Thinkorswim, the trading platform offered by TD Ameritrade, no longer accepts retail Singapore investors (since December 1, 2023).

As a result, no Singaporean can sign up for TD Ameritrade, leaving potential clients to look for other alternatives.

This article will be useful to Singapore retail clients looking to open a brokerage account!

Thinkorswim Singapore Alternatives

#1 Trader Workstation (IBKR GlobalTrader)

Trader Workstation at a glance

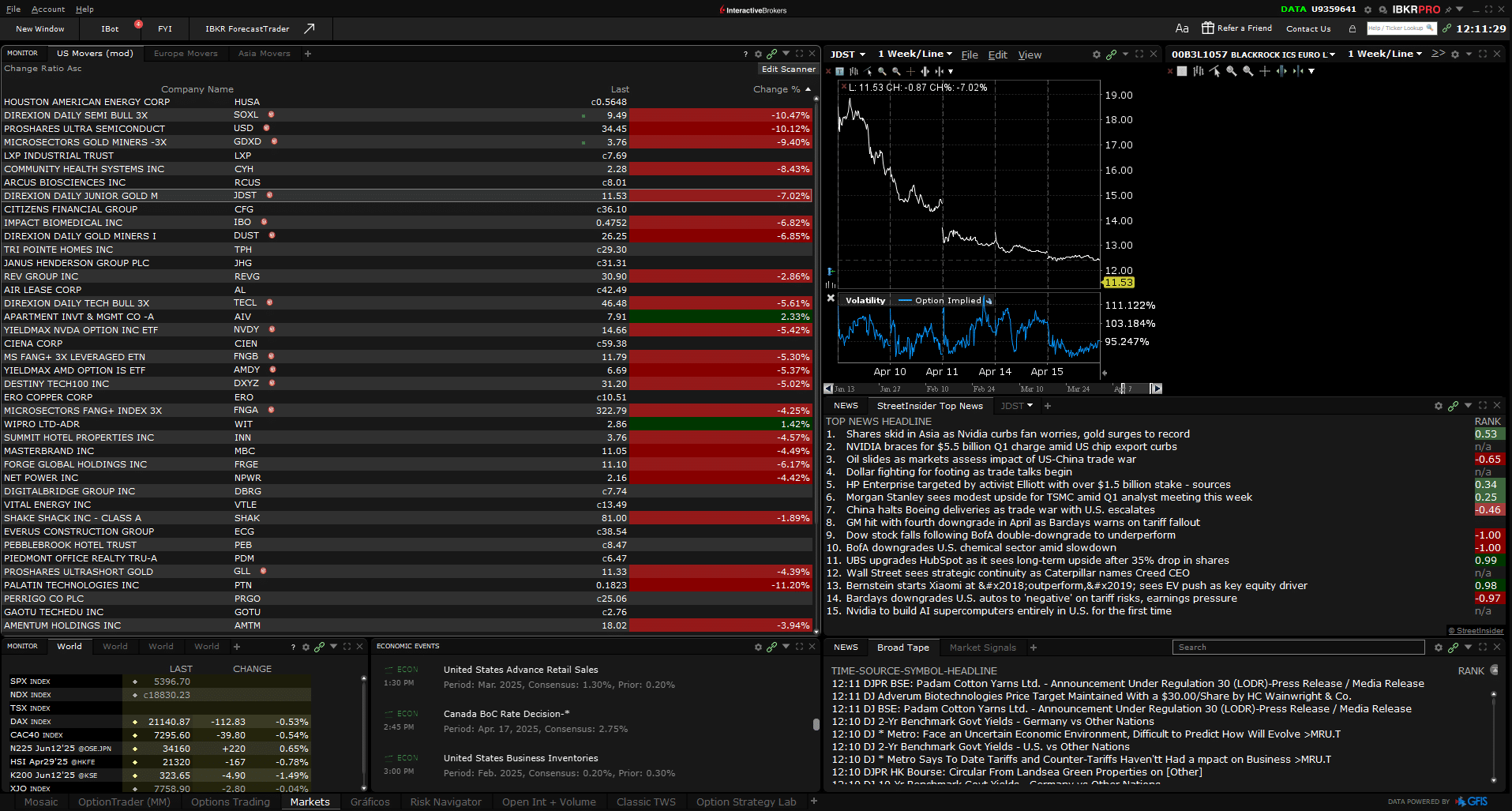

Trader Workstation (TWS), the proprietary trading platform of Interactive Brokers, is one of the most innovative trading platforms developed by a brokerage firm. It includes two sub-sets: the “TWS Mosaic”, which displays a fully customisable workspace, and the “Classic TWS”, where you can find more complex/advanced tools for more experienced traders.

