Have you come across Dominion Markets online? Dominion Markets presents itself as an investment firm, operating as a CFD broker.

While Dominion Markets operates as a CFD broker, this information is not clearly stated on their website. Additionally, it’s crucial to highlight that CFDs are forbidden in the US, meaning that Dominion Markets is not an option for you if you’re from the US.

Want to know more about Dominion Markets and how it operates? Do you also want to know if the company’s license provides investors with some protection? Look no further—this Dominion Markets review is your ultimate guide to discovering more about the company.

Is Dominion Markets safe?

Unfortunately, Dominion Markets doesn’t seem to be safe! This investment firm operates under a non-reputable license issued by the Offshore Finance Authority of Anjouan, Comoros Union. Although this fact does not guarantee that the company runs a scheme, it alerts the investors to potential frauds, since the company is not overseen by any top-tier (FCA/SEC) or even mid-tier regulators (CySEC).

It’s crucial to note that this warning sign may expose investors to potential fraud risks. Legitimate brokers hold licenses from reputable financial regulatory bodies, providing investors with higher security due to strict standards and regulations.

Offshore Finance Authority of Anjouan: Is it reliable?

Anjouan is an island that is part of the Union of the Comoros (Comoros). Based on a document published by the U.S. government, the Offshore Finance Authority of Anjouan operates independently from the Union’s Central Bank. Union had established AML laws, which established them to reduce corruption in the region.

However, it seems there is limited ability to implement AML laws (the Anti-Money Laundering Act of 2002) in Anjouan by the Union. For example, there is no absolute requirement to report large cash transactions.

Moreover, the document from the U.S. Government states that it appears Anjouan does have an AML law. However, it applies to Anjouan but not to the offshore entities it licenses. This shows that the regulation that Dominion Markets holds does not provide safety for its investors.

Trustpilot reviews

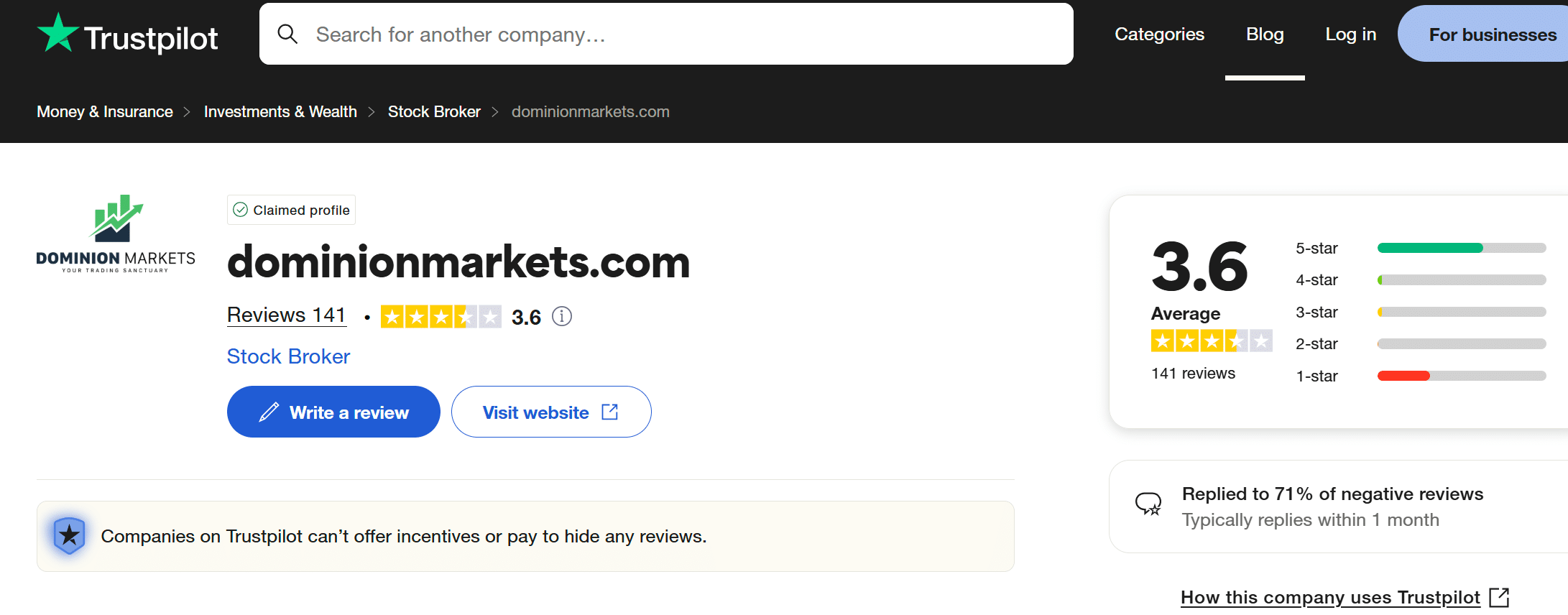

Dominion Markets boasts over 140 reviews on Trustpilot:

Our team would like to highlight several highly negative reviews that indicate a lack of security for investors. While the company addresses these negative reviews, there appear to be numerous complaints regarding the withdrawal of funds from clients’ accounts. Clients have reported instances where the company accused them of engaging in arbitrage practices, thereby preventing them from withdrawing their funds.

