Choosing good traders to copy is hard! There are good traders to copy on all social trading platforms, but finding them takes some time and skills. Most of them are beginners with bad bankroll management skills and high-risk profiles. In this article, you will learn how to perform an in-depth analysis when searching for the best signal provider to follow on copy trading platforms such as eToro, NAGA or Zulutrade.

A case study

In 2012, if you had invested anything by following Michaelfx, one of the most popular eToro’s Popular Investors back then, you would have lost everything! If you had spread out your risks by copying all of the remaining 9 on the list, however, you would have made some money. Also, if you had invested $1000 in each one of the 10 Popular Investors, you would have lost over $700 because of Michaelfx.

Moral of the story: Popularity is a reasonable point to start when looking for a decent signal provider but is by no means a recipe for success in social trading. There are numerous accounts of traders in the top 10 or even editor’s choice list who lost nearly all their account balances and their copiers’ allocation. You might want to dig deeper into your analysis before picking a signal provider. A good analysis will enable you to discard many traders.

1. Trusted traders

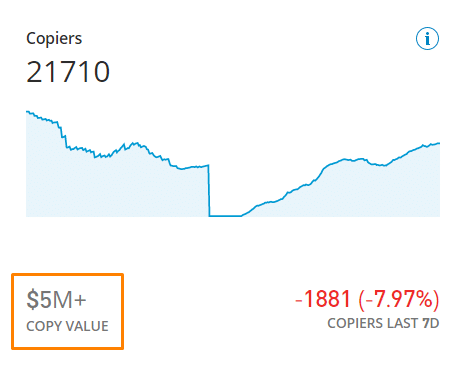

The easiest way to identify a great social trader is to investigate how much other followers trust them. Check out the amount of real money (not demo accounts) that other people have invested with them to get signals from the trader. More so, you might want to consider the profits those followers are getting by following that signal provider. You will find this information on their profile page.

Generally, if a trader has very few copiers and followers, it is a bad sign, and you should avoid him. Also, the most copied traders don’t mean that they are good traders. Some of them just found ways to boost their rankings through questionable actions, like manually copying the activity of other good traders or creating various accounts and sticking with the one that, by luck, did best.

The amount of money invested in the trader is a better performance indicator than the number of copiers. On eToro, Zulutrade, or NAGA, for instance, people have a chance to rank the traders by “Copy Value” (or AUM), which means the amount of money invested in them.

The “Copy Value” rank makes for a more relevant reflection of the signal provider’s popularity. It shows how much copiers trust that particular trader with their real money.

One reason why the number of copiers would be a poor choice for gauging the level of trust is that even if a trader lost 90%, they might still have all the copiers who did not set a CSL (stop loss) sticking around. With “Copy Value”, however, the amount of money following them would decrease sharply, and so will their “Copy Value” rank.

2. Returns

Negative returns are obviously bad. Also, very high returns may seem appealing, but be careful – annual returns of around 70% or more are not usual and are most likely down to luck or high risk. Also, look at the monthly returns to understand if the performance is due to a certain month/months.

