Ireland has the second-highest GDP per capita in the Eurozone, trailing only Luxembourg. As a result, its residents enjoy a very high level of disposable income. With money to spend, the question that naturally comes to mind is how to make the most of it. One easily accessible way to build and preserve wealth is through the stock market.

In this article, we’ll delve into ways for the Irish to pick stocks, how to buy shares on the international markets, gain exposure to the national stock market, tips for choosing a stock broker to buy shares, opportunities for foreigners to gain exposure to Irish shares, and more!

Choose a stock to buy

Since there are tens of thousands of public companies around the world, there is no silver bullet when it comes to choosing a stock to purchase. That said, generally, companies are divided in two ways:

- Value stocks: these companies are usually attractively priced in terms of price-to-earnings or other ratios but face slower growth going forward;

- Growth stocks: these companies offer a high long-term growth rate but are more expensive from a valuation perspective in the near term.

You can favour one type or diversify across value and growth with value companies in your portfolio to meet medium-term goals. In contrast, growth companies should be able to help you achieve your long-term aspirations!

Resources you can use are:

- Stock screeners such as Finviz

- Company reports, filings and presentations

- Macroeconomic and industry publications

In any case, make sure to consider several companies, evaluate their performance relative to competitors, and try to pick the most attractively priced business!

How to buy shares on the international markets (Step-by-step guide)

1. Choose a good stock broker

Once you have chosen the stock you want to invest in, you need to find a broker where you can make the purchase. Since Ireland is well-integrated into global financial markets, there are plenty of brokers to choose from. Below we highlight five brokers which are available to residents of Ireland:

| Broker | Stock commission, US | Minimum Deposit | Regulators |

| eToro | $0 (other fees apply) | $50 | FCA, CySEC, ASIC |

| Interactive Brokers | $0.005 per share with a minimum of $1.00 | €0 | FINRA, SIPC, SEC, CFTC, IIROC, FCA, CBI, AFSL, SFC, SEBI, MAS, MNB |

| DEGIRO | €1 (+€1 handling fee) | €1 | DNB and AFM |

| Trading 212 | €0 | €10 | FCA, CySEC |

Disclaimer: Investing involves risk of loss.

2. Open and fund your account

Once you have weighed the pros and cons of each broker, you are all set to open an account. The process usually takes a few days as the broker verifies your identity. After the process is finalised, you must deposit money into your account.

3. Place a “Buy Order”

If you have found an online broker that suits your needs, managed to open an investment account, and made the initial deposit, you are all set to buy your stock. All you have to do is find the share within your chosen broker and place a buy order. For this example, we will use eToro:

