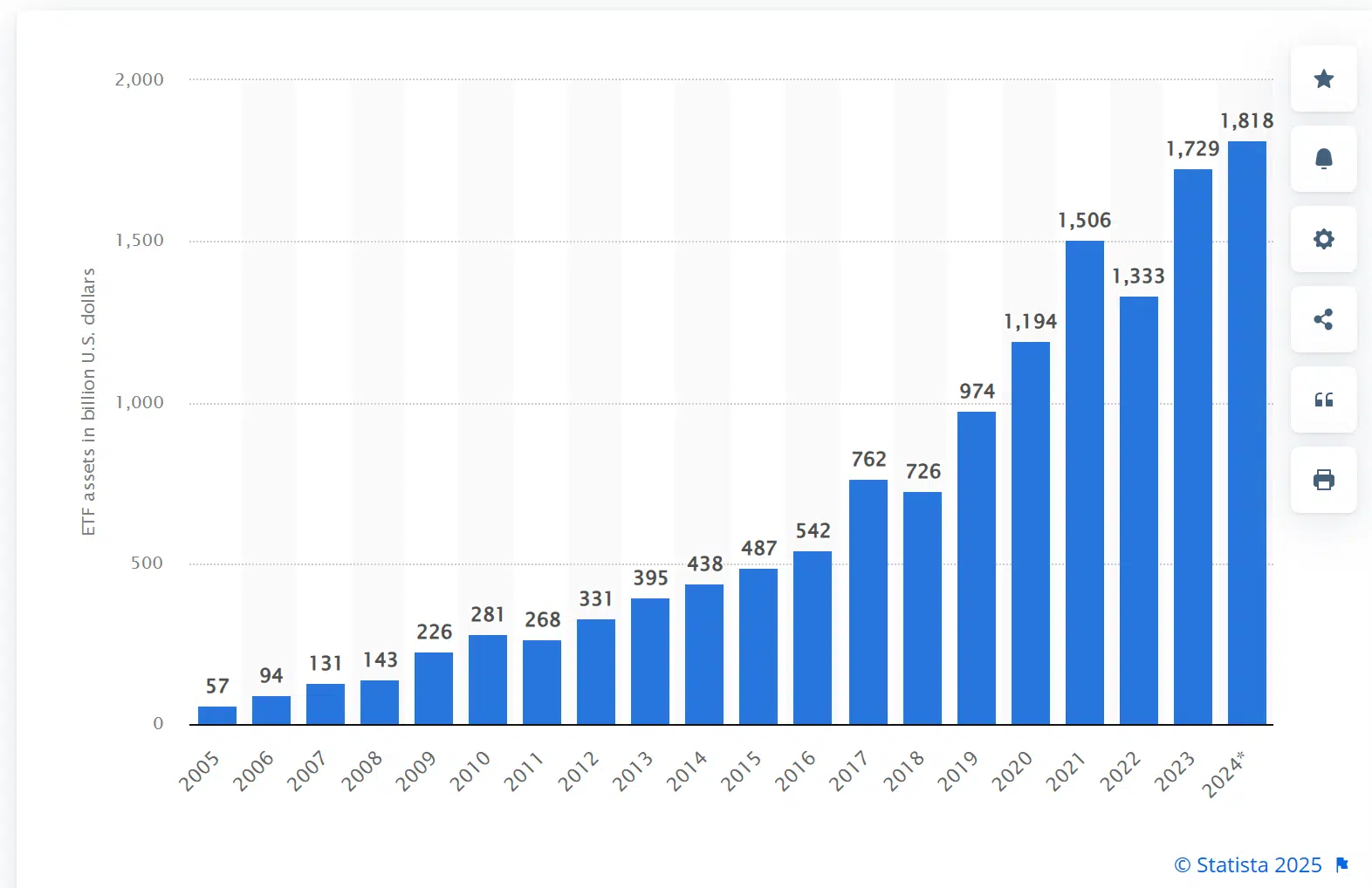

Exchange-traded funds (ETFs) have become an increasingly popular investment vehicle for many investors worldwide and, of course, in Europe:

Within Europe, one of the most prominent categories is the UCITS ETF. In this article, we will demystify UCITS ETFs, clarify how they are regulated, and discuss where you can buy them, drawing on guidance from the European Securities and Markets Authority (ESMA) – in particular, the document “ESMA’s Guidelines on ETFs and other UCITS issues”.

