If you want to invest beyond stocks and ETFs, investing in options might be a suitable choice. However, not all platforms, including Trading 212, allow it.

Trading 212 has gained popularity as a go-to platform for commission-free trading. Despite its appeal, investors have noticed a significant gap in the platform’s offerings: the absence of options trading. Options trading is a crucial tool for investors looking to hedge risks, speculate on market movements, or enhance their portfolios with strategic flexibility.

In this article, we will explore when Trading 212 plans to offer trading options and alternatives already available in the market! Let’s dig in!

Are options available on the Trading 212 platform?

No. Trading 212 doesn’t offer options trading just yet. According to the latest update on Trading 212 Forum, the company intended to offer options during 2024 (which did not happened):

Still, you do not have to wait. Other brokers have been offering options trading for quite some time and can be considered a better alternative due to their experience dealing with this financial instrument.

Let’s explore them!

Comparison table (pricing)

| Broker | US options pricing (per contract) |

| Interactive Brokers | From $0.15 (minimum of $1 per order) |

| Saxo | From $0.75 |

| DEGIRO | €/£0.75 (+€/£5 monthly commission) |

| tastytrade | $1 (free to close) |

| TradeStation | $5 commission per trade (+$0.60 per contract) |

Disclaimer: Investing involves risk of loss.

Still undecided? Watch our Youtube video, where we summarize our preferred options trading platforms in Europe:

Reviews

Interactive Brokers at a glance

Founded in 1978 and publicly listed in NASDAQ (ticker: IBKR), Interactive Brokers is a global online broker that has surpassed significant financial crises, showing resilience and a rigorous risk management process.

