Investing in the stock market has never been easier, thanks to the numerous online trading apps available today. Still, you will need to make a choice, and finding the best trading app in Pakistan can be difficult.

Fortunately, we have successfully analyzed many trading apps and conducted multiple trading app reviews so that we can clarify some of your doubts and help you make an informed decision! In this article, we listed Pakistan’s best stock trading apps, comparing their specificities and highlighting their strengths.

Best stock trading apps in Pakistan

- Interactive Brokers: Best overall trading app in Pakistan

- Fusion Markets: Best for US stock CFDs and Forex

- IG: Best for CFDs

- IC Markets: Best for CFD day trading

74-89% of retail CFD accounts lose money.

70% of retail CFD accounts lose money.

74-89% of retail CFD accounts lose money.

Best stock trading apps in Pakistan compared

| Broker | Fees on stocks | Minimum deposit | Trading apps | Stocks available for trading |

| Interactive Brokers | Between $0.0005 and $0.0035 per US share (min. per order of $0.35; max: 1% of trade value). Between 0.01% and 0.08% for other markets. | $0 | IBKR GlobalTrader, IBKR Mobile and Trader Workstation | ✔ |

| Fusion Markets | $0 Commission US shares CFDs | $0 | MetaTrader 4, MetaTrader 5, cTrader | ✘ (Only CFDs on stocks) |

| IG | From $10 per trade in stock CFDs | $0 | ProRealTime MetaTrader 4 |

✘ (Only CFDs on stocks) |

| IC Markets | $3.50 per side or 0.02% for cTrader | $200 | MetaTrader 4, MetaTrader 5, cTrader | ✘ (Only CFDs on stocks) |

Interactive Brokers at a glance

Interactive Brokers has proven to be one of the most reliable brokers in the market. The company is available on the Pakistan market and was founded over 40 years ago and survived many financial crises, making it a well-established and trustworthy broker, regulated by many top-tier regulators.

