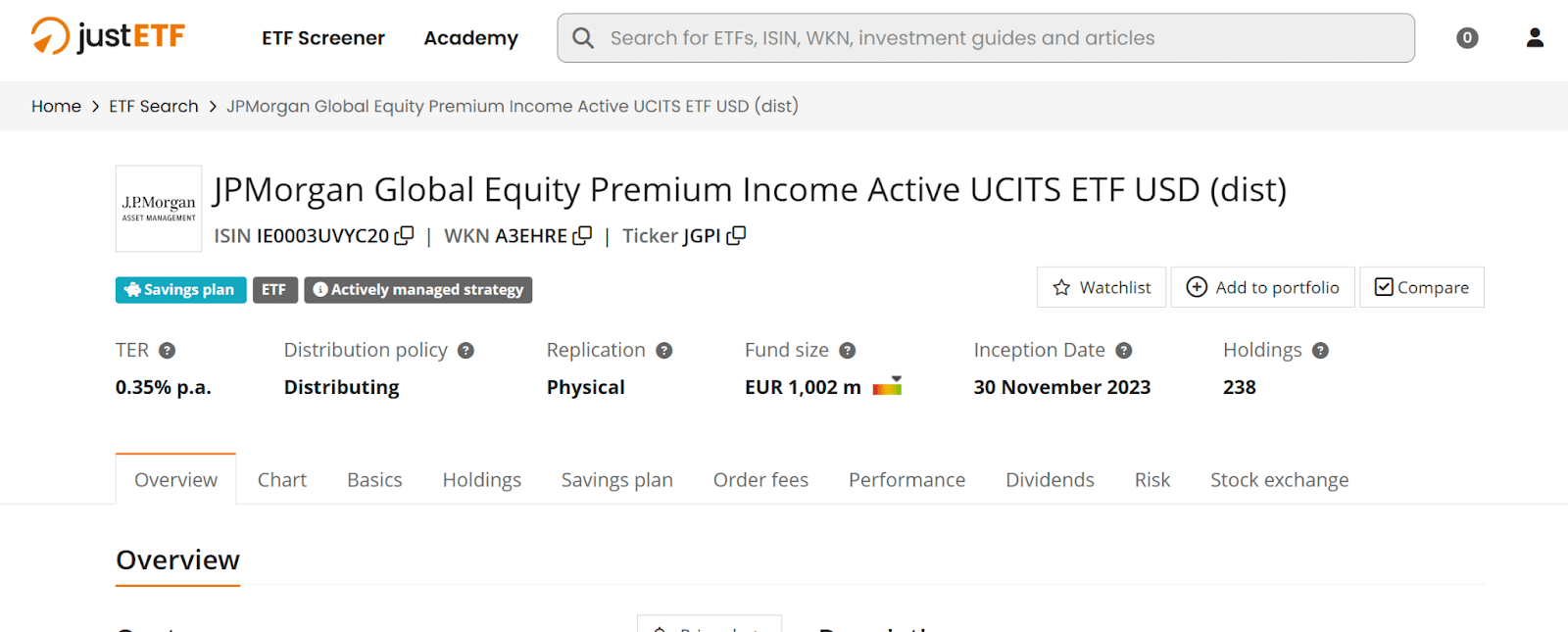

4. JPMorgan Global Equity Premium Income UCITS ETF (JEPG.EU)

- ISIN: IE0003UVYC20

- Ticker: JEPG

- Sector: Global Equities (MSCI World Index)

- Yield: ~7% (as of June 2025) – Target figure, not guaranteed returns

- TER: 0.35%

- Replication: Physical

- Assets under management: +$1 billion

- Payout frequency: Monthly

- Key feature: Broad diversification across countries and sectors

JEPG is ideal for income‑oriented investors seeking broad exposure to global equities via the MSCI World Index while generating some income. Its monthly payout structure and global scope make it particularly attractive to investors seeking steady income while still wanting equity upside potential.

Covered call ETFs compared

| ETF Name | Yield (June 2025) | TER | Key Feature |

| Global X Nasdaq 100 Covered Call (QYLD) | ~12.1% | 0.45% | High payout stability, limited growth |

| JPMorgan Nasdaq Equity Premium Income (JEPQ) | ~10.4% | 0.35% | Actively managed, benefits from volatility |

| Global X S&P 500 Covered Call (XYLU) | ~9.0% | 0.45% | Income via S&P 500 covered call strategy |

| JPMorgan Global Equity Premium Income (JEPG) | ~7.0% | 0.35% | Broad diversification, global income |

How to invest in a Covered Call ETF? Step by step

The process of investing in a covered call ETF is identical to that of investing in any other ETF or stock. Following our previous example, we will use Freedom24, a CySEC-regulated broker, to illustrate the process.