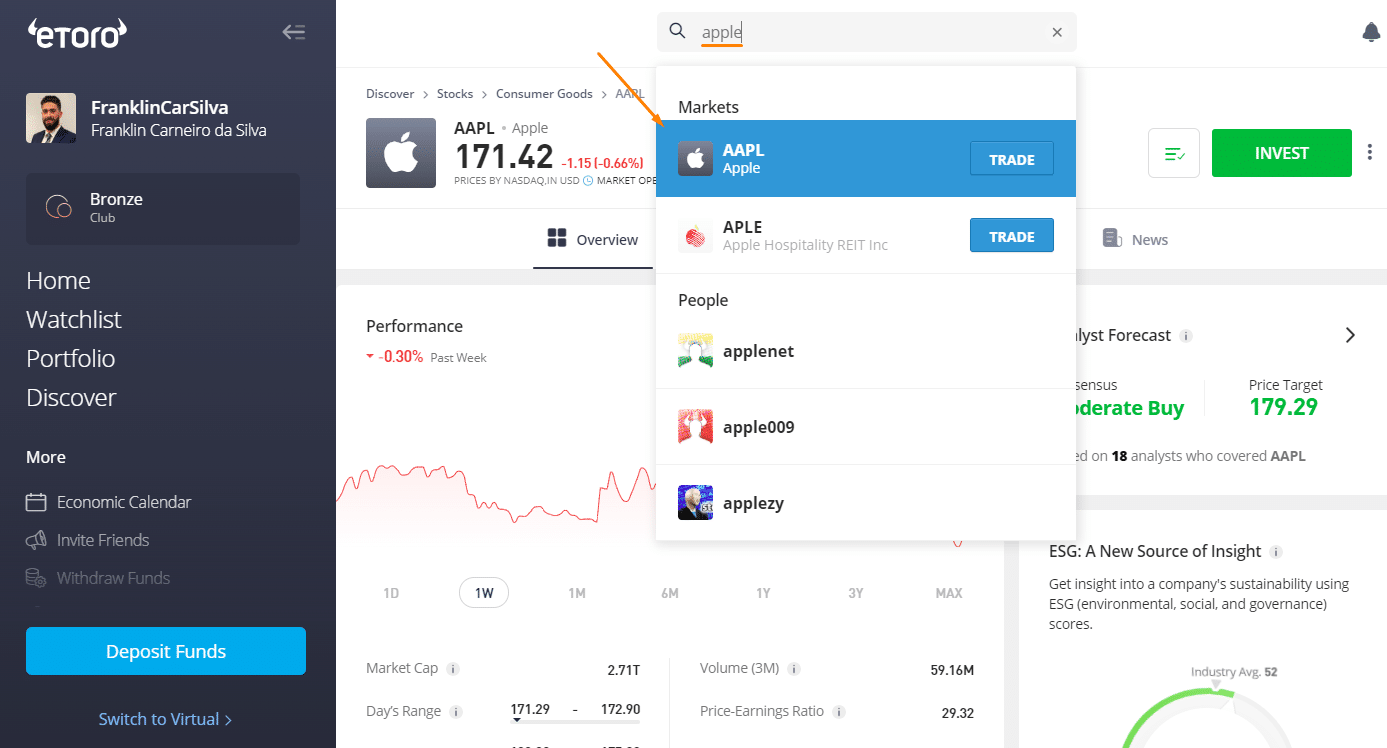

1 – Search for the chosen stock (we will use Apple, ticker “AAPL”):

