You have probably heard about the Robinhood app on YouTube and want to know if it’s available in Indonesia, right?

Robinhood is a modern and easy-to-use investment app from the US, which has introduced the concept of commission-free trading in financial products such as stocks and ETFs, alongside its biggest rivals, Webull, E*TRADE, and TD Ameritrade.

Want to know if Robinhood is available in Indonesia, its expansion plans, and the alternatives available for Indonesian users? We’ve got you covered!

Is Robinhood available in Indonesia?

Unfortunately, Robinhood is not yet available in Indonesia.

Currently, it’s only available in Europe, the US and the UK.

Currently, Robinhood has show no indications to expand to Indonesia. While it is a great market for brokers, it is also a highly regulated and competitive market.

Robinhood alternative in Indonesia

Interactive Brokers | Best for intermediate and advanced investors

Online broker with a sophisticated trading platform that offers a wide range of products. The company, founded in the US, provides the app IBKR GlobalTrader, which is ideal for beginners.

Interactive Brokers at a glance

Interactive Brokers has proven to be one of the most reliable brokers in the market. The company was founded over 40 years ago and survived many financial crises, making it a well-established and trustworthy broker regulated by many top-tier regulators.

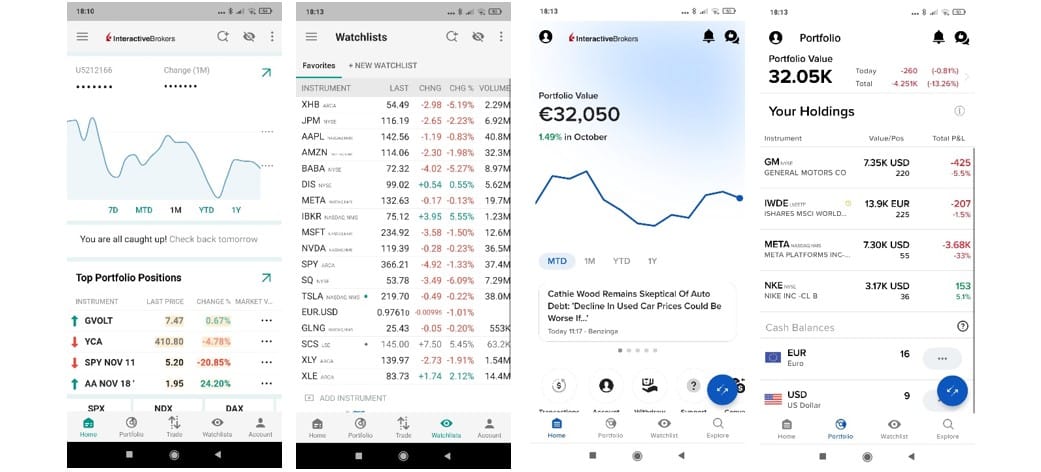

They offer some of the best stock trading apps in Indonesia, where you can trade stocks using sophisticated and powerful tools and find a wide range of products available for trading with low prices, including forex instruments. The broker offers different mobile apps and web-based platforms that should be used according to your knowledge and experience. The mobile app IBKR GlobalTrader is a user-friendly app suitable for beginners because it simplifies investments without losing the powerful tools for which the broker is famous.

If you want to make the most out of the powerful tools the broker provides, you can use the IBKR Mobile, a complete and sophisticated trading app to trade stocks, ETFs, and options. As the features of this app can be overwhelming for beginners, we would recommend the IBKR GlobalTrader if you do not have a lot of experience.

In addition to the mobile apps, you will also find a desktop app and web-based apps where you have sophisticated trading tools to access the global financial markets. Overall, we believe that Interactive Brokers offers the best stock trading apps in Indonesia, and you can find what you are looking for, irrespective of your needs!

Please check our Interactive Brokers review to find out more about the broker.

Which platform should you choose?

Some factors you should know when choosing an online broker are the fees charged if it is regulated by top-tier institutions in Indonesia, the range of products it allows you to trade (not all platforms allow you to trade Asian stocks), among others.

The best online broker in your specific case will depend on your profile, preference, and objectives. Explore the websites above and decide for yourself!

A reminder that the above should not be seen as investment advice and should be considered information only. Investors should do their own research and diligence about the best-suited services and opportunities for their risk, returns, and impact strategy.

FAQs

Can I use Robinhood from Indonesia with a VPN?