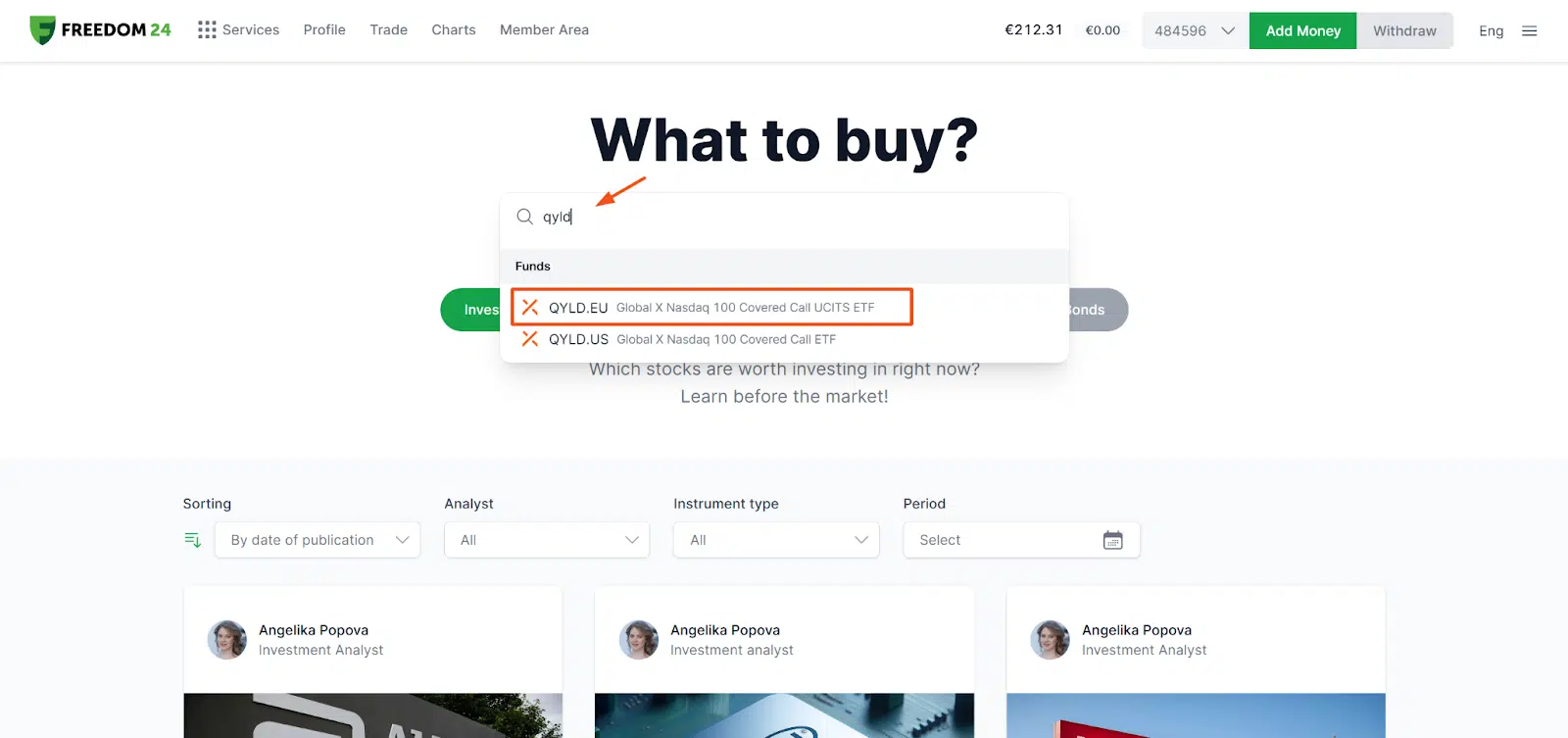

Step 1: Search for the covered call ETF

Let’s go for the “QYLD”:

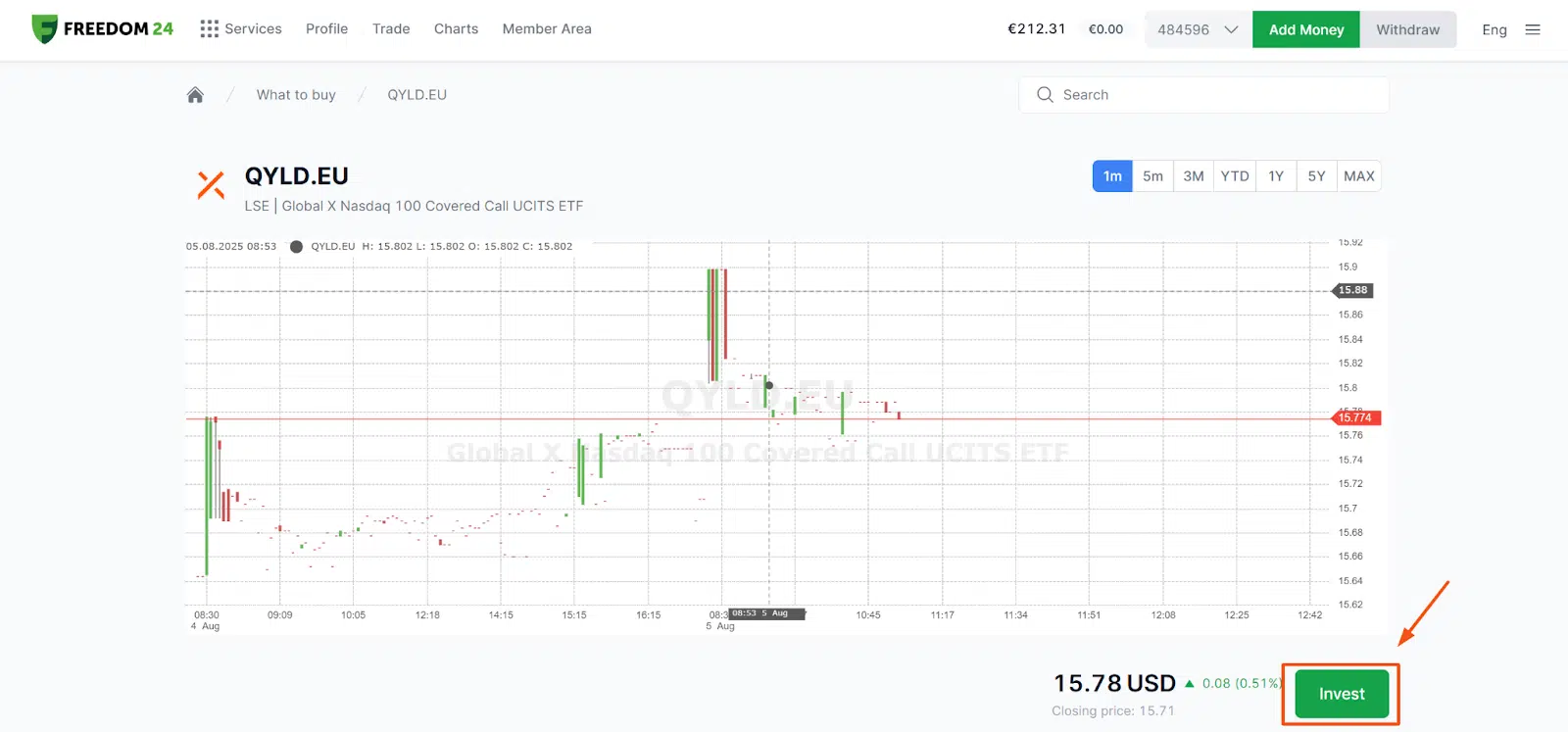

Step 2: Select the first ETF and click “Invest”:

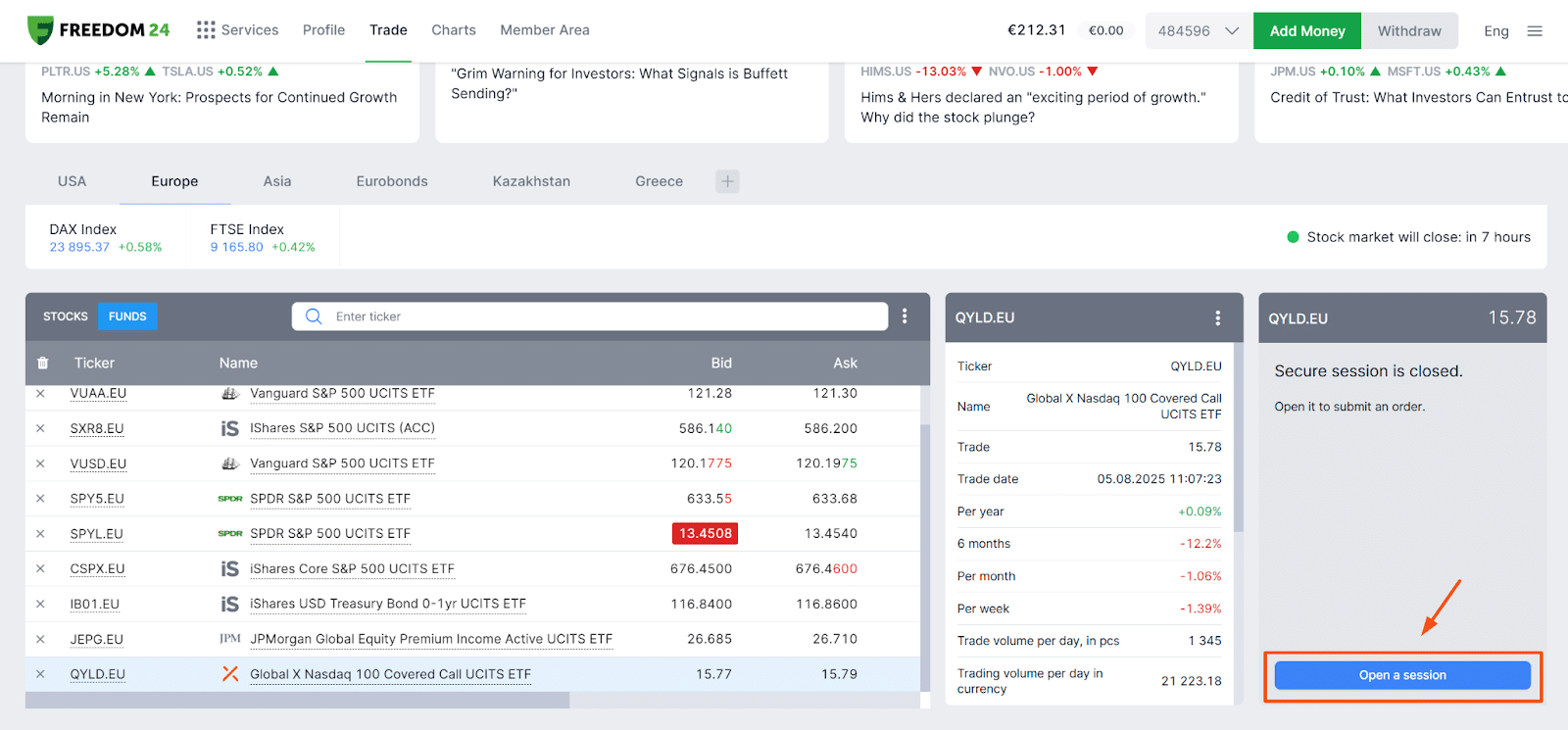

Step 3: Open a session

After clicking “Invest”, you will be redirected to the “Trade” window. Now, you will need to click on “Open a session” and follow the security steps (you will need to open the Freedom24 app on your mobile phone and use the QR code scanner within the app).