What does UCITS mean?

UCITS stands for “Undertakings for Collective Investment in Transferable Securities”. This term originates from a series of EU directives establishing a harmonized regulatory framework for mutual funds within Europe. Key points include:

- Investor protection: UCITS funds must meet stringent requirements designed to protect retail investors. This includes diversification rules, restrictions on leverage, and requirements for transparent disclosure.

- Example: Single issuer exposure limits. A UCITS fund cannot invest more than 10% of its net assets in securities or money market instruments issued by a single entity.

- Passporting across the EU: Once a UCITS fund is authorized in one EU Member State, it can be marketed and sold across the entire European Economic Area (EEA) without needing separate authorizations from each country.

- Standardized regulation: The UCITS brand is widely recognised, providing investors with trust and clarity regarding operational and risk management standards.

What is a UCITS ETF?

A UCITS ETF is an ETF that complies with the UCITS directive. Like other ETFs, it is:

- Exchange-listed and tradable on a stock exchange throughout the trading day;

- Passively managed (in most cases) to track a specific index such as the S&P 500, STOXX Europe 600, or other market benchmarks. However, actively managed UCITS ETFs also exist, though they are less common.

- Regulated under UCITS rules, ensuring the product meets specific guidelines around portfolio diversification, transparency, and investor protection.

Because UCITS ETFs meet EU regulatory standards, they often attract not just European investors, but also international investors seeking an investment product that meets established European rules.

The regulatory framework of UCITS ETFs

ESMA’s guidelines outline several important regulatory aspects for UCITS ETFs:

- Transparency requirements: UCITS ETFs must clearly disclose their investment objectives, index-tracking methodologies, and risks in the Key Information Document (KID).

- Diversification: UCITS-compliant funds have strict diversification rules. In most cases, no single asset can make up more than 10% of the fund’s total assets.

- Liquidity management: The ETF must ensure it can meet investor redemptions, typically requiring it to hold sufficiently liquid assets.

- Collateral requirements: In cases where the ETF engages in securities lending or uses derivatives, ESMA guidelines dictate the nature and quality of collateral it must hold to manage counterparty risk.

- Investor disclosure: Additional disclosures are required when a UCITS ETF departs from its usual index-based strategy or invests in financial derivative instruments (FDIs).

These regulatory demands aim to enhance investor protection, enforce transparency, and preserve market integrity.

The advantages and disadvantages of UCITS ETFs

Advantages

- High investor protection: UCITS ETFs are subject to stringent rules, providing reassurance to retail and institutional investors alike.

- Tax efficiency: Depending on your tax jurisdiction, UCITS ETFs can be more tax-efficient than non-UCITS funds (e.g., US-domiciled ETFs) due to international tax treaties and favourable withholding tax conditions.

- Diversification and liquidity: UCITS ETFs offer exposure to a range of underlying assets, sectors, and geographic markets, while being easily tradable throughout the trading day.

- Regulatory transparency: Regular and standardized reporting ensures investors know exactly what is happening with the fund’s holdings, fees, and performance.

Disadvantages

- Limited choices for certain markets: Compared to some US-listed ETFs, the selection of UCITS ETFs can be narrower for specific niche sectors or thematic strategies.

- Trading costs: While ongoing charges (TER, or total expense ratio) may be low (but still higher than their US counterparts), investors should consider brokerage fees, bid-ask spreads, and currency conversion costs.