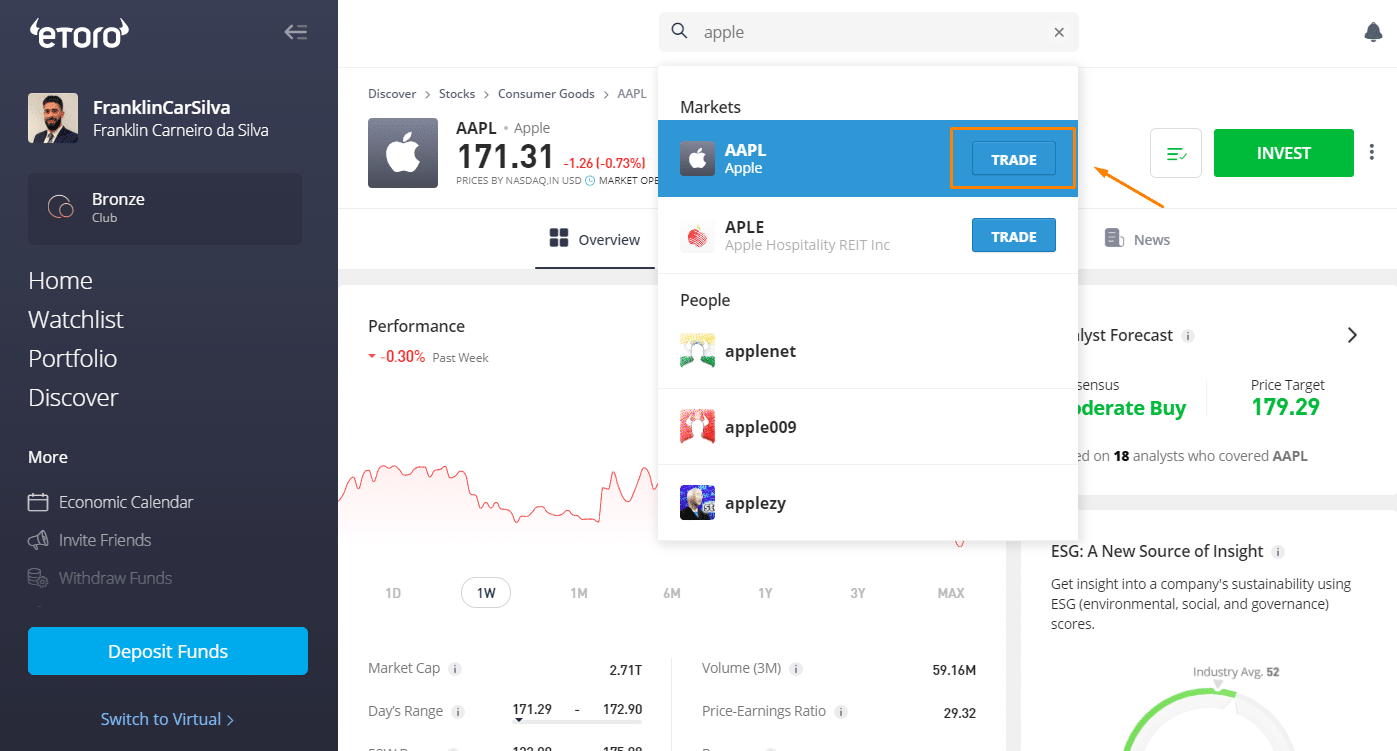

2 – Click “Trade”:

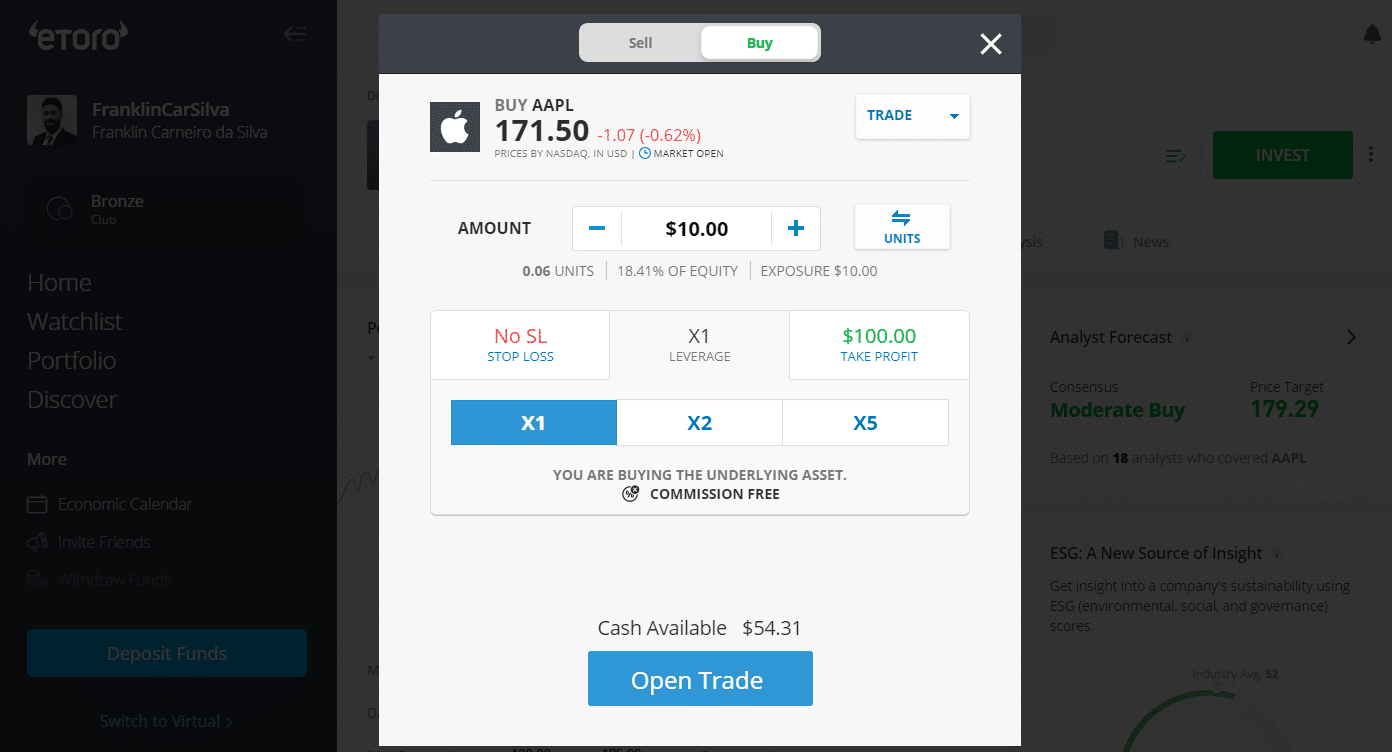

3 – Choose the order details. Now, it’s time to choose how to invest:

- Amount: You choose the amount you want to invest in Apple instead of the number of shares. In this way, your investments may be fully or partially in fractional shares.