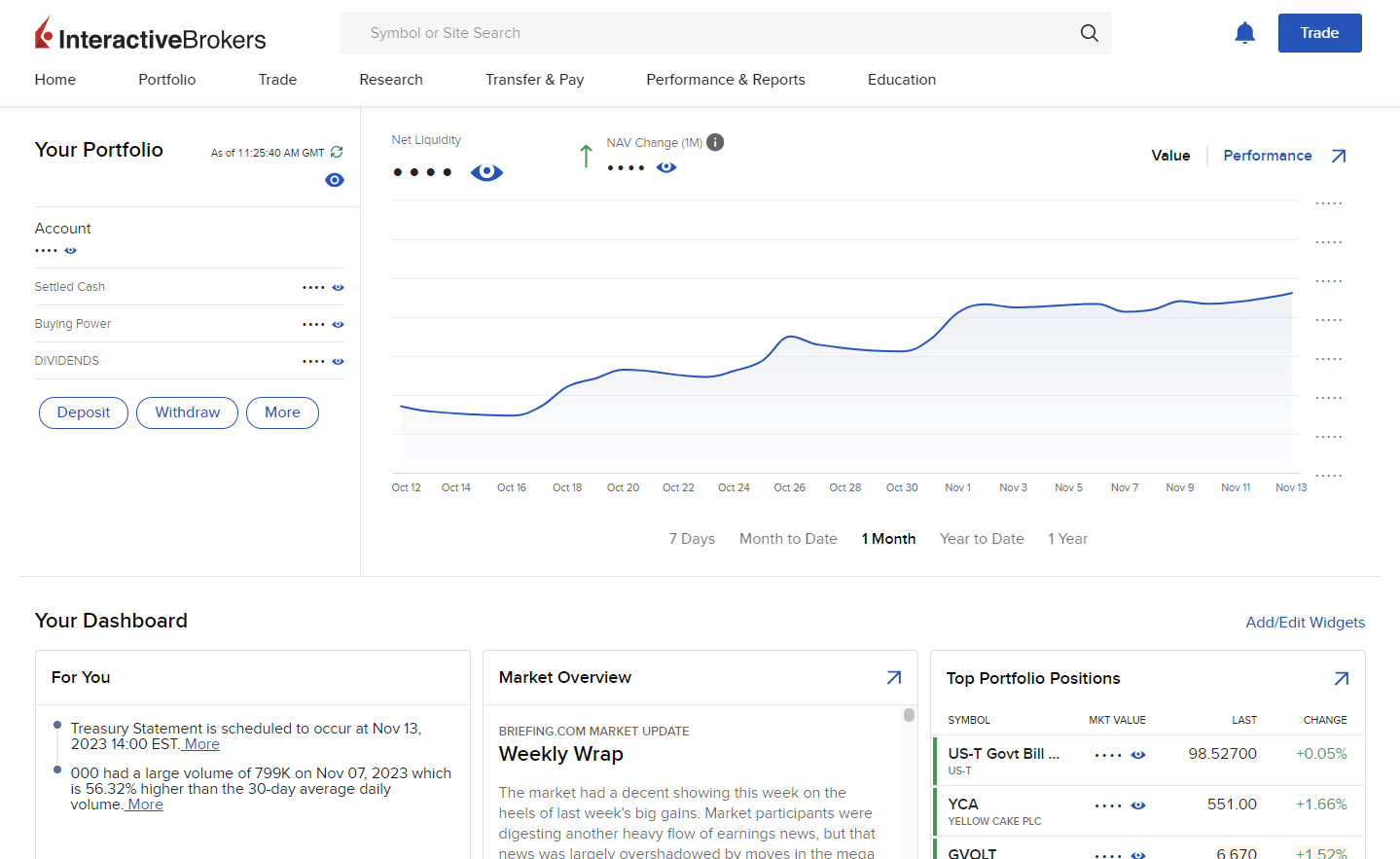

They offer trading apps to trade stocks with sophisticated and powerful tools, a wide range of products available for trading, and low prices. The broker offers different mobile apps and web-based platforms that should be used according to your knowledge and experience. The mobile app IBKR GlobalTrader is a user-friendly app suitable for beginners because it simplifies investments without losing the powerful tools for which the broker is famous.

If you want to make the most out of the powerful tools provided by the broker, you can use the IBKR Mobile, a complete and sophisticated trading app where you can do much more than buy and sell stocks. As the features of this app can be overwhelming for beginners, we would recommend the IBKR GlobalTrader if you do not have a lot of experience.

In addition to the mobile apps, you will also find a desktop app and web-based apps where you have sophisticated trading tools to access the global financial markets. Overall, we believe that Interactive Brokers offers the best stock trading apps in Pakistan, you will be able to find what you are looking for, irrespective of your needs!

If you want to know more about this platform, please check our Interactive Brokers review and visit IBKR’s website!

Fusion Markets at a glance

74-89% of retail CFD accounts lose money.

Fusion Markets, founded in 2017, aims to reduce trading costs for investors and is available to Pakistani traders. The platform facilitates trading in forex, commodities, metals, indices, cryptocurrencies, and US stock CFDs, catering to a global audience with few exceptions.

Offering various account types, including a beginner-friendly demo account, Fusion Markets supports trading through cTrader (desktop, web, and mobile) and MetaTrader 4 and 5, tailored to experienced traders.

One of the main advantages of Fusion Markets is its low spreads and the absence of hidden fees, such as deposits, inactivity, or withdrawal fees. However, the platform lacks investor protection and offers a limited product selection, excluding physical stocks, bonds, or ETFs.

In summary, Fusion Markets appeals to traders seeking simplicity, low fees, and advanced tools. Nonetheless, the absence of investor protection and limited product offerings should be considered.

For further insights, explore our detailed Fusion Markets review and visit Fusion Markets’ website!

IG at a glance

70% of retail CFD accounts lose money.

IG is a well-renowned broker, offering a wide choice and low commissions in primarily CFDs and forex trading. The IG Group (established in 1974) is one of the most valuable UK public companies (included in the FTSE 250 index), has over 300,000 clients worldwide, and covers 18,000+ markets in total.

