You have probably heard about the Webull app on YouTube and want to know if it’s available in Switzerland, right?

Webull is a modern and easy-to-use investment app from the US, which has introduced the concept of commission-free trading in financial products such as stocks and ETFs.

Want to know if Webull is available in Swizterland, the company’s expansion plans, and the alternatives available? We’ve got you covered!

Is Webull available in Switzerland?

Unfortunately, Webull is not yet available in Switzerland. Currently, Webull can be used in the following markets:

- United States,

- Hong Kong,

- Canada,

- Singapore,

- Japan,

- The UK,

- Australia,

- Brazil,

- South Africa,

- Thailand,

- Indonesia,

- Malaysia,

- Mexico (with Flink).

Webull has not yet made any public announcement about a possible expansion to the Swiss or European market. Although this market is interesting, it is also highly regulated and already has similar solutions (which we will cover below).

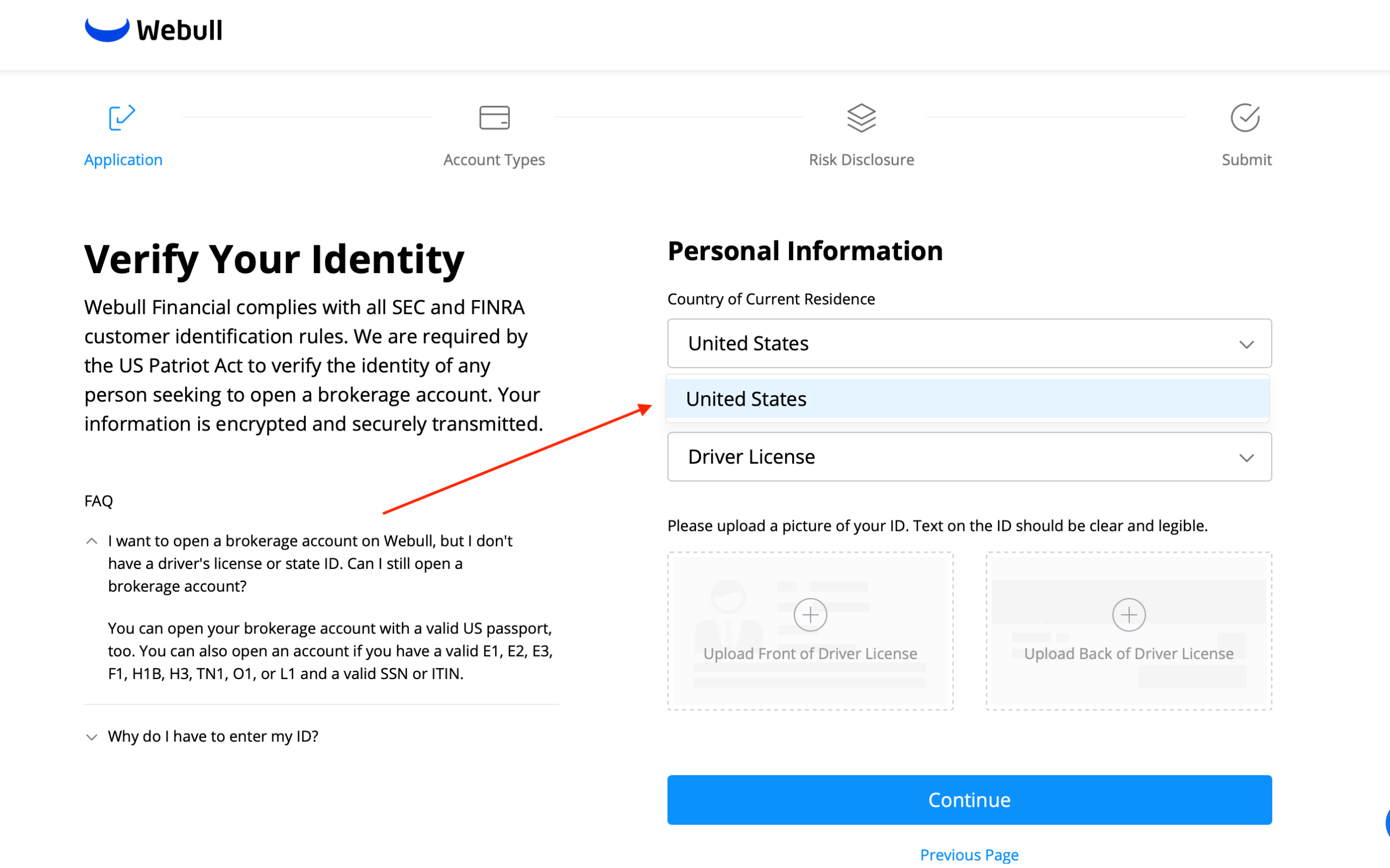

Can you use Webull in Switzerland with a VPN?

No, you cannot use a VPN to open a Webull account from Switzerland. After registration, Webull will ask for specific documents that prove you are a valid user.

Webull alternatives in Switzerland

To help you find a Webull Switzerland equivalent, we have only focused on low-cost commission brokers available in Switzerland. Here are our suggestions:

eToro

With over 30 million users, eToro is the leading social investing platform (copy and follow other traders/investors). It offers commission-free stock trading.

Disclaimer: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Interactive Brokers

Founded in 1978, IBKR is one of the world’s most trustworthy brokers. It offers an enormous range of financial products (stocks, ETFs, Options,…), and low currency conversion fees (FX fees).