Additionally, other criticisms focus on the inadequate support provided. Indeed, our team submitted a query to the support team, which went unanswered for over 48 hours. This lack of timely response suggests that the negative reviews are likely legitimate and well-founded.

Products and markets

Dominion Markets offers trading in over 100 currency pairs, 10 indices, 3 commodities (+13 metals pairs), 60 stocks, and over 100 crypto pairs. However, these investment products are offered through CFDs. which is not clearly mentioned on their website.

CFDs are high-risk, leveraged products, with no asset ownership. This means that when you buy a stock CFD through Dominion Markets, you don’t own a piece of the company, but a contract that promises to pay you in case the price goes up (with additional fees).

- Forex trading is offered in over 100 pairs, each consisting of main pairs and more exotic ones.

- Commodity trading is offered through two main categories: “commodities,” which include Crude (Brent and US) and Natural Gas, and “metals,” which encompass metals such as gold, platinum, and more.

- Stocks CFDs are offered on large-cap US stocks such as Apple, Amazon, Google (Alphabet), and some European Stocks, such as SHEL, and BMW.

- Crypto trading is offered in over 100 pairs, much like Forex, with main pairs such as BTCUSD, as well as more exotic pairs. Additionally, pairs with currencies and crypto-crypto pairs are also available.

Account types

Dominion Markets provides clients with a range of 4 account options: Standard STP, ECN, ECN Plus, and Islamic. Each account type offers unique features such as spreads, commissions, leverage, and minimum deposits.

- Standard STP: Ideal for beginners desiring straightforward market access. The Standard STP account necessitates a minimum deposit of $100 and provides leverage up to 500:1.

- ECN: Tailored for seasoned traders seeking deep liquidity and narrow spreads. The ECN account requires a minimum deposit of $1000 and offers leverage up to 500:1.

- ECN Pro: Ideal for professional traders. The ECN Plus account offers institutional-grade liquidity with reduced commissions compared to the ECN account. It entails a minimum deposit of $10000 and provides leverage up to 500:1.

- Islamic: Catering to traders adhering to Sharia law. The Islamic account permits holding trades over days without swap fees. With a minimum deposit of $1000, it offers leverage up to 500:1.

Trading platform

Dominion Markets allows investors to utilize CTrader as a trading platform, which is accessible in versions for both laptops and the web, with a very similar interface. Additionally, CTrader can be downloaded for various platforms, including Mac, Windows, Android, and iOS.

Fees

When it comes to the fee structure, Dominion Markets does not provide clear information.

- The standard account, STP, has a minimum spread of 1.0 pip

- ECN and ECN Pro both have a minimum spread of 0 pips but with a flat rate fee per trade.

- The Islamic account has a minimum spread of 1.0 pip, just like STP, with the addition of a flat rate of $5 per trade.

When it comes to deposit and withdrawal fees, Dominion Market, once again, does not provide clear information. However, a fee for crypto deposits is mentioned.

Dominion Markets’s failure to provide a clear fee structure for its investors is a significant downside related to transparency, which, combined with dubious regulation, raises numerous red flags.

Account opening

Dominion Markets is available worldwide, with exceptions including Canada, the US, and the Islamic Republic of Iran.

| Account opening information | |

| Minimum Deposit | $100 |

| Currencies Supported | USD, GBP, EUR or CAD |

| Currency Conversion Fees | Information not found |

| Deposit Methods | Crypto, Credit / Debit Card, Bank Transfer, Wire Transfer and Electronic Wallets |

| Deposit Fees | 1% on crypto deposits |

The primary deposit option for Dominion Markets investors is cryptocurrency. However, the company states in its FAQs that the platform supports USD, GBP, EUR, and CAD.

When we attempted to deposit, we did not find the option to fund the account in any currency other than USD. The option for EUR still appears, but it must be converted to cryptocurrency.

Dominion Markets alternatives

61% of retail CFD accounts lose money.

62% of retail CFD accounts lose money.

Bottom line

After conducting an in-depth review of Dominion Markets, we’ve determined that there are superior alternatives for investors. Our primary concern lies in its regulatory framework, which appears questionable due to the jurisdiction it operates in. Without a reliable regulator, investors can’t be sure their trades follow industry standards, and their money is completely safe.

Additionally, we’ve identified issues with the clarity of information regarding certain investment products like CFDs, as well as fee structures and deposit methods, including available currencies.

Given these findings, we cannot recommend Dominion Markets as a safe investment choice. Instead, we suggest trustworthy alternatives with broader offerings, particularly in Forex and CFDs. These include Interactive Brokers, Saxo Bank, and eToro, which provide a more secure investment environment.