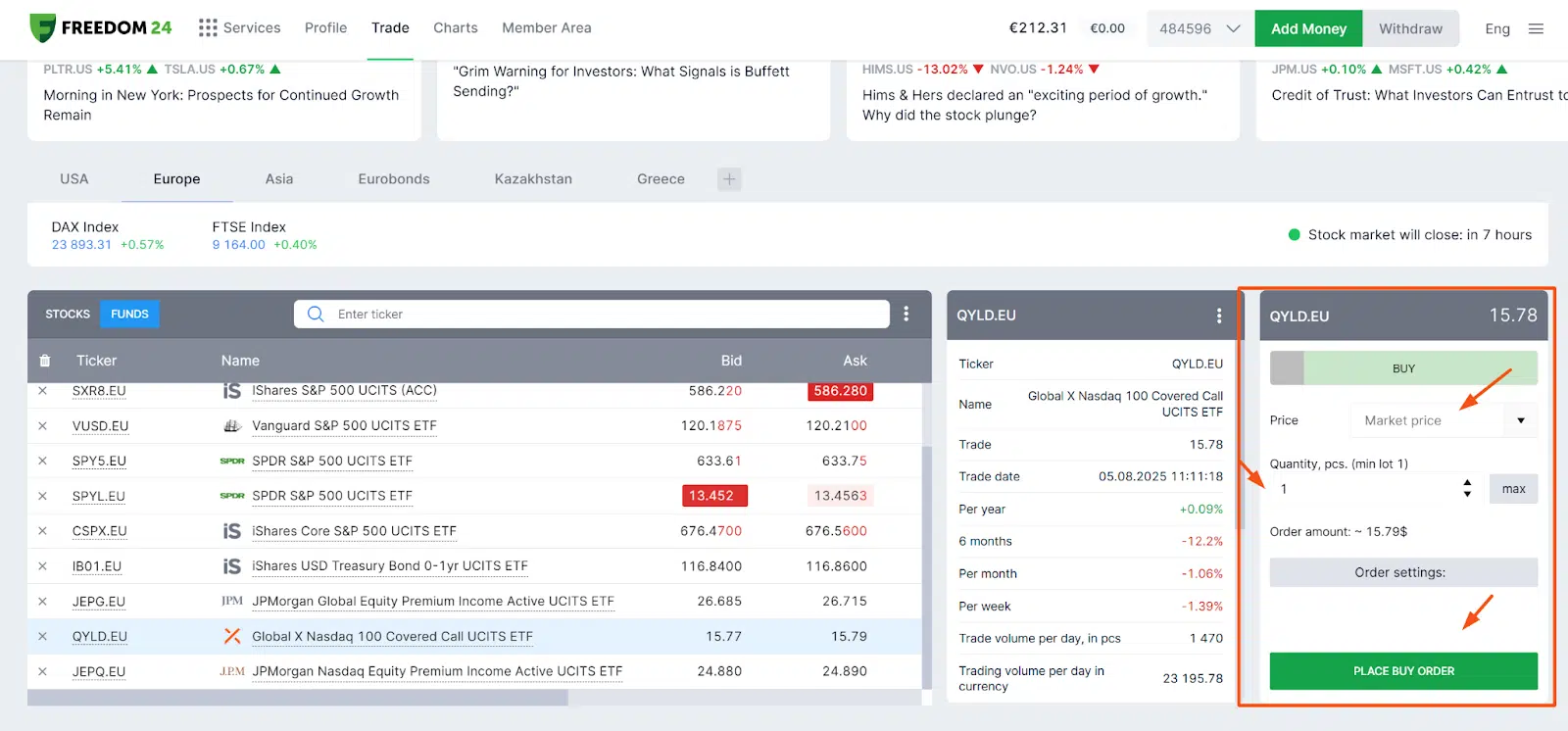

Step 4: Place a buy order

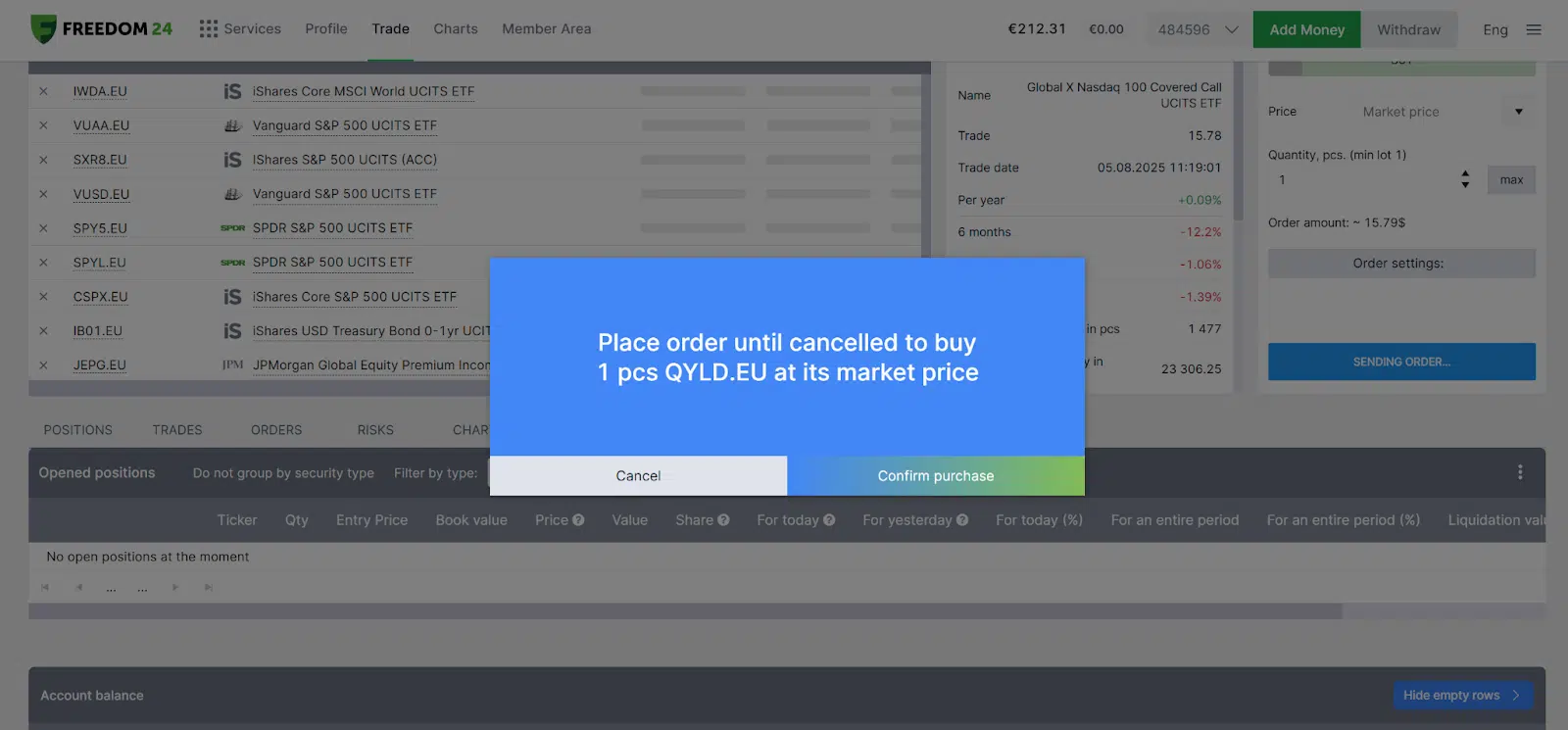

Define the amount you want to buy (1 share in our case) and the order type (We went for “market price”). Then, click “PLACE BUY ORDER”:

Please note that the QYLD is traded in USD, which means that you will need to convert your euros to dollars (go to the top right corner and press the “3 lines” icon, then select “currency exchange”, select the “USD” and then simply write the amount you want to convert (“buy”).

Step 5: Final trade confirmation

Just click on “confirm purchase”:

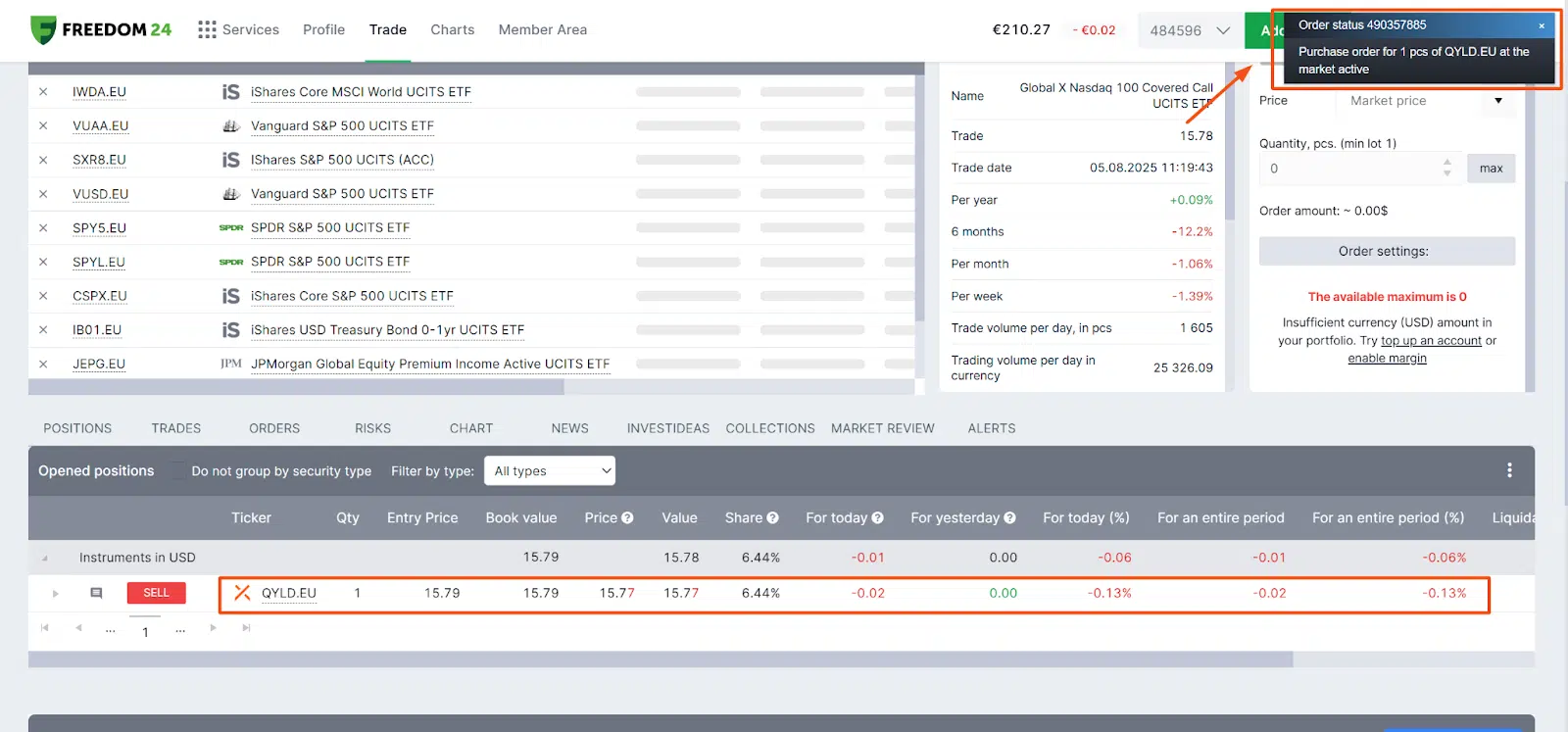

Step 6: Your order has been fulfilled, and it is in your portfolio:

What is a covered call ETF?

First, we need to understand what a call is. A call option gives the buyer the right to purchase 100 shares of a specific company at a specified price (the strike price) by a certain date (the expiration date). However, in a covered call ETF, we are selling an option, not buying it.

What does this mean? As a seller, you have the obligation (not the right, as the buyer) to sell the stock at the strike price only if the buyer exercises the option. Still confusing? We give an example below!

A covered call ETF is a type of exchange-traded fund that combines stock ownership with the sale of call options to generate extra yield. These funds typically own shares in major indices, such as the S&P 500, Nasdaq 100 or Euro Stoxx 50, and then write (meaning “sell”) call options on those same holdings. The premiums received from selling those options are collected and paid out to investors, boosting income without needing higher dividend-paying stocks.

At the same time, the upfront premiums received help buffer small market declines, softening the impact of moderate drawdowns. While it’s important to recognize that the upside is capped, meaning outperformance in strong bull markets is sacrificed, the trade-off can be appealing for income-focused investors seeking a smoother ride alongside their equity exposure. What draws many investors is the attractive income, typically in the 7–12% annual range, alongside frequent distribution schedules (monthly or quarterly).

How do covered call ETFs work? (with an Example)

On the mechanics: the ETF holds a portfolio of equities and systematically sells call options at strike prices slightly above current market levels.

If share prices stay below the strike, the fund retains both stocks and premium. If the price exceeds the strike, the ETF may have to sell shares at that price, sacrificing some potential upside, but keeps the premium.