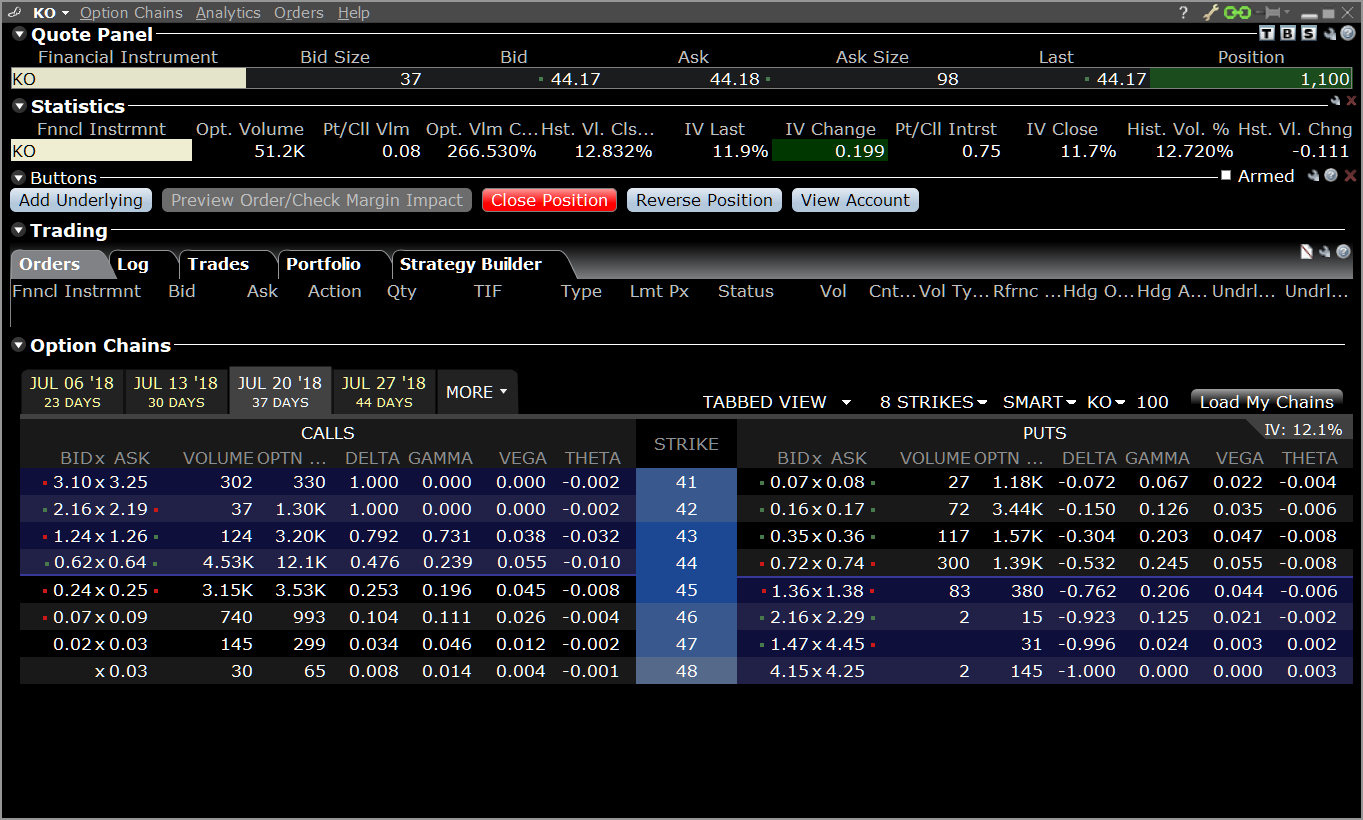

Options Trading is offered on 30+ market centers with commissions starting from $0.15 per contract (minimum of $1 per order) for US option contracts. The trading platform presents advanced options trading tools such as Rollover Options Tool, OptionTrader, and Option Analytics. You can view your positions, market data, and option chains and customize your trading strategies using a Strategy Builder. The Interactive Brokers Traders’ Academy might be excellent for deepening your knowledge of options!

They provide zero account opening fees and no minimum activity fees.

Interested? Read our comprehensive IBKR review.

Saxo at a glance

62% of retail CFD accounts lose money.

Our runner-up, Saxo Bank is a deeply research-oriented broker with a track record, like IBKR, spanning decades. They cater to all levels of experience with a variety of different platforms, but their focus on premium perks and design works best for intermediate to advanced options traders.

We find that SaxoTraderGO will work best for most traders, while those who operate professionally or daily could do even better with SaxoTraderPRO. The former is an award-winning platform that blends the sophistication of desktop-based trading alongside a powerful mobile app for 24/7 coverage.

Their tiered pricing structure feels somewhat convoluted with three possible options, but fortunately, they explain the key details well. The basic “Classic” choice charges USD 2 per US stock option contract, the “Platinum” charges USD 1 and the “VIP” offering charges USD 0.75.

Read our comprehensive Saxo review.

DEGIRO at a glance

Investing involves risk of loss.

DEGIRO is Europe’s leading broker for low-cost options trading through an advanced desktop platform, or streamlined mobile app, providing access to European and American options.

The platform operates an extensive blog catering to beginners and intermediate traders, or anyone who wishes to brush up on the basics before diving into options trading. You can immediately feel that DEGIRO, while championing the “do-it-yourself” ethos, also has “safety first” in mind. This is not a discount brokerage that sees you as a number and wants you to succeed.

From a cost perspective, it’s extremely competitive at EUR 0.75 plus a flat EUR 5 for “connecting” to relevant options exchanges. The broker does cover the necessities for active trading, such as charting, news alerts, and analyst views, but the research may not be deep enough for value- or fundamentals-based investors. A solid third place entry.

Read our comprehensive DEGIRO review.

Disclaimer: Investing involves risk of loss.

