Fees can be very detrimental to your investment returns. The European Securities and Markets Authority (ESMA) has done several studies showing the high impact of costs on performance.

As such, we have written this article dedicated to Freedom24 fees to help you access all the costs you might incur when trading on this platform (and also other non-trading fees like when withdrawing your money). Let’s dig in!

Service plans (account types)

On the top of Freedom24 website, you have a tab called “Service Plans” where you can check an overview of the fees presented at Freedom24:

There are two pricing plans, namely (summary of the picture above):

- Prime in EUR:

- Your base currency is the EUR

- No monthly fee;

- Stock and ETFs in Europe and US: Very similar to the “All inclusive in USD” but with a reduction in the fee for the volume for each transaction from 0.50% to 0.25%. The total fees for the same example above would be $7.05 + $0.12 + $1.2 = $8.37. Since you have EUR in your account and Apple is traded in USD, you will also be charged a currency conversion fee (explained below)

- US options: €5 per order + $1.5 per contract.

- Smart in EUR:

- Your base currency is the EUR;

- No monthly fee;

- Stock and ETFs in Europe and US: €/$2 per order + €/$0.02 per share. Your Apple trade would cost you $2 + $0.20 = $2.20. Since you have EUR in your account and Apple is traded in USD, you will also be charged a currency conversion fee (explained below)

- US options: $0.65 per contract. It’s much cheaper than the previous pricing plans.

Regardless of the pricing plan you choose, you can always change it at a later stage.

Monthly fee

There are no monthly fees for any of the Freedom24 pricing plans.

Trading fees (commissions)

Trading fees depend on the service plan chosen and the asset you choose (Stocks, ETFs, options,…). For instance:

- Prime in EUR:

- Stocks and ETFs in the US and Europe: 0.25% of the transaction volume + 0.012 USD per share + 1.2 USD per order;

- Stocks and ETFs in Asia: 0.25% of the transaction volume + 10 HK$ per order;

- US options: 1.5 USD per contract + 5 EUR per order.

- Smart in EUR:

- Stocks and ETFs in the US and Europe: €/$2 per order + €/$0.02 per share;

- US options: 0.65 USD per contract + 0 USD per order.

Deposit and withdrawal fees

There are no deposit fees. However, you will find withdraw fees:

- Via bank transfer: €7 per withdrawal

- Via card: 0.65% of the transaction amount but not less than €/$2 per withdrawal

Inactivity fees

There are no inactivity fees mentioned for Freedom24 accounts.

Securities transfer fees

Transfer fee of securities (Stocks, ETFs…): €/$100 per ISIN (per asset). This applies to both incoming and outgoing transfers.

Account closing fees

Account closing: €/$100.

Margin rates

Margin rate in EUR accounts: 0.049315% per day (~18% in a full year). Margin rate in “all inclusive” is 0.041095% per day (~15% in a full year).

Currency conversion fee (or FX fee)

