In 2014, DEGIRO expanded its online trading platform across several European countries outside the Netherlands, its country of origin. Since then, it has been growing steadily, reaching over 3 million clients in 15 countries in Europe.

Want to know if DEGIRO is available in Austria, what its expansion plans are, and the alternatives available? We’ve got you covered!

Is DEGIRO available in Austria?

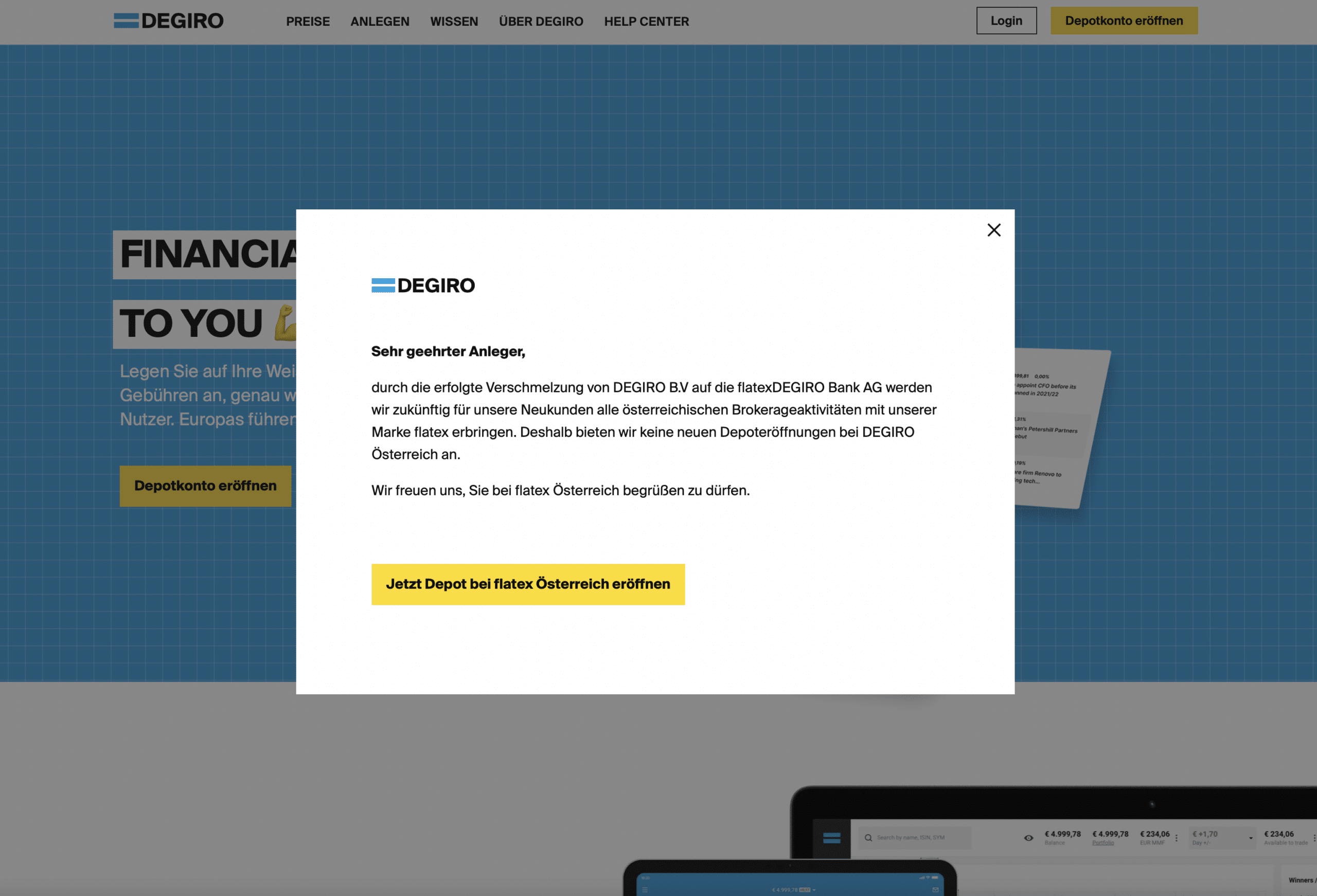

Unfortunately, DEGIRO is not available in Austria (a.k.a. Österreich) anymore.

Flatex has acquired DEGIRO, and they now operate as “FlatexDEGIRO”. While the broker is referred to as Flatex in Austria, it retains the DEGIRO name in the rest of Europe.