- Units: As opposed to “Amount,” here you define the number of shares you want to purchase (note: you can buy using either “Amount” or “Units,” up to you!)

- Leverage: You can choose the level of leverage. “X1” means no leverage (if it were “X2” or above, you would not be trading real stocks, but CFDs on Apple stock instead). That’s why you see “you are buying the underlying asset.”

- Stop Loss: Define the maximum you are willing to lose before closing your position automatically;

- Take profit: Define the profit amount that makes you close your position automatically (if reached)

Stop Loss and Take Profit are not guaranteed and trading with leverage involves high risk.

Only the “Amount” (or “Units”) and “Leverage” are mandatory fields.

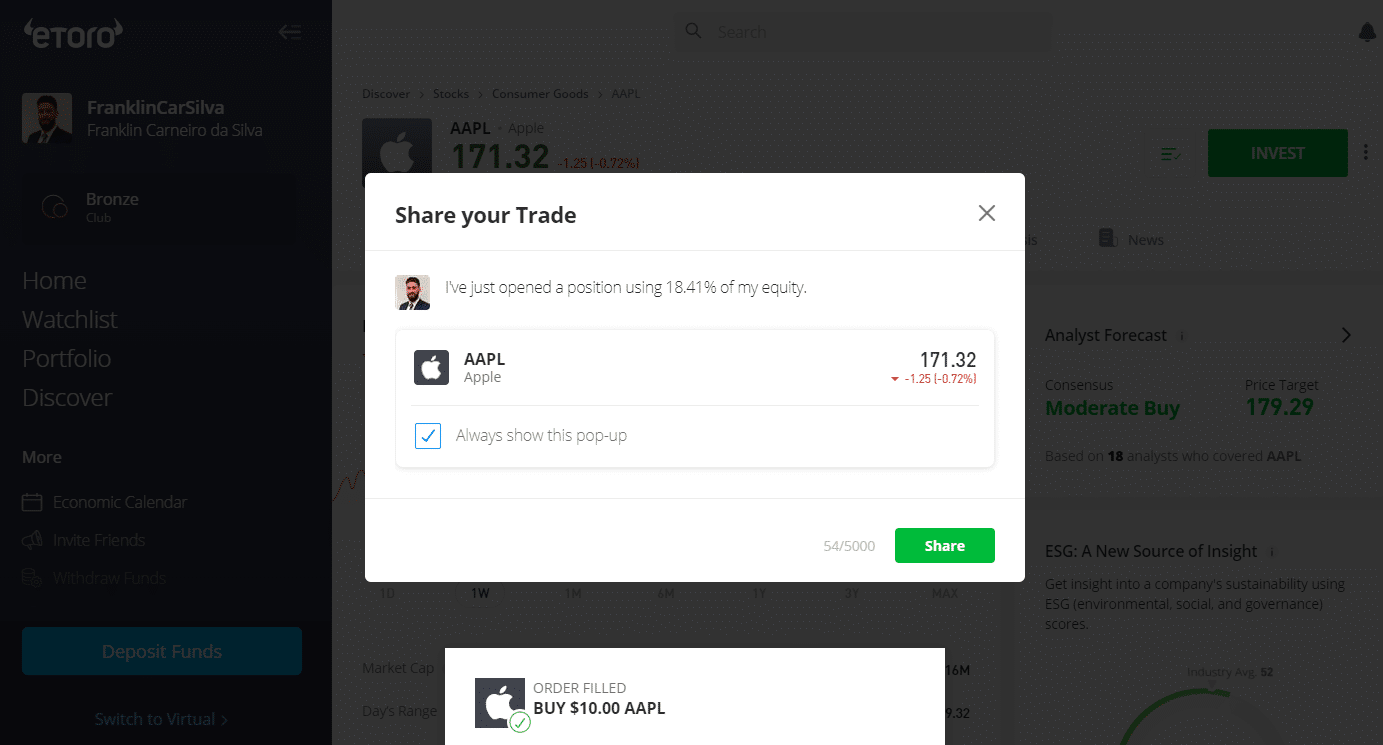

4 – Place the order: Finally, click “Open Trade,” and a new window will show up where it says “order filled,” your exposure, and lets you share your trade with other people.”