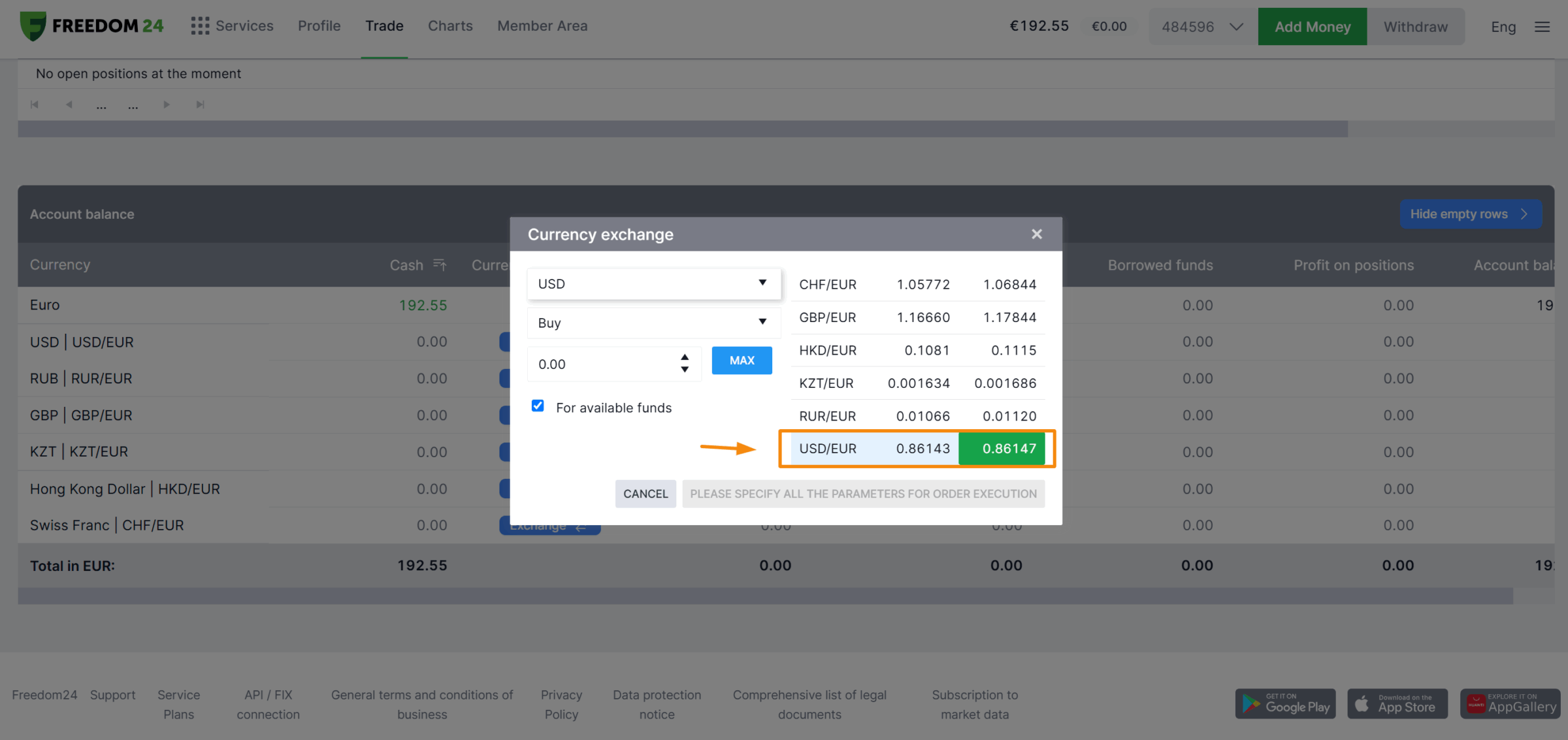

The detailed fee schedule does not mention any currency conversion fees, but they do exist! When I tried to convert from EUR to USD, this was the exchange presented (shown as the number of EUR per 1 USD):

The first column besides the “USD/EUR” shows the bid price (0.86143) and the third column shows the ask price (0.86147). The difference between these two is called the spread, which is an implicit cost that you face when transactions are in USD and have an account in EUR.

Per our example, the spread fee is 0.0046% ((0.86147-0.86143)/0.86147)*100). So, converting €1,000 to USD would cost around €2.