Due to the merger between DEGIRO B.V and flatexDEGIRO Bank AG, all Austrian brokerage services for new customers will be provided under the flatex brand. So, DEGIRO is not accepting any new DEGIRO Austria deposit openings.

What happened to Austrian DEGIRO users?

Austrian DEGIRO users’ accounts were closed. They had until the end of September 2021 to either close all positions or transfer them to another broker; otherwise, the accounts would be closed. However, users had the opportunity to move their existing positions to Flatex before the deadline.

While Flatex is a good DEGIRO alternative, it has some drawbacks, including high commissions for buys at certain exchanges. Below, we uncover good DEGIRO alternatives for Austrian users:

DEGIRO Alternatives in Austria

eToro

With over 35 million customers worldwide, it is a technology-first platform with no trading fees for stocks and some ETFs (other fees apply). Ideal for learning the ropes of active trading and for people looking for social trading.

Disclaimer: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Interactive Brokers

Founded in 1978, IBKR is one of the world’s most trustworthy brokers. It offers an enormous range of financial products (stocks, ETFs, Options,…), and low currency conversion fees (FX fees).

💡 Interactive Brokers also launched IBKR GlobalTrader, a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors.

All these alternatives to DEGIRO are regulated (or registered) by top-tier regulators such as the UK’s Financial Conduct Authority (FCA), Germany’s Federal Financial Supervisory Authority (BaFin) and Cyprus’ Securities and Exchange Commission (CySEC).

#1 eToro

eToro at a glance

50% of retail CFD accounts lose money.

Founded in 2006, eToro is a well-known worldwide fintech startup and the leader in the social trading field (follow other people’s trades), with over 30 million users worldwide and that offers commission-free stock and ETFs trading in Austria (not all ETFs are commission-free). You can also invest in other products such as CFDs, ETFs, stocks, commodities and Forex through their platform, which is intuitive and simple to use, making it a good choice for beginners or someone looking for a DIY (“do it yourself”) platform.

Opening an account and depositing is easy, and you can even try it out with a Demo Account (virtual money). On the downside, spreads can be high for some products. The only currency accepted is the USD, which means that you’ll be charged currency conversion fees upon deposit and withdrawal if you deposit in another currency.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 50% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

#2 Interactive Brokers

Interactive Brokers at a glance

Founded in 1978 and publicly listed in NASDAQ (ticker: IBKR), Interactive Brokers is a global online broker which surpassed major financial crises, showing resilience and a rigorous risk management process.

Interactive Brokers offers an advanced investment platform that includes a wide range of products (stocks, options, mutual funds, ETFs, futures, bonds, and currencies) from 150 markets, solid trade execution (IB SmartRouting), and a set of technical and fundamental tools to help you in your investment decisions.

Beginners and intermediate investors have educational tools to explore, but the learning curve will be steep. That´s why we mainly endorse it to more advanced traders. Besides, the customer service gives crystal clear answers to your doubts, so there is no need to go back and forth.

On the downside, Interactive Brokers’ fee structure is quite complex, the registration process is lengthy but fully online, and the broker doesn’t offer commission-free trading. However, when considering FX fees, narrower spreads, and the stock loan program, Interactive Brokers’ clients still get significant savings compared to most brokers.

Interactive Brokers also launched IBKR GlobalTrader, a modern mobile trading app to trade Stocks, Options and ETFs, ideal for beginner investors. Some of the features of IBKR GlobalTrader include automatic currency conversions, fractional shares, demo account, and more.

Want to know more about Interactive Brokers? Check our Interactive Brokers Review.

Other resources

If you’re still unsure which alternative to choose, feel free to explore our website, as well as our Youtube channel, where we dive into the best brokers in several regions, as well as provide step-by-step guides on how to invest in some of these platforms.

If you’re still unsure, feel free to contact us or just book a meeting with us.

Which platform should you choose?

Whether you decide to invest in stocks through eToro, Interactive Brokers, or any other trading platform, you should take the time to compare the platforms before you decide which one to use.

Be sure to compare education resources, pricing information and the products offered before pressing the trigger and opening an account. This process will help ensure that you do not need to maintain multiple accounts to access all the tools you need.

The best online broker in your specific case will depend on your profile, preference, and objectives. Explore the websites above and decide for yourself!

A reminder that the above should not be construed as investment advice and should be considered information only. Investors should do their own research and due diligence about the services and opportunities best suited for their risk, returns, and impact strategy.

Happy investments!