tastytrade at a glance

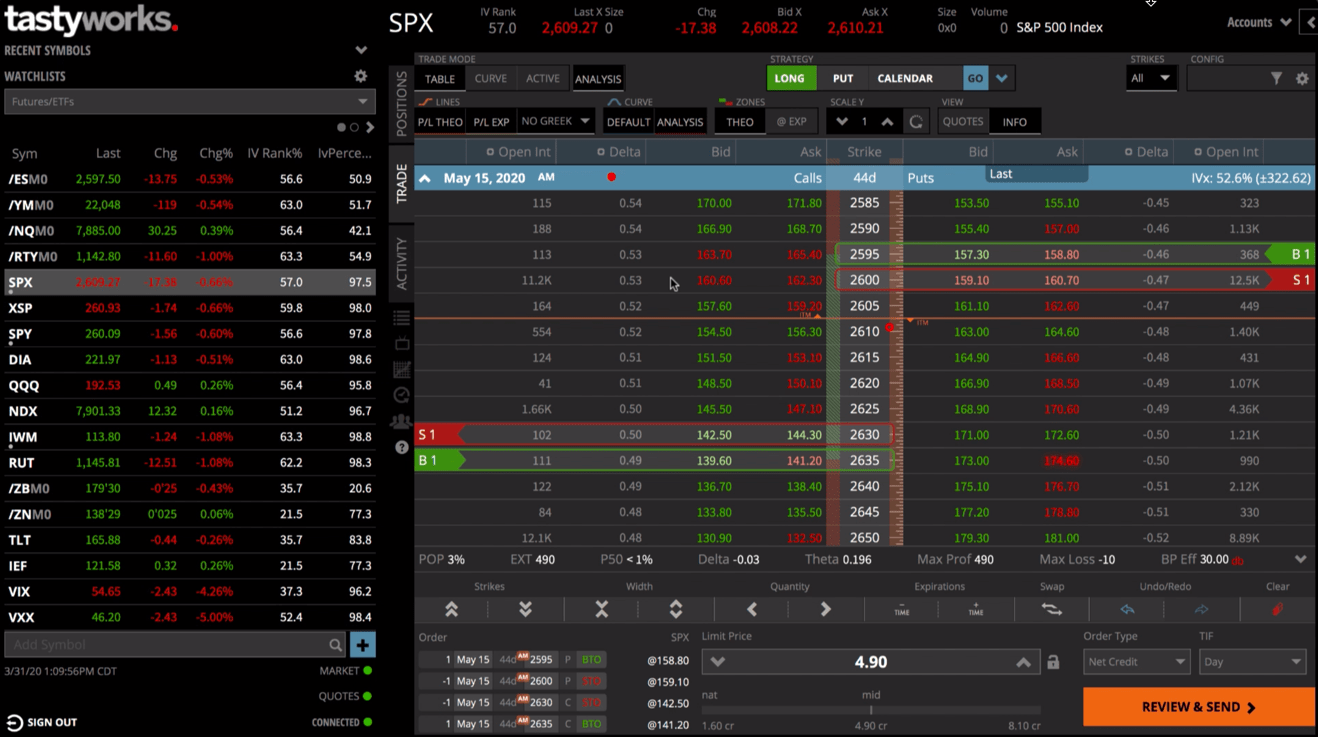

Tastytrade, formerly known as Tastyworks, is an online brokerage firm based in the US focused on options trading, but it also provides access to stocks, ETFs and cryptos. The robust trading platform was developed by the same people who built the thinkorswim trading platform (operated by TD Ameritrade).

Tastytrade offers options on stocks and ETFs, futures, and micro futures for a commission of $1 ($10 cap), $2.50 and $1.50 per contract, respectively. No commission is charged to close any options position.

