You have probably heard about the Webull app on YouTube and want to know if it’s available in India, right?

Webull is a modern and easy-to-use investment app from the US. It has introduced the concept of commission-free trading in financial products such as stocks and ETFs alongside its biggest rivals, Robinhood, TD Ameritrade, and E*TRADE.

Want to know if Webull is available in India, the company’s expansion plans, and the alternatives available? We’ve got you covered!

Is Webull available in India?

Unfortunately, Webull is not yet available in India. Currently, Webull can be used in the following markets:

- United States,

- Hong Kong,

- Canada,

- Singapore,

- Japan,

- The UK,

- Netherlands (EU),

- Australia,

- Brazil,

- South Africa,

- Thailand,

- Indonesia,

- Malaysia,

- Mexico (with Flink).

Webull has not yet made any public announcement about a possible expansion to the Indian market. Although this market is interesting, it is also highly regulated and already has similar solutions (which we will cover below).

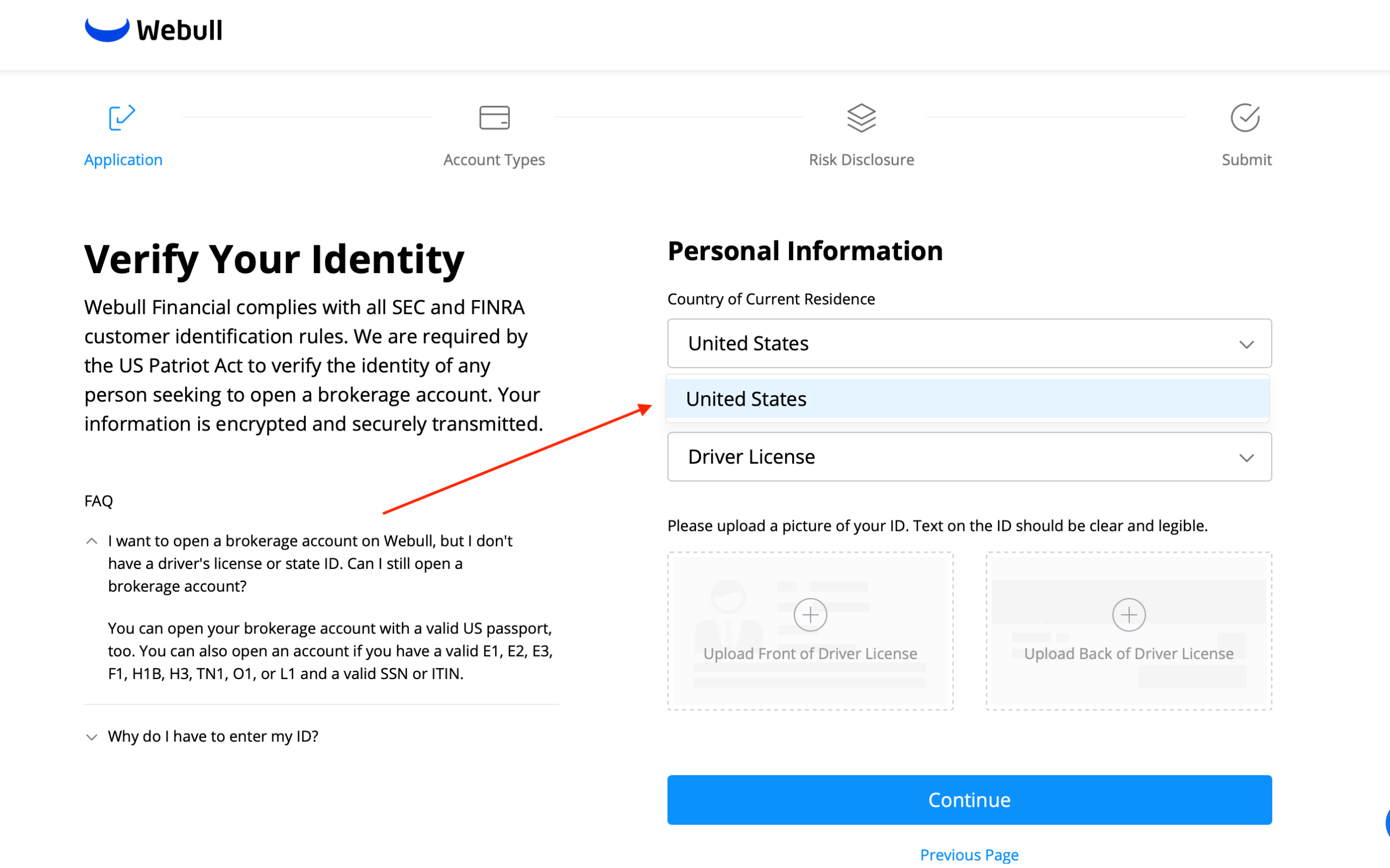

Can you use Webull in India with a VPN?