ETFs – an alternative way to gain exposure

ETFs or exchange-traded funds, allow you to gain exposure to a dozen or even hundreds of companies with a single investment. ETFs can be a good option if you:

- Are unsure which specific stock to choose;

- Want to limit your portfolio volatility (usually, ETFs invest in companies in several sectors affected by vastly different factors, limiting your exposure to idiosyncratic risks);

- Are interested in following a specific theme in your investments (Irish stocks, technology stocks, real estate stocks, etc).

Some ETFs you may want to consider are:

- WisdomTree ISEQ 20 UCITS ETF (ticker ISQE) tracks the 20 constituents of the leading ISEQ index. The ETF distributes dividends and is UCITS compliant (required if you are buying the ETF from the European Union). The expense ratio is 0.49%.

- iShares MSCI Ireland ETF (EIRL) is more diversified than ISQE, investing in 25 Irish stocks. The benchmark is the MSCI All Ireland Capped Index (capped indices are good for diversification since they limit the share of any individual company to a certain amount). The ETF distributes dividends. The expense ratio is 0.5%.

You are free to choose from thousands of ETFs investing worldwide.

How to invest in the S&P 500 from Ireland

Another way to invest in the stock market from Ireland is to invest in the S&P 500, one of the most popular indexes worldwide. Check our video summary if you’re interested:

Buying shares on Euronext Dublin

The process of buying shares directly on the local market is very similar to the one outlined above for international securities. Euronext Dublin is part of the exchange operator Euronext, which operates Euronext Amsterdam, Brussels, Lisbon, Milan, Paris and Oslo. All 3,545 stocks listed on Euronext markets are available here. Applying a filter only to Euronext Dublin, we see that just 35 shares are listed for trading.

The main benefit of buying shares on the local market is that you will not incur foreign exchange conversion fees from opening an account in USD, GBP or any other currency. This is because shares on Euronext Dublin trade in Euro. If you buy Apple stock (on the US market), you would have to:

- Sell EUR and buy USD to open the trade

- Sell USD and buy EUR to close the trade

Thus, you would incur two foreign exchange fees in the process.

The Irish government imposes a 1% stamp duty on purchases (not sales) of stocks and shares listed on Euronext Dublin. You can learn more here. The silver lining is that the 16 companies listed in the growth segment, Euronext Growth Dublin, are exempt from the levy.

The drawback of the local market is that you are limited to the small number of instruments available to trade there, many of which are tightly correlated with Ireland’s economic fortunes. Thus if you want to diversify your wealth worldwide, the best way is to invest overseas or pick an export-oriented company.

Accessing Irish equities as a foreigner

If you are an investor outside Ireland and want to gain exposure to the country’s growth potential and stable institutions, the most straightforward way to buy Irish equities is through an ETF, as highlighted above. The downside is that country-specific ETFs for small countries such as Ireland usually have a higher expense ratio compared to the ETFs for large markets like the United States. Thus you must carefully evaluate whether the excess return you expect will cover the higher ETF costs!

If you want to buy a specific Irish company, the best way would be to get in touch with one of the leading brokers listed above. The drawback is that you may have to incur foreign exchange fees only if you come from a country where the euro is not the main currency

Bottom line

To sum it up, here’s what you need to do:

- Choose a stock to buy. If you want to invest outside Ireland, you need to carefully consider which company or ETF to pick, as there are a myriad of companies to choose from. The local market has only 41 listed shares, which is far from ideal for building a diversified portfolio.

- Find a suitable stock broker: For international markets, make sure the broker works with residents of Ireland. For Euronext Dublin, all brokers listed above offer trading on Euronext exchanges. In any case, consider the fees and market access of the broker.

- Open an account and deposit money: After deciding which trading platform to use, you must go through the account opening process and deposit money.

- Send a buy order to your broker for the stock you like: That’s the easiest part (the process is intuitive)! After having your brokerage account and the name of the company that you want to buy, you just have to place a trade!

We hope that this post addressed some of your concerns. Make sure to do your research to find the best investing strategy for you!

Happy investing!