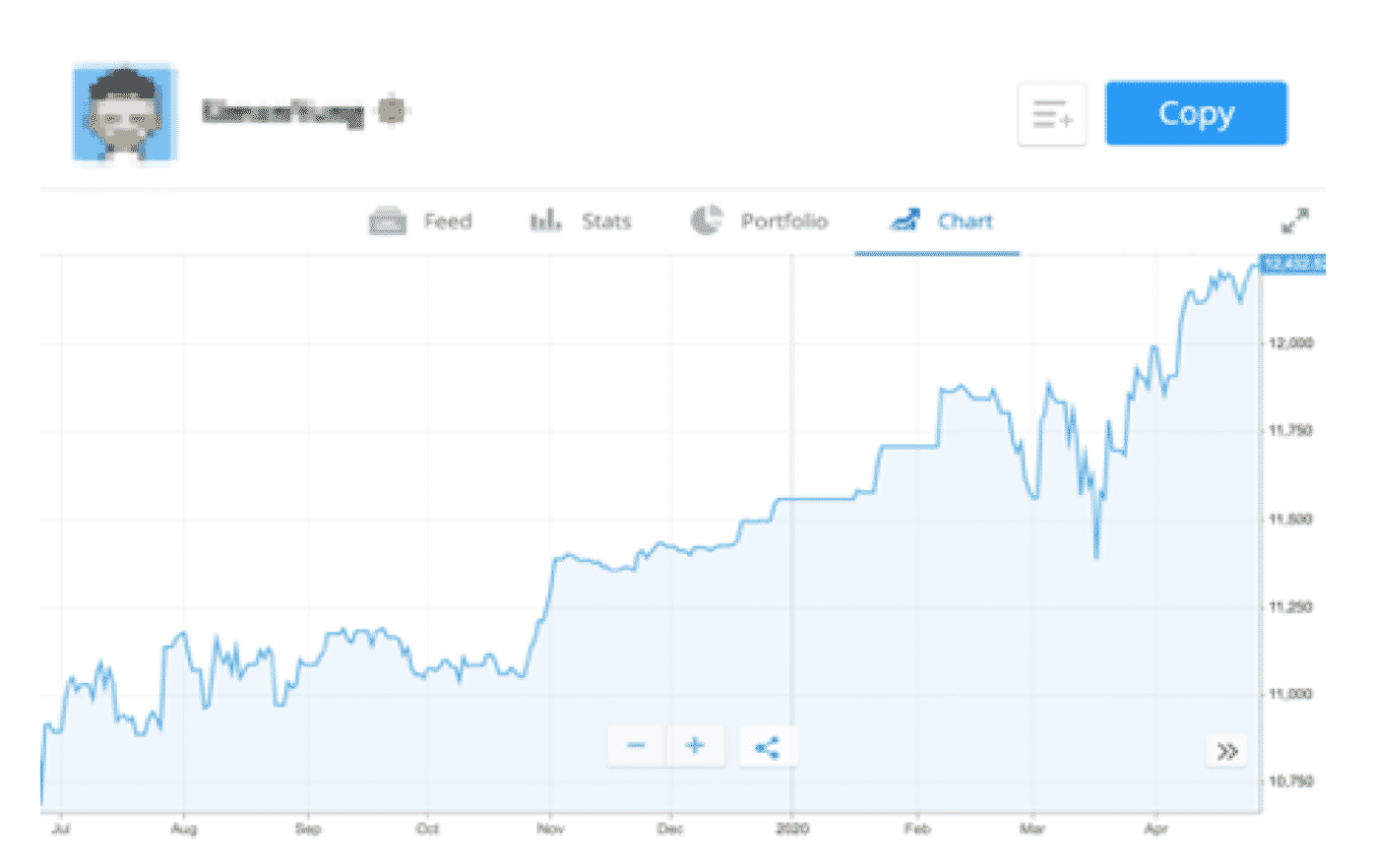

Be sure to check out the traders’ profit charts. You want to go with someone who has consistently risen in profit for a while. This should be evident through a smooth, steady rise in profits. Anyone with an irregular graphical representation is probably gambling around, which would explain the alternating periods of high profits and huge losses.

A smooth equity curve without large drawdowns is more important than fast growth (which also tends to lead to fast losses). This eToro trader has an equity curve that looks pretty attractive in our view—a screenshot from eToro.

More so, be extremely cautious about traders who get 100% or unbelievably high winning ratios. Anyone can do that by simply keeping a losing trade open, although this would impact your performance significantly. How is that? Well, a trader in the forex market may start off with a 100 pips stop level on a trade and increase the numbers to 1000 so that they can keep the trade open. Now, the amount you have left that can be used to open new trades will be lower.