No, you cannot use a VPN to open a Webull account from India. After registration, Webull will ask for specific documents that prove you are a valid user.

Webull alternatives in India

If you’re in India and want to access the best brokerages and investing options, there are some alternatives to Webull that provide more choice and flexibility. Here are some of the best brokerages available in India that may be more suitable than the limited Webull:

Interactive Brokers | Best overall

Interactive Brokers is one of the best options for Indian investors looking to invest in US stocks, providing access to global markets, advanced trading tools, and intuitive mobile apps. It offers a competitive trading experience with low fees, making it an ideal choice for those seeking exposure to a wide range of US stocks.

Vested | Best for beginners

Vested is a user-friendly platform for Indian investors looking to invest in US stocks. It offers diverse investment options, competitive pricing, educational resources, and pre-built portfolios ideal for newcomers looking to access the US stock market.

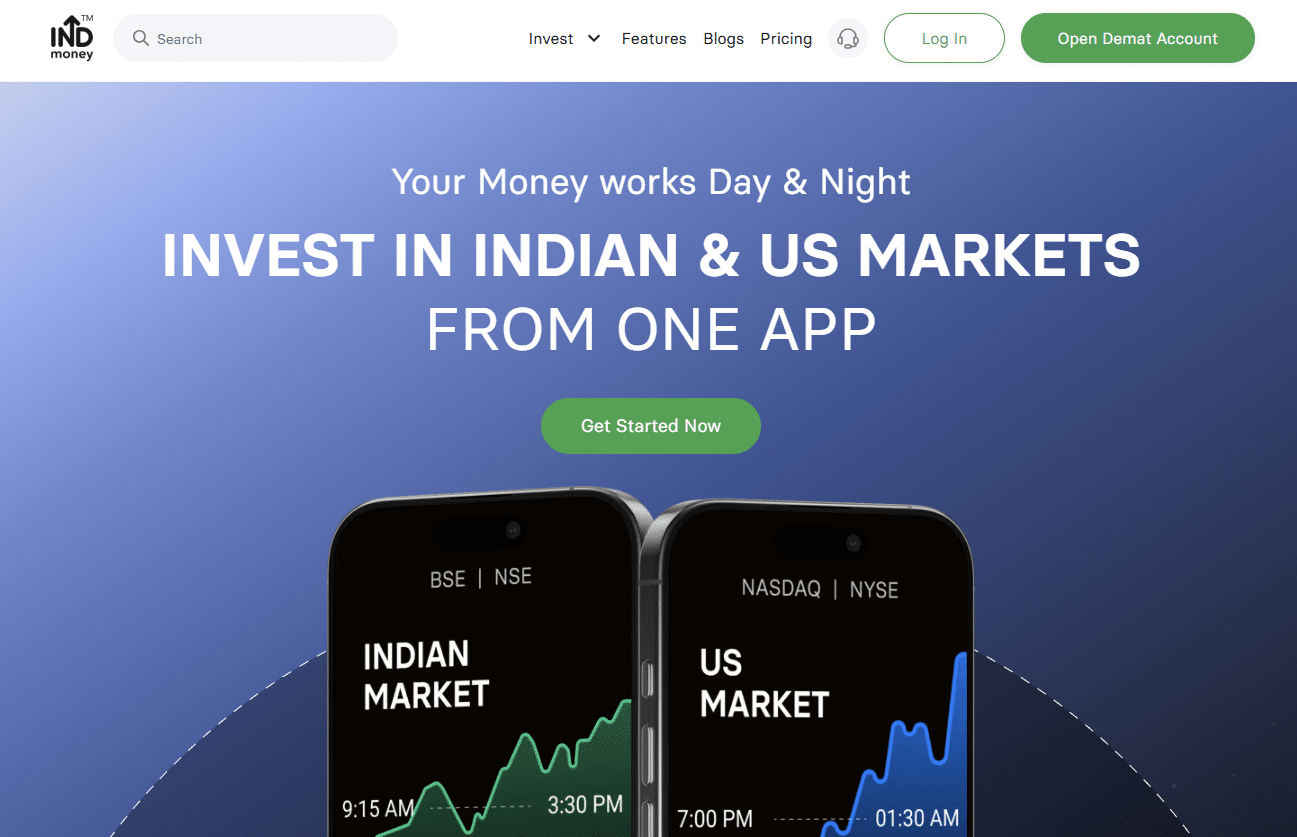

INDmoney | Best for financial management features

INDmoney is a leading Indian mobile app renowned for its exceptional financial management features. It offers a comprehensive range of services, including investment opportunities, savings tools, and personalized financial planning, in addition to providing access to US stock investing and expert financial advisory.

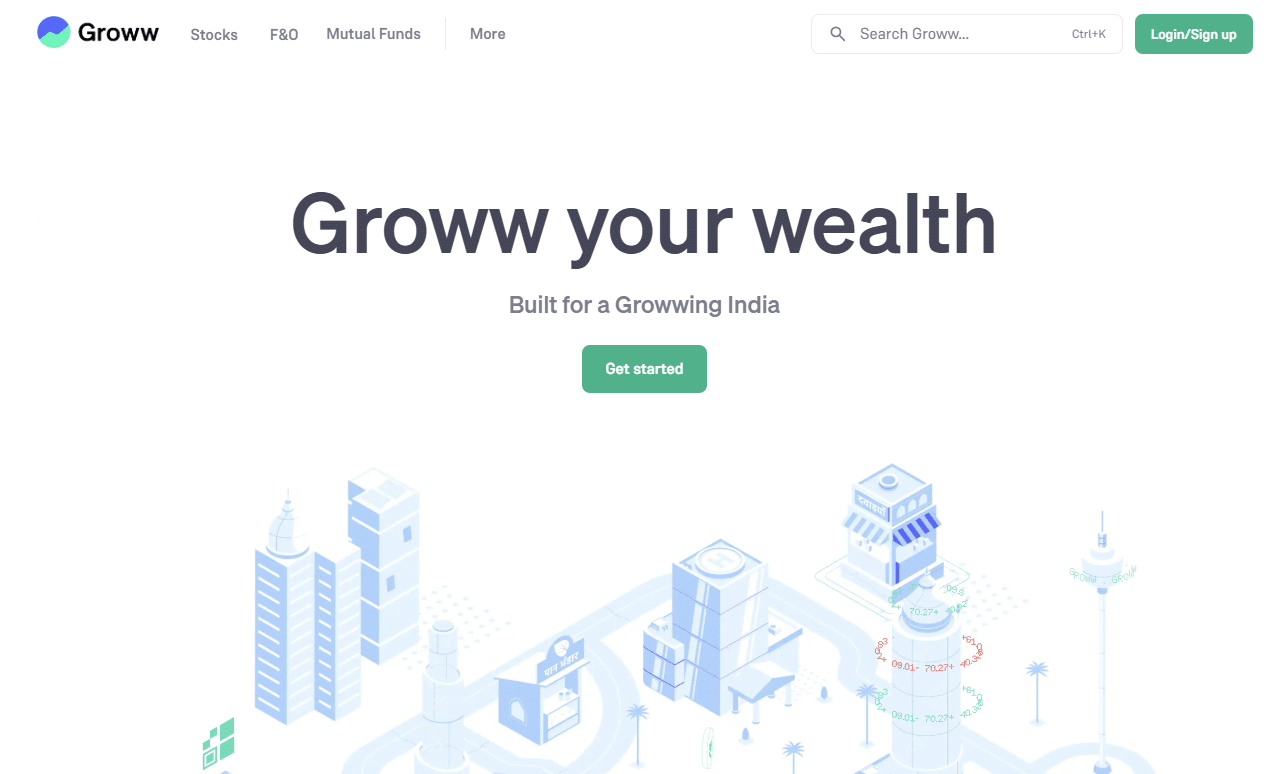

Groww | Best for low fees

Groww is a popular investment app offering a range of financial products, including US stocks and ETFs. It is an ideal choice for cost-conscious investors as it charges only $0.02 per trade, making it one of the most affordable options for investing in US stocks.