You get comprehensive order management, technical charts, watchlists, and other portfolio tools in a single view. You can organise your trading activity by asset classes and, at the same time, keep up to date with relevant market news impacting the markets. Not to mention the critical financial information on thousands of companies from Reuters Worldwide Fundamentals.

Interactive Brokers also offers a web-based alternative called “Client Portal”, a “light” version of TWS, which lets you keep track of your portfolio performance and other essential features with few constraints. The same goes for its mobile app (“IBKR GlobalTrader”), which lets you check every piece of information on the go.

#2 SaxotraderGO

SaxoTraderGO at a glance

62% of retail CFD accounts lose money.

Features three platforms for trading: SaxoInvestor, SaxoTraderGO, and SaxoTraderPRO. Assuming that most people visiting this page have average knowledge of financial markets, we will focus on the middle one: SaxoTraderGO, which, by the way, is the most popular consumer-facing trading platform of the broker.

SaxoTraderGO is an award-winning web-based platform equipped with crucial features: fundamental and technical analysis tools, an extensive charting package, performance analysis, a comprehensive account overview, and a user-friendly interface. It allows you to synchronise every piece of information with the mobile app.

You will have access to a comprehensive all-in-one screen where you can manage your investments from a wide range of asset classes, currencies, and countries. The financial products offered in SaxoTraderGO are the same as in SaxoTraderPRO: FX, FX Options, CFDs, stocks, ETFs, futures, listed options and bonds, bond mutual funds and commodities.

Interactive Brokers vs Saxo Bank

Now that we have outlined the capabilities offered by each of the trading platforms, let’s compare how the two brokers stack up:

| Broker | Minimum Deposit | Products | Stock commission, US | Regulators |

| Interactive Brokers | $0 | Stocks, Options, Futures, ETFs, Currencies, Structured Products, Metals, Indices, Bonds, and Mutual Funds. | USD 0.0035 per share with a minimum USD 0.35 | FINRA, SIPC, SEC, CFTC, IIROC, FCA, CBI, AFSL, SFC, SEBI, MAS, MNB |

| Saxo Bank | $2,000 (varies between countries) | Crypto, Forex, CFDs, Stocks, Commodities, Futures, Options, ETFs, Bonds, and Mutual Funds. | Up to 0.08% (min. USD 1) | ASIC, FSA, FCA, SFC, MAS, FINMA, DFSA |

Interactive Brokers (IBKR) is a great option for retail investors interested in trading international stocks, ETFs, bonds, futures, options, and even penny stocks. It is ideal for beginners or professionals looking for a large number of instruments and a secure broker.

On the downside, if you are new to investing, the platform might be a bit complicated with too many buttons and features. Furthermore, Interactive Brokers does not allow you to invest in Crypto. You can read our IBKR review and check IBKR’s website for more information.

Saxo Bank has a product offering very similar to IBKR, with Crypto standing out as a differentiating factor. SaxoTraderGO’s functionalities arguably make it more suited to sophisticated investors who do not mind the slightly higher trading fees. Saxo Bank also has a dedicated website for funding details for Singapore residents.

You can read our dedicated Saxo Bank vs Interactive Brokers comparison here.

Bottom line

To sum it up, here’s where you stand:

- Thinkorswim is not available in Singapore anymore. Unless you plan on becoming an accredited investor, you should consult TD Ameritrade’s dedicated website on how to close your account.

- Good Alternatives are available!: Trader Workstation from Interactive Brokers or SaxoTraderGO from Saxo Bank offer everything you need to continue investing!

- Just open an account and deposit money: After deciding which trading platform to use, you must go through the account opening process and deposit money.

- Continue investing: After having your brokerage account funded, you can continue to invest in world markets, even after Thinkorswim is no longer available in Singapore!

We hope that this post addressed some of your concerns. Do your research to find the best investing strategy for you!