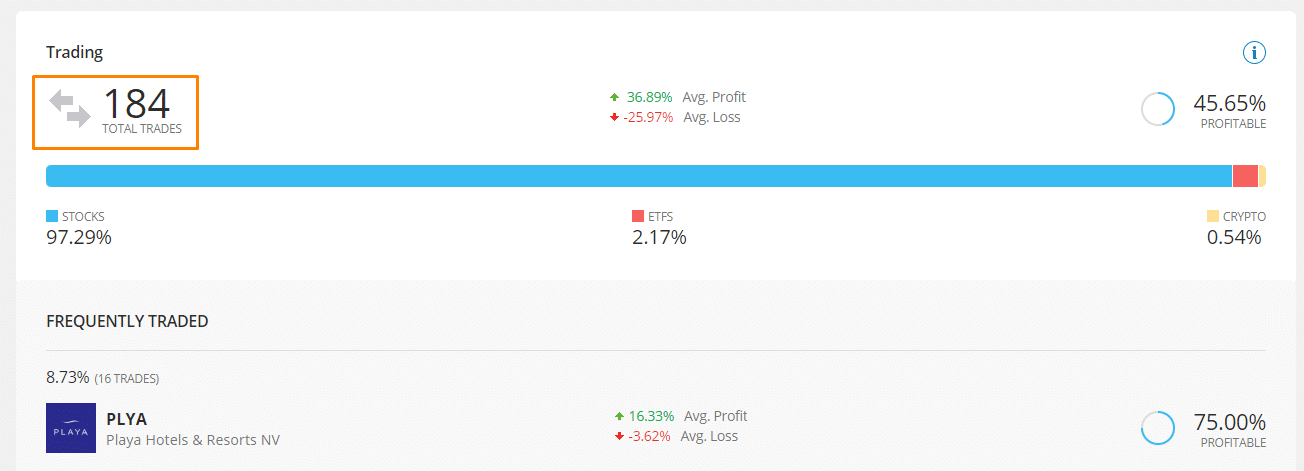

3. Number of trades

Another factor worth evaluating when choosing the best social trader to follow is the number of trades the signal provider undertakes. A high amount of closed trades – like 100 and over – is a good indicator. A high value can help assess that the trader is an expert and that their success is not down to luck. Obviously, this also depends on the trader’s strategy. More long term traders tend to hold their positions for a longer time, and thus a smaller number of trades can be justified by this.

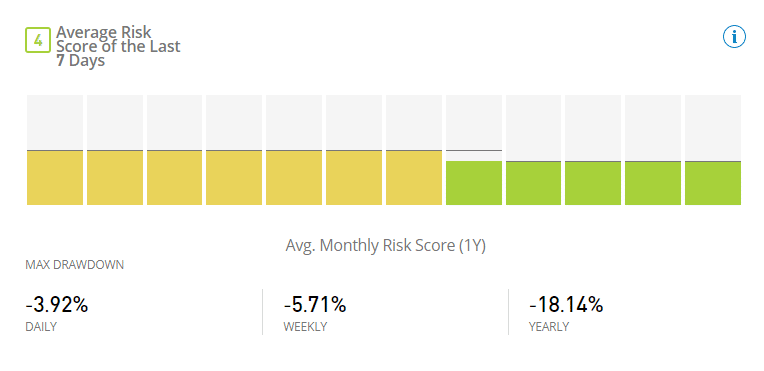

4. Risk score

Whether on a demo or live account, certain technicalities are associated with copy trading that you should get to know. One of these is the so-called Risk Score, calculated by most social trading platforms on a scale from 0 to 10. You want to look for traders with consistent risk scores that do not change much over time. In addition to having a consistent risk score, however, the score should also ideally be as low as possible while still ensuring you get the results you want.

As always, in investing and trading, there is an inverse relationship between risk and expected returns. However, if you ask us, we’d recommend choosing a risk level between 0 to 5, depending on how conservative you want to be in your approach.

Also, stay away from traders who forget to use the Stop Loss function – this is a key principle of risk management. About 90% of traders don’t use the stop-loss function.

5. Consistency

Besides the number of closed trades, you also want to zoom in on the consistency. Someone who has several successive profitable months (say 12 months) with minimal losses in between makes for an ideal candidate. Not to forget, ensure that the investor you are copying has been in the game for a while. Again, at least 12 months in the trading platforms would be fine – don’t copy beginners whose success might be down to temporary luck.

6. Open trades

Investigate their open trades as well – it should be available from your social trading platform provider in the trader’s profile. Open trades – just like playing around with stop levels – have a huge impact on your available equity.