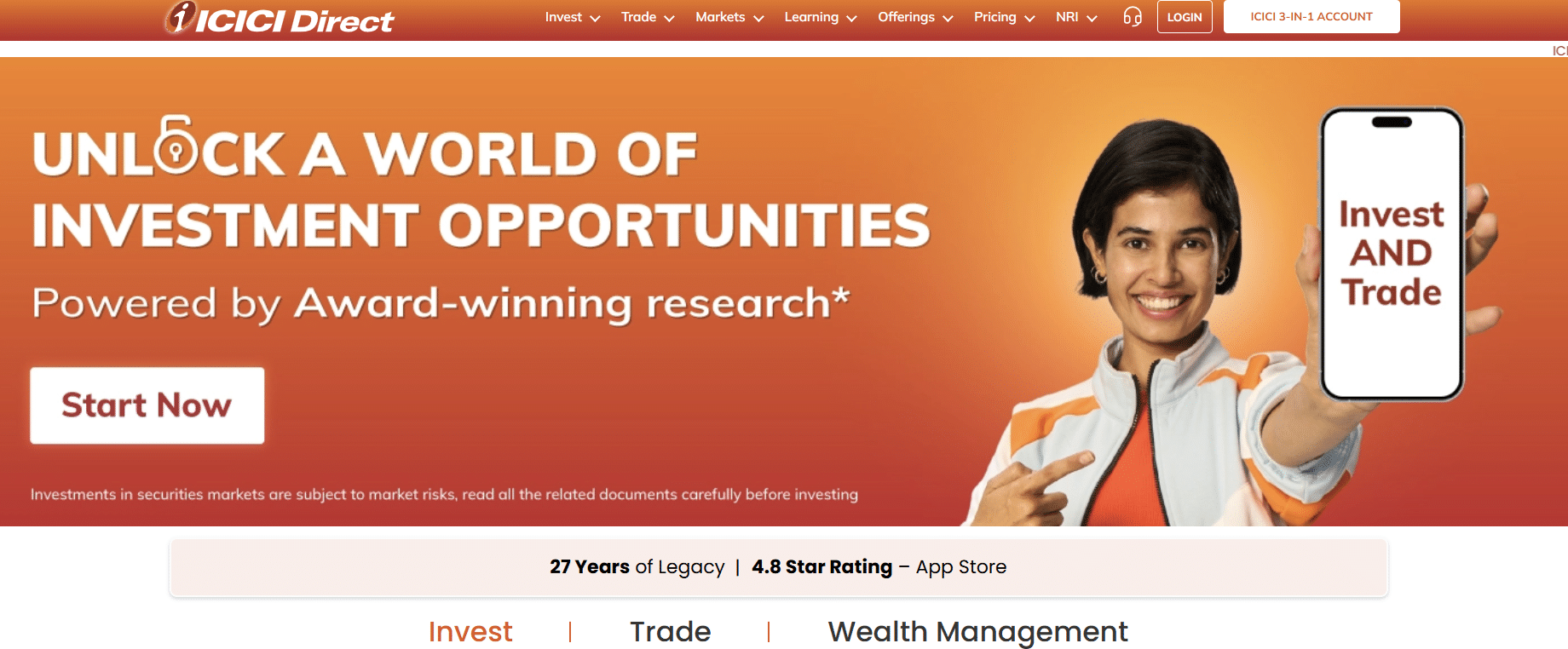

ICICI Direct | Best for professional investors

ICICI Direct is a leading Indian broker offering various investment options, including US stocks, ETFs, and local market investment products. It offers advanced trading tools, expert research insights, and robust customer support, making it an excellent choice for professional investors seeking a comprehensive platform for their investment needs.

| Broker | Minimum deposit | Deposit Method | Fees on stocks | Number of US stocks |

| Interactive Brokers | $500 | Wire transfer | Between $0.0005 and $0.0035 per share (min. $0.35) | 17,500+ |

| Vested | $0 | Wire transfer | $0 (Account fees apply based on plan) | 5,000+* |

| INDmoney | $0 | Wire transfer | $0 (Deposit fees apply) | 8,000+* |

| Groww | $0 | Wire transfer | $0.02 per trade charged by exchange | 3,700+ |

| ICICI Direct | $0 | Wire transfer | Between $0 and $2.75 per trade, depending on your subscription plan | 17,500+ |

*Stocks and ETFs

Other Webull alternatives in India

Want to explore other alternatives?