The user-friendly platform is available internationally (with some exceptions) and offers six base currencies: USD, GBP, AUD, EUR, SGD, and HKD. Most traders will be drawn to IG because of its CFD and Forex trading capabilities. Some of the features of the platform include:

- Extensive educational materials;

- 24-hour-a-day support;

- Weekend trading and extended hours trading;

- Fast execution times;

- Access to Meta Trader 4 (a leading forex trading application);

- Advanced tools: customizable screener, recommended news based on your account…

They offer commission-free trading for most CFDs but charge their own spread on top of the market spread. The exception is share CFDs, which are offered at the real market price without added spread, but there is a commission when opening and closing a position.

Other fees include:

- FX conversion fee of 0.5%;

- Overnight fees (depending on the product);

- Inactivity fee ($18 monthly after 2 years of inactivity);

You can learn more about their fees at this link.

In a nutshell, IG is a broker that primarily offers CFD and Forex trading in a user-friendly interface and with competitive fees. It is tailored to both beginner and advanced traders due to a mix of educational materials and advanced trading tools.

IC Markets at a glance

74-89% of retail CFD accounts lose money.

IC Markets, founded in 2007, is an Australian broker offering a wide range of CFDs on various financial instruments. Pakistani traders can access the platform, which is known for its competitive pricing, fast execution, and advanced trading platforms.

IC Markets provides a variety of account types, including a demo account for practice. Traders can choose between the popular MetaTrader 4 and 5 platforms, as well as cTrader, each offering different features and tools to suit individual preferences.

The broker boasts tight spreads, starting from 0.0 pips for major currency pairs, and offers various commission structures depending on the chosen account type and platform. Additionally, IC Markets does not charge any deposit or withdrawal fees.

While IC Markets excels in providing a robust trading environment, it’s important to note that CFD trading involves significant risk, and it’s not suitable for all investors.

Overall, IC Markets is a reputable choice for traders seeking a wide range of CFDs, competitive pricing, and advanced trading platforms. However, potential users should carefully consider the risks associated with CFD trading before investing.

If you want to know more about this platform, please visit IC Markets’ website!

Methodology

When making this list, we wanted to help investors in Pakistan make an educated choice when choosing the best stock trading app. We prepared this list considering the following criteria:

- Prices: the price cannot be the only aspect to be considered when choosing the trading app to invest in, but it is definitely important. You do not want to pay more for a service when you can get the same quality for cheaper prices.

- Educational resources: high-quality educational resources may be a great advantage, especially for beginners, who can use them to educate themselves before investing money.

- Range of products and markets available: Does the app offer real stocks and ETFs or only CFDs? Does it have crypto?

- Customer service: irrespective of your choice, problems almost always appear, and it is important to find trading apps developed to help you when it does happen.

- The trading app itself: we considered the platform’s functionalities and usability, as well as its specific features.

- Security: all platforms in the list are regulated by top-tier authorities.

What is the difference between a stock and a stock CFD?

While the stock gives you a property right over a share of the company, the CFD does not. The stock CFD is a derivative contract where the underlying asset is the stock and where the broker promises to pay you back the difference in value between the time you opened the position and the time you closed it. CFDs have a leverage effect: if you buy a stock CFD and its price goes down, you will need to borrow money from the broker to keep the position open. This makes the instrument a risky option that is not suitable for beginners.

Bottom line

To summarize, here’s the list of “Best stock trading apps in Pakistan”:

Interactive Brokers

Best OverallFusion Markets

Best for US stock CFDs and ForexIG

Best app for CFD tradingIC Markets

Best for CFD day trading

It is hard to choose the right stock trading app in Pakistan. Luckily, we have helped many people in the same situation before and can help you now. To facilitate your choice, we listed some of Pakistan’s best stock trading apps, highlighting their strengths and weaknesses.

We know that trading stocks is a good way to achieve financial freedom, but, like everything in life, there are risks involved. We hope that our analysis was enough to help you make an educated decision acknowledging those risks, whether you are experienced or a novice in the trading world.

In any case, keep on studying, do due diligence, know your investment profile, and invest wisely!