Professional traders know when to accept the losses and leverage stop levels effectively before the losses become unbearable. You will find that a trader with few open trades and whose winning ratio is at 60-80% are more likely to perform well eventually, as opposed to a signal provider boasting a winning ratio of 100% alongside over 10 open trades.

Some traders keep losing positions open so that it doesn’t affect their statistics. Make sure you check their open positions, and if there are many “reds” from weeks/months ago, this can be a bad sign.

However, this can also be due to market conditions and/or having a long-term investing strategy (in this case, you should see both losses and gains, not a lot of trading frequency, and it should be consistent with the average holding time). Meaning if their average holding time is consistent with the holding time of his losing open positions, it can just be due to market conditions and not a way to manipulate statistics.

Therefore, be sure to check out the trader’s tied-up equity under the “Portfolio” tab.

7. Maximum drawdown as well as winning trades

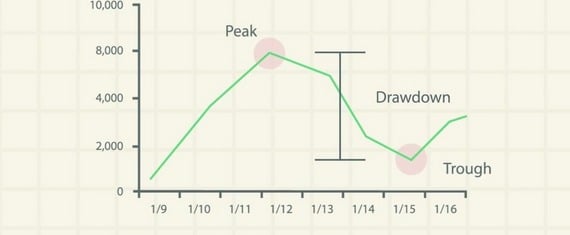

Drawdown means how much money the trader lost before they started turning profits again. It represents the reduction in your capital after several losing trades. It is normally calculated by subtracting a relative trough in capital from a relative peak and expressing it as a percentage of the trading account.

Remember, drawdown is not an actual loss but rather the loss seen before your social trader begins to make profits again while the trade remains open. An actual loss would be the loss seen when the trade is finally closed.

That being said, social traders with very high drawdowns are extremely risky to work with. They might drive your account into margin call, especially when you don’t have enough capital to withstand a series of losses.

Avoid copying traders with large drawdowns in their equity, such as this one. Screenshot from eToro

Now, how does a trader with 100% winning trades sound? Not so good! It only means they leave their trades open for a long time until they turn around. Therefore, a signal provider with a 20% or less maximum drawdown is ideal to follow.

On the other hand, anyone who conducts profitable trades for months but then a single trade bites a huge chunk (like 40%) of the total account is too risky to bank on because they clearly get a very high drawdown.

Moreover, if you wish to perform trades daily, you must consider your signal provider’s daily drawdown. The same applies if, say, you want to trade or make withdrawals weekly or monthly.

8. Level of activity

Another factor you want to consider is how active your signal provider is. Ideally, you want to go with traders who have at least traded actively in the past five weeks.

However, this might depend on whether the signal provider is a long term or short term trader.

There are different types of traders:

- Long-term (monthly or yearly horizon)

- Swing trader (day/week horizon)

- Day trader (hour/daily horizon)

- Scalper (minutes, seconds, or even less horizon)

For small-time horizons, be aware that if the pip size of the gains is small, slippage can eat a big chunk of your profits and thus, your returns be smaller than the ones from your signal provider.

Not to forget, ensure your trader has been in the game for a while. Anyone can start with a small amount of money, take some risks, get lucky, and make money a few months in a row. As time goes by, however, it gets more difficult to maintain such results. That’s where the pros separate themselves from ordinary gamblers. A trader with a minimum social trading history of one year is safer to follow.

9. Trader level

Some social trading platforms rank their traders by levels – to climb to the next level, the trader has to fulfil certain conditions such as controlling the drawdown, increase the real money invested, ensure constant gains, etc. Generally, the higher the level, the more the guarantee that the trader is not a novice.

Also, some platforms allow signal providers to operate with demo accounts. Make sure you copy a trader who operates with real money – it’s always good to know that he has some skin-in-the-game.

10. Average trade size

The average trade size reflects a trader’s money management. If they initiate deals with a substantial amount compared to the account balance, they are probably taking extremely high risks in their trading. It’s like putting all the eggs in one basket.

Similarly, keeping the average trade size on the low is a reflection of flexibility. Such a trader’s overall performance is not dependent on a single deal, and the risk is therefore spread out. You might want to go with an average trade size that is lower than 10%.