Check our BrokerMatch tool, to get matched with your right broker based on your country and preferences, and explore our Broker Comparison, Broker reviews, Bonuses, and best brokers for earning interest.

It is difficult to choose the best Webull alternative for every investor, as the best broker will depend on which country you live in, your investor experience, the financial products you want to trade, and more.

Explore the websites mentioned here, our tools, and decide for yourself!

And if you need any help, feel free to reach out to us.

Webull alternatives reviewed

Interactive Brokers at a glance

Founded in 1978, Interactive Brokers is one of the largest international brokers listed on the NASDAQ exchange (Ticker: IBKR) and is at the top of our list of the best apps to invest in US stocks from India. It provides access to over 90 global market centers, allowing you to trade stocks in addition to options, futures, currencies, bonds, and funds.

The broker provides powerful trading apps with sophisticated tools and features with over 100 order types and advanced trading tools. The comprehensive reporting features, real-time trade confirmations, and portfolio analysis tools allow you to effectively monitor and manage your investments. The user-friendly IBKR GlobalTrader app is suitable for beginners, providing simplified investments without compromising on the powerful tools that the broker is known for. For experienced traders seeking more advanced features, the IBKR Mobile app offers a complete and sophisticated trading experience for stocks, ETFs, and options.

Opening an account with Interactive Brokers is straightforward and comes with no fees or minimum activity requirements. You also benefit from a free DEMAT account and competitive interest rates on instantly available cash balances. The minimum deposit for Indian residents is $500, or its equivalent in INR, and funding your account can be done through a bank wire transfer. Commissions for US stocks and ETFs range from USD 0.0005 to USD 0.0035 per share.

One of the key advantages of trading with Interactive Brokers is the global access it provides. The platform also lets you buy fractional shares so that you can invest in almost any US stock, regardless of its price. For those looking to generate extra income, the Stock Yield Enhancement Program allows you to lend your fully paid shares to traders who want to short and are willing to pay interest to borrow the shares.

Please check our Interactive Brokers review to find out more about the broker.

Vested at a glance

Vested Finance is an online investment platform offering an app designed for Indian investors seeking to invest in US stocks and ETFs. Vested lets you trade over 5,000 US stocks and ETFs. Moreover, you can buy fractional shares; for example, you can buy a portion of Amazon or Google for as little as $1.

The app’s intuitive design ensures that beginners and experienced investors can navigate the platform easily. Real-time price feeds, news updates, interactive charts, and fundamental data are readily available on the app, empowering investors with up-to-date information for making informed decisions. Additionally, Vested provides research content and exclusive insights into the US markets, allowing investors to stay informed about market trends and identify investment opportunities.

Vested offers a range of investment options to cater to different investor preferences. Investors can choose from ready portfolios called “Vests,” curated portfolios comprising stocks and ETFs. These Vests are designed with various themes and goals, providing you with pre-selected diversified investment opportunities. Getting started with Vested is quick and convenient. The platform offers a fully digital onboarding process, allowing you to open an account within minutes. They partnered with a US-regulated broker DriveWealth LLC to provide Indian investors access to the US stock market.

Vested offers two subscription plans, Basic and Premium, each designed to cater to different investor needs. The Basic plan, available at a one-time fee of ₹250, provides essential features such as zero brokerage charges, easy money transfers, access to curated Vests, and basic research tools like AlphaScreener Basic. On the other hand, the Premium plan, priced at a monthly fee of ₹375.00, offers additional benefits, including unlimited free withdrawals with Vested Direct, advanced research tools like AlphaScreener Plus, priority support, and access to exclusive Vests and premium content.

INDmoney at a glance

INDmoney is a leading Indian investment platform that simplifies investing in US stocks listed on exchanges like NASDAQ and NYSE from India. It was founded in 2019 and is known for offering zero-commission on US stocks. Opening an account with INDmoney is a fast and straightforward process, requiring just a few minutes to complete. Moreover, INDmoney has partnered with reputable US brokers, including Drivewealth, LLC and Alpaca Securities LLC, to ensure a secure and compliant trading environment for Indian investors.