💡 Interactive Brokers also launched IBKR GlobalTrader, a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors.

DEGIRO

A discount broker from Europe with a low commission structure. Offers commission-free stock and ETF trading.

Disclaimer: Investing involves risk of loss.

All the companies mentioned above are regulated and/or registered with the Financial Conduct Authority (FCA) in the UK.

Other Webull alternatives in Switzerland

Want to explore other alternatives?

Check our BrokerMatch tool, to get matched with your right broker based on your country and preferences, and explore our Broker Comparison, Broker reviews, Bonuses, and best brokers for earning interest.

It is difficult to choose the best Webull alternative for every investor, as the best broker will depend on which country you live in, your investor experience, the financial products you want to trade, and more.

Explore the websites mentioned here, our tools, and decide for yourself!

And if you need any help, feel free to reach out to us.

Webull alternatives reviewed

eToro at a glance

61% of retail CFD accounts lose money.

Founded in 2006, eToro is a well-known worldwide fintech startup and leader in the social trading field (following other people’s trades), with over 30 million users worldwide. You can also invest in other products such as CFDs, stocks, commodities, Forex, and cryptocurrencies through its platform, which is intuitive and simple to use, making it a good choice for beginners. It has also started offering commission-free stock trading in Switzerland.

Opening an account and depositing is easy, and you can even try it out with virtual money. On the downside, withdrawing money is slow, and spreads can be high for some products, like cryptocurrencies. For more information, read our article about eToro in Switzerland.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Interactive Brokers at a glance

Founded in 1978 and publicly listed in NASDAQ (ticker: IBKR), Interactive Brokers is a global online broker which surpassed major financial crises, showing resilience and a rigorous risk management process.

Interactive Brokers offers an advanced investment platform that includes a wide range of products (stocks, options, mutual funds, ETFs, futures, bonds, and currencies) from +150 markets, solid trade execution (IB SmartRouting), and a set of technical and fundamental tools to help you in your investment decisions.

Beginners and intermediate investors have educational tools to explore, but the learning curve will be steep. That´s why we mainly endorse it to more advanced traders. Besides, the customer service gives crystal clear answers to your doubts, so there is no need to go back and forth.

On the downside, Interactive Brokers’ fee structure is quite complex, the registration process is lengthy but fully online, and the broker doesn’t offer commission-free trading. However, when considering FX fees, narrower spreads, and the stock loan program, Interactive Brokers’ clients still get significant savings compared to most brokers.

Interactive Brokers also launched IBKR GlobalTrader, a modern mobile trading app to trade Stocks, Options and ETFs, ideal for beginner investors. Some of the features of IBKR GlobalTrader include automatic currency conversions, fractional shares, demo account, and more.

Want to know more about Interactive Brokers? Check our Interactive Brokers Review.

DEGIRO at a glance

Investing involves risk of loss.

Founded in 2013, DEGIRO is a low-cost brokerage firm that has become very popular due to its low rates! Withover 3 million users, the innovative platform has become widely known for its “do-it-yourself” philosophy in the sense that you have everything at your disposal to start investing on your own. It offers a wide range of financial assets to trade, including stocks, ETFs, bonds, options, futures contracts, warrants, investment funds, and some leveraged products (not quite the same as CFDs. More info here).

For instance, you can trade some stocks and ETFs for free (a €1.00 flat handling fee – external costs – still applies). You also have a list of 200 ETFs where you may trade once a month completely free with no minimum amount required. The web trading platform is basic, but it is efficient and straightforward to use. In a matter of minutes, you get used to it. The same applies to its mobile app. On the downside, there is an absence of any significant fundamental research, a €2.50 connectivity fee applies and pricing alerts are missing.

Regarding security, DEGIRO is the Dutch branch of flatexDEGIRO Bank AG (a German-regulated bank). In the unlikely event that the segregated assets cannot be returned to clients, DEGIRO falls under the German Investor Compensation Scheme, which compensates any losses from non-returned assets up to 90% (with a maximum of EUR 20,000), so do bear this in mind if you are planning to invest much larger volumes. Furthermore, any money deposited on a DEGIRO Cash Account with flatexDEGIRO Bank AG will be guaranteed up to an amount of EUR 100,000 under the German Deposit Guarantee Scheme.

Still any doubts? Go through our DEGIRO Review!

Which platform should you choose?

Some factors you should be aware of when choosing an online broker are the fees charged if it is regulated by top-tier institutions such as the FCA in the UK and the range of products it allows you to trade (not all platforms allow you to trade cryptocurrencies or stocks listed on the London Stock Exchange, for instance), among other factors.

The best online broker in your specific case will depend on your profile, preference, and objectives. Explore the websites above and decide for yourself!

A reminder that the above should not be construed as investment advice and should be considered information only. Investors should do their own research and due diligence about the services and opportunities best suited for their risk, returns, and impact strategy.

Happy investing!

What is Webull?

Webull is an investment app based in the United States, which does not charge a commission when investing in stocks or other financial products.

Due to its user-friendly and modern app and the fact that it does not charge fees when investing in stocks and other products, this company has become well known worldwide, alongside its biggest rival, Robinhood.

Once again, the Internet has democratized access to investments. Through apps like Webull or Robinhood, anyone can invest in the stock market without a lot of money or having to pay high fees for that.

Its success was due to its innovative product and its referral program, which encourages users to recommend others and receive a reward for doing so, making this company a world first.