TradeStation at a glance

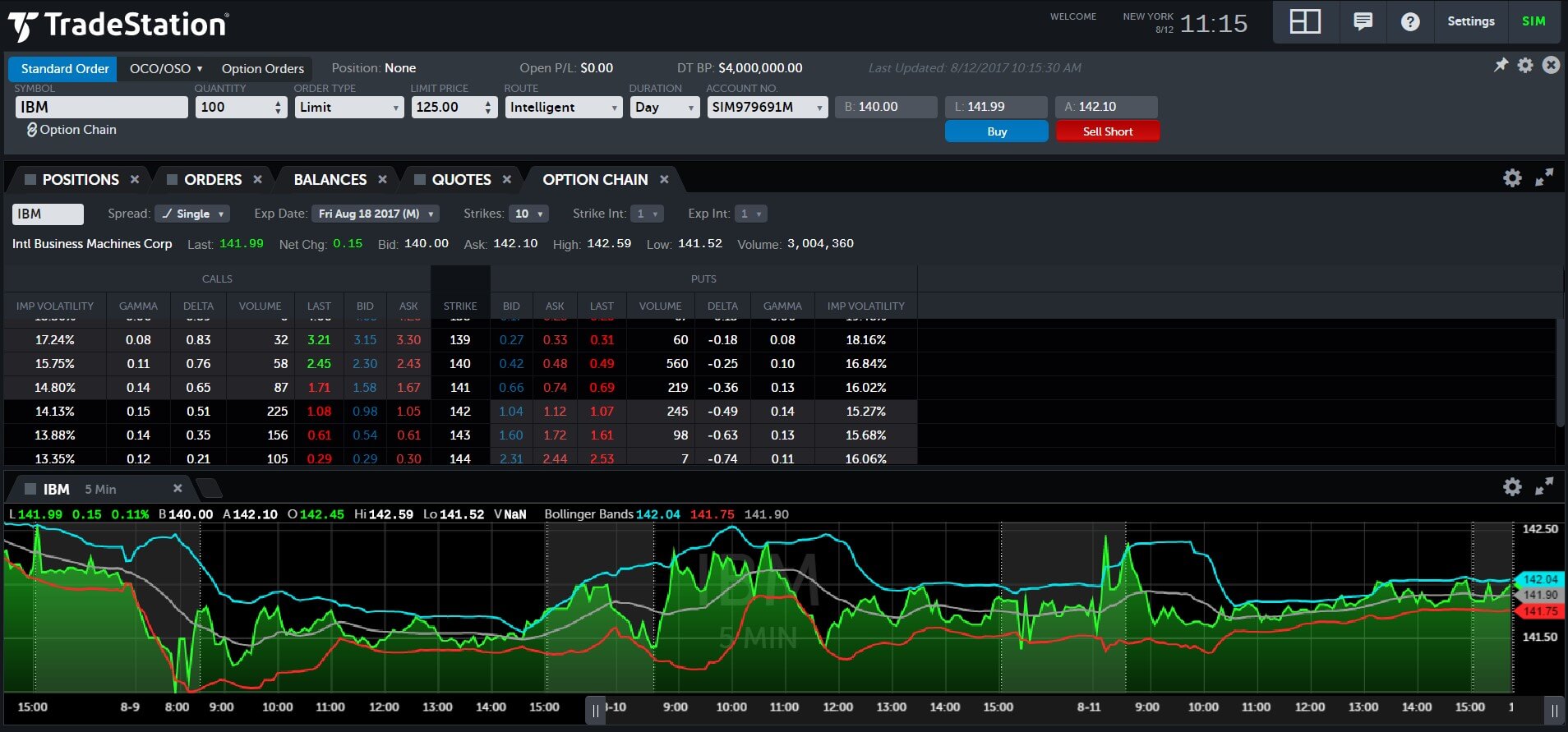

Founded in 1982, TradeStation is a US broker committed to offering you the best trading experience within their rewarded platforms and brokerage services. You can trade stocks, ETFs, options, futures and crypto with competitive pricing models.

The price per contract starts at $0.60 with access to real-time data for stock options. The platform has been developed with powerful and intuitive tools that match the needs of both beginner and advanced investors. The in-house software, OptionStation Pro, lets you quickly build options chains, analyze any options strategy scenario, and then promptly place trades directly into the market.

To complement, it offers a variety of multimedia educational and training resources designed to help you continually improve your trading skills.

Bottom line

Trading 212 is a popular platform for investors seeking commission-free trading and a user-friendly experience. However, its current lack of options trading might be a significant drawback for those who wish to engage in more sophisticated trading strategies.

While there is no exact date for when options trading will become available on Trading 212, investors should explore other platforms that already offer this financial instrument.

The investment firms shown above are well-suited alternatives for options. All of them, provide comprehensive options trading along with a variety of tools and resources to support traders. Please consider the fees, educational resources, and customer support when choosing the right platform for trading options.