INDmoney’s Super Money App offers a wide range of features to empower users to manage their finances effectively. From Demat & Trading accounts to automatic money tracking, mutual fund investments, investment calculators, insurance services, IPO centre, advanced reports, INsta Cash, and credit score monitoring, the app provides a comprehensive suite of tools to help users achieve their financial goals and make informed financial decisions.

Regarding the minimum investment amount, INDmoney’s US Stocks account enables trading in fractional shares, allowing investors to invest as little as $1 in stocks like Apple, Netflix, Tesla, and more. The trading process is straightforward and can be done directly on the INDmoney platform. Investors can browse through the catalogue of US stocks and ETFs or consult their wealth manager to receive a customized investment proposal.

INDmoney provides a transparent fee structure, with no account opening fees or brokerage charges on US stock trading. However, the platform has a nominal INDmoney platform fee of 0.75% of the deposit amount, capped at ₹1000. Moreover, the cost of withdrawing funds from the US stock account back to an Indian bank account is $5 per request.

Groww at a glance

Groww is a comprehensive investment app that enables users to invest in a wide range of financial products, including over 3,700+ US stocks and 700+ US ETFs. Founded in 2017, the app offers various investment options, such as mutual funds, SIPs, futures, and options.

Groww’s app has features that aim to improve the investing process. It offers fractional shares, enabling users to invest in smaller portions of a share, accommodating smaller investment amounts. Additionally, the app provides comprehensive charts and analysis tools, empowering users to conduct thorough research on companies and make well-informed investment choices.

Groww provides customers with the convenience of opening an account online. The process is quick, easy, and completely paperless. There are no charges for opening an account, and there are no maintenance fees. To get started, download the Groww mobile app or visit their website to register and complete the setup process. Your brokerage account is managed by Viewtrade Securities (VTS), which works with Apex Clearing Corporation for trade clearing and custodian aspects of user accounts.

When it comes to pricing, Groww maintains transparency with $0 brokerage fees for US stocks. However, they state that the exchange imposes a $0.02 fee on each sell transaction. And for withdrawals, Groww charges $9 per transaction to cover the fees levied by their US counterpart bank.

ICICI Direct at a glance

ICICI Direct is a reputable broker founded in 1995 that provides the opportunity to open an ICICI Direct Global account, enabling investments in six major global markets: the US, the UK, Germany, Japan, Singapore, and Hong Kong.

Opening an ICICI Direct Global account is very easy, completed entirely online with just a few clicks, eliminating the need for physical documentation. One notable feature is the availability of fractional shares, allowing you to start with small amounts and purchase fractional shares in the US markets. Moreover, there is no minimum balance requirement, giving you the freedom to invest without worrying about maintaining a certain account balance.

Their digital platform is powered by their broker partner Interactive Brokers LLC, which is the broker that executes and clears your trades as ICICI Securities is an introducing broker to Interactive Brokers. Furthermore, ICICI Direct provides access to over 80 curated portfolios managed by global fund managers, enabling investors to benefit from their expertise and knowledge.

The app provides a consolidated view of your portfolio’s performance across different asset classes, ensuring you can easily track your investments and a biometric-based login. Managing your portfolio is simpler with personalized watchlists, pre-defined lists, and trade execution algorithms. The app also offers a dark mode option for comfortable viewing and smart features like Flash Trade for quick F&O trading.

When it comes to pricing, ICICI Direct offers competitive plans where you can choose between zero subscription and zero brokerage plans. Here’s a brief overview of their three plans: Global Classic (₹0 subscription per year and $2.75 per trade), Global Select (₹999 per year and $1.99 per trade), and Global Advantage (₹9,999 per year and $0 per trade).

Which platform should you choose?

Some factors you should be aware of when choosing an online broker are the fees charged, if it is regulated by top-tier institutions, and the range of products it allows you to trade (not all platforms allow you to trade cryptocurrencies or stocks listed on the London Stock Exchange, for instance), among other factors.

The best online broker in your specific case will depend on your profile, preference, and objectives. Explore the websites above and decide for yourself!

A reminder that the above should not be construed as investment advice and should be considered information only. Investors should do their own research and due diligence about the services and opportunities best suited for their risk, returns, and impact strategy.

We hope this has helped.

Happy investing!