- Risk of tracking error: As with any index fund, the ETF’s returns can deviate from its benchmark due to fees, transaction costs, and portfolio rebalancing.

How to identify a UCITS ETF?

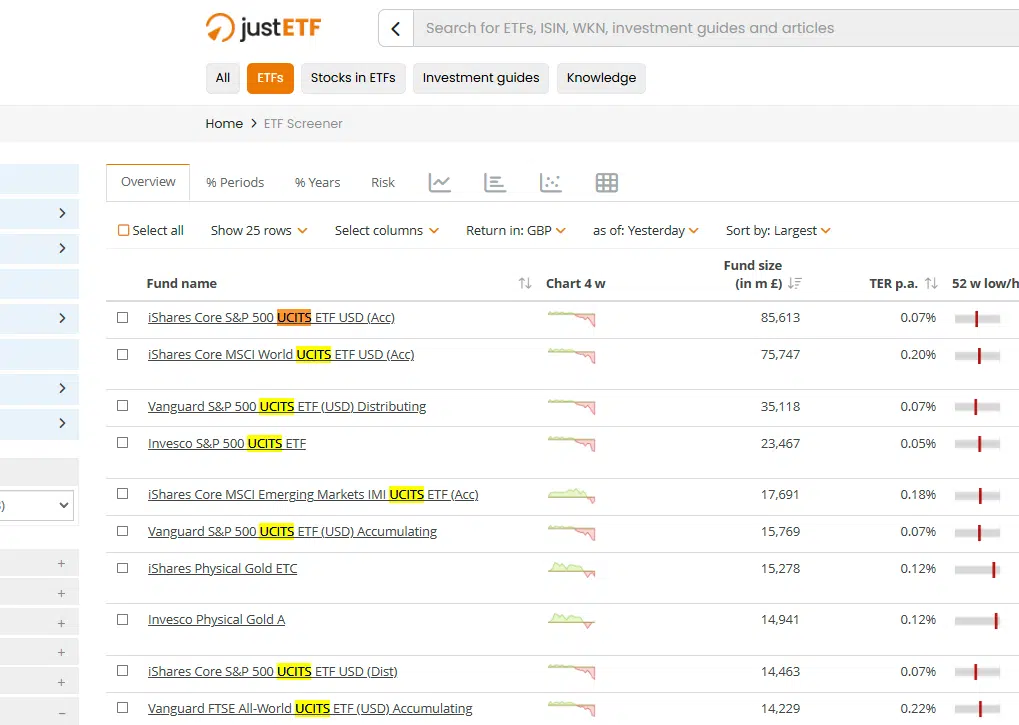

The best way is to look at the full name of the ETF you want to invest. If you go to justetf.com, you will find thousands of ETFs. In all UCITS ETFs, you will notice the word “UCITS” in their names:

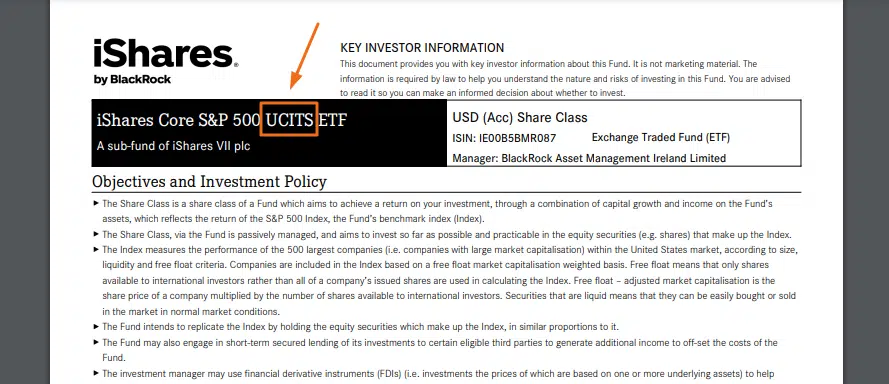

If you are still in doubt, check for the Key Investor Information Document (KIID). Example for the iShares Core S&P 500 UCITS ETF:

Where and how to trade in UCITS ETFs

Trading UCITS ETFs is broadly similar to trading stocks:

- Open a brokerage account: You will need an account with a broker that offers access to European exchanges (e.g., Euronext, Xetra, Amsterdam or the London Stock Exchange).