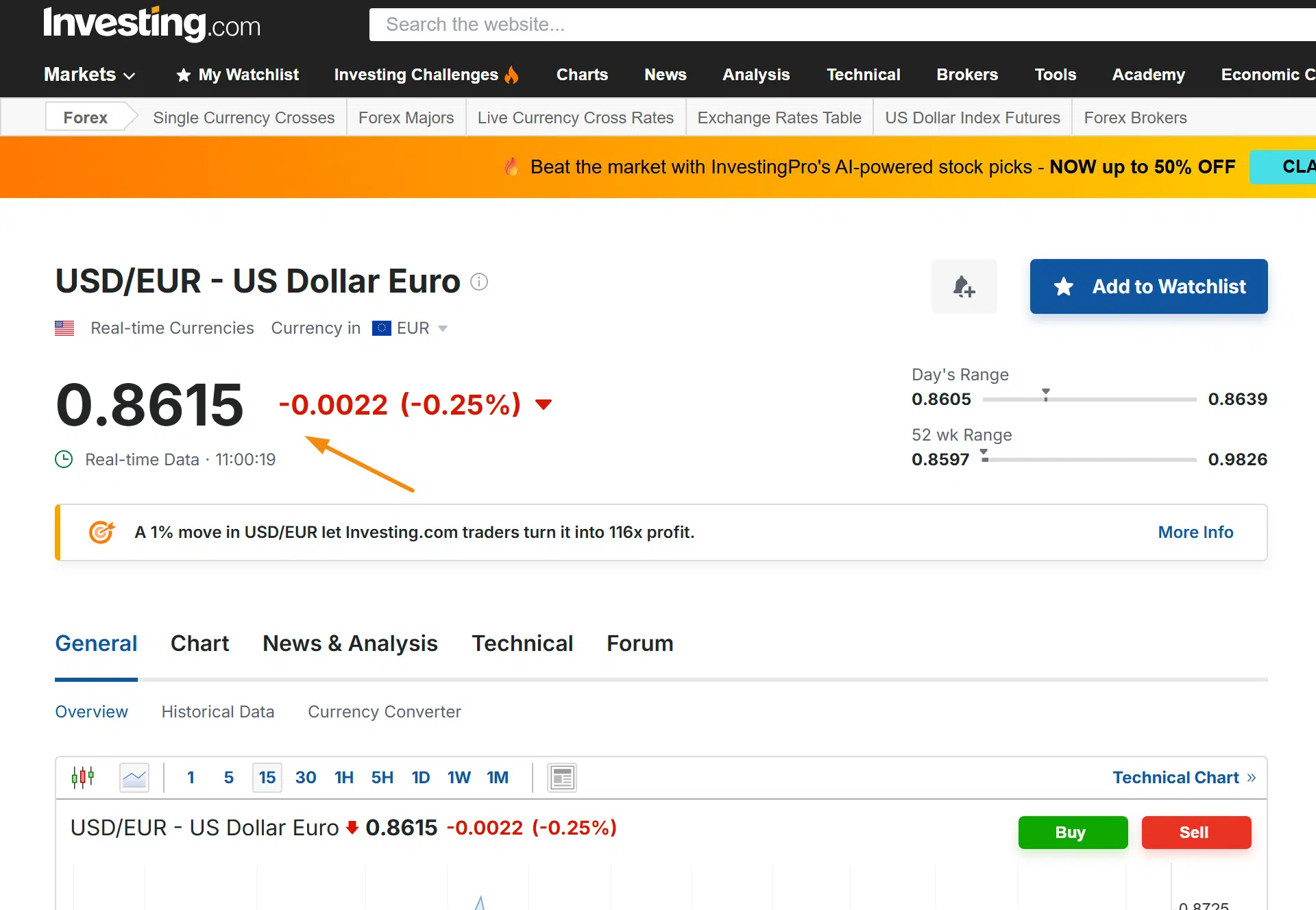

At the same time, the USD/EUR market rate was 0.8615:

All existing fees and commissions can be found under the general terms and conditions of business in Appendix 6.

Comparison table

In the table below, we will show you the cost of investing in 20 units of the iShares Core MSCI World UCITS ETF USD (Acc), assuming a share price of €90 (€1,800 as total investment) and within the pricing plan “Smart in EUR”, the cheapest one at Freedom24.

| Broker | Commission per share (1) | Commission per order (2) | Total Cost (1) + (2) |

| Freedom24 | €0.40 | €2 | €2.40 |

| Interactive Brokers | €0 | €1.25 | €1.25 |

| DEGIRO | €0 | €1 (+€2.50 annual connectivity fee) | €3.50 |

| Trading 212 | €0 | €0 | €0 |

| Saxo | €0 | €5 (+0.15% of custody fee per year – €2.70) | €7.70 |

Bottom line

When analysing the fees (on any trading platform for that matter), we need to take into account both trading fees (buying stocks, ETFs,…) and non-trading fees (custody, inactivity, withdrawal fees and so on).

By doing so, investors can make informed decisions and maximise their returns while minimising unnecessary expenses, which, again, can be very detrimental to your long-term returns.

Overall, Freedom24’s fee schedule is designed to cater to most investors, but as a current or potential user, you should carefully evaluate how these fees align with your investment goals.