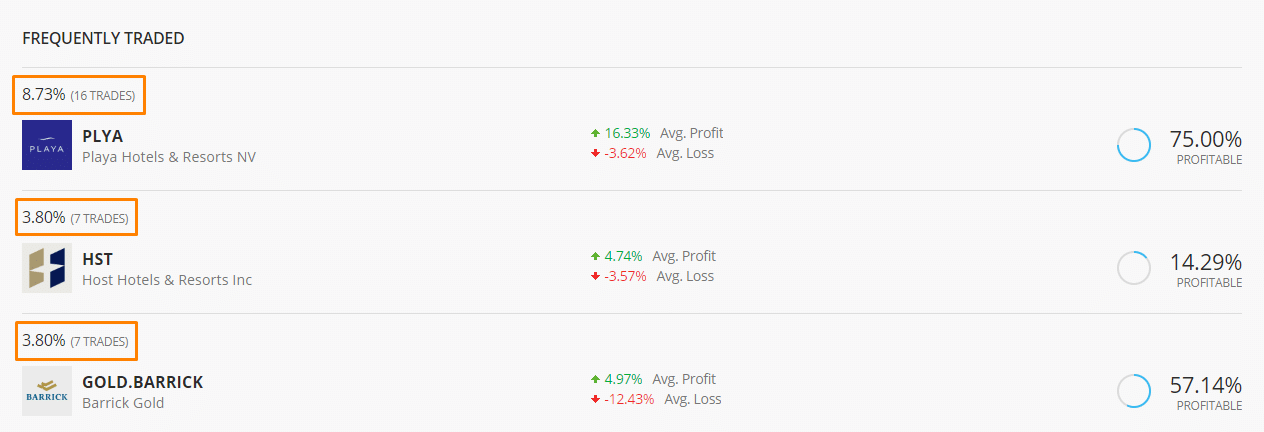

11. Understand their strategy and behaviour

Make sure you read the profile description and understand the trader’s investment style – it may or may not fit yours. Which strategies is he using? Is he using leverage? Which products is he trading and why?

Try to assess closed operations to understand his strategy, for example: “Trader X is investing mainly in stocks, mainly Tesla, operating short-term, and looking for small but safe profits in each operation”.

No trader is good in every market, like forex, stocks, indexes, cryptos, all at once. Look for someone specialized in a specific few markets or products. Of course, they can make some trades in other areas to diversify, but the bulk should be in the markets and products in which the trader is specialized. Also, look for traders with complementary specializations to diversify your portfolio further. Ex: a trader specialized in forex, another one in stocks.

Some social trading platforms, such as eToro’s, have a neat filter function that lets you search for traders to copy based on particular parameters. Here, you can easily find traders who specialize in different markets by searching according to “Allocation.”

eToro lets users search for traders to copy depending on which assets they have allocated capital to. Screenshot from eToro.

Getting to know the strategies and behaviour of your signal providers is crucial for risk management, especially when you are following several traders to try and spread out the risk. Be sure to compare their strategies alongside the history of trades. If two people you are following are employing the same strategy, your risks are not well spread.

A great way of understanding your trader is by analyzing whether they frequently communicate with their copiers, as well as their profile description. And if so, what do they say? You want someone who updates you frequently and shares some of their strategies and views concerning various markets. It’s also a great way to learn along the way.

More so, examine how they behave, especially during or after a bad run. When someone is winning, it is easy for them to stay calm and maintain communication since they speak for themselves. During a losing streak, however, that’s when a professional’s trader’s best qualities manifest.

The last thing you want is a signal provider who panics and begins to change their way of doing things. Poor traders try to chase their losses by employing martingale kind of strategies or trading more frequently with the hopes of winning the profits back. On the other hand, professionals stick with their tried and tested systems.

There you go! Now you are set to start searching for your ideal social trader to follow. Don’t forget that past performance is not indicative of future results, and that’s why there are no guarantees in investing. The same happens in social trading. The goal is to detect which ones have a higher probability of repeating what they’ve accomplished in the past.

Still not sure if a trader is a good choice for you? Want to learn more about the trader’s activity and if he is a good fit for you? Just ask him, as most of the traders are open for discussion and will reply to your questions.

Do you have any more tips to share? Feel free to reach out to us.