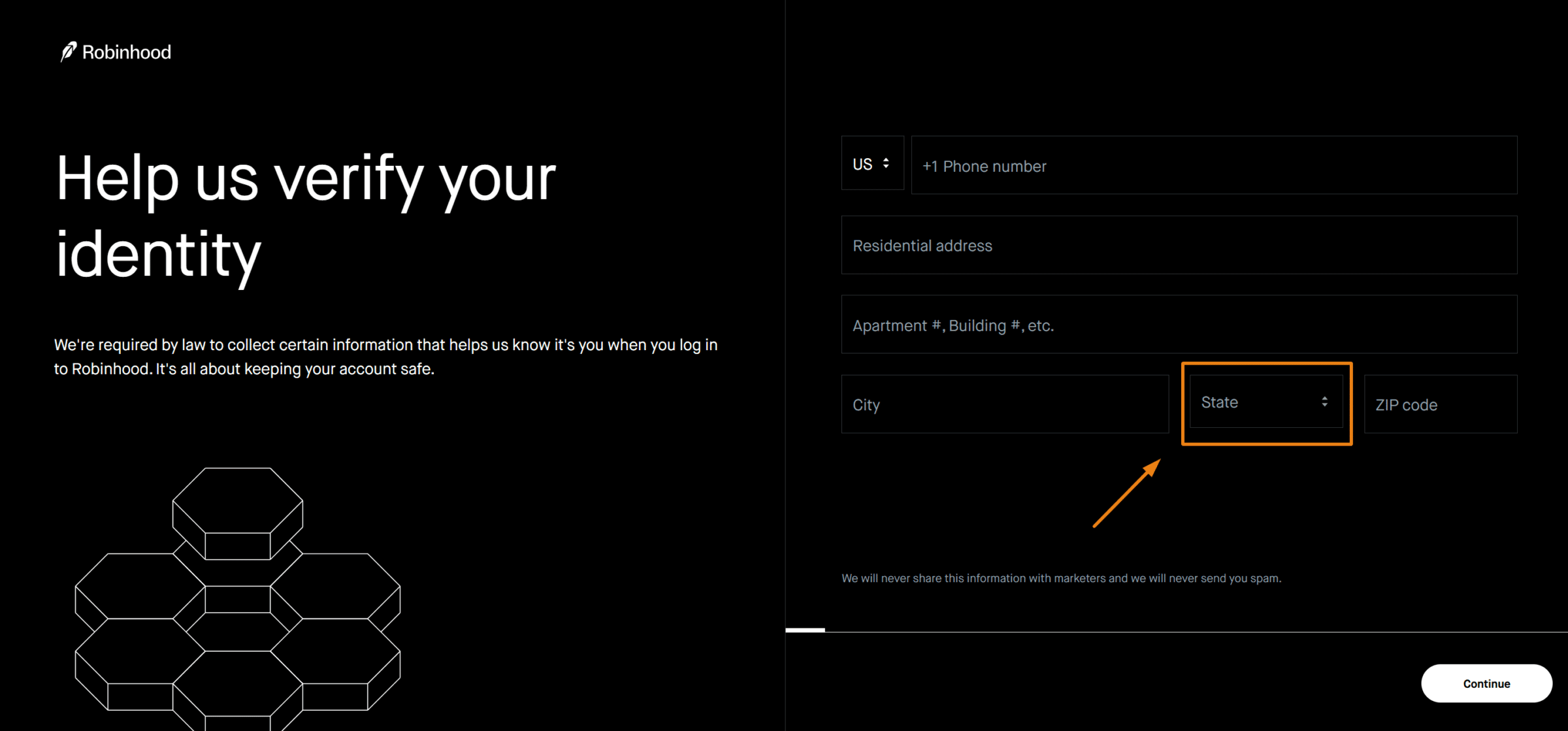

No, Indonesian investors cannot use a VPN to open a Robinhood account. Upon account opening, Robinhood requires specific documentation that proves that you are a US citizen.

How exactly does Robinhood make money?

The online broker earns money from interest earned on customers’ cash balances (money in your account not invested), by selling order information to third parties (high-frequency traders, for instance), and margin lending.

Regarding the selling of orders, the US Securities and Exchange Commission (SEC) is still investigating Robinhoodfor not fully disclosing its practice of selling clients’ orders to high-speed trading firms.

Until October 2018, Robinhood would not clearly state that it was receiving payments for order flows. By law, any financial company must reveal all the material facts an investor would want to know before making any investment decision.