Real-life example

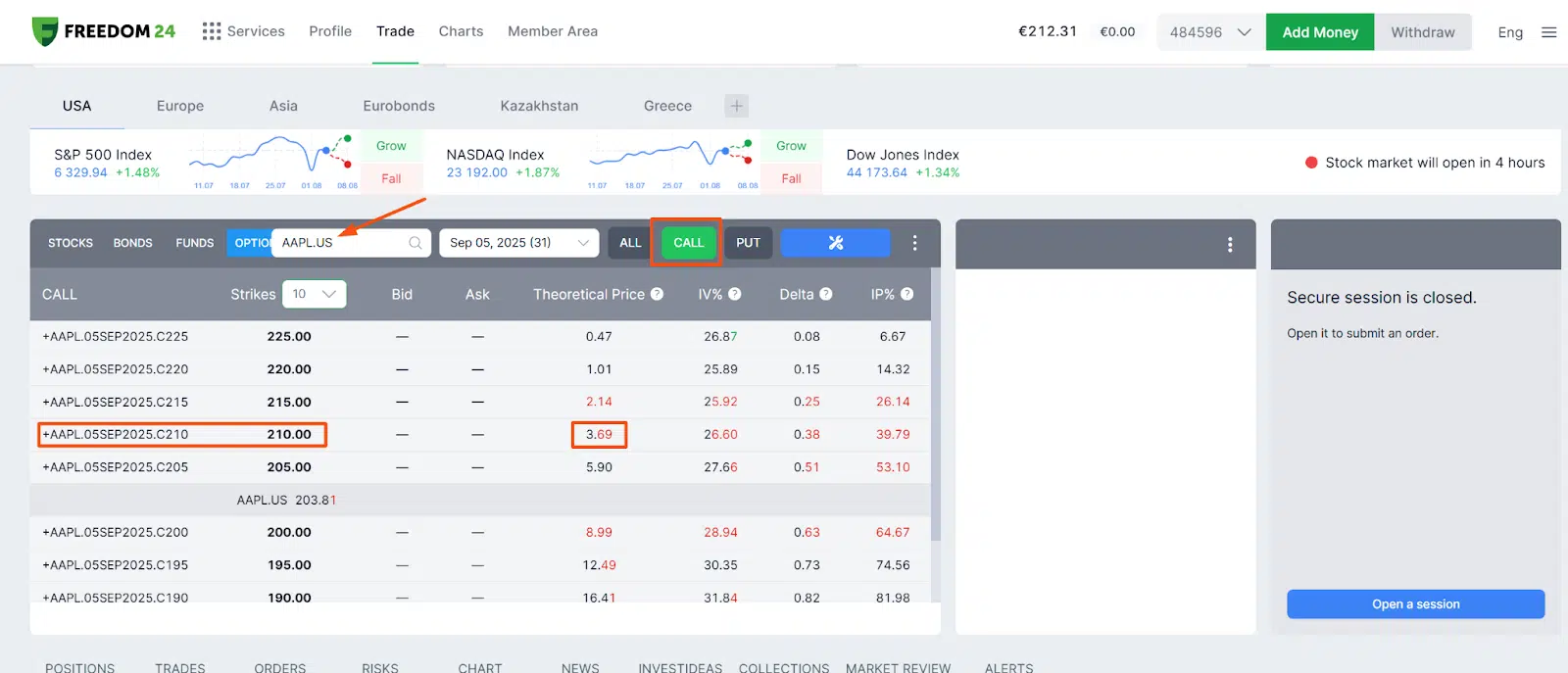

Suppose you own 100 shares of Apple, which trade at ~$203 per share, as of August 8th, 2025 (we will use Freedom24 as the investment platform for this example – new users get 20 free shares when signing up).

You decide to sell a call option on Apple with a $210 strike price and an expiration date on September 5th, 2025. In exchange, you receive $3.69 for each of your 100 Apple shares, providing $369 of immediate income.

If Apple’s price rose from $203 to $220 at the expiration date, the options buyer would pay you $210 (the strike price) for your shares.

You’d keep the $3.69 per share of premium income. However, you would have made $10 ($220-$210) per share if you had held Apple without a no-options strategy behind it.

Still, if Apple’s share price stagnated or declined, you keep your shares and receive the premium, which would enhance your returns.

Bottom line

Covered call ETFs are gaining momentum among European investors seeking steady income and reduced volatility without completely withdrawing from equity markets. While the upside is capped, these ETFs can be a powerful tool for those prioritizing predictable cash flow, especially in uncertain markets.

If you’re looking to start investing in covered call ETFs, Freedom24 offers a simple, regulated platform to buy and manage these funds efficiently. We’ve prepared a detailed Freedom24 review to help you understand its features, fees, and how it compares to other brokers, making it easier for you to decide if it’s the right choice for your investment strategy.