You have probably heard about the Webull app on YouTube and want to know if it’s available in your country, right?

Webull is a modern and easy-to-use investment app from the US, which has introduced the concept of commission-free trading in financial products such as stocks, options, and ETFs.

Want to know where Webull is available, the company’s expansion plans, and the alternatives available? We’ve got you covered!

Where is Webull available?

Currently, Webull is available in the following countries:

- United States,

- Hong Kong,

- Canada,

- Singapore,

- Japan,

- The UK,

- Australia,

- Brazil,

- South Africa,

- Thailand,

- Indonesia,

- Malaysia,

- Mexico (with Flink).

The company has been expanding internationally year after year.

Being available in all these countries, means that Webull is also registered and/or regulated by several local financial regulatory authorities:

Webull alternatives

Is Webull not available in your country?

No worries – at Investing in the Web, we follow +100 investment platforms worldwide, and built a product that can help you easily find them and compare them.

Here are a few resources that can help you find the right investment platform for you:

- BrokerMatch tool, to get matched with your right broker based on your country and preferences,

- Biggest brokers by assets: check which platforms have the highest assets under management and how they compare to other providers. High net worth individuals tend to choose platforms that they can trust and provide good services.

- Broker Comparison,

- Broker reviews,

- Bonuses,

- Best brokers for earning interest.

It is difficult to choose the best trading app for every investor, as the best broker will depend on which country you live in, your investor experience, the financial products you want to trade, and more.

Explore the pages mentioned here, our tools, and decide for yourself!

And if you need any help, feel free to reach out to us.

Can you use Webull with a VPN?

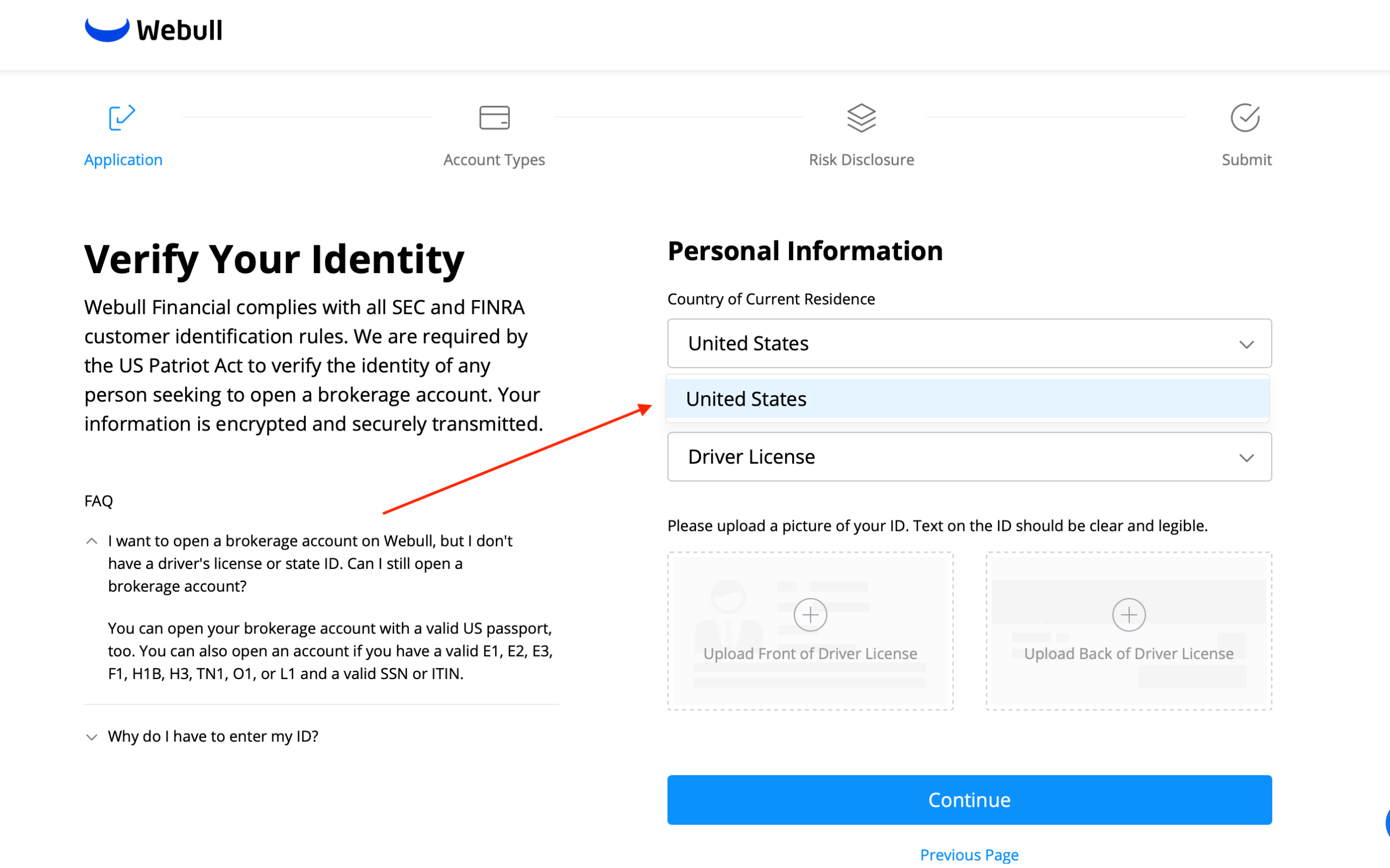

No, you cannot use a VPN to open a Webull account from a country that is not yet supported. After registration, Webull will ask for specific documents that proves you are a valid user.

Conclusion

While Webull is still limited to certain countries, the company continues expanding to different regions, and doesn’t seem to be slowing the process!

It’s always great to see good platforms expand worldwide, especially if they do so complying with all the local laws – it means that the management team wants to do things right and is focused on the long-term.

Hope we helped, and feel free to reach out in case you have any questions or feedback!

FAQs

Is Webull available in Spain? 🇪🇸

No, Webull is not available in Spain. You can explore Webull alternatives here.

Is Webull available in France? 🇫🇷

No, Webull is not available in France. You can explore Webull alternatives here.

Is Webull available in Germany? 🇩🇪

No, Webull is not available in Germany. You can explore Webull alternatives here.

Is Webull available in Romania? 🇷🇴

No, Webull is not available in Romania nor any other European country (besides the UK). You can explore Webull alternatives here.