- Search for the ticker: Each UCITS ETF has a ticker symbol. For instance, an ETF tracking the MSCI World Index might trade under a specific ISIN and ticker on multiple European exchanges.

- Place a buy order: You can place market or limit orders during the exchange’s trading hours.

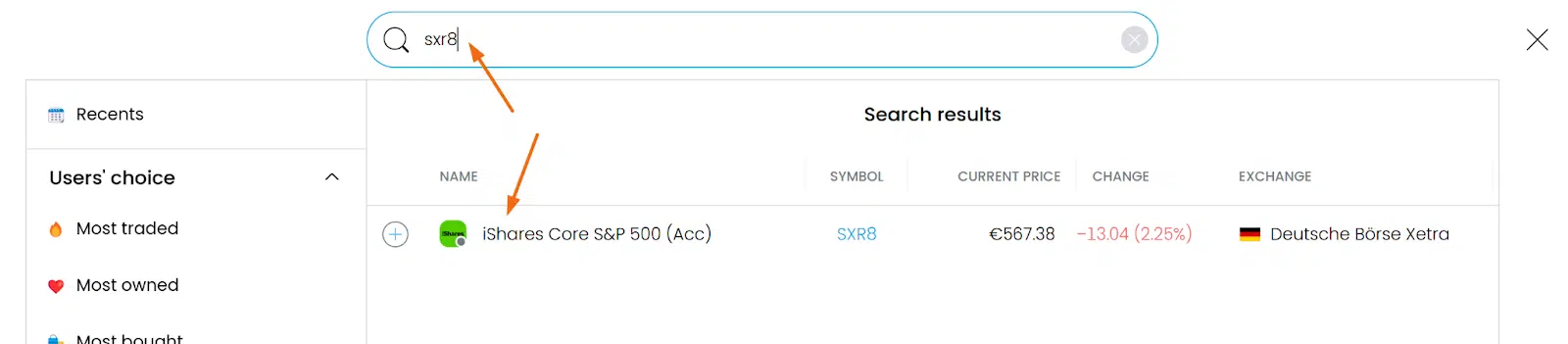

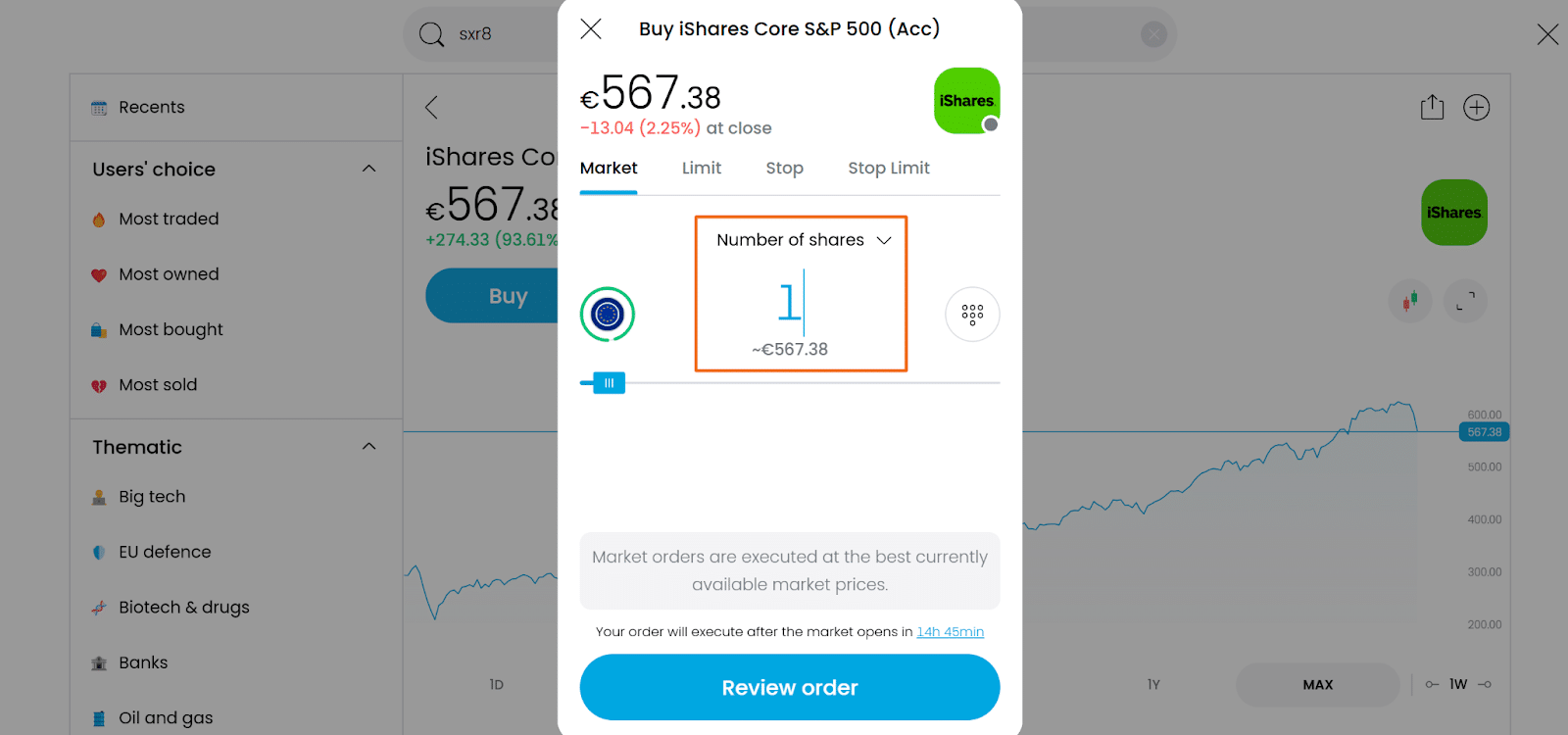

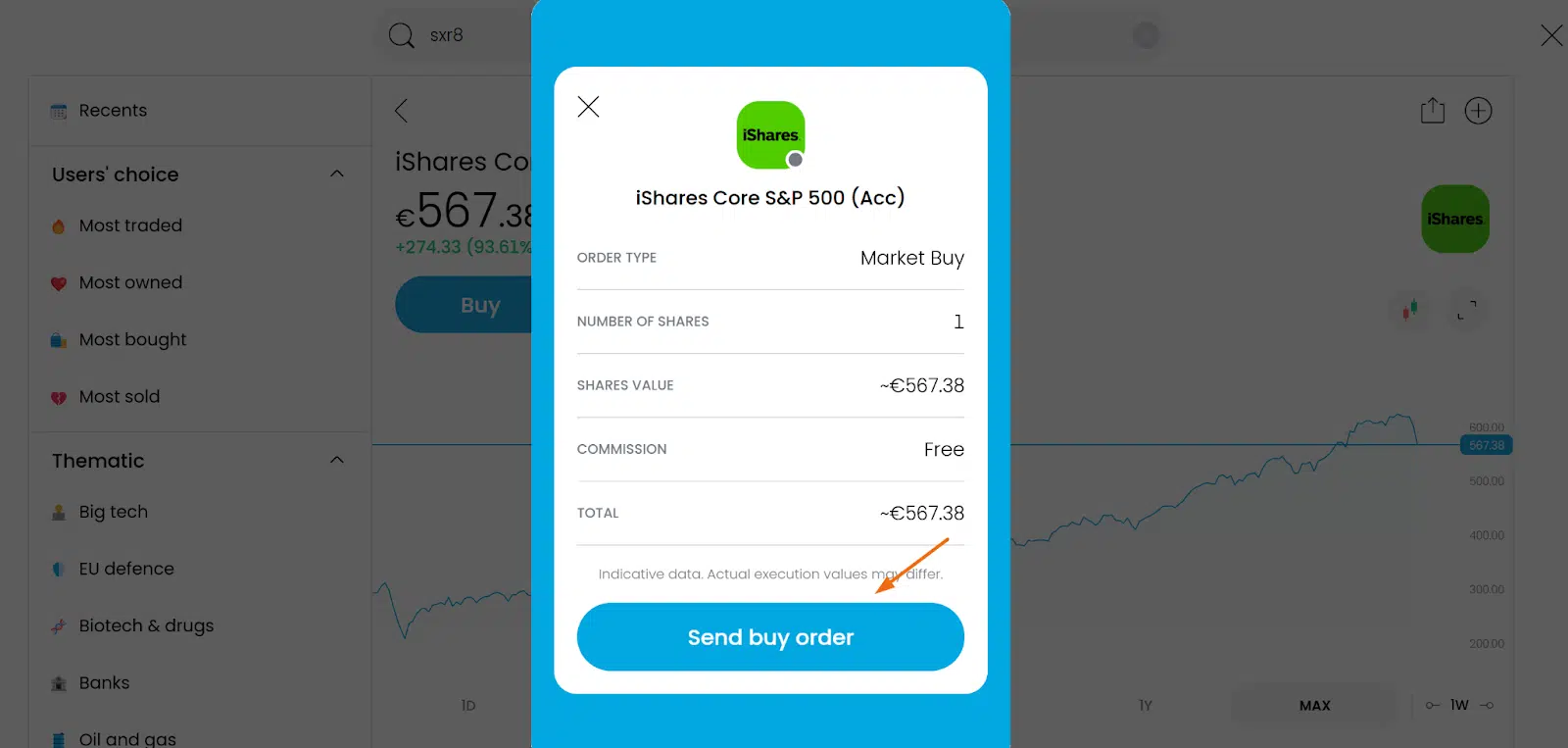

For our example, we will be buying the iShares Core S&P 500 UCITS ETF USD (ticker SXR8) while using Trading 212, a broker with zero commission for ETFs.

- First, search for SXR8:

- Second, select the ETF, click “Buy” and choose the number of stocks (one, in our case):

- Third, click “Review” (the ETF is no trading commissions) and finally “Send buy order”:

Other investment platforms to consider

Apart from Trading 212, you can find others that allow you to buy UCITS ETFs. Ensure your broker or platform offers trading on European exchanges. Here are a few popular options:

- Interactive Brokers: A global brokerage with wide market access, suitable for advanced traders wanting international reach.

- Lightyear: A newer platform focusing on low-cost trading, including European stocks and ETFs.

- Freedom24: A platform known for its long-term funds’ placement alongside a broad stock and ETF offering.

When choosing a broker, consider trading fees, currency conversion charges, spread, and the regulatory framework in your home country.

Bottom line

UCITS ETFs offer investors exposure to a diverse range of assets, strong regulatory oversight, and the convenience of intraday trading. They are a popular choice for those seeking a reliable, transparent, and potentially tax-efficient way to invest in global markets.

While they come with certain trading costs and may have a narrower range of niche offerings than some non-UCITS funds, their investor protections and ease of cross-border marketing in the EU make them a compelling choice for many portfolios.

If you are looking to invest in UCITS ETFs, remember to research thoroughly, choose a reputable broker, and evaluate how these funds align with your long-term investment goals and risk tolerance.

As with any investment decision, always consider seeking professional financial or tax advice tailored to your personal circumstances.